Stephen Clapham's Blog, page 14

March 8, 2022

#4 – The Not Quite Trillion Dollar Man

Until 2015, Quintin Price was Global Head of BlackRock’s Alpha Strategies business where he was responsible for nearly $1 trillion of assets under management and was a member of the Global Executive Committee, working closely with Larry Fink. Quintin has 30 years of experience in financial markets and is exactly the sort of guest we seek to have on the podcast – a wealth of experience, retired from day to day fund management, and not afraid to speak out, as you will hear.

SUMMARYIn this interview, a rarity for Price, he talks about his snakes and ladders route to success, why doing the work is an integral part of his approach, and how putting clients first is the key to success in any business. Putting yourself in the client’s shoes not only ensures that you are delivering the right product, it also removes any possible temptation for ethical conflict.

INTRODUCTIONQuintin Price was born in Saigon, grew up in India and, for the past twenty years has worked at the very top of the financial services industry. He currently advises a variety of public and private companies. Until 2015, he was Global Head of BlackRock’s Alpha Strategies business where he was responsible for nearly $1 trillion of AUM. Quintin’s wealth of experience at the highest level of the asset management industry and his willingness to speak out made this an insightful episode.

GETTING INTO INVESTING

GETTING INTO INVESTINGQuintin did not originally start as an equity analyst but he explains how he made his mark as a sell-side analyst at James Capel, when he exposed the lack of earnings and cash flow at Robert Maxwell’s quoted vehicle.

Source: The Guardian

BLACKROCK

BLACKROCKQuintin reached the Global Executive Committee of Blackrock, one of the world’s largest asset managers. Some saw him in the running for the role of Fink’s successor as CEO.

HOW TO SUCCEED IN ASSET MANAGEMENTTo be successful in asset management, you need flair and effort – these are the keys to success and you need a sense of engagement and energy, you need to be deeply interested in what you are doing.

He worked closely with Larry Fink for 10 years. Recently, Blackrock overtook Goldman, Sachs in capitalisation. He was very patient, he upgraded people progressively. But he also worked incredibly hard and his command of the details of my business (45% of Blackrock’s revenues) were greater than mine.

Learn what he thinks of Larry Fink, after watching him for 10 years at close quarters.

WHAT MAKES A GREAT PM?Talent comes in all sorts of diverse shapes and sizes. Great investors have extraordinary clarity of thought; are not proud about reversing their decisions; and understand what process works for them. Blackrock did not seek to impose a top down style – Quintin believes that everyone has their own approach and that will be what works for them.

HELPING OTHERSOn Reggie Nelson, the council house kid whom Quintin and his wife Elizabeth helped and guided to a job in asset management, who was featured on the BBC – Reggie was just trying to work out “how do I end up in a big house in Kensington?”

ABOUT QUINTIN PRICEQuintin has had a varied career in finance, notably at Blackrock as a member of the Global Executive Committee, responsible for nearly $1 trillion in assets under management covering all active (fundamental & quantitative) equity strategies globally, as well as fixed income. He began his career as a credit analyst followed by four years in derivatives research & trading and subsequently in equity research. He then joined James Capel & Co. as an analyst, becoming Global Head of Research before moving to asset management in a similar role at Puttnam, moving to Gartmore and then to Blackrock. Quintin is a graduate of Bristol University in Economic & Social History and the author of “Warrants, Options & Convertibles”.

BOOK RECOMMENDATIONS

BOOK RECOMMENDATIONSQuintin recommended two books: The Will to Lead by Marvin Bower and Winning by Jack Welch.

Buy on amazon.com Buy on amazon.co.UK

Buy on amazon.com Buy on amazon.co.UK  Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTS

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTSQuintin’s wife, Elizabeth, used to be a fund manager and was one of Steve’s favourite clients. He visited them on a business trip to Boston – Elizabeth kindly gave him a bed for the night when every hotel room for miles around was booked up for the biggest baseball game of the season – and they have stayed in touch since. It was Elizabeth who invited Reggie in for a cup of tea and changed his life – a wonderful story which Quintin explains in the podcast; a video of Reggie is below. Quintin kindly reviewed Steve’s book, and has always been available to give Steve advice, as has Elizabeth, who is an executive coach. Thank you both!

Prev#3 – Two UK Venture Leaders #5 – Lucy Macdonald The PianistNextThe post #4 – The Not Quite Trillion Dollar Man appeared first on Behind The Balance Sheet.

#3 – Two UK Venture Leaders

Pete Davies has long been one of the best and deepest long term thinkers in the hedge fund world. He was early to recognise the opportunities to provide venture capital to UK academia and his firm, Lansdowne Partners, was instrumental in setting up Oxford Science Innovation.

Spencer Crawley is the co-founder of FirstMinute Capital, a UK seed investor which boasts 111 unicorn founders as investors.

In this interview we discuss the UK venture scene, why early stage investing is truly a long term activity, and how this cycle compares to the late 1990s tech boom.

SUMMARYIn this fascinating interview, Pete Davies of Lansdowne Partners and Spencer Crawley of First Minute Capital discuss the UK venture scene, look at why academia is such a fertile source of innovation, discuss how venture networks operate and look at how today compares with the 1990s tech boom.

INTRODUCTIONI have known Pete since he started in the stockmarket, and I was amazed back then at how he could solve problems from first principles through sheer brainpower when even with my longer experience, I struggled to keep up. Nothing has changed in the intervening 25-odd years – every time I meet Pete, I come away mulling over some of his insights for days afterward.

Spencer is the co-founder with Brent Hoberman of First Minute Capital, a seed venture firm, and his explanation of his role and the operation of his firm was fascinating. The pace of technological change is increasing, so this is an aarea every investor, even those focused on quoted stocks, need to understand better. Spencer did a great job in making it accessible.

GETTING INTO INVESTINGPete started at Mercury Asset Management, attracted by the idea that performance was independently measured and by the constant need to be current. He didn’t consider many other roles. Spencer started at Goldman Sachs, then joined a spinout fund before setting up FirstMinute Capital with Brent.

THE VALUE OF NETWORKS AS A VCNetworks are extremely valuable in venture capital. At a time when capital is plentiful, great founders can often choose their backers. FirstMinute benefits from its 111 unicorn founders as investors and from its relationship with Founders Factory, another of Brent Hoberman’s investments. The Lansdowne team benefit from Pete Davies’ long record of involvement in early stage investing and Pete cites two criteria – curiosity and trust – as being critical. Curiosity is important as it has led him to many discussions and opportunities; and trust, because he is conscious that these long term relationships are valuable and founders can trust him to give sensible advice and not to abuse the relationship.

JUDGING FOUNDERS AND MANAGERSSpencer recognises this is the key skill of the early stage seed investor and places great emphasis on authenticity – can they attract similar talent to help them realise their ambitions. They often look at new opportunities with a “prepared mind” where they have already formed a view on a space and have decided the criteria necessary for success. Pete doesn’t like judging managers which is why he leaves the seed decision to others and invests in companies that are usually 3 or more years old.

ABOUT PETER DAVIESPeter joined Lansdowne Partners in June 2001 and is Head of the Developed Markets Strategy. Prior to joining Lansdowne, Peter was a Director at Merrill Lynch Investment Managers, previously Mercury Asset Management, which he joined as a graduate in 1993. He is a non-executive director of Oxford Sciences Enterprise plc, a company that invests in, develops and advises spin-out companies established to exploit and commercialise intellectual property developed by Oxford University. Lansdowne funds also hold shares in the company. He has a first class honours degree in Philosophy, Politics and Economics from Oxford University.

ABOUT SPENCER CRAWLEY

ABOUT SPENCER CRAWLEYSpencer Crawley is co-founder & General Partner of firstminute capital. The fund currently has $210m AUM, a team of 18, and invests at the seed-stage across technology sectors, focused on Europe and the US. He sits on the board of Generation Home, a UK digital mortgage lender launched in October 2020, and Frontier, a US-based platform connecting work-at-home jobseekers with employment opportunities. Crawley co-founded firstminute with Brent Hoberman CBE.

He started his career at Goldman Sachs in Moscow in the Fixed Income, Currencies and Commodities division, before becoming the first hire at DMC Partners, a Special Opportunities fund spun out of Goldman Sachs. This was followed by an MBA at INSEAD, and a stint at AppDirect, the cloud commerce platform-provider. Spencer studied History at Exeter College, Oxford, where he received the Waugh scholarship, and speaks fluent Russian.

BOOK RECOMMENDATIONS Spencer recommends

Spencer recommendsBad Blood, the story of Elizabeth Holmes and Theranos, by John Carreyrou. Steve echoes this, which is one of his favourite business books – it reads like a novel and has so many lessons of warning signals to watch out for.

Buy on amazon.com Buy on amazon.co.UK Pete recommends

Pete recommendslooking back at a period in history you haven’t explored or experienced, for example more inflationary times and recommends Peter Lynch’s One Up on Wall Street.

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTSSteve has known Pete Davies since he started at Mercury Asset Management and Pete, with Stuart Roden, was Steve’s nr 1 client on the sellside for many years. Steve is an investor in Lansdowne’s funds and Lansdowne is a long term client of Behind the Balance Sheet. Steve met Spencer through Jamie Macfarlane, CEO of the Creator Fund, where Steve is invested alongside them.

Prev#2 – The Risk Taker: Stuart Roden discusses his investment philosophy. #4 – The Not Quite Trillion Dollar ManNextThe post #3 – Two UK Venture Leaders appeared first on Behind The Balance Sheet.

#2 – The Risk Taker: Stuart Roden discusses his investment philosophy.

Stuart Roden achieved spectacular success in managing money, yet he is an incredibly modest and humble guy. If you met him, you probably would have no idea how successful he has been. This interview for me was packed full of wisdom and great advice. I hope you enjoy it and learn a lot – I certainly did.

SUMMARYIn this fascinating interview, Stuart Roden, former Chairman of Lansdowne Partners, explains the 5 keys to a successful fund, how his 25 year partnership with Pete Davies produced one of the most successful hedge funds in the UK and how now managing venture capital is a different, yet similar, game.

INTRODUCTIONI have known Stuart for over 25 years but I learned more in this hour about his philosophy than I had previously. He has that winning combination of a razor sharp intellect, a love of markets, a wealth of experience and a nose for a winning idea.

In this interview, we hear how he was tempted to fire a client, the 5 key factors to run a successful fund, why you are either an analyst or a portfolio manager, how handwriting can reveal whether you will be a good employee, and how he and Pete Davies ran an incredibly successful $10bn hedge fund. I know you will enjoy listening to this as much as I enjoyed recording it.

GETTING INTO INVESTING

GETTING INTO INVESTINGStuart has a love of gambling – he used to play a lot of poker at school and spent the summer at the racetrack.

FIRST SHARE

FIRST SHAREHe bought his first share age 13 – Acorn, the computer company. He has always been attracted to risk.

RUNNING A SUCCESSFUL HEDGE FUNDWhen he and Pete Davies started their hedge fund, they believed that the written communication to clients was extremely important, and they were always very clear about what was happening. Nobody likes surprises and clients really like unpleasant surprises, especially if there is thesis drift.

ANALYSTS ARE VERY DIFFERENT FROM PORTFOLIO MANAGERSAnalysts want binary answers. The skill of a great portfolio manager is taking on uncertainty and risk. It’s much easier to interview analysts – give them a difficult case study. With a PM, it’s an attitude, how they think about the world.

LIFE AFTER FUND MANAGEMENTBeing a good investor doesn’t equip you for anything else afterwards. And it can make you impatient and frustrated as there are few other endeavours where you can make things happen so quickly and then turn on a dime to pivot.

CONCLUSIONThis was a fascinating discussion with a huge amount of wisdom. I don’t think anyone could come away from this, no matter what their level of experience, without learning something. I know I learned a lot.

ABOUT STUARTUntil January 2019 Stuart was Chairman of Lansdowne Partners and Chairman of the Management Committee having previously co-managed the Developed Markets funds since their inception in 2001.

Stuart is non-Executive Chairman of Hetz Ventures and non-Executive Chairman of Tresidor Investment Management.

He is Chairman and Founder of UP: Unlocking Potential, a trustee of The National Gallery and The Centre for Social Justice and is a member of LSE Council.

Stuart started his career in the City in 1984, joining SG Warburg & Co, he worked at McKinsey and prior to joining Lansdowne in 2001, was a Managing Director of Merrill Lynch Investment Managers.

Stuart received a first-class honours degree in Economics (BSc) from the London School of Economics.

BOOK RECOMMENDATIONS

BOOK RECOMMENDATIONSThe Education of a Poker Player Ishi Press

And try to read investment letters – what are good investors buying and why? Some of Buffett’s letters, the greatest ones are in the past.

Buy on amazon.com Buy on amazon.co.UK HOW STEVE KNOWS THE GUESTS

HOW STEVE KNOWS THE GUESTSSteve has known Stuart since he was at Mercury Asset Management and was one of his top 5 clients when Steve was on the sell-side. When Stuart and Pete Davies moved to Lansdowne, they became Steve’s nr 1 client, and Lansdowne Partners was one of Steve’s first clients at Behind the Balance Sheet. Steve is also invested in some of Lansdowne’s funds.

Prev#1- Head to Head: John Armitage and Brent Hoberman discuss where quoted investing meets venture. #3 – Two UK Venture LeadersNextThe post #2 – The Risk Taker: Stuart Roden discusses his investment philosophy. appeared first on Behind The Balance Sheet.

Adjusted EBITDA – The Hut Group

The Hut Group’s share price has fallen by over 70% in recent weeks, following critical broker comment. My friends at influential research boutique The Analyst initially raised questions about the company and its valuation. More recently, Sky News revealed that a Numis salesman later sent an email to clients, also suggesting accounting irregularities. Numis, which helped float THG, also apparently cut its target price in half for the group. According to that article, the company apparently fell out with Numis at the time of or after the float; this is just one of a number of red flags which should have raised investor concern.

Source: Behind the Balance Sheet from Sentieo data

Part of the pitch by the Analyst apparently relates to the significant adjustments the company makes to its accountants’ standard earnings number (a £538.2m loss) to derive management’s preferred metric of adjusted EBITDA (quoted 29 times in the 2020 annual report) of £150.8m.

The definition of adjusted earnings numbers is one of those grey areas where company Finance Directors often disagree with my views. One of us has share options, but it’s only fair to point out that there are sometimes legitimate arguments on the other side. It’s easiest to think of the -£538.2m loss turning into a positive £150.8m in two stages – the real “GAAP” earnings number is a loss of £538m. First, the company makes £531m of adjustments (which we shall examine below) to derive an adjusted loss of -£7.1m.

Second, the difference between the -£7.1m of adjusted earnings/losses and the £150.8m of EBITDA represents the exclusion of tax, interest charges and depreciation and amortisation. All of these are costs, but investors (private equity in particular) often like to look at EBITDA-based metrics as they exclude the effects of different debt levels and tax treatments. This is preferred by private equity because they frequently load companies with debt and don’t pay any tax as a result; hence they are interested in a cash earnings measure, depreciation being a non-cash item.

Source: The Hut Group 2020 Accounts

In the company’s P&L, the £531.1m of adjustments are broken down into:

· tax impact of £3.8m being the additional tax levied on the £527m of pretax adjustments – the additional earnings being presented are largely not taxable, which might give an indication of their quality

· a credit to distribution costs of £55m

· a £472m credit to administration costs

ADJUSTED EBITDAIn the notes to the accounts, there is a useful breakdown as shown in the table, explaining adjusted EBITDA:

Source: The Hut Group 2020 Accounts

Note that the heavy use of adjusted EBITDA is a yellow flag and one which I highlight in my YouTube video Finance Demystified #2 – 7 Flaws with EBITDA which explains why EBITDA is over-used and can be dangerous to investors’ wealth.

The £48m of depreciation and the £57m of amortisation are “normal“ adjustments. The £332m of share-based payments (more on this below) and the £105m of impairments are similarly conventional adjustments employed by many public companies. The £90.6m is the most interesting number which we can investigate further. A more detailed explanation in note 4 to the accounts is more granular and therefore easier to analyse:

Adjustments to Reported Profit

Source: The Hut Group 2020 Accounts

My usual method of dealing with this is to review the elements line by line:

1) Transportation, delivery and fulfilment costs in relation to Covid-19 £39m. This is a logical addback for many companies as the costs of dealing with the pandemic were significant and presumably non-recurring. But generating an accurate picture of Covid-related costs is tricky and I would generally be sceptical.

The company explains that this relates to “specific and identifiable additional costs such as chartering THG exclusive flights, identified Covid surcharges as specified on invoices and identifiable external costs relating to the use of alternative routes”. In my view, it would be extremely tricky to assess how much of the cost was Covid and how much non-Covid. And while there were certainly additional costs, there was also a large uplift in Covid-related revenues. The conservative investor should therefore be sceptical about this adjustment.

2) Commissioning – new facilities £16m. I have followed logistics and transportation businesses for many years. The cost of commissioning new facilities is an ordinary part and parcel (sorry) of the business. This is especially true for a growth company valued at 6x sales last year. The company has identified non-recurring costs such as testing and commissioning, the costs of migrating operations, and bulk internal warehouse transfers.

I have moved office twice in just a few weeks (thanks WeWork), but I doubt my accountant will let me set off the costs of the moves as an exceptional item. The last logistics company which adjusted for these expenses went bust. In my view, these costs should not be an adjustment to reported earnings.

3) Decommissioning – legacy facilities £0.2m. It was larger the previous year and most companies would just take this on the chin. The accounts state “There is commonly a period of overlap of operations of both a legacy warehouse and the new facility designed to replace it, and duplicated costs are recorded as adjusted items as they do not reflect the underlying cost base of the Group. The costs associated with the decommissioning and closure of these facilities, from the period they are deemed to be surplus to the closure/exit date, are included within adjusted items”.

Again, I don’t think that this is an appropriate add-back. If you are going to add back the commissioning costs, then I suppose it’s only logical to add back the decommissioning. And while the company says that “these costs are not expected to be recurring for each specific site and do not reflect the underlying cost base of the Group”, I would disagree. If this is to be a growth business, it will continuously need new sites. Amazon is a classic example of ongoing investment in new facilities. But last time I looked, Amazon did not make any adjustment for the cost of opening a new warehouse, or closing an existing one.

4) Share-based payments £332m. I have written a much more detailed blog on this subject which may be of interest to the accounting geeks. It was titled “Stock-based comp – the disappearing expense” as the item is not presented anywhere in most companies’ analyst presentation materials and many analysts simply ignore it. This is pretty dangerous as of course, it is a real expense and one which dilutes shareholders.

“The charge relating to share based payments has been treated as an adjusting item as the underlying driver for the share awards (e.g. the IPO) is also an adjusting item. Any share-based payment charges relating to employee reward and retention remain as an underlying cost”. I haven’t managed to find any cost for share-based payments actually charged against adjusted profits. 216m shares vested on listing alone; at a listing price of £6, this amounts to c.£1.3bn and I estimated a slightly higher net cost based on the accounts disclosures. It’s a big number and one which shareholders should monitor carefully going forward.

There are various ways of measuring this, but by far the simplest is just to look at how many shares are being issued to employees for free or at a discount and adding these to the share count and market capitalisation, adjusting for any cash received. More is in the blog.

5) Impairment on assets held for sale, and sale and leaseback charges £105m. This is a non-recurring item, and might involve assets transferred to the founder; the assets include two hotels which raised an eyebrow. But it’s quite normal to exclude this from the adjusted earnings. The sale and leaseback charges would commonly be added back as a deduction from the profits on sale although the property sale profits are not separately identified here.

6) Donations and other covid-19 related costs £11m. The accounts state “ the Group made several charitable donations to the local region, totalling £6.6m…with the remainder relating to additional costs incurred as part of making the business Covid-19 secure (temperature sensors, PPE etc) for its people and customers. This is expected to be non-recurring”. On a £1bn revenue base, a £4m “investment” in sanitisers etc is hardly a big deal. It’s £740 per employee, which is more than I would expect. And would temperature sensors not be capitalised?

There is a useful lesson here. Some analysts will not worry about this line as it’s just £11m and not worth investigating. But this is exactly the sort of adjustment which tells you something about the psychology of the management team which is trying to sell you the shares. Everything is in the shop window here, certainly all the good stuff.

7) Acquisitions – restructuring and integration £6m. It’s quite normal for a company to add back the costs of integrating acquisitions to calculate adjusted profits and it’s a reasonable thing to do to give a picture of the underlying performance. But I am often suspicious that the add-back is generous and that the amounts adjusted include other “normal” costs. It’s a very easy way for a company to flatter its performance. I cannot say that this is unfair in the case of The Hut Group. They spent £102m on acquisitions in 2020 (£84m in 2019) and added back £6m of integration costs in both years. The level is enough to buy quite a lot of integration but I haven’t looked at how many deals they have done and it’s not sufficient to move the earnings needle.

8) Acquisitions – legal and professional costs £3m. Again it’s quite normal to exclude these from the operational performance but fees are usually included in the cost of acquisitions and it’s not clear why these would be charged against profit in this case.

9) Other legal and professional costs £2m. I was surprised to see this as an add-back, with the accounts explaining “The Group incurs legal and professional costs that are non-recurring, one-off in nature and not related to trading activities. These costs are included as adjusted items and can include, but are not limited to, costs associated with equity raises that occurred before the IPO, and other fees associated with investor activities”. This loss-making company’s capex averaged £150m pa for the last two years. Legal and professional costs related to capital raising are an essential part of the operational activities and such costs should not be added back in my view.

CASH FLOWAn additional motivation behind all these adjustments may be to represent the cash flow more positively:

Source: The Hut Group 2020 Accounts

It’s unusual for a company to present its cash generation in this way and a £98m “exceptional” cash outflow certainly makes the numbers look better. But how the £90.6m of P&L adjustments (outside the share based comp and the property impairment) translates to £98m of cash flow is not obvious. The company generated a £103m adjusted increase and a £22m actual increase in cash from operations on a £473m increase in revenues. Working capital was a net positive as increased payables more than offset higher inventories and receivables. I haven’t investigated further but the company’s representation of its cash flow is unconvincing at first glance.

CONCLUSIONAfter a 70% price fall, I don’t know if The Hut Group is still a short, as was suggested by my friends at The Analyst. The company’s equity is now valued at £2.8bn for sales last year of £1.6bn and of course, it’s loss-making and not generating any free cash flow, and limited cash flow before investment in the business. The extensive explanation of adjustments to reported earnings may indicate a management team anxious to give investors a faithful representation of underlying performance in an unusual year. Or it may reflect a management team trying to paint an unduly flattering picture. What do you think? Why not email me and let me know?

The post Adjusted EBITDA – The Hut Group appeared first on Behind The Balance Sheet.

China Changes

Much has been written about the derating of the Chinese tech giants in response to recent aggressive initiatives from the Chinese state. The first signal was interference in the Ant Financial float, continuing through to its most recent actions in relation to ride hailing company Didi Chuxing post its IPO, and even more aggressively against the private education sector.

I claim no Chine expertise – in my hedge fund days, I invested in the region and at times it was an important part of the portfolios. I published a Forensic Accounting Report on five of their largest tech companies – Alibaba, TenCent, JD.com, Baidu and Meituan last summer. That report focused on how the companies presented their financial numbers, where we found multiple deficiencies, and did not address these wider issues.

The principal point we made on valuations was that the group had invested the equivalent of five Vision Funds in six years, primarily in tech in China. Now it’s a big market but arguably the Vision Find itself has had an impact on global tech valuations. It seemed implausible that you could invest five times that in a single market and not impact valuations. And we suggested there were potential consequences for some of the five.

But we had not anticipated (and were not asked to review) the Chinese Government action. Indeed we refused those elements of the original brief which covered local China issues as we are not experts. Now, however, with the drastic impact on several Chinese stock prices, I wanted to return to the issue and offer a few thoughts. Spoiler: there are no easy answers.

NEWSLETTER SIGN-UP THE ISSUESI think we need to consider the following issues:

1 The state’s objectives and how these companies fit in

2 China country risk

3 US attitude to China and implications

4 Investor protection

5 Level of uncertainty now and going forward

6 Have the stocks been adequately derated

1 STATE OBJECTIVESI repeat that I am not a China expert and I no longer have access to the people on the ground on whom I formerly relied. I respect George Magnus, formerly of UBS, who writes extensively on China; he is a research associate at Oxford University’s China Centre and author of Red Flags: Why Xi’s China is in Jeopardy. To be honest, I haven’t read the book, but I have seem George present on it and discussed its conclusions with him; he is thoughtful and knowledgeable about China and his most recent article is worth reading, as is a piece for the FT.

Investors need to understand the objectives of state and party and how the tech and other companies can help achieve them. Of course, this is China so it’s not immediately obvious, but Magnus has highlighted and it has been widely reported that there is a renewed emphasis on social inequality. Imposing higher taxes on the wealthy would impact senior party officials and members and would be ineffective at helping the poor, given the sheer numbers.

There has already been some reaction within China. Zhang Weiying, an economics professor at Peking University, wrote that “Targeting rich people and entrepreneurs will only hurt jobs, consumers, charitable giving and lead the nation back into poverty” in an article published by the Chinese Economists 50 Forum, a think tank that includes some of the nation’s most prominent economists.

Higher income taxes and initiatives on inheritance and property taxes are likely, although there are probably too many vested interests, especially the municipal authorities, to do too much with the the latter, which is the engine of significant economic growth.

Corporates, however, may be an easier target. In the firing line so far have been Ant Financial which kicked off this trend and the wider tech sector (new laws affecting both are coming into force). Also targeted have been ride hailing (gig economy), private education (inequality), music streaming (frivolous) and gaming (potentially addictive, opium for the mind).

I guess the objective is to allow the incumbent tech giants, Alibaba in e-commerce, Tencent in gaming and music, Ant in payments, to continue to dominate, but less lucratively. Policies to curb their power will redistribute some of their markets and profits to smaller operators, merchants on their platforms, app developers, and to their customers and workers. The state will also likely seek to boost second-tier cities as tech hubs. The impact is hard to gauge.

First measurable impact was Tencent’s announcement that it will set aside 50 billion yuan ($7.7 billion, the first of two such payments) for a “common prosperity program,” a philanthropic initiative that provides aid in areas such as education, building out medical infrastructure and helping low-income communities.

“This new strategy of Tencent’s is a proactive answer to our nation’s strategy.”

Is this the end? Unlikely. 50 billion here, 50 billion there, it soon adds up. It might be 1-2% of the market cap but it’s close to 10% of revenue. That’s how we should measure it unless it’s a “one and done”. As I “went to press”, Alibaba announced a 100 billion donation over 5 years, over 10% of projected revenues. Bottom line: to understand the risk, you need to get inside the head of Xi Jinping. Not sure how easy that is.

One knock-on effect might be on the luxury sector – not sure how many SUVs Ferrari will sell if the Chinese decide that ostentatious consumption is out of fashion. Prada handbags, Louis Vuitton bags and clothing and many more could be affected.

Ferrari Purosangue SUV. Source:driveandcar.com

2 CHINA COUNTRY RISKClearly the country risk has increased significantly and this merits some derating. An op-ed by George Soros in the FT was scathing about Xi, suggesting he “does not understand how markets operate” and that “he is putting in place an updated version of Mao Zedong’s party”. (One Twitter wit: “Surprising that the head of the communist party could be a communist”). Soros concluded that

“No investor has any experience of that China because there were no stock markets in Mao’s time. Hence the rude awakening that awaits them.”

Assuming that one accepts the risk, the question is how large a derating is required, and perhaps China was cheap before (disclosure: I bought A-share exposure as I considered the market cheap a couple of years ago). Higher risk implies some correction in share prices, although not the decline we have seen in some of these stocks.

CHECK OUT OUR COURSESThat decline would be justified if there was a serious and enduring deterioration in the climate for Chinese companies. Soros clearly believes this and his vision is echoed by a Chinese blogger, Li Guangman, who wrote an article that revolution is underway in China. He is being taken seriously because the article appeared on dozens of official party and state websites. Li that “China is undergoing a major change. From the economic sphere to the financial sphere, from the cultural sphere to the political sphere, a profound transformation is underway – or, one might say, a profound revolution.” Echoes of the Cultural Revolution perhaps, but that didn’t turn out well, and surely that lesson has been learned?

3 US ATTITUDE TO CHINA AND IMPLICATIONSIt would be easy in the circumstances to focus solely on the domestic issue and forget that the US has its own tensions with China. Investors must accept that the US attitude to China will likely become tougher under Biden and that the US quoted Chinese tech stocks are right in the crosshairs. If the US authorities want to exert minor pressure on China, the SEC is a possible route.

For example, the SEC could insist on proper audit supervision by the US: a potential consequence is ultimate delisting, which would cause a massive technical issue and share overhang. It’s not my central assumption, as the US want to maintain their stockmarket supremacy, but it’s perfectly possible – indeed, a well-known hedge fund manager, close to the Trump administration, told me that certain factions were keen to use this route. It’s hard to factor this into prices, as I discuss under uncertainty below.

Meanwhile, the Chinese state seems relaxed if US investors lose money as a result of its actions and conceivably might prefer these companies to be listed locally. US listed Chinese stocks have a collective market cap near $1.5tn, and the Nasdaq Golden Dragon China index which tracks them was down nearly 50% from the 2021 peak at one point.

The issue for the Americans is that retaliatory action would be inevitable and would likely be targeted at Apple which relies on China for almost all its manufacturing capacity and is its second biggest market – oddly in my view, there is nothing in its share price for this risk.

4 INVESTOR PROTECTIONInvestors in these stocks have always needed to accept that the normal rule of law which operates in most markets is not applicable to China, for two reasons:

First, the VIE structures employed mean that investors’ legal rights are questionable (Kyle Bass has been particularly vocal on this). In the past, I dodged this by allowing the boss to make the judgment, but I never felt comfortable. Each individual will have a different perception of this risk and the required return as a consequence.

Second, in China, the state and party have ultimate control, which is why point 1 is so important and why you need real local expertise to invest there.

I claim no particular insight, but the VIE discount should be a more significant factor today. There has always been a risk that an investor in a VIE could end up with a zero. Recent actions by the Chinese authorities have certainly increased this risk. This may relatively benefit Hong Kong listed Tencent at the expense of Alibaba, JD.com and others.

5 LEVEL OF UNCERTAINTY NOW AND GOING FORWARDEvery stock has an element of uncertainty. One of my podcast guests explained that he thought this was a critical difference between a portfolio manager and an analyst. The analyst shuns uncertainty while the PM embraces it and asks if the price is right. Often uncertainty can provide an opportunity in stocks which is one reason why local knowledge can be so helpful. With greater uncertainty comes a wider range of possible outcomes. The interest expressed by China in the tech sector has shifted that range of outcomes to the left, and hence some derating of the sector is necessary, although calibrating that is extremely difficult.

Former valuations sometimes seemed to suggest near limitless upside for some of these stocks. Today, both the earnings potential and the multiple applied have been adversely affected. Scott Galloway suggests that

“This is a rare moment when beachfront property is going on sale. Xi may have rapped the knuckles of Jack Ma and the tech entrepreneur class, but it’s difficult to imagine he’ll cut off their fingers”

It may be beachfront property on sale but there is what looks like a tsunami on the horizon. Nervous investor sentiment is perfectly understandable and the state action may itself crimp growth; the Economist noted:

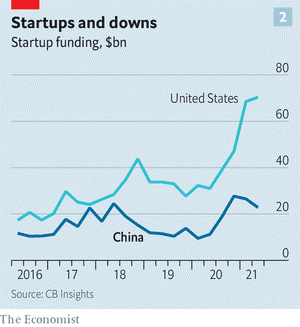

“…venture capitalists are already getting cold feet. Fundraising for privately held tech firms peaked at $28bn in the last quarter of 2020, when the techlash began, according to CB Insights, a data provider. In the second quarter of this year Chinese startups raised just $23bn, even as those in America raked in ever more capital”

Galloway is correct in pointing out that Xi needs economic growth to continue as the economic miracle is “only half-complete”. Tech stocks in particular benefit from very low tax rates; more charitable and social initiatives will also dent the bottom line. It’s inconceivable that these companies’ earnings power will not be lower; and it’s highly unlikely that investors will pay as much for that lower growth stream of cash flows given the risk of further action. One can argue that the fall has been overdone but a serious and likely permanent diminution in value has likely taken place.

6 HAVE THE STOCKS BEEN ADEQUATELY DERATED?There has been a significant difference in the share price performance of the 5 stocks I reviewed in July 2020. Alibaba ($BABA) has fared by far the worst, hit first by the Ant Financial actions and the disappearance of Jack Ma, and suffering a second leg down this summer. Its performance compares badly to US peer Amazon. Is this enough? Charlie Munger thought so some months ago and to much fanfare. Valuation comparisons are fraught with danger, however, because the two companies report profit in a very different fashion, and much of Alibaba’s profits come from spurious revaluations of unlisted investments; these obviously need to be excluded but significant other adjustments are also required.

For the other companies, there is a range of outcomes – some are trading above their summer 2020 price but have fared less well than their US quoted peers. Again, valuations are often distorted by aggressive accounting and by the investment revaluations.

The recent bounce in some of these shares may be a dead cat bounce or may be a bottom. It’s probably early to predict which and much will depend on the activity of the Chinese state.

CONCLUSIONSPredictions about these stocks clearly depend on the attitude of the China state. And I wonder if the recent share price action will make some investors feel unqualified to hold some of these stocks. In my view, it should, as the state interference may be a key driver for several years. My advice is to follow George Magnus and Michael Pettis as they have offered some useful insights in the past.

The action in respect of the education sector has been most aggressive and investors here have suffered the biggest losses. If a company is deemed a net negative to society in China, investors should expect to lose money.

The bears will argue that BABA et al have always been uninvestible and this proves their case. The bear argument goes along the lines of

Nobody has read the 1000+page BABA 10-K (shorter more recently).

The financials are meaningless anyway, given the number of acquisitions, the 800 subsidiaries and the financial chicanery.

You are partnering with the Chinese Communist Party.

You need to be a local to understand the Chinese politics.

The holders are taking comfort from the involvement of Munger and acolytes, without proper due diligence.

But if you believed that these share prices, notably BABA, were fairly valued prior to the Ant float announcement, you presumably would have to buy now. Here is the BABA chart, this in a climate which has been positive for markets and tech stocks in particular:

Behind the Balance Sheet from Sentieo data

This is not an investment recommendation! Aswath Damodoran takes the view that Tencent is now cheap, and that the risk of greater Government interference is in the price: see his recent video.

My view is that it’s too early to tell and that stock selection is paramount. But the dead cat bounce could continue, if there is no further action from the authorities. And if Soros is right, the knock-on effects might be significant – not just on luxury manufacturers like Ferrari, Prada, LVMH and peers, but on US stocks like Apple (or even Tesla) with high China dependencies.

If you have enjoyed this blog, we shall be starting a more regular newsletter – be sure to sign up below.

CHECK OUT OUR COURSES NEWSLETTER SIGN UPThe post China Changes appeared first on Behind The Balance Sheet.