Eugene Volokh's Blog, page 74

July 14, 2025

[Josh Blackman] The Supreme Court Is Supreme, And The Inferior Courts Are Inferior

[Mi CASA no es su CASA]

Trump v. CASA is one of the Supreme Court's most important decisions about the powers of the Supreme Court. It ranks up there with City of Boerne v. Flores, Cooper v. Aaron, and maybe even Marbury v. Madison. To be clear, CASA was not a ruling about the Article III powers of the lower courts. Justice Barrett was quite clear the Court was only ruling based on whether the Judiciary Act of 1789 permitted universal injunctions.

Our decision rests solely on the statutory authority that federal courts possess under the Judiciary Act of 1789. We express no view on the Government's argument that Article III forecloses universal relief.

CASA also did not directly discuss the Article III powers of the Supreme Court in particular. Instead, the majority seemed to accept the premise of judicial supremacy, at least based on the Solicitor Generals' representation. By contrast, Justice Kavanaugh embraced it wholeheartedly. In short, the Supreme Court is Supreme, and the inferior courts are inferior. Or, mi CASA no es su CASA.

Justice Barrett, citing her opinion in Brackeen, explains that a judicial opinion has no legal force. Rather, it is the judgment of a federal court that has force, and can remedy an injury.

In her law-declaring vision of thejudicial function, a district court's opinion is not just persuasive, but has the legal force of a judgment. But see Haaland v. Brackeen, 599 U. S. 255, 294 (2023) ("It is a federal court's judgment, not its opinion, that remedies an injury").

I disagree with much in Brackeen, but this statement is correct.

However, in Footnote 18, Barrett explains that the Supreme Court's opinions do have legal force. Or at least she quotes Solicitor General Sauer's representation on this point.

The dissent worries that the Citizenship Clause challenge will never reach this Court, because if the plaintiffs continue to prevail, they will have no reason to petition for certiorari. And if the Government keeps losing, it will "ha[ve] no incentive to file a petition here . . . because the outcome of such an appeal would be preordained." Post, at 42 (opinion of SOTOMAYOR, J.). But at oral argument, the Solicitor General acknowledged that challenges to the Executive Order are pending in multiple circuits, Tr. of Oral Arg. 50, and when asked directly "When you lose one of those, do you intend to seek cert?", the Solicitor General responded, "yes, absolutely." Ibid. And while the dissent speculates that the Government would disregard an unfavorable opinion from this Court, the Solicitor General represented that the Government will respect both the judgments and the opinions of this Court. See id., at 62–63.

I'm not sure that Justice Barrett agrees with that statement. Indeed, Brackeen suggests just the opposite. But when the Solicitor General makes a representation, that representation is binding on the government. I agree with Jack Goldsmith that this acquiescence to judicial supremacy will come back to haunt the government for generations.

While Justice Barrett is perhaps tepid, Justice Kavanaugh fully embraces this species of judicial supremacy. He thinks it would be an "abdication" of the Supreme Court's "proper role" to let the lower courts make the "interim" ruling that would last for years.

That suggestion is flawed, in my view, because it would often leave an unworkable or intolerable patchwork of federal law in place. And even in cases where there is no patchwork—for example, because an application comes to us with a single nationwide class-action injunction—what if this Court thinks the lower court's decision is wrong? . . . . So a default policy of off-loading to lower courts the final word on whether to green-light or block major new federal statutes and executive actions for the several-year interim until a final ruling on the merits would seem to amount to an abdication of this Court's proper role.

Kavanaugh sees the Supreme Court's supremacy as either a matter of fact (de facto) or a matter of law (de jure). Descriptively, I probably agree with the former claim. Even before Cooper, the Supreme Court was the de facto body to resolve judicial conflicts. But the de jure claim to supremacy claim was only made in Cooper.

Second, if one agrees that the years-long interim status of a highly significant new federal statute or executive action should often be uniform throughout the UnitedStates, who decides what the interim status is? The answer typically will be this Court, as has been the case both traditionally and recently. This Court's actions in resolving applications for interim relief help provide clarity and uniformity as to the interim legal status ofmajor new federal statutes, rules, and executive orders. In particular, the Court's disposition of applications for interim relief often will effectively settle, de jure or de facto, the interim legal status of those statutes or executive actions nationwide.

Here, Justice Kavanaugh is embracing Cooperian supremacy. But Cooper did not concern the Supreme Court's power to issue universal injunctions. And that case concerned a ruling against state officials, not a coordinate branch of government. If the Court has the power to issue universal injunctions against the federal government de jure, that power would have to come from a statute or Article III itself. Justice Sotomayor raises this point in her dissent:

What, besides equity, enables this Court to order the Government to cease completely the enforcement of illegal policies? The majority does not say.

No, Justice Barrett does not say. If the Judiciary Act of 1789 does not give inferior courts the power to issue a universal injunction, where does the Supreme Court get that power? Justice Kavanaugh also does not say. And Justice Sotomayor thinks it is "naive" to believe the government would abide by this ruling "de facto."

So even if this Court later rules that the Citizenship Order is unlawful, we may nevertheless lack the power to enjoin enforcement as to anyone not formally a party before the Court. In a case where the Government is acting in open defiance of the Constitution, federal law, andthis Court's holdings, it is naive to believe the Government will treat this Court's opinions on those policies as "de facto" universal injunctions absent an express order directing total nonenforcement. Ante, at 6 (opinion of KAVANAUGH, J.).

I don't think any of these statements were necessary to rule that universal injunctions were impermissible. These statements of judicial supremacy are regrettable.

Justice Scalia closed his Noel Canning concurrence with this admonition:

We should therefore take every opportunity to affirm the primacy of the Constitution's enduring principles over the politics of the moment. Our failure to do so today will resonate well beyond the particular dispute at hand. Sad, but true: The Court's embrace of the adverse-possession theory of executive power (a characterization the majority resists but does not refute) will be cited in diverse contexts, including those presently unimagined, and will have the effect of aggrandizing the Presidency beyond its constitutional bounds and undermining respect for the separation of powers.

I could say the same thing about CASA, changing "aggrandizing the Presidency" to "aggrandizing the Supreme Court."

The post The Supreme Court Is Supreme, And The Inferior Courts Are Inferior appeared first on Reason.com.

[Eugene Volokh] 9th Circuit Revives Challenge to Community College "Diversity, Equity, Inclusion, and Accessibility" Requirements for Teaching and Other Professional Work

Here's a short excerpt from the Nov. 2023 Report and Recommendations by Magistrate Judge Christopher D. Baker (E.D. Cal.) in Johnson v. Watkin; the plaintiff is a history professor at Bakersfield College, a California public community college. The opinion is long, so I've excerpted it heavily; read the whole thing for more of the legal analysis, and the interesting and contentious factual backstory. The District Court dismissed the case, holding that plaintiff lacked standing, but just today a Ninth Circuit panel (quoted below) reversed that standing decision as to this issue, so the matter will go back down to the lower court.

Cal. Code of Regs. § 53602(a) ["Advancing Diversity, Equity, Inclusion, and Accessibility in Evaluation and Tenure Review Processes"] requires faculty demonstrate (or progress toward) proficiency in the locally-developed DEIA [diversity, equity, inclusion, and accessibility] competencies, or those published by the Chancellor for their evaluation, including tenure review. For instance, § 53602(b) provides that "District employees must have or establish proficiency in DEIA-related performance to teach, work, or lead within California community colleges." Similarly, § 53605(a) provides that "Faculty members shall employ teaching, learning, and professional practices that reflect DEIA and anti-racist principles, and in particular, respect for, and acknowledgement of the diverse backgrounds of students and colleagues to improve equitable student outcomes and course completion."

Likewise, § 53605(c) provides that "[s]taff members shall promote and incorporate culturally affirming DEIA and anti-racist principles to nurture and create a respectful, inclusive, and equitable learning and work environment." [Defendant California Community College Chancellor Sonia Christian's] characterization of these regulations as merely "articulat[ing] the aspirational goal" of promoting DEIA is disingenuous—by their plain language, the regulations require faculty members like Plaintiff to express a particular message.

The Supreme Court "[has] held time and time again that freedom of speech 'includes both the right to speak freely and the right to refrain from speaking at all.'" Moreover, compelling individuals to mouth support for views they find objectionable, like the government's preferred message, violates the "cardinal constitutional command" that "'no official, high or petty, can prescribe what shall be orthodox in politics, nationalism, religion, or other matters of opinion.'"

The principles behind DEIA regulations may be laudable to some, to many, and maybe to most. But as the District Defendants tacitly acknowledge, they involve "politically charged" and "potentially polarizing" issues. For Plaintiff, his "conscience does not allow him to believe in and practice the state's 'embracing diversity' ideology." Christian's argument during the motion hearing that the challenged regulations do not compel Plaintiff to teach DEIA concepts in the classroom, but rather, merely to demonstrate proficiency in DEIA competencies, is untenable. The regulations clearly require faculty to "employ teaching, learning, and professional practices that reflect DEIA and anti-racist principles." It is unclear how Plaintiff could demonstrate proficiency in DEIA principles, for purposes of tenure review, if he is not required to advocate and promote these concepts in his classroom. In short, Defendants are unable to reconcile how Plaintiff could be fairly evaluated in his "proficiency in DEIA principles" were he to criticize and oppose DEIA concepts within the classroom.

Christian separately argues the regulations are constitutionally permissible non-discrimination policies that "do[] not target speech or discriminate on the basis of its content, but instead serve to remove access barriers imposed against groups that have historically been excluded.'" … [But] that one or even the principal intention behind a regulation is to "remove access barriers" for historically marginalized populations is not dispositive. In other words, Defendants' "intent" behind the DEIA regulations "is irrelevant in the Free Speech analysis."

Christian argues "even if [Plaintiff] could state a constitutional claim challenging the [DEIA] regulations—which he cannot—his motion should still be denied, as the crucial public interest served by the challenged regulations … outweighs the nominal infringement of speech [Plaintiff] alleges he may experience as a result of the regulations." She further contends California has a strong interest in ensuring nearly two million community college students have equal educational opportunities and "ensuring that concepts of diversity, equity, inclusion, and accessibility are promoted in all community colleges." … [But] California's goal of promoting diversity, equity, inclusion, and accessibility in public universities does not give it the authority to invalidate protected expressions of speech….

A bit of legal background: In Garcetti v. Ceballos (2006), the Court held that the First Amendment generally doesn't "protect[] a government employee from discipline based on speech made pursuant to the employee's official duties," but it left room for a possible exception for scholarship and teaching in higher education:

There is some argument that expression related to academic scholarship or classroom instruction implicates additional constitutional interests that are not fully accounted for by this Court's customary employee-speech jurisprudence. We need not, and for that reason do not, decide whether the analysis we conduct today would apply in the same manner to a case involving speech related to scholarship or teaching.

Several appellate courts, including the Ninth Circuit (which includes California), have concluded that scholarship and teaching in colleges and universities is indeed constitutionally protected, if it (1) consists of speech on matters of public concern, and (2) passes a balancing test set forth by Pickering v. Bd. of Ed. (1968)—i.e., if the employee's First Amendment rights aren't outweighed by "the interest of the State, as an employer, in promoting the efficiency of the public services it performs through its employees." The Report and Recommendations applied this framework:

Plaintiff asserts Defendants have chilled his ability to teach in the classroom, express his objections to "DEI ideology," manage and post on [a faculty organization's] Facebook page, write editorials, appear in media, hold events, [and] invite guest speakers …. Plaintiff claims much of his "speech at issue here—posting on Facebook, writing editorials, inviting and sponsoring speakers, and appearing in media—is speech [he] would make in his personal capacity." Plaintiff asserts any other speech he made was pursuant to his official duties as a professor and constitutes teaching and scholarship.

The Undersigned agrees with Plaintiff that his proposed posts on social media, media appearances, editorials, and events are speech he would make in his personal capacity…. [And] Plaintiff's decision on what to teach in the classroom and criticism of "DEI ideology" would qualify as teaching and academic writing.

Neither Plaintiff nor Defendants dispute that Plaintiff's proposed speech regarding DEIA pertains to matters of public concern…. Plaintiff's proposed speech regarding "Cultural Marxism" and his protest of the participation of males in female sports and drag queen story hours are subjects of general interest, value, and concern to the public. Likewise, Plaintiff's intent to speak on matters concerning Bakersfield College academics, operations, and policies qualify as matters of public concern….

For the reasons set forth above, the Undersigned concludes Plaintiff is likely to prevail in satisfying the second step of the Pickering test and that the State's interest in imposing the DEIA regulations and the DEI Competencies and Criteria Recommendations do not outweigh Plaintiff's First Amendment rights.

Here's the relevant part of the Ninth Circuit's procedural decision today in Johnson v. Fliger, by Ninth Circuit Judges Consuelo Callahan, Bridget Bade, and Lucy Koh:

We reverse the district court's conclusion that Johnson lacks standing to sue Defendant-Appellant officials of the Kern Community College District … [as to] Cal. Code Regs. tit. 5, §§ 53602(b), 53605(a) and (c), and, to the extent it incorporates those regulations, Cal. Educ. Code § 87732(8) …. Johnson has sufficiently alleged "an intention to engage in a course of conduct arguably affected with a constitutional interest" under the First Amendment. His intended conduct is "arguably proscribed" by these provisions, because they directly regulate Johnson as an employee and faculty member of the Kem Community College District (KCCD).

Johnson has also adequately alleged a "credible threat" of enforcement under these provisions. Johnson has established a "'concrete plan' to violate the law" based on his allegations regarding his desired speech and his refusal to express support for diversity, equity, inclusion, and accessibility (DEIA) principles…. [T]he "concept of 'intention' is more counterfactual than practical" and that courts "ask whether the plaintiff would have the intention to engage in the proscribed conduct, were it not proscribed" …. And importantly, the District Defendants have not disavowed enforcement.

Johnson's allegations establishing a credible threat of enforcement are not defeated by the absence of a specific threat of enforcement by the District Defendants, and the lack of a history of enforcement carries little weight because these regulations were enacted only months before Johnson filed suit….

Plaintiff is represented by Alan Gura and Endel Kolde (Institute for Free Speech).

The post 9th Circuit Revives Challenge to Community College "Diversity, Equity, Inclusion, and Accessibility" Requirements for Teaching and Other Professional Work appeared first on Reason.com.

[Josh Blackman] CASA, Grupo Mexicano, and Ex Parte Young

[Does Ex Parte Young find an "Analogue in the Relief Exercised in the English Court of Chancery"?]

One of the challenges with Trump v. CASA is accounting for nearly a century worth of Supreme Court decisions. There are a host of landmark decisions where the Court arguably approved of universal injunctions, such as Pierce v. Society of Sisters and West Virginia v. Barnette. Mili Sohoni says these were universal injunctions. Mike Morley disputes these accounts. Justice Barrett discounts these "drive-by" remedial rulings as modern cases that postdate the Judiciary Act of 1789 by more than a century. Justice Sotomayor also cites Brown v. Board of Education II, which proposed some very unusual equitable remedies with "all deliberate speed." Barrett does not respond to Brown. The harder case, in my view, would have been the equitable remedy for Bolling v. Sharpe against the federal government.

But one case where the majority and dissent do engage each other is Ex Parte Young, the classic FedCourts case.

Justice Sotomayor argues that Young is evidence that equitable jurisdiction is not trapped in amber, but instead evolves over time:

Indeed, equitable relief in the United States has evolved in one respect to protect rights and redress wrongs that even the majority does not question: Plaintiffs today may obtain plaintiff-protective injunctions against Government officials that block the enforcement of unconstitutional laws, relief exemplified by Ex parte Young, 209 U. S. 123 (1908). That remedy, which traces back to the equity practice of mid-19th century courts, finds no analogue in the relief exercised in the English Court of Chancery, which could not enjoin the Crown or English officers. See supra, at 24, n. 4; see also Sohoni, 133 Harv. L. Rev., at 928, 1002–1006; see also R. Fallon, D. Meltzer, & D. Shapiro, Hart and Wechsler's The Federal Courts and the Federal System958–959 (5th ed. 2003) (noting that, in Young, "the threatened conduct of the defendant would not have been an actionable wrong at common law" and that the "principle [in Young] has been easily absorbed in suits challenging federal official action"). Under the majority's rigid historical test, however, even plaintiff-protective injunctions against patently unlawful Government action should be impermissible.

Justice Barrett responds to Justice Sotomayor in a footnote:

Notwithstanding Grupo Mexicano, the principal dissent invokes Ex parte Young, 209 U. S. 123 (1908), as support for the proposition that equity can encompass remedies that have "no analogue in the relief exercised in the English Court of Chancery," because Ex parte Young permits plaintiffs to "obtain plaintiff-protective injunctions against Government officials," and the English Court of Chancery "could not enjoin theCrown or English officers," post, at 30 (opinion of SOTOMAYOR, J.). But contrary to the principal dissent's suggestion, Ex parte Young does not say—either explicitly or implicitly—that courts may devise novel remedies that have no background in traditional equitable practice. Historically, a court of equity could issue an antisuit injunction to prevent an officer from engaging in tortious conduct. Ex parte Young justifies its holding by reference to a long line of cases authorizing suits against state officials in certain circumstances. See 209 U. S., at 150–152 (citing, e.g., Osborn v. Bank of United States, 9 Wheat. 738 (1824); Governor of Georgia v. Madrazo, 1 Pet. 110 (1828); and Davis v. Gray, 16 Wall. 203 (1873)). Support for the principal dissent's approach is found not in Ex parte Young, but in Justice Ginsburg's partial dissent in Grupo Mexicano, which eschews the governing historical approach in favor of "[a]dynamic equity jurisprudence." 527 U. S., at 337 (opinion concurring in part and dissenting in part).

I think Justice Barrett gets the better of this argument. The basis of equitable jurisdiction in Ex Parte Young was an "antisuit injunction to prevent an officer from engaging in tortious conduct."

Seth Barrett Tillman and I explained this aspect of Young in our article on the Foreign Emoluments Clause litigation:

The posture of Young was, admittedly, complex. The case began when shareholders of the railroad company sued the company and its directors.285 The shareholders wanted the directors to challenge the constitutionality of the state regulations as violations of the Due Process Clause of the Fourteenth Amendment.286 At the time, Minnesota Attorney General Edward Young enforced the railroad regulations.287 The shareholders could invoke the equitable jurisdiction of the federal court because they relied on traditional equitable principles and former Equity Rule 94.288 This provision was the precursor to the modern-day Fed. R. Civ. P. 23.1, which governs derivative actions.289 In Young, the shareholders sought to enforce their fiduciary relationship with the directors. This "trust"-like relationship lies at the core of historical equitable jurisdiction. Indeed, in Federalist No. 80, Hamilton listed "trust" as a traditional cause of action, along with "fraud," "accident," and "hardship."290 Therefore, the shareholders could also rely on a traditional equitable cause of action to challenge the regulations. In the English High Court of Chancery, and in early American courts, causes of action existed that would allow private citizens to challenge government regulations of their own property—even where, as here, title was held beneficially. In Young, the government was regulating the railroad company. Such disputes about contested rights and duties involving property (e.g., interpleader) also lie at the core of historical equitable jurisdiction. Specifically, the Young plaintiffs sought to prevent future state action regulating their own property. To accomplish this goal, they invoked the court's equitable jurisdiction to sue their company, its directors, and state officers before those state officers could regulate the plaintiffs' own property through an imminent coercive lawsuit.291 Professors Bamzai and Bray observe that in Young, "equity [was] invoked to protect a proprietary interest." They write that this "equity-property connection helps focus the dispute and prevents equity from pushing aside other areas of law that have their own separate logic, limits, and principles."292

An interference with private property was, and is, tortious conduct. The basis for equitable jurisdiction in Young was premised, as Barrett wrote, on the government's alleged tortious conduct against private property. This sort of suit would have been permitted in 1789 by the English Court of Chancery.

The post CASA, Grupo Mexicano, and Ex Parte Young appeared first on Reason.com.

[David Kopel] Turning Credit Cards into Comprehensive Financial Surveillance

[New laws on interchange fees will transform credit card payments into detailed government-accessible records of every item purchased, including firearms]

In 2011 the Obama administration unleashed Operation Choke Point to use informal regulatory pressure on banks to debank the firearms industry, but that plan withered when exposed in congressional hearings. A few years later, the gun prevention lobbies convinced several states to mandate separate merchant category codes (MCCs) for stores that sell firearms; unfortunately for this initiative, the number of states with statutes that (opens in a new tab)forbid special MCCs for such stores far exceeds the number of states that mandate them. Today, the gun prevention movement is receiving an unexpected gift from merchant lobbies who are pushing to embed sophisticated surveillance infrastructure into the basic architecture of electronic commerce. With that architecture in place, the government will be able to track every item purchased with a credit card — firearms and everything else. The surveillance scheme emerges as an unintended consequence of superficially appealing legislation — namely state-level interchange fee laws — which are promoted as being aimed at helping waitresses, waiters, and small mom-and-pop shops.

This post first describes Operation Choke Point, then its replacement by Merchant Category Codes(MCCs) tracking, and finally the new program for comprehensive surveillance of all purchases. The first two matters are described in my Dickinson Law Review article Big Business as Gun Control, and in my recent post summarizing the article. This post is coauthored with Kristian Stout, who is Director of Innovation Policy at the International Center for Law & Economics, a public policy research organization whose "work is dedicated to the memory"of the famous Law and Economics scholars Armen Alchian and Henry G. Manne.

The first state-level interchange fee statute was enacted in Illinois in June 2024. In the state legislatures, based on who's lobbying for what, the battles over interchange bills often appears as credit card companies versus big box stores, with pro-waitress and pro-small business lobbies chiming in to support the big box stores. But this framing ignores the enormous privacy implications for everyone who uses a credit card: namely forcing credit card companies to make records of the items purchased in every transaction.

A First Foray into Financial Weaponization: Operation Choke Point

The Obama administration unleashed Operation Choke Point in 2011 in an attempt to debank, and thus destroy, politically disfavored businesses. The Federal Deposit Insurance Corporation issued a guidance document warning banks about "merchant categories that have been associated with high-risk activity."

The "high-risk" activity was not high risk that a banking client might use his or her account for something illegal, such as money laundering, for which there are already extensive regulations from the Treasury Department units: the Office of the Comptroller of the Currency (OCC) and the Financial Crimes Enforcement Network (FinCEN). To the contrary, "high risk" was claimed to include the amorphous concept of "reputation risk." That is, a banking client might be politically unpopular, and so the bank's reputation might be harmed.

The "guidance" about "reputation risk" was accurately understood by banks as a threat. The same as if an organized crime underboss told a building contractor, "Just some friendly non-binding guidance: if you keep doing business with that cement supplier we don't like, you might get a bad reputation. They're not very popular around here."

The FDIC deliberately conflated entirely legal businesses with patently illegal activities. The agency's "high-risk" list included legitimate enterprises such as "Ammunition Sales," "Firearms Sales," and "Coin Dealers" alongside clearly illegal operations such as "Ponzi Schemes" and "drug paraphernalia." Rather than pursuing transparent rulemaking, the FDIC made implicit threats to achieve their anti-gun policy objectives without legislative authorization.

Just about any bank can be killed through ratings downgrades and uber-audits. Even if the bank ultimately prevails in court, the bank can be ruined or severely damaged by years of intense targeted investigations. Submitting to the Obama administration's unlawful regulatory threats, banks began debanking firearms businesses. For example, Maryland ammunition dealer TomKat Ammunition, with an unblemished record of regulatory compliance, was systematically denied financial services, with banks citing only its "industry" as justification.

The illegal Operation Choke Point was exposed through official investigations. The FDIC Office of Inspector General documented predetermined supervisory outcomes aligned with political objectives rather than legitimate safety concerns. Following legal challenges, the FDIC admitted that employees had engaged in "regulatory threats, undue pressure, coercion, and intimidation designed to restrict access to financial services for lawful businesses."

Notwithstanding the FDIC's admissions that Operation Choke Point had been illegal, the Biden administration in January 2023 began what critics called "Operation Choke Point 2.0," featuring coordinated attacks on the cryptocurrency and fintech sectors. The abuses included systematic debanking of targeted individuals based on political views, with tech investor Marc Andreessen documenting over 30 entrepreneurs debanked during the Biden administration. As detailed in Kopel's Dickinson Law Review article, other debanking targets during the Biden administration included Melania Trump and Christian religious organizations. In short, the Biden administration flagrantly defied the law and created "a privatized sanctions regime" that operated independently of traditional oversight mechanisms.

MCCs: The Institutionalization of Surveillance Infrastructure

The push for firearm-specific Merchant Category Codes represented an evolution from the covert pressures of Operation Choke Point to overt, institutionalized surveillance infrastructure. In September 2022, the International Organization for Standardization approved MCC 5723 for "Firearms Stores, Gun Stores, and Ammunition Stores" following a petition by a coalition of gun control advocates.

Merchant credit codes are used to distinguish broad categories of businesses — such as agriculture, transportation, professional services, or retail. There are a few codes used for businesses where the risk of credit card fraud is particularly high, such as casino gaming chips or online tobacco sales. Merchants who are assigned these categories typically have to pay higher interchange fees (which are described below).

Unlike Operation Choke Point's informal regulatory "guidance," behind-the-scenes pressure, and implied threats of enforcement action, the MCC system creates self-executing surveillance that requires no ongoing regulatory intervention. Using the firearms Merchant Category Code, payment networks and financial institutions can now automatically flag and track purchases at firearms retailers.

This technical infrastructure transforms surveillance from an episodic regulatory tool into a permanent feature of the financial system. Unlike the informal pressures that characterized Choke Point, MCCs embed tracking capabilities into the fundamental architecture of electronic payments, making surveillance the default rather than the exception. Three states — California, Colorado, and New York -- have enacted firearms MCC mandates, while 19 states — Texas plus 18 midsize or smaller states -- have forbidden the use of such codes.

The shift from regulatory pressure to technical infrastructure creates a permanence problem that extends far beyond traditional policy reversals. Bureaucratic systems, once established, develop institutional momentum that makes them extraordinarily difficult to dismantle. The technical infrastructure required to implement MCCs — from payment processor updates to merchant acquirer systems — represents significant capital investment that creates powerful incentives for continued use regardless of changing political winds.

Like other data streams, the firearms data stream from MCCs justify their own existence, creating bureaucratic constituencies with vested interests in maintaining and expanding the system. Technical capabilities, once built, exert pressure for utilization regardless of their original justification.

The pretext for firearms MCCs is prevention of gun deaths, particularly mass shootings. However, as Kopel's Dickinson Law Review article explains, this rationale falls apart unless one presumes that every firearms purchase, such as a single handgun and a box of ammunition, will trigger an in-depth investigation by law enforcement. More realistically, the banking system's forced segregation of firearms store transactions will create a database of persons who likely are firearms owners, providing the foundation for enforcement of future restrictions, including registration requirements and potential confiscation policies similar to those implemented in other nations — such as Australia or Great Britain, whose confiscations have been praised as a model by former Vice-President Harris.

Not that the list would be perfect. At this stage of technology, a MCC identifies merchant types, not specific products purchased, meaning that any purchase at a store assigned the firearms code — whether for a gun safe, hunting equipment, or sporting goods — would be flagged for potential scrutiny. Large sporting goods retailers that sell firearms alongside boats, ATVs, and camping equipment would trigger the same surveillance alerts regardless of what customers actually purchase. Even so, a person who shops at a small firearms retailer, even to buy bow-hunting equipment, is relatively more likely to be a firearms owner, and so, to a lesser extent, is someone who buys anything (such as a fishing rod) at Bass Pro Shops.

Obviously the MCC would function better as a de facto firearms registry if retailers that sell a variety of products were forced to establish a separate "store" for firearms purchases. So if you went to Cabela's a bought hiking boots, the transaction would be rung up at "general retail" register, and if you bought a box of shotgun ammunition, the transaction would have to be rung up a separate register. Future advocacy efforts may focus on supposed "loopholes" in existing MCC mandates, potentially leading to proposals requiring stores to establish separate merchant credit accounts solely for firearms-related transactions.

But maybe the gun prevention lobbies won't have to go to such trouble. What if every credit card transaction had to provide to the bank that operates a merchant's or consumer's bank an itemized list of everything that a consumer purchased? Then credit card records could, in essence, function as gun registries. Enacting such an intrusive statute might require more political capital than the gun prevention lobbies currently possess. Fortunately for them, other interest groups are doing the job for them, to create the technical necessity for banks to look directly into your shopping basket, as detailed in the next part of this Post.

Interchange Regulation and the Dawn of 'Shopping Basket' Surveillance

A credit card transaction on a network like Visa or Mastercard involves multiple parties: the cardholder, who is buying something; the merchant, who is selling something; the issuing bank, which gave a credit card to the cardholder; the acquirer, which is a bank or other entity (e.g., Stripe, Paypal) that services the retailer's sales; and the "network." When a sale takes place, the acquirer provides information about the sale to the network, which notifies the bank that issued the buyer's credit card. The issuing bank then approves or declines the sales transaction, uses the network to notify the acquirer of the decision, and the acquirer notifies the seller. The four major American networks are Visa, MasterCard, Discover, and American Express. Visa and Mastercard are "open" networks, whereas American Express and Discover are "closed-loop" networks, in which the issuing bank (to the purchaser) and the acquiring bank (for the retailer) are the same. The interchange laws described below would apply to open networks (Visa, Mastercard) but not closed ones (American Express, Discover).

The acquirer applies a "merchant discount rate"(MDR) that covers its own costs, fees charged by the networks (Visa and Mastercard), and the interchange fee, which is retained by the issuing bank. For example, on a transaction of $100 where the MDR is 3%, the interchange fee is 2%, and the network fee is 0.13%, the merchant receives $97; the issuer retains $2; the network receives $0.13, and the acquirer retains $0.87

The MDR is typically about 1% to 4%. It includes a fee charged by the acquiring bank for its services, often 0.2% to 0.5%. The MDR also reflects fees that were charged by other parties in the transaction: first, network fees (charged by Visa or Mastercard), typically 0.1% to 0.2%. The MDR also incorporates the interchange fee, which is retained by the card-issuing bank.

Interchange fees vary by type of merchant, type of card, and type of transaction. For any specific merchant and card, interchange fees are lowest for "card present" transactions (when the physical credit card or mobile wallet was used at a point of sale device) and highest for online transactions (because of greater risk of fraud). Interchange fees generally range from 1% to 3%.

In the Colorado legislature this year, there was a proposal to restrict interchange fees, and the public relations campaign very much focused on waitstaff. Suppose you dine at a restaurant, and the tab is $100, including tax and tip. You pay the $100 with your credit card, so the restaurant will receive $97 in its bank account. The $3 that didn't go into the restaurant's bank account might have been comprised of a 15 cent network fee by Visa, a 45 cent fee by the restaurant's bank, and a $2.40 interchange fee by the diner's credit card issuer.

Although the restaurant, and theoretically the waitstaff, may make a slightly lower amount for each transaction, both make more money in the long run because the restaurant accepts credit cards. Extensive data shows that consumers spend more, including at restaurants, when they pay by credit card. See, e.g., Julian Morris and Ben Sperry, The Cost of Payments: A Review, ICLE White Paper (2024) (literature review).

The Illinois legislature, however, has already enacted the Illinois Interchange Fee Prohibition Act (IFPA), which prohibits banks from collecting interchange fees on sales tax and gratuity amounts. The law, if it goes into effect in 2026, will force credit card companies to implement systems that account for sales taxes and tips, rather than just on the total amount.

For example, as of today in Illinois, if your total restaurant bill is $100, your credit card issuer doesn't care how the $100 was divided among food, alcohol, tax, and tip. But once the interchange law goes into effect, the issuer will have to sort out the tax and the tip as line items, and subtract them before charging the interchange fee.

In principle, some larger merchants with sophisticated point of sale (POS) systems might be able to do this quite easily, as those systems are at least capable of recording and transmitting line-item data. By contrast, the simple POS systems used by most restaurants and merchants in the United States only provide the total transaction amount and some related data such as the card number, expiration date, transaction date, and the Merchant Category Code. This is called Level 1 data. At Level 2, the system can separate out the sales tax (and some other items). Line-item data is only available at Level 3.

However, Level 2 and 3 data are currently only regularly collected for business credit cards, not consumer cards. As explained in the 2024 ICLE white paper State Regulation of Interchange Fees, the Illinois statute would effectively require "considerable reprogramming by all parties in the payment stack," including merchants, acquirers, networks, and issuers. The problem is even worse for debit cards, which were never designed for such detail.

The IFPA also introduces an even more worrying prospect. By mandating the exclusion of interchange fees on taxes and tips, the government successfully forces the creation of a much more detailed data pipeline. By compelling the payments industry to adopt systems capable of processing the specific contents of a purchase, Illinois sets the stage for transforming routine transactions into detailed surveillance events. A law that in Illinois permits restaurants to collect and remit tax and tip data could in California or New York become a requirement for stores to disclose the sales of firearms. And from there, it could extend to all manner of specific items, or even a general reporting requirement. Then, a government administrative subpoena to an acquirer or issuer would reveal much more than a list of people who bought something at Cabela's or Uncle Joe's Hunting Shack; it would reveal precisely what each customer purchased.

A mandate requiring the reporting of level 3 data exponentially magnifies the "mosaic effect," a phenomenon where individually innocuous data points combine to reveal intimate personal details, including personal beliefs, associations, and constitutionally protected activities. Such a mandate would allow the government, via administrative subpoenas, to discover the books you bought, your purchase of kosher food at a grocery store, an Islamic prayer rug at a department store, or the 50 cans of beans and dozen gallons of bottled water you purchased at Costco. The last two items might get you identified as a "survivalist," which according to a leaked 2009 memo from the Department of Homeland Security means you might be a domestic terrorist. Or in a state where abortion is illegal, the simultaneous purchase of a pregnancy test plus two boxes of maxi pads would be a lead for finding women using at-home abortion pills.

Don't count on the law to protect your privacy. Under the third-party doctrine created by the Supreme Court, you have no Fourth Amendment right of privacy for data you voluntarily share with a third party, such as a bank or credit card company. See, e.g., United States v. Miller, 425 U.S. 435 (1976) (government subpoena of bank records, 7-2, opinion by Powell, dissents by Marshall and Brennan); Liza Goldenberg, Going Cashless: Privacy Implications for Gun Control in a Digital Economy, 17 The Journal of Business, Entrepreneurship & the Law 124 (2024) (Pepperdine). The Gramm-Leach-Bliley Act, Pub. L. No. 106-102, 113 Stat. 1338 (1999) places some limits on the financial industry's ability to aggregate and share consumer data. The Act is why merchants have to ask your permission to share (sell) your information to other businesses. But the Act does not limit law enforcement agencies' subpoenas for data. 15 U.S.C. sect. 6802(e)(5).

Nor should you expect your bank to stand up for your privacy rights as a customer. Even without an administrative subpoena, Bank of America voluntarily provided customer data to federal investigators following January 6th, without any warrant or legal process identifying customers who made purchases at weapons-related merchants This included the FBI asking Bank of America for "ANY historical purchase" in the previous six months of weapons or from weapons-related vendors, for anyone who traveled to D.C. around the time of the infamous January 6 attack on the Capitol. Staff of H.R. Comm. on the Judiciary, 118th Cong., Financial Surveillance in the United States: How the Federal Government Weaponized the Bank Secrecy Act to Spy on Americans 26 (Comm. Print 2024).

While Visa correctly argued in 2022 that requiring a separate Merchant Credit Code for stores that sell firearms, would be "an invasion of consumers' privacy" and create a "dangerous precedent," the Illinois Interchange Fee Prohibition Act compels the very infrastructure Visa said shouldn't exist.

Conclusion

The evolution from Operation Choke Point to firearm-specific MCCs, and now to state-mandated interchange fee regulations illustrates a broader pattern in American governance: the systematic expansion of the panopticon state through private intermediaries that circumvent constitutional constraints. By deputizing banks and payment processors as surveillance or enforcement agents, regulators achieve policy objectives impossible through direct government action, exploiting the reality that participation in the modern financial system is not truly voluntary.

What began as purportedly nonbinding "guidance" against politically disfavored industries has evolved into a two-pronged surveillance infrastructure. MCCs enable categorical tracking of where citizens shop, while interchange fee laws like Illinois's IFPA create the technical necessity to monitor what they buy. This combination transforms the financial system from a tool of commerce into a comprehensive surveillance apparatus capable of monitoring both merchant categories and shopping basket contents with unprecedented granularity.

Technical infrastructure built for one purpose inevitably expands to serve others, creating what could become comprehensive transaction surveillance affecting all aspects of personal autonomy and constitutional rights exercise. Until the 1970s, Social Security Number cards included the warning "NOT FOR IDENTIFICATION," but the numbers now serve as de facto centralized national ID number for everyone. Internet Protocol (IP) Address Tracking (meaning your computer has a unique Internet ID) was developed by in the 1970s by the Advanced Research Projects Agency Network (ARPANET) for technical efficiency in routing data packets, but is now pervasively used by websites (and government) as one of the tools to track Internet users. Automated License Plate Readers were introduced in the 1990s for their utility in finding stolen vehicles and fugitives. But today, they are used for mass tracking of everyone, with over two billion scans stored in databases. A similar story can be told for Facial Recognition Technology. When the above tools were first brought in for innocuous purposes, it would have been better if laws had been enacted restricting broader uses that would otherwise be inevitable as the tools and computing power improved.

Without protective legislation, the notion that requiring payment networks to enable the transmission of Level 3 data on all transactions will not eventually lead to mass surveillance of every item you buy with a credit card appears implausible. The American Revolution was founded on "that ancient maxim of prudence; obsta principiis" (resist the first advances). Simeon Howard, A Sermon Preached to the Ancient and Honorable Artillery Company in Boston, June 7, 1773. As of 2025, Americans have lost much of their privacy and freedom from government and corporate surveillance because they did not resist the first advances, including many of the intrusions described above.

The post Turning Credit Cards into Comprehensive Financial Surveillance appeared first on Reason.com.

[Eugene Volokh] Monday Open Thread

[What's on your mind?]

The post Monday Open Thread appeared first on Reason.com.

July 13, 2025

[Josh Blackman] Donald Trump, The Transformational President

[The New York Times admits that Trump is going further than Buckley, Reagan, Goldwater, and Taft "might have imagined possible"]

Today the New York Times published a "news analysis" titled "From Science to Diversity, Trump Hits the Reverse Button on Decades of Change." For those who do not read the Times--and I don't blame you--a "news analysis" is where a reporter writes an op-ed. It is not entirely objective, but instead allows a card-carrying journalist to tell us what he really thinks. Yet, if you read between the lines, you can actually see some admiration: Trump is doing what was once thought impossible. Consider this excerpt:

Mr. Trump's shift into reverse gear reflects the broader sentiments of many Americans eager for a change in course. The United States has cycled from progressive to conservative eras throughout its history. The liberal period ushered in by Franklin D. Roosevelt eventually led to a swing back to the right under Ronald Reagan, which led to a move toward the center under Bill Clinton.

But Mr. Trump has supercharged the current swing. The influential writer William F. Buckley Jr. once defined a conservative as someone standing athwart history and yelling, "Stop!" Mr. Trump seems to be standing athwart history yelling, "Go back!"

He has gone further than noted conservatives like Mr. Buckley, Mr. Reagan, Barry Goldwater or Robert Taft might have imagined possible. While they despised many of the New Deal and Great Society programs that liberal presidents introduced over the years, and sought to limit them, they recognized the futility of unraveling them altogether.

"They were living in an era dominated by liberals," said Sam Tanenhaus, author of "Buckley," a biography published last month. "The best they could hope for was to arrest, 'stop,' liberal progress. But what they dreamed of was a counterrevolution that would restore the country to an early time — the Gilded Age of the late 19th and early 20th centuries."

"Trump," he added, "has outdone them all, because he understands liberalism is in retreat. He has pushed beyond Buckley's 'stop,' and instead promises a full-throttle reversal."

Indeed, although Mr. Reagan vowed during his 1980 campaign to abolish the Department of Education, which had been created the year before over the objections of conservatives who considered it an intrusion on local control over schools, he never really tried to follow through as president, because Democrats controlled the House. The issue largely faded until Mr. Trump this year resurrected it and, unlike Mr. Reagan, simply ignored Congress to unilaterally order the department shuttered.

One of Trump's greatest strengths is his ability to not care what elites think. Usually, when the elites calls a conservative a racist or sexist or homophobe or something else, he wilts. When they accuse a conservative of trying to hurt poor people or roll back progress, he caves. When they charge a conservative with standing on the wrong side of the arc of history, he switches sides. Not Trump. He can almost single-handedly shift the Overton window on what topics are open for discussion. And Trump inspires other conservatives to likewise discount what elites think. That mantra has spread.

Things that have been accomplished would have been unfathomable a decade ago. Let's just rattle off a few high points. Roe v. Wade is gone. Humphrey's Executor is on life support. Even after Obergefell and Bostock, we got Skrmetti. Despite all the outrage, illegal immigration at the southern border has basically trickled to a halt. Blind deference to "experts" has been irreparably altered by the distrust occasioned by COVID and transgender medicine for children. The federal bureaucracy is being dismantled. Nationwide injunctions are no more. And so on.

A common refrain is that Trump is ignoring the Constitution. During the New Deal and the Great Society, FDR and LBJ did great violence to the Constitution and the separation of powers. They got away with it because they were trying to do the "right" thing. Yet critics expect Trump to behave nicely, and be a good conservative like George W. Bush or Mitt Romney. That's not what we have. And in Trump's defense, some (but not all) of his actions are seeking to restore the original meaning of the Constitution, whereas the same could not be said for FDR and LBJ.

Speaking of book projects, I am in the early stages of a three-volume set on the Trump presidency and the Constitution. I actually wrote most of the first installment by the end of 2020, but put it on hold after January 6. I had no idea what the future would bring, so I stood down. I think the first installment would track from the moment Trump came down the golden escalator to election day in 2020. The second installment would start with the 2020 election, cover January 6, and chronicle the three years of Lawfare (Jack Smith, Section 3, and everything else). The third installment would begin on inauguration day 2025, through… Well, I'm not really sure where this all ends. But it is clear enough to me that Trump has transformed the nation in ways that likely cannot just be forgotten come 2029.

The post Donald Trump, The Transformational President appeared first on Reason.com.

[Josh Blackman] Constitutional Law, in Pop Culture

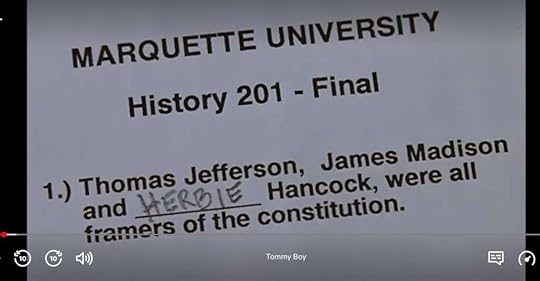

A funny movie from my youth was Tommy Boy, starring Chris Farley and David Spade. I recently rewatched it. This question on Chris Farley's final exam in history made me cringe (and not because he wrote Herbie Hancock).

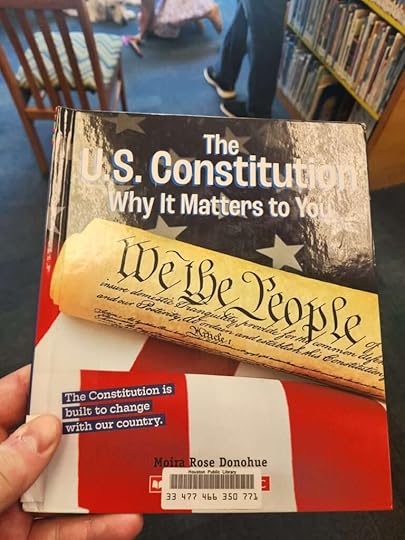

Then again, perhaps I should let the producers off easy. I recently saw this book at the Houston Public Library, and also cringed.

No, the Constitution is not built to change with our country. It was made notoriously difficult to amend. This author has no apparent expertise about the Constitution, but I suppose that shouldn't stop her from writing about it.

One of my long-term goals is to write children books about the Constitution. It's on the agenda.

The post Constitutional Law, in Pop Culture appeared first on Reason.com.

[Josh Blackman] Today in Supreme Court History: July 13, 1787

7/13/1787: The Articles of Confederation Congress enacts the Northwest Ordinance.

The Articles of Confederation

The Articles of ConfederationThe post Today in Supreme Court History: July 13, 1787 appeared first on Reason.com.

July 12, 2025

[Jonathan H. Adler] Does Hiring Diversity Officers Increase University Diversity?

[It is easier for universities to hire administrators than to engage in meaningful change.]

A new study in the Southern Economic Journal suggests that university efforts to enhance diversity by hiring DEI executives to oversee diversification efforts were largely ineffective. Specifically the study, "The Impact of Chief Diversity Officers on Diverse Faculty Hiring," finds that hiring CDOs had no effect on faculty diversity.

The abstract reads:

Racial diversity among faculty, students, and administrators is increasing at universities in the United States. These changes have been uneven, with growth in underrepresented students exceeding that of faculty diversity. To address these and other inequities, a growing number of universities have established an executive-level chief diversity officer (CDO). Our study offers a first empirical examination of this effort at selected 4-year U.S. universities from 2001 to 2019 using unique data on the initial hiring date of a CDO and publicly available demographic data. We provide a comprehensive overview of demographic trends within our data and find confidence intervals around the estimated instantaneous average treatment effect for an executive-level CDO on diverse hiring tightly contain zero. Estimated treatment effects are small and lack statistical significance within 4 years of a CDO position being established. We discuss other possible factors that explain trends toward higher diversity on campus and several possible constraints.

Should the paper's results be surprising? Not particularly. It is relatively easy for a university (or any large, bureaucratic institution) to hire administrators and adopt superficial policies. Actually changing hiring practices, on the other hand, can be quite difficult, and changing the composition of a faculty can be quite slow. If a university faculty is resistant to hiring people of different backgrounds (or viewpoints), hiring a few administrators is unlikely to change things very much.

None of this means that hiring DEI administrators has no impact. There are certainly anecdotal accounts suggesting that some such efforts can affect university culture (and perhaps in quite negative ways--as seems to have occurred at the University of Michigan). The point is that such investments do not appear to produce the sorts of changes that they promise.

The post Does Hiring Diversity Officers Increase University Diversity? appeared first on Reason.com.

[Irina Manta] The Role and Ethics of AI Use in Online Dating

[From Helpful Learning Tool to Problematic Deception]

The Washington Post has a new podcast up this week about the ways that AI is changing online dating. Some of these ways risk crossing the line into the territory of deception. I have written previously in law review articles here and here about the issues with deception in online dating, from sexual fraud to hiding one's true identity for purposes of financial fraud or downright violence.

Deploying AI as a learning tool seems relatively unproblematic and could even turn someone into a genuinely better partner. Users of AI dating coaches have at times reported positive experiences with self-development in the relationship context. When it comes to coaching, one way to describe the line into the unethical might be the distinction between truly improving oneself versus seeking out manipulation techniques to trick others, in the genre of pick-up artists.

Those who use AI in the online dating context should ask themselves if their interaction style in the physical world will fail to reflect the image that the AI-improved texting suggested. Another, related question is whether their mate would experience frustration if they learned the extent of said AI use. It would certainly be unethical to use AI to engage in what Prof. Jill Hasday has deemed in her book on intimate lies and the law "linchpin deception," meaning to hide a known dealbreaker (sometimes in the hope of overcoming it via personal charm or the like down the line).

Another phenomenon that the WaPo podcast mentions is that AI may hide red flags (or as they call it, signals) about an individual in a profile or chat. Scholar Jennie Young, in particular, has become known for her linguistic analyses of such texts in what she calls the Burned Haystack Dating Method--accompanied now by a Facebook group boasting over 200K members. For example, she recommends that women left-swipe men who engage in so-called directive behavior (telling another user what to do) in their profiles or texting as it suggests problematic relational patterns down the line.

We can easily imagine AI being fed Young's techniques to make sure a predatory user does not tip his hand that easily. And that could assist individuals who would turn out not to be a merely "bad date" in person but in fact downright dangerous. That said, one might also picture the reverse: perhaps AI could be deployed to detect cues that another user might be problematic and/or, to come full circle, used AI in his profile or texting!

For safety purposes, the increased use of AI in text-based media may militate even more toward having a phone call or video chat before a date than was already warranted. While there remains a risk of deepfake technology being used in a video chat, this requires a greater level of sophistication on the part of predators than the mere use of a chatbot. In short, it's a safety measure far better than nothing.

The post The Role and Ethics of AI Use in Online Dating appeared first on Reason.com.

Eugene Volokh's Blog

- Eugene Volokh's profile

- 7 followers