Stephen Clapham's Blog, page 13

May 17, 2022

#10 – Mr BRICs

/*! elementor - v3.6.5 - 27-04-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block}

/*! elementor - v3.6.5 - 27-04-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block} Former Goldman, Sachs partner, Jim O’Neill, or more properly, Lord O’Neill, is best known as the man who coined the term BRICs. He correctly identified that this group of emerging markets would drive global growth and published a paper on it over 20 years ago. In this wide discussion, we talk about the BRICs, about why for the first time in 30 years of close study of the country, he is puzzled on Chinese policy, and what inevitably lower Chinese growth means for the global economy.

Of course we discuss his beloved Manchester United, kids’ education, a cause close to both our hearts, and how his involvement in the anti microbial review, leading to the publication of the book Superbugs was the most interesting work he has ever undertaken.

Jim is quite critical of central banks who he thinks are behind the curve and he gives his assessment of the long term outlook for inflation. Listen to the end to learn why he calls himself a spoilt brat.

SUMMARYIn this wide ranging interview, Jim talks about the unlikely progression of a kid from a comprehensive school in a poor area made it to Partner at Goldman Sachs; how he got involved in looking at Superbugs and the risks he identified; the problems facing China; why the BRICs may have a better decade after a weaker time, China aside, in the last 10 years; why inflation may not be here to stay; and he finishes with an elegant and radical idea for Governments anxious about debt levels and the need to stimulate growth.

INTRODUCTIONJim came from quite a poor background and his father, who had left school at 14, was intent on his 4 children going to University. Without that impetus, Jim might never have gone to Goldman, Sachs but would happily have spent his time playing football.

/*! elementor - v3.6.5 - 27-04-2022 */.elementor-widget-image-box .elementor-image-box-content{width:100%}@media (min-width:768px){.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper,.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{display:-webkit-box;display:-ms-flexbox;display:flex}.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{text-align:right;-webkit-box-orient:horizontal;-webkit-box-direction:reverse;-ms-flex-direction:row-reverse;flex-direction:row-reverse}.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper{text-align:left;-webkit-box-orient:horizontal;-webkit-box-direction:normal;-ms-flex-direction:row;flex-direction:row}.elementor-widget-image-box.elementor-position-top .elementor-image-box-img{margin:auto}.elementor-widget-image-box.elementor-vertical-align-top .elementor-image-box-wrapper{-webkit-box-align:start;-ms-flex-align:start;align-items:flex-start}.elementor-widget-image-box.elementor-vertical-align-middle .elementor-image-box-wrapper{-webkit-box-align:center;-ms-flex-align:center;align-items:center}.elementor-widget-image-box.elementor-vertical-align-bottom .elementor-image-box-wrapper{-webkit-box-align:end;-ms-flex-align:end;align-items:flex-end}}@media (max-width:767px){.elementor-widget-image-box .elementor-image-box-img{margin-left:auto!important;margin-right:auto!important;margin-bottom:15px}}.elementor-widget-image-box .elementor-image-box-img{display:inline-block}.elementor-widget-image-box .elementor-image-box-title a{color:inherit}.elementor-widget-image-box .elementor-image-box-wrapper{text-align:center}.elementor-widget-image-box .elementor-image-box-description{margin:0} GETTING INTO INVESTING

GETTING INTO INVESTINGLike many of the highly successful investors and commentators we have hosted on the podcast, Jim ended up in finance by chance. Yet he joined Goldmans as a partner and stayed for 19 years. He says in the podcast that the life of a partner is generally 10 years - it’s a highly competitive environment.

CHINAJim has closely followed China for 30 years and this is the first time that he doesn’t understand China policy. Aside from the Evergrande fallout, which clearly represents a risk, given the reliance of the economy directly and indirectly on residential property speculation, he cites

the regulatory clampdown on the private sector, including notably the or profit education sector, which is dampening appetite for risk-taking

the zero-Covid policy which is much more difficult to implement and maintain with the faster spreading Omicron variant and will need to be relaxed at some point

China is the only BRICs country to deliver Jim’s Goldman Sachs predictions in 2001. Why these policies are being implemented now is a question.

SUPERBUGSJim was asked to chair the Anti Microbial Review, and he says it was the most interesting thing he has done in his life. The final report had 29 recommended interventions, which at a cost of $42bn would prevent a potential disaster – the alternative was that by 2050, 10 million people could die and an economic loss of $100tn if we don’t develop the new antibiotics and vaccines.

One of the recommendations was better personal cleanliness, notably washing hands and much greater use of vaccines – big pharma has inadequate economic incentives to develop vaccines and antibiotics. Jim cites insufficient application of “profit with purpose”.

MANCHESTER UNITEDA lifelong fervent fan, Jim was one of the Red Knights, a group which looked at an acquisition of the club over 10 years ago (although I am not sure that the group’s composition has been officially acknowledged). Like many fans, he is bitterly opposed to the current ownership of the club and gets mild consolation for the fact that investors have suffered as much as the club’s supporters as they shares have tracked sideways since the IPO, in sharp contrast to other comparable global media properties. The chart below is to the day of the recording of the podcast and shows that the stock is down 13% in dollars although it would be up 8% in sterling terms. The S&P 500 index has trebled in the same period.

Source: BTBS from Sentieo data

SHINE CHARITYJim is a co-founder and a trustee of charity SHINE. It is an education charity that works with teachers, schools, and other organisations, helping disadvantaged children in the North of England to fulfill their true potential. It started out helping schools in disadvantaged areas of London and achieved considerable success so moved north – obviously helping the north of England is another of Jim’s priorities as he is has been heavily involved in the UK’s Northern Powerhouse and various other roles related to the Government’s so-called levelling-up agenda.

Children’s education is a cause close to my heart and the podcast is dedicated to the FT Financial Literacy and Inclusion Campaign, FT FLIC. If you enjoy the podcast, please take 5 minutes and donate to either or both these great charities – even a small contribution helps. Chances are that if you are reading this, you have received a decent education and it has helped your career – everybody deserves that start. Thank-you!

INFLATIONJim believes that inflation is policy dependent and that in the UK we don’t need QE and should have higher short rates. He was taught that rates should be equivalent to nominal GDP so 2% would be appropriate. But we may not have inflation forever, the quality of the economic debate is dumbed down by the 24/7 news cycle. He uses the University of Michigan 5 Year Inflation Expectations as his best guide, as seen in the chart below:

Source: University of Michigan, University of Michigan: Inflation Expectation [MICH], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MICH, February 25, 2022.

ABOUT JIM O’NEILLJim O’Neill is an internationally published economist, and until 2013 was Chairman of Goldman Sachs Asset Management, having previously been the organisation’s Head of Economic Research.

Jim is best-known for his work in relation to developing economies, having coined the term BRICs in 2001 as an acronym for Brazil, Russia, India, China foreseeing the radical shift in global economic power away from the established western economies towards these rapidly-expanding economies. Since then, Jim’s work has shone a light on the development of the next wave of emerging economies, including the ‘MINTs’ – Mexico, Indonesia, Nigeria and Thailand. He left GS in 2013 – I met him there on his last day and since then he has done various voluntary work.

This includes work for the UK Government as the Commercial Secretary of the Treasury and leading the work for the Government on the Northern Powerhouse, city devolution and infrastructure.

He also sits on an array of think tanks. He is Chair of Chatham House, sits on the QFINANCE Strategic Advisory Board, is a member of the board of Bruegel, the European think tank for international economics, sat on the economic advisory board to the IFC, the investing arm of the World Bank. He is one of the founding trustees of the UK educational charity, SHINE and serves on the board of ‘Teach for All’ and a number of other charities specialising in education.

O’Neill is chairman of the Greater Manchester Local Enterprise Partnership Advisory Board, which advises on the growth of the Greater Manchester economy.

Source: Wikipedia

He is an avid Manchester United fan, and served as a non-executive director from 2004 to 2005, before the club was returned to private ownership. In 2010, he was one of the Red Knights, a group of wealthy Manchester United fans which confirmed interest in a possible takeover of the club.

In May 2015 he was made a Life Peer to the House of Lords. His is the longest CV I have ever read and I have omitted much in the cause of brevity. Apologies if I have omitted something important.

/*! elementor - v3.6.5 - 27-04-2022 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#2c2c2c;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:-webkit-box;display:-ms-flexbox;display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);-ms-flex-negative:0;flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:-webkit-box;display:-ms-flexbox;display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{-webkit-box-align:center;-ms-flex-align:center;align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;-webkit-box-flex:1;-ms-flex-positive:1;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl} BOOK RECOMMENDATIONJim recommended that aspiring economists should read The Economist rather than a book, but when pressed, suggested Macro Economics by Rudiger Dornbusch and Stanley Fisher. Not being added to my reading list, but Jim probably thought I was asking for a text book.

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTS

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTSI met Jim for the first time on his last day at Goldmans. I had requested a meeting as I was doing some work on football finances, at the behest of my pal Tim Keogh, then a partner at April Strategy. The two of us built an app looking at football teams’ finances (video below), as we thought the introduction of the Financial Fair Play rules might mean something. Tim is a genius at visualisation and we scored football teams not just on points for games and financial performance but in metrics like how many goals you would see at home games per pound of season ticket.

Tesco nearly commissioned us to do something similar to help their shop staff understand how the business was faring but you know what happened next at Tesco. I still think there is huge scope for companies to improve their financial performance narrative by being much more creative and would love to resuscitate that project.

Still from our Footy Finance App

Anyway, Jim was interested in the project and to see the app – many were, one hedge fund manager wanted to buy it! We had an enjoyable chat and have had occasional contact since. I read Jim’s article on China in Project Syndicate and asked him if he would discuss it with me on the podcast and he kindly made room in his hectic schedule.

A video run through of the app is below – it’s fun, check it out, especially if you are a company CEO or CFO wanting to communicate your finanical performance more effectively to teh workforce – we can help.

/*! elementor - v3.6.5 - 27-04-2022 */.elementor-widget-video .elementor-widget-container{overflow:hidden;-webkit-transform:translateZ(0);transform:translateZ(0)}.elementor-widget-video .elementor-open-inline .elementor-custom-embed-image-overlay{position:absolute;top:0;left:0;width:100%;height:100%;background-size:cover;background-position:50%}.elementor-widget-video .elementor-custom-embed-image-overlay{cursor:pointer;text-align:center}.elementor-widget-video .elementor-custom-embed-image-overlay:hover .elementor-custom-embed-play i{opacity:1}.elementor-widget-video .elementor-custom-embed-image-overlay img{display:block;width:100%}.elementor-widget-video .e-hosted-video .elementor-video{-o-object-fit:cover;object-fit:cover} PrevSteve writes on capital intensity for Investors Chronicle Steve writes about Home Country Bias for the ICNextThe post #10 – Mr BRICs appeared first on Behind The Balance Sheet.

May 13, 2022

Steve writes on capital intensity for Investors Chronicle

The post Steve writes on capital intensity for Investors Chronicle appeared first on Behind The Balance Sheet.

Steve analyses Netflix for the IC

The post Steve analyses Netflix for the IC appeared first on Behind The Balance Sheet.

Steve interviews Horizon Kinetics manager James Davolos for Real Vision

The post Steve interviews Horizon Kinetics manager James Davolos for Real Vision appeared first on Behind The Balance Sheet.

Steve is quoted on Netflix and tech valuations

The post Steve is quoted on Netflix and tech valuations appeared first on Behind The Balance Sheet.

April 20, 2022

#9 Russell Napier & Jeremy Hosking – 2 Capital Cyclists

/*! elementor - v3.6.5 - 27-04-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block}

/*! elementor - v3.6.5 - 27-04-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block} Russell Napier is one of the foremost macro commentators in the world and has been an adviser on asset allocation to global investment institutions for over 25 years. He is the author of Anatomy of The Bear: Lessons From Wall Street’s Four Great Bottoms and of The Asian Financial Crisis 1995–98: Birth of the Age of Debt. He founded and runs a course called A Practical History of Financial Markets (in person and online), he founded the Library of Mistakes and is a non executive director of more than one quoted company.

Jeremy Hosking is a partner of Hosking Partners and was previously a founding partner of Marathon Asset Management in London. He is a co-author of the cult book Capital Account and its sequel Capital Returns (on whose cover Russell Napier is quoted). Both books explain the Capital Cycle theory, whose origin Jeremy discusses in the podcast.

In this interview we discuss the coming age of financial repression and why the capital cycle theory will be so important for investors in this new era. We also discuss the banks sector, the Asian crisis, value vs growth and the problem with ESG.

SUMMARYIn this fascinating interview, we have a wide ranging interview with Russell Napier and Jeremy Hosking, covering everything from banks to ESG, from Tobin’s Q to excessive liquidity, and from the tragic events in Ukraine to the sinking of the Titanic. One theme is constant, however – the capital cycle, and we discuss in detail its mechanics and the reasons why it’s such an effective investment tool.

INTRODUCTIONI have known Russell for several years – we met in a bar in Hong Kong and continue to have fascinating conversations over a glass. Russell has long been one of the most intellectually advanced thinkers in the stock market and often prefaces his predictions with the caveat that he can be years early. His last major forecast – that he was abandoning his long held view of disinflation and now foresaw an inflationary period ahead – in the summer of 2020 was prescient.

Quite coincidentally, I also met Jeremy in Hong Kong, at an investor presentation by Manchester United. He is a shareholder in Crystal Palace. H enow runs Hosking Partners, a global long-only value firm, having previously been a partner in Marathon Asset Management which produced the books Capital Account and Capital Returns, both authored by Edward Chancellor.

Russell had agreed to do the podcast and as his last quarterly was entitled the Capital Cycle in an Age of Financial Repression, suggested we get Jeremy to join us to give his unique perspective on this topic.

A one hour podcast was never going to be enough to do justice to this multi-faceted subject. Apart from covering why we are entering an era of financial repression, and why the capital cycle becomes even more important, we also tried to explain what financial repression is and to explain the capital cycle.

Many investors have come into the business in the last ten years and it would be easy to assume that an era of falling rates and massive liquidity was normal; that growth stocks would be pushed to excessive valuations, especially in private markets; that companies in the real world would continue to be starved of investment; and that mean reversion was a 20th century phenomenon.

In the podcast we discuss why such a view will produce terrible investment results in the next decade and we touch on why the retreat of globalisation adds another dimension to the capital cycle argument. We recorded the podcast on Thursday, March 10 and Russell and I met David Einhorn on Monday, March 14. His commentary was such a strong reinforcement of our podcast discussion that I recorded a postscript with Russell afterwards.

If you are a growth investor, some of this may make you feel uncomfortable. If you are a value investor, some of this will make you very curious.

GETTING INTO INVESTINGRussell trained as a lawyer and joined Baillie Gifford in order to work in Edinburgh, rather than out of any strong desire to be a fund manager. Jeremy’s first role was with growth manager GT Management and watching the tech collapse in 1983 led him to the capital cycle approach. He and two partners then founded Marathon – he was the oldest at 28

THE ERA OF FINANCIAL REPRESSIONRussell Napier changed his long held disinflationary view when he saw the degree of money printing in the pandemic and now believes inflation is here to stay. He believes that the consequence is that Governments will have to force savers to hold their bonds and prevent some institutions from holding their current levels of equities. Naturally, this will have consequences for equity valuations, and Russell believes that investors will have to focus on value stocks as equity indices may not perform as they have in the past. This is quite radical thinking, but Russell explains his logic in the podcast.

BANKSJeremy is invested in banks and believes they could prove very cheap if they are disciplined on capital allocation, although he is not confident that their management are up to the task. Russell, formerly a banks analyst, explains that the old 3-6-3 regime (pay 3% interest on deposits, lend money out at 6%, and be on the golf course at 3pm) may come back into vogue – in an era where credit is rationed, “you will have lent all your money by 2.30pm”.

REPLACEMENT VALUE OF ASSETSWe discuss Tobin’s Q and why some understanding of this variable is particularly important when investing using a capital cycle framework. Like all valuation parameters today, this variable stands near a high (and if it falls to its historical bear market bottom of 0.3x, we could be in for some trouble). Jeremy discusses why accounting is sometimes unhelpful and Russell explains that the Q tracks the CAPE ratio, in spite of increasing emphasis on intangibles.

ABOUT RUSSELL NAPIER

ABOUT RUSSELL NAPIERProfessor Russell Napier has been an adviser on asset allocation to global investment institutions for over 25 years.. He worked for Baillie Gifford from 1989 and for Foreign & Colonial Emerging Markets from 1994. In 1995 he joined stockbrokers CLSA in Hong Kong as its Asian equity strategist. Since 1999 he has been a consultant global macro strategist advising institutional investors. He is author of Anatomy of The Bear: Lessons From Wall Street’s Four Great Bottoms and The Asian Financial Crisis 1995–98: Birth of the Age of Debt. He founded and runs a course called A Practical History of Financial Markets (in person and online). He founded and is the Keeper of the Library of Mistakes, a free public business and financial history library based in Edinburgh. He founded an online marketplace (ERIC) for the sale of high-quality investment research to institutions. Russell is Chairman of the Mid Wynd International Investment Trust and is Senior Non-Executive Independent Director of Midwich plc. In his spare time (!), he likes to fish.

ABOUT JEREMY HOSKING

ABOUT JEREMY HOSKINGJeremy Hosking is a founding partner of Hosking Partners and was previously a founding partner of Marathon Asset Management in London. He is a co-author of the cult book Capital Account and its sequel Capital Returns. Russell Napier is quoted on the dust jacket of the sequel. Both books explain the Capital Cycle theory, whose origin Jeremy discusses in the podcast. Nick Sleep, whose letters have received considerable attention (and are available in our library) was a colleague at Marathon and also contributed to the original book.

Hosking was part of a consortium which rescued Crystal Palace from administration and with his wife he owns a country house hotel, Gravetye Manor. He is a well-known railway enthusiast and has a number of steam locomotives (and he takes the tube to work).

/*! elementor - v3.6.5 - 27-04-2022 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#2c2c2c;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:-webkit-box;display:-ms-flexbox;display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);-ms-flex-negative:0;flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:-webkit-box;display:-ms-flexbox;display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{-webkit-box-align:center;-ms-flex-align:center;align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;-webkit-box-flex:1;-ms-flex-positive:1;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl} BOOK RECOMMENDATION /*! elementor - v3.6.5 - 27-04-2022 */.elementor-widget-image-box .elementor-image-box-content{width:100%}@media (min-width:768px){.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper,.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{display:-webkit-box;display:-ms-flexbox;display:flex}.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{text-align:right;-webkit-box-orient:horizontal;-webkit-box-direction:reverse;-ms-flex-direction:row-reverse;flex-direction:row-reverse}.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper{text-align:left;-webkit-box-orient:horizontal;-webkit-box-direction:normal;-ms-flex-direction:row;flex-direction:row}.elementor-widget-image-box.elementor-position-top .elementor-image-box-img{margin:auto}.elementor-widget-image-box.elementor-vertical-align-top .elementor-image-box-wrapper{-webkit-box-align:start;-ms-flex-align:start;align-items:flex-start}.elementor-widget-image-box.elementor-vertical-align-middle .elementor-image-box-wrapper{-webkit-box-align:center;-ms-flex-align:center;align-items:center}.elementor-widget-image-box.elementor-vertical-align-bottom .elementor-image-box-wrapper{-webkit-box-align:end;-ms-flex-align:end;align-items:flex-end}}@media (max-width:767px){.elementor-widget-image-box .elementor-image-box-img{margin-left:auto!important;margin-right:auto!important;margin-bottom:15px}}.elementor-widget-image-box .elementor-image-box-img{display:inline-block}.elementor-widget-image-box .elementor-image-box-title a{color:inherit}.elementor-widget-image-box .elementor-image-box-wrapper{text-align:center}.elementor-widget-image-box .elementor-image-box-description{margin:0} Jeremy recommends

Jeremy recommendsThe Tao Jones Averages: A Guide to Whole-Brained Investing by Bennett Goodspeed. Neither Russell nor I had even heard of this book which is still available on Kindle. The blurb reads ”Although influenced by logical factors, changes in the market are often irrational and illogical. This savvy and amusing little book demonstrates how- with the help of both the left (logical) and the right (intuitive) hemispheres of your brain- you can anticipate market fluctuations and achieve a greater financial return”.

Buy on amazon.com Buy on amazon.co.UK Russell recommends

Russell recommendsThe classic Adam Smith’s The Money Game, a particular favourite of Steve’s who has read the book 3 or 4 times and Chapter 12 several more. Russell also suggests Triumph of the Optimists: 101 Years of Global Investment Returns by Elroy Dimson, Paul Marsh and Mike Staunton priced at £101 on Amazon UK and $140 on Amazon.com.

Steve met Russell in a bar at the CLSA conference in Hong Kong and Russell has been instrumental in the setting up of Steve’s training business, by introducing him to Stewart Investors in Edinburgh, for whom the original Forensic Accounting Course was designed. Thanks Russell!

Steve has known James Seddon, Jeremy’s partner at Hosking Partners and prior to that at Marathon Asset Management for many years, and James introduced Steve and Jeremy. Russell and Jeremy are old friends so this made for a fun collaboration.

THE LIBRARY OF MISTAKESRussell is quiet about his extensive charitable activities but one which is well-known and deserves a wider audience is the Library of Mistakes. It is moving to new premises and will be officially opened by Lord Darling the week after the podcast airs. I visited its original site and it is just full of fascinating material on all aspects of investing, but I particularly enjoyed the materials on past frauds. If you are in Edinburgh, it’s a must visit.

HOSKING PARTNERS

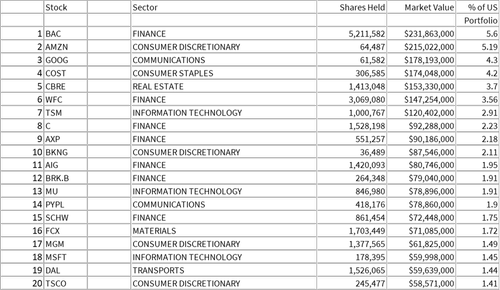

HOSKING PARTNERSJeremy’s firm publishes an interesting blog and its strategy is explained on its own website and in this interview with James Seddon. Some of its top US holdings are listed in the table. There is an interesting mix of value and growth and banks are well represented. Note Costo, Berkshire and Delta Airlines. Total US holdings are reported to be $4bn, the company does not disclose its total AUM.

Source: Whale Wisdom, as of 12/21

RUSSELL’S WORKIf you want to learn more about Russell’s work, you can

sign up for his newsletter here

enrol in the online version of his course, The History of Financial Markets, here

enrol in the in-person History of Finanical Markets course here

buy his first book, Anatomy of the Bear, on Amazon UK or Amazon.com

buy his second book, The Asian Financial Crisis 1995–98, on Amazon UK or Amazon.com

THE MARATHON ASSET MANAGEMENT BOOKS

The original book, Capital Account, is now out of print, but Capital Returns is still available – Amazon UK or Amazon.com.

These are Amazon affiliate links and we donate the money raised to charity. Fill your baskets!

Prev#8 – GREED and FearThe post #9 Russell Napier & Jeremy Hosking – 2 Capital Cyclists appeared first on Behind The Balance Sheet.

March 21, 2022

#8 – GREED and Fear

Chris Wood has been one of the world’s top strategists for 20-odd years. Pre-Covid, he wrote the weekly GREED and Fear publication from a different city almost every week, and offered an incredible range of insightful commentary on everything from Taiwan’s economy to the political complexion of the next Fed appointee. In this episode, we discuss the regime change after 40 years of falling rates, why government in China puts the UK to shame, why ESG has peaked, why Tesla will beat legacy auto, the importance of M2, why he doesn’t use Zoom and the relative merits of gold vs bitcoin. And much more. Warning – we jump around a bit and cover a lot of ground, I wouldn’t listen at 1.5x speed. We recorded before the tragic invasion of Ukraine.

SUMMARYIn this wide ranging interview, Chris, Global Head of Equity Strategy at investment bank Jefferies, talks about his route to success, why he is bullish on energy stocks, some of his fun trades (long Ryanair, short Zoom), why he doesn’t use Zoom, how the pandemic has altered his approach and why his multi-million air miles account won’t get built up quite so much going forward. We cover the long term outlook for the global economy, why the Fed has a straight jacket, and how the world will look as we move from a regime of falling rates. Spoiler – he doesn’t see a repeat of ‘20/21 in ‘22.

INTRODUCTIONChris Wood started as a journalist, so it’s no surprise that he writes well. That introduction and a training in economics equipped him ideally for his current role. At the hedge funds, my week was not complete without reading his weekly, GREED and Fear, which is like a North Star for many investors who use Chris as a guide through an often turbulent world.

GETTING INTO INVESTING

GETTING INTO INVESTINGChris achieved all he wanted to at the Economist, having seen the US savings and loan crisis as Bureau Chief in New York and then watching the fallout from the bursting of the bubble in Japan as Bureau Chief in Tokyo. He is best known from his long stint at CLSA which was then the number one broker in Asia where he was repeatedly voted the number 1 Asia Strategist, before moving to Jefferies in 2019.

NO LONGER A DISINFLATIONISTWood was in the disinflation camp for many years, since the 1980s in fact, partly a legacy of his time observing the fallout from the Japanese bubble, and for all the usual reasons – technology, demographics, globalisation and debt. The response to Covid was so extreme with an explosion of the money supply that he reversed his 3 decade held view.

GOLD VS BITCOINWood has been a long time gold enthusiast, using an allocation to the precious metal as a hedge in portfolios. In 2021, he re-allocated a portion of his gold allocation to bitcoin and increased the exposure on a dip. His rationale was that when the cryptocurrency became accessible to institutional investors, he wanted to have exposure. He explains his rationale, why he believes that bitcoin has real integrity and why he now holds both gold and bitcoin in his model portfolios.

STING IN THE TAILWood believes that the US economy will prove resilient to higher rates and that consumers will benefit from rising wages, while the Fed will only go so far in increasing rates. But he believes that markets will continue to be uncomfortable with this environment and that there will be a sting in te htail, from hidden leverage. He explains where the problems might surface.

OTHER TOPICSWe covered a lot of ground from Exxon to GM to Tesla to Alibaba; from ESG to China’s Covid policy; from developed markets to Chine and India.

We recorded this before Russia’s shocking invasion of Ukraine. Neither Chris nor I thought that was a likely outcome. I mentioned in the podcast that I had looked at Russia but I didn’t feel it was a sufficiently uncomfortable trade – a lucky miss for me and another reminder that risk management is critical. I have been donating some of the losses I avoided to Ukraine.

There was so much in this interview and I could have gone on. In fact we continued chatting in the lobby for another 20 minutes before we had to rush to other appointments on a windswept London day. My takeaway – it’s so much better to conduct these conversations in person than over Zoom.

If you would like to hear more of Chris Wood’s views, there is a video on the excellent Jefferies website here and more insights here. But listen to the podcast first!

ABOUT CHRIS WOODPrior to entering the investment business, Wood was a financial journalist. He started at the Hong Kong-based Far Eastern Economic Review (1982-84) and moved to The Economist (1984-94), and served as both the New York and Tokyo Bureau Chief.

He was also the author of three acclaimed books while at The Economist. “Boom and Bust: The Rise and Fall of the World’s Financial Markets” published in 1989; “The Bubble Economy: Japan’s Extraordinary Speculative Boom of the ’80s and the Dramatic Bust of the ’90s” published in 1992; and “The End of Japan Inc.: And How the New Japan Will Look” published in 1994.

Evidently, stockbroking keeps him busier than journalism as he hasn’t written any more books. He is best known as the number 1 Asia strategist, an award he won multiple times at CLSA, where he worked until moving to Jefferies in 2019, where he is Global Head of Equity Strategy.

Chris has been publishing his renowned weekly investment report GREED & fear since July 1996. He was ranked No. 1 Equity Strategist in the Asia Money polls between 2002-2004 and 2006-2021. There have been 1,269 issues of GREED & fear (including regular and ad-hoc flash notes) over the past 23 years of publication.

Source: Jefferies

For the first time in more than 21 years, GREED & fear has not been published over the past four consecutive weeks (as we go to press in mid-March, 2022). The last time this occurred was in the four weeks ended 19 March 1998 during a previous contractual-driven interlude. The other periods since the first publication in July 1996 where GREED & fear had not been published were a two-week period in November 1998 and a two-week period in December 2001.

Chris recommends a number of portfolios, of which the longest running is his Asia ex Japan long only. Since inception at the end of 3Q02, that portfolio has risen by 3,196% (annualised 19.9%) ($, total return) to end-‘21, vs a 659% (11.1% p.a.) increase in the MSCI AC Asia ex-Japan Index and a 759% (11.8% p.a.) increase in the S&P500. In 2021, it rose by 12.1% (vs a 4.5% decline in the benchmark). He’s pretty good.

BOOK RECOMMENDATIONChris recommended The Road to Serfdom, a book written in the early 1940s by Austrian-British economist and philosopher Friedrich Hayek. We have been getting quite a few older books recommended by podcast guests which is interesting – if it can stand the test of time, a book is probably worth reading. And my reading list has been increasing which is probably good news for my education.

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTS

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTSAt my first CLSA Forum in Hong Kong, I woke up after my usual interrupted sleep (for the first few days, I always wake up at 3am and fall asleep at 4pm in Hong Kong) and dragged myself to the grand opening of the conference – a double act with Chris and economist Dr Jim Walker. I didn’t quite know what to make of it – they each expressed quite different opinions on the state of the world. I later grew accustomed to the relaxed attitude at CLSA which allowed its star analysts to say what they thought, even if it meant disagreeing with a colleague. After all, at least one of them would be right; I am not sure if this was an official line, but it was quite smart.

Wood’s presentation was impressive and I read his note every week for several years and always tried to attend to his group presentations on his London visits. I only ever had a single 1-1 meeting with him, which we laughed about when we met for the podcast (I am not allowed to disclose the details). But Chris was an invaluable guide to the macro world when I was at the hedge funds and I imagine it would be so much more difficult without his unique insight.

I was really pleased when Chris agreed to do the podcast and hope listeners enjoy it half as much as I did.

Prev#7 – A Scotsman & an Englishman #9 Russell Napier & Jeremy Hosking – 2 Capital CyclistsNextThe post #8 – GREED and Fear appeared first on Behind The Balance Sheet.

March 8, 2022

#7 – A Scotsman & an Englishman

Dylan Grice is a former economist, prop desk trader, strategist and family office investor. Rob Crenian is the former UK CEO of Renaissance Technologies, the world’s most successful hedge fund. They teamed up to form Calderwood Capital whose reason d’etre is preservation of capital in what is likely to prove a much more difficult long term environment in the next decade or two than in the last.

SUMMARYIn this interview, Dylan Grice and Rob Crenian discuss how markets work, how “stupid” investors have been winning of late but will not do so for much longer, how quants think, how real alpha will be more difficult to come by, and how this will likely be found not by being smarter but by doing something different; and they explain how they are seeking to preserve wealth with an unconventional investment strategy at Calderwood Capital.

INTRODUCTIONI met Dylan when he was working on Albert Edwards’ team at SG and I used to enjoy his weekly missive, Popular Delusions, a title he has resuscitated for his new newsletter. I hadn’t met Rob before this episode which we recorded in person in the podcast studio at my office. We really had a fun conversation in which I probably participated too much, and we carried on in the pub afterwards. Spoiler: this episode is longer than usual.

They got together to set up Calderwood Capital which is an unusual hegde fund, deploying unconventional strategies to preserev and grow wealth, as they explain in the podcast. Their principles are that diversification is the most potent tool in capital preservation yet is the least effectively used; but radical diversification requires radically orthogonal (it seems to be their favourite word – statistically independent) return streams. They talk about the evaluation of risk-return as needing to take place after the research, not before.

You get the picture…………..

GETTING INTO INVESTINGBoth started at Dresdner Kleinwort with Dylan going on to work with Albert Edwards at SG and Rob moving to quant manager Aspect Capital. They therefore have had very different career experience, which brings diversity to their new venture.

THE ROLE OF THE FAMILY OFFICEFamily offices are attracting some really high quality investors who enjoy the relative lack of constraints. But the job, capital preservation, is much more difficult than it was say 20 years ago, because of the lack of yield.

VALUE INVESTING“You don’t have to be the smartest guy in the room, but you do have to be different.”

Value investing hasn’t been working; what has worked recently is “craziness, recklessness”. Dylan mentioned when talking about SPACs and similar features of recent markets:

QUANTS“it’s crazy how dreams were being priced”

I was quite surprised by some of the things I learned about quants. Good quants just connect data, and there is the analogy of continuous improvement with F1 teams, where success often depends on the data. Quant managers too have to accept that they live in an ever-changing world and Renaissance used to talk about the “half-life” of a quant model – the ability to generate alpha decays over time.

STRATEGYTheir strategy is to build a portfolio that doesn’t depend on getting markets. macro or forecasts right. When you get into more esoteric areas of markets, you find a genuine risk premium – for example, the reinsurance industry depends on collecting more premiums than it pays out in the long term – there has to be a profit incentive. By assembling a basket of such strategies and some quants exposure, they hope to be able to survive interest rates at 20% and still make money.

I thought this was a fascinating discussion, full of gems, and it made me reconsider whether gold was a sufficient insurance policy in my portfolio and what else I should be thinking about. You should too – strategies which have been successful over the last 40 years are unlikely to work in the next 20. That’s why I am continuing this macro series with a very special guest next month.

ABOUT DYLAN GRICEDylan was formerly Head of Liquid Investments at Calibrium AG, Zurich, where he helped build and establish one of the largest family offices in Europe. He started his career at Dresdner Kleinwort Benson in 1997 in the Quant, Strategy and Economics group, where he spent time as a prop trader before moving to Société Générale’s highly regarded global strategy team, working alongside Albert Edwards. He is a graduate of Strathclyde University (as is last month’s guest, Hugh Hendry) and the London School of Economics.

ABOUT ROBERT CRENIAN

ABOUT ROBERT CRENIANRob is the former CEO of Renaissance Technologies (UK) where he ran and managed the London office responsible for the EMEA regions. He started his career in 1997 as a derivatives risk manager at Dresdner Kleinwort Benson – where he first met Dylan Grice – before switching to quantitative strategy/research. He subsequently moved to Citigroup as a quant researcher in the number one ranked team (Institutional Investor survey 2003/4) before joining Aspect Capital as Head of Product Management. He is a graduate of UCL and the Universities of Cambridge and Bristol.

Dylan recommends

Dylan recommendsSebastian Mallaby, More Money than God. Dylan commented that he liked his view that what works now won’t work in future. Dylan also recommends Manias, Panics, and Crashes: A History of Financial Crises by Charles P. Kindleberger.

Buy on amazon.com Buy on amazon.co.UK Rob recommends

Rob recommendsCharles Schwager’s Market Wizards and Liar's Poker by Michael Lewis. Both books were among those on his desk when he joined Aspect Capital, along with a DVD of the movie Trading Places.

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTSSteve has known Dylan from when he worked on Albert Edwards’ team. Steve had always liked the team, including Dylan’s predecessor James Montier, now at GMO, but became a massive fan in 2008, ahead of the credit crisis, when Albert was one of the few voices to warn of the trouble ahead. Dylan’s team heard this podcast and got in touch to say he would like to come on and I hesitated for a nano-second – it’s really a privilege to produce something like this and to be allowed to chat to brilliant people. Thanks to the listeners who enable this!

Prev#6 – The Existentialist #8 – GREED and FearNextThe post #7 – A Scotsman & an Englishman appeared first on Behind The Balance Sheet.

#6 – The Existentialist

Until 2017, Hugh Hendry was a maverick – an outspoken and highly controversial hedge fund manager. He closed his fund in 2017 after a period of lackustre but far from shocking performance and has become a property developer and landlord of upmarket rentals on the billionaire favourite Caribbean hideaway of St Bart’s. In this episode, he talks about his new life, how he has traded in his Bloomberg for surfing and yoga, why he is still a worrier and why he has chosen this new life as a property magnate.

SUMMARYFormer hedge fund manager Hugh Hendry is best known as the man who made 30% in 2008, when others crashed, including many so-called hedge funds. He described his cockroach mandate as being a survivor no matter what. He closed the fund in 2017 after a period of lackustre but far from shocking performance and has become a property developer and landlord of upmarket rentals on the billionaire favourite Caribbean hideaway of St Barts. But few owners of vacation lets could tell you what the 10 year bill has done in the last month, let alone give a coherent view of how it might move in 2022. Hugh may have retired but he has certainly not let go. He views the world through a different prism – he is like a photographer who only uses a fish-eye lens. We recorded on a cold London day and on St Barts, it was just as windy, as you may hear.

Hendry talks of how he nearly became an accountant (really!), the conceit and arrogance of a well-informed argument, how he had a lot of engagement with James Anderson when he was at Baillie Gifford, the conundrum as we recorded in December, 2021, of high current inflation and lower trending bond yields, how he exploited unexplored corner of the stock markets to profit from tail events and his views on Modern Monetary Theory. Hendry talks of having swapped his past life, a “life spent in the future”, for a rigorous exercise regime, surfing and yoga, but he remains a keen student of markets.

INTRODUCTIONHendry was born in Castlemilk in Glasgow, Scotland, in 1969. Castlemilk was a scary place. It probably still is. As a 12 year old, I have strong memories of standing at the bus stop outside the swimming pool, fearful of attack. I would never have stood there without friends – a lone schoolboy in a blazer would have been an irresistible target for the local gangs. Hendry’s achievements, including being the first of his family to go to university, should therefore not be under-estimated. And it’s this background which always comes to my mind when he starts quoting French philosopher, Albert Camus.

Hendry was always seen – and sees himself – as a maverick. The hedge fund world is not solely populated by shy retiring quants so this is saying something. But he prospered as a highly original, very opinionated manager who took on complex trades that few others had even thought of, often betting on black swan type events which would afford a highly asymmetric payoff in the event of a financial disaster.

He is definitely a Marmite character whom people either love or hate, but his insights are often unusual and invariably perceptive. He puts together a framework from the world of macro by joining unrelated areas, by picking individual equities as a lever for exposure to macro changes and by assembling a series of apparently unrelated best which have a hidden correlation.

In this interview, we talked about his current life, his investing philosophy and touched on how he sees the future unfolding. I was surprised at how closely he still monitors markets in his new role.

Hendry once said to an interviewer: “To my mind, the three most important principles when it comes to investing are Albert Camus’s principles of ethics: God is dead, life is absurd and there are no rules.”

ST BART’S

ST BART’SHendry has swapped his Bloomberg for life as a landlord. He now rents out this villa, 6 beds, for $180k per week at peak season.

WRITTEN WORD VS VISUALSHendry, as you would expect, is a brilliant writer. Now he enjoys doing the occasional podcast and he also has a highly successful YouTube channel and Instagram account. He explains that he has always been visual, something which he neglected at Baillie Gifford. He didn’t thrive in their environment. But when he joined Odey Asset Management, Crispin used charts and this was a revelation. Crispin taught him to misbehave, to dare to be different and inspired in him greater creativity. Hence the richness of his YouTube videos (some filmed by famous director Dean Freeman) – watch this one with Hendry skateboarding in his Paris apartment – and his Instagram account. The social media presence is a prelude to a book about his life in finance – watch this space.

CHARTSHendry used charts extensively. He was always engaged in two things in conflict with one another – the fundamentals and the charts. At Baillie Gifford, without the chart element, he was rich in fundamentals and had great processing power and worked with people he really admired, but didn’t perform that well. He reflects on the “conceit and arrogance of a well-formed argument” and recalls a disastrous foray in Reader’s Digest – he kept buying all the way down until he was taken out of the trade. It went bust. The fundamentals alone are not enough. There is a danger that smart people like him can be over-confident and see things that are not there and there is an honesty in buying things that are going up and selling things that are going down.

His objective was to hold a warehouse, an inventory of rich narratives and smart ideas. Then the market would make them legitimate and he could implement the trade. An example was Weir Group which had gone sideways for 15 years and then moved, which was the signal for him to enter the trade. The stock did extremely well and Hendry can still recall the valuation metrics 15 years later –

PEOPLEAt Baillie Gifford, he clashed with James Anderson whom he acknowledges as one of the great investors of the last 30 years. Crispin Odey was very different and encouraged Hugh to “touch hot plates”. Hendry is also an admirer of Niall Ferguson, another successful Glaswegian, who has produced some excellent video as well as being a brilliant writer. Analysts are conservative. We need to teach people to be brave, to make bold claims and to get things wrong.

CHANGE OF REGIMEWe have had 40 years of falling interest rates, but Hendry doesn’t believe that we are on the cusp of a regime change but rather believes that without an intervention, bond yields will trend down; the path will be lower real rates to stabilise the situation.

CHINAHendry thinks China’s investments in real estate and fixed assets are lunacy. We discussed the relative values of the US and China real estate pools. IN 2008, Hendry recognised that the stock of US real estate was 3x the flow of GDP; hence any diminution in value would be significant. He correctly recollects that the value of US real estate is $36tn. We discussed the value of China real estate and my Google searches suggest $55tn.

ABOUT HUGH HENDRYHendry was born in Glasgow, Scotland, in 1969 and graduated from Strathclyde University in 1990 with a BA in economics and finance. His father worked as a lorry driver and he was the first member of his family to go to university. His mother was a receptionist.

In 1991, Hendry joined the prestigious Edinburgh investment management firm, Baillie Gifford. He claimed that he was hired only because investors had instructed the company to recruit more working-class employees.

Hendry joined Odey Asset Management in 1999. “It was a meeting of minds,” Hendry said. “He checked my references, got the message that I was a troublemaker, and said, ‘You’re one of us, you’re one of the pirates”.

Hendry’s hedge fund was up 30% in 2008. He closed the fund in September 2017, after losing 9% that year; the main fund was down to $30m from a $1.3bn peak and total AUM was $200m.

A journalist described lunch with Hendry as akin to dining simultaneously with a hyperactive child, foul-mouthed chef Gordon Ramsay, and a free market policy wonk. He says “I have always been a heretic and argued against the consensus. I have always been angry.”

BOOK RECOMMENDATIONS

BOOK RECOMMENDATIONSHugh thinks reading is really important but advises reading widely, outside finance – inspiration is everywhere. He therefore recommended Gap in the Curtain by John Buchan plus several books on finance:

Edwin Lefevre’s Reminiscences of a Stock Operator about the life of Jesse Livermore

Jack Schwager’s books – there are several.

and Fisher’s Common Stocks and Uncommon Profits and Other Writings

Buy on amazon.co.UK Buy on amazon.com

Buy on amazon.co.UK Buy on amazon.com  Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTS

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTSMany years ago, I suggested to my then boss that we might copy one of Hugh’s trades, after reading one of Eclectica’s letters. I subscribe to the philosophy that there is no such thing as an original idea in the stock market. I later sent Hugh a message on Bloomberg, explaining our common Glaswegian upbringing and asked if he might spare me time for a coffee. To my surprise, he said yes. That was several years ago, but when I was thinking about the podcast schedule for 2022, I decided that we should explore the issue of regime change with some macro experts. Hugh was an obvious choice.

/*! elementor - v3.6.5 - 27-04-2022 */.elementor-widget-video .elementor-widget-container{overflow:hidden;-webkit-transform:translateZ(0);transform:translateZ(0)}.elementor-widget-video .elementor-open-inline .elementor-custom-embed-image-overlay{position:absolute;top:0;left:0;width:100%;height:100%;background-size:cover;background-position:50%}.elementor-widget-video .elementor-custom-embed-image-overlay{cursor:pointer;text-align:center}.elementor-widget-video .elementor-custom-embed-image-overlay:hover .elementor-custom-embed-play i{opacity:1}.elementor-widget-video .elementor-custom-embed-image-overlay img{display:block;width:100%}.elementor-widget-video .e-hosted-video .elementor-video{-o-object-fit:cover;object-fit:cover} Prev#5 – Lucy Macdonald The Pianist #7 – A Scotsman & an EnglishmanNextThe post #6 – The Existentialist appeared first on Behind The Balance Sheet.

#5 – Lucy Macdonald The Pianist

Lucy MacDonald is the former CIO of Global Equities at Allianz Global Investors where she worked for almost 20 years and managed £5bn or $8bn of assets. She is currently a NED on JP Morgan GEM Income Trust and has her hands full, taking care of a new puppy. Lucy has 30 years of experience in financial markets and is exactly the sort of guest we are hoping to have on the podcast – a wealth of experience, semi-retired, and not afraid to speak out, as you will hear.

SUMMARYIn this podcast, MacDonald explains her really unusual route to finance, her approach to running successful portfolios, how to run a team of fund managers and analysts and how a woman copes in a man’s world.

INTRODUCTIONLucy MacDonald is the former CIO of Global Equities at Allianz Global Investors where she worked for almost 20 years. She headed up the Global Equity Fund Management team, which managed over £5bn of assets in mandates for institutional and retail clients around the world. She was also the lead manager of the Brunner Investment Trust. She has strong views on and considerable expertise in ESG and on the role of women in finance, which we discuss in the podcast, along with her unusual route into fund management.

GETTING INTO INVESTING

GETTING INTO INVESTINGLucy started at Barings and her interest was sparked by conversations when she was playing piano in a bar, as a music student. A lovely story, early in the podcast.

ALLIANZ GI

ALLIANZ GILucy reached the level of CIO Global Equities for this giant asset manager. In the podcast, she explains her approach to running a successful investment team.

LESSONS FROM THE COLLAPSE OF BARINGSAs a younger member of the team, Lucy learned some lessons from the Barings collapse – that her superiors didn’t necessarily have all the answers. Her takeaway – do your own research.

Barings was a great training ground though, working with the future principals of some of London’s future top hedge funds – Sloane Robinson, Thames River Capital and Odey Asset Management (yes, Crispin himself).

ADVICE FOR YOUNG PEOPLE COMING INTO THE INDUSTRY

Lucy’s advice is simple, albeit perhaps difficult to execute: Get a good boss.

She explains that your first boss can have a profound impact on your career, so you need to make sure they are someone who can properly teach you.

RUNNING AN INVESTMENT TEAM

Lucy places emphasis on avoiding groupthink. She used blind voting. It means a wider dispersion of opinion and often creates additional debate which is helpful in arriving at the right decision. Her 3 tips for avoiding groupthink:

1) Leader goes last and does not influence others

2) Diversity of inputs (gender and background) is important

3) Blind votes

ABOUT LUCY MACDONALDLucy MacDonald ASIP is the former CIO of Global Equities at Allianz Global Investors where she worked for almost 20 years and managed £5bn or $8bn of assets. She is currently a NED on JP Morgan GEM Income Trust and for the last several years has been a member of the CFA UK Advisory Council. She was the lead manager of the Brunner Investment Trust from 2016-2020, having previously managed the overseas portion of the Trust since 2005. She is a member of the Nomination Committee for the CFA UK board and sits on the CFA investor panel. Lucy is known for having strong views on ESG and on the role of women in finance, both areas in which she has considerable expertise. Lucy graduated from Bristol University with a music degree.

BOOK RECOMMENDATIONS

BOOK RECOMMENDATIONSLucy recommended two books:

Thinking Fast and Slow by Daniel Kahneman. Knowing yourself and the other people you are working with helps performance.

Against the Gods Peter Bernstein. The History of Risk.

Buy on amazon.com Buy on amazon.co.UK

Buy on amazon.com Buy on amazon.co.UK  Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTS

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTSSteve met with Lucy to talk about her approach to ESG, which she touched on in the podcast. This was part of a research into a possible new course which he has not yet constructed, as there is a huge amount to do, but may do at some point. When Lucy retired, they stayed in touch, Steve asked her to review his book and she kindly offered to appear on the podcast.

Prev#4 – The Not Quite Trillion Dollar Man #6 – The ExistentialistNextThe post #5 – Lucy Macdonald The Pianist appeared first on Behind The Balance Sheet.