Steve Bull's Blog, page 1195

February 10, 2018

Fake News by Omission: the Haiti Example

“I’m happy to have a president that will bluntly speak the truth in negotiations,” Eric Prince commented on Breitbart News. “If the president says some places are shitholes, he’s accurate.” Thus did Mr. Eric Prince pay homage to Mr. Donald Trump. Prince of course being the renowned founder of Blackwater, the private army which in September 2007 opened fire in a crowded square in Baghdad, killing 17 Iraqi civilians and seriously wounding 20 more.

Speaking of Haiti and other “shitholes”, Prince declared: “It’s a sad characterization of many of these places. It’s not based on race. It has nothing to do with race. It has to do with corrupt incompetent governments that abuse their citizens, and that results in completely absent infrastructure to include open sewers, and unclean water, and crime. It’s everything we don’t want in America.”

Like the US media, Prince failed to point out that on two occasions in the recent past when Haiti had a decent government, led by Jean-Bertrand Aristide, which was motivated to improve conditions, the United States was instrumental in nullifying its effect. This was in addition to fully supporting the Duvalier dictatorship for nearly 30 years prior to Aristide.

Aristide, a reformist priest, was elected to the presidency in 1991 but was ousted eight months later in a military coup. The 1993 Clinton White House thus found itself in the awkward position of having to pretend – because of all their rhetoric about “democracy” – that they supported the democratically-elected Aristide’s return to power from his exile in he US. After delaying his return for more than two years, Washington finally had its military restore Aristide to office, but only after obliging the priest to guarantee that he would not help the poor at the expense of the rich – literally! – and that he would stick closely to free-market economics.

…click on the above link to read the rest of the article…

February 9, 2018

Why is U.S. not globally condemned for its military occupation of Syria?

On February 8th, at the U.N., the Russian Government, through its U.N. Representative Vasily Nebenzia, said against the U.S. Government’s forces in Syria, “They are in fact illegally in Syria, nobody called them there, they constantly assert that they are fighting there against international terrorism, but we see that they go beyond this framework.”

No public response has yet been issued by the U.S. Government.

Furthermore, the U.N. Security Council was presented on February 8th with a resolution condemning the bombing on February 6th of the Russian trade mission in Syria’s capital of Damascus, and this condemnation was blocked by the U.S. and UK delegations, which said that there wasn’t enough “information” about the event to condemn it.

Russia and Syria say that the attack had been done by jihadists, “terrorists,” by a shell fired by armed groups who were deployed in the eastern Ghouta suburb of Damascus, as part of repeated attacks on the Russian Embassy in Damascus, but the U.S. and UK refused to condemn the attack, regardless. Consequently, the U.N. Security Council’s press office was blocked from issuing a statement to the press saying that the Council condemned the attack on the Russian facility in Damascus.

Not only is the U.S. trying to take over part of sovereign Syrian territory (using Al Qaeda and Kurdish forces as their boots-on-the-ground to do it), but the U.S. and its UK ally are, essentially, supporting Al Qaeda allied jihadists who shell the Russian trade mission in Damascus.

Though the U.S. Congress has not yet declared war against Syria and against Russia, the U.S. Executive branch, the Commander-in-Chief or President of the United States, has placed the U.S. Government at war against both Russia and Syria, and America’s allies are not expresssing disgust at this act by their ally, which violates not only the U.S. Constitution but international law.

…click on the above link to read the rest of the article…

Why I Own Gold and Gold Mining Companies – An Interview With Jayant Bandari

Opportunities in the Junior Mining Sector

Maurice Jackson of Proven and Probable has recently interviewed Jayant Bandari, the publisher of Capitalism and Morality and a frequent contributor to this site. The topics discussed include currencies, bitcoin, gold and above all junior gold stocks (i.e., small producers and explorers). Jayant shares some of his best ideas in the segment, including arbitrage opportunities currently offered by pending takeovers – which is an area that generally doesn’t receive much attention, but seems to harbor quite a bit of potential.

Jayant Bandari at the at the Sprott Natural Resource Symposium in Vancouver in 2017.

Jayant Bandari at the at the Sprott Natural Resource Symposium in Vancouver in 2017.

The interview dovetails nicely with something we are working on at the moment and plan to make available to our readers soon, namely a comprehensive list of gold and silver juniors (plus a few base metals juniors), which summarizes the most important background information on them and provides links to more in-depth data for further study. The list should serve as a useful starting point for anyone planning to create a broadly diversified portfolio focused on junior gold companies.

As far as we can tell, Jayant prefers to pursue a more concentrated approach, while our list is basically about obtaining exposure to the sector’s potentially large upside, while at the same time mitigating risk through diversification (this approach lowers risk but also caps upside potential to some extent, but will no doubt be quite useful for people who would like to invest in the sector but don’t have the time to analyze and follow it in depth. We should also mention that we do not believe that the currently available junior ETFs are good substitutes for a carefully chosen diversified portfolio focused on the sector).

…click on the above link to read the rest of the article…

American Think Tanks Are Hired Purveyors of Fake News

A couple of decades or more ago when I was still in Washington, otherwise known as the snake pit, I was contacted by a well-financed group that offered me, a Business Week and Scripps Howard News Service columnist with access as a former editor also to the Wall Street Journal, substantial payments to promote agendas that the lobbyists paying the bills wanted promoted.

To the detriment of my net worth, but to the preservation of my reputation, I declined. Shortly thereafter a conservative columnist, a black man if memory serves, was outed for writing newspaper columns for pay for a lobby group.

I often wondered if he was set up in order to get rid of him and whether the enticement I received was intended to shut me down, or whether journalists had become “have pen will travel”? (Have Gun—Will Travel was a highly successful TV Series 1957-1963).

Having read Bryan MacDonald’s article on Information Clearing House, “Anti-Russia Think Tanks in US: Who Funds them?,” I see that think tanks are essentially lobby groups for their donors. The policy analyses and reform schemes that they produce are tailored to support the material interests of donors. None of the studies are reliable as objective evidence. They are special pleading.

Think tanks, such as the American Enterprise Institute, Brookings Institution, and the Atlantic Council, speak for those who fund them. Increasingly, they speak for the military/security complex, American hegemony, corporate interests, and Israel.

Bryan MacDonald lists those who support the anti-Russian think tanks such as the Atlantic Council, the Center for European Policy Analysis, German Marshall Fund of the US, and Institute for Study of War. The “experts” are mouthpieces funded by the US miliary security complex. http://www.informationclearinghouse.info/48755.htm US goverment agencies use taxpayer dollars to deceive taxpayers.

In other words insouciant Americans pay taxes in order to be brainwashed. And they tolerate this.

Central Bank Musical Chairs

If the last few stock market days are interrupting your sleep, Jim Bianco and CNBC’s Rick Santelli are saying, get used to it. The total assets of all central banks hit $16.4 trillion plus (an all-time high) and these banks now, collectively, own 33 percent of all the world’s sovereign bonds (someone/something had to buy ‘em).

Santelli’s question to Bianco was, if the aggregate size of the world’s central banks is at an all-time high, and these bank’s have purchased a third of all government paper, will these banks be able to “normalize in size” (shrink) without “going through a lot more stock market anguish?” Bianco’s response was a flat, “no.”

Reversing trillions of dollars worth of securities purchases will create market turmoil. And now that price inflation has entered the equation, the ride is bound to be bumpy. So, who should 401k investors be worried about and keeping an eye on? Bianco and Santelli agree, that person is ECB head man Mario Draghi. Santelli believes Draghi may be caught without a chair in this game of monetary musical chairs. By the way, it’s not all about the Fed any more. “All central bank stimulus is fungible,” says Bianco, “it doesn’t matter who does it.”

The patron saint of central bankers, John Maynard Keynes, wrote in The General Theory,

“For it is, so to speak, a game of Snap, of Old Maid, of Musical Chairs — a pastime in which he is victor who says Snap neither too soon nor too late, who passed the Old Maid to his neighbour before the game is over, who secures a chair for himself when the music stops. These games can be played with zest and enjoyment, though all the players know that it is the Old Maid which is circulating, or that when the music stops some of the players will find themselves unseated.”

…click on the above link to read the rest of the article…

The (Mind) Games People Play

Fair warning! This is a long and dense read and not intended for the faint-hearted

While most of us would accept there are two states of mind when it comes to perceiving reality, belief and disbelief, I posit there are three. And this third state of mind, the suspension of disbelief, is employed by nearly all of us most of the time when interacting within our own perceived reality.

If we are to recognize the prevailing global cultural insanity as a long duration event, meaning it started many centuries ago and will last many centuries beyond today, being logical and rational, while an essential component of survival, can only be viewed as a significant disability when trying to make sense of an insane world.

This is particularly true when we closely examine group and individual psychology and how it affects everything from culture to money to politics and all the prevailing memes in-between. Any sober assessment of the human condition leads to one conclusion only. Everyone is insane, including you and me. It is only a matter of degree, not if.

That said; for the sake of this article let us assume one can be sane enough to recognize his or her own insanity. While nearly all will point to the actual behavior of the insane as proof of the illness, I tend to focus on the driving force behind the behavior. My experience shows this to be our horribly distorted belief system(s) which propel us deeper and deeper into our madness.

But belief is a misnomer for what actually occurs in the real world. The word belief implies action, intent and effort, as in a verb or adjective. However this should be differentiated from passive belief, which is a subconscious and conscious embrace of a thought or idea which we embody in whole and absolutely.

…click on the above link to read the rest of the article…

Jim Rogers: “Next Bear Market Will Be Worst In My Lifetime”

For months now, Jim Rogers has been talking to anybody (who cares to listen) about the coming equity crash, which he said would be the “worst in his lifetime” – and he’s a spry 75 years old.

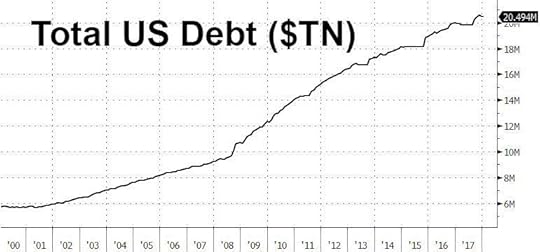

Today, in his latest pessimistic prognostication, the co-founder of George Soros’ Quantum Fund told Bloomberg that the fact that the total US debt pile has only increased since the financial crisis threatens to upend stocks, and that he believes the current turmoil will continue until Jerome Powell and company hike rates next month. Or alternatively, it could just make the crash that much worse: as volatility surges and investors in certain highly risky volatility-linked products have seen all of their savings wiped out, the new Fed chair could rethink a hike, for fear of exacerbating the selloff.

“When we have a bear market again, and we are going to have a bear market again, it will be the worst in our lifetime,” Rogers said. “Debt is everywhere, and it’s much, much higher now.”

Rogers has seen severe bear markets, including the most recent crash when the Dow plunged more than 50% during the financial crisis, from a peak in October 2007 through a low in March 2009. It sank 38% from its high during the IT bubble in 2000 through a low in 2002.

“Jim has been talking about severe corrections since I started in business over 30 years ago,” said Alibaba Group President Mike Evans, a former Goldman Sachs Group Inc. banker. “So I’m sure he’ll be right at some point.”

* * *

Ok, so we know the magnitude, we just don’t know the timing: why not also give a time frame for this next “epic” market crash? Simple: Rogers admits he’s terrible at timing selloffs, which – of course – is just as important as getting the event right.

“I’m very bad in market timing,” Rogers said. “But maybe there will be continued sloppiness until March when they raise interest rates, and it looks like the market will rally.”

Listen to the interview below:

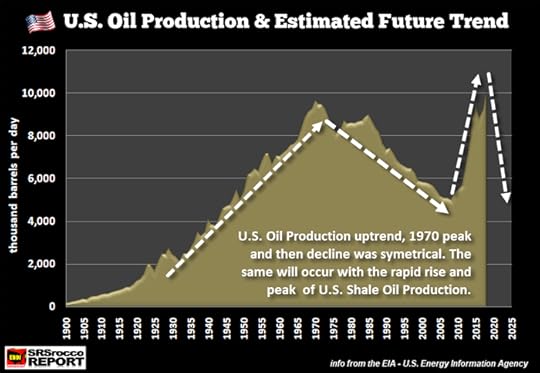

Party On, Dudes

As of this week, the shale oil miracle launched US oil production above the 1970 previous-all-time record at just over ten million barrels a day. Techno-rapturists are celebrating what seems to be a blindingly bright new golden age of energy greatness. Independent oil analyst Art Berman, who made the podcast rounds the last two weeks, put it in more reality-accessible terms: “Shale is a retirement party for the oil industry.”

It was an impressive stunt and it had everything to do with the reality-optional world of bizarro finance that emerged from the wreckage of the 2008 Great Financial Crisis. In fact, a look the chart below shows how exactly the rise of shale oil production took off after that milestone year of the long emergency. Around that time, US oil production had sunk below five million barrels a day, and since we were burning through around twenty million barrels a day, the rest had to be imported.

Chart by Steve St. Angelo at www.srsroccoreport.com

In June of 2008, US crude hit $144-a-barrel, a figure so harsh that it crippled economic activity — since just about everything we do depends on oil for making, enabling, and transporting stuff. The price and supply of oil became so problematic after the year 2000 that the US had to desperately engineer a work-around to keep this hyper-complex society operating. The “solution” was debt. If you can’t afford to run your society, then try borrowing from the future to keep your mojo working.

The shale oil industry was a prime beneficiary of this new hyper-debt regime. The orgy of borrowing was primed by Federal Reserve “creation” of trillions of dollars of “capital” out of thin air (QE: Quantitative Easing), along with supernaturally low interest rates on the borrowed money (ZIRP: Zero Interest Rate Policy). T

…click on the above link to read the rest of the article…

Moody’s Threatens US Downgrade Due To Soaring Debt, “Fiscal Deterioration”

Back in 2011, Standard & Poors’ shocked the world, and the Obama administration, when it dared to downgrade the US from its vaunted AAA rating, something that had never happened before (and led to the resignation of S&P’s CEO and a dramatic crackdown on the rating agency led by Tim Geithner).

Nearly seven years later, with the US on the verge of another government shutdown and debt ceiling breach (with the agreement reached only after the midnight hour, literally) this time it is Warren Buffett’s own rating agency, Moody’s, which on Friday morning warned Trump that he too should prepare for a downgrade form the one rater that kept quiet in 2011. The reason: Trump’s – and the Republicans and Democrats – aggressive fiscal policies which will sink the US even deeper into debt insolvency, while widening the budget deficit, resulting in “meaningful fiscal deterioration.”

In short: a US downgrade due to Trumponomics is inevitable. And incidentally, with today’s 2-year debt ceiling extension, it means that once total US debt resets at end of day – unburdened by the debt ceiling – it will be at or just shy of $21 trillion.

We expect if not a full downgrade, then certainly a revision in the outlook from Stable to Negative in the coming months.

Here’s Moodys:

The stable credit profile of the United States (Aaa stable) is likely to face downward pressure in the long-term, due to meaningful fiscal deterioration amid increasing levels of national debt and a widening federal budget deficit. However, the US economy is very strong, wealthy, dynamic and well diversified, and its role in the global financial system is unmatched. These factors help compensate for the impending fiscal weakness, Moody’s Investors Service says in a new report.

…click on the above link to read the rest of the article…

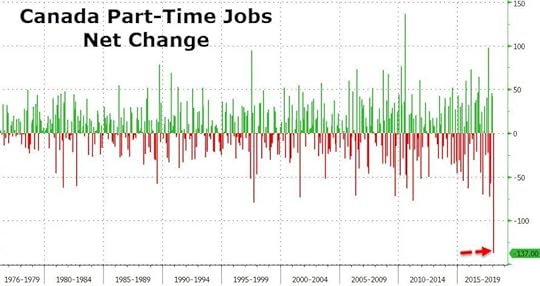

Oh Canada! Part-Time Jobs Crash Most In History

The Canadian job market has never lost more part-time jobs – ever – than in January…

Canada’s unemployment rate rose to 5.9% as total job losses for January dropped the most since 2009, but it was the 137,000 collapse in part-time jobs that stands out.

So what is driving this collapse?

Simple – Minimum Wage Hikes In Ontario.

Ontario raised the minimum wage 21 percent to C$14 ($11.26), making it the highest in Canada.

And as Reuters reports, the steep minimum wage increase that went into effect on Jan. 1 in Ontario, Canada’s most populous province,has had a rocky start as some employers cut workers’ hours and benefits to reduce its impact on the bottom line.

The provincial government, controlled by the Ontario Liberal Party, positioned it as a measure to improve the livelihood of workers in Ontario, home to the nation’s largest city, Toronto, and its capital, Ottawa.

Yet some employers responded by implementing hiring freezes, cutting hours of existing workers, eliminating paid breaks and boosting benefits costs.

Shocker – sending minimum wage costs soaring leads to less demand for low-skill employees?

Will they never learn?

Of course, some see a silver lining as average hourly earnings jumped 3.3% (vs 2.9% previous month) thanks to the min wage hike, the fastest pace since 2015.

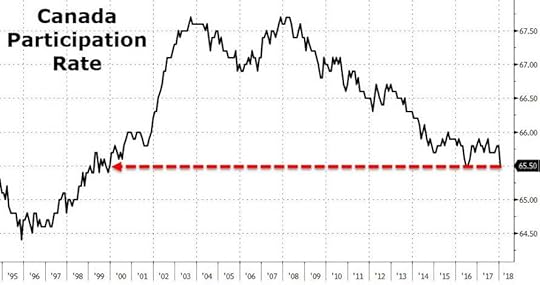

But, it appears the minimum wage hike has sent more people ‘out’ of the work force as the participation rate plunges to its lowest since 1999…

As a reminder, The Bank of Canada hiked ‘dovishly’ in January…

The BOC also noted that “while the economic outlook is expected to warrant higher interest rates over time, some continued monetary policy accommodation will likely be needed to keep the economy operating close to potential and inflation on target.”

We suspect that hike-trajectory may slow.

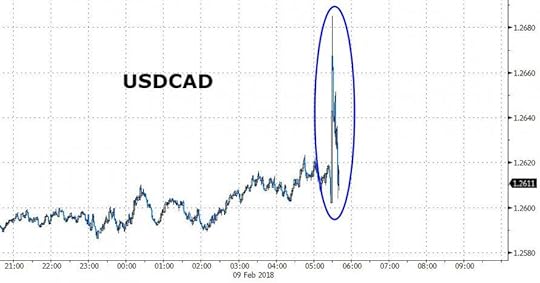

The reaction in the Loonie is quite chaotic…