Brenda Bradley's Blog, page 6

February 23, 2024

The Future Of Online Banking: Trends And Innovations

If we define our era as an era marked by digital advancements, then it won’t be wrong. As with time, personal finance India is becoming digitalized, and every aspect of our lifestyle is turning its way around digitalization. But for now, we will specifically be talking about the banking sector and what we can expect in the future in terms of trends and innovation in our online banking system.

Seamless User Experience

Seamless User ExperienceAn undeniable fact about home credit is its convenience and easy access. Still, financial institutions are investing heavily in making the interface of online banking, as it is the first thing that customers see when checking out any online banking app or website. So to make navigation easy with smooth transactions is all customers want. And that is exactly what banks are trying to do; they are making the user interface more fun and not a boring task for us customers.

Artificial Intelligence (AI) and Machine LearningAI is everywhere, from managing digital wallets to online EMI payment, so why will online banks be left behind? Machine learning and AI are helping banks offer customers personalized recommendations, from the kind of account they should open to the security actions a customer should take from their side. Chatbots are also an innovation coming out from these technologies. This particular trend not only enhances the experience of a customer but also boosts operational efficiency

Biometric AuthenticationThe traditional password was a safe way of transacting some years back, but with advanced cyber attacks, we need advanced cyber security as well. Biometric authentication is one such advanced security measure, which includes fingerprint, facial recognition, and iris scan, that provides better security and convenience for customers when they login into their digital wallets app Or insta personal loan app.

Open Banking and APIsOpen banking initiatives are also a great way to ensure we have some of the most innovative apps and websites in our service in the future. Through APIs, banks can share financial data with authorized third-party applications, and this trend will encourage the development of innovative financial services and offer customers a broader range of options.

Enhanced Security MeasuresCyber attacks are not hidden from anyone, but with better technology in place, we can definitely expect enhanced security measures. The credit industry has been investing in advanced cybersecurity technologies such as – real-time transaction monitoring and multi-factor authentication. Such advanced technologies will help in safeguarding customer accounts.

Internet of Things (IoT) IntegrationIoT is expanding itself in the banking industry as well, where smart devices can connect through IoT that will help in providing real-time financial updates and automate banking transactions. An amazing example of this integration is a smart refrigerator, which will monitor grocery purchases and reorder items if necessary and directly pay it from your account. Isn’t this great? So, we can definitely expect some amazing IoT integrations in the online banking world.

Conclusion:With online banking making its way into our houses, through various kinds of loans like payday loans or urgent loans to paying through UPI. These trends and innovations are something that we will expect in the near future. And right so! From seamless user experience to easy integration of IoT in our smart devices, the future of online banking holds the promise of greater efficiency and accessibility. By staying abreast of such developments, we can surely make informed choices when it comes to banking options or any financial decision in general.

The post The Future Of Online Banking: Trends And Innovations appeared first on Elderbrendabradley.

February 21, 2024

From Novice To Pro: Unveiling Advanced Investment Strategies

Venturing into the domain of financial speculation may appear overpowering to various beginners. Yet, equipped with appropriate managing stoxcalls methodologies, an individual is capable of evolving from a rookie investor to becoming experienced in this field.

This composition functions as a navigational instrument aiming at clarifying complex stox options while assisting people in elevating their speculative ventures to unprecedented heights.

Understanding the Basics:

Understanding the Basics: It’s pivotal to first comprehend the primary components of investment before venturing into complex tactics. Beginners need to grasp vital notions like risk acceptance of share market, dividing assets, grasp market stoxcalls, and the influence of compounding. Mastering these rudiments paves a sturdy foundation for learning refined techniques in investing.

Diversification and Portfolio Management:A pivotal element of sophisticated investing methods is diversification. Beginners frequently undervalue the importance of distributing their investments and sell stoxcalls among different asset categories. This part underscores the vital role that diversification plays in reducing risks and attaining a harmonious portfolio. Examining various kinds of assets, such as stocks, bonds, and alternative investments, facilitates an all-encompassing understanding of productive portfolio governance.

Risk Management:Veteran investors know how crucial it is to manage risk and stay updated with stox options calls when protecting their assets. This portion illuminates the importance of evaluating danger and reducing its potential impact.

Explore everything from comprehending stoxcall insights all the way to applying strategies that set a buffer against financial downturns.

Market Analysis and Research:Within the sphere of sophisticated stox trading app, detailed market scrutiny and investigation are integral. This section aids users in implementing exhaustive basic and stock market strategy, facilitating informed trade choices.

The perusal of different evaluation tools like trend studies, stoxcall analysis or fiscal ratio critique offers traders an advantage to anticipate market evolutions and pinpoint profitable prospects.

Advanced Trading Techniques:If you’re eager to venture into an active stoxcall investment, gaining expertise in progressive trading methods is crucial. This part acquaints readers with notions such as options betting, short sales, and margin trades. By grasping the intricacies of these techniques, market participants can refine their trade plans, consequently potentially amplifying their chances for profit within the marketplace.

Evaluating Economic Trends:Advanced investors thrive on a stoxcall trading app to predict and adjust according to shifts in financial trends. This portion dives into the skill of deciphering economic signals while recognizing how they affect different sectors. By remaining alert to worldwide monetary progressions and geopolitical incidents, investing approaches can be tweaked to take advantage of arising opportunities while diminishing latent hazards.

Adopting a Long-Term Mindset:Embarking on a journey into sophisticated stoxcalls investment tactics, it’s crucial to underscore the importance of keeping an expansive future-focused outlook. This piece cheers for building steadiness and self-control in investors’ financial game plans – extolling the virtues of multiplying riches progressively over time. Nurturing this forward-thinking mindset promotes sturdiness, assisting money managers in riding out transient market whirls while staying concentrated on their fiscal targets.

Final Thoughts:Initiating your voyage with simple stoxcalls online theories and gradually voyaging into profound trading practices and market scrutiny, the transformation from a beginner to an experienced investor is significant. By grasping subtle distinctions of diversification, risk control measures, plus financial drifts, individuals can confidently make their way in this intricate sphere of investments deftly. With sustained determination coupled with ongoing enlightenment along with keeping up a long-lasting outlook, anyone could decode sophisticated investing tactics successfully, laying out their path towards fiscal triumph.

The post From Novice To Pro: Unveiling Advanced Investment Strategies appeared first on Elderbrendabradley.

February 12, 2024

Seven Features You Must Look Out For In Food Delivery Apps

Food delivery apps have become quite popular among both food enthusiasts and busy professionals, given how prevalent they are nowadays. While these apps make it easy to order food from your favorite restaurants, cafés and coffee shops across the city, not all are created equal. If you’re planning to use a food delivery app, like Swiggy, for the first time or are looking for an alternative to your current food delivery app, this piece is for you. We’ve compiled a list of features that you should look for in a food delivery app to ensure that you get the best experience.

1. Order Customization: If you have special dietary requirements, choices, or restrictions, you would want the ability to customize your order. Thus, the ideal food and dining app for you would be the one that lets you directly communicate with the restaurant staff to help you convey your preferences.

2. Live Order Tracking: One of the main reasons why apps like Swiggy are at the forefront in the food delivery industry is because they offer the live order tracking feature. Waiting for food from your favorite cafes and bars can be a period filled with excitement and anticipation. Live order tracking can help you accurately predict the delivery time. Thus, you can easily make arrangements at home before the food arrives at your doorsteps, eliminating the chances of the food losing its freshness if it’s not immediately consumed.

3. No Minimum Order Value: A good food delivery app, like Swiggy, acknowledges that users should have the flexibility to order as much or as little as they want. When there’s no minimum order rule, you eliminate the chances of food wastage if you have ordered more than what you require.

4. Payment Mode: Leading apps, including Swiggy, accept various payment methods. They would seldom have any restrictions on payment methods, regardless of whether you’re ordering from lesser-known dessert restaurants or well-known food outlets.

5. Wide Restaurant Selection: Naturally, the entire concept of food delivery apps gets defied if an app doesn’t serve in your locality or excludes certain casual dining restaurants. Usually, the more popular apps, like Swiggy, would make their operational details clear. Thus, you would be able to gauge better if the app covers restaurants in your neighborhood. For instance, Swiggy offers one of the largest networks with thousands of popular regional restaurants, national chains, and more.

6. Customer Support: While ordering food is a relatively simple task, it shouldn’t be assumed that you won’t encounter errors or disputes while using these apps. Nonetheless, a good food delivery app would never resist offering assistance to you. Whether you’re facing a payment discrepancy with brunch spots that recently took your orders or are unable to get your request processed, a good app would always be clear about how you can reach out to the support team to get your queries answered.

Final Thoughts:Food delivery apps may offer a range of features, but truly gauging their utility comes down to individual needs and preferences. Popular apps like Swiggy encompass all the features listed above, ensuring that you get the best experience at all times of the year.

The post Seven Features You Must Look Out For In Food Delivery Apps appeared first on Elderbrendabradley.

January 26, 2024

Enhance Your Investment Journey with a Stocks Portfolio App

In the fast-paced world of finance, managing your investments has never been more critical. With the advent of technology, investors now have powerful tools at their fingertips to streamline and optimize their stock portfolios. In this article, we will explore the benefits of using a Stocks Portfolio App to enhance your investment journey.

Gone are the days of managing stock portfolios with cumbersome spreadsheets and manual calculations. Today, savvy investors leverage cutting-edge technology to stay ahead in the market. A Stocks Portfolio App is a game-changer, offering a user-friendly interface and a host of features that make managing your investments a breeze.

One of the key advantages of utilizing a Stocks Portfolio App is the ability to access real-time market data. Stay informed about the latest stock prices, market trends, and news updates that could impact your investments. This dynamic feature allows you to make informed decisions promptly, helping you seize opportunities and mitigate risks effectively.

The convenience of having your entire stock portfolio in one place cannot be overstated. A Stocks Portfolio App consolidates all your investments, providing a comprehensive overview of your assets. Whether you’re a seasoned investor with a diverse portfolio or a beginner just starting, having a centralized platform simplifies tracking and monitoring your investments.

Moreover, these apps often come equipped with analytical tools that offer insights into your investment performance. From historical data analysis to risk assessment, a Stocks Portfolio App empowers you with the information needed to refine your investment strategy.

For those who are always on the go, the mobility aspect of these apps is a game-changer. Access your Stocks Portfolio,Stock Portfolio App anytime, anywhere, and execute trades with a few taps on your smartphone. This flexibility ensures that you are in control of your investments, even when away from your desktop.

In conclusion, embracing a Stocks Portfolio App is a smart move for investors looking to elevate their investment game. Take advantage of real-time data, streamlined portfolio management, and on-the-go accessibility to make informed decisions that align with your financial goals. As you embark on this tech-driven investment journey, the power to optimize your stock portfolio is literally in the palm of your hands. So why not leverage this transformative tool to navigate the complex world of finance and maximize your returns?

The post Enhance Your Investment Journey with a Stocks Portfolio App appeared first on Elderbrendabradley.

January 20, 2024

Credit Score 101: How It Affects Your Instant Personal Loan?

Managing your finances can prove to be complex if you’re starting your journey in the personal financial market. Numerous tools can help you in this journey of yours to manage your finances; a credit score is one such tool. This is a tool that can make your journey smooth and efficient if utilized correctly. Using this tool, you can manage your expenses with a quick loan in times of need. Let’s dive deep and understand how it affects your instant personal loan.

What is a Credit Score?Credit Score is an intricate tool of the financial market. Data-based financial institutions calculate it, and it is a numerical representation of one’s financial history, ranging from 300 to 900. It plays an important role in determining your eligibility for securing any credit service, like instant personal loans and an instant credit line. Its computation encompasses a multifaceted analysis, encompassing variables such as payment history, credit utilization, credit account average lifespan, credit account diversity, and recent credit inquiries.

Credit Score and Its EffectsCredit Score helps financial institutions determine borrowers’ creditworthiness and their risk tolerance. Lenders with a discerning eye on risk mitigation rely heavily on this score as a determinant of your suitability as a borrower. Having a good credit score reduces risk and increases your chances of securing an instant cash loan.

Instant personal loans are the latest and most useful tool to employ in times of emergencies. These instant personal loan apps offer an easy and smooth onboarding process thanks to their modern algorithms that analyze the risk tolerance of borrowers and do quick loan approval, too. These apps make use of your credit score and offer you interest rates based on it.

Among the many privileges associated with a robust credit score, the prospect of reduced interest rates stands as one of the most compelling. Financial institutions tend to offer more competitive rates to individuals boasting a history of prudent financial conduct.

Moreover, having a robust credit score also enables you to get access to an expansive repertoire of loan products. Lenders are more amenable to extending a variety of credit options to individuals with good credit profiles, bestowing borrowers with a diverse array of financial solutions like instant personal loans and instant credit lines.

Tips to Improve Credit ScoreJust like every other tool, you can take charge of your credit score in your own hands and improve it. You can follow the below given alongside good financial habits to improve your credit score:

Review Your Credit Reports: First, analyze your credit report and score, look for any anomalies, and contact your bank to resolve them, as this has a high impact on your credit score.Timely Repayments: Making timely repayments also highly impacts your credit score, and doing so can help you improve your credit score in no time.Credit Limit Utilization: Traditionally, It is advised to only make use of 30% of your credit limit to impact your credit score positively.In summation, your credit score serves as a compass on your financial voyage. Its impact extends beyond mere loan eligibility, encompassing the terms and rates at which you can access credit lines. A commendable credit score may grant you access to fast and adaptive loans on a loan app India, offering quick financial solutions to meet your financial objectives.

The post Credit Score 101: How It Affects Your Instant Personal Loan? appeared first on Elderbrendabradley.

Clearing Up Confusion About Chicken For A Healthier You

Chicken, a widely cherished and delectable source of protein, consistently claims its place on our dining tables. Yet, it’s really important to acknowledge and puzzle out the various misconceptions circulating regarding its impact on health. These misconceptions start from concerns about fat content to questions about the best cooking methods. In this thorough guide, our mission is to not only address these prevalent myths but to dissect them. We will be providing an in-depth exploration into the nutritional complications that make chicken a vital asset to our overall health.

From examining the diverse range of chicken cuts to scrutinizing the significance of opting for fresh chicken over frozen alternatives, we aim to empower you with a nuanced understanding of how chicken can be optimally incorporated into a nutritious and well-balanced diet. By navigating through these details, our goal is to equip you with the knowledge needed to make informed choices and fully appreciate the nutritional brilliance that chicken brings to your plate.

Myth 1: Chicken breast is the only healthy choice:Let’s start by talking about the chicken breast—a focal point in our discussion due to its reputation for being a lean and adaptable choice. Yes, it’s a lean source of protein, ideal for those aiming to cut down on fat and calories.

However, it’s crucial to recognize that other parts of the chicken, such as drumsticks and thighs, aren’t nutritional adversaries. Each cut offers a distinctive nutritional profile. Chicken breast stands out for its leanness, but drumsticks and thighs, with slightly higher fat content, bring essential nutrients to the table. Chicken breast is like the sprinter, and drumsticks and thighs are the long-distance runners – different strengths, both winners.

Myth 2: Drumsticks and thighs are the unhealthy options:Now, some people think chicken drumsticks and thighs are troublemakers with their slightly higher fat content. Let’s clear the air – they’re not the bad guys. Drumsticks are like the guardians of your joints. They have connective tissues that keep everything running smoothly.

Thighs, on the other hand, bring more flavor to the team and pack extra iron and zinc. It’s all about balance. Embracing these cuts in moderation ensures a holistic approach to nutrition, adding diversity to your plate.

Myth 3: Fresh chicken vs. frozen chicken – Is there really a difference?Fresh chicken versus frozen chicken – is there a big deal? Some say fresh chicken is just a fancy term, but there’s more to it. The misconception that fresh chicken isn’t significantly different from frozen alternatives needs debunking.

Fresh chicken is like the prima donna of poultry, offering an experience that goes beyond being merely unfrozen. It represents a direct journey from the farm to your table, preserving the chicken’s natural qualities. The result? A superior taste, optimal texture, and retained nutritional goodness.

A closer look at the chicken’s role in the diet:Now, let’s explore why chicken is not just a protein source but a nutritional ally, enriching your diet with essential elements.

Chicken breast: This is your go-to if you’re watching your calories. Considered the Most Valuable Protein (MVP), chicken breast is a lean powerhouse. Low in fat and calories, it’s a go-to choice for those aware of their dietary intake. You can cook it up in so many ways, making it a hero for healthy recipes.Chicken drumsticks: Often underestimated, drumsticks contribute more than just flavor. These are like the sidekicks with benefits. They’re not just tasty; they’re good for your joints. The slightly higher fat content adds moisture to dishes, making them a hit in the flavor department. Chicken thighs: The dark knights of the chicken realm, a chicken thigh brings a depth of flavor to your meals. Beyond taste, they offer additional nutritional benefits, boasting higher levels of iron and zinc. Including thighs in your diet adds both variety and essential nutrients.Fresh chicken: Elevating the chicken experience, fresh poultry is the VIP (Very Important Poultry). Choosing fresh over frozen ensures not only a superior taste but also a higher retention of nutrients. That means you are getting the best of the best. More nutrients, better taste, and a feel-good vibe about where your food comes from.Understanding the source of your chicken provides an added layer of assurance regarding its quality and impact on the environment.

In closing:Chicken is not just a meal; it’s a nutritional powerhouse. By understanding the roles of chicken breast, drumsticks, thighs, and the importance of fresh chicken, you’re on your way to a healthier lifestyle. Mix it up, enjoy the variety, and remember, moderation is the key. So, go ahead, embrace the goodness of chicken, and let it be your sidekick in the journey to a tastier and healthier you!

The post Clearing Up Confusion About Chicken For A Healthier You appeared first on Elderbrendabradley.

January 18, 2024

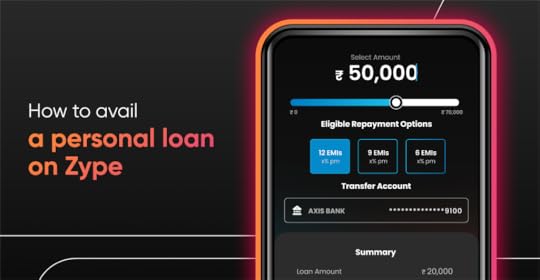

Future Of Personal Loans: Trends And Innovations In Lending

Personal loans are always changing due to shifting customer tastes, technological improvements, and changes in the financial sector. As we move towards the future, a number of trends and innovations are reshaping borrowing and altering how people access credit. In this blog, we’ll look at how personal loans will develop in the future while emphasizing the trends and technologies that are on the verge of revolutionizing the borrowing industry.

Complete digitization

Complete digitizationBefore, you had to visit the bank repeatedly in the hopes that your loan application would be granted. Nowadays, everyone owns a smartphone, and the fintech boom has made it simple to submit a personal loan application using a reliable loan app personal. The personal loan application process being digital has helped sales climb.

The arduous and time-consuming loan application process is a thing of the past. In this situation, you can submit an online personal loan application. Now, it’s also simple to compare the features of several loans, and the application process may be finished in a few minutes.

Customized ProductsAs data machine learning and analytics skills advance, lenders will be able to provide more specialized loan solutions that are suited to the requirements of specific borrowers. With the help of an easy loan app, offerings for personalized loans take into account things like income, spending patterns, financial objectives, and risk tolerance. Lenders can offer more pertinent and advantageous borrowing choices by tailoring loan conditions to each borrower’s particular situation.

Bigger competition, better productsPrior to now, the majority of banks and non-banking financial institutions would scrutinize your loan application in great detail. However, the situation has now altered with the emergence of a small loan app. The majority of applicants were turned down, and those who made the shortlist had to demonstrate their capacity to repay by offering further documentation as additional proof.

The situation has now altered. Banks and lenders are interested in improving their sales by expanding access to personal loans because of the increased competition in the market.

Credit score awarenessFor someone with little or no credit history, traditional credit scoring models that mainly rely on credit history can be a hurdle. However, the future of personal loans is evolving with the emergence of personal loan apps India. In order to evaluate creditworthiness, these techniques use non-traditional data sources like utility bill payments, rental history, and even social media activity. Alternative credit scoring enables lenders to assess the credit risk of a more varied pool of borrowers by taking into account a wider range of data.

Better accessibility and availabilityBeing essential to consumer finance, personal loans’ business reach, and smooth touchpoints play a crucial role in the development of the market and in how they are conducted. Accessibility, or the degree of digital adoption (mobile phones, digital literacy, adoption), and availability. The variety of digital channels, devices, and platforms—including mobile phones, the web, and physical models—address these issues. Due to technology, borrowers now have access to credit every single day of the year.

Conclusion

Borrowers can anticipate a more inclusive, user-friendly, and effective borrowing procedure as the financial sector adopts these advances. With the introduction of cutting-edge technologies, the landscape of personal loans is expected to open up to a wider spectrum of people while also providing specialized solutions that address certain requirements and preferences.

In order to navigate the changing personal loan market and take full advantage of the opportunities that are presented in the borrowing future, it will be essential for borrowers to be educated about these trends and innovations.

The post Future Of Personal Loans: Trends And Innovations In Lending appeared first on Elderbrendabradley.

January 15, 2024

How Ordering Groceries Online Will Make Your Winter Easier

As winter sets in, the colder weather and shorter days often make routine tasks more challenging. However, with the advent of technology and the convenience of fresh vegetables online UAE shopping, one aspect that can significantly ease the seasonal burden is ordering groceries online.

Embracing this digital convenience not only simplifies your life but also offers numerous advantages that make navigating winter more manageable. Here are ten compelling reasons why ordering groceries online will make your winter a breeze.

1. Comfort and Convenience at Your Fingertips:The primary allure of online grocery shopping during winter lies in its convenience.

From the warmth and comfort of your home, you can effortlessly browse through a vast array of products, add items to your cart, and complete the transaction with just a few clicks, saving you from braving the cold and navigating icy roads.

2. Avoiding Winter Weather Hassles:Bypassing the need to venture out in inclement weather is a significant advantage of online grocery shopping.

Whether facing snowstorms, freezing rain, or bone-chilling temperatures, you can skip the hassle and potential risks associated with traveling to the store, ensuring your safety and comfort.

3. Time-Saving Solutions:Winter often brings a hectic schedule with holiday preparations, shorter daylight hours, and increased demands on your time.

Ordering online vegetables Dubai allows you to save valuable time by eliminating the commute, parking, and waiting in lines at crowded stores, enabling you to concentrate on other essential tasks or enjoy more leisure time.

4. Precise and Personalized Shopping:Online grocery platforms often offer personalized recommendations based on your previous purchases and preferences.

Additionally, you can easily create shopping lists, set up recurring orders for essentials, and quickly find specific items without the hassle of navigating crowded aisles, ensuring you get exactly what you need.

5. Access to Diverse Options and Specialties:Online grocery stores provide access to an extensive selection of products, including specialty items, organic produce, online vegetables, international ingredients, and dietary-specific foods.

This diverse range allows you to explore and experiment with different culinary delights without limitations, catering to specific tastes and dietary needs.

6. Simplified Meal Planning and Budgeting:Planning meals becomes more streamlined with online grocery shopping. You can compare prices, check nutritional information, and plan your meals more efficiently while staying within your budget.

Online platforms often showcase deals, discounts, and promotions, enabling you to make cost-effective choices.

7. Flexible Delivery Options:Most online grocery Dubai services offer flexible delivery schedules to accommodate your convenience.

You can select any delivery time slot that aligns with your availability, whether it’s same-day delivery for urgent needs or scheduling deliveries for a specific day and time, allowing for maximum flexibility.

8. Contactless and Safe Transactions:Amid health concerns and the ongoing need for safety precautions, online grocery shopping minimizes contact with others, avoiding the risk of exposure to illnesses.

Contactless delivery options allow for a safer transaction, providing peace of mind during uncertain times.

9. Effortless Accessibility for Everyone:Online grocery shopping is a boon for individuals with limited mobility, seniors, or those without easy access to transportation. Physical activities such as walking to the stores can be physically straining to those with limited mobility. This challenge is only amplified during the winter months. Thankfully, grocery delivery apps offer a solution.

It ensures that everyone who needs it has access to essential items without the physical strain or logistical challenges of going to a physical store.

10. Environmental Benefits:Opting for online grocery shopping can contribute to environmental conservation. By reducing individual trips to the store, there’s a decrease in carbon emissions from transportation, helping to mitigate your carbon footprint and support sustainable practices.

In conclusion, embracing the convenience of ordering groceries online during winter is a smart and practical choice that offers an array of benefits.

From saving time and avoiding weather-related challenges to personalized shopping experiences and enhanced safety measures, online grocery shopping simplifies the season, allowing you to focus on enjoying the comforts of winter without the added stress.

Make this winter more manageable and efficient by harnessing the power of technology to streamline your grocery shopping experience from the comfort of your cozy home.

The post How Ordering Groceries Online Will Make Your Winter Easier appeared first on Elderbrendabradley.

January 9, 2024

Some Of The Most Common Mistakes We Make As Traders

Stock trading is truly an exciting journey, and this journey is not all about perfection and success. And an investor who even knows a little about the stock market, options trading, or even trading in general will understand this fact very well. There are some mistakes that a lot of investors or traders make, and then they learn from them. We will address these mistakes today and understand how we can avoid them and have a better and more stable financial future.

Lack of Research

Lack of ResearchThis mistake is extremely common in novice traders as they try to enter the market with insufficient knowledge and research. Researching and market analysis are the two most important factors for any kind of investment, be it future trading or intraday trading, and this fact should be known to you at all costs. So thoroughly research before investing in any stock or share and see how things change for the better.

Overlooking DiversificationPutting everything in one basket is never a good move because you never know which stock will perform well and which will fall suddenly. But if you diversify your investments strategically, you can easily get away with this problem. Try to invest in various sectors and industries and safeguard your investments against every type of fluctuation.

Ignoring Long-Term TrendsWhenever you make any financial decision, ensure you have your long-term goal in mind. Use a margin calculator to understand the margin requirements for long term investment opportunities. And remember, short-term fluctuations are very common, so never make any decision in hassle and later regret it.

Emotional TradingWe often tend to ignore the importance of emotions when it comes to making decisions. But our emotions actually play a crucial role in every decision we take, be it greed or fear. So, never make impulsive decisions based on your emotions. Create a plan that covers everything, and try to stick to it.

Neglecting Risk ManagementRisk is subjective but investment theories believe that as humans we are mostly risk-averse. And this is true because a major portion of investors are actually risk-averse. So be aware of your risk tolerance and then create stop loss limits to avoid any potential losses. Using an option calculator is also a smart move where you can analyze the different options.

Chasing Hot TipsIn this world of social media, relying on hot tips given by influencers is very common. Though sometimes it could be valuable to use these tips, it is not always; remember to verify information from authentication sources and then conduct your analysis.

Overlooking Fees and CommissionsAs an investor, you should also consider the fees and commission charges that come with trading platforms. Never ignore these charges, as they actually impact your profits. Try to compare various fees and choose a platform that best suits your needs.

Conclusion

The f&o market can truly be unpredictable and offer us challenges when we expect them the least. Just any other life decision, it is also very difficult to make strategies and survive in this investment world. Enter into this world, do your research, and make strategies. Even if some decisions fail, you will learn from them, and that was the whole point of this article. Go ahead and venture into this world. Happy investment future ahead!

The post Some Of The Most Common Mistakes We Make As Traders appeared first on Elderbrendabradley.

January 8, 2024

Online Personal Loan: Benefits That You Need To Know Today

We all have financial emergencies; we cannot go and spend our entire savings on it. Even if we did, there is a chance of getting a higher requirement of money. Taking a personal loan from the bank will take a lot of time, and you have to submit all the documents and wait in a queue to process your application. The wise solution brought up by banks is an online personal loan app. You will get your application approved in no time.

Helps in emergencies

Helps in emergenciesIn financial emergencies, we don’t have to stand in a queue and wait for approval before bank branches. All we need is an online flexi loan app to fill up the KYC details and required amount. After verification, the loan will be disbursed to our account directly. The most important thing in getting an online personal loan is that we should be eligible according to the organization’s policy.

Documentation processOnce you apply for a personal loan, the app will ask you to upload your documents. You don’t have to take any original copies of documents and run to the office for this. You can upload e-documents in the app. By doing this, we can reduce the risk of losing our documents or damaging them. Starting from giving your information till you upload documents, everything is an online process.

Faster approvalTraditional banking involves a long process for documentation, verification, and approval. But here in the fast loan app, you will get approval for all types of personal loans in minutes. Since everything is handled online, the approval process is easier, faster, and quicker than traditional banking.

Tracking processIn the online personal loan application process, you will get to see the updates immediately in the best online loan app. If any documents are pending for the approval process, you can see that in the tracking process. Once it is approved, the app will notify you about the approval. You will get the information about when the disbursal of your instant cash will be settled. The stages of application processing will be clear and explained in the online application process.

Comparison of loansYou can compare the interest rates of personal loans or business loan online for self-employed, salaried, etc. You can choose your tenure and the amount in the online app. Then, you can easily compare the interest rates with other online bank applications. Some apps charge an extra fee for processing. Check the fee rate with other apps, then go for the one that suits you.

Conclusion:For a personal loan, you don’t have to submit any collateral or securities. All you need is a good cibil score, and you should meet the eligibility criteria. You will get loan instantly if you satisfy the eligibility criteria of the organization. Calculate your expenses and the EMI amount that you can spend, then go for the personal loan. Don’t ever miss out on paying the EMI on time, or else you will be coming under the defaulters list, and your cibil score will go down. This affects your future loan opportunities. So, keep the points in mind and go ahead and download the loan app you want!

The post Online Personal Loan: Benefits That You Need To Know Today appeared first on Elderbrendabradley.

Brenda Bradley's Blog

- Brenda Bradley's profile

- 3 followers