Stephen Clapham's Blog, page 9

April 14, 2023

#22 -The Octogenarian

/*! elementor - v3.12.1 - 02-04-2023 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#69727d;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#69727d;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block}

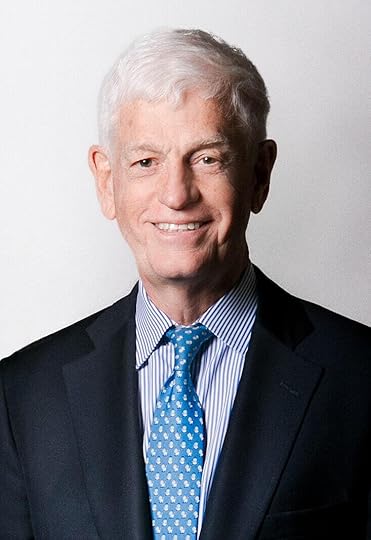

/*! elementor - v3.12.1 - 02-04-2023 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#69727d;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#69727d;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block} Mario Gabelli is the founder of Gamco, a billionaire, and still working in his 80s. His workload would be punishing for someone 30 years younger, but he is committed to an in-depth research process and likes to lead from the front.

/*! elementor - v3.12.1 - 02-04-2023 */.elementor-column .elementor-spacer-inner{height:var(--spacer-size)}.e-con{--container-widget-width:100%}.e-con-inner>.elementor-widget-spacer,.e-con>.elementor-widget-spacer{width:var(--container-widget-width,var(--spacer-size));--align-self:var(--container-widget-align-self,initial);--flex-shrink:0}.e-con-inner>.elementor-widget-spacer>.elementor-widget-container,.e-con-inner>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer,.e-con>.elementor-widget-spacer>.elementor-widget-container,.e-con>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer{height:100%}.e-con-inner>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer>.elementor-spacer-inner,.e-con>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer>.elementor-spacer-inner{height:var(--container-widget-height,var(--spacer-size))} SUMMARYMario Gabelli is the billionaire founder of Gamco and still managing money in his 80s. He believes in an in-depth research process, limiting his investments to the sectors he feels he understands. He believes in visiting companies – not just investees but their competitors and their whole value chain; in reading trade journals; and in monitoring the results of the sector. The day after we spoke he was due to visit a company he first visited in 1967!

/*! elementor - v3.12.1 - 02-04-2023 */.elementor-widget-image-box .elementor-image-box-content{width:100%}@media (min-width:768px){.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper,.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{display:flex}.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{text-align:right;flex-direction:row-reverse}.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper{text-align:left;flex-direction:row}.elementor-widget-image-box.elementor-position-top .elementor-image-box-img{margin:auto}.elementor-widget-image-box.elementor-vertical-align-top .elementor-image-box-wrapper{align-items:flex-start}.elementor-widget-image-box.elementor-vertical-align-middle .elementor-image-box-wrapper{align-items:center}.elementor-widget-image-box.elementor-vertical-align-bottom .elementor-image-box-wrapper{align-items:flex-end}}@media (max-width:767px){.elementor-widget-image-box .elementor-image-box-img{margin-left:auto!important;margin-right:auto!important;margin-bottom:15px}}.elementor-widget-image-box .elementor-image-box-img{display:inline-block}.elementor-widget-image-box .elementor-image-box-title a{color:inherit}.elementor-widget-image-box .elementor-image-box-wrapper{text-align:center}.elementor-widget-image-box .elementor-image-box-description{margin:0} GETTING INTO INVESTING

GETTING INTO INVESTINGFrom the age of 13, Mario used to hitchhike from the Bronx to Westchester to caddy at golf clubs. Here he started to learn from market professionals. He bought his first stocks when he was a teenager but it was at Columbia Business School that he realised that he wanted to be an analyst. He took a course in security analysis taught by Professor Roger Murray, who succeeded Graham and Dodd at Columbia. He first studied accounting and philosophy at Fordham; he found the accounting helpful but is dismissive of the philosophy classes.He was an analyst covering the autos sector initially and then took on the media sector, before setting up an institutional research firm in 1977, in the middle of a bear market. The CEO of a company he visited then persuaded him to start managing money, giving him a cheque for $100,000.

INVESTMENT PHILOSOPHYGabelli’s investment philosophy is rooted in the principles of legendary investors Benjamin Graham and David Dodd. He is a value investor and in the 1970s, he came up with the idea of valuing businesses using the concept of private market value with a catalyst.

He used this to develop a skill in identifying companies that would get taken over, and this led to some major success in the 1980s when he became known for his bets in the media and telecom sectors.

His belief in deep industry knowledge continues – his team of analysts visit the companies they invest in, their competitors and across the whole value chain. Steve used to employ exactly the same philosophy in his hedge fund days.

Gabelli likes to lead from the front and still enjoys visiting companies today, not just in the US but around the world. The day after we spoke he was flying at 4am to Atlanta, Georgia to visit Genuine Parts, a company he first visited in 1967.

It’s hard to imagine the compounding of knowledge of a business over a 50+ year continuous period of analysis.

BOOTS ON THE GROUND

Gamco has offices across the US and around the world. The corporate HQ is in Greenwich, Connecticut, and there are US offices in Rye, New York as well as in Palm Beach, St Louis and elsewhere. Gamco also has offices internationally, in London, Shanghai, Hong Kong and in Tokyo.

They have 5 analysts in London and analysts in the US can operate from home or from offices in the network – Gabelli says that not everyone wants to be in New York City – and each morning at 8.15am they have a meeting.

The team are listed on the website and apart from one gentleman (who is 84 and joined the firm 4 years ago), they all have long tenure – the shortest experience is 15 years (two analysts including Mario’s son, Joseph) and the longest is Mario himself with 58 years. Gabelli likes the long tenure and having a stable team.

One speciality of the firm is conferences with the firm holding industry conferences, some of which have been going for decades – their first autos conference was almost 50 years ago.

SILICON VALLEY BANKWhen we recorded, SVB was very much in the news, but Gabelli was not concerned. He recalled that in the late 1960s, Chemical Bank was a takeover target, in the late 1980s, they had the Savings and Loans crisis and in 2008, we had Lehman and the Global Financial Crisis. They own a few local banks in Florida and Georgia and they own State Street, a custodial stock, because they use the service and recognise the quality of that business, but they don’t have any real wider exposure. He clearly doesn’t see the attraction of banks.

VALUE VS GROWTHMario’s title other than Chairman and CEO is co-CIO Value and there is also a CIO, Growth (who has 45 years of experience). Gabelli explained it simply – his private market value with a catalyst simply doesn’t work for a stock like Meta so they needed a different approach.

ABOUT MARIO GABELLIGabelli, the son of Italian immigrants, was born in The Bronx in 1942. He won a scholarship and graduated from Fordham University summa cum laude in 1965. He received his Master of Business Administration degree from Columbia Business School.

Gabelli runs Gabelli Asset Management Company Investors (Gamco), a mutual fund and investment firm he founded in 1977. His reputation for stock-picking took off in the 1980s when he found success betting on the media and telecom sectors. He was named Morningstar’s Fund Manager of the Year in 1997 and The Institutional Investor’s Money Manager of the Year in 2010.

Gabelli and his wife Regina have signed the Giving Pledge, a commitment by the world’s wealthiest individuals and families to dedicate the majority of their wealth to giving back. According to Forbes magazine, Gabelli’s net worth was $1.7 billion as of December, 2022

Source: Greenwich Time /*! elementor - v3.12.1 - 02-04-2023 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#0c0d0e;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl}.e-con-inner>.elementor-widget-divider,.e-con>.elementor-widget-divider{width:var(--container-widget-width,100%);--flex-grow:var(--container-widget-flex-grow)} BOOK RECOMMENDATIONS

Source: Greenwich Time /*! elementor - v3.12.1 - 02-04-2023 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#0c0d0e;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl}.e-con-inner>.elementor-widget-divider,.e-con>.elementor-widget-divider{width:var(--container-widget-width,100%);--flex-grow:var(--container-widget-flex-grow)} BOOK RECOMMENDATIONSEver the value investor, when asked to recommend a book, Gabelli quipped 3 years of Berkshire Hathaway’s annual reports – they are free. He wasn’t joking. He recommends Merger Masters, a book on the art of arbitrage, which he published. He also recommends Security Analysis by Graham & Dodd.

Merger Masters was written by Kate Welling and Gabelli.

Buy on amazon.co.uk Buy on amazon.com

Security Analysis - recommended by John Armitage on podcast #1.

Buy on amazon.co.UK Buy on amazon.com HOW STEVE KNOWS THE GUESTSSteve was asked to interview Mario in 2021 for Real Vision and he was delighted when Marion agreed to come on the podcast as one of the few investors who experienced the 1970s and are still investing today. Steve is looking forward to meeting Mario in person in Omaha, Mario having invited Steve to attend his conference and the Berkshire AGM.

Prev#21 -The EconomistThe post #22 -The Octogenarian appeared first on Behind The Balance Sheet.

April 3, 2023

5 Market Shaping Themes For 2023

I have been writing a lot about conferences recently, but I think they have been worth sharing. Today I’m going to share some insights from the Edelman Smithfield Investor Summit. Edelman Smithfield has an impressive array of 25 asset management clients and there were some notable guest speakers at this small event which I wanted to write about for two reasons:

1 the subject of earnings downgrades came up and it was something I had been discussing over a very cold (outdoors) glass of wine with Russell Napier the previous evening.

2 there was considerable discussion of ESG and this is one of the topics I am going to focus on in 2023, particularly on the podcast (where I have exciting episodes planned) but also here in the newsletter. But it will be ESG with a difference – , much more E, for a start.

The conference was held at the London Stock Exchange on December 13, 2022. Keep reading for a summary of the most interesting debates and insights.

The Macro Outlook for 2023Nigel Bolton, co-CIO of Fundamental Equity, BlackRockSeema Shah, Chief Global Strategist, Principal Asset ManagementGurpreet Gill, Macro Strategist, Global Fixed Income, Goldman Sachs Asset ManagementShah suggested that the outlook for markets is mainly dependent on earnings, while Bolton thought that inflation would set the tone and that to stage a further recovery, markets would need to see inflation trending lower. Gill was most optimistic, with a rosy central scenario for a soft landing in the US and China reopening and a decline in inflation to 3% by end-2023. She sees next year as the most attractive year for a decade in fixed income and is focused on high quality short duration investment grade bonds. I should add that Gill’s LinkedIN profile reveals she has been at Goldmans for 9 years after university.

In contrast, Nigel Bolton has been in markets for 37 years and this is his sixth bear market. He suggested that this is rather different from previous ones because it is occurring in an inflationary period; recent bear markets have all taken place in deflationary environments. Previously, central banks could come to the rescue of markets by cutting rates – he doesn’t believe that will happen this time. I agree with this analysis which suggests that markets may be over-optimistic on the potential for a Fed pivot. Bolton was a client of mine eons ago when I was on the sell-side; he is super smart.

Bolton’s view of the world is quite similar to mine and Russell Napier’s. He thinks that you now need to be active, you can’t just take beta (markets rose significantly in the 2010s and even an index tracker delivered fantastic returns). Valuation will be crucial, given that the cost of capital is higher. He thinks that small caps and EM are interesting, as are Europe and the UK – he highlighted that the UK is on 9.7x earnings! He sees some great businesses in UK mid-caps. But he warned that there are issues around earnings as downgrades are to come – I shall return to this in the appendix for paying subscribers.

Other notable comments included that the standard US recession is 11 months and Shah and Principal think that is feasible in 2023, as long as the Fed isn’t too aggressive on inflation.

The panel was asked about tail risks which led to discussion of private credit markets. These are opaque and feature some quite cyclical borrowers. This is important because some of these companies will be seeking to refinance debt when they are experiencing a recession and facing an increase of 2x or 3x on their interest cost.

How Material is the S in ESG to Valuations?Saker Nusseibeh CBE, CEO, Federated Hermes Limited

Nikesh Patel, Managing Director, Head of Client Solutions & CIO, Van Lanschot Kempen

Luis Olguin, Portfolio Manager, William Blair

Nusseibeh is well known as a leading proponent of ESG and made some valid points about why looking after staff was central to a successful business (full disclosure, Federated Hermes is a client). Although some good points were made by all 3 panellists, I came away thinking that the answer to the title question was “not very”. Looking after employees is obviously fundamental to managing a successful; business, but it’s really hard to analyse.

Are we doing enough to meet Net Zero targets?Lord Browne of Madingley, Chairman, Beyond Net ZeroJeremy Taylor, UK CEO, Lazard Asset ManagementSarah Williamson, CEO, FCLT GlobalStephanie Maier, Global Head, Sustainable & Impact Investment, GAM InvestmentsThe answer to this question was no, but there was a good discussion. Lord Browne is an engineer by training and now chairs a green investing firm. He made a string of good points:

Global net investment spend on Net Zero projects has been running at $1tn pa. We need to spend $3tn pa, so we are way behind the curve.He believes in using science-based targets to create real accountability – management must achieve third party set targets. As investors, they demand that their investee companies additionally produce data on targets above what is required to reach net zero.The biggest problem facing many green companies is that they aren’t very scalable.He sees opportunities in the rollout of electric vehicles and related charging infrastructure, materials and control systems for buildings, and areas of the circular economy. In services, there are opportunities in optimising the supply chain to reduce the carbon footprint.The Inflation Reduction Act will divert a lot of green investment to the US and enable the development of new scalable industries.He emphasised the opportunity in small scale nuclear reactors and pointed out that we absolutely need this, just to maintain nuclear output.It wasn’t all Browne, of course. Maier pointed out that the crucial question to ask a public equity investor was whether their portfolio and engagement had resulted in fewer emissions in the real world – I think this is the right way to think about ESG.

Taylor pointed out that Lazard had been studying and publishing the economics of renewable production for 18 years. It’s only recently that the cost of wind and solar have become competitive with the marginal cost of fossil fuel, hence the IEA prediction that renewables investment in the next 5 years will equal that in the past 20.

Lazard also reckon that as we move to a more sustainable world, 11% of quoted companies’ revenues will deteriorate and only 7% will benefit, although Taylor was vague on the specifics of this very precise estimate. And amid discussion of decarbonisation of portfolios vs real world emissions reduction, Sarah Williamson made the point that there is no point in just throwing trash in your neighbour’s garden – a nice analogy.

I asked them what they thought the “right” carbon price was and the consensus was $100/ton. The European future is not that far away:

Carbon Futures (€/tonne) Source: EmberThe Trends which will Create Winners and Losers in the Coming YearsLaura Cooper, Senior Macro Strategist for iShares EMEA, BlackRockColm Walsh, Managing Director, ICGLuke Barrs, Global Head of Client Portfolio Management for Fundamental Equity, Goldman Sachs Asset Management

Source: EmberThe Trends which will Create Winners and Losers in the Coming YearsLaura Cooper, Senior Macro Strategist for iShares EMEA, BlackRockColm Walsh, Managing Director, ICGLuke Barrs, Global Head of Client Portfolio Management for Fundamental Equity, Goldman Sachs Asset ManagementThere was much discussion of climate change and inflation and it was the latter which struck me as important. Blackrock’s view is that inflation will be the dominant theme and highlighted three driving forces:

Participation rates have fallen since the pandemic and this is inflationaryThe net zero transition will likely be disorderly but is almost certainly inflationaryGeopolitical fragmentation will increase nearshoring which is inflationaryI am more in this camp than the Goldmans speaker who suggested that the Fed will get it down to 3% next year. One commentator at this conference suggested that in developed markets it takes 10 years to get inflation from over 5% to 2%. The truth is that we know very little about inflation.

The chart below shows a study (h/t Joachim Klement) of the impact of an interest rate hike on inflation, judged over 3 different time periods.

The first column is the total sample, 1973-2020. The middle column is mid-1979 to 2012 and the right column is 1988 to 2020. The response is much faster and greater in the latest period – when inflation was higher, rate hikes seemed to have less impact and took longer.

Response to a 25bp monetary policy shock

Y-axis CPI, X-axis months. Shaded regions report bootstrapped 90% standard-error bands.

Y-axis CPI, X-axis months. Shaded regions report bootstrapped 90% standard-error bands.Source: Bauer and Swanson 2022The Outlook for Financials in 2023 and BeyondLloyd Harris, Head of Fixed Income, Premier MitonJean-Francois Neuez, Head of European Financials, Janus Henderson InvestorsSebastiano Pirro, Chief Investment Officer, Algebris Investments

Readers will know that I tend to avoid financials (those who are interested should check out Marc Rubinstein’s Net Interest) and will be surprised that I found this the most interesting and action-oriented panel. Pirro reckons banks have become so cheap because they are now irrelevant to markets after a large decline in profits. At today’s more normal rates, banks can make money again and have a huge opportunity as they have aggressively cut costs.

The consensus on the panel was that loan losses will clearly increase as economies slow but that capital ratios are plenty strong enough and the margin upside from normalised rates outweighs the temporary, cyclical increase in loan loss provisions. If a bank makes 12% RoE and is trading on a 4x P/E, at 0.5x book, there is plenty of upside.

Pirro also likes bank credit which is lower risk and higher income than bank equity.

Check out our Course How to Read a 10-K

The post 5 Market Shaping Themes For 2023 appeared first on Behind The Balance Sheet.

March 31, 2023

Steve appears on the Global Capital podcast to talk bank runs

The post Steve appears on the Global Capital podcast to talk bank runs appeared first on Behind The Balance Sheet.

March 10, 2023

#21 -The Economist

/*! elementor - v3.11.1 - 15-02-2023 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block}

/*! elementor - v3.11.1 - 15-02-2023 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block} Gavyn Davies is an economist, co-founder of 4 multi-billion asset managers, a former Government adviser to both Labour and Tory administrations and a former Chairman of the BBC. He takes the bus to work!

SUMMARYGavyn Davies is an economist and a former partner of Goldman, Sachs. He is the Chairman and co-founder of macro asset manager Fulcrum Asset Management and is a co-founder of 3 other multi-billion asset managers. He is a former Government adviser and was Chairman of the BBC, the UK public service broadcaster. Of course we talk about economics, about investing, and about financial services; but we also cover public service broadcasting, streaming and politics.

/*! elementor - v3.11.1 - 15-02-2023 */.elementor-widget-image-box .elementor-image-box-content{width:100%}@media (min-width:768px){.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper,.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{display:flex}.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{text-align:right;flex-direction:row-reverse}.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper{text-align:left;flex-direction:row}.elementor-widget-image-box.elementor-position-top .elementor-image-box-img{margin:auto}.elementor-widget-image-box.elementor-vertical-align-top .elementor-image-box-wrapper{align-items:flex-start}.elementor-widget-image-box.elementor-vertical-align-middle .elementor-image-box-wrapper{align-items:center}.elementor-widget-image-box.elementor-vertical-align-bottom .elementor-image-box-wrapper{align-items:flex-end}}@media (max-width:767px){.elementor-widget-image-box .elementor-image-box-img{margin-left:auto!important;margin-right:auto!important;margin-bottom:15px}}.elementor-widget-image-box .elementor-image-box-img{display:inline-block}.elementor-widget-image-box .elementor-image-box-title a{color:inherit}.elementor-widget-image-box .elementor-image-box-wrapper{text-align:center}.elementor-widget-image-box .elementor-image-box-description{margin:0} GETTING INTO INVESTING

GETTING INTO INVESTINGGavyn always wanted to be an economist – he liked the analytics. He started as a government advisor and saw an opportunity in providing macro-economic research to investors – amazingly in the mid-1980s there were very few macro-economists at investment banks, and the quality of economic research was not that high (one of those has changed). He joined Goldman, Sachs in its early days in London when it had only a few hundred employees and had no international economists.He voted for Goldman to go public as the trading risk had become too large for a partnership and partners’ personal exposures.

MACRO ECONOMICSToday we have a lot more economists than when Gavyn joined Goldmans. The subject has become much more dominant in the way people think about investing. And of course there is a lot more attention paid to the Fed and analysis has become deeper and wider and economics as a discipline has grown along with markets.

Some equity investors who focus on micro company research are sceptical of the value added by macro economists. Gavyn understands their preference but points out that this likely needs a much longer timescale to deliver performance and clients have to be willing to tolerate drawdowns which can last several years – that’s uncommon today and it’s challenging to maintain client trust and confidence.

Gavyn thinks we are too short term in a number of areas – markets react sharply to short term changes in newsflow. He cites the example of the collapse in sterling, a 15% fall in a week, which subsequently recovered. The impact of Truss on the pound and gilts was greater than Brexit. But these are opportunities for a macro fund like his. He also sees short term thinking in politics.

THE MEDIA

Gavyn is a former Chairman of the BBC. He was always interested in the economics of public service broadcasting and how you could justify such a large incursion into free markets and how you should fund it. (For overseas listeners, the BBC is funded by a licence paid by each household with a TV.)

I set out the objective of my podcast as “to inform, educate and entertain” which are the values John Reith used as the foundation for the BBC’s inception in 1922. They still stand and I could not and cannot think of a better objective for this type of show.

The proliferation of alternatives and the media have changed but the need for an unbiased source of news is greater than ever. And young people today still know they can access a good version of the truth on the BBC. And the proliferation of streaming channels has broadened the choice, although the BBC is now unable to compete for the more expensive media – the most popular sports and the best drama – Gavyn is impressed with the Crown on Netflix.

THE INVESTMENT CLIMATEWe have had 40 years of falling rates but Gavyn does not see this as a massive bubble. Rather, he perceives it as a decline in the equilibrium rate of interest in the economy. Central banks had to follow this with downward rates to prevent a massive deflation in the system. By 2021, in some parts of the market there was a bubble but those have largely been deflated.

But the high returns we have seen have borrowed from the future and hence he expects returns to be lower in the future. And if interest rates have to rise further to stem inflation, that will be a further drag on returns.

Overall his long term prognosis is that the returns from markets he saw in his career as an economist are a lot higher than we are likely to see in the future.

He sees inflation as persistent – not at the levels of 2022, which was fuelled by energy and food, but at higher levels than hitherto.

PENSION FUNDS AND PRIVATE EQUITYHe does not see this as causing particular stress in pension funds or private equity, to name two examples. The move from defined benefit to defined contribution funds makes them less vulnerable to increasing rate or lower returns. Government pension schemes will have to adjust, especially if longevity continues to increase.

Gavyn co-founded two private equity firms, one in the UK and one on the west coast. For the most part, he sees private equity returns as being leveraged public equity returns; he expects them to be healthily positive by lower than in the last 10-20 years.

Interestingly, the demands on the economists at private equity funds have sharply increased. Half the fortnightly calls currently are devoted to the macro-environment. KKR is unusual in private equity firms as having a significant emphasis on economics, but it’s making a lot of sectoral choices.

Gavyn reckons that macro-economists tend to be better in bad times than in good times. They are pessimistic by nature but you cannot be a pessimist in private equity, because you will never buy anything. Gavyn says he is trying to be more optimistic in his day job.

DEBT AND FINANCIAL REPRESSIONDebt matters, it increases economic risk, especially in a period of inflation. And the importance of debt was highlighted in the UK when Truss was Prime Minister. Gavyn agrees that the most likely outcome is that we shall muddle through and flags Olivir Blanchard’s book which concludes that as long as nominal GDP growth exceeds the interest on the debt, serious problems can be avoided. And that’s where we are.

This creates a positive environment for macro. Fulcrum has done pretty well in the last decade, not keeping up with flying macro, but positive returns and more consistent than some of the faster charging higher risk macro wizards. Fulcrum takes much more diversified positions in markets, not trying to blow the lights out and genuinely trying to hedge and managing assets with a n objective of low (8%) volatility – trying to be macro investors rather than a macro hedge fund

ECONOMICS AS A CAREERGavyn and Steve share a passion for inspiring young people to adopt a career in analysis or macro economics. Gavyn points out that macro is always about things that matter – it’s about subjects that are in the news that are intrinsically important and issues like inflation and unemployment matter to large parts of the population. It also gives scope to different types of analytical thought – mathematical, econometric and political economics which is not readily quantifiable. But you need to be good at what you do, work hard and you almost certainly need a PhD from the right university to get into a big bank

ABOUT GAVYN DAVIES

Gavyn Davies is a Co-Founder and the Chairman of Fulcrum AM. He started his career as a Government advisor before moving to the City, working as an economist. He joined Goldman Sachs in 1986 and became Partner in 1988 when he also became the Chief International Economist.

Gavyn was Chairman of the BBC from 2001-04. He has had several public service roles including as a member of H.M.Treasury Independent Forecasting Panel and as an Economic Policy Adviser to the British Prime Minister (1976-1979).

Gavyn graduated in Economics from Cambridge in 1972 followed by two years of research at Oxford.

Source: Wikipedia /*! elementor - v3.11.1 - 15-02-2023 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#2c2c2c;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl}.e-con-inner>.elementor-widget-divider,.e-con>.elementor-widget-divider{width:var(--container-widget-width,100%);--flex-grow:var(--container-widget-flex-grow)} BOOK RECOMMENDATIONS

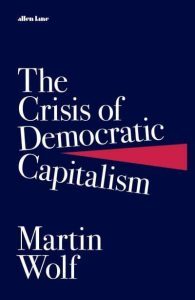

Source: Wikipedia /*! elementor - v3.11.1 - 15-02-2023 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#2c2c2c;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl}.e-con-inner>.elementor-widget-divider,.e-con>.elementor-widget-divider{width:var(--container-widget-width,100%);--flex-grow:var(--container-widget-flex-grow)} BOOK RECOMMENDATIONSWe talked about Martin Wolff, whom Gavyn reckons is the best economic correspondent in the world. He has just published his magnum opus, In Defence of Democratic Capitalism which Gavyn thoroughly enjoyed. Wolff’s family were refugees from Nazi Germany and he warns that it could happen again.

He wraps together democracy and market economics as two sides of the same coin. They thrive together but the can also be challenged and fail together and there are signs that economies are not performing as well, that the market system is coming under strain and that could lead to negative developments for our democracies.

Gavyn also neatly summarised Olivier Blanchard’s book, Fiscal Policy under Low Interest Rates.

/*! elementor - v3.11.1 - 15-02-2023 */.elementor-column .elementor-spacer-inner{height:var(--spacer-size)}.e-con{--container-widget-width:100%}.e-con-inner>.elementor-widget-spacer,.e-con>.elementor-widget-spacer{width:var(--container-widget-width,var(--spacer-size));--align-self:var(--container-widget-align-self,initial);--flex-shrink:0}.e-con-inner>.elementor-widget-spacer>.elementor-widget-container,.e-con-inner>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer,.e-con>.elementor-widget-spacer>.elementor-widget-container,.e-con>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer{height:100%}.e-con-inner>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer>.elementor-spacer-inner,.e-con>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer>.elementor-spacer-inner{height:var(--container-widget-height,var(--spacer-size))}

This book, In Defence of Democratic Capitalism, is a favourite.

Buy on amazon.co.uk Buy on amazon.com

Fiscal Policy under Low Interest Rates sounds even heavier.

Buy on amazon.co.UK Buy on amazon.com HOW STEVE KNOWS THE GUESTSSteve met a former colleague of Gavyn’s when speaking at a school careers fair and he kindly introduced us. We had a great introductory call and Gavyn generously agreed to give up his time. He is obviously rich but amazingly, likes to take the bus to work!

Prev#20 -The Data ScientistThe post #21 -The Economist first appeared on Behind The Balance Sheet.

The post #21 -The Economist appeared first on Behind The Balance Sheet.

March 9, 2023

Steve appears on the Citywire podcast with Algy Hall

The post Steve appears on the Citywire podcast with Algy Hall appeared first on Behind The Balance Sheet.

March 1, 2023

Steve is interviewed by Belgian magazine De Tijd

The post Steve is interviewed by Belgian magazine De Tijd appeared first on Behind The Balance Sheet.

February 15, 2023

#20 -The Data Scientist

/*! elementor - v3.10.1 - 17-01-2023 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block}

/*! elementor - v3.10.1 - 17-01-2023 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block} Tian Yang is an economist and the Chief Executive of boutique macro research firm Variant Perception which uses a combination of man and machine.

SUMMARYTian Yang trained as an economist and is now the Chief Executive of boutique macro research firm Variant Perception which uses a combination of man and machine, following Gary Kasparov’s maxim that a man with a machine will beat either alone. They have followed this quantamental strategy for some years, long before it became more fashionable. We discuss this, the capital cycle, the long run cycle for commodities and how Tian solves two puzzles – the fundamentals and what he calls playing the game – the shorter market cycles.

/*! elementor - v3.10.1 - 17-01-2023 */.elementor-widget-image-box .elementor-image-box-content{width:100%}@media (min-width:768px){.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper,.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{display:flex}.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{text-align:right;flex-direction:row-reverse}.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper{text-align:left;flex-direction:row}.elementor-widget-image-box.elementor-position-top .elementor-image-box-img{margin:auto}.elementor-widget-image-box.elementor-vertical-align-top .elementor-image-box-wrapper{align-items:flex-start}.elementor-widget-image-box.elementor-vertical-align-middle .elementor-image-box-wrapper{align-items:center}.elementor-widget-image-box.elementor-vertical-align-bottom .elementor-image-box-wrapper{align-items:flex-end}}@media (max-width:767px){.elementor-widget-image-box .elementor-image-box-img{margin-left:auto!important;margin-right:auto!important;margin-bottom:15px}}.elementor-widget-image-box .elementor-image-box-img{display:inline-block}.elementor-widget-image-box .elementor-image-box-title a{color:inherit}.elementor-widget-image-box .elementor-image-box-wrapper{text-align:center}.elementor-widget-image-box .elementor-image-box-description{margin:0} GETTING INTO INVESTING

GETTING INTO INVESTINGTian studied economics at Cambridge and started as a trader at Bank of America Merrill Lynch. He joined Variant Perception as an analyst and became Chief Executive just 7 years later. He had intended to become an economics professor but was seduced by the lure of finance. He won various competitions set up by large investment banks in his first two years at Cambridge and became hooked. His enthusiasm for markets is clear in our discussions.

THE COMMODITY SUPER CYCLEVP produced a report looking at the rubber, whaling and fur industries to detect the long run commodity cycle. Steve has researched the rubber and plantation industries and recalls visiting Manaus, the centre of world rubber production in the early 1900s when tire demand was growing like cloud storage today. Manaus has an opera house which would look good in Milan.

The British stole rubber seeds from Brazil and planted in Malaysia. Later, when much of Asia was occupied by Japan in WWII, the US Government backed various programmes to develop synthetic rubber. In the 1970s, oil price supply shocks made synthetic rubber more expensive and natural rubber gained in importance. But the natural product and the synthetic substitute happily co-existed for decades.

These can be highly complicated cycles.

Tian points out that demand is often inelastic – fuel for heating is a good example. Therefore when supply gets disrupted, you end up with extreme price moves and prolonged cycles. In the long run, producers will try to expand the market and technology can enable alternative uses. For fossil fuels in particular, they have high energy density and are such efficient forms of energy that he sees them as hard to replace. He concluded that you often need a major event – a war or similar catalyst – to accelerate the development of alternative technologies.

THE CAPITAL CYCLEThe commodities discussion leads straight to the Capital Cycle. Tian became interested in the capital cycle theory after reading the book Capital Returns, the collection of Marathon Asset Management’s writings, edited by Edward Chancellor. He sees this as central to almost every sector and fundamental to the way the world works, but perhaps unsurprisingly given the man plus machine theme underlying Variant Perception’s work, takes a quantitative approach.

VP use 3 lenses to examine the capital cycle:

capex to assetsdepreciation to assets andROICThe first factor is the level of capex R&D to assets – this is a measure of to what degree a company or industry is increasing supply and VP aggregate by sector to give an industry outlook.

Depreciation plus amortisation as % assets gives an further indication as to whether the capacity is growing or shrinking and if it’s ageing.

The really clever filter is ROIC. Tian points out that in an industry like shipping, there can be a lot of capacity outside the quoted sector which may not even have a profit motive – a Chinese shipbuilder SEO may be seeking to provide employment as much as generate an economic return, while Greek ship owning families may take a much longer term view. In order to determine if a supply shortage is worth buying, VP uses the delta in marginal ROIC to detect whether that capacity shortage is resulting in improved returns and is worth buying.

THREE TIME HORIZONSTian views the world in 3 time buckets:

Structural Indicators: Modelling long term themes like demographics, capital cycles, debt and currency crises. The fundamentals are the strongest driver over horizons of 2-3 years and more and this is where their work on the capital cycle comes to the fore.

The firm views the business cycle over 6-12 months. They use leading indicators to navigate this time frame and pace emphasis on indicators like building permits and temporary labour which Steve has historically used as powerful indicators of the next trend in revenues for the related sectors.

VP also uses tactical indicators for trading and short term positioning over horizons of days and weeks.

THE AGE OF SCARCITYThe decades of cheap commodities, cheap labour and cheap financing are over. That makes for a very different investing landscape in which leadership clearly moves from tech to energy. The last decade of tech startups’ prevalence in an era of easy money are gone. Input costs are going up and the cost of labour is rising.

In the age of abundance, you can have independent central banks. In the age of scarcity, governmments will be in charge and we shall move to the China model of the government directing the allocation of credit. And these changes again dictate a change of sector leadership.

ABOUT TianTian joined Variant Perception in 2014 as a research analyst after working as a trader at Bank of America Merrill Lynch for 4 years where he helped to build their Delta One Global Index business. He became Head of Research in 2016 and moved up to become CEO in mid 2021 when founder Jonathan Tepper left to set up his asset management business. He went to high school in Nottingham then read Economics at Cambridge where he was runner up in the JM Keynes Essay Competition in 2009 ; the title was What Keynes would advise if he were alive today.

/*! elementor - v3.10.1 - 17-01-2023 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#2c2c2c;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl}.e-con-inner>.elementor-widget-divider,.e-con>.elementor-widget-divider{width:var(--container-widget-width);--flex-grow:var(--container-widget-flex-grow)} BOOK RECOMMENDATIONS

/*! elementor - v3.10.1 - 17-01-2023 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#2c2c2c;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl}.e-con-inner>.elementor-widget-divider,.e-con>.elementor-widget-divider{width:var(--container-widget-width);--flex-grow:var(--container-widget-flex-grow)} BOOK RECOMMENDATIONSWe talked about Joel Greenblatt’s books, How to be a Stock Market Genius and The Little Book that Beats the Market. His two main recommendations were an old favourite and one which was new to Steve and has been added to his list.

This book, The Volatility Machine by Michael Pettis, was a game-changer for Tian. It’s a practical guide rather than theoretical. Pettis is best known as a China expert but has a brilliant mind.

/*! elementor - v3.10.1 - 17-01-2023 */.elementor-column .elementor-spacer-inner{height:var(--spacer-size)}.e-con{--container-widget-width:100%}.e-con-inner>.elementor-widget-spacer,.e-con>.elementor-widget-spacer{width:var(--container-widget-width,var(--spacer-size));--align-self:var(--container-widget-align-self,initial);--flex-shrink:0}.e-con-inner>.elementor-widget-spacer>.elementor-widget-container,.e-con-inner>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer,.e-con>.elementor-widget-spacer>.elementor-widget-container,.e-con>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer{height:100%}.e-con-inner>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer>.elementor-spacer-inner,.e-con>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer>.elementor-spacer-inner{height:var(--container-widget-height,var(--spacer-size))} Pettis" class="elementor-button-link elementor-button elementor-size-sm" role="button"> Buy on amazon.com Pettis" class="elementor-button-link elementor-button elementor-size-sm" role="button"> Buy on amazon.co.UK

Capital Returns, a collection of Marathon Asset Management’s writings should be well-known to this podcast’s audience, as we have had Jeremy Hosking as a guest.

Capital Returns" class="elementor-button-link elementor-button elementor-size-sm" role="button"> Buy on amazon.com Capital Returns" class="elementor-button-link elementor-button elementor-size-sm" role="button"> Buy on amazon.co.UK WHERE YOU CAN FIND TIANVariant Perception has a website and a Substack.

HOW STEVE KNOWS THE GUESTSVariant Perception was founded by Jonathan Tepper, who is a friend of Steve’s and he suggested Tian as a guest. Thanks Jonathan!

Prev#19 – The Value InvestorThe post #20 -The Data Scientist appeared first on Behind The Balance Sheet.

January 16, 2023

#19 – The Value Investor

Chris Bloomstran is a value investor, best known for his incredibly detailed analysis of the valuation of Berkshire Hathaway.

/*! elementor - v3.9.1 - 14-12-2022 */.elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=".svg"]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block} SUMMARY

SUMMARYChris Bloomstran is best known for his incredibly detailed analysis of the valuation of Berkshire Hathaway. He is not only an outstanding value investor, he is a highly accomplished analyst. His Semper Augustus annual letter runs at over 100 pages and in recent years, it has included an evaluation of Berkshire Hathaway – his analysis of the stock is the best I have read.

In this interview, we discuss his start in the business, his investment approach, why college investment funds make a great apprenticeship, why he writes such a detailed letter and an analysis of the long term outlook for markets.

/*! elementor - v3.9.1 - 14-12-2022 */.elementor-widget-image-box .elementor-image-box-content{width:100%}@media (min-width:768px){.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper,.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{display:flex}.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{text-align:right;flex-direction:row-reverse}.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper{text-align:left;flex-direction:row}.elementor-widget-image-box.elementor-position-top .elementor-image-box-img{margin:auto}.elementor-widget-image-box.elementor-vertical-align-top .elementor-image-box-wrapper{align-items:flex-start}.elementor-widget-image-box.elementor-vertical-align-middle .elementor-image-box-wrapper{align-items:center}.elementor-widget-image-box.elementor-vertical-align-bottom .elementor-image-box-wrapper{align-items:flex-end}}@media (max-width:767px){.elementor-widget-image-box .elementor-image-box-img{margin-left:auto!important;margin-right:auto!important;margin-bottom:15px}}.elementor-widget-image-box .elementor-image-box-img{display:inline-block}.elementor-widget-image-box .elementor-image-box-title a{color:inherit}.elementor-widget-image-box .elementor-image-box-wrapper{text-align:center}.elementor-widget-image-box .elementor-image-box-description{margin:0} GETTING INTO INVESTING

GETTING INTO INVESTINGChris’ first investment, of his hard earned savings as a college student, was in a Norwegian tanker stock which went bust within 6 months. Having lost all his money, he wrote to the company which sent him its last 3 annual reports in the mail (no email back then) which he dissected – he learned a few lessons about the importance of the financial statements and a conservative balance sheet. He proceeded to immerse himself in reading the 10-Ks and 10-Qs. His only regret is that he never received a share certificate which he could have framed on his wall as a reminder.

HE STARTED HIS OWN FIRM IN HIS TWENTIESOpportunity knocked is Chris’ explanation of this brave move. The story of his introduction to his anchor client is told in his 2021 annual letter – it’s fascinating. They shared the belief that in the late 1990s, they were in a stockmarket bubble. The client, Bob Smith, had gone into cash prior to the 1929 crash and then proceeded to take advantage of the ensuing bear market. Chris now followed a similar strategy six decades later.

Chris believed that some of his client’s holdings were significantly overvalued. GE, which he had owned for over 60 years, was a good example. Chris was nervous about the valuation and highly dubious about Jack Welch’s “make the quarter” culture. They liquidated a large proportion of the portfolio, including GE, which was massively overvalued and switched into traditional value plays, including Berkshire. GE has fallen 80% since and meantime, the firm’s portfolios have compounded at 11% pa. Had they not sold down that GE position, each $1m held would have turned into $250k, vs $11m in the portfolio before fees.

WHY CHRIS FOCUSES ON THE FINANCIAL STATEMENTSChris advises investors to read the 10-K, read the footnotes, and to read the policy for revenue recognition. Steve did not prime him to say this! He says you must understand what happens to the numbers when accounting rules change (another of Steve’s favourites). Chris goes slowly and pays great attention – he has never been in a hurry to get anything off his desk. He says that it’s very apparent that few people read the annual report beyond the Chairman’s letter.

THE LETTERThe Semper Augustus letter is a work of investment art and with the 2021 edition running to 129 pages, is almost a book. Until 2011, Semper Augustus outperformed massively with an 11% pa return vs a 1% pa return for the S&P 500. Then the portfolio had 4 years of underperfomance with a 10% annual return vs 22% for the S&P. This culminated in 2015 when it lost9%, vs the S&P up 1%. Chris recalls inbound calls that year asking if he was losing it (and with Berkshire down 12.5%, if Buffett was past it).

The stocks had declined but the businesses had performed fine and the portfolio was as cheap as it had ever been. He decided to write up his analysis of Berkshire , his different methods of valuation and the intricacies of the accounting and taxation treatments, which took 50 pages. Joe Koster (who introduced Steve and Chris and who publishes Value Investing World) told Chris it was the best analysis of Berkshire he had ever read (it clearly is) and persuaded him tp publish it.

The letter now serves as a great marketing tool for the firm and by the time they make contact, they understand the investment approach and are a self-selecting group. (In Episode 17, Vitaliy Katsenelson made a similar observation).

THE OUTLOOKChris thinks the closest analogy to the present situation is the 1970s and he thinks the Fed will keep going until something breaks. His comments on the show should really be read in conjunction with the valuation section of his newsletter – he believes the multiple could go below 15.5x, that margins of 13.3% could go to 9% or worse, although nominal revenues could continue to grow at a decent clip.

THE LETTERIn the last letter, Chris explains the change in the S&P by looking at the change in earnings and the change in multiple. He looks at the total return from common stocks as having three components –growth in earnings per share, change in the P/E multiple, and earnings from dividends. Total return is easily calculated by multiplying EPS growth by multiple growth and adding the dividend yield:

Total Return = (EPS Growth x Change in P/E Multiple) + Dividend Yield

In this 2021 letter, he sees the components of drivers of the last decade’s 16.6% index return as extraordinary and impossible to repeat during the coming ten years. A large part of this was driven by the Fab 5 (or FAANGs).

These numbers obviously dwarf the total index, but the drivers are interesting. Sales for the index grew by 3.7% pa (for the big 5 tech, 20%); margins increased from 9.2% to 3.4% (mainly the impact of lower interest and tax) (tech margins fell 2 pp to 21.1%).

But it was valuation which was the real driver of this bull market – the market multiple increased from 13.0x to 23.6x (tech 14.3x to 33.4x!). The share count actually increased for the market but shrank for the tech stocks.

The explanations in the letter are well worth reading.

Source: Semper Augustus 2021 Letter ABOUT Chris

Source: Semper Augustus 2021 Letter ABOUT ChrisHe is the President and Chief Investment Officer of Semper Augustus Investments Group LLC. Chris has three decades of professional investment experience with a disciplined, value-driven approach to fundamental equity and industry research. Semper Augustus manages concentrated equity portfolios of well-run, well-capitalized businesses with share prices trading below conservative appraisals of intrinsic value.

Prior to forming Semper Augustus in 1998 – in the midst of the stock market and technology bubble – Chris was a Vice President and Portfolio Manager at UMB Investment Advisors. Chris has a Bachelor of Science in Finance from the University of Colorado at Boulder, where he also played football. He served as President of the Board of Directors for the CFA Society of St. Louis from 2006-2007 and as a Director on the Board for twenty years, from 2001 to 2021. Chris served as a member of the Bretton Woods Committee in Washington DC, an institution championing and raising awareness of the International Monetary Fund, the World Bank and the World Trade Organization. He has also served on various not-for-profit boards in St. Louis. His family resides in St. Louis. He earned his Chartered Financial Analyst (CFA) designation in 1994.

/*! elementor - v3.9.1 - 14-12-2022 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#2c2c2c;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl}.e-con-inner>.elementor-widget-divider,.e-con>.elementor-widget-divider{width:var(--container-widget-width);--flex-grow:var(--container-widget-flex-grow)} BOOK RECOMMENDATIONS