Brenda Bradley's Blog, page 9

October 18, 2023

Umuhimu Wa Mikopo Ya Biashara Na Huduma Za Kifedha

Katika kutafuta ukuaji wa kibinafsi na kitaaluma, watu mara nyingi hukutana na changamoto za kifedha ambazo zinaweza kuzuia maendeleo yao. Hapa ndipo mikopo ya biashara, mikopo ya mikopo, na huduma za kifedha huingilia kati ili kuchukua jukumu muhimu. Katika makala haya, tutachunguza jinsi rasilimali hizi za kifedha zilivyo zana muhimu kwa watu binafsi wanaotazamia kukua na kufikia malengo yao.

1. Mikopo ya Biashara: Kuchochea Ndoto za Ujasiriamali

1. Mikopo ya Biashara: Kuchochea Ndoto za UjasiriamaliUjasiriamali ni kichocheo kikuu katika uchumi wa leo, na mikopo ya biashara huwapa wajasiriamali wanaotarajia na walioimarika msaada wa kifedha wanaohitaji ili kugeuza mawazo yao kuwa ukweli. Hivi ndivyo mikopo ya biashara inaweza kubadilisha mchezo kwa watu wanaokua:

a. Mtaji wa Kuanzisha: Kwa watu binafsi walio na dhana bunifu za biashara, mtaji wa kuanzia mara nyingi ndio kikwazo cha awali. Mikopo ya biashara inaweza kutoa fedha zinazohitajika ili kuzindua mradi mpya, kununua vifaa, au kulipia gharama za awali za uendeshaji.

b. Fursa za Upanuzi: Biashara zilizoanzishwa zinazotaka kupanuka zinaweza kufaidika sana kutokana na mikopo ya biashara. Iwe ni kufungua eneo jipya, kuwekeza katika uuzaji, au kuongeza hesabu, mikopo hii hutoa msukumo wa kifedha unaohitajika kwa ukuaji.

c. Mtaji wa Kufanya kazi: Kudumisha mtiririko mzuri wa pesa ni muhimu kwa biashara yoyote. Mikopo ya biashara inaweza kutumika kuziba mapengo katika mtaji wa kufanya kazi, kuhakikisha uendeshaji mzuri wa shughuli za kila siku.

d. Faida ya Ushindani: Katika tasnia zenye ushindani, kukaa mbele mara nyingi kunahitaji uwekezaji katika teknolojia, talanta, au ukuzaji wa bidhaa. Mikopo ya biashara huwawezesha wajasiriamali kukaa washindani na kukabiliana na mabadiliko ya mienendo ya soko.

2. Mkopo wa Mkopo: Njia ya Maendeleo ya KibinafsiAplikesheni ya mkopo, ikijumuisha mikopo ya kibinafsi na njia za mkopo, hutoa msaada wa kifedha kwa anuwai ya mahitaji ya kibinafsi. Ni muhimu katika kuwezesha watu kufuata ndoto zao na kushinda changamoto za kifedha:

a. Elimu: Watu wengi hutafuta elimu ya juu ili kuendeleza taaluma zao au kuchunguza nyanja mpya. Mikopo ya elimu huwawezesha kufuata digrii, vyeti, au programu za kujenga ujuzi.

b. Umiliki wa Nyumba: Kununua nyumba ni hatua muhimu kwa wengi. Mikopo ya rehani huwawezesha watu binafsi kuwekeza katika mali isiyohamishika, kujenga usawa, na kulinda mustakabali wao wa kifedha.

c. Ujumuishaji wa Madeni: Kwa wale wanaosimamia madeni mengi na viwango vya juu vya riba, Mikopo rahisi inaweza kutumika kuunganisha madeni kuwa malipo ya kila mwezi yanayoweza kudhibitiwa zaidi, kusaidia kuboresha utulivu wa kifedha.

d. Gharama Muhimu: Iwe ni harusi, gharama za matibabu, au likizo ya ndoto, mikopo salama ya Mikopo salama inaweza kutoa pesa zinazohitajika ili kulipia matukio muhimu ya maisha au gharama zisizotarajiwa.

3. Huduma za Kifedha : Kuongoza Njia ya Mafanikio ya KifedhaHuduma za kifedha hujumuisha rasilimali nyingi ambazo watu binafsi wanaweza kutumia ili kufanya maamuzi sahihi ya kifedha, kudhibiti mali zao na kufikia malengo yao ya kifedha. Huduma hizi ni pamoja na:

a. Upangaji wa Fedha: Washauri wa kitaalamu wa kifedha huwasaidia watu binafsi kuunda mipango ya kina ya kifedha inayolenga malengo yao, mapato na uvumilivu wa hatari. Mipango hii inawaongoza kuelekea mustakabali salama wa kifedha.

b. Usimamizi wa Uwekezaji: Huduma za kifedha zinaweza kusaidia watu binafsi katika kudhibiti uwekezaji wao, kuboresha portfolio zao, na kubadilisha mali zao ili kufikia ukuaji wa muda mrefu.

c. Upangaji wa Kustaafu: Huduma za kupanga kustaafu husaidia watu binafsi kujiandaa kwa miaka yao ya dhahabu, kuhakikisha wana usalama wa kifedha wa kufurahia kustaafu bila wasiwasi.

d. Upangaji wa Ushuru: Wataalamu wa kodi huwasaidia watu binafsi kupunguza madeni yao ya kodi huku wakitii sheria za kodi, kuongeza akiba na uwekezaji wao.

Kwa kumalizia, Mikopo ya biashara, mikopo ya mikopo, na huduma za kifedha ni rasilimali zisizohitajika ambazo huwezesha watu wanaokua kushinda changamoto za kifedha, kufikia malengo yao, na kupata mustakabali wao wa kifedha. Kwa kutumia rasilimali hizi kwa busara, watu binafsi wanaweza kufanya ndoto zao kuwa ukweli na kufanya kazi kuelekea mustakabali mzuri wa kifedha.

The post Umuhimu Wa Mikopo Ya Biashara Na Huduma Za Kifedha appeared first on Elderbrendabradley.

October 15, 2023

Mastering Men’s Grooming: From Shaving To Skincare

Who doesn’t love a personal grooming session? But the problem is we don’t have time for long ten steps routine in our fast-paced world. Grooming helps us reflect self-care and self-love through our care for looking and feeling good. Thousands of things come under-grooming, especially men’s grooming – like shaving, skincare, haircare, and whatnot. We will touch on some key grooming tips and techniques that will make you feel good and, simultaneously, won’t take a lot of time.

Shaving Techniques:

Shaving Techniques:Shaving is a fundamental part of most men’s grooming routines. To achieve a smooth and irritation-free shave, it is crucial to prepare the skin properly. Begin by washing your face with warm water to open up the pores and soften the facial hair. Apply high-quality shaving cream, use a sharp, clean razor, and shave with the grain of your facial hair to minimize irritation. After shaving, rinse with cold water to close the pores and follow up with a soothing aftershave balm to hydrate and nourish the skin.

Beard Care:If you love growing your beard and enjoy that look, you should also enjoy the beard care routine. This will ensure you have a healthy and fluffy-looking beard at all times. Keep trimming it regularly to maintain a shape, and invest in a good quality beard serum and trimmers. Never buy those cheap flimsy ones, and always wash your beard with a mild cleanser.

Skincare Routine:You know, when a baby is born, we put lotions and oils as per their doctor’s recommendations, but we often forget to take care of our skin. This is so not understandable because a baby is just born and has such great skin, but we have matured skin when it comes to us. So always take advice from your dermatologist and buy skincare accordingly.

Moisturizer and sunscreen are key in any skincare routine, it doesn’t matter whether you put hundreds of serums or not, but if you do not moisturize and protect your skin accordingly, it won’t show any good results.

Tackling Skincare Issues:Men may face specific skincare concerns like razor bumps, acne, or ingrown hairs. To address these issues, it’s crucial to adopt targeted treatments. Consider using an aftershave with glycolic acid or salicylic acid to exfoliate and prevent inflammation for razor bumps. For acne-prone skin, incorporate products containing benzoyl peroxide or tea tree oil into your routine to combat breakouts effectively. If you struggle with hair fall, use a gentle hair cleanser to reduce hairfall.

Hair Care:Don’t neglect your hair in the grooming process. Regular haircuts and styling can enhance your overall look. Find a hairstyle that suits your face shape and personal style. Use quality hair products to maintain your chosen style and keep your hair looking healthy and lustrous. If facing hair loss problems, go ahead and connect with your hair fall doctor to find the best solutions.

It isn’t so hard to master grooming skills; first, you must love yourself and be happy in your skin because it’s yours. If you love yourself, it will reflect on your skin, hair, everything. Always remember that grooming is not just about creating vanity, it is much more than that, and it makes a lasting self-care journey that truly resonates with your personality.

The post Mastering Men’s Grooming: From Shaving To Skincare appeared first on Elderbrendabradley.

October 14, 2023

Tips To Grab Flight Tickets At The Most Affordable Price

We’ve all gone through the arduous, repetitive quest to get the best deals on flights to a particular location. Finding inexpensive flights is overwhelming because there are so many search engines, and prices always change. Here are some essential suggestions that can help you save money, time, and frustration when you book your next flight.

Social media

Social mediaSocial media’s widespread usage has benefited us from various consumer advantages. Travelers who desire to visit another country can now follow well-known airlines on various social media channels and discover attractive international or domestic flight deals. Using this ninja tactic, you may learn more about several last-minute promotional offers that airlines make. Additionally, you may sign up for some of them to receive frequent alerts about airline specials and the finest flash bargains.

Go incognitoIt’s another creative method for locating the least expensive flights because you ultimately receive updates about the subject after using your login information to search. The same thing occurs when flight booking online. It is encouraged to use the new incognito mode when looking for low-cost flights because frequent searches cause costs to soar. Your history won’t be saved in this way. Use other electronic devices, like laptops, phones, and PCs, to make flight reservations without allowing cookies.

Book earlyWhile airline rates frequently continue to rise, there are always methods to score good deals. You might now be wondering how it is feasible. We reply that it is possible to book your flight well before your departure. By doing this, you can fly to your destination during peak travel times at a discounted rate.

Multiple Search engineWe can only recommend this tactic to you for finding inexpensive airline tickets online if you have the patience. Because using this strategy requires you to compare several flights, rates, and drips through many search sites. Additionally, you should be careful to monitor notifications of fare increases. To get the finest flight deal, always try combining several search engines.

Flight related newslettersOne option available to those looking to fulfill their desire to book cheap flights is to join some flight-related newsletters or mailers. By subscribing to these, you can obtain great offers and deals that fit your schedule. As a result, please take advantage of these great offers and discounts whenever you can because they only last for a short time.

Connecting flightIt may be less expensive to schedule a connecting trip than a non-stop ticket if you aren’t in a rush to reach your destination. You can use search engines to filter flight schedules by non-stop, one-stop, and two or more stops. You could save money by using a blended carrier.

Conclusion.

The best strategies for international air ticket booking are social media and reserving early, but you can use any of these tips to grab a good deal. While there are some last-minute offers available, your choices will be limited. With each journey, you may easily locate cheaper flights by comparing the costs and alternatives offered by the carrier, independent online travel agencies, and credit card rewards programmes.

The post Tips To Grab Flight Tickets At The Most Affordable Price appeared first on Elderbrendabradley.

October 13, 2023

How To Open Demat Account For Minors: A Comprehensive Guide

Day by day, the Indian economy is booming. More investors are entering the capital market for various investment opportunities. Especially after the availability of demat online, the whole system became quite easier. So, the overall financial condition is changing rapidly around the economy. Even nowadays, parents are teaching financial skills like investment to their children.

To teach financial skills to the next generation, it is a better option to open a trading demat account. A Demat account is a prerequisite to start investment, even for minors like your children or teenagers. But you may be shocked that without a minimum of 18 years of age, how can one open a demat account? It is also possible to open a demat account for them. Individuals under 18 years of age are also able to own their demat account. Yes, you read it right.

Here are the comprehensive details of the demat account opening for minors.

Demat account for minors in India:

Demat account for minors in India:The Central Depository Services Limited and NSDl control all demat accounts in India. Previously, only adults could open their demat account through stock brokers. Now, anyone can open demat accounts through a demat account opening app. Even minors are also eligible to open their demat accounts through mobile apps or online sites.

Though there are some restrictions to opening a demat account for minors, they can also hold shares of publicly listed companies according to the Companies Law Act 2013. According to the law, minors are not able to buy or sell any kind of shares for themselves. They will have one guardian or parents. The court of India will decide the appointment of parents or guardians for the purpose of purchasing or selling any share. The documented owner will be the minor, but the guardian takes care of all kinds of work like opening demat accounts, closing, and managing accounts.

What are the documents required for opening minor demat accounts?To open a demat account for minors, these below-mentioned documents are mandatory.

Pan card details of guardianBirth certificate of the minor individualIdentity proof and address proof Bank details like a bank accountThe guardian should also submit their details KYC if required. Usually, any modern demat account app demands these documents to verify the identity.

What are the restrictions for minor demat account opening?According to the legal rules, there are some restrictions for minor trading demat accounts as follows.

There is no chance of opening a joint demat account while opening a minor demat account. All kinds of transactions are solely the responsibility of the guarding. The guardian is the authorized controller of the account. Intraday trading and currency trading are not allowed for minor demat accounts. Through a minor demat account, you can only buy and sell equity. Benefits of minor demat accountOpening a minor demat account has a few benefits.

Safe future: Opening a demat account means drafting the path of investment. It can build a safe future for the children. Over the long term, this small move will return huge rewards. Financial skill: When you will open a Demat account for your children, they will learn an overview of investment and financial skills. They will understand the importance of investment from a very early age. Slowly, they will ace the financial state. Conclusion:Investment is one of the best things for all to build a strong wealth for the upcoming days. From a very early age, it is a good practice to start learning about investment or other financial skills. A minor demat account is one such way to learn financial skills.

The post How To Open Demat Account For Minors: A Comprehensive Guide appeared first on Elderbrendabradley.

October 7, 2023

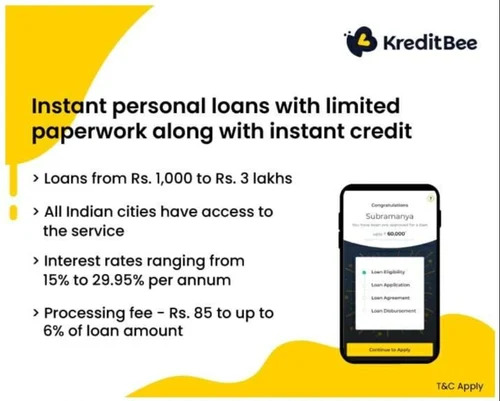

Quick Cash At Your Fingertips: Explaining Personal Loan Apps

In today’s fast-paced world, financial needs can arise at any moment. Whether it’s an unexpected medical expense, a sudden car repair, or even a dream vacation, having access to quick and reliable funds has become more essential than ever. This is where the power of personal loan apps comes into play, revolutionising how we secure and manage our finances.

In this article, we’ll delve into the world of personal loan apps, their benefits, and how they are transforming the lending landscape.

The Rise of Personal Loan Apps:

The Rise of Personal Loan Apps:Disappeared are the times of extended waitings at the financial institution, ample documentation, plus holding back weeks for loan confirmations. Personal loans applications have arisen as an energetic solution to these customary miseries. These applications have revolutionised the loan-acquiring procedure into an effortless digital involvement.

Convenience Redefined:Unrivalled convenience is the key attraction of personal loan apps. The conventional loan procedures usually involve repeated trips to the bank and endless documentation. However, with loan apps, you can effortlessly accomplish the entire process from the cosiness of your residence or workplace. Bid farewell to wasted time in traffic or enduring lengthy queues. Acquiring funds with a few effortless touches empowers you to promptly attend to your financial requirements and focus on the genuine priorities in your life.

Flexible Repayment Options:Personal loan apps understand that one size does not fit all regarding loan repayment. These apps empower you with a range of flexible repayment options. Whether you prefer to repay the loans lump sum or break it down into smaller instalments, the choice is yours. This flexibility ensures you can align your loan repayment with your financial circumstances, reducing the stress often accompanying traditional fixed repayment plans.

Competitive Interest Rates:Financial well-being is closely tied to interest rates, and personal loan apps have taken note. These apps offer competitive interest rates that rival or even outshine traditional lenders. This means that not only are you getting the instant loan you need promptly, but you’re also doing so without breaking the bank in interest payments. It’s a win-win situation that reflects the modern borrower’s desire for affordable and transparent lending solutions.

Easing the Documentation Burden:A significant concern when applying for a loan is the overwhelming amount of paperwork needed. Personal loan applications have taken a proactive approach to address this problem by decreasing the necessary documentation. Several applications utilise technology to authenticate your identity and financial details, lessening the requirement for numerous photocopies and paperwork.

Financial Empowerment:In addition to the immediate advantages of obtaining funds, personal loan applications have a noteworthy impact on monetary liberation. These applications frequently offer informational materials and utilities that assist borrowers in making educated choices. From pointers on budgeting to comprehending credit ratings, these applications transform borrowers into financially astute individuals who are better prepared to handle their finances.

Final Thoughts:Apart from the instant profits of acquiring funds, personal loan applications remarkably affect monetary freedom. These applications frequently provide informative resources and tools that aid borrowers in making informed decisions. From tips on managing finances to understanding credit scores, these applications transform borrowers into financially savvy individuals better equipped to manage their money.

The post Quick Cash At Your Fingertips: Explaining Personal Loan Apps appeared first on Elderbrendabradley.

October 6, 2023

Tips For Individuals Interested In Short-Term Stock Trading

If you are a person who is looking to invest in stocks but is scared of having limited knowledge about it, you have landed in the right spot. Here, we will help you understand stocks better, which will help you invest wisely.

Adding to that, we will also lay out a few tips and tricks to ace short term stocks trading.

But before we get into those tips, let’s clear the basics first.

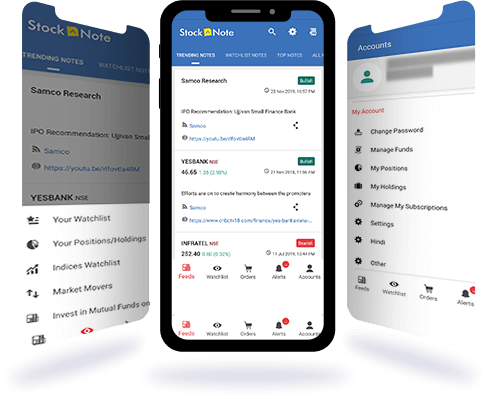

1.What is short-term trading?In Short-term trading, you can get a position that can last from seconds to several days. It is often seen as an alternative to the buy-and-hold strategy, where buyers can hold a position for long if they please.Here, the primary focus is on price action, not the long-term fundamentals of an asset. In short-term trading, you can expect profits through quick moves in the prices. 2.Short-term trading and stock market protips Momentum tradingHere, stocks are purchased based on the recent trends in the market. Here, traders look for market movements that are strong enough to continue for a while.In momentum trading, it is very crucial to identify both downward and upward trends so they can leverage them to get more profits. For beginners, it is wise to practice momentum trading with a free demo trading account that is provided on many online platforms. Range tradingRange trading helps to make trade by staying within the boundaries of support and resistance. Since range-bound markets do not show much movement, it might be tiresome for long-term trade. However, the same is excellent for short-term traders to maximize tiny profits from small movements. Short-term trading for range traders is profitable as it opens a position at a known level of resistance. Thus creating ample opportunities to leverage the price falling to the support level. As a range trader, you can use tools like fractals indicators to get a heads-up on when the market price might break from a particular range.Reversal tradingReversal trading comprises techniques where you identify when an existing trend will change its direction. Reversals can occur in both directions. When the market is at the bottom of a downtrend and is exhibiting signs of becoming an uptrend, it is called a ‘bullish reversal.’ The opposite of this is called a ‘bearish reversal.’By identifying the quick price reversal, short-term traders can make small and quick profits. So, what did we learn?Short-term trading is a good way to earn quick and small profits without taking many risks. Carefully follow the online trading tips and the short-term trading strategies mentioned in the article. Make effective use of necessary tools like fractals indicators to identify the fluctuation prices and get valuable insight to make the right trade decisions.You can always learn more about short-term trading through an Indian trading app, where you can set up a free demo account to practice these strategies before jumping into the real market to make profits.

The post Tips For Individuals Interested In Short-Term Stock Trading appeared first on Elderbrendabradley.

October 2, 2023

A Beginner’s Guide to Roulette: Understanding the Rules and Strategies

Gambling enthusiasts and novices alike have witnessed the transformation of traditional games into their 21st-century counterparts, thanks to advancements in technology. One such game that has stood the test of time is Roulette, a classic casino game that has evolved over the centuries. If you’re a beginner eager to delve into the world of online Roulette, understanding the rules and strategies is paramount.

What is Roulette?

What is Roulette?Roulette, derived from the French phrase “little wheel,” traces its roots back to 18th-century France. Its predecessor, the Italian game Biribi, laid the foundation for the game we know today. The basic premise involves players placing bets on numbers, groups of numbers, or the colors red or black. A croupier spins a wheel, and a ball is introduced, eventually settling into one of the numbered pockets. Winners are determined based on correctly predicting the outcome of the spin.

Roulette Rules for BeginnersBefore diving into the thrilling world of online Roulette, understanding the fundamental rules is essential:

1.Place bets on allocated spaces on the roulette table.

2.Adhere to table limits when placing bets.

3.Bet before the dealer closes the session.

4.Only the dealer handles payouts and losing bets.

5.Avoid touching the marker of the winning number during play.

How to Play Roulette for BeginnersEmbarking on your online Roulette journey is simple:

1.Pick a bet from the roulette table.

2.The dealer initiates the round by introducing a ball into the spinning wheel.

3.Betting concludes when the dealer announces, “no more bets.”

4.The ball’s landing determines winners and losers.

5.Repeat or adjust your wager for the next round based on your strategy.

Types of RouletteUnderstanding the various types of Roulette enhances your gaming experience:

European Roulette: 36 black and red pockets with a single zero.

American Roulette: Two zeros, increasing the house edge.

French Roulette: Similar to European Roulette, with special bets like “en prison” and “La Partage.”

Live Roulette: An online version with a live dealer.

Types of BetsMastering the art of betting is crucial:

Inside Bets: Include straight up, split bet, street, and corner.

Outside Bets: Encompass red/black, odd/even, high/low, and dozens.

In conclusion, armed with this comprehensive guide, you are ready to embark on your Roulette adventure. Whether you opt for the thrill of Live Roulette or the classic European variant, understanding the rules and strategies will undoubtedly enhance your gaming prowess.

The post A Beginner’s Guide to Roulette: Understanding the Rules and Strategies appeared first on Elderbrendabradley.

September 22, 2023

Is Expense Management Easy Task & How To Do It On Your Own?

Expense management is one of the most crucial factors for any business. From a very early age, everyone must adopt the expense management process if they have their own saving bank accounts. It will benefit everyone, especially those who want to start their own business.

Well, here you can find expense management details like what it is and other related factors.

What is an expense?Everything you will need in exchange for money is an everyday expense. It can be purchasing school supplies, college fees, good clothes, cars, etc. Though all costs are not the same or mandatory, some are fixed in everyone’s life. Properly managing expenses can save money. Besides, you can easily understand your essential costs and what can be avoided once you start assessing your daily expenses.

How many types of expenses are there?Here are some different kinds of expenses you may incur in your daily life. Have a look at these.

Essential expenses: The name says it all. Whatever you need in your life always, or in other words, the necessary costs for spending life are essential costs. It consists of food, water, house, and clothing expenses. You can not cut down any of these to spend your life smoothly. These are very basic costs you have to bear. Usually, people start saving their money in a saving account after covering their essential expenses completely.Optional expenses: Optional expenses are not necessary, but you may like them sometimes. These expenses are optional which means that are not always required compulsorily but if you can satisfy those needs, it can give you mental peace. For example, you can watch a movie with friends. It comes under the optional costs. Some other examples can be hobbies, luxury bikes, cars, etc.Fixed expenses: Fixed expenses are something that is set beforehand. You can not avoid these expenses. Fixed expenses help you to determine your other expenses. Some of the fixed expenses are WiFi bills, mobile bills, utility bills, etc. Variable expenses: Variable expenses are also quite important and are included in almost everyone’s life. Variable expenses do not have a fixed amount of requirement for money. It can change over time based on the type of expenses you need to go through. Variable costs include grocery expenses, medicine requirements, fuel needs, etc. How can you manage your expenses?Expense management is a very important procedure that ensures you stay within your budget. Also, you can have a good grasp on your overall savings, investment, etc.

Here are some ways you can manage your expenses.

Effectively track your expenses. It can be done by maintaining a spreadsheet on your own. Some expense management mobile apps can also help you to do this. In this way, you can have a strong understanding of your expenses. You can mention all transactions you must go through within a mobile application. These can include your debit card , credit card, etc. These days, many financial apps are available to guide you through this. Always have a zero balance bank account open to save your money effectively in order to manage expenses. Always categorize what you need urgently or what is necessary for your daily life. Avoid extra expenses or optional expenses as much as you can. Pay off your debt first. Also, try to repay all kinds of loans as soon as possible.So, here is an overview of expense management, an important life skill. Always keep track of your expenses daily. Take the help of various financial apps or any online payment app that is useful and trustworthy.

The post Is Expense Management Easy Task & How To Do It On Your Own? appeared first on Elderbrendabradley.

September 8, 2023

Revolutionizing Urban Mobility: Exploring Ride Booking through Taxi Apps in the Philippines

In the bustling urban centers of the Philippines, a transportation revolution is underway. The keywords “rides,” “book car,” and “taxi app” encapsulate the transformative power of technology-driven services that are reshaping how Filipinos move within cities. This article delves into the impact of these keywords on the transportation landscape and how they are redefining the concept of getting from one place to another.

The Rise of Ride BookingIn a society where time is of the essence, the notion of “rides” has taken on new meaning. Traditional modes of transportation are being replaced by innovative alternatives enabled by cutting-edge technology. The ability to “book car” services through “taxi apps” has introduced an unprecedented level of convenience for commuters.

Seamless Convenience with Taxi AppsWith the advent of “taxi apps,” the process of securing transportation has been streamlined. Commuters can now effortlessly “book car” services from their smartphones, eliminating the need to hail a taxi on the street. These apps enable users to pinpoint their location, select their destination, and track the approaching vehicle in real time, creating a sense of control that was once unimaginable.

Empowering Commuters through Technology

Empowering Commuters through TechnologyThe convergence of “rides,” “book car” services, and “taxi apps” has put power back into the hands of commuters. No longer beholden to the uncertainties of taxi availability or haggling over fares, Filipinos can simply rely on their smartphones to access reliable transportation options. This empowerment is especially valuable in a region where traffic congestion and transportation challenges are prevalent.

Navigating Urban ChallengesThe prevalence of “taxi apps” has not only enhanced convenience but also presented a solution to some of the most pressing urban challenges. With millions of people moving through the Philippines’ cities daily, traffic congestion and pollution have become critical issues. By promoting the use of shared rides through “taxi apps,” urban planners hope to alleviate congestion and reduce the carbon footprint.

Economic Opportunities and the Gig EconomyThe integration of “taxi apps” has created economic opportunities for many Filipinos. Becoming a “book car” driver allows individuals to earn income on their terms, participating in the growing gig economy. This model is particularly appealing in a region where flexible employment options are highly sought after.

Changing Landscape of Traditional TaxisAs “taxi apps” gain prominence, traditional taxi services are also evolving. Faced with competition from digital platforms, many taxi companies have integrated technology into their operations. Some have developed their own “taxi apps,” bridging the gap between traditional taxis and the modern convenience offered by ride-hailing services.

Challenges and Future ProspectsWhile the impact of “rides,” “book car” services, and “taxi apps” is undeniable, challenges remain. The digital divide and access to smartphones can limit the reach of these innovations, particularly in rural areas. Additionally, regulatory considerations must be addressed to ensure fair competition and passenger safety.

ConclusionThe evolution of transportation in the Philippines is a testament to the potential of technology to reshape daily life. The convergence of “rides,” “book car” services, and “taxi apps” has ushered in a new era of urban mobility, where convenience, empowerment, and economic opportunity intersect. As these keywords continue to redefine transportation, the future promises a more connected, efficient, and accessible transportation ecosystem for Filipinos across the archipelago.

The post Revolutionizing Urban Mobility: Exploring Ride Booking through Taxi Apps in the Philippines appeared first on Elderbrendabradley.

February 10, 2021

Make sure you sign up for yoga classes online for free

Learning Yoga through online classes has popularized in recent times. Online yoga classes are similar to face-to-face courses with the instructor. The instructor provides lessons keeping clients requirements and health issues in mind. Yoga is for everyone but works wonder for people who are dealing with stress and anxiety. Yoga is a beautiful tool to reduce stress and tension from your daily life.

Today many even provide yoga classes online for free to reach out to the people who can’t afford help for themselves.

Work out sequence followed in the yoga classes; Any form of workout includes a small warm-up in the beginning. For Yoga, warm-up includes simple stretchesThen it is followed up by Surya namaskar ( Sun Salutation ). The minimum number of sets to be done is 12, and it can extend up to 108After Surya, namaskar is then followed up by several asanas ( yoga postures) After practising the asanas, students practice pranayama, which is breathworkAnd, finally, pranayama is followed up meditation

Work out sequence followed in the yoga classes; Any form of workout includes a small warm-up in the beginning. For Yoga, warm-up includes simple stretchesThen it is followed up by Surya namaskar ( Sun Salutation ). The minimum number of sets to be done is 12, and it can extend up to 108After Surya, namaskar is then followed up by several asanas ( yoga postures) After practising the asanas, students practice pranayama, which is breathworkAnd, finally, pranayama is followed up meditationThis is a primary sequence which any yoga instructor will follow in the class. The combination of postures, meditation and breathing exercises helps in relieving stress and anxiety.

How Yoga helps in reducing stress and anxiety?Today, most people spend hours sitting in front of the screen, which can be stressful for the mind and body. Yoga is a form of workout in which slow movements involved, and slow movements allow deep stretches. Deep stretches are suitable for your body as it opens the muscles near the joints and helps in releasing physical stress. Physical stress near the neck, back and hips slow down productivity. So to have a more productive day, start your day with few stretches.

Apart from relieving physical stress, yogic breathing exercises, and mediation helps in achieving mindfulness. There are several forms of meditation techniques used in Yoga to make the mind focused. The best way to achieve mindfulness is to sit down comfortable place in a relaxed posture, lower your vision or close your eyes, and try to focus on your body’s breathing mechanism. To have more focused breathing, practitioners can even count their breath. The mind will wander a lot at the beginning of meditation, and that completely okay. The only important thing is to focus on breathing when you feel you have lost your connection.

Breathwork, mediation, and asanas help you feel relaxed and start your day with an open mindset while helping you have a positive outlook on life. Yoga classes online for free available to teach people mindfulness and awareness so that people can be there best selves in their day to day life.

Stress and anxiety can become a barrier for people to achieve their goals. Yoga is here to teach us how to manage such stressful days in our lives. The goodness of Yoga is discussed over the world, and it is also practised by many. You can also be one of those many people who have embraced Yoga in their lives for better productivity and livelihood.

In today’s consumerism world, it is hard to find anything suitable for free. Ifyoga classes online for free is available, then, in my opinion, everyone should sing up for that class as the uncountable number of mental and physical benefits. Sign up for a free yoga class and use Yoga as a powerful tool to fight your daily challenges. The magic of Yoga can potentially make a massive difference in a practitioner’s life. So make Yoga a part of your everyday life by signing up for yoga classes online for free.

Brenda Bradley's Blog

- Brenda Bradley's profile

- 3 followers