Stephen Clapham's Blog, page 12

September 22, 2022

Tobias Carlisle’s podcast reviews Steve’s Substack on quality

The post Tobias Carlisle’s podcast reviews Steve’s Substack on quality appeared first on Behind The Balance Sheet.

September 15, 2022

#14 – The Coach

/*! elementor - v3.7.3 - 29-08-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block}

/*! elementor - v3.7.3 - 29-08-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block} Sir Clive Woodward is a winner. He is best known for managing the England rugby team, taking them from world #6 to a world cup win. In this revealing interview, he explains that there is no difference between managing a sports team, a business or an investment team. It’s all about managing people. Winning teams are made up of winning individuals – you can persuade the individuals in a team to strive to improve performance and the team will benefit. He is a proponent of continuous learning, and his team members must be teachable. I was fascinated by his management philosophy and investors and business people can learn so much from sport. No detail goes unchecked in his quest for 1% gains – he he explains why the team’s second half performance improved when they changed strips at half time. You don’t need to be a rugby fan to enjoy and learn from this exposition of what makes a winning team.

SUMMARY

SUMMARYSir Clive Woodward has a keenly developed management philosophy which is equally applicable to business and sport.

In this interview, we discuss hot hands – he believes in winning streaks – and how to profit from losses, or success from setbacks as he describes it. He explains his philosophy in coaching individuals, which is central to the development of a winning team. His DNA of a Champion is a 6 factor system for getting the best out of people. As he says, talent alone is not enough.

Winning is at the heart of his philosophy and he quotes Nelson Mandela. “I never lose. I either win or I learn”. And this philosophy of continuous learning is something he passionately believes in. He describes people as rocks or sponges. Rocks are fixed mindset people who are unwilling to embrace new ideas. To be part of Woodward’s team, you have to be a sponge, keen to learn and to test new approaches.

/*! elementor - v3.7.3 - 29-08-2022 */.elementor-widget-image-box .elementor-image-box-content{width:100%}@media (min-width:768px){.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper,.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{display:-webkit-box;display:-ms-flexbox;display:flex}.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{text-align:right;-webkit-box-orient:horizontal;-webkit-box-direction:reverse;-ms-flex-direction:row-reverse;flex-direction:row-reverse}.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper{text-align:left;-webkit-box-orient:horizontal;-webkit-box-direction:normal;-ms-flex-direction:row;flex-direction:row}.elementor-widget-image-box.elementor-position-top .elementor-image-box-img{margin:auto}.elementor-widget-image-box.elementor-vertical-align-top .elementor-image-box-wrapper{-webkit-box-align:start;-ms-flex-align:start;align-items:flex-start}.elementor-widget-image-box.elementor-vertical-align-middle .elementor-image-box-wrapper{-webkit-box-align:center;-ms-flex-align:center;align-items:center}.elementor-widget-image-box.elementor-vertical-align-bottom .elementor-image-box-wrapper{-webkit-box-align:end;-ms-flex-align:end;align-items:flex-end}}@media (max-width:767px){.elementor-widget-image-box .elementor-image-box-img{margin-left:auto!important;margin-right:auto!important;margin-bottom:15px}}.elementor-widget-image-box .elementor-image-box-img{display:inline-block}.elementor-widget-image-box .elementor-image-box-title a{color:inherit}.elementor-widget-image-box .elementor-image-box-wrapper{text-align:center}.elementor-widget-image-box .elementor-image-box-description{margin:0} GETTING INTO COACHING

GETTING INTO COACHINGWoodward played rugby for his country and then went on to coach amateur and then professional teams but on a part time basis. His call to manage the England team in the new professional environment was a surprise and not universally welcomed. But after a rocky start, he dragged the team into a more professional approach and they started to win matches, eventually beating the mighty All Blacks, South Africa and Australia and winning the World Cup, a feat never before achieved by a northern hemisphere team.

People Over React to LosingClive’s philosophy advocates learning from winning. When they land that big contract, companies usually go to the pub to celebrate. When they lose, they have a Monday morning debrief on what went wrong. He advocates switching tis around. You cannot win every game or every big client pitch; when you lose, it’s better to go the pub and have a drink afterward. He believes in doing the debriefing after the wins and analysing what went well. Of course you can also learn from losing a game or a pitch, but learning from the wins is important.

Basics and Critical Non-EssentialsWoodward went to Israel to meet Yehuda Shinar, an ex-fighter pilot who had studied high performance behaviours. Shinar taught him about the importance of basics. Interestingly the national side had not agreed what the basics were, what was important.

He learned from an Australian dentist about critical non-essentials. These are the aspects of an endeavour which are not essential but are critical to achieving the right result. Every dentist will be able to fix your teeth; that’s the essentials. But the critical non-essentials were a welcome drink when you arrived, the right ambience in the reception and a warm greeting on your arrival. Clients didn’t get their teeth fixed any better than the dentist up the road, but they enjoyed the experience more. This was executed to the max in the England rugby environment where Clive went out of his way to make the players feel special, something which had hitherto been neglected. This helped him achieve the winning mindset.

How to WinWoodward’s second book was published in 2020 and analyses the 2019 Rugby World Cup. But it’s more than a sporting tournament story as he explains his unique leadership philosophy. There is a huge amount here for any business person or investor to take away and think about.

/*! elementor - v3.7.3 - 29-08-2022 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#2c2c2c;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:-webkit-box;display:-ms-flexbox;display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);-ms-flex-negative:0;flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:-webkit-box;display:-ms-flexbox;display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{-webkit-box-align:center;-ms-flex-align:center;align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;-webkit-box-flex:1;-ms-flex-positive:1;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl}.e-container>.elementor-widget-divider{width:var(--container-widget-width,100%);--flex-grow:var(--container-widget-flex-grow,0)}

Source: Sky Sports ABOUT Sir Clive Woodward

Source: Sky Sports ABOUT Sir Clive WoodwardSir Clive Woodward is a rugby coach, businessman and sporting legend. He is best known for leading England’s rugby team to World Cup victory in Australia in 2003 – the first time England (or indeed any northern hemisphere nation) won. Sir Clive later became Director of Sport for the Olympic Team GB including its most successful Olympic games In London. He is now a sports and business consultant and founder of Hive Learning, an app which digitises his coaching methods.

BOOK RECOMMENDATIONSSir Clive recommended Outpacer: The Blueprint for Breakthrough Success in the Digital Era by Alex Holt, which describes the characteristics of the great tech stocks, their culture and strategies, along with profiles of business leaders, sporting and film stars who share these winning characteristics. Steve has already bought it!

He also recommended two books by Dr Paddi Lund, Building the Happiness-Centred Business and The Absolutely Critical Non-Essentials which are both now out of print, but will be waiting for Steve on his next visit to the British Library.

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTS

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTSI didn’t know Sir Clive, but we were speaking on the same platform at a London investment conference. My hand was tired from taking so many notes as I was fascinated by his presentation. Everything he said not only rang true to me, but it made so much sense in a business and investing environment. I went up afterwards and explained how much I enjoyed his presentation and asked him on the podcast. Somewhat to my surprise, he agreed.

I really enjoyed the research for this podcast. He has written two books and Alison Kervin has written his biography. I also listened to 8 podcasts. His philosophy is so insightful and often challenges conventional wisdom. I had not previously realised how much investors and business people can learn from sporting winners. But in sport, you only get one chance on the Saturday to win the match and preparation therefore becomes critical.

I started the podcast as a fun project and I had not envisaged how much I would learn and that it would be a gateway to meet people I would not otherwise, let alone a sporting icon like Woodward. Most important is this concept of continuous learning which is my passion, as well as Sir Clive’s.

Prev#13 – The ContrarianThe post #14 – The Coach appeared first on Behind The Balance Sheet.

July 21, 2022

Steve writes about stock options

The post Steve writes about stock options appeared first on Behind The Balance Sheet.

July 13, 2022

#13 – The Contrarian

Richard Oldfield is a true value investor. Author of the delightful commonsense investing book, Simple but not easy, in this interview he recites several wonderful anecdotes from his long experience as a value investor. We even get a song (and Steve recites one of Richard’s investment poems). Richard has an innate belief in the cyclical nature of markets and the madness of crowds. He is a classic contrarian investor and he came out with numerous gems about how to think in this way. Richard is a truly independent thinker. He doesn’t believe in index funds, likening them to hanging on to the coat-tails of a lunatic. He believes, as do I, that anyone with some common sense, experience and ability to manage their emotions can outperform the market.

SUMMARYRichard Oldfield is a true English gentleman, with a self deprecating manner, a sharp wit and a deep understanding of investment.

In this interview, we discuss Richard’s brilliant yet under-appreciated book, Simple but not Easy. It’s chock full of anecdotes from his long experience as a value investor. Richard has an innate belief in the cyclical nature of markets and the madness of crowds. He is a classic contrarian investor and he came out with so many gems about how to think in this way.

He also frets about the mess central banks have got themselves into, but believes in the long term, equities will continue to deliver the 5-6% real that they always have. But he believes the time is now ripe for value and that the few true value investors left – those who have not given up the faith and veered off into quality investing – will have a field day.

GETTING INTO INVESTING

GETTING INTO INVESTINGRichard's father was a stockbroker and did not encourage him to follow in his path, but he had a real interest and used to read the share prices in the newspaper from a young age. In the podcast he tells the story of his first investment, in Britannia Arrow. He made money as the stock was shunned through its association with the failed Slater Walker, even though the company was perfectly solid.Picture: Jim Walker. Source: The Guardian

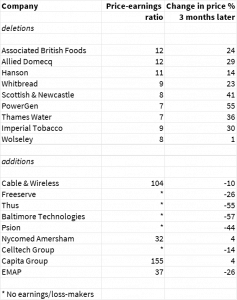

On Index FundsRichard has a rather jaundiced view of index funds. He describes participation as hanging on to the coat-tails of a lunatic, as the weighting is increased in what has already gone up. The practice of index revisions is to eliminate stocks which have gone down and increase participation in what has already gone up, which he describes as exactly the opposite of what you should be doing.

In his book, he describes the revisions to the FTSE 100 Index at the peak of the tech boom. Of course, the companies aded all had stratosperic valuations or were loss-making and the companies which were ejected from the index were old economy deep value stocks. The table shows the additions and deletions and the subsequent 3 month performance.

A DittyIn Richard’s book, below, there is a wonderful ditty on the merits of Russia and China.

A DittyIn Richard’s book, below, there is a wonderful ditty on the merits of Russia and China.Was China finer?

It appeared,

We feared,

When the dollars were counted,

The odds had mounted

The convincing prospect

Of the growth we expect

Was Russia lusher?

It depended

We tended,

On how much imputing

To President Putin

Of a dubious motive

To increase his vote if,

As part of his prospectus,

He was seen by elector

To come out strong

When things done were wrong.

Too much faith in Khodorkhovsky. Could quite frankly be sort of costly.

Simple, but not easy

Simple, but not easyRichard published the original book in 2007 and Harriman reissued an updated edition in 2021. He always enjoyed writing and having accumulated a lot of prejudices about investing over the years, wanted to give vent to his thoughts. He also thought that most of the investment books were not very approachable. The book is a common sense approach to investing and is aimed at those who want to maximise their long run returns.

Richard’s publisher (and mine), Harriman House, are offering the book at half price to podcast listeners this summer. Use the Code SBNE50.

ABOUT Richard OldfieldRichard founded Oldfield Partners LLP in 2004 and was chief executive until 2013, and chairman until 2022. He is now a partner, a non-executive director of the firm, and he contributes to the overall investment selection. Oldfield Partners is a value-style asset management firm with over $4bn in assets under management.

Richard was chief executive of Alta Advisers Ltd. from 1997 to March 2005. Before joining Alta in 1996 he was a director of Mercury Asset Management plc and head of the global team. He joined the S.G. Warburg & Co./Mercury group in 1977 on graduating from Oxford University.

Richard was Chairman of the Oxford University Investment Committee and of Oxford University Endowment from the latter’s inception in 2007 until 2014 and is Chairman of Shepherd Neame, a director of Witan Investment Trust plc and a trustee of Royal Marsden Cancer Charity and Canterbury Cathedral Trust.

Richard holds a BA Hons in History from Oxford University. His book about investing, ‘Simple but not easy’, was published in 2007.

BOOK RECOMMENDATIONRichard recommended two books, one by Ben Graham and one by Peter Cundill. I chose Intelligent Investor as I think it’s the more approachable book. There’s Always Something to Do by Cundill is available on Kindle.

Buy on amazon.co.UK Buy on amazon.com Buy on amazon.co.UK Buy on amazon.com HOW STEVE KNOWS THE GUESTS

Buy on amazon.co.UK Buy on amazon.com Buy on amazon.co.UK Buy on amazon.com HOW STEVE KNOWS THE GUESTSI didn’t know Richard, but bumped into him at the London Value Investor Conference. I explained how much I enjoyed his book and asked him on the podcast. He was keen to promote the second edition and to my delight, he agreed. I really enjoyed talking to him. This is one reason why I started the podcast – I get to meet people I would not otherwise, and I get to learn, which is my passion.

Prev#12 – The Value Architect #14 – The CoachNextThe post #13 – The Contrarian appeared first on Behind The Balance Sheet.

Draft podcast

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block}

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block} Richard Oldfield is a true value investor. Author of the delightful commonsense investing book, Simple but not easy, in this interview he recites several wonderful anecdotes from his long experience as a value investor. We even get a song (and Steve recites one of his investment poems). Richard has an innate belief in the cyclical nature of markets and the madness of crowds. He is a classic contrarian investor and he came out with numerous gems about how to think in this way. Richard’s is a truly independent thinker. He doesn’t believe in index funds, likening them to hanging on to the coat-tails of a lunatic. He believes, as do I, that anyone with some common sense, experience and ability to manage their emotions can outperform the market.

SUMMARYRichard Oldfield is a true English gentleman, with a self deprecating manner, a sharp wit and a deep understanding of investment.

In this interview, we discuss Richard’s brilliant yet under-appreciated book, Simple but not Easy. It’s chock full of anecdotes from his long experience as a value investor. Richard has an innate belief in the cyclical nature of markets and the madness of crowds. He is a classic contrarian investor and he came out with so many gems about how to think in this way.

He also frets about the mess central banks have got themselves into, but believes in the long term, equities will continue to deliver the 5-6% real that they always have. But he believes the time is now ripe for value and that the few true value investors left – those who have not given up the faith and veered off into quality investing – will have a field day.

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-image-box .elementor-image-box-content{width:100%}@media (min-width:768px){.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper,.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{display:-webkit-box;display:-ms-flexbox;display:flex}.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{text-align:right;-webkit-box-orient:horizontal;-webkit-box-direction:reverse;-ms-flex-direction:row-reverse;flex-direction:row-reverse}.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper{text-align:left;-webkit-box-orient:horizontal;-webkit-box-direction:normal;-ms-flex-direction:row;flex-direction:row}.elementor-widget-image-box.elementor-position-top .elementor-image-box-img{margin:auto}.elementor-widget-image-box.elementor-vertical-align-top .elementor-image-box-wrapper{-webkit-box-align:start;-ms-flex-align:start;align-items:flex-start}.elementor-widget-image-box.elementor-vertical-align-middle .elementor-image-box-wrapper{-webkit-box-align:center;-ms-flex-align:center;align-items:center}.elementor-widget-image-box.elementor-vertical-align-bottom .elementor-image-box-wrapper{-webkit-box-align:end;-ms-flex-align:end;align-items:flex-end}}@media (max-width:767px){.elementor-widget-image-box .elementor-image-box-img{margin-left:auto!important;margin-right:auto!important;margin-bottom:15px}}.elementor-widget-image-box .elementor-image-box-img{display:inline-block}.elementor-widget-image-box .elementor-image-box-title a{color:inherit}.elementor-widget-image-box .elementor-image-box-wrapper{text-align:center}.elementor-widget-image-box .elementor-image-box-description{margin:0} GETTING INTO INVESTING

GETTING INTO INVESTINGRichard's father was a stockbroker and did not encourage him to follow in his path, but he had a real interest and used to read the share prices in the newspaper from a young age. In the podcast he tells the story of his first investment, in Britannia Arrow. He made money as the stock was shunned through its association with the failed Slater Walker, even though the company was perfectly solid.Picture: Jim Walker. Source: The Guardian

On Index FundsRichard has a rather jaundiced view of index funds. He describes participation as hanging on to the coat-tails of a lunatic, as the weighting is increased in what has already gone up. The practice of index revisions is to eliminate stocks which have gone down and increase participation in what has already gone up, which he describes as exactly the opposite of what you should be doing.

In his book, he describes the revisions to the FTSE 100 Index at the peak of the tech boom. Of course, the companies aded all had stratosperic valuations or were loss-making and the companies which were ejected from the index were old economy deep value stocks. The table shows the additions and deletions and the subsequent 3 month performance.

A DittyIn Richard’s book, below, there is a wonderful ditty on the merits of Russia and China.

Was China finer?

It appeared,

We feared,

When the dollars were counted,

The odds had mounted

The convincing prospect

Of the growth we expect

Was Russia lusher?

On how much imputing

To President Putin

Of a dubious motive

To increase his vote if,

As part of his prospectus,

He was seen by elector

To come out strong

When things done were wrong.

Too much faith in Khodorkhovsky

Could quite frankly be sort of costly.

Simple, but not easy

Richard published the original book in 2007 and Harriman reissued an updated edition in 2021. He always enjoyed writing and having accumulated a lot of prejudices about investing over the years, wanted to give vent to his thoughts. He also thought that most of the investment books were not very approachable. The book is a common sense approach to investing and is aimed at those who want to maximise their long run returns.

Richard’s publisher (and mine), Harriman House, are offering the book at half price to podcast listeners this summer. Use the Code SBNE50.

ABOUT Richard Oldfield

ABOUT Richard Oldfield Richard founded Oldfield Partners LLP in 2004 and was chief executive until 2013, and chairman until 2022. He is now a partner, a non-executive director of the firm, and he contributes to the overall investment selection. Oldfield Partners is a value-style asset management firm with over $4bn in assets under management.

Richard was chief executive of Alta Advisers Ltd. from 1997 to March 2005. Before joining Alta in 1996 he was a director of Mercury Asset Management plc and head of the global team. He joined the S.G. Warburg & Co./Mercury group in 1977 on graduating from Oxford University.

Richard was Chairman of the Oxford University Investment Committee and of Oxford University Endowment from the latter’s inception in 2007 until 2014 and is Chairman of Shepherd Neame, a director of Witan Investment Trust plc and a trustee of Royal Marsden Cancer Charity and Canterbury Cathedral Trust.

Richard holds a BA Hons in History from Oxford University. His book about investing, ‘Simple but not easy’, was published in 2007.

BOOK RECOMMENDATION

Richard recommended two books, one by Ben Graham and one by Peter Cundill. I chose Intelligent Investor as I think it’s the more approachable book. There’s Always Something to Do by Cundill is available on Kindle.

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTS

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTSI didn’t know Richard, but bumped into him at the London Value Investor Conference. I explained how much I enjoyed his book and asked him on the podcast. He was keen to promote the second edition and to my delight, he agreed. I really enjoyed talking to him. This is one reason why I started the podcast – I get to meet people I would not otherwise, and I get to learn, which is my passion.

PrevSteve is interviewed by the leading Czech paperThe post Draft podcast appeared first on Behind The Balance Sheet.

July 11, 2022

Steve is interviewed by the leading Czech paper

The post Steve is interviewed by the leading Czech paper appeared first on Behind The Balance Sheet.

July 4, 2022

#12 – The Value Architect

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block} SUMMARY

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block} SUMMARYChris Pavese, President and CIO of Broyhill Asset Management, is a seriously thoughtful investor. We talk about how investing straddles left and right brain thinking, about whether the advantage of being located outside the bustling environment of a New York or London will continue to confer the same benefit in the days of Zoom, and about the benefits and joy of reading widely. Chris explains his investment philosophy, why he has fewer than 20 stocks in the portfolio, why the only research he buys is from a short seller, even though he doesn’t short, and we discuss the north-south divide in Europe and the US.

INTRODUCTION

Chris Pavese is the President and CIO of Broyhill Asset Management. In this podcast we explore what makes it distinctive, talk about Chris’ views on fashionable tech stocks (spoiler – they may have fallen a long way but Google and Facebook could easily see advertising revenues fall, as advertising is a cyclical business), and what lessons he learned from selling Microsoft and Apple too soon.

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-image-box .elementor-image-box-content{width:100%}@media (min-width:768px){.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper,.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{display:-webkit-box;display:-ms-flexbox;display:flex}.elementor-widget-image-box.elementor-position-right .elementor-image-box-wrapper{text-align:right;-webkit-box-orient:horizontal;-webkit-box-direction:reverse;-ms-flex-direction:row-reverse;flex-direction:row-reverse}.elementor-widget-image-box.elementor-position-left .elementor-image-box-wrapper{text-align:left;-webkit-box-orient:horizontal;-webkit-box-direction:normal;-ms-flex-direction:row;flex-direction:row}.elementor-widget-image-box.elementor-position-top .elementor-image-box-img{margin:auto}.elementor-widget-image-box.elementor-vertical-align-top .elementor-image-box-wrapper{-webkit-box-align:start;-ms-flex-align:start;align-items:flex-start}.elementor-widget-image-box.elementor-vertical-align-middle .elementor-image-box-wrapper{-webkit-box-align:center;-ms-flex-align:center;align-items:center}.elementor-widget-image-box.elementor-vertical-align-bottom .elementor-image-box-wrapper{-webkit-box-align:end;-ms-flex-align:end;align-items:flex-end}}@media (max-width:767px){.elementor-widget-image-box .elementor-image-box-img{margin-left:auto!important;margin-right:auto!important;margin-bottom:15px}}.elementor-widget-image-box .elementor-image-box-img{display:inline-block}.elementor-widget-image-box .elementor-image-box-title a{color:inherit}.elementor-widget-image-box .elementor-image-box-wrapper{text-align:center}.elementor-widget-image-box .elementor-image-box-description{margin:0} GETTING INTO INVESTING

GETTING INTO INVESTINGChris started to train as an architect but investing turned out to be a more attractive and quicker option as he explains in the podcast. And he joined Broyhill at quite an early age, but he certainly seems to be enjoying it.

FINDING VALUEChris runs a highly concentrated portfolio – less than 10 stocks is too concentrated; while more than 20 is too diversified. This is unusual for a professional investor but he feels that knowing what he owns is critical and he has the advantage of having family office quasi permanent capital. Because of the long term nature of his strategy, he will run heavy cash positions, as high as 40%, at times, if he cannot find enough stocks to meet his value criteria.

BROYHILL APPROACHChris discusses the idea that unanimity in the team is not necessarily the best route to performance. In one team he knows with four portfolio managers, they all discussed every idea, with one person leading. The decision was not however a team decision and they found that the most successful ideas were those where there was the most dissent. It was the controversy that created the opportunity. Accordingly, he is the ultimate decision maker at Broyhill.

ABOUT ChrisChris Pavese is the President and CIO of Broyhill Asset Management, a boutique investment firm established as a family office in 1980. Chris trained as an architect and then switched to finance and had two jobs before Broyhill. He first was an associate, then joined JP Morgan Asset Management where he spent five years as a PM, before being recruited by the Broyhill family to manage their family office at quite a young age.

The firm was established as a family office and is guided by a value orientation. Chris believes the detachment of being located in the Blue Ridge Mountains confers an advantage.

Source: Broyhill Asset Management

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#2c2c2c;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:-webkit-box;display:-ms-flexbox;display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);-ms-flex-negative:0;flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:-webkit-box;display:-ms-flexbox;display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{-webkit-box-align:center;-ms-flex-align:center;align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;-webkit-box-flex:1;-ms-flex-positive:1;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl} BOOK RECOMMENDATIONSAlthough he never used to be much of a reader, and really only started when he was in the middle of his career, Chris set up the Broyhill Book Club and is making up for lost time. He gave an extensive list of recommendations.

For an example of creative thinking coupled with scientific process, he enjoyed Leonardo da Vinci by Walter Isaacson.

He recommends anything by Richard Feynman for his knowledge and humour. Surely you’re Joking Mr Feynman is one of Steve’s favourites. He puts E.O. Wilson in the same category.

He likes Daniel Kahneman’s Thinking Fast and Slow, Superforecasting by Stephen Tetlock and Thinking in Bets by Annie Duke, again all favourites of Steve’s.

Seeking Wisdom by Peter Bevelin and his A Few Lessons from Sherlock Holmes as well as the Sherlock Holmes books are all recommended.

On financial history, Chris recommends Extraordinary Popular Delusions and the Madness of Crowds by Charles Mackay and Manias, Panics, and Crashes: A History of Financial Crises by Charles P. Kindleberger.

In that genre he also likes Edward Chancellor’s Devil Take the Hindmost.

By the same author, he thinks Capital Account and Capital Returns are great analogues for the related periods of the 1990s and early 2000s. These are two of Steve’s favourites also.

Buy on amazon.com Buy on amazon.co.uk Buy on amazon.com Buy on amazon.co.UK

HOW STEVE KNOWS THE GUESTS

HOW STEVE KNOWS THE GUESTSSteve first became aware of Broyhill thorugh the book club and then through various research notes. Chris is the first American investor on the show, and Steve had been looking to broaden the list beyond UK shores. He reached out to Chris and they managed to get a date together. It’s one of the most fun elements of doing the podcast – you can contact someone you don’t know and spend an hour learnings from them and then share that with the audience.

Prev#11 – The InvestigatorThe post #12 – The Value Architect appeared first on Behind The Balance Sheet.

June 15, 2022

#11 – The Investigator

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block}

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block} Dan McCrum is the award winning FT journalist who exposed Wirecard as a fraud. Once a stockmarket darling valued at over €25bn, Wirecard crashed to worthless in June 2020, when its auditors could not confirm €1.9bn of cash. Dan pursued the story for six years and has now written a book about the saga. “Money Men” is an amazing account of how the company used every tactic possible to disguise its activities. This is an extraordinary tale and Dan, a brilliant raconteur, explains the highs and lows of his struggle to reveal the truth. We also speak to market participants on the buy and sell side to get their perspective.

SUMMARYOrdinarily, we summarise the conversation, but other than the usual introduction to Dan’s career, this episode has one subject, the saga of how Dan uncovered the fraud and how he and the FT kept their nerve. Dan’s colleagues, his immediate boss Paul Murphy and editor Lionel Barber, deserve praise for their support, especially Barber who is a brilliant journalist and was prepared to take on the German establishment.

We also wanted to put Dan’s work into perspective so we talked to:

Mark Hiley, founder of The Analyst, a research boutique which published over 40 sell notes on Wirecard over a similar 6 year period andFreddy Brick, a partner at Muddy Waters, who explained the perspective of a short seller and who recounts the story of how Wirecard tried to bribe Carson Block.This is the story of a lifetime for most journalists but Dan is pretty ambitious and looking forward to his next big coup, which he suspects may lie in the crypto space. If you want to blow the whistle, you can contact him at danmccrum@ft.com. Tell him we sent you.

ABOUT DANDan McCrum is a multi-award winning journalist and author. His reporting for the Financial Times has been recognised with prizes from the London Press Club, the Society of Editors, the New York Financial Writers’ Association, the Overseas Press Club and the Gerald Loeb awards. He was also awarded the Ludwig Erhard Prize for economic journalism, a Reporters Forum Reporterpreis and a special award by the Helmut Schmidt prize jury for investigative journalism. In 2020, he was named Journalist of the Year at the British Journalism Awards.

Dan is part of the FT’s investigations team. He is a former editor of FT Alphaville, and his work includes helping to expose accounting problems at Wirecard, a German payments group; the listed law firms Quindell and Slater & Gordon; Globo, a UK software provider; and Folli Follie, a Greek company which invented €1bn of sales. In more than a decade at the FT he’s also been Capital Markets Editor, worked as the FT’s Investment Correspondent in New York, and had stints writing for the Lex Column.

Before that Dan worked briefly at the Investors Chronicle, and has at one point or another carried furniture, sold kids books on doorsteps, and painted but not really decorated.

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#2c2c2c;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:-webkit-box;display:-ms-flexbox;display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);-ms-flex-negative:0;flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:-webkit-box;display:-ms-flexbox;display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{-webkit-box-align:center;-ms-flex-align:center;align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;-webkit-box-flex:1;-ms-flex-positive:1;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl} BOOK RECOMMENDATION

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#2c2c2c;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:-webkit-box;display:-ms-flexbox;display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);-ms-flex-negative:0;flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:-webkit-box;display:-ms-flexbox;display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{-webkit-box-align:center;-ms-flex-align:center;align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;-webkit-box-flex:1;-ms-flex-positive:1;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl} BOOK RECOMMENDATION  Buy on amazon.com Buy on amazon.co.UK

Buy on amazon.com Buy on amazon.co.UK For this podcast, there can obviously only be one book recommendation. “Money Men” is set to be a classic, like Bethany McLean’s “The Smartest Guys in the Room” which recounted the Enron scandal. I really enjoyed the book and it’s more of a thriller than anything else. Dan is a brilliant raconteur, and he brings the characters to life by painting intimate details of their personas, and giving incredible detail on their surroundings, friendships and similar facets of their personal lives. And one of the principal protagonists, Jan Marsalek, is really a larger than life character, with connections to the underworld and the Russian security services. You feel you really start to know these characters and although you know the ending – spoiler, the good guy wins and the bad guys get caught – you get caught up in the excitement and the highs and lows of the chase.

McCrum was followed, he was scared his house was under surveillance, the FT’s offices were targeted with long range listening devices, and Dan was hacked multiple times. When he met with a whistleblower in Singapore, the documents he was given were kept in an isolated machine, well away from the FT network and even the internet. Much of Dan’s work was conducted in a safe room which had no external connections – this is more MI5 than finance.

Dan was originally given the tipoff about Wirecard by famed short seller John Hempton, an Australian hedge fund manager who is one of the world’s top experts on spotting frauds. He asked Dan if he would like to hear about some “German gangsters”. This was 2014 and it set Dan off on a journey which would change his life.

Wirecard purported to be a hot new German tech company, the sort every European fund manager, unable to invest in Silicon Valley, longed for. To Dan, and to many short sellers, everything about Wirecard looked a little too good. It was reporting fantastic growth, but there was little evidence of happy customers; small Asian acquisitions made no sense; and the company responded to critics in an unusual and defensive fashion. When Dan interviewed CEO Markus Braun, he was evasive and didn’t answer questions. When accused of fraud, he responded defensively rather than being shocked and outraged. Dan suspected all was not as it seemed.

Source: Behind the Balance Sheet from Sentieo Data

He followed the company over a period of several years and kept in touch with various short sellers but the stock price went from strength to strength. In 2017, the German regulator BaFin cleared Wirecard of wrongdoing and recommended a criminal investigation into market manipulation of the Wirecard stock price by short sellers and the FT, naming Dan and a colleague. McCrum became the victim. This was one of the lows.

His big breakthrough came when a Sikh lawyer’s mother contacted him – he found a whistle blower in Singapore. This gave him enough evidence to prove there had been a fraud in Asia and that the company was complicit in the cover-up. The FT published the story but the company continued to shrug off the criticism and the amounts involved were small in the context of the market capitalisation and investors accepted the company’s explanation that this was a minor local incident.

The plot continues, with a sting operation conducted in London to frame the FT for insider dealing, an offer of a bribe to Paul Murphy, Dan’s boss, over lunch. Under pressure, the company appointed KPMG to conduct an investigation into the internal frauds and the book traces the denouement as the journalist team and markets await the result of the EY 2019 audit. The account of the auditor’s efforts to track down €1.9bn in the Philippines is quite hilarious.

This is a great story and it’s well told. I loved some of the lines. One of my favourites was an account of a trip to Bahrain; in the Intercontinental Bar where the journalists hang out, he says “the two other people there may have been at the heart of international intrigue but they were focused on murdering Beyonce’s legacy through karaoke”.

Buy the book on Amazon.co.uk or Amazon.com (affiliate link, proceeds go to the FT FLIC charity).

/*! elementor-pro - v3.7.1 - 16-05-2022 */@charset "UTF-8";.entry-content blockquote.elementor-blockquote:not(.alignright):not(.alignleft),.entry-summary blockquote.elementor-blockquote{margin-right:0;margin-left:0}.elementor-widget-blockquote blockquote{margin:0;padding:0;outline:0;font-size:100%;vertical-align:baseline;background:transparent;quotes:none;border:0;font-style:normal;color:#55595c}.elementor-widget-blockquote blockquote:after,.elementor-widget-blockquote blockquote:before,.elementor-widget-blockquote blockquote cite:after,.elementor-widget-blockquote blockquote cite:before,.elementor-widget-blockquote blockquote footer:after,.elementor-widget-blockquote blockquote footer:before{content:"";content:none}.elementor-blockquote{-webkit-transition:.3s;-o-transition:.3s;transition:.3s}.elementor-blockquote__author,.elementor-blockquote__content{margin-bottom:0;font-style:normal}.elementor-blockquote__author{font-weight:700}.elementor-blockquote footer{margin-top:12px;display:-webkit-box;display:-ms-flexbox;display:flex;-webkit-box-pack:justify;-ms-flex-pack:justify;justify-content:space-between}.elementor-blockquote__tweet-button{display:-webkit-box;display:-ms-flexbox;display:flex;-webkit-transition:.3s;-o-transition:.3s;transition:.3s;color:#1da1f2;-ms-flex-item-align:end;align-self:flex-end;line-height:1;position:relative;width:-webkit-max-content;width:-moz-max-content;width:max-content}.elementor-blockquote__tweet-button:hover{color:#0967a0}.elementor-blockquote__tweet-button span{font-weight:600}.elementor-blockquote__tweet-button i,.elementor-blockquote__tweet-button span{vertical-align:middle}.elementor-blockquote__tweet-button i+span,.elementor-blockquote__tweet-button svg+span{margin-left:.5em}.elementor-blockquote__tweet-button svg{fill:#1da1f2;height:1em;width:1em}.elementor-blockquote__tweet-label{white-space:pre-wrap}.elementor-blockquote--button-skin-bubble .elementor-blockquote__tweet-button,.elementor-blockquote--button-skin-classic .elementor-blockquote__tweet-button{padding:.7em 1.2em;border-radius:100em;background-color:#1da1f2;color:#fff;font-size:15px}.elementor-blockquote--button-skin-bubble .elementor-blockquote__tweet-button:hover,.elementor-blockquote--button-skin-classic .elementor-blockquote__tweet-button:hover{background-color:#0967a0;color:#fff}.elementor-blockquote--button-skin-bubble .elementor-blockquote__tweet-button:hover:before,.elementor-blockquote--button-skin-classic .elementor-blockquote__tweet-button:hover:before{border-right-color:#0967a0}.elementor-blockquote--button-skin-bubble .elementor-blockquote__tweet-button svg,.elementor-blockquote--button-skin-classic .elementor-blockquote__tweet-button svg{fill:#fff;height:1em;width:1em}.elementor-blockquote--button-skin-bubble.elementor-blockquote--button-view-icon .elementor-blockquote__tweet-button,.elementor-blockquote--button-skin-classic.elementor-blockquote--button-view-icon .elementor-blockquote__tweet-button{padding:0;width:2em;height:2em}.elementor-blockquote--button-skin-bubble.elementor-blockquote--button-view-icon .elementor-blockquote__tweet-button i,.elementor-blockquote--button-skin-classic.elementor-blockquote--button-view-icon .elementor-blockquote__tweet-button i{position:absolute;left:50%;top:50%;-webkit-transform:translate(-50%,-50%);-ms-transform:translate(-50%,-50%);transform:translate(-50%,-50%)}.elementor-blockquote--button-skin-bubble .elementor-blockquote__tweet-button:before{content:"";border:.5em solid transparent;border-right-color:#1da1f2;position:absolute;left:-.8em;top:50%;-webkit-transform:translateY(-50%) scaleY(.65);-ms-transform:translateY(-50%) scaleY(.65);transform:translateY(-50%) scaleY(.65);-webkit-transition:.3s;-o-transition:.3s;transition:.3s}.elementor-blockquote--button-skin-bubble.elementor-blockquote--align-left .elementor-blockquote__tweet-button:before{right:auto;left:-.8em;border-right-color:#1da1f2;border-left-color:transparent}.elementor-blockquote--button-skin-bubble.elementor-blockquote--align-left .elementor-blockquote__tweet-button:hover:before{border-right-color:#0967a0}.elementor-blockquote--button-skin-bubble.elementor-blockquote--align-right .elementor-blockquote__tweet-button:before{left:auto;right:-.8em;border-right-color:transparent;border-left-color:#1da1f2}.elementor-blockquote--button-skin-bubble.elementor-blockquote--align-right .elementor-blockquote__tweet-button:hover:before{border-left-color:#0967a0}.elementor-blockquote--skin-boxed .elementor-blockquote{background-color:#e6e9ec;padding:30px}.elementor-blockquote--skin-border .elementor-blockquote{border-color:#e6e9ec;border-left:7px #e6e9ec;border-style:solid;padding-left:20px}.elementor-blockquote--skin-quotation .elementor-blockquote:before{content:"“";font-size:100px;color:#e6e9ec;font-family:Times New Roman,Times,serif;font-weight:900;line-height:1;display:block;height:.6em}.elementor-blockquote--skin-quotation .elementor-blockquote__content{margin-top:15px}.elementor-blockquote--align-left .elementor-blockquote__content{text-align:left}.elementor-blockquote--align-left .elementor-blockquote footer{-webkit-box-orient:horizontal;-webkit-box-direction:normal;-ms-flex-direction:row;flex-direction:row}.elementor-blockquote--align-right .elementor-blockquote__content{text-align:right}.elementor-blockquote--align-right .elementor-blockquote footer{-webkit-box-orient:horizontal;-webkit-box-direction:reverse;-ms-flex-direction:row-reverse;flex-direction:row-reverse}.elementor-blockquote--align-center .elementor-blockquote{text-align:center}.elementor-blockquote--align-center .elementor-blockquote__author,.elementor-blockquote--align-center .elementor-blockquote footer{display:block}.elementor-blockquote--align-center .elementor-blockquote__tweet-button{margin-right:auto;margin-left:auto}HOW STEVE KNOWS THE GUESTS“It’s a fantastic book. Think of Dan as a bespectacled James Bond with a keyboard instead of a gun.”

We met at a fundraising dinner for the FT charity, FLIC. Dan was the guest speaker and I made a short speech explaining why I am supporting the charity. Given my interest in forensic accounting and the amazing job which Dan had done on Wirecard, it was natural to ask and Dan kindly agreed to come on. What I hadn’t realised was that he is an amazing raconteur and we could have done with a lot more time, but perhaps we shall get him back.

Prev#10 – Mr BRICsThe post #11 – The Investigator appeared first on Behind The Balance Sheet.

#11- Dan Mccrum

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block}

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block} Dan McCrum is the award winning FT journalist who exposed Wirecard as a fraud. Once a stockmarket darling valued at over €25bn, Wirecard crashed to worthless in June 2020, when its auditors could not confirm €1.9bn of cash. Dan pursued the story for six years and has now written a book about the saga. “Money Men” is an amazing account of how the company used every tactic possible to disguise its activities. This is an extraordinary tale and Dan, a brilliant raconteur, explains the highs and lows of his struggle to reveal the truth. We also speak to market participants on the buy and sell side to get their perspective.

SUMMARYOrdinarily, we summarise the conversation, but other than the usual introduction to Dan’s career, this episode has one subject, the saga of how Dan uncovered the fraud and how he and the FT kept their nerve. Dan’s colleagues, his immediate boss Paul Murphy and editor Lionel Barber, deserve praise for their support, especially Barber who is a brilliant journalist and was prepared to take on the German establishment.

We also wanted to put Dan’s work into perspective so we talked to:

Mark Hiley, founder of The Analyst, a research boutique which published over 40 sell notes on Wirecard over a similar 6 year period andFreddy Brick, a partner at Muddy Waters, who explained the perspective of a short seller and who recounts the story of how Wirecard tried to bribe Carson Block.This is the story of a lifetime for most journalists but Dan is pretty ambitious and looking forward to his next big coup, which he suspects may lie in the crypto space. If you want to blow the whistle, you can contact him at danmccrum@ft.com. Tell him we sent you.

ABOUT DANDan McCrum is a multi-award winning journalist and author. His reporting for the Financial Times has been recognised with prizes from the London Press Club, the Society of Editors, the New York Financial Writers’ Association, the Overseas Press Club and the Gerald Loeb awards. He was also awarded the Ludwig Erhard Prize for economic journalism, a Reporters Forum Reporterpreis and a special award by the Helmut Schmidt prize jury for investigative journalism. In 2020, he was named Journalist of the Year at the British Journalism Awards.

Dan is part of the FT’s investigations team. He is a former editor of FT Alphaville, and his work includes helping to expose accounting problems at Wirecard, a German payments group; the listed law firms Quindell and Slater & Gordon; Globo, a UK software provider; and Folli Follie, a Greek company which invented €1bn of sales. In more than a decade at the FT he’s also been Capital Markets Editor, worked as the FT’s Investment Correspondent in New York, and had stints writing for the Lex Column.

Before that Dan worked briefly at the Investors Chronicle, and has at one point or another carried furniture, sold kids books on doorsteps, and painted but not really decorated.

Dan got a taste for newsprint as a paper boy in North Devon. Before he became a writer he tried his hand at painting and decorating, selling kids books door to door, and he also spent four years loitering in Citigroup’s equity research department where he picked up a few ideas about the value of luck, timing and a catchy pitch.

/*! elementor - v3.6.6 - 08-06-2022 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#2c2c2c;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:-webkit-box;display:-ms-flexbox;display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);-ms-flex-negative:0;flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:-webkit-box;display:-ms-flexbox;display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{-webkit-box-align:center;-ms-flex-align:center;align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-bottom:0;-webkit-box-flex:1;-ms-flex-positive:1;flex-grow:1;border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{-webkit-box-flex:0;-ms-flex-positive:0;flex-grow:0;-ms-flex-negative:100;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-top:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl} BOOK RECOMMENDATION Buy on amazon.com Buy on amazon.co.UK

Buy on amazon.com Buy on amazon.co.UK For this podcast, there can obviously only be one book recommendation. “Money Men” is set to be a classic, like Bethany McLean’s “The Smartest Guys in the Room” which recounted the Enron scandal. I really enjoyed the book and it’s more of a thriller than anything else. Dan is a brilliant raconteur, and he brings the characters to life by painting intimate details of their personas, and giving incredible detail on their surroundings, friendships and similar facets of their personal lives. And one of the principal protagonists, Jan Marsalek, is really a larger than life character, with connections to the underworld and the Russian security services. You feel you really start to know these characters and although you know the ending – spoiler, the good guy wins and the bad guys get caught – you get caught up in the excitement and the highs and lows of the chase.

McCrum was followed, he was scared his house was under surveillance, the FT’s offices were targeted with long range listening devices, and Dan was hacked multiple times. When he met with a whistleblower in Singapore, the documents he was given were kept in an isolated machine, well away from the FT network and even the internet. Much of Dan’s work was conducted in a safe room which had no external connections – this is more MI5 than finance.

Dan was originally given the tipoff about Wirecard by famed short seller John Hempton, an Australian hedge fund manager who is one of the world’s top experts on spotting frauds. He asked Dan if he would like to hear about some “German gangsters”. This was 2014 and it set Dan off on a journey which would change his life.

Wirecard purported to be a hot new German tech company, the sort every European fund manager, unable to invest in Silicon Valley, longed for. To Dan, and to many short sellers, everything about Wirecard looked a little too good. It was reporting fantastic growth, but there was little evidence of happy customers; small Asian acquisitions made no sense; and the company responded to critics in an unusual and defensive fashion. When Dan interviewed CEO Markus Braun, he was evasive and didn’t answer questions. When accused of fraud, he responded defensively rather than being shocked and outraged. Dan suspected all was not as it seemed.

Source: Behind the Balance Sheet from Sentieo Data

He followed the company over a period of several years and kept in touch with various short sellers but the stock price went from strength to strength. In 2017, the German regulator BaFin cleared Wirecard of wrongdoing and recommended a criminal investigation into market manipulation of the Wirecard stock price by short sellers and the FT, naming Dan and a colleague. McCrum became the victim. This was one of the lows.

His big breakthrough came when a Sikh lawyer’s mother contacted him – he found a whistle blower in Singapore. This gave him enough evidence to prove there had been a fraud in Asia and that the company was complicit in the cover-up. The FT published the story but the company continued to shrug off the criticism and the amounts involved were small in the context of the market capitalisation and investors accepted the company’s explanation that this was a minor local incident.

The plot continues, with a sting operation conducted in London to frame the FT for insider dealing, an offer of a bribe to Paul Murphy, Dan’s boss, over lunch. Under pressure, the company appointed KPMG to conduct an investigation into the internal frauds and the book traces the denouement as the journalist team and markets await the result of the EY 2019 audit. The account of the auditor’s efforts to track down €1.9bn in the Philippines is quite hilarious.

This is a great story and it’s well told. I loved some of the lines. One of my favourites was an account of a trip to Bahrain; in the Intercontinental Bar where the journalists hang out, he says “the two other people there may have been at the heart of international intrigue but they were focused on murdering Beyonce’s legacy through karaoke”.

Buy the book on Amazon.co.uk or Amazon.com (affiliate link, proceeds go to the FT FLIC charity).