Steve Bull's Blog, page 1164

March 13, 2018

“I hope for Goldman Sachs’ bankruptcy”: Nassim Nicholas Taleb on Skin in the Game

PHOTO: DAN CALLISTER/REX

“I hope for Goldman Sachs’ bankruptcy”: Nassim Nicholas Taleb on Skin in the Game

In Taleb’s universe, the fieriest circle of hell is reserved for bankers and neoconservatives.

Nassim Nicholas Taleb is an intellectual brawler, a philosophical pugilist. His new book, Skin in the Game, put me in mind of the final scene of The Godfather or Reservoir Dogs: everybody gets whacked. Bankers and bureaucrats, warmongers and wonks – all are targeted by Taleb.

For the Lebanese-American thinker, their shared sin is that (with some exceptions) they lack “skin in the game”. By this, Taleb means they are insulated from the consequences of their actions: they do not have “a share of the harm” or “pay a penalty if something goes wrong”. This “asymmetry in risk bearing”, he warns, leads to “imbalances”, “black swans” (the rare but high-impact events described in his 2007 mega-seller) and “potentially, to systemic ruin”.

When I meet Taleb, 57, at the Club Quarters hotel in central London I am mentally primed for conflict (journalists are another of his targets). But the self-described flâneur is courteous and polite, helpfully advising me to add an espresso to the hotel’s insufficiently strong coffee. I ask him how his deadlifts are (the stocky Taleb once boasted of lifting 400lbs). An unrelated injury, he laments, has “set him back” but he has shed fat, not muscle (“it could be that when you deadlift you’re always hungry”).

“I consider myself in the same business as journalists,” Taleb says when I raise the subject of my trade. “But if you don’t take risks it becomes propaganda or PR.” Taleb, a man sometimes described as having praise only for himself, speaks admiringly of the New Statesman’s in-house philosopher John Gray. “My respect for him is so great… He, visibly, has skin in the game, he was not afraid to be a Thatcherite when it was unpopular and later an anti-Thatcherite when it was also unpopular.”

In Taleb’s universe, the fieriest circle of hell is reserved for bankers and neoconservatives. “The best thing that could happen to society is the bankruptcy of Goldman Sachs,” he tells me. “Banking is rent-seeking of industrial proportions.” Taleb, who became rich as a derivatives trader, is not a foe of capitalism but of “cronyism”. “If you’re taking risks, God bless you. This is why I accept inequality. I’ve seen people go from trader to cab driver and back again.”

…click on the above link to read the rest of the article…

On borrowed time: America’s companies have binged on debt; a reckoning looms

The total debt of American non-financial corporations as a percentage of GDP has reached a record high of 73.3%

AMERICA’s companies have been powering ahead for years. Amid growing profits, the recession that began in 2007 seems an increasingly distant memory. Yet the situation has a dark side: companies have binged on debt. For now, as the good times have coincided with a period of record-low interest rates, markets have been untroubled. But a shock could put corporate America into trouble.

No matter how it is measured, the debt load looks worrying. When calculated as a percentage of GDP, the total debt of America’s non-financial corporations reached 73.3% in the second quarter of 2017 (the latest available data). This is a record high. Measured against earnings before interest, tax, depreciation and amortisation (EBITDA), the net debt of non-financial companies in the S&P500 hit a ratio of 1.5 at of the end of 2016, a level not seen since 2003. And it remained nearly as high in 2017 (see chart).

To be sure, things are less worrying than they were before the financial crisis. According to a recent analysis by S&P Global Ratings, a ratings agency, for example, debt is now more evenly distributed. Only 27% of American firms in 2017 were highly levered (defined as a debt-to-earnings ratio higher than five), down from 42% of firms in 2007, meaning that fewer firms are immediately at risk.

The use of the extra debt was also somewhat different. Bob Michele of J.P. Morgan reckons that in recent years much of it was used by companies to finance share buy-backs, essentially for purposes of balance-sheet management (rather than, say, big expansions or acquisitions).

Even so, certain industries look particularly vulnerable under their debt loads. David Tesher of S&P Global Ratings says that retail is the sector in America most at risk. Such companies accumulated high levels of debt after more than a decade of private-equity-sponsored activity. They must also cope with tough competition from e-commerce. Around 50 American retailers filed for bankruptcy in 2017 alone, many due to the debt piled on by their private-equity owners. The most prominent example is Toys R Us, which was acquired by a consortium of private-equity firms in 2005. In the case of Payless ShoeSource, a retailer that also went bankrupt last year, creditors argued in court filings that its private-equity owners should share the blame for its collapse; after much argument, the owners agreed to put more than $20m back into the company.

…click on the above link to read the rest of the article…

New Jersey Prepares To Raise Taxes On “Almost Everything” As It Nears Financial Disaster

Last week we noted that in what was a radical U-turn to what other public pension funds have been doing in recent years – most notably Calpers – the struggling New Jersey public pension system decided that instead of lowering its expected rate of return, it would raise it, from 7% to 7.5%.

The simple reason behind this odd increase in projected returns was an accounting sleight of hand which would allow the state of New Jersey to save some $238 million in pension contributions as a result of the higher discount rate applied to the fund’s liabilities. And with a pension funding level of only 37% for the 2015 fiscal year, the worst of any state in the US, New Jersey would gladly take even the most glaring accounting gimmickry that would delay its inevitable death.

Unfortunately, being the not so proud owner of the most distressed and underfunded public pension fund in the US is just the start of New Jersey’s monetary woes, and as Bloomberg reports, New Jersey’s fiscal situation is so dire that new Governor Phil Murphy has proposed taxing online-room booking, ride-sharing, marijuana, e-cigarettes and Internet transactions along with raising taxes on millionaires and retail sales to fund a record $37.4 billion budget that would boost spending on schools, pensions and mass transit.

The proposal which is 4.2% higher than the current fiscal year’s, relies on a tax for the wealthiest that is so unpopular it not only has yet to be approved, but also lacks support from key Democrats in the legislature, let alone Republicans. It also reverses pledges from Murphy’s predecessor, Republican Chris Christie, to lower taxes in a state where living costs are already among the nation’s highest.

Murphy, a Democrat who replaced term-limited Christie on Jan. 16, said his goal is to give New Jerseyans more value for their tax dollars; instead he plans on bleeding them dry. He has promised additional spending on underfunded schools and transportation in a credit-battered state with an estimated $8.7 billion structural deficit for the fiscal year that starts July 1.

…click on the above link to read the rest of the article…

Russia Threatens UK: “One Does Not Give 24Hrs Notice To A Nuclear Power”

On the heels of UK PM May’s red hot rhetoric and ultimatum yesterday and Germany’s pressure this morning, Russia has cranked up their response to ’11’ on the Spinal Tap amplifier of global armageddon.

Having made clear this morning that:

“We have certainly heard the ultimatum voiced in London,” Russia’s top diplomat Sergey Lavrov said.

“The spokesperson for the Foreign Ministry has commented on our attitude to this,” he added referring to Maria Zakharova branding of May’s appearance in Parliament as a “circus.”

Russia faces warning from Germany too, as Reuters reports Merkel and May spoke this morning about the nerve agent attack. Merkel condemned the attack and stated that she was “taking very seriously the British government’s view that Russia might be responsible.” Merkel then said Russia “needs to give prompt answers to the British’ justified questions.”

But then, Interfax reports Russian Foreign Ministry Spokeswoman Maria Zakharova turne dup the heat dramatically, warning (or threatening):

“One does not give 24 hours notice to a nuclear power.”

Adding that the “Skripal poisoning was not an incident but a colossal international provocation.“

Slamming the British for “not using a single international legal mechanism to probe the Skripal case.”

The Press Association reports that Russia has warned Britain to “consider the consequences” of mounting a retaliatory cyber strike after the Salisbury spy poisoning.

In a fresh sign of the escalating diplomatic tension sparked by the case, the Russian Embassy cautioned against “such a reckless move”.

…

The Government has not publicly disclosed the options under consideration but reports on Tuesday suggested one possibility was a cyber counter-attack.

Responding to the speculation, the Russian Embassy in the UK said: “Statements by a number of MPs, ‘Whitehall sources’ and ‘experts’ regarding a possible ‘deployment’ of ‘offensive cyber-capabilities’ cause serious concern.

“Not only is Russia groundlessly and provocatively accused of the Salisbury incident, but apparently, plans are being developed in the UK to strike Russia with cyber weapons.

“Judging by the statements of the Prime Minister, such a decision can be taken at tomorrow’s meeting of the National Security Council.

“We invite the British side to once again consider the consequences of such a reckless move.”

…click on the above link to read the rest of the article…

Hungarian National Bank Decides to Bring Gold Reserves Back Home

HUNGARIAN NATIONAL BANK DECIDES TO BRING GOLD RESERVES BACK HOME

The leadership of the Hungarian National Bank (MNB) has decided to bring back home Hungary’s gold reserves. Up to now, 100,000 ounces (3 tons) of the precious metal were stored in London, which is in total worth some 33 billion forint ($130 million) at current gold prices.

The decision seems to be in line with international trends as storage of gold reserves out of the country is now considered risky by more and more central banks. Austrian, German, and Dutch central banks are among those who have recently decided to repatriate their gold reserves. According to MNB, this may also further strengthen market confidence towards Hungary.

Photo: MNB.

Photo: MNB.MNB has been holding gold reserves since its foundation in 1924. Towards the end of World War II, it had been transported to Austria on the famous Gold Train, captured by the Americans, then repatriated in full in 1946. The highest amount Hungary has ever had was around 65-70 tons at the beginning of the 70s. At the end of the 1980s, however, a decision was made to decrease gold reserve to the lowest possible level and rather to invest in sovereign debts, which as a consequence of the collapse of the Bretton Woods system are considered safer, more liquid and potentially of higher yields. At the beginning of 2010 this tendency changed again and central banks started to accumulate gold as a potential response to the financial crisis.

The Largest gold reserves in the world belong to the US and Germany, while in comparison to other Central-European countries Hungary has one of the tiniest amounts of the precious metal; for instance, Romania and Poland both have 103 tons, and Serbia has 13 tons. Since 1992, Hungary’s activity has remained steady, as the MNB hasn’t bought or sold any of its gold reserves.

Russia Threatens Military Action Against US If Washington Strikes Syria

While mystery still surrounds the statement by now-former Secretary of State Rex Tillerson who on Monday – when he already knew he was fired – said that Moscow is “clearly” behind the poisoning of Russian double-agent Skripal in the UK and that the Russian action would “trigger a response”, and whether this was a tacit defiance of Trump as he no longer had anything to lose, it is clear that relations between Russia and the US, if not so much Trump, are once again at rock bottom, if not worse.

Confirming this, one week after the WaPo reported that the US is considering new military action against Syria over Assad’s alleged chemical weapons attacks (as on every other prior occasion), the Russian military threatened action against the U.S. if it strikes Syria’s capital city of Damascus. The threat, by Chief of Russia’s General Staff Valery Gerasimov, was reported by Russia media sites such as state news agencies RIA and Tass, according to CNBC.

Chief of the General Staff of the Russian Armed Forces, General Valery Gerasimov

Chief of the General Staff of the Russian Armed Forces, General Valery Gerasimov The General also said Russia had “reliable information” about militants preparing to falsify a government chemical attack against civilians. In other words, another US-false flag attack, like the one launched in 2013 which nearly caused military conflict between Russia and the US.

Gerasimov predicted that the U.S. would then use this attack to accuse Syrian government troops of using chemical weapons. He added that the U.S. would then plan to launch a missile strike on government districts in Damascus.

“In several districts of Eastern Ghouta, a crowd was assembled with women, children and old people, brought from other regions, who were to represent the victims of the chemical incident, ” Gerasimov said, according to RIA.

But far more ominously, Gerasimov said Russia would respond to a U.S. strike on Syria if the lives of Russian servicemen were threatened, targeting any missiles and launchers involved: “In case there is a threat to the lives of our military, the Russian Armed Force will take retaliatory measures both over the missiles and carriers that will use them,” the Russian General said.

…click on the above link to read the rest of the article…

Australia’s east coast solar generation is replacing coal by only 2% in late summer

This is an analysis of late summer. Data are taken from Open NEM: http://opennem.org.au/#

The graphs in this post are a bit different from those on the above website

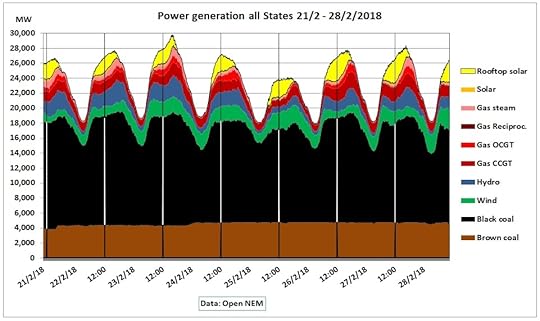

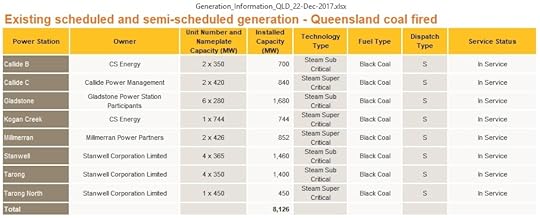

Fig 1: Generation by fuel: 55% black coal, 19% brown coal, 9% gas, 7% wind, 6% hydro, 4% solar

All times shown in NEM time. AEST is one hour later.

The vertical lines show 12:00 noon, the start of hot afternoons. Note that Feb 24th – 25th was a weekend with lower demand.

Coal

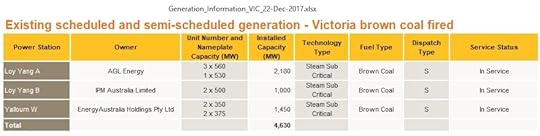

Victoria’s inflexible brown coal was running 24/7 at an average of around 4,500 MW, near to capacity of 4,630 MW. The minimum was 3,800 MW on 21/2/2018. There are problems with Loy Yang as reported by The Australia Institute: http://www.tai.org.au/gas-coal-watch Fig 2: Nameplate capacities of Victoria’s brown coal

Fig 2: Nameplate capacities of Victoria’s brown coal

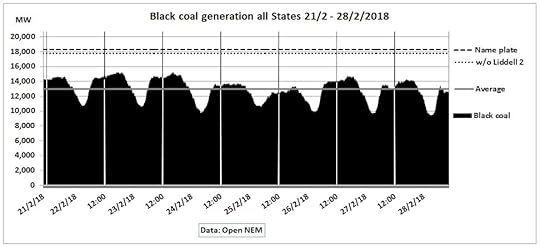

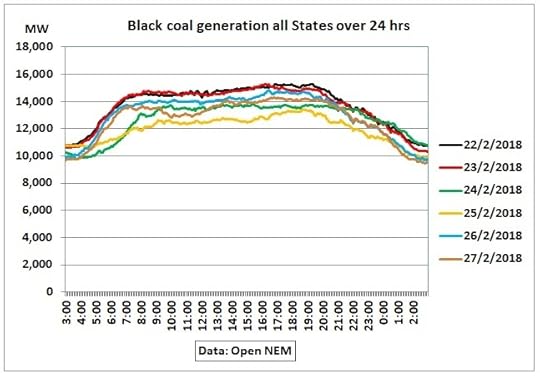

Fig 3: Black coal generation

Fig 3: Black coal generation

Black coal had an average generation of 13,000 MW, variable between a minimum of 9,400 MW (at night around 3 am, -27% down from average) and 15,300 MW (afternoon, +18% above average)

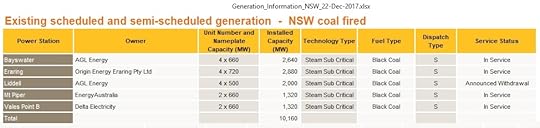

Fig 4: Nameplate capacities of NSW black coal

Fig 4: Nameplate capacities of NSW black coal

Fig 5: Nameplate capacities of Queensland black coal

During day time, black coal is less variable as shown in this graph:

Fig 6: Black coal generation over 24 hrs/6 days

Fig 6: Black coal generation over 24 hrs/6 days

Compared to 7 am power generation at 7 pm was up to 800 MW (average 500 MW) higher or around 4%-6% which is not very peaky.

…click on the above link to read the rest of the article…

Quantum Computers Will Make Even “Strong” Passwords Worthless

The race is on to perfect quantum computing. It will make your bank passwords and all existing security methods useless.

The Hutch Report has a fascinating 44-page PDF on Quantum Computing.

If perfected, existing methods of encryption will cease to work. Your bank account password and passwords to cryptocurrencies will easily be hackable.

The ability to break the RSA coding system will render almost all current channels of communication insecure.

This is a national security threat.

The benefits are also huge: Quantum computers will be superior at hurricane detection, airplane design, and in searching DNA for markers to help find cures for diseases such as Autism, Alzheimer’s, Huntington’s, and Parkinson’s.

Classical Computers

Classical computers use strings of 0’s and 1’s with a single digit a “bit” and strings of bits a “byte”. A bit is either a one or a zero.

Excerpts from the Hutch report now follow. I condensed 44 pages to a hopefully understandable synopsis of the promise and problems of quantum computing.

Quantum Background

Quantum computing does not use bits, but uses qubits which can be one, zero, or both zero and one at the same time. This state or capability of being both is called superposition. Where it gets even more complex is that qubits also exhibit a property called entanglement. Entanglement is an extraordinary behaviour in quantum physics in which particles, like qubits, share the same state simultaneously even when separated by large distance.

As comparison a classic computer using bits of zero and one can only store one state at a time and can represent 2n states where n is the number of bits. In the case of two bits, this would be 2*2 which is four states: 00, 01, 10, 11.

A normal computer would require four operations to examine each state. Two qubits could store the four states at one time. When the number of states are low there is not a major processing difference. As the number of possible state combinations increases, the difference in processing time between quantum computers using qubits and a classic computer using classic bits, increases exponentially. The following chart depicts this well showing that 20 qubits can represent simultaneously over 1 million permutations of classical bits.

…click on the above link to read the rest of the article…

The Limits of Free Markets, Both Economic and Intellectual

Both in economics and speech, the market is a powerful metaphor. Free economic markets are efficient, and produce the greatest good for the greatest number of people by the fair interplay of sellers and buyers. The marketplace of ideas is supposed to produce truth, and maximize free inquiry of ideas through the competition or rival ideas. Both marketplaces are supposed to support contrasting forms of individual freedom. Except the truth is that neither work in practice compared to theory, fixing their externalities and preventing one from corrupting the other is challenge and task of contemporary western politics.

The market is a metaphor of modern western politics. Belief in the efficiency of economic free markets dates at least to Adam Smith’s 1776 The Wealth of Nations. For some economists, free markets maximize individual freedom producing both what is called Pareto efficiency (no one can be made better off without someone being made worse off) and Kaldor-Hicks efficiency (overall greatest net wealth for a society). Government regulation interferes with economic markets, damaging both individual freedom and both forms of efficiency. Market fundamentalism in the guise of contemporary Republican or neo-liberal politics, ascribes to this belief.

Yet there are limits to this economic market fundamentalism. The same Adam Smith who wrote The Wealth of Nations also penned The Theory of Moral Sentiments and argued how economic markets are circumscribed by ethical values and virtues. The Wealth of Nations in book five recognizes an important role for the government investing in infrastructure. Later on, other economists have described unregulated markets as producing externalities such as pollution or monopolies. Others see externalities to include the mal-distributions of wealth and income in the world or racial and gender discrimination. Economic markets are also plagued by problems such as free riders or collective goods. These problems necessitate government action. Even Milton Friedman recognized the need of the government to enforce the rules of the marketplace against force and fraud so that it would work properly.

The point is markets are not architectonic. Markets are not inherently self-regulating or natural. Karl Polany’s 1944 The Great Transformation made this point. It took enormous state power to construct and maintain market capitalism. The logic of both capitalism and human nature is often against free markets, wanting to produce collusion, monopolies, or engage in rent-seeking behavior or political action to favor oneself. Pure self-interest left on its own, as Nobel Prize economist Kenneth Arrow pointed out, cannot be aggregated to produce collective goods for a society.

…click on the above link to read the rest of the article…

Are We Nearly There Yet? Employment, Interest Rates and Inflation

Rising interest rates and inflation are spooking financial markets

Unemployment data suggests that labour markets are tight

Central Banks will have to respond to a collapse in the three asset bubbles

There are two factors, above all others, which are spooking asset markets at present, inflation and interest rates. The former is impossible to measure with any degree of certainty – for inflation is in the eye of the beholder – and the latter is divergent depending on whether you look at the US or Japan – with Europe caught somewhere between the two extremes. In this Macro Letter I want to investigate the long term, demand-pull, inflation risk and consider what might happen if stocks, bonds and real estate all collapse in tandem.

It is reasonable to assume that US rates will rise this year, that UK rates might follow and that the ECB (probably) and BoJ (almost certainly) will remain on the side-lines. An additional worry for export oriented countries, such as Japan and Germany, is the protectionist agenda of the current US administration. If their exports collapse, GDP growth is likely to slow in its wake. The rhetoric of retaliation will be in the air.

For international asset markets, the prospect of higher US interest rates and protectionism, spells lower growth, weakness in employment and a lowering of demand-pull inflationary pressure. Although protectionism will cause prices of certain goods to rise – use that aluminium foil sparingly, baste instead – the overall effect on employment is likely to be swift.

Near-term impact

Whilst US bond yields rise, European bond yields may fail to follow, or even decline, if export growth collapses. Stocks in the US, by contrast, may be buoyed by tax cuts and the short-term windfall effect of tariff barriers. The high correlation between equity markets and the international nature of multinational corporations, means global stocks may remain levitated a while longer. The momentum of recent economic growth may lead to increased employment and higher wages in the near-term – and this might even spur demand for a while – but the spectre of inflation at the feast, will loom like a hawk.

…click on the above link to read the rest of the article…