Steve Bull's Blog, page 1166

March 11, 2018

Watch: Colonel Says Israel Is Dragging the United States Into World War III

(ANTIMEDIA Op-ed) — Israel is in the process of plunging America into a war with Iran that could destroy what’s left of the Middle East and ignite a third world war, Col. Lawrence Wilkerson, former chief of staff to Secretary of State Colin Powell, warned in Washington approximately a week ago.

Wilkerson, a retired army colonel who now teaches at Washington-area universities, didn’t hold back in his critique of where the status quo is leading the United States via its client state, Israel.

At the annual Israel lobby conference at the National Press Club, sponsored by the Washington Report on Middle East Affairs and Institute for Research: Middle East Policy, Wilkerson explained that Israel is headed toward “a massive confrontation with the various powers arrayed against it, a confrontation that will suck America in and perhaps terminate the experiment that is Israel and do irreparable damage to the empire that America has become.”

One of the principal antagonists begging for a war with Iran that Wilkerson identified was none other than Avigdor Lieberman, Israel’s Russian-born Defense Minister. Wilkerson stated:

“Lieberman will speak in April in New York City at the annual conference of the Jerusalem Post. The title is, ‘The New War with Iran.’ It is clear that he’s [at] the forefront of promoting this war.

“And nowhere does my concern about such a war focus more acutely at the moment than Syria. As [the] president of France Emmanuel Macron described it recently, ‘The current rhetoric of the U.S., Saudi Arabia, and Israel is pushing the region toward conflict with Iran.’”

Despite Prime Minister Benjamin Netanyahu’s incessant denigrations of Iran, including claiming the greatest danger facing the Jewish state is the Islamic republic — a country he accuses of fanning the flames of anti-Semitism — Wilkerson blew these accusations out of the park using simple logic. He said:

…click on the above link to read the rest of the article…

The Global Economy’s Wile E. Coyote Moment

Economies and markets may already be plunging off a cliff.

Always behind.

Photographer: Justin Sullivan/Getty Images

Our prediction last year of a global growth downturn was based on our 20-Country Long Leading Index, which, in 2016, foresaw the synchronized global growth upturn that the consensus only started to recognize around the spring of 2017.

With the synchronized global growth upturn in the rearview mirror, the downturn is no longer a forecast, but is now a fact.

The chart below shows that quarter-over-quarter annualized gross domestic product growth rates in the three largest advanced economies — the U.S., the euro zone, and Japan — have turned down. In all three, GDP growth peaked in the second or third quarter of 2017, and fell in the fourth quarter. This is what the start of a synchronized global growth downswing looks like.

Still, the groupthink on the synchronized global growth upturn is so pervasive that nobody seemed to notice that South Korea’s GDP contracted in the fourth quarter of 2017, partly due to the biggest drop in its exports in 33 years. And that news came as the country was in the spotlight as host of the winter Olympics.

Because it’s so export-dependent, South Korea is often a canary in the coal mine of global growth. So, when the Asian nation experiences slower growth — let alone negative growth — it’s a yellow flag for the global economy.

The international slowdown is becoming increasingly obvious from the widely followed economic indicators. The most popular U.S. measures seem to present more of a mixed bag. Yet, as we pointed out late last year, the bond market, following the U.S. Short Leading Index, started sniffing out the U.S. slowdown months ago. Specifically, the quality spread — the difference between the yields on junk bonds and investment-grade corporate bonds — has been widening for several months.

…click on the above link to read the rest of the article…

March 10, 2018

US Still Pouring Massive Supply of Weapons Into War-Torn Yemen

(ANTIWAR.COM) — Three years into the 2015 Saudi-led invasion of Yemen, untold thousands are dead. Northern Yemen has been through the worst cholera outbreak in human history, and civilians continue to die in bunches from Saudi airstrikes against the region.

To call Yemen war-torn is really putting it mildly. Yemen is in a disastrous state, with a Saudi-led naval blockade threatening to starve millions. If there’s one thing Yemen has no shortage of, however, it’s weapons, with the US ensuring a massive supply continues to pour into the hands of Saudi and Emirati forces.

US arms sales are themselves at a record high during this war, in no small part because of purchases by the United Arab Emirates, and particularly by the Saudis, who are dropping US bombs on northern Yemen as fast as they can buy them.

And while bombs and warplanes are the big dollar amount of sales, they also include large numbers of US-made automatic rifles and small arms ammunition. The UAE is particular bought $60 million in small arms in 2016 alone, both for their own direct involvement in Yemen and to arm their allied factions on the ground. The Saudis bought another $11 million.

Yemen isn’t a place to send weaponry that you want well-documented and carefully tracked, either. The Pentagon has confirmed they can’t account for about $500 million more in weapons that they’d given to the Hadi government up to 2015.

So the Saudi and UAE-bought small arms are being sent to Yemen to replace those “lost” weapons, but it’s not as if those weapons literally disappeared. Rather, they’re just not in the hands of officials, or at least not in any above-board way. That’s virtually certain to be the fate of this new influx as well.

…click on the above link to read the rest of the article…

Pollution, Invasive Aliens, & Mass Extinction: 20,000 Scientists ‘Warn Humanity’ The End Is Nigh

A wave of nationalist/populist/anti-globalization, record high debt, nuclear doomsday clock at its highs, soaring financial leverage, and now trade wars.

If the world did not have enough to worry about, 20,000 scientists have a few more reasons to believe ‘the end is nigh’…and President Trump is not to blame for any of it (yet).

A dire warning to the world about its future, predicting catastrophe for humanity, continues to gain momentum, becoming one of the most discussed pieces of scientific research ever.

As The Independent reports, the new letter was actually an update to an original warning sent from the Union of Concerned Scientists that was backed by 1,700 signatures 25 years ago. It said that the world had changed dramatically since that warning was issued – and almost entirely for the worse.

Mankind is still facing the existential threat of runaway consumption of limited resources by a rapidly growing population, they warn; and “scientists, media influencers and lay citizens” aren’t doing enough to fight against it.

If the world doesn’t act soon, there will be catastrophic biodiversity loss and untold amounts of human misery, they wrote.

The lead author of the warning letter and new response paper, ecology Professor William Ripple, from Oregon State University, said: “Our scientists’ warning to humanity has clearly struck a chord with both the global scientific community and the public.”

* * *

World Scientists’ Warning to Humanity: A Second Notice

The “second notice” clearly charts the environmental degradation in the past quarter-century and notes that only one out of nine areas assessed, the ozone layer, has improved.

…click on the above link to read the rest of the article…

The Everything Bubble—Waiting For The Pin

Yesterday we noted that financial markets have become completely uncoupled from reality and that the recent feeble bounces between the 20-day and 50-day chart points were essentially the rigor mortis of a dead bull. As it happened, we were able to share those sentiments with what remains of CNBC’s audience of carbon-based units:

As we also noted as per the chart point mavens, the 20-day average down at 2703 (red line) on the S&P 500 was supposed to represent “support” while the 50-day average (blue line) purportedly functioned as “resistance”.Well, upon the official announcement of the Donald’s lunatic trade war, there she sat at yesterday’s close—less than one point under the 50-day moving average at 2739.8 (blue line).

But rather than “resistance”, which the raging robo-machines ripped through today like a hot knife through butter, we’d say the blue line represents the last frontier of sanity. That’s because a stock market trading at 25X earnings under today’s baleful circumstances is nothing less than a brobdingnagian bubble (i.e. a huuuge one) frantically searching for the proverbial pin.

We essay the razor sharp aspects of the pin below, but suffice it to say here that the cyclical calendar has just plain run out of time. It is way, way too late in the cycle at 105 months of age to be “pricing-in” anything except the end of the party. And this bubblicious party has embodied the most spectacular central-bank fueled mania yet—meaning that the morning after is going to bring a truly hellacious hangover.

Among the many sharp edges of the pin are these:

1) the virtual certainly of a recession within the next two years and a typical 30%-50% drop in earnings;

…click on the above link to read the rest of the article…

Japanese Bubble Bursting Playbook

Every now and then I stumble across a new source of information that I can’t wait to share with my readers. Today is one of those days. If you have even the tiniest shred of interest in commodities, then head over to the Goerhring & Rozencwajg website immediately. It’s just terrific stuff.

I must admit to being partial to their bullish commodity story, but in a recent RealVision TVinterview, Leigh Goehring solved a problem that I have wrestled with for some time.

What if China rolls over?

We all know the China bear story. For the past couple of years, famed China skeptics like Jim Chanos (FT Article – “China:market bulls beat the short sellers – for now”) and Kyle Bass (Reuters Article – “China credit bubble ‘metastasizing’”) have been warning about a China credit bubble implosion. Although I am hopeful that China will avoid the apocalyptic scenario they paint, there is a little part of me that worries when I am betting against Chanos.

Chanos might have lost the Tom Selleck mustache (and in the process, given away a fair amount of his hipster cred), but I hate being on the other side of his trade. I am pretty sure God has an account at Kynikos Accociates. They are simply that good.

So I have always struggled with being long commodities in the face of a potential China credit implosion. After all, China is the world’s largest importer and user of commodities, a slowdown would be catastrophic for commodities, right?

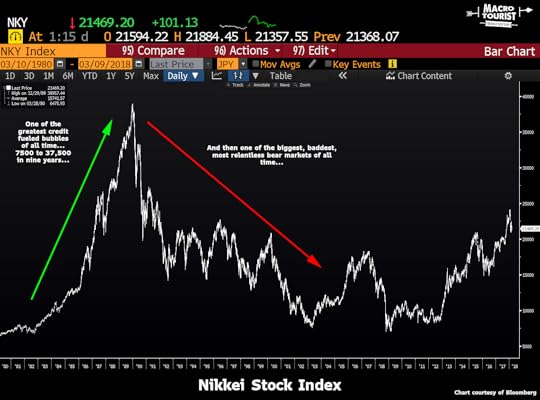

Not so fast. As Leigh Goehring so aptly notes, a great analogy for a potential China credit crisis would be the Japanese credit collapse of 1990.

There can be no denying that in the wake of the Japanese bubble bursting, their economy suffered a credit contraction that rivals the world’s greatest slowdowns. Given this horrible setback, it would be logical to conclude that Japan’s commodity usage suffered a similar contraction.

…click on the above link to read the rest of the article…

$21 Trillion And Rising: How Central Banks Are LBOing The World In One Stunning Chart

Back in late 2016, we showed the unprecedented domination of capital markets by central banks using a chart from Citi, which had put together a fascinating slideshow asking simply “Where is the utility in marginal QE” and specifically pointing out that the longer unconventional monetary policy such as QE continues, the bigger its marginal cost, until eventually QE becomes a detriment.

A broad criticism of monetary policy, the presentation carried an amusing footnote: “This presentation does not change any of Citi’s existing, published views on the actual future path of monetary policy. It is merely intended as a contribution to the ongoing debate about the efficacy of available policy tools” – after all, the last thing the market wanted is the realization that even banks no longer have faith in the central planners.

Incidentally, Citi’s broad critique of global QE took place when central banks owned just over $18 trillion in assets.

Fast forward to today when in its latest update of central bank holdings, Citi shows that as of this moment not only has the total increased by another $3 trillion to a grand total of $21 trillion and rising, but that the big six central banks now own over 40% of global GDP, more than double the 17% they held before the financial crisis less than a decade ago.

Which is remarkable in a world where there is still some confusion about what is behind the “global coordinated recovery”, and where there are deluded people who claim that central banks are now out of the picture.

It is also remarkable because now that central banks are gradually phasing out QE, it is the central bankers themselves who are terrified of what happens when the market starts selling; terrified that they have lost control. Recall that following stunning admission from Citi’s Hans Lorenzen last November:

…click on the above link to read the rest of the article…

Assange Lashes Out: “Hypocritical Motherf*ckers… Remember How I Exposed Your Secret Deal With The Saudis”

Wikileaks founder Julian Assange lashed out at the UK government over Twitter on Friday after Britain’s official UN account (UK Mission to the United Nations) tweeted “A free and independent media fulfils a vital role in holding the powerful to account and giving a voice to the powerless,” with a link to a puff piece waxing eloquent over the UK’s commitment to free speech.

Assange – apparently not included in the UK’s definition of “free and independent media” (facing arrest and detention should he leave the Embassy), fired off a stunning reply – claiming that the UK’s has spent roughly twice as much spying on him as it has on their entire international human rights program.

“And that is exactly why you have detained me without charge for eight years in violation of two UN rulings and spent over 20 million pounds spying on me you hypocritical mother fuckers. Your entire international human rights programme is £10.6m you pathetic frauds.”

Julian Assange

Julian Assange  @JulianAssange

@JulianAssangeAnd that is exactly why you have detained me without charge for eight years in violation of two UN rulings and spent over 20 million pounds spying on me you hypocritical mother fuckers. Your entire international human rights programme is £10.6m you pathetic frauds. https://twitter.com/UKMissionGeneva/status/972057244593479680 …

7:28 AM – Mar 9, 2018

Assange then followed up with “Remember how I exposed your secret deal to put Saudi Arabia on the Human Rights Council?” referring to a 2015 vote-trading deal in which the UK approached Saudi Arabia in secret, promising it a seat on the UN Human Rights Council in exchange for council support.

…click on the above link to read the rest of the article…

An Inflation Indicator to Watch, Part 3

“During the 1980s and 1990s, most industrial-country central banks were able to cage, if not entirely tame, the inflation dragon.”

—Ben Bernanke

Ben Bernanke began his oft-cited “helicopter speech” in 2002 with a few kind words about his peers, including the excerpt above. Speaking for central bankers, he took a large share of the credit for the low inflation of the 1980s and 1990s. Central bankers had gained a “heightened understanding” of inflation, he said, and he expected the future to bring even more inflation-taming success.

Of course, Bernanke’s cohorts took a few knocks in the boom–bust cycle that followed his speech, but their reputations as masters of inflation (and deflation) only grew. Today, the picture he painted seems even more firmly planted in the public mind than it was in 2002, notwithstanding recent data showing inflation creeping higher.

Public perceptions aren’t always accurate, though, and public figures aren’t the most reliable arbiters of credit and blame. In this 3-part article, I’m proposing a theory that challenges Bernanke’s narrative, and I’ll back the theory with data in Part 3. I’ll show that it leads to an inflation indicator with an excellent historical record.

But first, let’s recap a few points I’ve already discussed.

The Endless Tug-of-War

In Part 2, I said inflation depends on a tug-of-war between purchasing power (on the demand side) and capacity (on the supply side), and the war takes place within the circular flow, in which spending flows into income and income flows back to spending. Two circular-flow patterns and their causes demand particular attention:

When banks inject money into the circular flow in the process of making loans, they can boost spending above the prior period’s income, thereby fattening the flow (or the opposite in the case of a deleveraging).

…click on the above link to read the rest of the article…

The Collapse of Venezuela Was “a systematic destruction to seize our freedom”

Editor’s Note: As we begin to become more concerned about the possibility of our own economic collapse, it’s important to see what has happened in other countries. Today, Jose explains how the collapse of Venezuela was deliberately engineered to make the populace bend to the will of a dictatorship. It didn’t happen all at once and most people never saw it coming until it was too late, and they were starving, oppressed, and dying. ~ Daisy

In this article, I would like to expose how this government-induced collapse has affected the psychological health of the population. And I would like to make special emphasis on the word induced. The nature of the corruption cases has been so large, and the damage to our economy has been so wide, with such devastating effects, that there is no any doubt that this could never have been generated by ignorance, lack of the needed aptitudes and skills, or plain and simple negligence, nor combination of all these factors.

This was a systematic destruction of our institutions, our government structure, and way of life, to allow the government, against the will of the people, to seize our freedom and our democratic system.

What is a crisis?

Let’s formally define what a crisis is.

A harmful, hazardous situation lived by a person or community as a consequence of an unexpected and sudden change in their living conditions. This situation is a threat to their welfare; physical integrity, social and economic stability, and the usual way to face adversity.

…click on the above link to read the rest of the article…