Gennaro Cuofano's Blog, page 92

September 16, 2022

Diathesis-Stress Model

The diathesis-stress model states that mental disorders arise from a combination of stressful life circumstances and genetic predisposition.

Understanding the diathesis-stress modelThe diathesis-stress model is based on the theory that mental and physical disorders develop in response to a genetic predisposition for that illness.

The model also believes that such an illness is more likely to develop after the individual has experienced a stressful or traumatic life event.

The diathesis-stress model touches on the subject of nature vs. nurture in psychology.

The subject, which was debated in ancient Rome and Greece, seeks to understand whether innate biological factors (nature) or social and situational factors (nurture) are the predominant cause of a disorder.

Rather than advocating one factor over another, however, the diathesis-stress model believes that a combination of the two is a more likely explanation.

To that end, the model posits that individuals with more predisposition to a disorder may require a less stressful event for it to manifest.

By the same token, the model has also been used to explain why some individuals who experience stressful life situations otherwise remain psychologically healthy.

The two components of the diathesis-stress modelLet’s take a more detailed look at the two components of diathesis and stress to better understand how they may interact to precipitate illness:

DiathesisDiathesis is an individual’s predisposition (or vulnerability) to a mental or physical disorder. It can be caused by:

Cognitive factors.Biology or genetics.Environmental stressors or traumatic experiences in childhood, andSituational factors, such as cohabiting with a parent who has a mental illness.While a child that lives with a mentally ill parent can eventually move out of home as an adult, most of these factors tend to remain with a person for their entire life and their negative effects are difficult to address completely.

Since diathesis is also a defacto measure of vulnerability, those who rate on the lower end of the scale will require a more stressful event to precipitate a disorder and vice versa.

StressStress may be caused by any number of events such as:

Divorce.Financial problems.Serious or chronic health issues.An upcoming test or exam.The death of a family member or friend, andThe COVID-19 pandemic.Irrespective of whether the stressor is short-term or chronic, it’s worth noting that diathesis can cause stress and the reverse is also true.

Protective factors in the diathesis-stress modelProtective factors explain why someone who experiences a lot of stress and is predisposed to illness can live their lives relatively unaffected.

The presence of protective factors has caused the model to be revised in recent years with some now calling it the “stress-vulnerability-protective factors model”. Examples of these factors include:

Professional counseling or therapy.Self-awareness.High emotional intelligence (EQ).Being a member of a support group.Stress management techniques, andUnderstanding of healthy coping mechanisms.Key takeaways:The diathesis-stress model states that mental disorders arise from a combination of stressful life circumstances and genetic predisposition.The diathesis-stress model is based on the interactions of diathesis (factors that predispose an individual to illness) and events that precipitate or induce the illness itself. Diathesis may cause stress and vice versa.Protective factors explain why someone who experiences stress and is predisposed to illness can live their lives relatively unaffected. Protective factors may take the form of self-awareness, professional help, support groups, and high emotional intelligence.Connected Business Frameworks The Fishbone Diagram is a diagram-based technique used in brainstorming to identify potential causes for a problem, thus it is a visual representation of cause and effect. The problem or effect serves as the head of the fish. Possible causes of the problem are listed on the individual “bones” of the fish. This encourages problem-solving teams to consider a wide range of alternatives.

The Fishbone Diagram is a diagram-based technique used in brainstorming to identify potential causes for a problem, thus it is a visual representation of cause and effect. The problem or effect serves as the head of the fish. Possible causes of the problem are listed on the individual “bones” of the fish. This encourages problem-solving teams to consider a wide range of alternatives. The 5 Whys method is an interrogative problem-solving technique that seeks to understand cause-and-effect relationships. At its core, the technique is used to identify the root cause of a problem by asking the question of why five times. This might unlock new ways to think about a problem and therefore devise a creative solution to solve it.

The 5 Whys method is an interrogative problem-solving technique that seeks to understand cause-and-effect relationships. At its core, the technique is used to identify the root cause of a problem by asking the question of why five times. This might unlock new ways to think about a problem and therefore devise a creative solution to solve it. You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.

You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing. Marketing consultant Philip Kotler developed the Five Product Levels model. He asserted that a product was not just a physical object but also something that satisfied a wide range of consumer needs. According to that Kotler identified five types of products: core product, generic product, expected product, augmented product, and potential product.

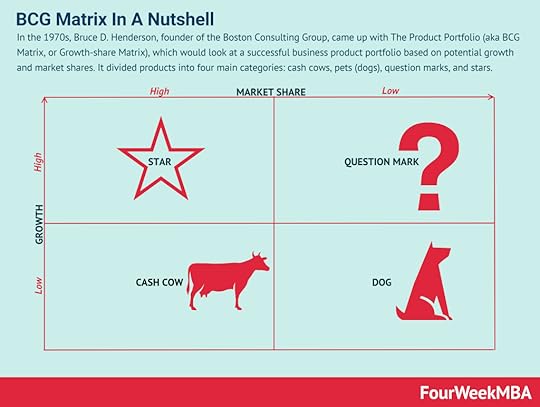

Marketing consultant Philip Kotler developed the Five Product Levels model. He asserted that a product was not just a physical object but also something that satisfied a wide range of consumer needs. According to that Kotler identified five types of products: core product, generic product, expected product, augmented product, and potential product. In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.

In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.The post Diathesis-Stress Model appeared first on FourWeekMBA.

Venture Capital Advantages And Disadvantages

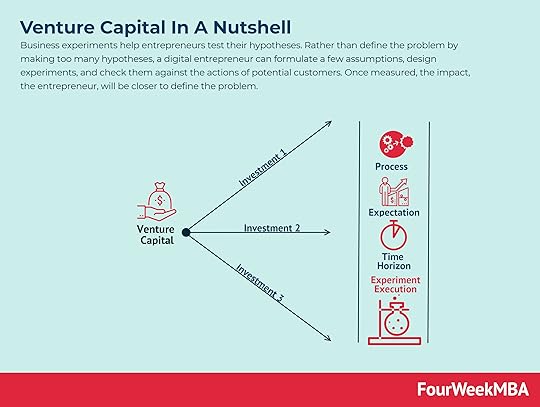

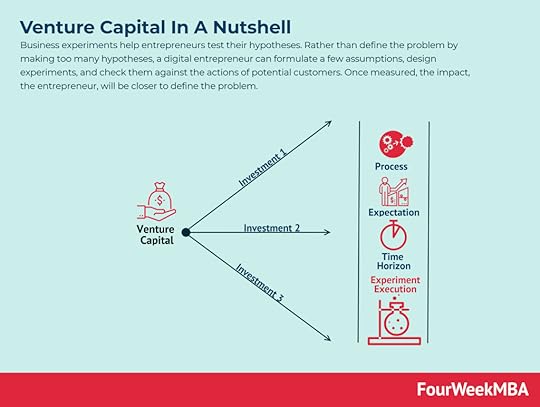

A venture capitalist generally invests in companies and startups which are still in a stage where their business model needs to be proved viable, or they need resources to scale up. Thus, those companies present high risks, but the potential for exponential growth. Therefore, venture capitalists look for startups that can bring a high ROI and high valuation multiples.

A glance at venture capital investingThe set of investments venture capitalists make; only a few will succeed. Therefore, they have to place more bets to make the system work in their favor.

In the end, the venture capitalist makes money (the so-called exit) by either reselling the stake in the company at a much larger valuation or with the IPO of the company they invested in.

When that happens, venture capitalists make substantial returns for their partners. Indeed, the venture capital firm is usually comprised by a group of partners which raised capital from another group of limited partners to invest for them.

The limited partners (or LPs) can be either large institutions or wealthy individuals looking for high returns.

Usually, venture capital firms invest in growth potential. Therefore, when a startup receives venture capital money, the venture capital firm – usually – expects aggressive growth.

Before we get to the advantage and disadvantages of taking venture capital money, let’s first understand the explicit and hidden incentives that drive venture capital firms. Indeed, at the end, taking venture capital money is mostly about interests alignment.

And if those interests do not converge, that is when probably it might be not a good idea to take that money.

Understand the venture capital incentivesTo understand how venture capital works, we need to look at the two resources that they allocate:

capital;and moneyTime, because VCs funds, compared to other models, where financial resources are endowed, do contribute to the growth of the firm they invest in. This contribution can come in several ways, from assistance in hiring to providing guidance, or also having a VC on the board.

On the other hand, VCs provide capital for funding the scale of those startups.

Why is it important to understand the two essential resources? Well, while capital might be a relatively scalable resource, assuming VCs can bring in continuously limited partners.

Time is not. Indeed, VCs usually run out of capacity in managing a certain number of investments as those investments need to be also managed and supported.

And in general, VCs look for a return anywhere between 3-10 years, depending on the market condition, startup growth and more.

Which means they also look for 10-30x ROI in a 5-10 year timeframe.

Therefore, a few aspects we can highlight so far:

venture capital have limited time resources to allocate due to the fact they can only manage a certain number of investments (as they provide several forms of support to startups);they look for extremely high returns (10-30x in the lifespan of the investment);those returns can happen anywhere between 3-10 years depending on several conditions (this means in this period VCs will ask for aggressive growth)Let’s look now at the advantages and disadvantages of getting VCs’ money.

Advantages of VC moneySome of the key advantages can be summarized in a few key points:

Guidance and expertise: usually VCs don’t bring just cash on the table but also the expertise of the team and partners part of the fund, which is one of the primary advantages of getting VCs’ money.Rapid Growth: if you’re looking for rapid growth, VCs will look for the same thing. Thus, you’ll both be aligned in terms of objective, which makes it easier to make this sort of agreement work.Connections: VCs will introduce you to the right people to unlock growth potential, which is another undeniable advantage.Hiring: the VC investing in your company can also help you find the right people to form your team and scale.Additional support: in some cases, VCs support can also come in other areas that are important to grow smoothly, which include legal, tax, and accounting matters.For all these reasons, VC money makes sense. Let’s see when it doesn’t.

Disadvantages of VC moneyThere are two significant disadvantages in taking VC money:

Loss of control and ownership: this is by far the most significant disadvantage as if you let VC in it means you need to be ready to give up some or a good part of the control. Therefore, you won’t be the only one in charge of the company’s vision and mission, but you’ll need to share that with the VC.While it is legitimate for VC to ask a high ROI for a risky startup which business model still needs to be proved viable. A very High ROI and an excessive push on growth might break things up. Remember that, companies, like products, might have a lifecycle and forcing too much on growth might well make the company implode.When does it make sense to take venture capital money?In a post entitled “The only thing that matters,” venture capitalist Marc Andreessen explained:

The only thing that matters is getting to product/market fit.

Product/market fit means being in a good market with a product that can satisfy that market.

How do you assess whether you passed through this product/market fit stage?

Marc Andreessen explained:

You can always feel when product/market fit isn’t happening.The customers aren’t quite getting value out of the product, word of mouth isn’t spreading, usage isn’t growing that fast, press reviews are kind of “blah”, the sales cycle takes too long, and lots of deals never close.

Therefore, there is no single way to measure that, but as Andreessen emphasized:

And you can always feel product/market fit when it’s happening.The customers are buying the product just as fast as you can make it — or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company checking account. You’re hiring sales and customer support staff as fast as you can. Reporters are calling because they’ve heard about your hot new thing and they want to talk to you about it. You start getting entrepreneur of the year awards from Harvard Business School. Investment bankers are staking out your house. You could eat free for a year at Buck’s.

And he highlighted something that would stick as a paradigm in the startup world for years to come:

Lots of startups fail before product/market fit ever happens.

On FourWeekMBA, I interviewed Ash Maurya, author of Running Lean and Scaling Lean and creator of the Lean Canvas.

As he explained to me:

This is (when to take VC money), of course, going to be a function of the kind of business model and product that you have. If you can bootstrap, if you can go all the way to product market fit and then raise money, you maintain the most control in your company. You have a lot of say in where the company goes from that point on.

And he continued:

In an ideal world, and it’s not just me, even the venture capitals and other angel investors will give you the same advice. The best ideal time to raise your big round of funding would be as you cross product-market fit.

Once you have product-market fit, some success is guaranteed. The question is how big can it get?

The other thing that’s also going in your favor then is that your goal, you being the entrepreneur or innovator, your goal and the investor’s goals are completely aligned. It’s all about growth.

You have figured out the product, you have figured out the customer, now it’s really engines of growth.

Source: blog.leanstack.com

Thus, if you were in the condition to bootstrap – grow with your resources, or with a profitable business model – your company is in a perfect place to be.

You can decide whether to move to the next stage (scale), thus take VC money. Or keep growing organically.

And he also highlighted:

What questions to ask before taking venture capital money?

If you were doing something that required capital investment upfront, this is where VC makes sense, but there is now, increasingly so, a very mature market of other investors that play in that space.

Those would be super angels or angel investors that understand that you still haven’t reached product-market fit and you are going to be learning and pivoting and course correcting, and they tend to be more patient for those types of things.

Therefore before taking VC money, I would ask the following questions:

can I validate the idea without external resources?Is the product technically complex that it requires additional resources to develop?Do I need money to scale?Am I ready to give up part of the control of my business?In short, if you are a control freak, and you want to keep your vision of the company intact, VC money might not be the best option. If you’re willing to give up some control in exchange for money and expertise that might make sense.

In other cases, if you managed to bootstrap your way to product/market fit you might be in a good position as VC will want you. Thus, you will be able to negotiate better deals.

In the case in which you need a long term perspective to grow your business and still be in charge of angel investing or “super angels” might be a better option.

In all the other cases, bootstrapping is the way to go!

Other business resources:

Successful Types of Business Models You Need to KnowThe Complete Guide To Business DevelopmentBusiness Strategy: Definition, Examples, And Case StudiesWhat Is a Business Model Canvas? Business Model Canvas ExplainedBlitzscaling Business Model Innovation Canvas In A NutshellWhat Is a Value Proposition? Value Proposition Canvas ExplainedWhat Is a Lean Startup Canvas? Lean Startup Canvas ExplainedWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And ExamplesMarketing vs. Sales: How to Use Sales Processes to Grow Your BusinessHow To Write A Mission StatementWhat is Growth Hacking?Growth Hacking Canvas: A Glance At The Tools To Generate Growth IdeasDistribution Channels: Types, Functions, And ExamplesConnected Investment Models An angel investor is usually a high net-worth individual who invests in early-stage start-ups in exchange for equity in the company. Angel investors are wealthy private investors focused on financing small business ventures in exchange for an equity stake. Unlike a venture capital firm, an angel investor invests their own capital during the early stages of a start-up when the risk of failure is relatively high, yet it might in the long-term unlock higher rates of return.

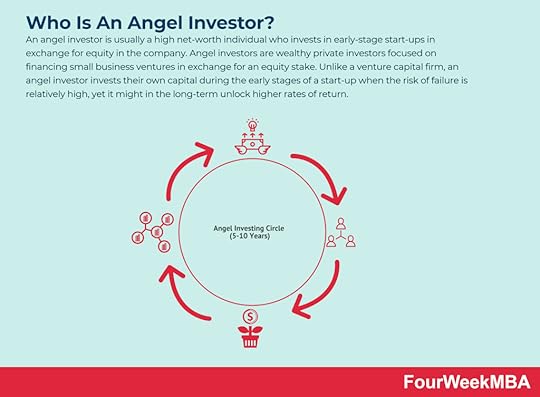

An angel investor is usually a high net-worth individual who invests in early-stage start-ups in exchange for equity in the company. Angel investors are wealthy private investors focused on financing small business ventures in exchange for an equity stake. Unlike a venture capital firm, an angel investor invests their own capital during the early stages of a start-up when the risk of failure is relatively high, yet it might in the long-term unlock higher rates of return.  A venture capitalist generally invests in companies and startups which are still in a stage where their business model needs to be proved viable, or they need resources to scale up. Thus, those companies present high risks, but the potential for exponential growth. Therefore, venture capitalists look for startups that can bring a high ROI and high valuation multiples.

A venture capitalist generally invests in companies and startups which are still in a stage where their business model needs to be proved viable, or they need resources to scale up. Thus, those companies present high risks, but the potential for exponential growth. Therefore, venture capitalists look for startups that can bring a high ROI and high valuation multiples. Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have.

Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have. Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns.

Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns.  Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.

Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.  A special purpose acquisition company (SPAC) is a company with no commercial operations that are created to raise capital through an IPO to acquire another company. The SPAC is also called for that reason a “blank check company” as it will use the money provided by investors to enable private companies to go public via the SPAC. Connected business frameworksBCG Matrix

A special purpose acquisition company (SPAC) is a company with no commercial operations that are created to raise capital through an IPO to acquire another company. The SPAC is also called for that reason a “blank check company” as it will use the money provided by investors to enable private companies to go public via the SPAC. Connected business frameworksBCG Matrix

In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.Benchmarking

In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.Benchmarking

Benchmarking is a tool that businesses use to compare the performance of their processes and products against businesses considered to be the best in their industries. Benchmarking allows a business to refine their practices and thus increase its overall performance. Generally, benchmarking can be broken down in the process, performance, and strategic benchmarking.SWOT Analysis

Benchmarking is a tool that businesses use to compare the performance of their processes and products against businesses considered to be the best in their industries. Benchmarking allows a business to refine their practices and thus increase its overall performance. Generally, benchmarking can be broken down in the process, performance, and strategic benchmarking.SWOT Analysis

A SWOT Analysis is a framework used for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. It can aid in identifying the problematic areas of your business so that you can maximize your opportunities. It will also alert you to the challenges your organization might face in the future.PESTEL Analysis

A SWOT Analysis is a framework used for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. It can aid in identifying the problematic areas of your business so that you can maximize your opportunities. It will also alert you to the challenges your organization might face in the future.PESTEL Analysis

The PESTEL analysis is a framework that can help marketers assess whether macro-economic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks such as SWOT or to gain a broader and better understanding of the overall marketing environment.Porter’s Five Forces

The PESTEL analysis is a framework that can help marketers assess whether macro-economic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks such as SWOT or to gain a broader and better understanding of the overall marketing environment.Porter’s Five Forces

Porter’s Five Forces is a model that helps organizations to gain a better understanding of their industries and competition. Published for the first time by Professor Michael Porter in his book “Competitive Strategy” in the 1980s. The model breaks down industries and markets by analyzing them through five forcesScenario Analysis

Porter’s Five Forces is a model that helps organizations to gain a better understanding of their industries and competition. Published for the first time by Professor Michael Porter in his book “Competitive Strategy” in the 1980s. The model breaks down industries and markets by analyzing them through five forcesScenario Analysis

Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision making by avoiding two pitfalls: underprediction, and overprediction.VRIO Framework

Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision making by avoiding two pitfalls: underprediction, and overprediction.VRIO Framework

The VRIO framework is a tool that businesses can use to identify and then protect the factors that give them a long-term competitive advantage. The VRIO framework will help assess reality based on four key elements that make up its name (VRIO): value, rarity, imitability, and organization. VRIO is a holistic framework to assess the business.

The VRIO framework is a tool that businesses can use to identify and then protect the factors that give them a long-term competitive advantage. The VRIO framework will help assess reality based on four key elements that make up its name (VRIO): value, rarity, imitability, and organization. VRIO is a holistic framework to assess the business.The post Venture Capital Advantages And Disadvantages appeared first on FourWeekMBA.

What Is the SERVQUAL Model? SERVQUAL Model In A Nutshell

The SERVQUAL model was created by researchers A. Parasuraman, Valarie Zeithaml, and Leonard L. Berry in 1985 to measure and drive quality in the service and retail sector. The SERVQUAL model is a framework for measuring service quality and customer satisfaction through five dimensions: reliability, responsiveness, assurance, tangibles, and empathy.

Understanding the SERVQUAL modelIrrespective of the industry, however, most businesses need to provide some degree of customer service. This requires an understanding of how the customer’s mind works and what drives their decisions or actions.

The SERVQUAL model helps bridge the gap in perception between what the company believes it is delivering to customers and what those customers expect, want, or need during customer service.

Although developed before the digital age, the SERVQUAL model is still relevant today. With customers now using the internet to share their thoughts with a vast and captive audience, perception management has never been more important.

The five dimensions of service qualityThe SERVQUAL model considers five dimensions customers use to evaluate the quality of service they receive from a business.

These dimensions include:

Reliability – how consistently does the organization deliver a product or service on time, as described, and without error? For the customer, reliability means the organization respects commitments and honors promises.Responsiveness – how quickly can the organization respond to customer needs? Despite the negative perception it creates, some businesses ignore or evade customer service requests for no apparent reason.Assurance – does the organization inspire trust and confidence in customers with professional service, great communication skills, technical knowledge, and the right attitude?Tangibles – or the visual aesthetic of a company derived from its logo, physical store, or the look and feel of its website. Tangibles also encompass equipment, with hand sanitizing and contactless payment devices influencing the consumers of today. Furthermore, the fourth dimension also includes the physical appearance of customer service staff. How well are they dressed? Do they practice good personal hygiene? Empathy – or the ability for employees to show genuine care and concern during customer service. In other words, are those tasked with providing customer service friendly and approachable? Do they actively listen to consumer needs? Indeed, are they sensitive to consumer needs?The five gaps of service quality in the SERVQUAL modelThe SERVQUAL model defines five scenarios where businesses often fall short of customer expectations.

As mentioned in the introduction, gaps emerge when there is a discrepancy between the needs or wants of the consumer and the services the organization provides.

Each of the five gaps is summarised below:

Knowledge gap – a knowledge gap occurs when an organization has not done its due diligence on the target audience. Whether through insufficient or careless research, knowledge gaps reflect a lack of market understanding.Policy gap – these gaps occur because of a conflict between what the customer wants and what the organization provides. Policy gaps may be caused by an insufficient commitment to service quality, lack of task standardization, or inadequately described service levels.Delivery gap – or dissimilarity between the standards of customer service set out in policies and the actual delivery standard. This is a common problem in many businesses and may be the result of poor technology, poor management, low employee engagement, and role ambiguity or conflict.Communication gap – this gap describes a difference between what the company chooses to advertise about a product and what the customer actually receives. Communication gaps occur because of over-commitment or a lack of cohesion between the advertising and product development departments.Customer gap – simply, the difference between customer expectations and the experience created for them by the business. Customer gaps can be explained by revisiting the five service quality dimensions of reliability, responsiveness, assurance, tangibles, and empathy.Key takeaways:The SERVQUAL model is a framework for measuring service quality and customer satisfaction. It was created by researchers in 1985 to measure and drive quality in the service and retail sectorThe SERVQUAL model assesses five dimensions of service quality: reliability, responsiveness, assurance, tangibles, and empathy.The SERVQUAL model also defines five knowledge gaps that help explain how and why a business falls short of customer expectations. These include gaps in knowledge, policy, delivery, communication, and general customer experience.Related Business Concepts Business development comprises a set of strategies and actions to grow a business via a mixture of sales, marketing, and distribution. While marketing usually relies on automation to reach a wider audience, and sales typically leverage on a one-to-one approach. The business development’s role is that of generating distribution.

Business development comprises a set of strategies and actions to grow a business via a mixture of sales, marketing, and distribution. While marketing usually relies on automation to reach a wider audience, and sales typically leverage on a one-to-one approach. The business development’s role is that of generating distribution. The more you move from consumers to enterprise clients, the more you’ll need a sales force able to manage complex sales. As a rule of thumb, a more expensive product, in B2B or Enterprise, will require an organizational structure around sales. An inexpensive product to be offered to consumers will leverage on marketing.

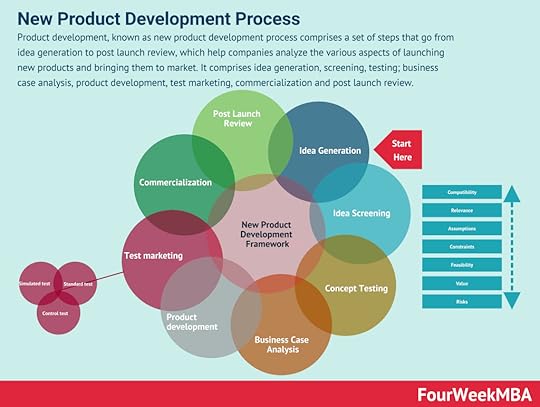

The more you move from consumers to enterprise clients, the more you’ll need a sales force able to manage complex sales. As a rule of thumb, a more expensive product, in B2B or Enterprise, will require an organizational structure around sales. An inexpensive product to be offered to consumers will leverage on marketing. Product development, known as the new product development process comprises a set of steps that go from idea generation to post-launch review, which help companies analyze the various aspects of launching new products and bringing them to market. It comprises idea generation, screening, testing; business case analysis, product development, test marketing, commercialization, and post-launch review.

Product development, known as the new product development process comprises a set of steps that go from idea generation to post-launch review, which help companies analyze the various aspects of launching new products and bringing them to market. It comprises idea generation, screening, testing; business case analysis, product development, test marketing, commercialization, and post-launch review. In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.

In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars. You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.

You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing. The term “user experience” was coined by researcher Dr. Donald Norman who said that “no product is an island. A product is more than the product. It is a cohesive, integrated set of experiences. Think through all of the stages of a product or service – from initial intentions through final reflections, from first usage to help, service, and maintenance. Make them all work together seamlessly.” User experience design is a process that design teams use to create products that are useful and relevant to consumers.

The term “user experience” was coined by researcher Dr. Donald Norman who said that “no product is an island. A product is more than the product. It is a cohesive, integrated set of experiences. Think through all of the stages of a product or service – from initial intentions through final reflections, from first usage to help, service, and maintenance. Make them all work together seamlessly.” User experience design is a process that design teams use to create products that are useful and relevant to consumers. A cost-benefit analysis is a process a business can use to analyze decisions according to the costs associated with making that decision. For a cost analysis to be effective it’s important to articulate the project in the simplest terms possible, identify the costs, determine the benefits of project implementation, assess the alternatives.

A cost-benefit analysis is a process a business can use to analyze decisions according to the costs associated with making that decision. For a cost analysis to be effective it’s important to articulate the project in the simplest terms possible, identify the costs, determine the benefits of project implementation, assess the alternatives. Empathy mapping is a visual representation of knowledge regarding user behavior and attitudes. An empathy map can be built by defining the scope, purpose to gain user insights, and for each action, add a sticky note, summarize the findings. Expand the plan and revise.

Empathy mapping is a visual representation of knowledge regarding user behavior and attitudes. An empathy map can be built by defining the scope, purpose to gain user insights, and for each action, add a sticky note, summarize the findings. Expand the plan and revise.  Perceptual mapping is the visual representation of consumer perceptions of brands, products, services, and organizations as a whole. Indeed, perceptual mapping asks consumers to place competing products relative to one another on a graph to assess how they perform with respect to each other in terms of perception.

Perceptual mapping is the visual representation of consumer perceptions of brands, products, services, and organizations as a whole. Indeed, perceptual mapping asks consumers to place competing products relative to one another on a graph to assess how they perform with respect to each other in terms of perception.  Value stream mapping uses flowcharts to analyze and then improve on the delivery of products and services. Value stream mapping (VSM) is based on the concept of value streams – which are a series of sequential steps that explain how a product or service is delivered to consumers.

Value stream mapping uses flowcharts to analyze and then improve on the delivery of products and services. Value stream mapping (VSM) is based on the concept of value streams – which are a series of sequential steps that explain how a product or service is delivered to consumers.Read the remaining product development frameworks here.

Read Next: SWOT Analysis, Personal SWOT Analysis, TOWS Matrix, PESTEL

Learn also:

Occam’s RazorSpeed-Reversibility MatrixGrowth-Share MatrixAnsoff MatrixMain Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post What Is the SERVQUAL Model? SERVQUAL Model In A Nutshell appeared first on FourWeekMBA.

History of AWS

Not all cloud businesses are born equal.

Some context below for Q2 of 2022:

– Amazon AWS = $19.7B

– Microsoft Intelligent Cloud = $20.9B (Note: this is a larger segment, comprising Azure + other cloud services).

– Google Cloud = $6.27B

As of now, Microsoft’s Azure is a real threat to AWS.

Google Cloud runs at negative margins.

The Google cloud segment lost $858 million in Q2.

Why does the cloud matter so much?

Well, the whole AI ecosystem is getting built on top of it.

In short, the cloud infrastructure is the basis for AI companies to develop, thus creating the next digital industrial revolution.

How come prominent players like Microsoft and Google couldn’t compete with AWS for years?

Two things:

– Early timing.

– Bezos played a trick on his competitors.

When Amazon officially launched Amazon AWS in 2006, none imagined what a cash machine it was and what it would become.

And Jeff Bezos was pretty smart about it.

What was the trap he employed?

Indeed, when AWS officially launched, it was priced as a utility.

Bezos wanted to avoid “Steve Jobs’ mistake” of pricing the iPhone at such high margins to quickly attract competition.

Instead, Bezos initially made AWS a low-margin business, and over time, it became a highly profitable segment.

AWS rolled out its first mass-market product, Simple Storage Service, or S3, on March 14, 2006.

That is the official date of birth of AWS!

However, AWS was born in the early 2000s. As Amazon went through the dot-com bubble, the company had to redefine its business model.

Jeff Bezos wanted to cash in the Internet revolution by placing bets everywhere. Yet by the early 2000s, many of these bets had turned to zero.

The primary example was pets-com, which went bust in November 2000.

Amazon had to refocus. Get back on strengthening its e-commerce infrastructure and, most of all, change the paradigm. Move from e-commerce to platform.

In short, to quickly expand the selection of goods while keeping prices low, they had to host as many third-party stores on Amazon.

That was an opportunity to fix the jumbled mess which had become the underlying Amazon infrastructure.

Thus, AWS also came about as a side effect of Amazon’s change in paradigm (from e-commerce to platform).

For a period in the 2010s, AWS has powered the whole Web2 startup ecosystem (Airbnb, Instagram, Netflix, Pinterest, Slack, and many more).

And a crucial personal detail, AWS was led by Andy Jassy since 2003. Eventually, Jassy took the place of Bezos as CEO of Amazon.

So you get what a revolution AWS was for Amazon from a business standpoint!

The low-margin strategy worked. Only in 2008 did Google realize the threat of AWS launching its own Google Cloud Platform.

And Microsoft took even longer, launching its Azure in 2010.

That gave AWS an incredible bandwidth to organically grow AWS into the most powerful tech company these days.

Three takes from this story:

– AWS was born as side effect of a paradigm shift: paradigm shifts can be extremely powerful when a breakthrough moment comes. And the dot-com bubble, a survive-or-die moment, really defined Amazon for the next twenty-five years. Also, from this paradigm shift, as an effect, of making difficult decisions, you might stumble upon gild mines! That is how Amazon stumbled upon AWS.

– The physical platform becomes the basis for building an incredible service business: when a company manages to build the next physical platform, initially, margins do not matter. indeed, in the long run, the company owning the physical platform will be able to build a service business on top of it with incredible margins. Often, the service side of the business will serve as the profit and cash flow center to keep subsidizing the physical product for a larger and larger group of people.

– Hide the margins: as the story shows, everyone wants to be in a high-margin business. And a few want to risk their margins. That is why the fact that Amazon hid under its hood the margins and profits of AWS helped it to become the tech giant we know today. Only two years later, from the first AWS official launch, Google came out with a cloud service, and only by 2010 Microsoft did do the same.

Read Also: Amazon AWS, Amazon Business Model, Business Model.

Connected to Amazon Business Model Amazon has a diversified business model. In 2021 Amazon posted over $469 billion in revenues and over $33 billion in net profits. Online stores contributed to over 47% of Amazon revenues, Third-party Seller Services, Amazon AWS, Subscription Services, Advertising revenues, and Physical Stores.

Amazon has a diversified business model. In 2021 Amazon posted over $469 billion in revenues and over $33 billion in net profits. Online stores contributed to over 47% of Amazon revenues, Third-party Seller Services, Amazon AWS, Subscription Services, Advertising revenues, and Physical Stores. Amazon’s mission statement is to “serve consumers through online and physical stores and focus on selection, price, and convenience.” Amazon’s vision statement is “to be Earth’s most customer-centric company, where customers can find and discover anything they might want to buy online, and endeavors to offer its customers the lowest possible prices.”

Amazon’s mission statement is to “serve consumers through online and physical stores and focus on selection, price, and convenience.” Amazon’s vision statement is “to be Earth’s most customer-centric company, where customers can find and discover anything they might want to buy online, and endeavors to offer its customers the lowest possible prices.”  In the Amazon Shareholders’ Letter for 2018, Jeff Bezos analyzed the Amazon business model, and it also focused on a few key lessons that Amazon as a company has learned over the years. These lessons are fundamental for any entrepreneur, of small or large organization to understand the pitfalls to avoid to run a successful company!

In the Amazon Shareholders’ Letter for 2018, Jeff Bezos analyzed the Amazon business model, and it also focused on a few key lessons that Amazon as a company has learned over the years. These lessons are fundamental for any entrepreneur, of small or large organization to understand the pitfalls to avoid to run a successful company! Amazon has a business model with many moving parts. With the e-commerce platform which generated over $222 billion in 2021, followed by third-party stores services which generated over $103 billion, Amazon AWS, which generated over $62 billion, Amazon advertising which generated over $31 billion and Amazon Prime which also generated over $31 billion, and physical stores which generated over $17 billion.

Amazon has a business model with many moving parts. With the e-commerce platform which generated over $222 billion in 2021, followed by third-party stores services which generated over $103 billion, Amazon AWS, which generated over $62 billion, Amazon advertising which generated over $31 billion and Amazon Prime which also generated over $31 billion, and physical stores which generated over $17 billion.

The Amazon Working Backwards Method is a product development methodology that advocates building a product based on customer needs. The Amazon Working Backwards Method gained traction after notable Amazon employee Ian McAllister shared the company’s product development approach on Quora. McAllister noted that the method seeks “to work backwards from the customer, rather than starting with an idea for a product and trying to bolt customers onto it.”

The Amazon Working Backwards Method is a product development methodology that advocates building a product based on customer needs. The Amazon Working Backwards Method gained traction after notable Amazon employee Ian McAllister shared the company’s product development approach on Quora. McAllister noted that the method seeks “to work backwards from the customer, rather than starting with an idea for a product and trying to bolt customers onto it.” The Amazon Flywheel or Amazon Virtuous Cycle is a strategy that leverages on customer experience to drive traffic to the platform and third-party sellers. That improves the selections of goods, and Amazon further improves its cost structure so it can decrease prices which spins the flywheel.

The Amazon Flywheel or Amazon Virtuous Cycle is a strategy that leverages on customer experience to drive traffic to the platform and third-party sellers. That improves the selections of goods, and Amazon further improves its cost structure so it can decrease prices which spins the flywheel. In the letter to shareholders in 2016, Jeff Bezos addressed a topic he had been thinking quite profoundly in the last decades as he led Amazon: Day 1. As Jeff Bezos put it “Day 2 is stasis. Followed by irrelevance. Followed by excruciating, painful decline. Followed by death. And that is why it is always Day 1.”

In the letter to shareholders in 2016, Jeff Bezos addressed a topic he had been thinking quite profoundly in the last decades as he led Amazon: Day 1. As Jeff Bezos put it “Day 2 is stasis. Followed by irrelevance. Followed by excruciating, painful decline. Followed by death. And that is why it is always Day 1.”The post History of AWS appeared first on FourWeekMBA.

What Is Evidence-based Management? Evidence-based Management In A Nutshell

Evidence-based management is a decision-making approach that uses critical thinking and the best available evidence. Evidence-based management is an approach that considers multiple sources of scientific evidence and empirical data as means of attaining knowledge and making decisions.

Understanding evidence-based managementThis means scientific literature is used to answer questions, guide strategy decisions, and formulate long-term plans. Evidence-based management is an emerging movement that forms part of the larger transition to evidence-based practices.

The transition began to gather momentum after the introduction of evidence-based medicine in 1992, with the approach quickly spreading to education, law, public policy, architecture, and many other fields.

Ultimately, the goal of an evidence-based approach is to encourage professionals to give more credence to evidence while making decisions. The approach seeks to replace the ineffective practices that base decision-making on tradition, intuition, and personal experience.

The key components of evidence-based managementIn a nutshell, evidence-based management is based on three key components:

The best available evidence – this means evaluating multiple sources of scientific evidence and empirical results to discover new interventions and strategies. In addition to scientific research, evidence may take the form of organizational data, professional expertise, or stakeholder values and concerns.Systematic decision-making – decisions are made by considering the published literature, critically appraising evidence, and crafting a strategy underpinned by science. Mental biases, prejudices, or lazy thinking must be reduced or eliminated.Re-evaluating and adapting – all decisions must be critically examined and evaluated using the scientific method. Consistently evaluating the original hypothesis is the only way to determine whether the strategy or decision had its intended effect.Incorporating evidence-based managementTo deliver better outcomes in an organizational context, the Chartered Institute of Personnel and Development and the Center for Evidence-Based Management developed six steps:

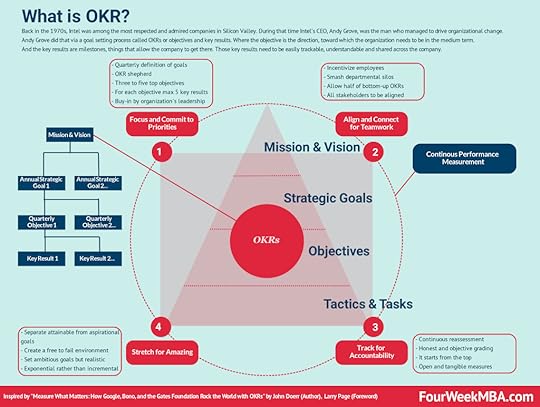

Asking – the process begins by taking a practical issue or problem and turning it into an answerable question.Acquiring – in the second step, decision-makers systematically search for and retrieve evidence.Appraising – the evidence is then critically appraised for trustworthiness, quality, and relevance. Where and how was the evidence gathered? Could it be biased? Is it the best available evidence? Is there enough evidence to reach a conclusion?Aggregating – in the fourth step, the evidence is combined and weighted according to relevance or importance.Applying – the most important evidence is then incorporated into decision-making.Assessing – in the assessment stage, the outcome of the decision must be evaluated regularly. Does the evidence-based decision support the answerable question or hypothesis? Key takeaways:Evidence-based management is a decision-making approach that uses critical thinking and the best available evidence. The approach seeks to replace decision-making based on personal experience, intuition, or tradition.Evidence-based management is based on three key components: the best available evidence, systematic decision-making, and re-evaluating and adapting. In addition to scientific research, the best available evidence may also be related to stakeholder values and concerns, internal data, and professional expertise.Evidence-based management delivers better organizational outcomes in six steps: asking, acquiring, appraising, aggregating, applying, and assessing. Collectively, the steps help decision-makers answer questions and test hypotheses. Related Goal-Setting & Growth Frameworks Andy Grove, helped Intel become among the most valuable companies by 1997. In his years at Intel, he conceived a management and goal-setting system, called OKR, standing for “objectives and key results.” Venture capitalist and early investor in Google, John Doerr, systematized in the book “Measure What Matters.”

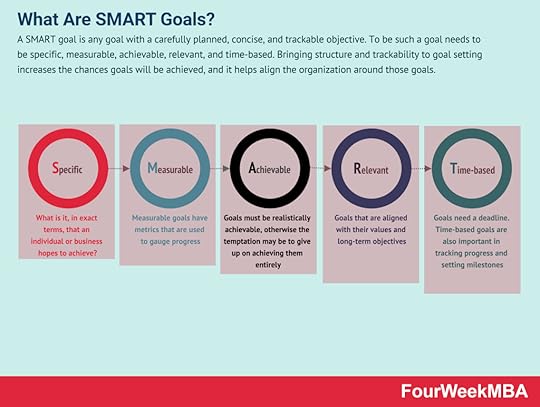

Andy Grove, helped Intel become among the most valuable companies by 1997. In his years at Intel, he conceived a management and goal-setting system, called OKR, standing for “objectives and key results.” Venture capitalist and early investor in Google, John Doerr, systematized in the book “Measure What Matters.” A SMART goal is any goal with a carefully planned, concise, and trackable objective. To be such a goal needs to be specific, measurable, achievable, relevant, and time-based. Bringing structure and trackability to goal setting increases the chances goals will be achieved, and it helps align the organization around those goals.

A SMART goal is any goal with a carefully planned, concise, and trackable objective. To be such a goal needs to be specific, measurable, achievable, relevant, and time-based. Bringing structure and trackability to goal setting increases the chances goals will be achieved, and it helps align the organization around those goals. First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business.

First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business. The theory was developed by psychologist Edwin Locke who also has a background in motivation and leadership research. Locke’s goal-setting theory of motivation provides a framework for setting effective and motivating goals. Locke was able to demonstrate that goal setting was linked to performance.

The theory was developed by psychologist Edwin Locke who also has a background in motivation and leadership research. Locke’s goal-setting theory of motivation provides a framework for setting effective and motivating goals. Locke was able to demonstrate that goal setting was linked to performance. Businesses use backcasting to plan for a desired future by determining the steps required to achieve that future. Backcasting is the opposite of forecasting, where a business sets future goals and works toward them by maintaining the status quo.

Businesses use backcasting to plan for a desired future by determining the steps required to achieve that future. Backcasting is the opposite of forecasting, where a business sets future goals and works toward them by maintaining the status quo. Moonshot thinking is an approach to innovation, and it can be applied to business or any other discipline where you target at least 10X goals. That shifts the mindset, and it empowers a team of people to look for unconventional solutions, thus starting from first principles, by leveraging on fast-paced experimentation.

Moonshot thinking is an approach to innovation, and it can be applied to business or any other discipline where you target at least 10X goals. That shifts the mindset, and it empowers a team of people to look for unconventional solutions, thus starting from first principles, by leveraging on fast-paced experimentation. fixed mindset believes their intelligence and talents are fixed traits that cannot be developed. The two mindsets were developed by American psychologist Carol Dweck while studying human motivation.Both mindsets are comprised of conscious and subconscious thought patterns established at a very young age. In adult life, they have profound implications for personal and professional success.Individuals with a growth mindset devote more time and effort to achieving difficult goals and by extension, are less concerned with the opinions or abilities of others. Individuals with a fixed mindset are sensitive to criticism and may be preoccupied with proving their talents to others.

fixed mindset believes their intelligence and talents are fixed traits that cannot be developed. The two mindsets were developed by American psychologist Carol Dweck while studying human motivation.Both mindsets are comprised of conscious and subconscious thought patterns established at a very young age. In adult life, they have profound implications for personal and professional success.Individuals with a growth mindset devote more time and effort to achieving difficult goals and by extension, are less concerned with the opinions or abilities of others. Individuals with a fixed mindset are sensitive to criticism and may be preoccupied with proving their talents to others. At its core, a growth mindset sees opportunities instead of obstacles. Despite scientific evidence to the contrary, many individuals believe their intelligence, talents, and skills do not advance once they reach adulthood. An eagerness to learn is something every person with a growth mindset possesses.

At its core, a growth mindset sees opportunities instead of obstacles. Despite scientific evidence to the contrary, many individuals believe their intelligence, talents, and skills do not advance once they reach adulthood. An eagerness to learn is something every person with a growth mindset possesses. Hockey stick growth is a pattern where company growth is slow until an inflection point is reached and the growth becomes exponential. The line connecting the numerous data points resembles the shape of a hockey stick, which gives the concept its name. Hockey stick growth is, therefore, a term used to describe a line chart in which there is a sudden sharp increase after a period of relative dormancy. Related Case Studies

Hockey stick growth is a pattern where company growth is slow until an inflection point is reached and the growth becomes exponential. The line connecting the numerous data points resembles the shape of a hockey stick, which gives the concept its name. Hockey stick growth is, therefore, a term used to describe a line chart in which there is a sudden sharp increase after a period of relative dormancy. Related Case Studies The innovation loop is a methodology/framework derived from the Bell Labs, which produced innovation at scale throughout the 20th century. They learned how to leverage a hybrid innovation management model based on science, invention, engineering, and manufacturing at scale. By leveraging individual genius, creativity, and small/large groups.

The innovation loop is a methodology/framework derived from the Bell Labs, which produced innovation at scale throughout the 20th century. They learned how to leverage a hybrid innovation management model based on science, invention, engineering, and manufacturing at scale. By leveraging individual genius, creativity, and small/large groups. In a business world driven by technology and digitalization, competition is much more fluid, as innovation becomes a bottom-up approach that can come from anywhere. Thus, making it much harder to define the boundaries of existing markets. Therefore, a proper business competition analysis looks at customer, technology, distribution, and financial model overlaps. While at the same time looking at future potential intersections among industries that in the short-term seem unrelated.

In a business world driven by technology and digitalization, competition is much more fluid, as innovation becomes a bottom-up approach that can come from anywhere. Thus, making it much harder to define the boundaries of existing markets. Therefore, a proper business competition analysis looks at customer, technology, distribution, and financial model overlaps. While at the same time looking at future potential intersections among industries that in the short-term seem unrelated. Business scaling is the process of transformation of a business as the product is validated by wider and wider market segments. Business scaling is about creating traction for a product that fits a small market segment. As the product is validated it becomes critical to build a viable business model. And as the product is offered at wider and wider market segments, it’s important to align product, business model, and organizational design, to enable wider and wider scale.

Business scaling is the process of transformation of a business as the product is validated by wider and wider market segments. Business scaling is about creating traction for a product that fits a small market segment. As the product is validated it becomes critical to build a viable business model. And as the product is offered at wider and wider market segments, it’s important to align product, business model, and organizational design, to enable wider and wider scale.  Disruptive innovation as a term was first described by Clayton M. Christensen, an American academic and business consultant whom The Economist called “the most influential management thinker of his time.” Disruptive innovation describes the process by which a product or service takes hold at the bottom of a market and eventually displaces established competitors, products, firms, or alliances.

Disruptive innovation as a term was first described by Clayton M. Christensen, an American academic and business consultant whom The Economist called “the most influential management thinker of his time.” Disruptive innovation describes the process by which a product or service takes hold at the bottom of a market and eventually displaces established competitors, products, firms, or alliances.  An innovation funnel is a tool or process ensuring only the best ideas are executed. In a metaphorical sense, the funnel screens innovative ideas for viability so that only the best products, processes, or business models are launched to the market. An innovation funnel provides a framework for the screening and testing of innovative ideas for viability.

An innovation funnel is a tool or process ensuring only the best ideas are executed. In a metaphorical sense, the funnel screens innovative ideas for viability so that only the best products, processes, or business models are launched to the market. An innovation funnel provides a framework for the screening and testing of innovative ideas for viability. A four-step innovation process is a simple tool that businesses can use to drive consistent innovation. The four-step innovation process was created by David Weiss and Claude Legrand as a means of encouraging sustainable innovation within an organization. The process helps businesses solve complex problems with creative ideas instead of relying on low-impact, quick-fix solutions.

A four-step innovation process is a simple tool that businesses can use to drive consistent innovation. The four-step innovation process was created by David Weiss and Claude Legrand as a means of encouraging sustainable innovation within an organization. The process helps businesses solve complex problems with creative ideas instead of relying on low-impact, quick-fix solutions. Innovation in the modern sense is about coming up with solutions to defined or not defined problems that can create a new world. Breakthrough innovations might try to solve in whole new way, well-defined problems. Business innovation might start by finding solutions to well-defined problems by continuously improving on them.

Innovation in the modern sense is about coming up with solutions to defined or not defined problems that can create a new world. Breakthrough innovations might try to solve in whole new way, well-defined problems. Business innovation might start by finding solutions to well-defined problems by continuously improving on them.Read Next: High-Performance Management.

Read Also: Eisenhower Matrix, BCG Matrix, Kepner-Tregoe Matrix, Decision Matrix,RACI Matrix, SWOT Analysis, Personal SWOT Analysis, TOWS Matrix, PESTEL Analysis, Porter’s Five Forces.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is Evidence-based Management? Evidence-based Management In A Nutshell appeared first on FourWeekMBA.

September 15, 2022

What is market depth?

Market depth shows the various buy and sell orders that have been placed on the market for a particular security. It is normally arranged in a table of live bid-ask prices with the total number of buyers and volume listed for each price.

Understanding market depthMarket depth is an indicator of volume and provides a real-time snapshot of buy and sell orders for a particular security.

Both investors and traders use market depth to analyze the various prices and volumes that accumulate on either side of the bid and ask price.

Relatively liquid securities will show good market depth, which means large orders will not impact the price significantly.

Relatively illiquid securities have poor market depth and their prices are more affected by large orders.

Market depth is particularly important for traders because it enables them to determine short-term market sentiment.

When sellers outnumber buyers, for example, there is weakness in the price of the security. When the reverse is true, the price of the security is likely to increase.

Information from market depth can also be used to:

Determine where one’s order sits in the queue of buyers or sellers and how long they may have to wait before it is filled. An order where the investor sets the specific buy or sell price is called a limit order.Analyze the amount of seller volume to determine whether a market order is appropriate or indeed cost-effective.Determine the point at which the majority of buyer and seller activity is taking place. This can be used to place an order at the head of the queue to ensure it is filled.Factors that influence market depthHere are a few factors that influence market depth:

Tick size – the minimum price increment at which trades may be executed. In the United States, the tick size is one-hundredth of a dollar, or $0.01. This was changed in 2001 from one-sixteenth of a dollar to improve market depth.Market transparency – while bid/ask prices are available most of the time, information about the size of an order or one that is pending is sometimes hidden from view. Less transparent market depth information can cause some investors and traders to refrain from participating.Available leverage – minimum margin requirements set by regulatory bodies stabilize the marketplace, but they also decrease market depth. In other words, those willing to take on more leverage cannot do so without obtaining more capital.Trade restrictions – various restrictions prevent market participants from adding depth when they are interested in doing so. Examples include options position and futures contract limits and the uptick rule, which states that short telling is only permitted when a security is on an uptick.Key takeaways:Market depth is an indicator of volume and provides a real-time snapshot of buy and sell orders for a particular security.Market depth is particularly important for traders because it enables them to determine short-term market sentiment. The ratio of buyers and sellers and their respective volumes may clarify whether there is strength or weakness in the price of the security.Factors that influence market depth include tick size, market information transparency, limits imposed on available leverage, and trade restrictions.Main Resources

Business Models

Business Strategy

Business Development

Digital Business Models

Distribution Channels

Marketing Strategy

Platform Business Models

Tech Business Model

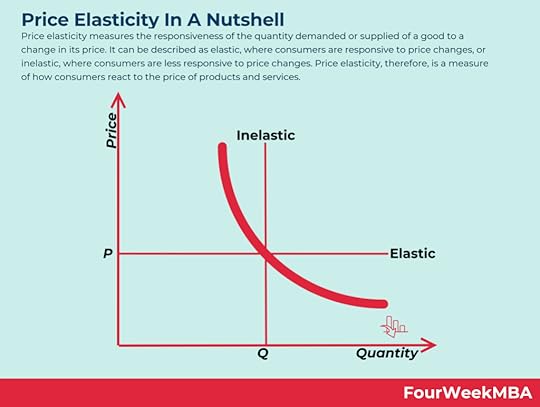

Price sensitivity can be explained using the price elasticity of demand, a concept in economics that measures the variation in product demand as the price of the product itself varies. In consumer behavior, price sensitivity describes and measures fluctuations in product demand as the price of that product changes.

Price sensitivity can be explained using the price elasticity of demand, a concept in economics that measures the variation in product demand as the price of the product itself varies. In consumer behavior, price sensitivity describes and measures fluctuations in product demand as the price of that product changes. A price ceiling is a price control or limit on how high a price can be charged for a product, service, or commodity. Price ceilings are limits imposed on the price of a product, service, or commodity to protect consumers from prohibitively expensive items. These limits are usually imposed by the government but can also be set in the resale price maintenance (RPM) agreement between a product manufacturer and its distributors.

A price ceiling is a price control or limit on how high a price can be charged for a product, service, or commodity. Price ceilings are limits imposed on the price of a product, service, or commodity to protect consumers from prohibitively expensive items. These limits are usually imposed by the government but can also be set in the resale price maintenance (RPM) agreement between a product manufacturer and its distributors.  Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes. Price elasticity, therefore, is a measure of how consumers react to the price of products and services.

Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes. Price elasticity, therefore, is a measure of how consumers react to the price of products and services. In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.

A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets.

Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets. Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth.

Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth. In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production.

In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty.

The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty. State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage.

State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage. The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.