Steve Bull's Blog, page 1194

February 11, 2018

The stock market swoon and our hatred of (some kinds of) volatility

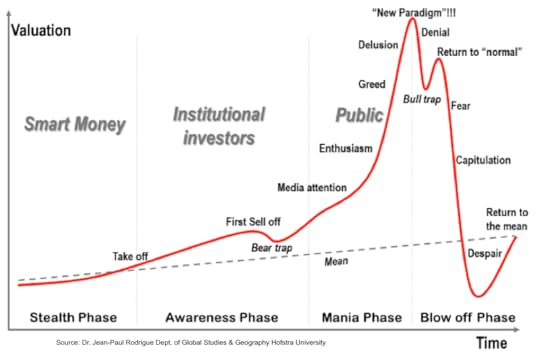

The steepest one-day point drop in the history of the Dow Jones Industrial Average last week shook stock investors into an awareness that all is not sweetness and light in the financial markets. The sudden downside stock market volatility had been preceded by the breathless upside volatility of a months-long melt-up—one that had financial gurus outbidding each other to increase their targets for major stock indices. (See here and here.) Investors, too, felt that heaven had arrived on Earth, at least financial heaven.

After years of steady gains—with only the occasional drop—stock and bond market investors had gotten used to narrow swings in price that didn’t disturb their sleep. In fact, whenever the stock (or bond market) looked like it might crash, the world’s central banks offered reassurance both in words and deeds. The deeds included unprecedented buying of bonds (which kept interest rates low) and in some cases the purchase of stocks. The Bank of Japan and Swiss National Bank are two central banks which buoyed stocks through purchases though they bought stocks for different reasons.

Whether the current volatility presages a market meltdown or not, I’ll leave to others. But volatility in the stock market isn’t the only kind of volatility humans don’t like. In fact, the entire project of human civilization might be characterized as an attempt to dampen volatility. The basis of civilization, that is, living in settlements, is agriculture, especially agriculture devoted to the production of grains. Why grains? Because grains can be stored from season to season and thereby smooth out food supplies throughout the year and cushion an unexpected drop in supplies from year to year due to drought, floods or other natural catastrophes.

…click on the above link to read the rest of the article…

Pentagon’s Nuclear Doctrine – Retrograde and Reckless

Pentagon’s Nuclear Doctrine – Retrograde and Reckless

In its latest Nuclear Posture Review (NPR), the American Pentagon declares at one point in the document that the Cold War is long over. Apart from that fleeting mention, however, one would think from reading the entire review that the Cold War, for Washington, has never been so palpable.

It is a fear-laden document, relentlessly portraying the world as fraught with existential danger to US national security.

Russia and China, as with two other recent strategic policy papers out of Washington, are again painted as adversaries who must be confronted with ever-greater US military power.

The latest NPR asserts that since the last such review in 2010, “America confronts an international security situation that is more complex and demanding than any since the end of the Cold War.”

It is clear from reading the 74-page document that Russia and China are the main source of security concern for the Pentagon – albeit the reasons for the concern are far from convincing. Indeed one might say downright alarmist.

Washington accuses Russia and China of pursuing nuclear weapons development which is threatening. It accuses Russia in particular of violating arms controls treaties and threatening American allies with its nuclear arsenal. There are several other such unsubstantiated claims made by the Pentagon in the document.

Russia and China responded by condemning the aggressive nature of the Pentagon’s latest doctrine, as they have done with regard to two other recent strategic papers published by the Trump administration.

It is deplorable that Washington seems to go out of its way to portray the world in such bellicose terms. The corollary of this attitude is the repudiation of diplomacy and multilateralism.

Washington, it seems, is a hostage to its own imperative need to generate a world of hostile relations in order to justify its rampant militarism, which is, in turn, fundamental to its capitalist economy.

…click on the above link to read the rest of the article…

February 10, 2018

Red Screen At Morning, Investor Take Warning

Shutterstock

Red Screen At Morning, Investor Take Warning

It’s time for safety. And it’s beginning to pay better, too

Growing up as I did in coastal New England, this old rhyme was drilled into us as children:

Red sky at night, sailor’s delight;

Red sky at morning, sailor take warning.

Because many of the people in town still made their living on the sea, the safety of person and property depended on being able to recognize the signs of approaching danger.

A notably red sky at morning is usually due to sunrise reflection off of moisture-bearing clouds, signifying an arriving a storm system bringing rain, wind and rough seas. Those who ignored a red sky warning often did so at their peril.

Red Sky In The Markets

I’m reminded of that childhood rhyme because the markets are giving us a clear “red sky” warning right now. One that comes after (too) many years of uninterrupted fair winds and smooth sailing.

The markets have plunged nearly 8% over just a single week. And the losses are across the board. Nearly every asset class from stocks to bonds to commodities to real estate are participating in the pain. Market displays are a sea of red.

We’ve written so often and recently of the dangerous level of over-valuation in asset prices (caused by years of central bank intervention) that to re-hash the premise again feels unnecessary.

But the chart below is worth our attention now, as it really drives home just how dangerously over-extended the markets have become. It’s a 20-year chart of the S&P 500, showing how it has traded vs its 50-month moving average (the thin green line).

Importantly, the chart also plots the Bollinger bands for this moving average. These are the thin red (upper) and purple (lower) lines above and below the green one.

…click on the above link to read the rest of the article…

What U.S. News Reports on Syria’s War Hide

What’s being hidden from the public by the U.S. news-media’s reports on Syria’s war is that, ever since 2012, the U.S. Government has been trying to overthrow Syria’s Government by supporting, training and arming, in Syria, the many jihadist groups who were being led by Al Qaeda in Syria — jihadist groups which unanimously accept Al Qaeda’s leadership there. Without Al Qaeda in Syria, the U.S. effort to overthrow the government of Bashar al-Assad (who was elected in 2014 to a new Presidential term in an internationally monitored democratic election, winning 89% of the vote) wouldn’t have come anywhere close to succeeding; but, with Al Qaeda’s help, it almost did succeed. America, even as late as late 2016, was demanding Russia to stop its bombing of Al Qaeda and of their allied jihadist groups in Syria, but Russia refused; this was a major hang-up in the years-long Kerry-Lavrov (U.S.-Russia) negotiations for a ceasefire in Syria. Kerry couldn’t get President Obama to go along with Russia’s (Putin’s) insistence upon continued bombing both of ISIS and of Al Qaeda; Obama insisted: No bombing of Al Qaeda.

More recently, after the effort to overthrow Syria’s Government failed during 2016, the U.S. goal (since nearly the very end of Obama’s Administration) has become assisting Kurds in Syria’s northeast who want to establish there a Kurdistan, which would be beholden to Washington and would cooperate with U.S. oil companies and their contractors such as Halliburton to extract Syria’s oil and to construct pipelines for both oil and gas from mainly three U.S. allies — Saudi Arabia, UAE, and Qatar — into the world’s largest energy-market, the EU, to enable the U.S. and those fundamentalist-Sunni allies to displace Russia from that market, where Russia currently is the largest energy-supplier.

…click on the above link to read the rest of the article…

What Kind of Stock Market Purge Is This?

Actions and Reactions

Down markets, like up markets, are both dazzling and delightful. The shock and awe of near back-to-back 1,000 point Dow Jones Industrial Average (DJIA) free-falls is indeed spectacular. There are many reasons to revel in it. Today we shall share a few. To begin, losing money in a multi-day stock market dump is no fun at all. We’d rather get our teeth drilled by a dentist. Still, a rapid selloff has many positive qualities.

Memorable moments from the annals of dentistry [PT]

Memorable moments from the annals of dentistry [PT]

For example, the days following a market correction are full of restoration and redemption. Like the prayer of Saint Francis of Assisi, Tuesday’s 567 point DJIA bounce brought hope where there was despair, light where there was darkness, and joy where there was sadness. President Trump even acknowledged that his powers over the stock market are less than omnipotent.

From a practical standpoint, a market correction clarifies that we live in a world that is exacting and just, as opposed to a fabricated fantasy. A stock market purge demonstrates that the central planners haven’t entirely broken the markets just yet. Markets still go both up and down. This important detail is always forgotten at the worst possible time.

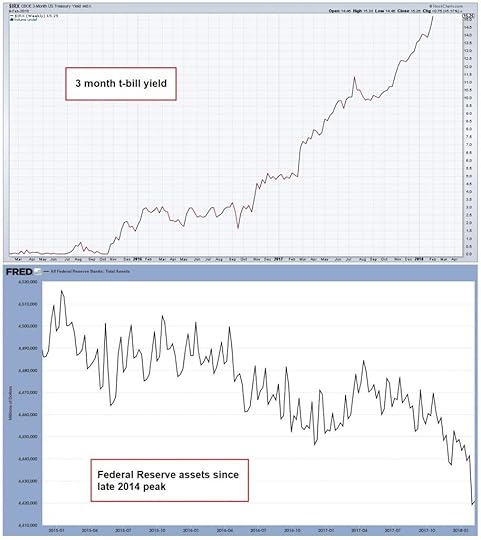

The stock market purge also clarifies that Fed actions provoke reactions. The Fed’s rate raising and quantitative tightening efforts are having an effect. After pumping stock and credit markets up for the last decade they are now, by design, deflating them. What a delicate and unnecessary game these central bankers play.

The tree month t-bill yield and total assets held by the Federal Reserve system – moving in opposite directions. Amazingly, many market participants seem to believe that when these data change direction, the stock market will remain unaffected. That is probably wishful thinking. [PT]

The tree month t-bill yield and total assets held by the Federal Reserve system – moving in opposite directions. Amazingly, many market participants seem to believe that when these data change direction, the stock market will remain unaffected. That is probably wishful thinking. [PT]

…click on the above link to read the rest of the article…

“This Is Where They Completely Lost Their Minds” – Hussman

– Hussman warns ‘the S&P 500 to lose approximately two-thirds of its value over the completion of this cycle’

– ‘the market has lost value, even since 2009, when overvalued, overbought, overbullish conditions were joined by divergent internals’

– Believes the market is going to learn lessons about the crash ‘the hard way’

In an almost prophetic blog post from John Hussman last week, we are warned about the bubble waiting to collapse in the US equity market and the hard lesson investors are about to learn.

Drawing on both his own experience and the work of the much revered Didier Sornette, Hussman looks at the current state of the US equity market, where it sits in its cycle and how it compares to history.

The prognosis is not good. Hussman warns that ” the market has lost value, even since 2009, when overvalued, overbought, overbullish conditions were joined by divergent internals…I expect the S&P 500 to lose approximately two-thirds of its value over the completion of this cycle.”

Of course, the lesson may have finally begun. On Monday February 5th the Dow Jones dropped over 1,000 points, the largest single day drop ever, on a points-basis. Meanwhile, also on the 5th, the S&P500 went negative for 2018 closing down more than 7 percent from a record set in January. Similar action was repeated on the 8th February, with many traders declaring they’d never seen anything like it.

Gold performed well following the rout and we believe gold prices may rise further as the drama leads period of risk aversion and a new found appreciation by investors looking for gold’s hedging and safe haven attributes.

You can hear more about our bubble crash predictions in our Goldnomics podcast. Here we take a look at one of the important financial questions of our day – is this the greatest stock market bubble in history?

…click on the above link to read the rest of the article…

The Deep State: Use an Existing Crisis, or Create One

Rahm Emmanuel was/is (in)famous for his alleged attribution of the quote “Never allow a good crisis to go to waste.” Nevertheless, in the manner that Chaucer’s “Canterbury Tales” is an “English echo” of “The Decameron” by Giovanni Boccaccio, the quote assigned to Emmanuel is a paraphrase of words emitted by the equally-nefarious Milton Friedman:

“Only a crisis – actual or perceived – produces real change. When that crisis occurs, the actions that are taken depend on the ideas that are lying around. That, I believe, is our basic function: to develop alternatives to existing policies, to keep them alive and available until the politically impossible becomes politically inevitable.” – “Capitalism and Freedom,” by Milton Friedman, Preface, Univ. Chicago Press, 1982.

Although he was an Economist (so-called), Friedman’s Marxist economic endeavors (germinated by the Frankfurt School of Economics “alumni”) were cracked akin to a whip throughout the world and used by the U.S. to further imperialism and fostered dependence by third-world nations. Such “dependence,” it must be added, took the form of loans through the IMF and World Bank…backed by military force. The “dependence” is almost that of the Helsinki Syndrome, in which the kidnapped captive becomes psychologically dependent upon the captor…but the captivity remains. Protection and extortion in the same vein.

These same “entangling alliances” were warned about for the fledgling United States by the Founding Fathers. Such forced alliances are easily seen for what they are: the creation of vassal states through force projection and intimidation. Even when we’re not directly involved, we “underwrite” the actions. The latest (and largest) prime example was the ousting of Ukraine’s president, Yanukovych, in 2014 and the attempt to force Ukraine to become a part of NATO, as well as another IMF-vassal in the NATO-Euro-hegemony.

…click on the above link to read the rest of the article…

Soros – One of the Greatest Threats Against Society?

It is no secret that I have no respect for George Soros and that is aside from the fact that we would often be on opposite sides of the market. I never saw Soros as a great trader. Even the reputation that he broke the Bank of England was nonsense. The “Club” was all on that trade and it was a guaranteed trade where if the peg broke, you made a fortune and if you were wrong, you got your money back. I was on the opposite side back then being called in by those in the British government. After a 7-year bull market in equities, Soros finally threw in the towel ending his bets on the stock market crash only after being wrong for so long.

Soros lost big time on the Russian manipulation when the “Club” was bribing the IMF to keep the loans to Russia going so they could make a fortune in interest rates. That failed and ended up in Long-Term Capital Management debacle. Soros lost $2 billion on that one. I believe he also lost when the “Club” was targeting the Japanese yen in 1999. So I never saw Soros as some fantastic trader. I believe he was just simply on the right side of a few big plays orchestrated by the “Club” and never by himself.

I personally believe he is very dangerous politically. I believe he stands for control of the people and is always plotting for the manipulation of society. He appears to be always on the side of Marxist/Socialism which disturbs me greatly. This is just his political philosophy. There has been a rising movement against Soros on a global scale. This is one person who the world will celebrate his death – not morn it.

…click on the above link to read the rest of the article…

Oil Prices Tank As U.S. Drillers Add Massive Number Of Rigs

As if the recent nosedive that oil prices have taken in the last few days wasn’t bad enough—Baker Hughes reported a staggering increase to the number of rigs. The number of active oil and gas rigs increased by 29 to Baker Hughes data. This brings the total number of oil and gas rigs to 975, which is an addition of 234 rigs year over year.

The number of oil rigs in the United States rose this week by 26 with the number of gas rigs increasing by 3. The number of oil rigs now stands at 791 versus 591 a year ago. The number of gas rigs in the US now stands at 184, up from 149 a year ago.

At 11:24 am EST, the price of a WTI barrel was trading down $1.35 (-2.21 percent) to $59.80—almost a staggering $5.00 under this same time last week. The Brent barrel trading down $1.39(-2.14 percent) to $63.42, also almost $5 per barrel under last week, and a loss of 9 percent since the highs in late January.

Pressing on prices are robust US production. US crude oil production rose again, to 10.251 million bpd, from 9.919 million bpd the week before, setting another new high and surpassing the psychological threshold of 10.0 million bpd.

Last week, the EIA pressured prices even further when it changed its US production forecast, with their prediction that the US would reach 11 million bpd by the end of 2018—a full year earlier than its previous estimates that it had made just last month.

The Permian basin rig count saw the greatest increase to the number of rigs at 10.

At 1:09pm EST, WTI was trading at $59.03 (-$2.12) with Brent trading at $62.68 (-$2.13).

Three Crazy Things We Now Accept as “Normal”

How can central banks “retrain” participants while maintaining their extreme policies of stimulus?

Human habituate very easily to new circumstances, even extreme ones. What we accept as “normal” now may have been considered bizarre, extreme or unstable a few short years ago.

Three economic examples come to mind:

1. Near-zero interest rates. If someone had announced to a room of economists and financial journalists in 2006 that interest rates would be near-zero for the foreseeable future, few would have considered it possible or healthy. Yet now the Federal Reserve and other central banks have kept interest rates/bond yields near-zero for almost nine years.

The Fed has raised rates a mere .75% in three cautious baby-steps, clearly fearful of collapsing the “recovery.”

What would happen if mortgages returned to their previously “normal” level around 7% from the current 4%? What would happen to auto sales if people with average credit had to pay more than 0% or 1% for a auto loan?

Those in charge of setting rates and yields are clearly fearful that “normalized” interest rates would kill the recovery and the stock bubble.

2. Massive money-creation hasn’t generated inflation. In classic economics, massive money-printing (injecting trillions of dollars, yuan, yen and euros into the financial system) would be expected to spark inflation.

As many of us have observed, “official” inflation of less than 2% does not align with “real-world” inflation in big-ticket items such as rent, healthcare and college tuition/fees. A more realistic inflation rate is 7%-8% annually, especially in the higher-cost regions of the US.

But setting that aside, there is a puzzling asymmetry between low official inflation and the unprecedented expansion of money supply, debt and monetary stimulus (credit and liquidity). To date, most of this new money appears to be inflating assets rather than the real world. But can this asymmetry continue for another 9 years?

…click on the above link to read the rest of the article…