Steve Bull's Blog, page 1167

March 10, 2018

For Two Months, I Got My News From Print Newspapers. Here’s What I Learned.

I tried to skip digital news for a while. My old-school experiment led to three main conclusions

Photo: Doug Chayka/The New York Times

I first got news of the school shooting in Parkland, Florida, via an alert on my watch. Even though I had turned off news notifications months ago, the biggest news still somehow finds a way to slip through.

But for much of the next 24 hours after that alert, I heard almost nothing about the shooting.

There was a lot I was glad to miss. For instance, I didn’t see the false claims — possibly amplified by propaganda bots — that the killer was a leftist, an anarchist, a member of ISIS and perhaps just one of multiple shooters. I missed the Fox News report tying him to Syrian resistance groups even before his name had been released. I also didn’t see the claim circulated by many news outlets (including The New York Times) as well as by Sen. Bernie Sanders and other liberals on Twitter that the massacre had been the 18th school shooting of the year, which wasn’t true.

Instead, the day after the shooting, a friendly person I’ve never met dropped off three newspapers at my front door. That morning, I spent maybe 40 minutes poring over the horror of the shooting and a million other things the newspapers had to tell me.

Not only had I spent less time with the story than if I had followed along as it unfolded online, I was better informed, too. Because I had avoided the innocent mistakes — and the more malicious misdirection — that had pervaded the first hours after the shooting, my first experience of the news was an accurate account of the actual events of the day.

…click on the above link to read the rest of the article…

Fourth Turning’s Neil Howe: “Today’s Demographics Defy Conventional Wisdom”

John Mauldin interviewed Fourth Turning best-selling author and demographics expert, Neil Howe about generational changes and their effect on the markets, during a session at the Strategic Investment Conference 2018. Howe said that demographics and generational factors have a huge impact on equity prices in the long run. Not only that, he thinks that there’s now a generational shift in wealth distribution that could spark major political and economic disruption.

Today’s Demographics Defies Conventional Wisdom

The main example Howe shared is that people in the 75+ age bracket still dominate stock ownership by far. This defies conventional wisdom that people reduce risk as they retire and leave the workforce. Meanwhile, Millennials have lower income and stock ownership levels than previous generations did at the same age.

This is a key change as senior adults once had the highest poverty rates. Younger people are now challenging that once-safe assumption.

Neil Howe

Neil HoweHowe also pointed out striking differences between early and late Baby Boomers. Those born in the mid/late 1940s inherited some of the Silent Generation’s wealth and good fortune. Late-stage Boomers born in the early 1960s score lower in all kinds of metrics.

Major Political and Financial Disruption Is Ahead

Neil Howe ended with an update on his Fourth Turning generational theory. He thinks we are about midway through it. From an economic standpoint, he foresees inflation fear and Fed tightening, which will be followed by a painful recession.

Politically, Millennials desperately want civic re-engagement. They are seeking to completely restructure institutions. The right wing is a brick wall on this subject and numbers have let them hold off the pressure so far. This will change as Millennials grow older and Boomers die.

…click on the above link to read the rest of the article…

Still None, and Even More Reasons to Expect None

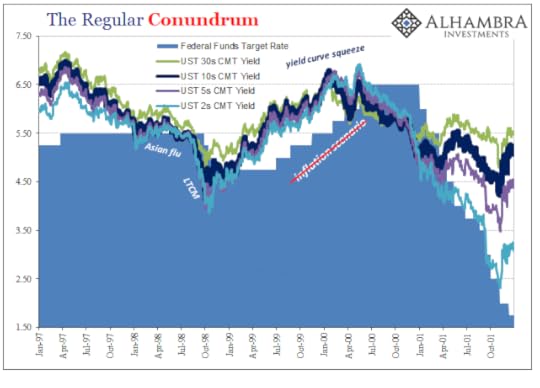

The parallels between the last few years and those at the end of the 1990’s are striking. There was a few years ago the monetary intrusion of the “rising dollar” which at its worst seriously depressed the global economy. Oil prices crashed, as did several key currencies, and deflationary pressures that often accompany a significant downturn were manifest.

Starting in 1997, there was all of that, too. Oil prices though much lower to begin with were crushed, overseas the “dollar” “rose”, and currency problems were everywhere particularly in Asia (Japan both times, China only the later). And there were asset bubbles in both.

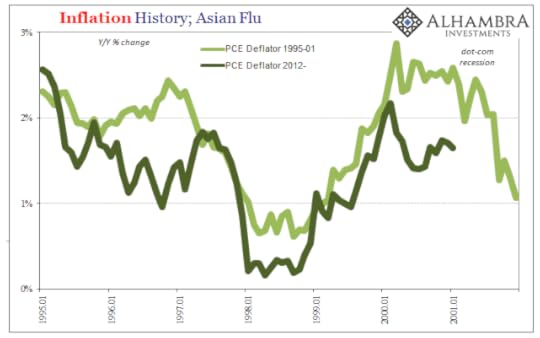

In terms of consumer price inflation, the similarities did not end. In 1999, the Federal Reserve having failed to account for the reasons behind the Asian flu began to act in anticipation of rising inflation. Ignoring bond market warnings, as Economists always do, the Fed took the excuse of oil price effects and their impacts on consumer price indices as justification.

Raising rates throughout 1999 and 2000, the central bank was eventually stopped by the collapse of the dot-com bubble and the deflationary pressures of recession as well as finance it did not foresee even though the bond market had been trading against them all along. Inflation, as a necessary consequence, fell back, too.

At its apex, the PCE Deflator in early 2001 reached a high of 2.87% and went no further. What was missing from the episode was every indication of broad-based consumer price inflation that might have suggested their concerns over acceleration or related imbalance. The so-called core rate never really moved all that much, indicating that oil prices off the 1999 lows were entirely responsible for the rise in the rate (WTI was up more than 60% year-over-year when the PCE Deflator registered that 2.87%).

…click on the above link to read the rest of the article…

March 9, 2018

The Amazing Amount of Gold The U.S. Exported Since 2000

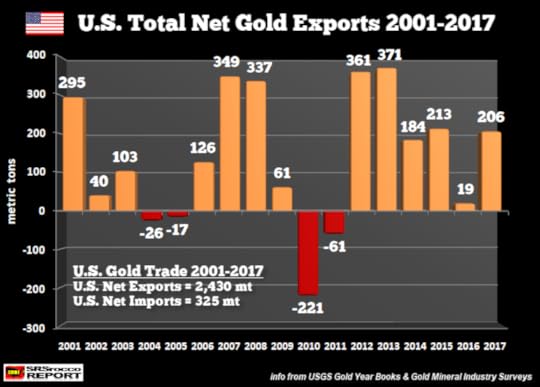

The U.S. exported a stunning amount of gold since the turn of the century. As the price of gold surged along with the massive increase in U.S. debt, gold exports jumped to record highs. In 2012 alone, the United States exported nearly 700 metric tons of gold. The total amount of U.S. net gold exports over the past 17 years equaled the combined gold reserves of six high ranking countries.

While the U.S. exported nearly 8,000 metric tons (mt) of gold since 2001, it also imported a great deal as well. Thus, we arrive at a “net export” figure by subtracting gold imports from gold exports. During the past 17 years, there were only four years where the U.S. imported more gold than it exported. These net gold import years were in 2004-2005 and 2010-2011 and totaled only 322 mt.

However, U.S. gold net exports were the mainstay as a staggering 2,340 mt of gold were shipped abroad. If we look at the chart below, U.S. gold net exports picked up during the 2007-2008 U.S. Housing and Investment Banking collapse:

From 2012 to 2017, U.S. net gold exports totaled 1,354 mt or 43.5 million. That’s one heck of a lot of gold. Of course, the United States produces a lot of gold, 210-225 mt annually, however, domestic demand consumes a large percentage of that amount.

Now if we compare U.S. net gold exports versus the official reserves at top-ranking countries, the number turns out to be quite large. The combined official gold holdings of the U.K., Saudi Arabia, Portugal, Taiwan, European Central Bank and India of 2,512 mt is about the same amount of U.S. net gold exports (2,430 mt) from 2001 to 2017. Moreover, Italy (2,452 mt) and France (2,436 mt) which rank 4th and 5th respectively in official world gold reserves, are approximately the same amount of U.S. net gold exports during the same period (official gold reserves: source, World Gold Council).

…click on the above link to read the rest of the article…

Is There a Method to the Socratic Madness?

Bear with me, and let’s together consider a scenario: Imagine one day you wake up, turn on the TV, and there is complete pandemonium. The news has just broken that the Trump administration has set up military tribunals; arrested hundreds of members of both political parties; arrested thousands of others outside government; renditioned George Soros; captured Edward Snowden; and seized Hillary Clinton, Bill Clinton, Barry Obama, and John McCain and charged them with treason. Additionally, imagine many of those arrested are charged with child trafficking for sex or organ harvesting, for drug trafficking, and for undermining the sovereignty of the United States. How would the populace react? How would the liberals react? How would the MSM characterize it? Imagine the totality of it.

I think there would be complete chaos. Society would be at the point of coming to a complete standstill, or a revolution, or a societal breakdown.

Most likely, the MSM would be in a full informational warfare stance. They would be characterizing these sweeping actions as dictatorial. They would say that President Trump had arrested the opposition, had lost his mind, was acting extra-Constitutionally, and had directed Sessions to fabricate evidence.

The Democrat Party, certainly, would be saying that Trump had become mentally unstable, that the “resistance” movement must rise up, that people must demand that their Congressmen must remove Trump from the Presidency, and they would basically call for riots.

If anyone arrested was a Republican, like John McCain or Lindsey Graham, the Republicans as well might call for Trump to be removed. The cancer of corruption, treason, selling out America and the Deep State collusion might have spread throughout the Congress.

…click on the above link to read the rest of the article…

Inventory your stored food

One of the chores you can do in the winter season is to inventory your stored food. Whether it’s dehydrated, canned or frozen, it all has an expiration date.

I always start my inventory with frozen things, since they have the shortest shelf life. I don’t have a lot of this sort of storage, since I like to keep the amount of frozen things below what I can can immediately if there is an extended power outage – for whatever reason. You’ve been labeling everything so you know how old it is, right?

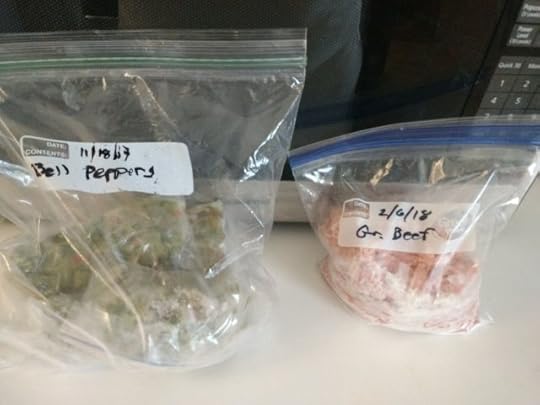

Individual portions of chopped bell peppers from 2017’s garden, and ground beef, labeled for the freezer.

Individual portions of chopped bell peppers from 2017’s garden, and ground beef, labeled for the freezer.

Clean out the entire freezer and change the box of baking soda that pulls odors from the freezer. Set the items you need to use up right away into the refrigerator, and plan your next few meals around them. IMPORTANT. When in doubt about freezer burn, cook the ingredients separately and see how it tastes before adding it to any other ingredients. That way, if it tastes “off ” you only throw away that one item.

Next are the home-canned goods. I keep mine in the dining room, under a side table. It’s cooler near the floor and that means they keep longer in my hot climate than in the pantry.

The clipboard at the start of this post is several pages long, and when I use something up, I note it on the clipboard. When I do my inventory, I put anything that needs to be used up soon on the kitchen counter and use those until they’re gone. NOTE: If you still have a lot of something, then don’t plant as much the next year. If you ran out, plant and can more of it. IMPORTANT: bulged and leaking home-canned goods can kill you.

…click on the above link to read the rest of the article…

The Illusion of War Without Casualties

America’s wars in the post-9/11 era have been characterized by relatively low U.S. casualties, but that does not mean that they are any less violent than previous wars, Nicolas J.S. Davies observes.

Last Sunday’s Oscar Awards were interrupted by an incongruous propaganda exercise featuring a Native American actor and Vietnam vet, featuring a montage of clips from Hollywood war movies.

Coffins of dead U.S. soldiers arriving at Dover Air Force Base in Delaware in 2006. (U.S. government photo)

The actor, Wes Studi, said that he “fought for freedom” in Vietnam. But anyone with even a rudimentary understanding of that war, including for instance the millions of viewers who watched Ken Burns’ Vietnam War documentary, knows that it was the Vietnamese who were fighting for freedom – while Studi and his comrades were fighting, killing and dying, often bravely and for misguided reasons, to deny the people of Vietnam that freedom.

Studi introduced the Hollywood movies he was showcasing, including “American Sniper,” “The Hurt Locker” and “Zero Dark Thirty,” with the words, “Let’s take a moment to pay tribute to these powerful films that shine a great spotlight on those who have fought for freedom around the world.”

To pretend to a worldwide TV audience in 2018 that the U.S. war machine is “fighting for freedom” in the countries it attacks or invades was an absurdity that could only add insult to injury for millions of survivors of U.S. coups, invasions, bombing campaigns and hostile military occupations all over the world.

Wes Studi’s role in this Orwellian presentation made it even more incongruous, as his own Cherokee people are themselves survivors of American ethnic cleansing and forced displacement on the Trail of Tears from North Carolina, where they had lived for hundreds or maybe thousands of years, to Oklahoma where Studi was born.

…click on the above link to read the rest of the article…

Beyond Supply and Demand: The Dynamic Equilibrium Between Global Thresholds and Allocations

As a monetary adviser, I spent many years questioning bankers on the authenticity of their balances sheets. What stood out most for me in these discussions was this: the social demand for commodities is often claimed by banks as having a direct link with the ecological supply of resources which are extracted, produced and sold as commodities. But this just isn’t true. Bank reserve assets are not discounted to reflect the decline of the world’s non-renewable resources. In fact, as society’s ecological debt continues to mount, no one is actually keeping track.

Consider how odd this is: the demand for goods is used as a proxy for the relative accessibility of non-renewable resources — yet the increasing scarcity of fossil fuels isn’t showing up in the price we pay at the gas pump. Same with water and rare minerals, which are not valued according to their declining availability. Nor does eco-value appear on the spreadsheets of most stock traders, insurance companies or other businesses.

What’s causing such rampant misreporting and misallocation? I’ve come to see this now as more a problem of accountability than accounting. Frankly, the challenge is to admit our mistakes and reconceptualize the modern system of economic valuation, starting with the theory that it’s based on a fundamental law of equilibrium. Take, for example, Adam Smith’s idea that the efforts of individuals in pursuing their own interests naturally benefit society, or the notion that an organic circular flow exists between market prices and people’s incomes. Are these assumptions valid? And what do we mean by economic balance? Is it a principle of physics or biology?

…click on the above link to read the rest of the article…

Spooked by Quakes, Oklahoma Toughens Fracking Rules

Canadian regulators stick with less stringent regulations despite growing risks from mega-fracking.

Across North America, fracking-caused earthquakes have led to public concern and protests. Photo by ProgressOhio, Creative Commons licensed.

Across North America, fracking-caused earthquakes have led to public concern and protests. Photo by ProgressOhio, Creative Commons licensed.After swarms of earthquakes caused by hydraulic fracturing, Oklahoma has introduced tougher regulations than those used by any Canadian energy regulator.

Last month the Oklahoma Corporation Commission ordered all drillers to deploy seismic arrays to detect ground motion within five kilometres of hydraulic fracturing operations over a 39,000-square-kilometre area in the centre of the state.

The commission, which regulates the industry, also lowered the minimum level of earthquakes at which operators must change practices from the current 2.5 magnitude to 2.

In addition, frackers must suspend their operations immediately for up to six hours after causing a 2.5 magnitude earthquake which can be felt at the surface.

The commission created the new earthquake protocol after hydraulic fracturing operations set off more than 70 earthquakes of at least 2.5 magnitude since 2016.

Canada’s energy regulators only make companies stop operations if they cause a magnitude 4 earthquake.

The Alberta Energy Regulator (AER), for example, doesn’t shut down an operation until it causes a magnitude 4 event. Even then the halt is temporary.

British Columbia’s Oil and Gas Commission requires operators “to immediately report” seismic events greater than magnitude 4 or unusual ground motion experienced by people within three kilometres of their operations.

In an attempt to reduce seismic activity, once thought to be solely caused by waste water injection, Oklahoma shut down wells and ordered the reduction of fluid volumes in 700 waste water disposal wells by 800,000 barrels per day between 2014 and 2015.

They also stipulated that if a waste water injection site triggered a 3.5 magnitude quake, it had to shut down operations.

…click on the above link to read the rest of the article…

U.S. Oil Rig Count Falls As Gas Rig Count Soars

Baker Hughes reported another 3-rig increase to the number of oil and gas rigs this week.

The total number of oil and gas rigs now stands at 984, which is an addition of 216 rigs year over year.

Despite the overall increase, the number of oil rigs in the United States decreased by 4 this week, for a total of 796 active oil wells in the US—a figure that is 179 more rigs than this time last year. The number of gas rigs rose by 7 this week, and now stands at 188; 37 rigs above this week last year.

The oil and gas rig count in the United States has increased by 60 in 2018.

Canada continued its losing streak, with a decrease of 29 oil and gas rigs for the week. Canada now has fewer rigs than it did a year ago.

Despite multiple bearish events this week, oil prices managed to climb, buoyed in part on Friday by positive job reports and reports about a possible meeting between President Donald Trump and North Korea’s leader, Kim Jong Un.

Neither the threat of steel tariffs—which some analysts opine could increase pipeline and other oil infrastructure costs—nor US crude oil production, which rose again in the week ending March 2nd to 10.369 million bpd, according to the EIA were able to keep oil prices down.

At 11:45 am EST, the price of a WTI barrel was resilient, trading up $1.72 (+2.86%) to $61.84—a significant increase from last week’s prices. The Brent barrel was also trading up on the day, by $1.76 (+2.77%) to $65.37.

Alaska, Louisiana, New Mexico, Oklahoma, and Utah all lost rigs this week, with Texas adding 7 rigs for a total of 490 active rigs—an increase of 98 over this time last year.

At 1:09pm EST, both benchmarks had lost some ground, with WTI trading at $61.77 (+$1.65) and Brent trading at $65.13 (+$1.52).

…click on the above link to read the rest of the article…