Marina Gorbis's Blog, page 1249

September 18, 2015

What Do You Do When Employees Start Using a Free Cloud Service?

What do you do as CIO when people in your company start using a free cloud service that’s better than the similar service you deployed for them at great expense? For example, what if your employees are spending time on a Jive social platform because it’s faster and easier to use than the solution you proudly put into place last year?

You could ban the cloud service or severely restrict their access to it. Or you could take the more open-minded approach used at IBM, itself a leading provider of cloud services. IBM gives employees broad scope to access cloud resources for nonsensitive data and application use.

But that’s not the end of the story. Through its Digital IBMer initiative, the company provides IT-policy training that guides employees to a detailed understanding of cloud risks and policies and ultimately ensures a high degree of security. IBM provides a paradigm for what other companies should be doing.

Use of cloud services that aren’t officially sanctioned by companies — shadow IT, as some people call it — is growing quickly. The average company now uses 923 distinct cloud services, such as Amazon Web Services, Microsoft’s Azure, Office 365, Salesforce, Box, and Yammer. Use of these services grew 21.6% in 2014, reports cloud-security firm Skyhigh Networks, which tracks 17 million users and 10,000 cloud services worldwide. Some 90% of companies’ cloud activity is attributable to individual employees and small teams, rather than corporations’ business-technology groups.

The security of these services is an issue: The vast majority (90%) of cloud services don’t encrypt data at rest (as opposed to in transmission), only 15% support multifactor authentication, and even fewer (6%) are ISO certified, says Skyhigh CEO Rajiv Gupta. (ISO 27001 was created in 2013 to ensure that security risks and threats to the business are assessed and managed, that physical security processes such as restricted access are enforced consistently, and that audits are conducted regularly.)

Because it’s so difficult to monitor and regulate employees’ use of file-sharing sites and other cloud services, many CIOs simply ignore the whole issue. Which is exactly what I did when, as “CIO” of my home, I recently tried to figure out whether and how to limit my kids’ internet access. It had been necessary for me to install a new operating system after they had picked up viruses while accessing sites that gave them clues on how to progress in their online games. Just like employees of your company, my kids are opportunistic: If they find a cloud service that provides something they want, they use it, without investigating. I wondered: Should I lock them down completely? Should I restrict them to trusted sources? If so, how? One option would have been to limit the router to addresses I knew. But their friends were telling them about new sites every day, and I wouldn’t have been able to keep up.

In the end I took a hands-off approach, hoping their common sense would limit any risky fringe behavior on game and media sites that I’d never heard of. Some of the sites they access are fine. But the risks are definitely out there.

Which is why companies can’t afford to be as hands-off as I am. Cloud services have become important productivity tools, driving cost savings and enhanced flexibility, but their unrestricted use not only opens a door for infiltrators to get into the company’s data, it also can provide a channel for that information to be extracted. In one company, after an employee had left, an audit showed that the individual had uploaded 4.5 gigabytes of files to Kanbox, a personal-cloud-storage solution recently acquired by Alibaba and hosted in China. In another company, an employee uploaded 48.7 gigabytes in a single day to RyuShare, from where the data was sent to a drop zone in another country. In yet another company, an employee uploaded sensitive programming to SourceForge, an open-source code repository that anyone can access.

IBM’s approach is to support employees’ use of cloud services, guide employees in product procurement and, in tandem, provide legal assistance to help employees understand the potential problems behind a cloud service’s terms and conditions, Robert Beasley, a member of IBM’s security-policies team, told me.

Supporting users’ cloud-services choices isn’t simple, however. It requires trust, which comes from a sense of shared responsibility. Although the leaders of the business-technology unit have ultimate responsibility for the systems’ integrity, accountability must be spread among the business-technology group, the unit owning the particular business process, and users. That means each of these parties needs to understand the riskiness of each cloud service on various dimensions such as encryption of data and adherence to security standards. Companies can find out about services’ risk level via the Cloud Trust Registry or by performing their own assessments using metrics from organizations such as the Cloud Security Alliance. Companies can also look at such issues as whether a cloud service provider adheres to the Privacy Level Agreement outlined by the European Commission.

At the same time, everyone involved in using cloud services needs to understand the security issues and take action accordingly. For example, in order to maintain compliance with privacy regulations, hospitals must encrypt protected health information at the source before sending it to a cloud-service provider; payment-card data, too, must be encrypted at the source.

In addition, there are new technologies aimed at protecting data:

Data hashing is a technology that creates a hash, or specific code, to identify a given dataset. This allows the integrity of the data to be checked every time the data is used or accessed by a credentialed individual at the firm. Hashing would prevent data from being changed by an unauthorized third party.

Digital watermarks allow data to be tracked. While this approach does not protect the data, it does allow it to be linked back to the individual who placed it on a cloud or at an unsanctioned location, making that person potentially responsible for any consequences to the data’s misappropriation.

Data-marking tools like these can be tied to trusted-party authentication technology that enables companies to restrict data access and movements — for example, allowing data to be moved from a work machine to a smartphone only if the recipient device has the appropriate authentication.

It’s not surprising that some of the most promising approaches to the problem of employee cloud use come not from regulation or corporate policies but from emerging cloud-based identification-as-a-service technologies. Researchers are attempting to create simple yet effective means of facilitating cross-cloud single-sign-on authentication, where a “foreign” cloud provider is required to gain trusted third-party status from the “home” cloud before being able to communicate with the user and the user’s applications.

Until this federated cloud-security framework is achieved, you may very well have to trust your employees’ behavior when it comes to the cloud. But as the new cross-cloud technological solutions approach, firms will increasingly be able to verify that employees are actually doing what they’re supposed to do with critical corporate data assets.

Understanding the Rise of Manufacturing in India

When many executives think about manufacturing, China is the first country that comes to mind. But there are other players grabbing a bit of that spotlight — like India. Despite the conventional wisdom that says India’s place in the global economy revolves around digital bits and services rather than material atoms, the country is starting to attract more attention for its manufacturing potential for a number of reasons: India is the third-largest economy in purchasing power parity after the U.S. and China, it has a large population of engineers and factory workers, its intellectual property is widely respected, and it is easy to find English-speaking managers there.

While Narendra Modi’s “Make In India ” initiative to promote manufacturing in India was mocked by some, North American executives are increasingly looking to expand their manufacturing supply chains beyond China. To decide if India is a good candidate for your operations, it’s important to understand the opportunities of doing business in the country — as well as the challenges.

American success stories in India

While American companies are only starting to explore India’s potential for manufacturing, we’re already seeing a few examples of how these efforts can be successful. For example, Chicago-based Abbott, which operates in 150 countries and owns top brands such as Similac infant formula, recently built a manufacturing facility in Jhagadia, Gujarat, in order to compete in India’s large branded generics market. In 2014, its 14,000 employees in India generated $1.09 billion in sales. This is largely because it manufactures products that reflect the local environment (to deal with spicy Indian food, it sells the antacid Digene), and are widely used there (to manage aches and pains, most Indians are prescribed Abbott’s Brufen when they want ibuprofen). It also adapts some its products to meet local expectations — for example, the plant caters to Indian mothers by manufacturing a version of the popular kids’ nutritional supplement PediaSure that is flavored with saffron and almonds.

India was one of the first expansion markets for Abbott, after Canada and the U.K, and today it’s the company’s third largest market globally — all six of the company’s business units have a presence in the country. “Last year, we signaled that India is a key manufacturing destination for us with a $75 million investment,” Abbott Vice President Bhasker Iyer told us. “It is one of the fastest growing markets globally — with a young population, strong macroeconomic indicators, a huge consumption story, and a politically stable government working to accelerate reforms. For a healthcare company, the reasons to be part of this vibrant country are even more compelling — it’s an opportunity to serve the unmet healthcare needs of a 1.2 billion population.”

Abbott’s new $75 million factory in Gujarat state. Courtesy of Abbott.

While Abbott does not currently export its products from India, the U.S. company Cummins does manufacture its engines, generators, and turbochargers there to export across the globe. India is hugely important to the company’s revenue stream, and Cummins India is only one of eight operations they have in the country. According to its latest investor presentation, Cummins India exports grew at 14% annually over the last five years and now constitute 40% of sales. The company has 20 manufacturing plants in India, compared to Abbott’s three, and one-sixth of Cummins’ 54,000 worldwide employees currently work there.

Another company planning to boost exports by manufacturing in India is GE. Among the nine factories it has in the country, its new factory in the city of Pune serves as a global supply source for a number of its diverse businesses, from aviation and turbo machinery to wind turbines and diesel locomotives. “In the future, manufacturing will be far more decentralized. But decentralization poses a challenge to the concept of economies of scale,” said Banmali Agrawala, President for GE South Asia.]The Pune factory helps solve this challenge. The company plans to send half of the output to GE’s global factories and the other half to the domestic market in India. And it was recently announced that CEO Jeff Immelt is headed to India again this month, in part to assert support for manufacturing in the country.

GE’s new plant in Maharashtra state will export half its production. Courtesy of GE.

While our success stories have focused on large companies, opportunities for manufacturing in India are open to smaller entities, even ambitious startups. Former Texas Instruments engineer Lou Hutter, now CEO of the startup Cricket Semiconductor, is raising $1B dollars (largely from investors of Indian origin) to build India’s first analog chip fabrication (“fab”) facility. Hutter and his partners hope to be located in the middle-sized city of Indore in Madhya Pradesh, where the Chief Minister has offered free land and a stable supply of water and electricity. Most fabs produce digital microchips that power modern electronics. But these digital devices must also interface with the analog real world in useful ways. The analog fab is much more aligned with India’s strength in automotive and industrial sectors, according to Hutter.

Overcoming challenges

While these companies show the potential of manufacturing in India, they can also illustrate the challenges western companies face when doing business in India. For example, Cummins’ biggest obstacle was navigating a difficult land acquisition process and complex government regulations. Land ownership is often opaque, and re-zoning from agricultural to industrial use has been fraught with peril and delays.

The first step to overcoming these challenges is to understand India as a collection of states, rather than one monolithic entity. It’s the states that are working to help companies establish their manufacturing facilities, and four have made significant recent advances. For example, the state of Madhya Pradesh has implemented a single online registration for business licenses to replace the complicated system businesses previously had to go through: 61 different registers operating under 13 separate federal labor laws. The state has also systematized the inspection process. Before, a barrage of inspectors would show up at companies without notice and slow down production; now the state has implemented process where inspectors come once every five years, and have to give advance notice. Meeting these challenges also requires a ground-up evaluation of your company’s needs in order to match them to India’s opportunities and current capabilities. If you don’t have in-house knowledge or resources, you may wish to consult state-based officials or engage a third party advisor.

Another challenge is that historically, India has regulated companies’ ability to fire factory workers, making it especially difficult for larger companies. While this was aimed at protecting jobs, one unintended consequence was that many factories stayed small to avoid increased regulatory burden and many others try to show their workers as contract labor.

Western companies also don’t have to build their own manufacturing facilities; they can rely on Indian factories. While advising American corporate clients, one of us (Bagla) found that Indian suppliers can be globally competitive in manufacturing items as diverse as manhole covers, automotive components, and even personal care cosmetics, which shows how India’s manufacturing sector is advancing beyond bits.

The takeaway

Just two decades ago, most Western executives thought of Ireland or Central America as the place to outsource software and business processes; today, we believe that India’s knowledge worker base rivals those two destinations combined. We don’t expect Indian manufacturing to go head to head with factories in China, Japan, the United States, or Germany any time soon. But top executives who wish to diversify their supply chains should no longer only consider India as a supplier of software and call center services. Manufacturing is the next frontier in India, and companies such as Abbott, Cummins, and GE have already proven that the countries resources hold tremendous potential.

We believe that western CEOs should follow Jeff Immelt’s lead and begin including India as part of their global supply chain. While there is no single formulaic answer to manufacturing success in India, patience and a trusted local partner or advisor to guide western executives’ efforts are necessary — as well as an understanding of the challenges.

And from India’s perspective, manufacturing is probably the only way to lift half a billion more of its population out of poverty. If Prime Minister Modi is able to inspire those around him to unlock India’s land and labor for manufacturing, domestic and global corporations will accelerate this transformation.

Why the U.S. Government Is Embracing Behavioral Science

For anyone interested in human behavior and decision making, September 15 will likely be a day to remember. On that day, President Obama ordered government agencies to use behavioral science insights to “better serve the American people.” In his executive order, Obama instructed federal agencies to identify policies and operations where applying findings from behavioral science could improve “public welfare, program outcomes, and program cost effectiveness,” design strategies for using behavioral science insights, and recruit behavioral experts whenever considered necessary or helpful. (Here is the full report by the White House Social and Behavioral Science Team, which discusses some of the work that has been already conducted using behavioral insights.)

This order reflects the evidence that scholars across a variety of fields — from behavioral economics to psychology to behavioral decision research — have accumulated in recent years that people often fail to make rational choices. Across a wide range of contexts, we often make foolish decisions that go against our self-interest. We exercise too little and eat too much. We spend too much, don’t save enough, and wind up heavily in debt.

Such deviations from rationality, well documented in the decision-making literature, are consistent across time and populations. For example, the typical person would dislike losing $50 more than he would enjoy gaining $50, which would not be the case if he were fully rational. And when making decisions, people tend to give disproportionate weight to information that readily comes to mind (a recent discussion, for example) and overlook more pertinent information that is harder to retrieve from memory. Again, this shouldn’t happen to so-called “rational agents.”

Public policy has often relied on assumptions of rationality when accounting for human behavior, which has led to suboptimal policies in the past. For example, citizens are sometimes bombarded by mass-media campaigns (designed to decrease smoking, increase seat-belt use, etc.) that assume they will be able to process an onslaught of messages to their best advantage. But such campaigns often have not worked, and may even have backfired at times.

Over the last decade or so, insights from behavioral science have been applied to public policy issues such as tax payments, medical decisions, consumer health and wellness, and climate-change mitigation. Consider work conducted by the Behavioural Insights Team (BIT), an organization set up in the United Kingdom to apply “nudges” to improve government policy and services. (A nudge, a term introduced by Richard Thaler and Cass Sunstein in their 2008 book Nudge: Improving Decisions About Health, Wealth, and Happiness, is any aspect of a process that changes how people behave in predictable ways “without forbidding any options or significantly changing their economic incentives.”)

For example, in one study, the BIT partnered with the U.K. Driver and Vehicle Licensing Agency to change the wording of the letter sent to people who were delinquent in paying their vehicle taxes. Departing from the complex legal language of the existing letter, the new letter in effect told people to “pay your tax or lose your car.” To make the demand more personal, some of the letters also included a photo of the car in question. The rewritten letter increased the number of people paying the tax; the rewrite with the photo changed behavior even more dramatically.

Another successful nudge (not involving BIT) involved sending letters to residential users of high amounts of energy in San Marcos, Calif. To influence them to consume less energy, the letters told them how their consumption compared with that of their neighbors. Finding out that they were consuming more than others like them triggered strong negative emotions that in turn led to behavioral changes and a 10% reduction in energy consumption.

Nudges like these speak to the power of developing interventions and policies that consider people for what they are: creatures whose information-processing capacity and emotions limit them from being rational agents. Well-designed behavioral studies can offer policymakers useful insights into human behavior that can improve policies. Such studies are applicable to a wide range of policy areas, wherever human behavior plays a role.

Similarly, as I wrote in the past, organizations can identify more effective management practices through a better understanding of human behavior. The implications could be wide ranging, from helping employees adopt healthier habits to increasing their happiness and productivity at work.

In its cafeterias, Google has experimented with this idea to encourage employees to adopt healthier eating habits. When “Googlers” reach for a plate, they encounter a sign informing them that people with bigger plates are inclined to eat more than those with smaller plates. Thanks to this simple change, the proportion of people using small plates has increased by 50%.

Or consider how simple interventions can increase employee happiness and productivity. Lalin Anik, Lara Aknin, Michael Norton, Elizabeth Dunn, and Jordi Quoidbach conducted a series of field experiments in which they found that when employees share their bonuses with coworkers and charities, they are more satisfied and perform at a higher level than those who don’t. Giving employees opportunities to spend money on others increases happiness, job satisfaction, and team performance, their research discovered.

As another example, a few years ago, my colleagues and I conducted a study in collaboration with a major U.S. car insurance company. We sent 13,488 of the company’s customers a form that asked them to report the number of miles they had driven the prior year, as indicated on their cars’ odometers. Cheating by under-reporting mileage would come with the financial benefit of lower insurance premiums. On about half of the forms sent out, customers were supposed to sign to indicate their truthfulness at the bottom of the page. The other half of the forms asked the customers to sign at the top of the page. The average mileage reported by customers who signed the form at the top was more than 2,400 miles higher than that reported by those who signed at the bottom. The simple change put customers in a more honest mindset.

Behavioral science can help managers design new practices, suggest improvements to existing ones, or provide ex-post explanations of why people reacted in a particular way. In short, using insights from behavioral science can have profound benefits across government and business, and more are being implemented every day. So, are you ready for a nudge?

September 17, 2015

Asking Open-Ended Questions Helps New Managers Build Trust

In many companies and organizations, new managers are selected as a result of their success in technical and operational roles. This seems to be a sensible approach, as the manager needs to understand the challenges facing his or her direct reports. At the same time, it’s fundamentally flawed. The skill set required to excel in a technical/operational role is different than the skill set required for success as a manager.

This paradox rears its head in virtually every business and organization. As an executive coach, I work with clients from diverse industries who are transitioning into management roles, such as a talented software engineer who was promoted to manage four teams of engineers; a physician with superb clinical skills who was assigned to chair a hospital division; and a salesperson with strong revenues who was told to stop selling and to start managing the firm’s 25 salespeople.

To win the trust of their direct reports and corporate leaders, these new managers and others like them need to swiftly adopt a repertoire of leadership behaviors. They must, for example, learn how to command attention and respect with nonverbal communication, including appropriate body language and facial expression. And their verbal communication must be firm and direct, yet supportive and collegial. It’s a daunting set of changes. Many first time managers feel overwhelmed as to what skills they should prioritize and implement from the outset.

When coaching such clients, I try to help them stay calm and grounded by focusing on making one immediate and powerful change: ask open-ended questions and avoid making directive statements. This strategy is simple, straightforward, and easy to remember. It’s also measurable quantitatively. The manager (or someone observing the manager) can count how many times he or she asked open-ended questions and made directive statements during a meeting with direct reports. The ratio of the former to the latter should be high, often in the neighborhood of 10 to 1 as judged by my experience with clients who went on to succeed in management roles.

Further Reading

HBR’s 10 Must Reads on Managing People

Leadership and Managing People Book

24.95

Add to Cart

Save

Share

How and why does this strategy work? The primary consideration here is the nature of an open-ended question, which prompts the respondent to think carefully and to reveal what’s on his or her mind. Unlike closed-ended questions (which evoke a “yes” or “no” response), open-ended questions promote dialogue and interpersonal engagement. When asked in a calm, neutral manner (without any hint about what the “right” answer should be), open-ended questions help the manager to gather essential information from direct reports about the challenges and opportunities they face. Open-ended questions promote confidence and trust in the relationship. The direct report receives an implicit message that his or her thoughts are valued and respected. The relationship between manager and direct report deepens, which enhances productivity and quality of life in the workplace.

To that end, here’s an example of an open-ended question a manager might ask his or her direct report: “When will you be ready to master that new technical skill that the CEO wants us to develop?” The reply will yield information about the employee’s level of motivation and adaptability, as well as what’s realistic in the current work environment. A directive statement like, “I need you to master that skill by the end of the month” is more likely to cause the direct report to experience fear, frustration, resentment, passive aggression, and failure to achieve the unilaterally imposed benchmark.

Open-ended questions also help to create developmental opportunities for direct reports. Many new managers are told to “delegate” operational tasks so that they can become more “strategic,” but this advice is frequently confusing and unrealistic because direct reports aren’t yet capable of performing all the operations that the manager had mastered. Instead of “delegating,” I encourage new managers to ask open-ended questions that will empower direct reports to develop the technical skills they need. Examples of this kind of question might be, “Who can help and support you in learning how to become proficient at this essential task?” or “How can I support you in figuring out how to do this on your own?”

As with any such strategy, a small subset of direct reports may not respond well to open-ended questions — and that’s usually a red flag. The manager should start with open-ended questions, but reserve the option to give clear instructions when the direct report isn’t responding productively. With truly recalcitrant employees, the manager may need to institute a performance improvement plan or, at worst, fire an underperformer. When coaching clients who are becoming managers, I sometimes use the political analogy that nations in conflict should start with diplomacy — but not take the military option off the table in case diplomacy fails.

But failure is rare when managers use open-ended questions thoughtfully. Rather than bringing their own agendas, new managers ought to ask good questions, listen carefully to the replies, and facilitate dialogue. “Bringing your own agenda” actually has a literal meaning here, with regard to who decides on specific agenda items for a meeting. Along these lines, here’s an open-ended question that new managers ought to consider asking direct reports: “What agenda items would you like to contribute for our next meeting?” The question breeds good will. The replies reveal key data about the business. And the direct reports take real ownership of the challenges that they’ve placed on the agenda by their own free choice. It’s a win-win that builds trust and boosts engagement.

Better Value in Health Care Requires Focusing on Outcomes

Implementing a value-based strategy is on the mind of nearly every health care organization in the U.S. It seems that every week, one or another announces a new “Center for Health Care Value” or “Center for Health Care Innovation.” These organizations are accepting the fact that the volume-driven system is in its dying days, and that the future will demand that they deliver demonstrably better value: improved outcomes, lower costs, or both.

Many institutions are overwhelmed by the change required and don’t know where to begin. As Michael Porter and Thomas H. Lee recently described in the HBR article “The Strategy That Will Fix Health Care,” implementing a value strategy involves dismantling specialty departments in favor of condition-specific practices, being paid and held accountable for results, pursuing geographic expansion, and more. It is a formidable transformation. But some institutions are succeeding, and we find that nearly every element of their value strategies builds on and is strengthened by one thing: the ability to measure outcomes.

Here are five reasons why:

1. Outcomes define the goal of the organization and set direction for its differentiation.

Few health care organizations have made it their explicit goal to deliver excellent outcomes. Providers commonly cite quality, research, or education as goals, but few measure their patients’ treatment outcomes or report them – either to their clinicians or the public. Improving value can only happen when providers align the focus of their clinical teams and their market strategy on achieving excellent outcomes, and in turn invest the resources to measure and report them.

In 2005, when Prof. Dr. Hartwig Huland led the opening of a Martini Klinik, a new prostate cancer center in Hamburg, Germany, he wanted to deliver the best care in the world for its patients, and he defined “best” in terms of outcomes: rates of cancer recurrence, incontinence, erectile dysfunction – things everyone knew were important but few measured. Focusing first on clinical excellence and driving his team to measure and improve it, Huland’s center gained a regional, then national, then international reputation and is now the highest volume center for prostate cancer care in the world. (See this Harvard Business School case for more.)

2. Outcomes inform the composition of integrated care teams.

Clinical training is inherently siloed, but value-based health care requires integration around the patient. This is not easy for specialists who are not used to working closely together, or worse, even dislike each other. But defining and measuring outcomes can bridge the disciplinary divide as teams must necessarily collaborate to achieve better results. Data that exposes poor performance in particular can be a strong motivator to join together to improve.

At Texas Children’s Hospital (TCH), in the early days of its pediatric cardiac surgery program, newly recruited director Charles Fraser investigated the hospital’s performance relative to national referral centers as reported in the literature. The conclusion was disheartening – on most procedure types, TCH significantly underperformed. Citing its outcomes performance as a mandate for change, Fraser set about a complete restructuring of the team: pediatric cardiac surgeons and cardiologists started collaborating more closely, dedicated pediatric cardiac surgery operating rooms and ICU space was created, and a systematic outcomes tracking program was put in place. The final result? Today, TCH enjoys a nationally recognized program with mortality rates significantly below the national average. (For more, see this HBS case.)

3. Outcomes motivate clinicians to compare their performance and learn from each other.

Comparison of outcomes is essential to disseminate innovations from one individual or team to another. Unfortunately, most quality measurement has focused narrowly on complying with evidenced-based processes. Although such compliance is important, it has limited impact on outcomes (often less than a quarter of variation in outcomes is estimated to be due to compliance with these processes). A more comprehensive focus on processes and outcomes and their interaction always shows opportunities to improve, from increasing survival rates and long-term functioning to reducing complications and speeding recovery. Comparing these types of outcomes in a transparent and collaborative way can be a powerful motivator for improvement.

This philosophy underlies a remarkable collaboration between Blue Cross Blue Shield of Michigan (BCBS Michigan), the state’s largest commercial payor, and a collection of public and private providers in the state. These “Collaborative Quality Initiatives (CQIs),” financially supported by BCBS of Michigan, focus on state-wide outcome measurement for particular medical conditions or procedures coupled with frequent in-person discussions among would-be competitors to understand variations in practice and performance and to debate how best to improve outcomes. This data-driven dialogue across the network dramatically speeds the identification and adoption of best practices. For example, in 2008 the network discovered high rates of complications in bariatric surgery patients who had deep venous thrombosis (DVT) filters placed during their operation. Within one year of the network-wide meeting where the results were discussed, DVT filter use dropped by 90%. Nationally, the FDA communication warning against use of such filters lagged by more than two years, and is still being implemented.

4. Outcomes highlight value-enhancing cost reduction.

Alongside influencing outcomes, clinical decisions also drive the cost of care: choosing which drugs to prescribe, which procedures to perform, and whether to admit patients to acute care facilities have significant cost impact. The trouble is, clinicians generally overestimate the benefit of their care, which means that many decisions lead to high costs with little impact on outcomes. Getting costs under control requires engaging clinicians with data that can help them understand which activities and services can be reduced or eliminated without compromising outcomes.

Insight Center

Measuring Costs and Outcomes in Healthcare

Sponsored by Medtronic

A collaboration of the editors of Harvard Business Review and the New England Journal of Medicine, exploring cutting-edge ways to improve quality and reduce waste.

At the Massachusetts General Hospital (MGH), amidst an aggressive shift from volume-based fee-for-service contracts to risk-based population contracts (which put providers at risk for the cost of care), the Division of Population Health Management team knew it needed a better process for determining who was best served by resource-intensive procedures, particularly those such as gastric bypass, diagnostic coronary catheterization, and lumbar fusion whose efficacy was uncertain. Rather than require that physicians follow rigid protocols, the Division created a decision support system to help clinicians determine when a procedure was indicated, based on a patient’s clinical circumstances. Criteria from the literature regarding the appropriateness of various procedures were integrated into the electronic medical record, and patients received videos and handouts explaining the risk and benefits of the various treatment options, as well as personalized consent forms that adapted those risk and benefits for their specific circumstances. The entire system was informed and refined by ongoing tracking of outcomes, as reported by both patient and clinicians.

Clinical decision making improved; for example, rates at which patients were determined to be “maybe” or “likely” appropriate for diagnostic catheterization climbed from 86% to close to 97%. Patients’ confidence in their own decision making also improved. One of the local private payors was so happy with the impact that it agreed to waive the requirement for prior authorizations on all procedures for which this system was in place — a triple win for patient, provider, and payor.

5. Outcomes enable payment to shift from volume to results.

As payment transitions from a fee-for-service world to a value-based world, good outcomes are shifting from a lofty idea into a business imperative. Paying for results and packaging payment into a bundled price will create a fundamentally different marketplace dynamic. At present, it is unclear which provider organizations will win business and which will lose business in this environment. It is clear, however, that without a clear knowledge of their outcomes, no provider will be able to succeed with .

In Stockholm County, Sweden, the single payor wanted to expand the delivery of hip and knee replacements to eliminate long waiting lists. Armed with two decades of detailed outcome and case-mix data from the national registry, the payor developed a reimbursement model that packaged pre-operative, operative, and early post-operative care into a single price with a two-year warranty (five years if an infection was found in the first two years). Although the pricing of the model was 20% lower than the typical market price, several small, focused private providers signed on. With a clear price but greater flexibility on the delivery of care, these providers set about streamlining operational efficiencies and adding in outcome-improving steps. Within two years, the volume of hip and knee replacements delivered at these small specialty hospitals tripled while full-service hospitals watched their volumes drop by 20% (see this HBS case for further reading). Now the initiative is being expanded across the country and in seven other conditions.

Earlier this year, the Centers for Medicare and Medicaid announced that by 2016, 85% of payments will be linked to quality. Private payors are joining arms with CMS in pushing this agenda. In other advanced economies, similar initiatives are underway. The value-based shift is upon us. If you are leading a health care provider organization and are uncertain how to navigate the shift, we have one suggestion: start by measuring your outcomes.

Assessment: Do You Know What a Strong B-School Application Looks Like?

How to Spot Hidden Opportunities for Sales Growth

In the hunt for sales growth, profit growth, or share growth from the sales force, every sales leader, whether new or seasoned, whether from a growth-stage or a mature-stage company, faces the same question. Where will the growth come from?

The best answers are frequently unearthed by looking at differences in performance, sales activity, and market potential across different pieces of the business — certain customer segments, selected products within a broad portfolio, or specific groups of salespeople. Better analytics, as well as improved data storage and organization technologies, are enabling companies to get more creative in the way they analyze data to discover and take advantage of these hidden pockets of growth.

Here are several examples:

Novartis gets more out of its average performers. Working first with the U.S. sales force, global healthcare company Novartis identified a group of salespeople who were outstanding performers and isolated a set of behaviors that differentiated their performance from that of average performers. The company developed a new sales process that was derived from the behaviors of the outstanding performers, and it aligned sales hiring, development, and other programs to support the new process. A key part of the initiative was a selling skills training program called Performance Frontier — The Next Generation in Sales Excellence. In a controlled study, newly trained previously “average” salespeople realized twice the growth rate in sales when compared to a control group of “average” salespeople who were not trained on the newly identified behaviors. Based on this success, Novartis replicated the approach globally.

A manufacturing company accelerates growth among new hires. A manufacturing company tracked performance of salespeople over their first 20 months with the company to understand how quickly new salespeople became effective and why. A key finding was that the quality of the first-line manager (FLM) had a large impact on new salesperson performance. Salespeople reporting to top-performing FLMs performed much better in their first 20 months on the job compared to salespeople working with average-performing FLMs. Top-performing managers did two things that contributed to the performance difference: they spent more time coaching in the field and they arranged for mentorship from experienced team members. Based on these findings, the company established new coaching expectations for FLMs and implemented a tracking system to ensure accountability.

A medical supply company boosts profits by reallocating sales effort across products. A medical supply company had several products in its portfolio. The amount of sales time devoted to each product varied by salesperson. By analyzing differences in the amount of time that salespeople spent by product and the resulting product sales and profits, the company determined a vastly improved way to allocate sales effort across the portfolio. The company aligned the incentive plan to reflect that effort allocation, and educated the sales force about how to spend sales time in order to optimize performance. The result was a measurable increase in sales and profits without any change in sales force headcount.

A business services outsourcing company improves performance in non-metro geographies. A business services outsourcing company compared performance of its 50 least urban (i.e. non-metro) sales territories to that of its 50 most urban territories. Sales per territory averaged $1.2 million in both groups. Yet when compared to urban territories, the non-metro territories had 79% more prospects and 49% more overall market potential. Salespeople in urban territories visited good prospects on average four times a year; but in non-metro territories, that average was just 2.8 visits. Salespeople in non-metro territories were not realizing opportunities because they were stretched beyond their capacity. The company reduced the size of non-metro territories and assigned coverage of many prospects in outlying areas to an inside sales team. This led to increased market share, reduced travel costs, and improved sales force effectiveness outside of metropolitan areas.

A telecom company gets more business from its low performing, high potential customers. A telecom company took advantage of an emerging way to hunt for opportunities by using a collaborative filtering model, similar in concept to algorithms used by companies such as Netflix and Amazon. The company found “data doubles” for low performing, high-potential customers – i.e. other customers who had a similar demographic profile (for example, the same industry and scale), but who were buying much more. The company analyzed the purchase patterns and sales strategies at these more-successful data double accounts and shared the insights gained with the sales force. The information enabled salespeople to improve targeting of the right products for under-performing customer accounts, thus driving stronger uptake of new product lines and dramatically improving the realization of cross-selling and up-selling opportunities.

Together, these examples provide great lessons about how to find sales growth opportunities. It’s not enough to look at aggregate performance across the sales force; aggregation hides insight. Finding opportunities requires observing and understanding differences within specific customer segments, products, or groups of salespeople, including differences in:

Performance outcomes. Novartis observed that salespeople with similar market potential had dissimilar sales results, and realized opportunity by understanding what those salespeople did differently. Similarly, the manufacturing company observed performance differences across new hires and the telecom company observed differences across demographically-similar customers.

Sales activity. The medical supply company observed that salespeople allocated time differently across products, and realized opportunity by understanding how these differences affected sales.

Sales potential. The business service outsourcing company observed differences in territory sales potential and realized opportunity by understanding the impact on sales activity and results.

Companies will always be thinking about their next source of growth. Today’s world of big data enables companies to creatively slice and dice historical sales force data to find new and better sources of insight.

September 16, 2015

How to Work with Colleagues Who Are Less Creative than You

Creative projects that call for collaboration often fail for a surprising reason. Our studies of groups working on design, writing, and R&D projects show they very rarely suffer from a lack of good ideas. Much more commonly, the problem is with incorporating the various ideas into the output. In particular, we found that members of the team who think of themselves as “artists” of their trade — that is, producers of creative output that bears their signature style and succeeds on terms beyond the purely commercial — have a greater tendency to reject others’ creative ideas. They may be great at idea making, but they can be lousy at idea taking.

When we presented this finding in our Harvard Business Review article, “Collaborating with Creative Peers,” we put the focus on implications for the non-artists in such project teams. By first understanding that their advocacy of ideas can feel like identity challenges to some of their most creative colleagues, they can thoughtfully adapt how they offer those ideas, and defuse resistance to them.

But, of course, the onus should not only be on these more pragmatic types to make collaborations succeed. Our research also identified tactics that artists themselves can use to enhance their openness to ideas given by collaborators. Here they are:

Think of others’ input as “general inspiration” to further thinking rather than specific challenges to your vision. We find that artists are generally more open to ideas when their colleagues present them not as corrections to flaws or lapses to the creative thinking so far, but as invitations to keep building on that thinking in some direction. However, artists themselves can also choose to treat others’ ideas as inspiration, whether they are presented in that spirit or not. Implementing this tactic can be as simple as asking a lot of questions about the general themes and rationales underlying suggestions. In our research, we saw artists doing this, and then backing up to think about those general themes rather than focusing on objections to the specific ideas their colleagues had arrived at.

In one example, a project team led by an artistic designer named Jenny was tasked with expanding a product line. When one of Jenny’s teammates came to her with a specific new product idea, Jenny’s reaction to it was immediate and visceral. It struck her as a violation of the artistic vision of the product line, and indeed of her control of that vision. But Jenny had the self-awareness to recognize and get past that knee-jerk reaction. Describing her tendencies to us later, she said:

If you’re coming to me saying, “We need to design X,” I might not be too excited about that. But if you say, “We need to expand our product line [to accomplish what X would]. How do we do that?” I prefer more general questions like that. I try to get to these general questions as the root of the suggestion you are giving. So, in this case, I asked for that. I said, “What’s the general motivation behind your idea? Can we talk about that first?” So we did that before getting into specifics, and it was much easier to not get defensive.

Maintain an unemotional demeanor. A second tactic that artists can use to increase their openness to ideas given by others is to maintain a calm and unemotional demeanor during collaborations. Reacting less in the moment to perceived identity threats helps to maintain an overall tone in the meeting that is less hostile to collaboration. For example, an R&D scientist named Kelly told us she had managed to teach herself to listen, and not to betray emotions, even when her gut was telling her that the idea-giver was off-base. She recalled one instance in which a team member passed her a note with an idea on it during the middle of a product presentation. Kelly’s emotional reaction to the note was, “No way. This is nuts!” But because she could not respond immediately, she found herself mulling over it. Before the meeting was over, Kelly had flipped over the note and responded with a simple, “Yes.” For Kelly this was an important lesson that surprised her so much that she now deliberately applies it to all of her collaborations:

I really try not to be too vocal or emotional too early, because I just don’t want to regret the resistance and the tone that would set. I find that, as I start to think about a suggestion more — again it’s all internal conversation in my head — there’s actually opportunities here. And that’s when I speak up, like, “OK, I think that makes sense. Let’s push on it.”

Delay responding to ideas given. Kelly’s comments point to a third and related tactic for artists who want to be better collaborators. They can delay making decisions about ideas given during creative sessions, and wait until some time later to fully consider them. The delay of course gives the artist time to take on and think creatively about the problem the idea giver was trying to address. But even just resolving not to make an immediate decision in the room also helps to tamp down emotional reactions to input that might otherwise feel like an assault on creative identity or signature style. Several artists we talked to said they accomplished this by writing lots of notes during meetings, rather than engaging in active decision-making. They could then think about the ideas later, where identity threats would not be so salient. One R&D scientist we talked with explained how he developed this strategy after presenting several products in a design review meeting. Many suggestions were given to him to better his designs. He acknowledged that if he relied on his initial reactions alone, he might end up regretting his response:

I try to take notes so that I can really sit down and think through all the pros and cons later. So, I usually prefer doing that. … I always like to, you know, if I’m not sure I’d rather put it in the parking lot and think about it afterwards than just saying no. That’s just my way of doing it.

Put yourself into a mindset of learning. Finally, artists can become better idea-takers if they change their stance toward collaborations to see them as ongoing learning opportunities, rather than focused efforts to get things right on specific projects. We found several artists who had adopted this tactic to help themselves be more open to ideas given at the start of a project. For example, one artistic R&D scientist, Greg, described a competitive environment in which his team was responsible for creating an entirely new product under tight management deadlines. Greg’s initial resistance to most of the early ideas was preventing the team from meeting its deadlines. It wasn’t until Greg reframed the goal of the project, in his own mind, as learning instead of product development, that he and the team were able to create a high-scoring consumer tested product that eventually went to market:

My team was looking at developing a product, but I needed to think about it as learning. I’ve found that if I think about what can I learn from this project, I get less attached to my ideas. So, sharing in learning instead of always trying to be the first to develop a solution is an important thing for me.

In sum, artistic collaborators may help themselves be better idea-takers by employing mindsets and decision-making tactics that reduce their own threat-induced motives to maintain their artistic identities. These tactics have not been recognized by most frameworks of creative collaboration, and represent a new angle for improving creativity and innovation in teams.

Why Paid Leave Matters for the Future of Business

At this time of year, as students return to campus, I always find myself reflecting on why I became a professor and the principles I’m about to teach the business leaders of tomorrow. But this year has been especially exciting, as employers have increasingly announced family-friendly policy changes — and as President Obama has just taken a historic step to increase access to paid sick leave for government employees, while also calling for an unprecedented U.S. national paid leave law.

I am now even more confident that the U.S. is in the midst of revolutionary change in how we think about what defines a successful business and a successful life. Companies and lawmakers are beginning to realize what many of us have long known – that what is good for workers and their families is good for business and our economy, and that improvement at the national level is long overdue.

This is why I am proud that more than 200 of my esteemed colleagues from business and management schools across the country are joining me this week in urging Congress to recognize the widespread benefits of ensuring all workers have access to paid family and medical leave. For the sake of the future business leaders we teach and the workforces they will direct, in this letter we call for passage of the Family And Medical Insurance Leave (FAMILY) Act.

The FAMILY Act would allow workers to earn a portion of their pay while they take up to 12 weeks of leave to deal with a serious health condition, including pregnancy or childbirth, or to care for a child, parent, or partner who has one. Leave could also be taken for the adoption of a child or for certain military caregiving needs. It would be paid for through small contributions from employers and employees.

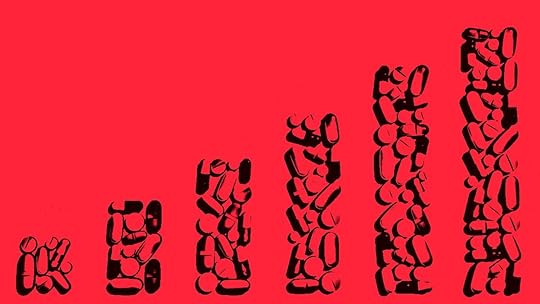

Right now, millions of workers are forced to choose between job and family when serious illnesses or injuries arise. Just 13% of workers have access to paid family leave through their employers, and fewer than 40% have access to employer-provided personal medical leave. Data, within and across firms, show that employees’ access to leave varies widely by industry, by job, by wage, and skill level.

That’s a recipe for an economy that leaves too many people behind and undermines sound business practices. The effects ripple throughout our communities. Businesses suffer when employees have low morale and reduced productivity due to changes at home, such as having a baby or a sick loved one to care for. And I see the impact in the classroom, when students express concern that workplace challenges will thwart their family and career ambitions. In a longitudinal study of Wharton’s graduating classes of 1992 and 2012, we found the percentage of those planning to have or adopt children fell from 79 to 42% over two decades. This baby bust was driven in part by fears of not having sufficient support to make life as a parent work.

In states, such as California, Connecticut, and New Jersey, where paid leave policies have already been implemented, we have ample evidence that they make good business sense while providing workers with the support they need to manage work and family. Paid leave reduces turnover and increases employee loyalty, which results in cost savings for businesses. It also enables employees to devote more time and attention to their home lives, which gives them a greater sense of control and increases efficiency, engagement and productivity.

Fortunately, some leading businesses recognize these benefits. Most recently, tech companies like Microsoft and Adobe have expanded their leave policies in an effort to attract and retain top talent, and the experiences of companies like Google and Ernst & Young have shown that this works. Unfortunately, we cannot count on all businesses in all industries to be able (or willing) to make similar changes. That is why federal legislation is critical.

The FAMILY Act would create a national paid-leave-policy floor for all businesses, no matter their profit margin. It employs a familiar, tested insurance pool framework and spreads the cost of leave in a way that is affordable and responsible. from other countries and states that have adopted similar programs, along with research many colleagues and I have conducted, demonstrate that it is a sound and smart approach.

Those who have signed our letter in support of this legislation include some of the most distinguished business faculty from nearly 90 schools, including the country’s most prestigious institutions. We hope that this adds to the tremendous momentum in support of paid leave, and to the efforts of advocacy groups like the National Partnership for Women & Families, which is leading the charge for the FAMILY Act. In this moment of opportunity, the nation must adopt a policy that is built for the populations, workforces, and businesses of today and tomorrow.

What Companies Have Learned from Losing Billions in Emerging Markets

Multinational corporations long have looked for growth opportunities in emerging markets. But after the Great Recession of 2007-2009, when developed economies effectively froze in place, their appetites only sharpened. And that hunger continues today. In 2014, according to the latest United Nations estimate, direct foreign investment (FDI) in emerging markets reached more than $700 billion — accounting for over half (56%) of all global FDI flows for the first time.

In a study we recently conducted of 150 North American and European-based companies with revenues over $1 billion, we found that along with growth, those investments can generate huge losses — more than $1 billion per responding company over the last five years. Those losses stemmed not from poor product, marketing, or supply chain decisions but from regulatory violations, loss of business and fines resulting from bribery and fraud, and concomitant reputational damage.

Of course, everyone knows that conducting business in some of these markets can be risky. Regimes change, violence can erupt. Crime exacts a toll. Regulations change, often unexpectedly. Corruption and bribery may be more common than in more stable countries.

But how much do these hazards actually cost global companies in emerging markets? Which are the most costly? And, most importantly, how can businesses avoid falling prey to them and contain the losses they produce?

Our survey found that the vast majority (83%) of these companies have suffered significant losses since 2010. The average cost per company over that time has been $1.38 billion, with the cost per incident estimated at $325 million. The average total loss per year was $260 million, or 0.7% of annual revenues.

Those are the costs. What are the risks?

In 99% of incidents that involved a loss, the cause could be traced to one of a regulatory violation, a case of bribery or fraud, or a damaging reputational issue. Of the very worst incidents resulting in the greatest losses (the remaining 1% of incidents), 60% involved more than one of these hazards, 35% involved two, and 25% involved all three, either simultaneously or in rapid succession. Regulatory issues were the most common (44%), and the most frequent cause of loss, but bribery and fraud led to the greatest losses, and reputational issues made the worst incidents even more damaging. Bribery/fraud accounted for 31% of loss incidents, and reputational issues 25%.

To find out how the most successful companies mitigated these risks, we divided our respondents into leaders and laggards, defining leaders as companies whose self-reported losses from regulatory violations, bribery and fraud, and reputational issues were in the lowest quartile, averaging 0.2% of annual revenues from 2010 to 2014. Laggards were in the highest quartile, and averaged losses of 2.2% of revenue.

Not surprisingly, leading companies think about risk differently than do laggards. Based on our interviews with executives, we found that there were three practices that correlated strongly with lower investment losses due to regulatory, bribery, and reputational risks:

1. Forgoing Short-Term Profits in Favor of Long-Term Reputation

Leaders rate the importance of maintaining a sterling reputation in the countries in which they operate 10 times higher than do laggards — the greatest variance we found. To preserve that reputation, they advise taking a long-term view of their investments in emerging markets — forgoing, in some case, quick and easy profits. One company sourced locally rather than nationally to assist local providers despite the economies of scale it could have gained by sourcing nationally. That long-term view is rated more highly by leaders by a ratio of 2:1.

When large companies do business overseas, they’re not just economic actors, but political ones, too. The impact they have on local economies is large. And U.S. companies often are seen, whether they appreciate it or not, not simply as businesses but as extensions of the U.S. government. For that reason, it is extremely important for companies to invest in the local market — whether that means using local suppliers, creating jobs, or investing in infrastructure improvements — and to communicate what the company is doing to the local press. One energy company, building a pipeline in Bangladesh, opened employment offices along the proposed route to help displaced farmers find jobs — often with the company itself.

If a company makes this kind of effort, it will come to be regarded as a positive force in the economic life of the area. Otherwise, it’s all too easy for a business to be seen as rapacious, an exploiter and despoiler of the environment. This will hurt the company’s reputation and inhibit future growth and profits.

Leaders understand this. Laggards seem not to. Indeed, the only risk mitigation practice laggards rated more highly than leaders was to run “preemptive publicity campaigns to counteract negative reactions.” But while public relations can be effective, it can add to the reputational damage it endeavors to minimize without real action to back it up.

2. Avoiding Locations Where Compliance Is a Moving Target

Regulatory issues — the number one source of risk — can surface suddenly in emerging economies due to endemic political instability. Leaders consider it more important (by a ratio of 5:1) to avoid doing business in places where the regulatory environment may make it too difficult to comply. They also believe it is critical to work with the local government, rating engagement in the political process more highly than laggards by a ratio of almost 3:1.

Often the best course is to give these jurisdictions a wide berth. One executive at an international agricultural company, who requested anonymity, noted that his company declined to invest in the Ukraine despite its abundance of high-quality arable land, which is some of the best in the world. Given the conflicts that have roiled the country in recent years, his company deemed both the political and regulatory risks too great. In contrast, in 2010 in Borneo Churchill Mining lost the right to use land it had purchased and spent $40 million surveying when Indonesia decentralized its government and a local authority changed the rules. The case is now languishing in the World Bank’s investment dispute court.

Even in more stable environments, regulations can be baroque and difficult to follow. For example, each of Brazil’s 27 states has its own tax rules, “and the rules change all the time,” says Renato Niemeyer, Chief of Tax Legislation of Roraima State, Brazil. According to Niemeyer, companies often respond by delaying paying their taxes as “the penalties [for postponement] are relatively low, and on-time payment is expensive due to the complexity.” However, Niemeyer says this is an invitation to bribery as when a company does pay, “corrupt officials will solicit the organization for bribes to lessen the penalties or to change the tax legislation to benefit the company.” This is an example of risks converging (a regulatory matter leading to a bribery issue that can lead to a reputational one) that can magnify losses.

3. Vetting Managers and Sub-Contractors for a Culture of Compliance

The risk of getting bitten by acts of bribery and fraud is magnified as companies in emerging markets establish local subsidiaries and increasingly work with armies of local subcontractors that are used to making facilitation payments, and may have unacknowledged, poorly paid political allies that are always looking to generate extra income. However, strict compliance, backed by a serious commitment to train all employees on both international and local laws (which means conducting a continuous dialogue, not simply checking a box), and instilling ethical corporate values is rated higher by our leaders by a ratio of almost 7:1.

As Ted Unton, former head of global financial compliance at Bemis, the packaging giant, succinctly puts it, Bemis’s “major concern was ethical, not FCPA or regulations. Local subsidiaries have to operate in ways acceptable to the parent company. You have to comply. The consequence [of non-compliance] is disproportionate to the amount of money [at risk] if you are in violation.”

The keys to avoid getting enmeshed in the coils of bribery and fraud is to implement a culture of compliance, establish (and maintain) policies tailored to the local culture, and conduct careful due diligence on local third parties before partnering with or engaging them. Where laggards most frequently go wrong is in not thoroughly vetting their subsidiaries’ local managers, and, even more often, not monitoring the subcontractors their local managers engage. Doing so takes time and money, but perhaps more importantly it takes a firm commitment to keep to the straight and narrow. One executive at a U.S.-based consumer goods and durable appliance company operating in India told us he stopped his managers from paying “speed money” (from $20 to $100) to local inspectors, who would always find problems at company plants. After establishing this policy, and after it had a short-term negative impact on the company’s results, the inspectors stopped coming.

There is a great deal of money than can be saved, and more that can be earned in emerging markets by companies that improve their strategies and tactics for managing these three major risks.

Marina Gorbis's Blog

- Marina Gorbis's profile

- 3 followers