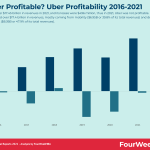

Is Uber Profitable? Uber Profitability 2016-2021

Uber made over $17.45 billion in revenues in 2021, and its losses were $496 million, thus in 2021, Uber was not profitable. In 2021, Uber generated over $17.4 billion in revenues, mostly coming from mobility ($6.95B or 39.8% of its total revenues) and delivery with Uber Eats ($8.36B or 47.9% of its total revenues).

Understanding Uber financialsUber made over $11 billion in dollars in revenues in 2018, and its profits were $987 million. In 2017, the company earned $7.9 billion in revenues, and its net losses were over $4 billion. And in 2016, Uber made $3.8 billion in revenues, and its net losses were over 370 million dollars.

It’s essential to notice that the profitability in 2016 was positively affected by the sales of Uber China for $2.9 billion. And in 2018 it was positively impacted by divestitures in Russian operations and gains on investments for Chinese’ Uber, called Didi.

Uber cash flows coming from dismissions in several business operations. Source: Uber Annual Report, 2018.

Sale of Uber China

Sales of Uber China, which would go to the Chinese startup, Didi. Source: Uber Financial Statements.

As pointed out in Uber financial statements:

On August 1, 2016, the Company sold its majority-owned subsidiary, Uber China, Ltd. (“Uber China”) to Xiaoju Kuaizhi, Inc. (“Didi”) for an equity stake in Didi, valued at the time at approximately $6.0 billion. The financial results of Uber China’s operations are presented as discontinued operations in the consolidated statements of operations and, as such, have been excluded from continuing operations for all periods presented. Refer to Note 15—Discontinued Operations for further information. During the year ended December 31, 2018, the Company completed the disposition of the Uber Russia and the Commonwealth of Independent States (“Uber Russia/CIS”) operations and the sale of the Southeast Asia operations. Refer to Note 19—Divestitures for further information. These 2018 divestitures did not represent a strategic shift that had a major effect on the Company’s operations and financial results, and therefore are not presented as discontinued operations.

Pretty much Uber sold to Didi, but then it acquired a stake into the company by 2017:

From the schedule above, you can see the several investments Uber made throughout the years, also based on dismissions, sales, and joint ventures.

Dismission of Russia/CIS operations with the creation of the Yandex joint ventureAs pointed out on Uber financial statements:

Uber operations in 2018In July 2017, a wholly-owned subsidiary of the Company agreed to contribute the net assets of its Uber Russia/CIS operations into a newly formed private limited liability company, MLU B.V., with Yandex and the Company receiving ownership interests in MLU B.V. As a result of this transaction, the Company determined that the contributed assets and liabilities were disposed of and met the held for sale requirement as of December 31, 2017. The Company performed an evaluation to determine if the sale constituted discontinued operations and concluded that the sale did not represent a major strategic shift, primarily because the Uber Russia/CIS operations did not materially affect consolidated assets, revenue or loss from operations of the Company. In addition, the Company determined the sale constituted the sale of a business in accordance with ASC 805. The carrying value of Uber Russia/CIS’s total assets and liabilities were $20 million and $15 million as of December 31, 2017, respectively. The transaction received approval from the necessary regulatory agencies in the fourth quarter of 2017 and closed on February 7, 2018.

Gain and divestitures are coming from dismissed, sold, and reorganized operations.

Gain on divestitures increased by $3.2 billion from 2017 to 2018. This increase was due to gains on the divestitures of our Russia/CIS and Southeast Asia operations.

Unrealized gain on investments increased by $2.0 billion from 2017 to 2018. This increase was primarily due to a gain from a fair value adjustment of our Didi investment.

Uber business model Uber is a is two-sided marketplace, a platform business model that connects drivers and riders, with an interface that has elements of gamification, that makes it easy for two sides to connect and transact. Uber makes money by collecting fees from the platform’s gross bookings.

Uber is a is two-sided marketplace, a platform business model that connects drivers and riders, with an interface that has elements of gamification, that makes it easy for two sides to connect and transact. Uber makes money by collecting fees from the platform’s gross bookings.

Read next:

Uber Eats Business ModelUber Business ModelLyft Business ModelHow Does HyreCar Make Money?Handpicked popular case studies from the site:

Google Business ModelHow Does Google Make Money?DuckDuckGo Business ModelAmazon Business ModelNetflix Business ModelSpotify Business ModelApple Business ModelOther business resources:

Business ModelBusiness DevelopmentBusiness StrategyMarket SegmentationMarketing StrategyMarketing vs. SalesHow To Write A Mission StatementGrowth HackingRelated Case Studies Netflix is a profitable company, which net profits were $5.1 billion in 2021. Growing from $2.7 billion in 2020. The company runs a negative cash flow business model, where it anticipates the costs of content development and licensing through the platform. Those costs get amortized over the years, as subscribers stick to the platform.

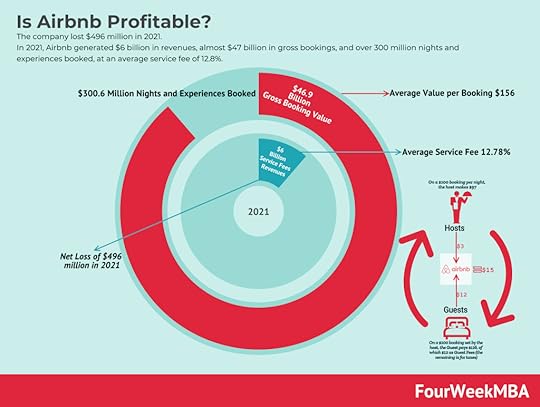

Netflix is a profitable company, which net profits were $5.1 billion in 2021. Growing from $2.7 billion in 2020. The company runs a negative cash flow business model, where it anticipates the costs of content development and licensing through the platform. Those costs get amortized over the years, as subscribers stick to the platform.  The company lost $496 million in 2021.

The company lost $496 million in 2021. Amazon was profitable in 2021. The company generated over $33 billion in net income, primarily driven by the Amazon AWS business, which contributed to over 55% of its operating margins and other profitable parts like Amazon Prime and Ads. The Amazon e-commerce platform runs at tight operating margins since it’s built for scale.

Amazon was profitable in 2021. The company generated over $33 billion in net income, primarily driven by the Amazon AWS business, which contributed to over 55% of its operating margins and other profitable parts like Amazon Prime and Ads. The Amazon e-commerce platform runs at tight operating margins since it’s built for scale. Uber made over $17.45 billion in revenues in 2021, and its losses were $496 million, thus in 2021, Uber was not profitable. In 2021, Uber generated over $17.4 billion in revenues, mostly coming from mobility ($6.95B or 39.8% of its total revenues) and delivery with Uber Eats ($8.36B or 47.9% of its total revenues).

Uber made over $17.45 billion in revenues in 2021, and its losses were $496 million, thus in 2021, Uber was not profitable. In 2021, Uber generated over $17.4 billion in revenues, mostly coming from mobility ($6.95B or 39.8% of its total revenues) and delivery with Uber Eats ($8.36B or 47.9% of its total revenues). Microsoft is the most profitable tech giant, with 41.6% operating margins, in 2021. Followed by Facebook (Meta) with 39.6% operating margins. Apple, with 29.6% operating margins. Google, with 22.6% operating margins. And Amazon’s 5.2% operating margins.

Microsoft is the most profitable tech giant, with 41.6% operating margins, in 2021. Followed by Facebook (Meta) with 39.6% operating margins. Apple, with 29.6% operating margins. Google, with 22.6% operating margins. And Amazon’s 5.2% operating margins. The post Is Uber Profitable? Uber Profitability 2016-2021 appeared first on FourWeekMBA.