Brenda Bradley's Blog

September 11, 2025

The Secret Story Of Vegetables And Recipes Revealed!

Vegetables carry a kind of secret life, one that we rarely stop to notice. We peel, chop, boil, fry, sprinkle them with salt, and move on, but beneath those ordinary gestures there are stories of migration, survival, even personality. It’s strange, isn’t it, how something as everyday as a green stalk or a purple skin can be a lesson if you let it linger long enough.

Think about broccoli. People love to joke about hating it, children pushing it to the side of their plates, and adults disguising it under cheese. Yet, when you really look at it, it stands there like a miniature forest, stubborn and architectural. It doesn’t wilt easily. It doesn’t beg to be liked. You steam it, roast it, stir-fry it, and it retains its quiet, earthy dignity. I sometimes think broccoli is like those friends who don’t speak much, but when they do, their words stay with you.

Then there’s parsley. Always an afterthought, a garnish left behind on the edge of a plate. But anyone who’s bitten into a handful knows it carries brightness, a fresh bite that wakes you up. It’s not a loud herb. It doesn’t try to dominate. It’s the quiet accent in a crowded conversation. And maybe that’s why we like it—it reminds us of those people who never fight for the spotlight but whose presence you notice once they’re gone. They hold the meal together in a way you don’t always recognize.

Now, eggplant—ah, that one has drama. Glossy, purple, almost regal, it sits in baskets as if it knows it belongs to royalty. Raw, it can be bitter, almost off-putting. But give it fire, give it oil, and it transforms into something silken and smoky. I’ve seen whole cuisines bend around it: smoky baba ghanoush scooped with warm bread, stuffed eggplant simmered in spices, baked layers melting into cheese. Eggplant teaches patience. It tells you that sometimes the most ordinary-seeming thing just needs the right amount of time and heat to reveal its truest form.

On the opposite end sits lettuce, fragile and cool. It doesn’t want fire, doesn’t want to be transformed. It wants to be eaten as it is—crisp, refreshing, carrying the clean taste of water and soil. There’s something honest about lettuce. It doesn’t pretend. It doesn’t hold back. And maybe that’s why it bruises so easily, because it doesn’t put on a shell. Some people dismiss it as boring, diet food, filler for sandwiches. But I think it has its own wisdom: sometimes nourishment is simple, and not every meal needs to be dressed in spices and smoke.

And then we arrive at okra. A vegetable with a reputation, slimy, slippery, avoided by some, adored by others. Lady’s finger, they call it, though I’ve never thought it looked particularly elegant. What fascinates me about okra is how it traveled, carried across continents, adapting to new soils and new kitchens. In gumbo, it thickens broth; in Indian curries, it soaks up spice; fried crisp, it turns into a delicacy. Okra carries with it the memory of journeys, of resilience under different skies. Eating it feels like being reminded that migration doesn’t erase identity—it reshapes it.

What we love about thinking of vegetables this way is how much they resemble people. Broccoli is the strong, quiet type. Parsley, the friend who adds brightness when things get heavy. Eggplant, the artist who changes depending on the stage. Lettuce, fragile but honest. Okra, the traveler, holding on to memory even as it adapts. Each one, in its own way, is a lesson in how to live.

And yet, when we walk into supermarkets, they’re reduced to barcodes and prices. Stripped of their stories, stacked under fluorescent light, forgotten until dinner. But vegetables are not just fuel. They are mood, texture, and memory. The crunch of lettuce on a summer afternoon, the bitterness of broccoli softened with garlic, the velvet of roasted eggplant—it’s not just eating, it’s living.

Even the act of cooking them is a kind of dialogue. Cutting through a crisp stalk, tearing leaves with your hands, stirring something slowly over a pan, it pulls you into a rhythm older than any recipe book. Somewhere in that process, you’re not just feeding yourself. You’re connecting with soil, with rain, with farmers who bent down to harvest these plants before they found their way into your kitchen.

Food, especially vegetables, reminds us of cycles. That which grows must be tended, what’s tender must be protected, and what nourishes us does so quietly, without asking for thanks. And maybe that’s the point. Maybe the dignity of a vegetable lies in how uncelebrated it often is.

The next time you hold one, pause. Notice its weight, its shape, the small details, the ridges on okra, the tree-like crowns of broccoli, the shine of eggplant skin. These are not just groceries. They’re stories, waiting to be tasted.

Because food is never only food. It’s migration and memory, resilience and simplicity, history and hope, all resting quietly in the palm of your hand, waiting for the knife, the fire, the bite.

The post The Secret Story Of Vegetables And Recipes Revealed! appeared first on Elderbrendabradley.

July 29, 2025

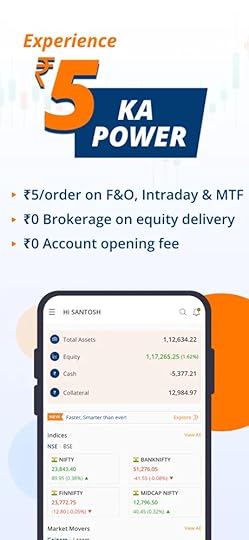

Common Mistakes To Avoid While Using Online Trading Apps

Trying out new things or venturing into a new industry (such as trading) can definitely lead to making mistakes. Mistakes are unavoidable, even a professional trader can make the most silly mistakes on a free trading app. And, indeed, a person learns best from their mistakes. However, if you are a newcomer, you must try your best to avoid these minor mistakes.

Let’s go through some of the most common mistakes that a trader commits while using an

online stock trading

platform: Investing Too Much In One Go: The success of any trading deal is never guaranteed. It can be tempting to invest a large sum of money in online stock trading, but doing so will only increase the odds of losing the entire amount. One thing that new traders can do in order to avoid a huge loss is to start investing or trading with small amounts. A free trading app does not have any restrictions on the amounts that can be invested in stocks. You can start with as little as you wish. Trading Without Researching: Trading without researching is as good as showing up to a costume party without a costume (you’ll end up regretting it for all the good reasons). Following your guts and listening to your intuitions don’t always work in the

share trading app

. Research is something that will take you a long way as a newcomer. Not following a proper research pattern can lead to misinformation and wrong investment decisions. Not Having A Trading Strategy: Buying and selling stocks on a share trading app without any specific strategy will not help you benefit from your investments. If you do not plan a strategy in advance, then you are most likely to get overwhelmed at the time of actual trading and potentially lose a significant amount in it. Not Implementing Stop Loss And Take Profit: These are the two most important market orders that will help you to automate the trading process on any

share market trading app

. These orders are basically your trading targets. If you fail to implement these orders, you will have to constantly monitor your investments at all times so as to avoid exposure to high rates of market volatility. Limiting Your Investment Options: Diversification of your investment portfolio is of key importance. It not only allows you to diversify your investment but also enables you to reduce the exposure to market volatility. Suppose one segment of your investment is exposed to high risks, but the other investment market is not experiencing any form of downward trend. This helps you to mitigate risk efficiently while exploring new opportunities in different markets.

Let’s go through some of the most common mistakes that a trader commits while using an

online stock trading

platform: Investing Too Much In One Go: The success of any trading deal is never guaranteed. It can be tempting to invest a large sum of money in online stock trading, but doing so will only increase the odds of losing the entire amount. One thing that new traders can do in order to avoid a huge loss is to start investing or trading with small amounts. A free trading app does not have any restrictions on the amounts that can be invested in stocks. You can start with as little as you wish. Trading Without Researching: Trading without researching is as good as showing up to a costume party without a costume (you’ll end up regretting it for all the good reasons). Following your guts and listening to your intuitions don’t always work in the

share trading app

. Research is something that will take you a long way as a newcomer. Not following a proper research pattern can lead to misinformation and wrong investment decisions. Not Having A Trading Strategy: Buying and selling stocks on a share trading app without any specific strategy will not help you benefit from your investments. If you do not plan a strategy in advance, then you are most likely to get overwhelmed at the time of actual trading and potentially lose a significant amount in it. Not Implementing Stop Loss And Take Profit: These are the two most important market orders that will help you to automate the trading process on any

share market trading app

. These orders are basically your trading targets. If you fail to implement these orders, you will have to constantly monitor your investments at all times so as to avoid exposure to high rates of market volatility. Limiting Your Investment Options: Diversification of your investment portfolio is of key importance. It not only allows you to diversify your investment but also enables you to reduce the exposure to market volatility. Suppose one segment of your investment is exposed to high risks, but the other investment market is not experiencing any form of downward trend. This helps you to mitigate risk efficiently while exploring new opportunities in different markets. There are many trading apps India that guide you step-by-step through the trading process. These apps have not only made the trading process a seamless experience for beginners but also made the investment market more accessible than ever. By following the tips mentioned above, you can easily trade with caution and enjoy the returns of your investment with no extra stress.

The post Common Mistakes To Avoid While Using Online Trading Apps appeared first on Elderbrendabradley.

July 23, 2025

Fun Ways To Support Toddler Learning With Interactive Play

A child’s toddler years are fun and crucial. Building language, problem-solving, creativity, and motor skills in early childhood prepares children for future learning. Many parents don’t realise that toddlers learn best via play and fun.

Interactive play is a powerful instrument for toddler learning, not just amusement. Children can learn cognitive and social skills through fun, informal activities. Today, there are many ways to include toddler, preschool, and kid learning games and apps into everyday routines to make early learning fun and effective.

This article will discuss enjoyable ways to enhance toddler learning through interactive play and how to use preschool learning games to prepare young children for academic achievement.

Interactive Play Benefits Toddler LearningToddlers are inherently curious. They want to experiment and copy the world. Toddler learning thrives on sensory, movement, and problem-solving activities.

Interactive play helps kids focus, communicate, and regulate their emotions. Interactive play, like peek-a-boo or colourful matching, makes everyday encounters educational.

Structured but engaging preschool games help children learn new ideas while staying focused.

Simple Learning Games for ToddlersTraditional toddler games like shape sorters, building blocks, and puzzles help promote hand-eye coordination, spatial awareness, and basic problem-solving. Tactile and visual stimulation are essential for toddler learning with these classic toys.

Toddlers play pretend with dolls, kitchen sets, and toy automobiles. Interactive play boosts language, storytelling, empathy, and sharing.

Even singing action songs or playing “Simon Says” can improve listening, memory, and following instructions, which are crucial for preschool.

Traditional toddler games can be combined with digital tools like learning apps for kids to create a well-rounded play-and-learn routine.

Digital Apps and Preschool Learning Games RiseMany parents use learning applications to enhance hands-on play in the digital age. In interesting, interactive ways, these applications teach basic literacy, numeracy, colours, shapes, and more.

Mobile preschool learning games with cute animations, enticing songs, and interactive challenges are popular with young learners. These apps are great because they adapt to each child’s pace, keeping them from being overwhelmed or bored.

Learning applications for kids can supplement physical play and reinforce key concepts when used wisely.

A youngster can use an app to practice recognising colours and shapes, then start playing real-world games like sorting coloured blocks or spotting shapes on a stroll.

How Preschool Games Prepare Toddlers for SchoolInteractive preschool games go beyond entertainment—they teach early learning skills in a fun way to prepare kids for school. These games teach counting, letter recognition, fine motor abilities, and early science concepts like sorting and matching.

Toddlers learn academics, follow directions, take turns, and focus by playing preschool games. These “soft skills” are as crucial as intellectual skills for school preparedness.

Whether digital or real, preschool games’ organised but joyful nature gives children a taste of classroom learning.

Conclusion:No pricey instruments or strict training are needed to help toddlers learn. Simple, enjoyable activities like constructing blocks, singing songs, or using an app assist young children develop literacy, numeracy, creativity, and social skills.

Parents may make everyday moments educational by mixing toddler games, preschool learning games, learning applications for kids, and preschool activities.

The post Fun Ways To Support Toddler Learning With Interactive Play appeared first on Elderbrendabradley.

July 3, 2025

Earn Income From Free Grahak Seva Kendra

In today’s evolving economy, opportunities for self-employment are expanding beyond traditional business models. One such opportunity is operating a Free Grahak Seva Kendra, a platform designed to bring basic banking and government services closer to rural and semi-urban populations. These centers function through Kiosk Banking, enabling people without direct access to traditional banks to carry out essential financial transactions.

This explores how you can earn income by running a Free Grahak Seva Kendra, the services you can offer, and how it contributes to both your financial growth and local community development.

What is a Free Grahak Seva Kendra?A Free Grahak Seva Kendra is a small service center that provides access to various public and banking services under one roof. These centers are set up primarily in rural and underbanked areas to extend the reach of financial services. The Kendra acts as a bridge between citizens and banks, government schemes, and utility services.

The core of this model is Kiosk Banking, a system that allows individuals to perform basic banking functions through digital tools at a remote location. As a center operator, you act as a service point or customer service representative, offering essential services to your community and generating revenue through commissions and transaction-based incentives.

How Kiosk Banking Works at a Grahak Seva KendraKiosk Banking is designed to bring banking services to people who lack access to a physical bank branch. Through a biometric device, printer, and internet connection, these centers can provide:

Cash deposit and withdrawalBalance enquiry

Mini statement generation

Fund transfer

Account opening assistance

Application support for government schemes

As an operator, your role involves facilitating these transactions and providing guidance to customers who may not be digitally literate. In return, you receive a commission for every service performed. These small commissions add up over time, making it a viable and sustainable income source.

Services Offered at a Free Grahak Seva KendraFree Grahak Seva Kendras are not limited to financial services. In fact, they cover a wide range of offerings that can make your center a one-stop solution for many needs:

1. Banking ServicesYou can support individuals in opening bank accounts, withdrawing cash, transferring funds, and checking their balances using Kiosk Banking. This is especially helpful in areas where the nearest bank is many kilometers away.

2. Utility Bill PaymentsYour Kendra can serve as a bill collection center. You can assist people in paying their electricity, water, gas, mobile recharge, and DTH bills.

3. Government SchemesMany rural citizens face difficulties accessing government benefits due to digital barriers. Through your center, you can help them apply for pensions, subsidies, and insurance schemes.

4. Documentation ServicesYou can offer services like printing, photocopying, scanning, and form-filling, which are essential for various official processes.

5. PAN Card and Other Application SupportYou may also assist in applying for identification documents, tax-related services, and other mandatory forms, further expanding your service list and income potential.

Income Opportunities from Grahak Seva KendraOperating a Free Grahak Seva Kendra provides multiple income streams:

a. Transaction-Based CommissionEach transaction—be it a fund transfer, cash deposit, or withdrawal—earns you a small commission. This adds up significantly as your customer base grows.

b. Fixed Service ChargesFor services like photocopying, scanning, or form filling, you can charge a nominal fee. These services are used regularly, providing a steady income stream.

c. Seasonal EarningsCertain times of the year, especially during government scheme enrollment periods, can bring in a higher volume of customers and greater income.

With time and trust, your center becomes an essential hub for villagers, thereby increasing your monthly income steadily.

Requirements to Set Up a Free Grahak Seva KendraStarting your own center is not capital-intensive. Here’s what you typically need:

A small rented or owned space in a visible locationA computer or laptop

Printer and biometric device

Internet connectivity

Basic digital knowledge

Registration with service aggregators or financial institutions

Once the infrastructure is ready, you can register with authorized platforms to start offering services.

Benefits of Running a Free Grahak Seva KendraSocial ImpactYou help bridge the gap between urban and rural access to essential services. By offering banking and government facilities in remote areas, you empower people and promote financial inclusion.

Low Investment, High ReturnWith minimal setup costs and recurring commissions, the return on investment is promising. Over time, your income grows with your reputation and the variety of services you provide.

Community RespectBeing a local point of assistance, you gain recognition and respect in your community for solving practical problems.

ScalabilityOnce established, your center can expand services, partner with more networks, and even train others under you, growing both your reach and income.

Challenges and How to Overcome ThemWhile the model is effective, it does come with a few challenges:

Awareness: Many rural people are unaware of these services. Regular outreach and word-of-mouth promotion can help.Digital Literacy: Some customers may not be familiar with digital services. Patiently guiding them builds trust and repeat engagement.

Technical Issues: Internet or device failures may cause delays. Having backups and proper support channels is essential.

Being consistent and reliable is key to building a successful Grahak Seva Kendra.

ConclusionSetting up a Free Grahak Seva Kendra is a meaningful and rewarding opportunity for self-employment. Through Kiosk Banking, you offer essential services that bring financial convenience to underserved populations while also creating a stable income for yourself.

As the need for accessible services grows, your center becomes a vital part of the community. With low investment, scalable operations, and growing demand, it’s a smart way to contribute to society and build a sustainable livelihood.

By choosing to operate a Free Grahak Seva Kendra, you not only earn but also empower. It’s a business that grows with trust, service, and responsibility—turning your commitment into both social impact and income.

The post Earn Income From Free Grahak Seva Kendra appeared first on Elderbrendabradley.

June 10, 2025

Get Instant Personal Loan Online In Minutes

Managing sudden financial needs can be challenging. Whether it’s a medical emergency, home repairs, or unplanned travel, immediate access to funds is often crucial. This is where applying for a personal loan online becomes highly convenient. With minimal paperwork and faster approvals, you can secure a quick loan within minutes. The digital lending landscape has simplified the borrowing process, making it easy for anyone with a steady income to access credit without visiting a physical bank or standing in long queues.

This explains how to apply for an instant personal loan online, the process involved, eligibility, and tips to ensure your application is approved swiftly.

What is an Instant Personal Loan Online?An instant personal loan is an unsecured form of credit offered digitally. The entire application process—from submission to disbursal—takes place online. Since it’s unsecured, you do not need to pledge any collateral, which makes it ideal for salaried professionals, freelancers, and self-employed individuals.

Online personal loans offer flexibility in usage. You can use the funds for medical bills, education, rent deposits, travel expenses, or even consolidating previous debts. The biggest advantage lies in the quick loan approval and disbursement mechanism.

Eligibility Criteria for Personal Loan OnlineBefore applying, it’s important to understand the basic eligibility requirements. Although the criteria can differ slightly, most online platforms follow these general parameters:

Age: Usually between 21 to 58 yearsEmployment Type: Salaried or self-employed

Minimum Income: Varies by location and lender; a stable income source is a must

Credit Score: A healthy credit score improves your chances but isn’t always mandatory

Bank Account: Must have an active savings account for disbursal

Being aware of these basic conditions helps speed up your application and reduces the chances of rejection.

Steps to Apply for an Instant Personal Loan OnlineApplying for a personal loan online is a straightforward process. Here are the typical steps:

Step 1: Choose the Loan Amount and TenureSelect the loan amount you require and your preferred repayment duration. Online calculators are often provided to help you determine a suitable EMI based on your income.

Step 2: Fill Out the Application FormEnter your basic details such as name, date of birth, mobile number, employment type, income details, and required loan amount. This is the primary screening step.

Step 3: Upload Required DocumentsMost applications require minimal documentation, such as:

Identity Proof (Aadhaar card, PAN card, etc.)Address Proof

Income Proof (salary slips or bank statements)

Employment Proof

These can be uploaded directly to the platform.

Step 4: Verification and ApprovalOnce you submit the form and documents, a digital verification process begins. If all details are in order, approval is usually granted within minutes.

Step 5: Loan DisbursalAfter approval, the sanctioned loan amount is credited to your bank account, often within the same day or even a few hours.

Benefits of Getting a Personal Loan OnlineFast ProcessingThe biggest benefit of applying online is the speed. From document upload to verification and disbursal, everything happens much faster compared to traditional methods.

No Collateral RequiredAs an unsecured loan, you don’t need to mortgage any property or assets, making the loan accessible to a broader range of borrowers.

Paperless ProcessThe entire journey—from application to approval—is digital, minimizing paperwork and physical interaction.

Flexible RepaymentBorrowers can choose the repayment tenure that suits them best, generally ranging from 6 to 60 months.

24/7 AccessibilityApplications can be made anytime from anywhere, making it especially useful during emergencies.

Tips to Improve Instant Loan Approval ChancesMaintain a Healthy Credit Score: Although not always mandatory, a good credit score reflects your creditworthiness.Accurate Information: Double-check all personal and income-related data you provide. Even small errors can lead to delays.

Submit Clear Documents: Ensure all uploads are legible, valid, and current.

Avoid Multiple Applications: Applying to too many platforms simultaneously can reduce your credit score and delay approvals.

Things to Keep in Mind Before ApplyingLoan Charges

Always check the processing fee, late payment penalties, pre-closure charges, and interest rates. Understanding the full cost helps avoid future financial stress.

Loan TenureChoose a repayment period that aligns with your monthly income and existing financial obligations. Shorter tenure means higher EMI but lower overall interest, while longer tenures ease monthly burden but increase interest cost.

Repayment DisciplineMissing payments can hurt your credit score and attract penalties. Set up automatic deductions or reminders to stay on track.

ConclusionA personal loan online can be a useful solution during financial crunches, offering quick access to funds without extensive paperwork or collateral. With most approvals and disbursals taking place in just a few minutes, borrowers today enjoy unparalleled convenience. However, it’s essential to borrow responsibly and only take a quick loan when truly needed.

By understanding the process, eligibility, and best practices, you can improve your chances of getting approved instantly. Make sure to compare options, read the terms carefully, and repay the loan on time to maintain your financial health.

So the next time you find yourself in need of urgent funds, remember—you can get an instant personal loan online in minutes, right from the comfort of your home.

The post Get Instant Personal Loan Online In Minutes appeared first on Elderbrendabradley.

February 9, 2025

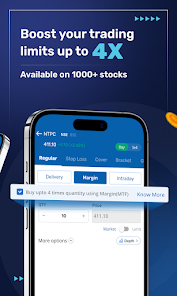

Smart & Simple Online Trading App For All Investors

The world of investing has evolved significantly in the past decade. Gone are the days when stock market trading was exclusively reserved for professional traders or those with significant financial resources. Today, thanks to the advent of online trading platforms, anyone with a smartphone and an internet connection can access the financial markets. This transformation is largely attributed to the rise of online trading apps that are revolutionizing how investors trade in the stock market.

An Indian stock trading app specifically offers features that cater to Indian investors, simplifying the process of buying and selling stocks, bonds, and other investment assets. In this article, we will explore how these apps have simplified investing, why they are beneficial, and what features make them indispensable for both novice and experienced investors.

Understanding Online Trading AppsAn online trading app is a digital platform that enables users to trade financial instruments like stocks, bonds, and mutual funds through their mobile devices or computers. The primary goal of these apps is to make trading accessible, efficient, and affordable. Users can execute trades, access market data, and manage their portfolios in real time.

In India, where the stock market has seen exponential growth, an Indian stock trading app offers significant advantages. These apps are designed to cater to local needs, with features such as Indian market insights, language preferences, and integration with Indian financial systems.

For an investor, a trading app simplifies the entire investment process. No longer do you need to visit a brokerage office or call up a broker to place a trade. With the push of a button, you can buy or sell securities and manage your portfolio seamlessly.

Why Opt for an Indian Stock Trading App?While international stock trading apps are widely available, an Indian stock trading app offers several unique benefits tailored to the Indian market. These apps are specifically designed to help Indian investors navigate the nuances of the domestic financial landscape. Some of the primary advantages include:

Access to Domestic Stock ExchangesOne of the key features of an Indian stock trading app is access to India’s leading stock exchanges, such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). These exchanges are home to the most widely traded stocks, and the apps allow investors to trade in real-time, staying updated on stock price movements, index changes, and company news.

Localized Features and ServicesMany online trading platforms provide a range of features that are relevant specifically to Indian investors. These may include integration with Indian banks for easy deposit and withdrawal, tax-related tools, and local news alerts that directly impact the Indian stock market.

Simplified Tax Filing and DocumentationAn essential part of investing is tax management, and many Indian trading apps make this easier for users by offering tools that automatically calculate capital gains, dividends, and tax liabilities. The app can also provide the necessary reports for filing tax returns, making tax filing much simpler for investors.

Affordable and Transparent Fee StructuresTraditionally, investors had to pay high brokerage fees when trading stocks through traditional methods. Trading apps have significantly lowered these fees, making it affordable for all types of investors. Many platforms now offer zero-commission trading or charge minimal fees for each transaction. This helps keep costs low, especially for active traders who make frequent transactions.

Educational Tools and Market InsightsAn excellent feature of most trading apps is the educational content they offer. Whether you are new to investing or looking to refine your strategies, these apps provide articles, videos, and tutorials to help users enhance their knowledge. Many also feature live market updates, technical analysis, and stock recommendations to assist with decision-making.

Essential Features of a Trading AppTo make trading easy and accessible, online trading apps come with a host of features that allow users to efficiently execute trades and manage their investments. Below are some key features that are crucial for any trading app:

1. Real-Time Market Data and UpdatesOne of the most significant advantages of using a trading app is access to real-time market data. Investors can track stock prices, indices, and trends as they happen, allowing them to make timely decisions. Stock price alerts, customizable watchlists, and live news feeds ensure that users never miss critical information that could affect their investments.

2. Advanced Charting and Technical Analysis ToolsFor experienced traders, access to advanced charting tools and technical indicators is essential. Many trading apps offer customizable charts, which allow investors to analyze stocks using a wide range of technical indicators. This helps traders identify patterns, trends, and possible entry or exit points.

3. Portfolio Tracking and ManagementManaging your portfolio is a breeze with a trading app. The app allows investors to view the performance of their stocks, calculate returns, and monitor their overall portfolio performance. Some apps even send notifications if the value of certain stocks drops or if it’s time to rebalance the portfolio.

4. Instant TransactionsGone are the days when traders had to wait hours for orders to be executed. Trading apps offer the convenience of instant transactions, where users can place buy or sell orders and have them executed immediately. This is particularly beneficial for active traders looking to capitalize on market fluctuations in real-time.

5. Secure TransactionsSecurity is a primary concern for any investor, and trading apps implement robust security features to ensure the safety of your funds and personal information. Features such as two-factor authentication (2FA), encryption, and secure payment gateways ensure that your account is protected from unauthorized access and fraud.

6. Custom Alerts and NotificationsCustom alerts allow users to stay on top of market changes, news updates, and stock price movements. Whether it’s a stock hitting a target price or a new development in the market, these alerts ensure that users never miss an opportunity.

How Trading Apps Simplify the Investment ProcessThe process of trading stocks has never been easier, thanks to online trading apps. These apps simplify the entire experience, from account setup to transaction execution. Here’s how:

Easy Account Setup and RegistrationSetting up a trading account on an app is quick and straightforward. Investors can register, complete KYC (Know Your Customer) processes, and link their bank accounts all within a few minutes. This eliminates the need for in-person visits to brokerage offices, making it faster and more convenient to start investing.

Accessibility at Your FingertipsUnlike traditional trading methods, trading apps allow you to manage your investments from anywhere, at any time. Whether you’re traveling, at work, or at home, you can execute trades, monitor stock performance, and stay updated on market conditions. This level of convenience is unparalleled.

Affordability for All InvestorsMany trading apps offer zero or low-cost commission structures, allowing investors of all backgrounds to participate in the stock market. This affordability encourages a wider range of people to invest, even those with limited capital to begin with.

TransparencyMost trading apps offer clear and transparent fee structures, ensuring that users are fully aware of the charges associated with each transaction. Unlike traditional brokers who might have hidden fees, trading apps ensure that the costs are upfront and easy to understand.

Selecting the Best Trading App for Your NeedsWith numerous trading platforms available, choosing the right one can be overwhelming. Here are a few factors to consider when selecting an online trading app:

1. User-Friendly InterfaceAn intuitive, easy-to-use interface is essential, especially for beginners. Look for apps with clean, simple designs that make it easy to execute trades, track your investments, and access market data.

2. Security FeaturesAlways choose a trading app that offers robust security features, such as encryption and two-factor authentication. These features ensure that your financial information and funds are protected from cyber threats.

3. Customer SupportReliable customer support is crucial, especially for first-time investors. Choose an app that offers 24/7 customer support via chat, email, or phone, so you can get assistance whenever needed.

4. Fees and ChargesCompare the commission and fee structures of different apps. Some platforms offer zero commissions, while others may charge a small fee per transaction. Choose the one that aligns with your budget and trading frequency.

5. Reviews and ReputationBefore committing to a trading app, take time to read reviews and testimonials from other users. Checking the app’s reputation can give you an idea of its reliability and user experience.

ConclusionIn today’s digital age, investing in the stock market has never been more accessible or convenient. Online trading app have simplified the entire investment process, allowing investors to trade in real time, track their portfolios, and access market insights with ease. By choosing the right Indian stock trading app, investors can benefit from the tools and features designed to meet their specific needs, ensuring a seamless and secure trading experience.

Whether you are a novice looking to dip your toes into investing or an experienced trader looking for an efficient way to manage your assets, an online trading app offers everything you need to navigate the stock market confidently.

The post Smart & Simple Online Trading App For All Investors appeared first on Elderbrendabradley.

January 22, 2025

How to Invest in US Stocks from India

Investing in US stocks from India is an excellent way to diversify your investment portfolio and gain exposure to some of the world’s largest and most successful companies like Apple, Amazon, and Google. However, it involves several factors such as regulatory compliance, taxation, and brokerage fees. This article will guide you through the different ways on how to invest in US stocks from India, along with key aspects to consider before you start.

Ways to Invest in US Stocks from India

Ways to Invest in US Stocks from IndiaThere are two primary methods to invest in the US stock market from India: direct investment and indirect investment.

1. Direct InvestmentDirect investment allows investors to purchase US stocks directly through international brokerage platforms. There are two ways to achieve this:

Domestic Brokers with International Tie-ups: Several Indian brokerage firms have partnerships with US-based brokers, allowing investors to trade US stocks via their domestic trading accounts.Foreign Brokers: Indian investors can open an account with US brokerage firms like Charles Schwab or Interactive Brokers to trade directly in the US market. This option often provides better market access but may involve additional compliance requirements.2. Indirect InvestmentFor those who prefer a simpler approach, indirect investment options such as mutual funds and Exchange-Traded Funds (ETFs) offer an excellent way to gain exposure to US stocks.

Mutual Funds: Many Indian mutual funds invest in US equities or international indices, allowing investors to indirectly benefit from the growth of US companies.ETFs: US-based ETFs track major indices such as the S&P 500, enabling Indian investors to diversify their portfolios without directly purchasing individual stocks.Online Investment Apps: Several online platforms and robo-advisors allow Indian investors to buy fractional shares of US companies with minimal investment requirements.Charges Involved in Investing in US StocksInvesting in US stocks from India involves several costs that investors should be aware of:

Tax Collected at Source (TCS): Effective from October 2023, a 20% TCS is applicable for remittances exceeding Rs. 7 lakh under the RBI’s Liberalised Remittance Scheme (LRS).Capital Gains Tax: Short-term gains (less than 24 months) are taxed as per the investor’s income slab, while long-term gains attract a 20% tax with indexation benefits.Dividend Tax: The US government imposes a 25% tax on dividends earned, but Indian investors can claim credit under the Double Taxation Avoidance Agreement (DTAA).Bank Charges: Foreign exchange conversion fees and transfer fees can add to the investment cost.Brokerage Fees: Depending on the broker, investors may pay commission fees, account maintenance fees, and trading fees.Key Considerations Before InvestingBefore investing in US stocks, Indian investors should keep the following aspects in mind:

Currency Exchange Rates: Fluctuations in INR to USD rates can impact investment returns.Regulatory Compliance: Ensure that the investment platform complies with RBI and SEBI guidelines.Taxation Rules: Understand the tax obligations in both India and the US.Investment Goals: Align your investment with long-term financial goals and risk appetite.Pros and Cons of Investing in US Stocks from IndiaPros:Diversification across global marketsExposure to high-growth sectors like technology and healthcarePotential for currency appreciation gainsAccess to renowned global companiesCons:Additional regulatory and compliance requirementsHigher transaction and maintenance costsCurrency fluctuation risksConclusionInvesting in US stocks from India offers a great opportunity to diversify your portfolio and participate in the growth of global giants. Whether you choose direct or indirect investment methods, it is crucial to understand the costs, regulatory requirements, and tax implications involved. With the right approach and thorough research, Indian investors can successfully navigate the US stock market and achieve their financial goals.

The post How to Invest in US Stocks from India appeared first on Elderbrendabradley.

January 13, 2025

How Crop Loans Empower Farmers For A Better Tomorrow

With food and livelihoods for millions of people, agriculture forms the foundation of our economy. Farmers can have great difficulties despite their importance: fluctuating weather, growing input prices, and changing market conditions. Financial instruments such as crop loans provide farmers the much-needed help to maintain their agricultural activities and open the path for a better and more safe future, therefore addressing these issues.

Crop Loans &Their Value

Crop Loans &Their ValueShort-term financial alternatives fit to farmers’ immediate requirements include crop loans. These loans assist to pay for necessary agricultural supplies including insecticides, fertilizers, and seeds. Crop loans guarantee farmers may ready their fields and plant without delay by providing prompt access to money.

One of the main advantages of crop loans is less reliance on unofficial lenders—who sometimes demand outrageous interest rates—by farmers. Farmers who obtain finance from official institutions get fair conditions, which helps them to concentrate on their farming operations free from financial worry. These loans also give the financial freedom required to use better farming techniques and make technological investments meant to increase output.

The Function of Crop Insurance in Protection of FarmersAlthough crop loans meet farmers’ financial needs, agriculture is nevertheless quite susceptible to outside hazards such as natural catastrophes, pests, and changing climate. Here is when crop insurance turns into a necessary instrument for reducing risk.

Crop insurance shields growers from unanticipated events causing losses. It serves as a safety net, making sure they get paid back for their investments should uncontrollably poor crops result from events beyond their reach. Along with helping farmers bounce back from losses, this financial backing increases their confidence to take measured chances. Farmers are more motivated to investigate creative agricultural methods and make investments in premium inputs knowing their efforts are safeguarded, therefore increasing their production and income.

Modernizing Agriculture with Agri-MachinesAgri equipment integration has transformed conventional farming into a more effective and profitable operation. Many times, farmers rely on crop loans to buy or lease contemporary equipment including irrigation systems, tractors, and harvesters.

These instruments help farmers to manage more acreage of land in less time by greatly lowering their reliance on physical labor. Agri machinery also improves accuracy in farming processes, guaranteeing better use of resources and increased output. Although the initial machinery purchase may seem high, farmers gain greater returns with lower running expenses, so the long-term advantages much exceed the expenses.

Improving the Kisan CommunityBeyond only technological and financial developments, the availability of sophisticated farming gear, crop insurance, and crop loans helps the Kisan community to grow robustly. Financially driven farmers are more suited to exchange expertise, cooperate, and help each other to overcome obstacles.

A vibrant Kisan community improves farmers’ negotiating strength and market access as well. Farmers working together can negotiate reasonable rates for their goods and make joint investments in resources good for the whole society. By means of agricultural training courses and seminars, they also keep current on sustainable methods and creative ideas, therefore fostering a culture of ongoing education and development.

Conclusion:More than just financial tools, crop loans enable farmers’ resilience and progress. These loans help farmers to overcome obstacles, embrace creative ideas, and guarantee a better future when combined with crop insurance, modern agricultural tools, and a unified Kisan community. Crop loans are essential in turning agriculture into a sustainable and profitable industry by attending to both short-term demands and long-term goals, thereby assuring farmers enjoy respectable and stable lives and help the country to develop.

The post How Crop Loans Empower Farmers For A Better Tomorrow appeared first on Elderbrendabradley.

January 10, 2025

Why Do You Need To Get eSIM When You Are Traveling Abroad?

Traveling abroad today requires one to remain connected to the rest of the world as it is a very interconnected world. No matter whether you are traveling to new places, you are in touch with your family and friends, or even when you are sharing your travel experience live, you will need a good signal from your mobile network.

Well, say hello to the eSIM, a concept that has completely transformed how people connect when they are traveling. But why eSIM? In this article, you will learn what an eSIM is and why it should be considered by any traveler going abroad.

Technological breakthroughs have transformed how we communicate and stay connected. eSIM is a digital SIM card technology that is becoming the preferred alternative for foreign travel. This article discusses why e SIM technology is altering the travel industry and is an essential tool for travelers.

Understanding the need for e-sim while traveling internationally:Significant cost savings.Second, eSIM for foreign travel represents a more cost-effective option for staying linked across borders. You may take advantage of low-cost international SIM plan and data plans without having to worry about expensive roaming charges. It does not matter where you are located because you can use eSIMs to access affordable local tariffs and data offers.

Convenient and flexibleThe eSIM eliminates the need for physical SIM cards and the trouble of replacing them whenever you travel overseas. Gone are the days of juggling multiple SIM cards or anxiously handling a tiny SIM card tray on an airport terminal floor. Managing your mobile subscriptions is as simple as a few touches on your device’s screen, making the process streamlined, efficient, and hassle-freeThe eSIM does away with the normal SIM cards as well as the inconvenience of having to change over to a new SIM card when one is in another country. Companies like aloSIM provide comprehensive international plans.

Seamless connectivityUsing eSIMs when traveling guarantees that you will never miss a beat with its capacity to deliver strong network coverage and mobile data plan throughout multiple nations and regions. This is why you won’t have to rush to get a local SIM card when you arrive. With eSIM, you’ll be connected as soon as you depart. This enables you to share your travel experiences in real time, stay in touch with loved ones, and get necessary information regardless of location.

Easy Switching ProvidersUnlike regular SIM cards, which are carrier-locked, eSIM allows you to transfer service providers without having to swap SIMs physically. This means that if you locate a local carrier with superior coverage or lower rates, you may switch immediately, saving both time and money. This also makes it easier to compare data plans, allowing you to select the best one for your trip needs.

Environmental ImpactFinally, eSIMs have a beneficial environmental impact. Switching to this digital solution eliminates the necessity for physical SIM cards, which helps reduce waste. So, by choosing eSIM, you are improving your travel experience while also supporting sustainability efforts.

If you travel frequently and want to maximize convenience, save money, and ensure reliable connectivity, eSIM technology is worth considering. Imagine a world where travel is stress-free, and there is complete worldwide connectedness. It sounds wonderful. eSIM companies like Redteago provide comprehensive plans.

With the best eSIMs for foreign travel, you may confidently embark on your next vacation. Stay connected, informed, and safe no matter where you go. As frequent travelers, they have found this solution helpful for staying connected while on the go.

The post Why Do You Need To Get eSIM When You Are Traveling Abroad? appeared first on Elderbrendabradley.

December 26, 2024

Online Trading App for Easy Market Access

The world of investing has undergone a massive transformation in recent years, thanks to the rise of online trading apps. These platforms offer individuals a quick and efficient way to access financial markets, monitor market trends, and make real-time decisions from anywhere at any time. One of the most popular indices that attract both novice and experienced investors is the Nifty 50, representing a benchmark of India’s top 50 companies. The integration of such tools into trading apps has revolutionized how people interact with the stock market. In this, we’ll explore the advantages of using an online trading app, particularly for trading in the Nifty 50, and how it simplifies the investment process.

Why Choose an Online Trading App for Easy Market Access?

Why Choose an Online Trading App for Easy Market Access?In the past, investors had to rely on brokers or physical exchanges to trade stocks, which often meant cumbersome paperwork, long waiting times, and high transaction fees. Fast forward to the present, and online trading platforms have completely eliminated these barriers. With the development of mobile trading apps, access to financial markets, including popular indices like the Nifty 50, has never been easier.

Convenience at Your FingertipsOne of the main advantages of using an online trading app is convenience. Gone are the days when you needed to be in front of a computer or visit a broker’s office to place a trade. Modern trading apps allow users to execute trades, monitor stock prices, and access market news from their smartphones or tablets. Whether you’re at home, in a café, or traveling, you can easily stay connected to the markets and make timely decisions.

These apps provide easy access to various financial instruments, including stocks, bonds, ETFs, and index funds. Among the most popular choices for traders is the Nifty 50 index, which tracks the performance of the 50 largest publicly listed companies on the National Stock Exchange of India. The Nifty 50 is a key benchmark that reflects the economic health of the country and is often a top choice for both beginner and advanced traders looking for a diversified portfolio.

Seamless Trading ExperienceTrading apps come equipped with a user-friendly interface that simplifies the entire trading process. Whether you’re making your first investment or managing a complex portfolio, these apps are designed to streamline your experience. From placing a market order to setting stop losses and tracking your performance, online trading apps provide a comprehensive toolkit for traders.

For those specifically interested in the Nifty 50, many apps offer specialized features that make it easy to buy or sell stocks from this index. Whether you’re tracking the real-time performance of these top companies or using technical indicators to inform your decisions, the trading experience is seamless and efficient.

Lower Costs and Transparent FeesTraditional brokerage firms typically charge hefty fees for executing trades. These charges can add up quickly and reduce overall returns. In contrast, many online trading apps offer lower or zero commission trading. This not only reduces the cost of investing but also ensures greater transparency, as users can easily see the fees before making any transactions.

When trading in the Nifty 50 or other popular indices, lower transaction costs can have a significant impact on long-term investment returns. Investors can make frequent trades without worrying about excessive fees, which makes online trading apps an attractive option for active traders.

Key Features of Online Trading AppsWhen selecting an online trading app, it’s important to consider features that will help you make informed and effective trading decisions. Below are some of the key features that make trading apps ideal for market access:

Real-Time Market DataOne of the most critical elements of online trading is having access to accurate, real-time market data. Online trading apps offer live market feeds, including updates on stock prices, indices like the Nifty 50, and relevant news that could impact your trades. This ensures you can make informed decisions without relying on outdated information.

Advanced Charting ToolsFor those interested in technical analysis, online trading apps often come with advanced charting tools. These tools help traders analyze market trends and predict future price movements. Whether you’re using technical indicators like moving averages, MACD, or RSI, an online trading app can provide all the resources needed to conduct thorough market research.

Security and PrivacySecurity is another major concern for traders who want to safeguard their investments. Reputable online trading apps use industry-standard encryption and other security measures to protect your data and transactions. This includes two-factor authentication (2FA) and secure login protocols to prevent unauthorized access.

With the growing focus on cybersecurity, these apps ensure that your personal and financial information remains safe, providing peace of mind while you trade, especially when dealing with volatile markets like the Nifty 50.

Easy Deposits and WithdrawalsThe convenience of using an online trading app extends to making deposits and withdrawals. Most trading apps support a range of payment methods, including bank transfers, debit/credit cards, and even UPI (Unified Payments Interface) for easy money transfers. This flexibility allows you to fund your trading account and access your earnings quickly and easily.

Investment Education and ResourcesMany online trading apps offer educational content, tutorials, webinars, and market analysis to help traders improve their skills. These resources can be especially helpful for beginners who are new to investing or those interested in learning more about specific indices like the Nifty 50. Whether you want to understand technical analysis or learn about fundamental analysis, these apps provide a comprehensive suite of learning tools.

How to Get Started with an Online Trading AppGetting started with an online trading app is simple and user-friendly. Follow these basic steps to begin your investment journey:

Step 1: Download the AppFirst, download the trading app from your app store. Ensure the app is from a trusted and secure provider. Once downloaded, open the app to begin the sign-up process.

Step 2: Create an AccountYou’ll need to create an account by providing some basic information, such as your name, email address, phone number, and financial details. Depending on the platform, you may need to complete KYC (Know Your Customer) verification, which is required for security purposes.

Step 3: Fund Your AccountAfter setting up your account, fund it using your preferred payment method. Most apps support various funding options, making it easy to deposit money into your trading account.

Step 4: Start TradingOnce your account is funded, you can start trading in the Nifty 50 or any other stocks or indices that interest you. Use the app’s tools to place buy or sell orders, set stop losses, and track your portfolio performance.

ConclusionThe rise of the online trading app has made it easier than ever to access the financial markets, including popular indices like the Nifty 50. These apps offer a seamless trading experience, low fees, and real-time data to help investors make informed decisions. Whether you’re new to investing or an experienced trader, an online trading app offers a convenient and efficient way to manage your investments.

By providing easy access to financial markets and simplifying the investment process, these apps have empowered individual investors to take control of their financial futures. So, if you’re looking for a user-friendly and cost-effective way to invest, consider exploring the range of online trading apps available today and start trading the Nifty 50 or other top indices.

The post Online Trading App for Easy Market Access appeared first on Elderbrendabradley.

Brenda Bradley's Blog

- Brenda Bradley's profile

- 3 followers