Chris Dillow's Blog, page 135

December 5, 2013

Debt & deficits: the maths

December 4, 2013

Profits and tail risk

There's a link between RBS's big IT failure this week and Aditya Chakrabortty's complaint about the "corporate myopia" that has led big UK firms to reduce basic research. Both highlight a trade-off between short-term and long-term profit maximization and show that this trade-off is affected by exposure to tail risk, the small chance of a disastrous failure.

For example, RBS's troubles are due to many years of under-investing in IT systems. Such under-investment helped raise profits; as Frances says, "profits don't come from upgrading basic infrastructure". But these came at a price, of increased exposure to the tail risk that a major IT failure will lead to an exodus of customers.

This is not the only example of how short-term profit optimization increases downside tail risk. BP under Lord Browne held down spending on maintenance. That looked like sensible profit maximization - until the Texas City refinery blew up. And Equitable Life did great business in the 80s and 90s by holding reserves low and selling guaranteed annuities - until disaster struck.

Under-spending on basic research is both like and unlike these cases. It's like them, in that such under-spending raises current profits. It's unlike them in that such under-spending actually reduces exposure to good tail risk - the slim chance of making a brilliant massively profitable innovation.

All these cases show that increasing short-term profits can come at the expense of more exposure to bad tail risk, and less exposure to good.

Now, this isn't necessarily irrational. Tail risk doesn't often materialize - that's why it's called tail risk. And if RBS can cause inconvenience to customers without them withdrawing their business, then it is a rational strategy, of monetizing consumer surplus.

Instead, I'm making two points here. One is that tail risk doesn't just matter for financial investments. It's also an issue for non-financial firms.

The other is that this makes it even harder to identify good management. BP under Browne, RBS under Goodwin and Equitable Life were for a long time among the most esteemed companies in the country. But they weren't as well-run as their profitability suggested. Instead, their reputations were inflated by taking on exposure to tail risk. Which poses the question: how can you be sure what's good management, and what's dangerous but (so far lucky) risk-taking?

December 3, 2013

Peers, & predictability

Peer effects matter for consumer spending. A new paper finds that "the consumption decisions of U.S. households are to a large extent driven by upwardly directed interpersonal comparisons." That is, we spend more if our neighbours are living it large.

This is not a new finding. It corroborates Robert Frank's theory of "expenditure cascades", evidence from the effects of the Dutch postcode lottery, and the large literature on the importance of peer effects.

This means Boris Johnson had a point when he said (pdf) that keeping up with the Joneses is a "valuable spur to economic activity." But it also supports those who blame the crisis (partly) upon inequality: people's efforts to emulate the spending of the rich led to them becoming over-borrowed.

But there's an angle here that is under-appreciated. Peer effects help explain why economic forecasting is a mug's game.

The argument for forecasting is that, across millions of people, individuals' whims cancel out. If this is so, the law of large numbers means we can ignore the crooked timber of humanity and think of a representative consumer responding predictably to changes in wealth, interest rates and such like.

But if peer effects are important, the law of large numbers no longer holds. If I buy a new car (I just have), my neighbours could so so as well. If so, my spendthrift urge ceases to be idiosyncratic. Instead, it's possible that whims can "go viral."

Now, you might object that, in practice, macroeconomic forecast errors are rarely due mainly to mispredictions of consumer spending relative to incomes. However, peer effects might also apply to corporate spending decisions. One reason for this is that, because bosses talk to each other at conferences, clubs and suchlike, firms' animal spirits are as likely to be at least as infectious as households'. Also, there's a business case for peer effects to hold; if a rival invests in cost-cutting equipment, you have to do so or else be competed out of business.

My point here is simple, and unoriginal - though not recognized by the swinish multitude which thinks economists should be in the forecasting game. It's that the economy cannot be treated as if it comprised merely a "representative" consumer or firm, but rather that interactions between agents matter and these mean that the economy is a complex emergent process which renders forecast errors all but inevitable. For this reason, we should not take seriously whatever forecasts the OBR makes on Thursday.

December 2, 2013

On generational determinism

Having recently notched up my half-century - in a style more like Chris Tavare than I'd have liked - I was pleased to see Lucy Kellaway write this:

Age continues to fascinate us. Whenever I interview anyone, I do not consider I’ve done the job properly unless I slip in how old they are. Someone’s age tells you something about their experience.

She's right. I suspect we under-estimate the extent to which our age shapes our worldview.

Lucy's surely right to say that "If nothing else, their age gives you a clue about their taste in pop music." But one defining feature of my generation - in common with younger ones but against much older ones - is the belief that popular culture matters. The fact that Joy Division and the Smiths mean more to men of my age than, say, the Beatles or Nirvana or whatever derivative pap passes for music these days surely tells us something. And those of us who saw Debbie Harry when we were teenagers are just baffled by the fuss about Rihanna or Miley Cyrus.

There are other ways in which age shapes our outlook:

1. Spending your formative years in a recession (pdf) - as we 50-year-olds did - makes you risk-averse. The only time I go into bookies is to drag my stepdad out. And when I do, I'm struck that the men in there are either older or younger than me, but rarely my age.

2. Gender relations. My youthful years came during the Aids scare and backlash against the 60s free love, and before women became more sexually confident and more integrated into universities and workplaces: men outnumbered women 2-1 when I was at Oxford, and vastly more when I got to work. This has given my generation a different attitude to women from the slut-shamers and violent misogynists of (some) younger people.

3. Class. During my formative years of the 70s and 80s, class conflict loomed larged. For this reason, people of my age are more sensitive to class than those in (say) their 30s. And we're pleased to see 20-something lefties like Owen Jones revive this.

4. Our intellectual development was a particular one. I studied economics before it became second-rate maths, and at a time when capitalism was in doubt. Also - under the influence of the Andrew Glyn and Jon Elster - I was brought up to think of the social sciences not in terms of models, but as a box of mechanisms. When I look at Post-Crash economics, therefore, I see things turn a full circle.

5. My generation are, more than others, ironists. Perhaps because we saw traditional class, gender and racial roles as forms of oppression to escape from, we see a distance between ourselves and our beliefs and identities. It's no accident that younger people - who have closed the gap between self and identity - are much more likely than us to have tattoos. And it's also no accident that when someone claims to take "offense", it's someone of my age who tells them to fuck off.

Now, I suspect that - in the improbable event of having read this far - you'll be screaming that all this is horribly solipsistic; by "my generation", I mean "me." Maybe. But I'm trying to get at something here - that we're not just products of our genes and/or class, but also of our age. And I suspect that in failing to appreciate the temporal parochialiness of our ideas, we are apt to misunderstand each other.

December 1, 2013

Building character

The old school headmasters were right; it is both desirable and possible to build character. That's the message of a new paper by James Heckman and Tim Kautz. They show that:

Character skills [such as conscientiousness, sociability and perseverence] change with age and with instruction. Interventions to improve skills are effective to di�fferent degrees for different skills at different ages. Importantly, character skills are more malleable at later ages.

This is consistent with some previous research (pdf), which shows that personality varies over time.

This matters, because character is an important influence upon educational attainment and earnings (pdf); one reason why IQ matters little (pdf) for income is that "soft skills" matter as well as cognitive ones.

However, if schooling shapes character, it's likely that other lifetime experiences do so as well. You don't have to be a crude Marxian economic determinism to suspect so. Econ 101 says people respond to incentives. But our preferences are our character: if we call a man hard-working or honest (say), we're describing his character as well as his preferences - and these traits might well be a response to (perceived) incentives.

This poses the question: does capitalism tend to promote "good" character or "bad"?

The case that it promotes good character has been made by Deirdre McCloskey. She's argued that a market economy promotes virtues such as prudence, diligence and even sympathy: if you want to sell a man something, it helps to think about what he wants.

There are, though, counter-arguments:

- Alasdair MacIntyre has argued that a capitalist economy elevates the goods of effectiveness (money, power) over those of excellence, and so destroys the possibility of virtue. You can read the deskilling hypothesis of Harry Braverman as a MacIntyrean one.

- In winner-take-all markets, young people have an incentive to chase celebrity or longshot chances of success, rather than the sort of academic merit that'll give them a higher chance of a middlingly good income.

- Richard Sennett argues that flexible capitalism, with its need that workers change careers undermines virtues such as community feeling and personal integrity.

- The most successful individuals within capitalist hierarchies are selected for overconfidence (pdf), narcissism, psychopathy and fanaticism.

It's not clear to me what the answer here is. But this is an important question. And it's one that's neglected by the mistaken belief that character is fixed. The causality between economic outcomes and personality runs both ways.

November 29, 2013

IQ and equality

Boris Johnson says (pdf):

It is surely relevant to a conversation about equality that as many as 16% of our species have an IQ below 85, while about 2% have an IQ above 130.

It might be relevant, but not in the way he intends.

The fact that 16% have IQs below 85 tells us not about people, but about the way standard IQ tests are constructed. They are designed so that it's always the case that 16% have a sub-85 IQ. This doesn't mean that IQ is fixed; the Flynn effect tells us it isn't.

However, whilst the distribution of IQs is fixed, the distribution of income isn't. The share going to top incomes - which I think is the relevant one in this context given Mr Johnson's talk of the 2% with IQs above 130 - shows a big U-shape over the last century.

This simple juxtaposition tell us that IQ alone doesn't much influence inequality; something that doesn't change can't explain something that does.

Of course, it could be that what's changed is the payoffs to IQ. The collapse in demand for unskilled workers in the west since the 1970s and rise in "winner-take-all" markets might mean that low-IQ is now penalized more than it was in the 60s and 70s, whilst a high IQ reaps bigger rewards.

Whilst these trends are undoubtedly important, I'm not sure they are strongly related to IQ. The correlation between IQ and incomes is low; many bosses, remember, fail basic maths. And insofar as there is a correlation, it is due in part to poverty causing low mental functioning and IQ tests favouring richer people's minds rather than to IQ causing income. In implying otherwise, Mr Johnson seems to be making that common error of the rich, of confusing success and merit.

But let's assume all this is false, and there were a link between IQ and inequality. Would this then mean inequality is tolerable? Not at all, for two reasons.

First, a link between IQ and income does not - in itself - tell us anything about the justice of a social system. If a dictator allocated jobs according to IQ, or if high-IQ people were better at stealing from others, there'd be a strong link between IQ and income. But this wouldn't mean the systems were just.

Secondly, a person's IQ is (largely) beyond their control. And one common principle of justice is that people should not suffer because of things they cannot control. If you think low IQ causes poverty, therefore, you might well reasonably think there's a strong case for redistribution. As John Rawls said, the distribution of talent is "arbitrary from a moral point of view":

There is no more reason to permit the distribution of income and wealth to be settled by the distribution of natural assets than by historical and social fortune. (A Theory of Justice, p74).

Sure, Rawls might be wrong. But this should be argued for - and Mr Johnson doesn't do this.

In claiming that IQ is relevant to a conversation about equality, then, Mr Johnson is wrong empirically. And even if he were right, IQ would be relevant in the opposite way from which he intends - because inequality of IQ might actually justify more egalitarian policies, and not an acceptance of inequality.

November 28, 2013

Inequality & growth

In his recent speech (pdf), Boris Johnson demonstrates a first-class mind - such a mind being one that tell its audience what it wants to hear. He says:

Some measure of inequality is essential for the spirit of envy and keeping up with the Joneses that is, like greed, a valuable spur to economic activity.

In part, this is a straw man; nobody is arguing for complete equality. It poses - but does not answer - the question: is the inequality we now have conducive to growth or not?

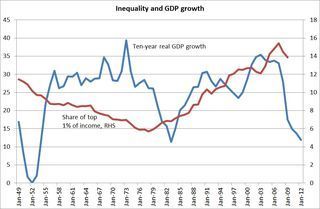

Two big things suggest not. First, GDP growth recently - and for that matter before the crisis - has been poor even as inequality, as measured by the share of incomes going to the top 1%, has risen. Secondly, we enjoyed decent growth in the 50s and 60s when inequality was lower than it is now.

Of course, these two facts prove nothing. There are countless possible influences upon trend GDP other than inequality, and it's probably impossible to control for them all. But they do hint at something - that perhaps there are some mechanisms offsetting the ones Mr Johnson mentions. And these might cause inequality - beyond some point - to depress growth (pdf). These are:

- The urge to keep up with the Joneses doesn't just spur useful work. It might also encourage people to get into debt to spend as much as the rich, and this can (perhaps) lead to over-gearing and a financial crisis. The experience of the 00s might not be the only data-point here. Rising inequality in the 1920s also ended in depression.

- Inequality can reduce trust, and distrust can reduce growth.

- Inequality might be a symptom of a dysfunctional economic and political system. If we have monopoly or other market failure and/or crony capitalism, we'll see some mega-rich people, but not a thriving economy.

- Inequality might itself create dysfunctional politics. If the poor push for redistributive policies which weaken investment incentives, or if the rich use their wealth to buy political favours, growth will suffer.

Now, I don't say this to claim that inequality is always and everywhere bad for growth. I do so merely to suggest that Mr J was expressing a very partial point of view, and was simplifying horribly. It's a good job he is merely a minor local politician who isn't in charge of anywhere important.

November 27, 2013

Luck

Rick's lovely account of how computers enabled him to write should remind us of a more general point - that luck determines pretty much all of our economic fate.

The standard Mincer equations express individual earnings as a function of schooling and exprience - and, in more sophisticated versions, of personality or cognitive skills as well. Even these leave a huge chunk of earnings' varation across individuals' unexplained - suggesting that luck plays a big role*.

However, these equations under-estimate the role of luck, because luck helps determine how much human capital we acquire in the first place. I'm thinking of several mechanisms here:

- When you were born. Rick was lucky enough to be born near enough to the computer age.Had he been born a few decades earlier, he'd never have unleashed his writing "talent.**" This point extends. In the 50s, only a few people could get to university. Now, many more can - which gives late developers especially more advantage. (It is of course, trivial that when you were born also affects the returns to your human capital; top footballers and CEOs earn more now than 40 years ago because their skills are in demand, not because they are necessarily more skilled than their predecessors.)

- The month you were born in. People born in September earn more than those born in the summer, perhaps because they are bigger and older for their school year, and so do better at school.

- Where you were born. I'm rich because I was born in England, not Ethiopia. Herbert Simon estimated that at least 90% (pdf) of the incomes of western individuals are due to this fortune of birth.

- Genes. Michael Young described meritocrats as members of the "lucky sperm club." He was surely right. If I'd inherited my dad's criminal tendencies rather than my mum's unimaginative sense of duty, I'd be very different***.

- Child poverty. Children from poor homes do worse in school (pdf) and later life - on average! - than those from wealthy homes. Although this doesn't seem to greatly affect life-satisfaction in adulthood, childhood emotional health does.

- The luck of getting a sympathetic teacher or good role models. Pretty much every successful person can point to these, surely.

- Chance meetings. Harry Markowitz has said that a "chance conversation" led him to study portfolio theory for which he won a Nobel prize. The story is surely typical; how many of us got valuable early experience simply because a job interviewer liked the cut of our gib, or were denied it because he didn't?

I suspect that pretty much all the differences between our incomes are due to luck; a capacity for hard work is also a matter for luck. We do not "deserve" our economic fate, and only the most witlessly narcissistic libertoon could claim otherwise.

Now, it doesn't follow automatically from this that the tax system should equalize incomes. As Nozick argued, people can be entitled to things they don't deserve. And justice is not the only virtue; efficiency might require some differences in post-tax income.

What it does mean is that the rich and successful should be more humble.

* The low R-squareds aren't necessarily all an indicator of luck. Earnings might vary for people of similar human capital because of differences in their choices of compensating advantages.

** The scare quotes are because of my scepticism about the nature of talent, not because of any lack of esteem for Rick.

*** I don't know if criminality is heritable, and don't much care; I'm speaking loosely.

November 26, 2013

Stagnation: in the mind?

Is "secular stagnation" a state of the world or a state of our minds? I ask for two different - indeed, contradictory - reasons.

The first is inspired by papers (pdf) by Ulrike Malmenider and Stefan Nagel and by Henrik Cronqvist and colleagues. They both show that our attitudes to the economy - as measured by how we invest our money - are shaped by experiences in our impressionable years. People who experience recessions in their formative years tend to be more risk-averse than those who enjoyed better times. They invest less in equities and less in growth stocks than more favoured generations.

And here's the thing. A lot of the talk of stagnation comes from those of us aged between around 45-60. We were scarred by the collapse of the Golden Age of capitalism in 1973 and/or by the recessions of the early 80s. These experiences disposed many of us to be "glass half-empty" kind of people - or, as our younger colleagues say, miserable old gits. It might be, therefore, that we are pessimistic not just because of the facts, but because of the legacy of our early experiences.

This is not the only way in which early-life experiences shape economic attitudes. It has been argued that one reason why inflation stayed low during the full employment years of the 50s and 60s was that workers' memories of the mass unemployment of the 30s depressed wage militancy. As those workers retired, to be replaced by those who had known only good times, the fear of unemployment receded and wage militancy rose.

I could push this hypothesis further. It's 45-60 year-olds who dominate corporate boardrooms and hence investment decisions. It might therefore be that capital spending is low because it is decided by people scarred into pessimism.

This, though, might be a stretch; bosses are, in part, selected for overconfidence and this selection effect mitigates the cohort effect.

There is, though, a second mechanism here. Why is investment so low? Standard explanations focus upon the dearth of (monetizable) investment opportunities due in part to slower technical change (pdf). But there might be something else at work. A few years ago William Nordhaus wrote:

Only a miniscule fraction of the social returns from technological advances over the 1948-2001 period was captured by producers, indicating that most of the benefits of technological change are passed on to consumers.

It might be that bosses have wised up to this - not so much because they've read Nordhaus but because they've learned from experience. If so, the problem isn't so much that technical progress has slowed, but that it never really paid in the first place and bosses have now learnt this and so cut investment. If so, stagnation is the result of rational learning.

My point here is a trivial one. Talk about stagnation - whether you're arguing for it or not - is talk not just about the world, but about our beliefs. And we should think about how these are shaped.

November 25, 2013

Triumph of the totalitarians

Viewers of Dominic Sandbrook's series on the Cold War get the impression that the Cold War was a fight between freedom and totalitarianism which the latter lost. However, some things I've seen recently make me suspect that it was the totalitarians who really won.

One is Puffles' description of the Labour party's hapless efforts to use social media. He points out that the party's aim to "dominate the conversation" is simply oxymoronic, and suggests - echoing Jeffrey Nielsen - that one reason for the decline of grassroots party activists is a dissatisfaction with ‘top down’ "oppressive discipline".

Secondly are a series of accounts of the decline of British universities.The Telegraph reports that "university leaders" are condoning gender segregation in debates; Adam Ramsey describes how heavy-handed university "security" is suppressing protest; and Nick Cohen says:

Instead of producing confident students who can handle any argument you throw at them, universities are a production line for cowed conformists. Instead of being free spaces where ideas can be debated without restraint, universities have become like the private and public bureaucracies the young will go on to join: speak out of turn, or even wear the wrong T-shirt, and the bosses will make you suffer.

These stories have something in common. They both show how managerialist ideology is being extended into places where it doesn't belong. Political activism and social media lend themselves best to loose egalitarian networks, not to top-down management - which is why big business so often makes an arse of itself on Twitter. And universities should be repositories of liberal values which recognize that intelligent young people are (or should be) fractious, noisy and rebellious, not production lines for conformists run by control freaks with a phobia of disorder who kowtow to their most frightening customers.

And this is why I say the totalitarians have won. A totalitarian is a fanatic who believes that one ideology should dominate society. And (some) managerialists are - in this sense - totalitarians, who have extended top-down control freakery to places where it is counter-productive and destructive of traditional values.

Which raises a paradox. During the Cold War, it was believed that Marxists were the totalitarians and capitalists were on the side of pluralism. Today, though, it is the other way around. At least one Marxist is siding with pluralism, whilst it is the boss class that are the totalitarians.

Chris Dillow's Blog

- Chris Dillow's profile

- 2 followers