Gennaro Cuofano's Blog, page 89

March 2, 2023

Salesforce Financials

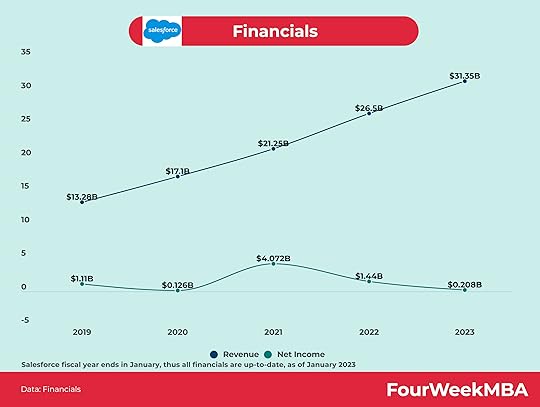

In 2023, Salesforce generated $31.35 billion in revenue, vs. $208 million in profits, compared to $26.5 billion in revenue in 2022, and $1.44 billion in profits. And $21.25 billion in revenue in 2021 and over $4 billion in profits.

Related Visual Stories Marc Benioff, Co-CEO of Salesforce is the main individual shareholder, with 3% of the company’s stock. Other major individual shareholders comprise Parker Harris, Co-Founder, and Chief Technology Officer, and Bret Taylor, who is the company’s CEO. Major institutional shareholders comprise The Vanguard Group, Fidelity, and BlackRock.

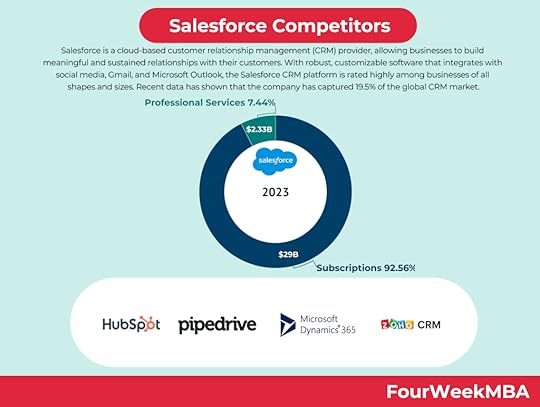

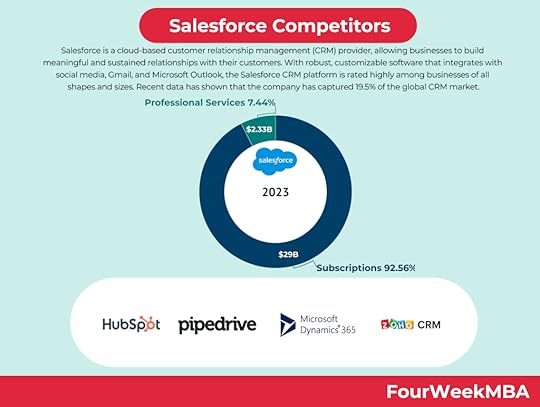

Marc Benioff, Co-CEO of Salesforce is the main individual shareholder, with 3% of the company’s stock. Other major individual shareholders comprise Parker Harris, Co-Founder, and Chief Technology Officer, and Bret Taylor, who is the company’s CEO. Major institutional shareholders comprise The Vanguard Group, Fidelity, and BlackRock.  Salesforce follows a SaaS business model, offering four main categories of cloud CRM (Customer Relationship Management) services spanning the sales cloud to the marketing cloud. Where subscriptions drive the primary revenue model. However, the company leverages professional assistance to push the adoption of the software and retention of paying subscribers. Indeed, in 2023 Salesforce generated $29 billion from subscriptions and $2.33 billion from professional services.

Salesforce follows a SaaS business model, offering four main categories of cloud CRM (Customer Relationship Management) services spanning the sales cloud to the marketing cloud. Where subscriptions drive the primary revenue model. However, the company leverages professional assistance to push the adoption of the software and retention of paying subscribers. Indeed, in 2023 Salesforce generated $29 billion from subscriptions and $2.33 billion from professional services. In 2023 Salesforce generated $29 billion from subscriptions and $2.33 in professional services, compared to $24.66 billion in subscriptions in 2022 and $1.83 in professional services.

In 2023 Salesforce generated $29 billion from subscriptions and $2.33 in professional services, compared to $24.66 billion in subscriptions in 2022 and $1.83 in professional services.  Salesforce had 73,000 employees in 2022, compared to 56,000 employees in 2021, and 49,000 employees in 2020.

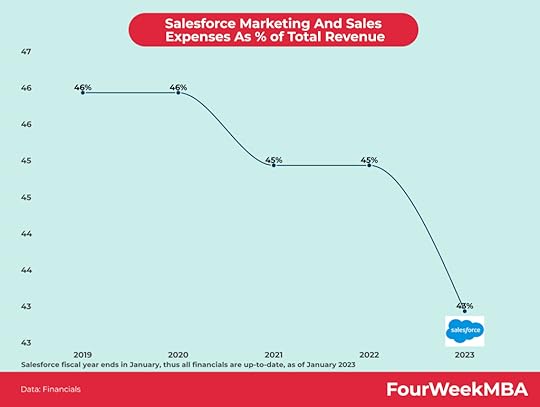

Salesforce had 73,000 employees in 2022, compared to 56,000 employees in 2021, and 49,000 employees in 2020.  In 2023, Salesforce spent 43% of its total revenue on marketing and sales expenses, compared to 45% in 2022, and 45% in 2021.

In 2023, Salesforce spent 43% of its total revenue on marketing and sales expenses, compared to 45% in 2022, and 45% in 2021.  Professional services are run at negative gross margins. In short, in 2022, on $2.33 billion in revenue from professional services, Salesforce reported a $208 million gross loss. In short, Salesforce runs professional services at a loss to boost its subscription revenue over time since professional services are used to enhance the use and retention of the software. The subscription revenue cost structure is quite effective. In 2022 on a $29 billion in subscription revenue, the company reported $5.82B in cost of revenue (expenses related to delivering the service and providing support, including the costs of data center capacity), thus generating a $23.2 billion in gross profits, in 2023.

Professional services are run at negative gross margins. In short, in 2022, on $2.33 billion in revenue from professional services, Salesforce reported a $208 million gross loss. In short, Salesforce runs professional services at a loss to boost its subscription revenue over time since professional services are used to enhance the use and retention of the software. The subscription revenue cost structure is quite effective. In 2022 on a $29 billion in subscription revenue, the company reported $5.82B in cost of revenue (expenses related to delivering the service and providing support, including the costs of data center capacity), thus generating a $23.2 billion in gross profits, in 2023.Salesforce Revenue Per Employee

Salesforce generated $208 million in profits in 2023, compared to $1.44 billion in 2021, and over $4 billion in profits in 2020.

Salesforce generated $208 million in profits in 2023, compared to $1.44 billion in 2021, and over $4 billion in profits in 2020.  Salesforce is a cloud-based customer relationship management (CRM) provider, allowing businesses to build meaningful and sustained relationships with their customers. With robust, customizable software that integrates with social media, Gmail, and Microsoft Outlook, the Salesforce CRM platform is rated highly among businesses of all shapes and sizes. Recent data has shown that the company has captured 19.5% of the global CRM market.

Salesforce is a cloud-based customer relationship management (CRM) provider, allowing businesses to build meaningful and sustained relationships with their customers. With robust, customizable software that integrates with social media, Gmail, and Microsoft Outlook, the Salesforce CRM platform is rated highly among businesses of all shapes and sizes. Recent data has shown that the company has captured 19.5% of the global CRM market. Salesforce’s mission is to build bridges between companies and customers. Salesforce does that via a SaaS platform, which is enhanced via professional services offered on top of it.

Salesforce’s mission is to build bridges between companies and customers. Salesforce does that via a SaaS platform, which is enhanced via professional services offered on top of it. Salesforce was founded in 1999 by Marc Benioff, Frank Dominguez, Dave Moellenhoff, and Parker Harris. In a relatively short time, the corporate powerhouse of enterprise software has made numerous acquisitions as part of its broader growth strategy to become a SaaS giant!

Salesforce was founded in 1999 by Marc Benioff, Frank Dominguez, Dave Moellenhoff, and Parker Harris. In a relatively short time, the corporate powerhouse of enterprise software has made numerous acquisitions as part of its broader growth strategy to become a SaaS giant!The post Salesforce Financials appeared first on FourWeekMBA.

Salesforce Profits

Salesforce generated $208 million in profits in 2023, compared to $1.44 billion in 2021, and over $4 billion in profits in 2020.

Related Visual Stories Marc Benioff, Co-CEO of Salesforce is the main individual shareholder, with 3% of the company’s stock. Other major individual shareholders comprise Parker Harris, Co-Founder, and Chief Technology Officer, and Bret Taylor, who is the company’s CEO. Major institutional shareholders comprise The Vanguard Group, Fidelity, and BlackRock.

Marc Benioff, Co-CEO of Salesforce is the main individual shareholder, with 3% of the company’s stock. Other major individual shareholders comprise Parker Harris, Co-Founder, and Chief Technology Officer, and Bret Taylor, who is the company’s CEO. Major institutional shareholders comprise The Vanguard Group, Fidelity, and BlackRock.  Salesforce follows a SaaS business model, offering four main categories of cloud CRM (Customer Relationship Management) services spanning the sales cloud to the marketing cloud. Where subscriptions drive the primary revenue model. However, the company leverages professional assistance to push the adoption of the software and retention of paying subscribers. Indeed, in 2023 Salesforce generated $29 billion from subscriptions and $2.33 billion from professional services.

Salesforce follows a SaaS business model, offering four main categories of cloud CRM (Customer Relationship Management) services spanning the sales cloud to the marketing cloud. Where subscriptions drive the primary revenue model. However, the company leverages professional assistance to push the adoption of the software and retention of paying subscribers. Indeed, in 2023 Salesforce generated $29 billion from subscriptions and $2.33 billion from professional services. In 2023 Salesforce generated $29 billion from subscriptions and $2.33 in professional services, compared to $24.66 billion in subscriptions in 2022 and $1.83 in professional services.

In 2023 Salesforce generated $29 billion from subscriptions and $2.33 in professional services, compared to $24.66 billion in subscriptions in 2022 and $1.83 in professional services.  Salesforce had 73,000 employees in 2022, compared to 56,000 employees in 2021, and 49,000 employees in 2020.

Salesforce had 73,000 employees in 2022, compared to 56,000 employees in 2021, and 49,000 employees in 2020.  In 2023, Salesforce spent 43% of its total revenue on marketing and sales expenses, compared to 45% in 2022, and 45% in 2021.

In 2023, Salesforce spent 43% of its total revenue on marketing and sales expenses, compared to 45% in 2022, and 45% in 2021.  Professional services are run at negative gross margins. In short, in 2022, on $2.33 billion in revenue from professional services, Salesforce reported a $208 million gross loss. In short, Salesforce runs professional services at a loss to boost its subscription revenue over time since professional services are used to enhance the use and retention of the software. The subscription revenue cost structure is quite effective. In 2022 on a $29 billion in subscription revenue, the company reported $5.82B in cost of revenue (expenses related to delivering the service and providing support, including the costs of data center capacity), thus generating a $23.2 billion in gross profits, in 2023.

Professional services are run at negative gross margins. In short, in 2022, on $2.33 billion in revenue from professional services, Salesforce reported a $208 million gross loss. In short, Salesforce runs professional services at a loss to boost its subscription revenue over time since professional services are used to enhance the use and retention of the software. The subscription revenue cost structure is quite effective. In 2022 on a $29 billion in subscription revenue, the company reported $5.82B in cost of revenue (expenses related to delivering the service and providing support, including the costs of data center capacity), thus generating a $23.2 billion in gross profits, in 2023.Salesforce Revenue Per Employee

Salesforce generated $208 million in profits in 2023, compared to $1.44 billion in 2021, and over $4 billion in profits in 2020.

Salesforce generated $208 million in profits in 2023, compared to $1.44 billion in 2021, and over $4 billion in profits in 2020.  Salesforce is a cloud-based customer relationship management (CRM) provider, allowing businesses to build meaningful and sustained relationships with their customers. With robust, customizable software that integrates with social media, Gmail, and Microsoft Outlook, the Salesforce CRM platform is rated highly among businesses of all shapes and sizes. Recent data has shown that the company has captured 19.5% of the global CRM market.

Salesforce is a cloud-based customer relationship management (CRM) provider, allowing businesses to build meaningful and sustained relationships with their customers. With robust, customizable software that integrates with social media, Gmail, and Microsoft Outlook, the Salesforce CRM platform is rated highly among businesses of all shapes and sizes. Recent data has shown that the company has captured 19.5% of the global CRM market. Salesforce’s mission is to build bridges between companies and customers. Salesforce does that via a SaaS platform, which is enhanced via professional services offered on top of it.

Salesforce’s mission is to build bridges between companies and customers. Salesforce does that via a SaaS platform, which is enhanced via professional services offered on top of it. Salesforce was founded in 1999 by Marc Benioff, Frank Dominguez, Dave Moellenhoff, and Parker Harris. In a relatively short time, the corporate powerhouse of enterprise software has made numerous acquisitions as part of its broader growth strategy to become a SaaS giant!

Salesforce was founded in 1999 by Marc Benioff, Frank Dominguez, Dave Moellenhoff, and Parker Harris. In a relatively short time, the corporate powerhouse of enterprise software has made numerous acquisitions as part of its broader growth strategy to become a SaaS giant!The post Salesforce Profits appeared first on FourWeekMBA.

November 8, 2022

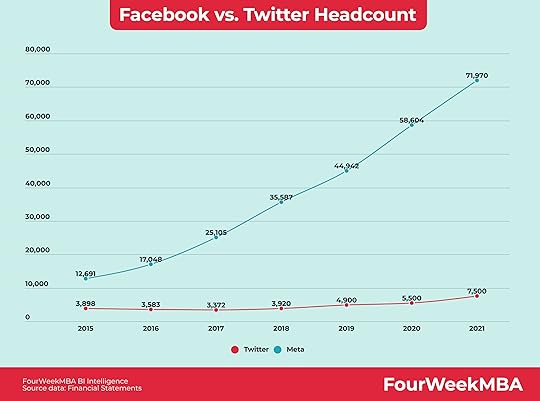

Facebook vs. Twitter Headcount

YearTwitter’s HeadcountMeta Headcount20153,89812,69120163,58317,04820173,37225,10520183,92035,58720194,90044,94220205,50058,60420217,50071,970FourWeekMBA BI Intelligence – Source data: Financial StatementsRelated Visual Stories

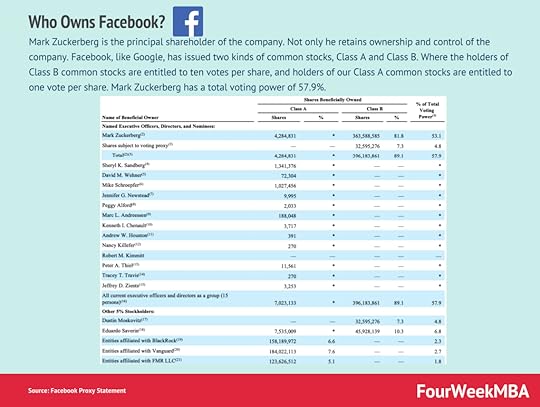

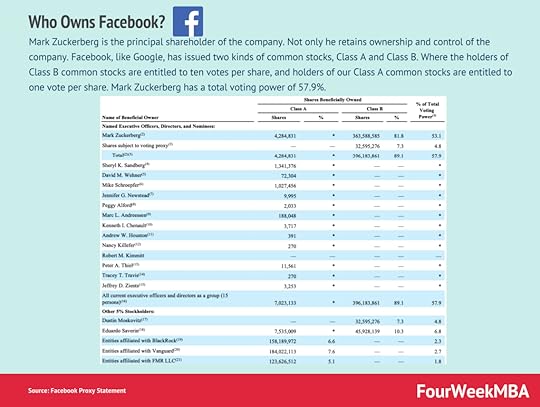

YearTwitter’s HeadcountMeta Headcount20153,89812,69120163,58317,04820173,37225,10520183,92035,58720194,90044,94220205,50058,60420217,50071,970FourWeekMBA BI Intelligence – Source data: Financial StatementsRelated Visual Stories Mark Zuckerberg is the principal shareholder of the company. Not only he retains ownership and control of the company. Facebook, like Google, has issued two kinds of common stocks, Class A and Class B. Where the holders of Class B common stocks are entitled to ten votes per share, and holders of our Class A common stocks are entitled to one vote per share. Mark Zuckerberg has a total voting power of 57.9%.

Mark Zuckerberg is the principal shareholder of the company. Not only he retains ownership and control of the company. Facebook, like Google, has issued two kinds of common stocks, Class A and Class B. Where the holders of Class B common stocks are entitled to ten votes per share, and holders of our Class A common stocks are entitled to one vote per share. Mark Zuckerberg has a total voting power of 57.9%. Attention-Merchants Business Model

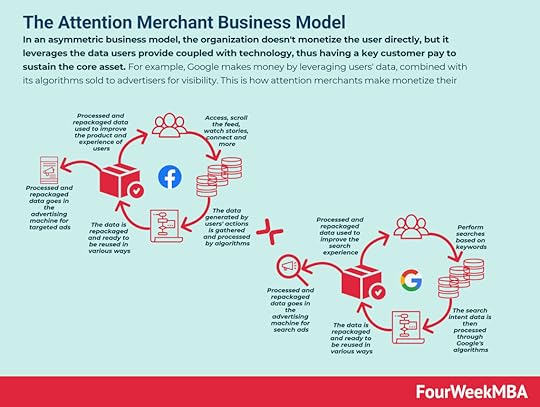

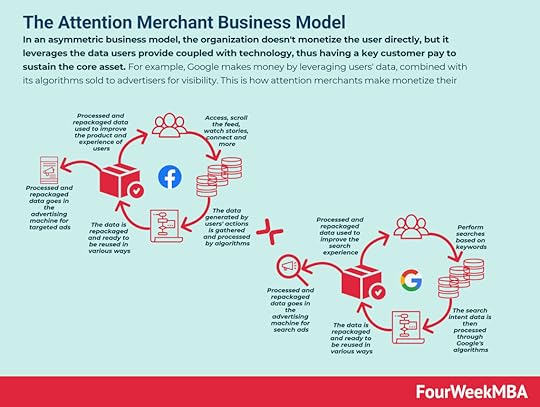

In an asymmetric business model, the organization doesn’t monetize the user directly. Still, it leverages the data users provide and technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data and its algorithms sold to advertisers for visibility. This is how attention merchants make monetize their business models.

In an asymmetric business model, the organization doesn’t monetize the user directly. Still, it leverages the data users provide and technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data and its algorithms sold to advertisers for visibility. This is how attention merchants make monetize their business models.  In an asymmetric business model, the organization doesn’t monetize the user directly. Still, it leverages the data users provide and technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data and its algorithms sold to advertisers for visibility.

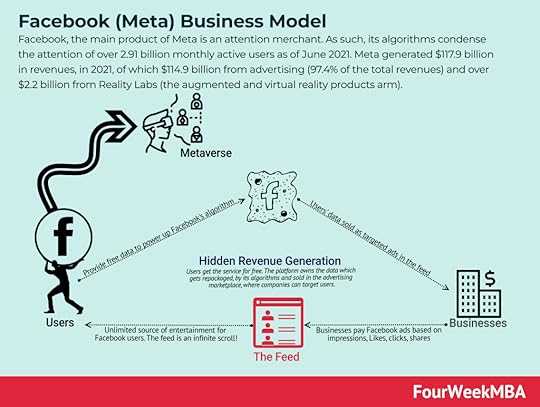

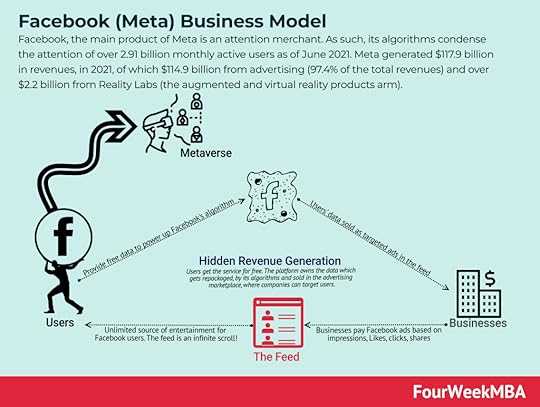

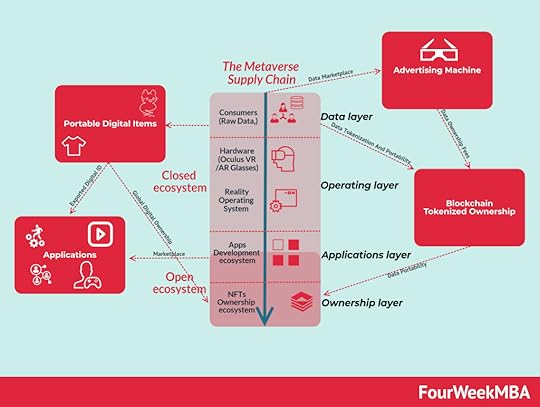

In an asymmetric business model, the organization doesn’t monetize the user directly. Still, it leverages the data users provide and technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data and its algorithms sold to advertisers for visibility.  Facebook, the main product of Meta, is an attention merchant. As such, its algorithms condense the attention of over 2.91 billion monthly active users as of June 2021. Meta generated $117.9 billion in revenues, in 2021, of which $114.9 billion was from advertising (97.4% of the total revenues) and over $2.2 billion from Reality Labs (the augmented and virtual reality products arm).

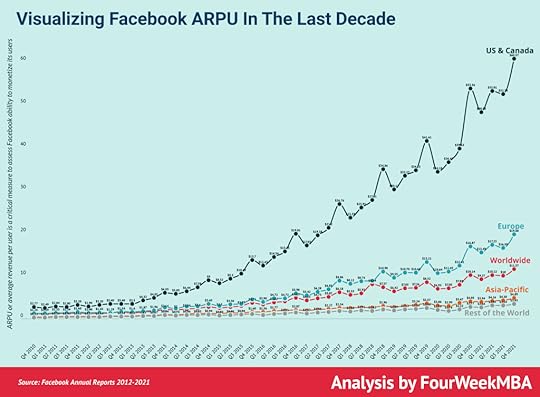

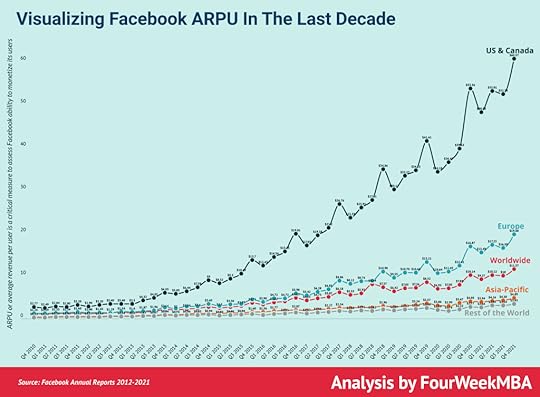

Facebook, the main product of Meta, is an attention merchant. As such, its algorithms condense the attention of over 2.91 billion monthly active users as of June 2021. Meta generated $117.9 billion in revenues, in 2021, of which $114.9 billion was from advertising (97.4% of the total revenues) and over $2.2 billion from Reality Labs (the augmented and virtual reality products arm).  The ARPU, or average revenue per user, is a key metric to track the success of Facebook – now Meta – family of products. For instance, by the end of 2021, Meta’s ARPU worldwide was $11.57. While in US & Canada, it was $60.57, in Europe, it was $19.68, in Asia $4.89, and in the rest of the world, it was $3.43.

The ARPU, or average revenue per user, is a key metric to track the success of Facebook – now Meta – family of products. For instance, by the end of 2021, Meta’s ARPU worldwide was $11.57. While in US & Canada, it was $60.57, in Europe, it was $19.68, in Asia $4.89, and in the rest of the world, it was $3.43.Facebook Organizational Structure

Facebook is characterized by a multi-faceted matrix organizational structure. The company utilizes a flat organizational structure in combination with corporate function-based teams and product-based or geographic divisions. The flat organizational structure is organized around the leadership of Mark Zuckerberg and the key executives around him. On the other hand, the function-based teams are based on the main corporate functions (like HR, product management, investor relations, and so on).

Facebook is characterized by a multi-faceted matrix organizational structure. The company utilizes a flat organizational structure in combination with corporate function-based teams and product-based or geographic divisions. The flat organizational structure is organized around the leadership of Mark Zuckerberg and the key executives around him. On the other hand, the function-based teams are based on the main corporate functions (like HR, product management, investor relations, and so on).

A hidden revenue business model is a pattern for revenue generation that keeps users out of the equation, so they don’t pay for the service or product offered. For instance, Google’s users don’t pay for the search engine. Instead, the revenue streams come from advertising money spent by businesses bidding on keywords.

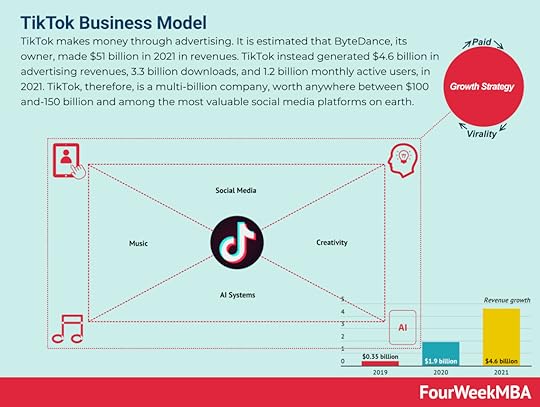

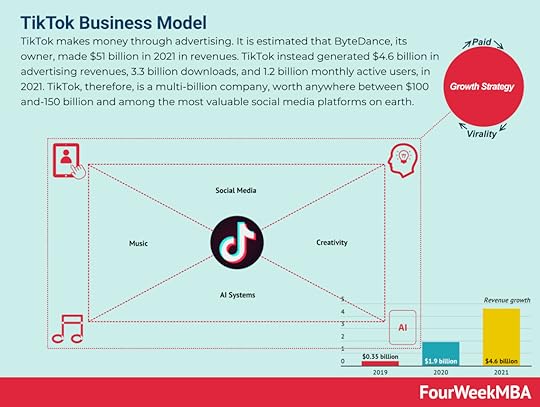

A hidden revenue business model is a pattern for revenue generation that keeps users out of the equation, so they don’t pay for the service or product offered. For instance, Google’s users don’t pay for the search engine. Instead, the revenue streams come from advertising money spent by businesses bidding on keywords. TikTok is a Chinese creative social media platform driven by short-form video content enabling users to interact and generate content at scale. TikTok primarily makes money through advertising, and it generated $4.6 billion in advertising revenues in 2021, thus making it among the most popular attention-based business models or attention merchants.

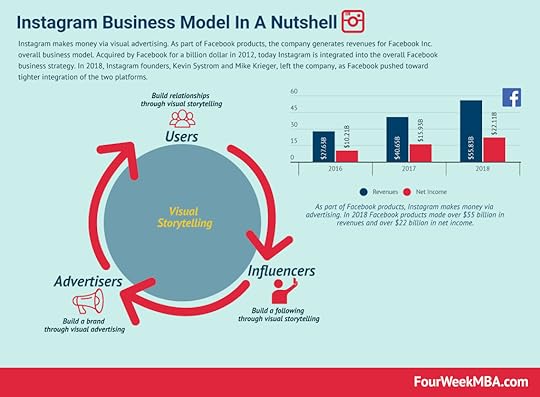

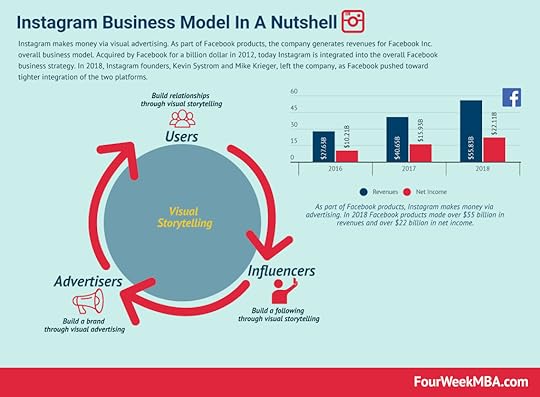

TikTok is a Chinese creative social media platform driven by short-form video content enabling users to interact and generate content at scale. TikTok primarily makes money through advertising, and it generated $4.6 billion in advertising revenues in 2021, thus making it among the most popular attention-based business models or attention merchants. Instagram makes money via visual advertising. As part of Facebook products, the company generates revenues for Facebook Inc.’s overall business model. Acquired by Facebook for a billion dollars in 2012, today Instagram is integrated into the overall Facebook business strategy. In 2018, Instagram founders, Kevin Systrom and Mike Krieger left the company, as Facebook pushed toward tighter integration of the two platforms.

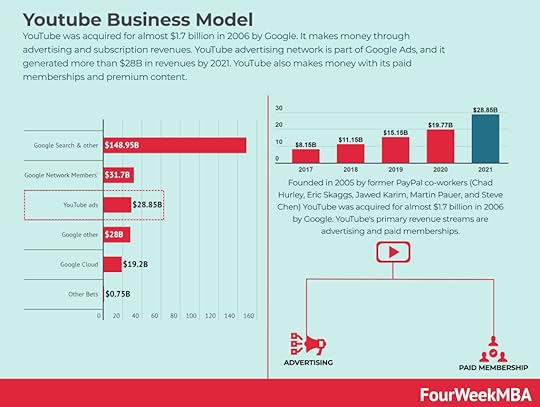

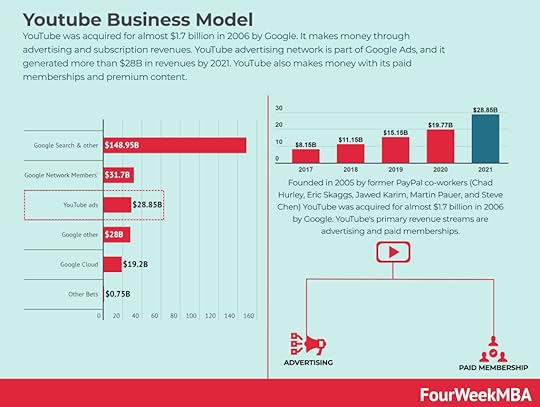

Instagram makes money via visual advertising. As part of Facebook products, the company generates revenues for Facebook Inc.’s overall business model. Acquired by Facebook for a billion dollars in 2012, today Instagram is integrated into the overall Facebook business strategy. In 2018, Instagram founders, Kevin Systrom and Mike Krieger left the company, as Facebook pushed toward tighter integration of the two platforms.  YouTube was acquired for almost $1.7 billion in 2006 by Google. It makes money through advertising and subscription revenues. YouTube advertising network is part of Google Ads, and it generated more than $28B in revenue by 2021. YouTube also makes money with its paid memberships and premium content.

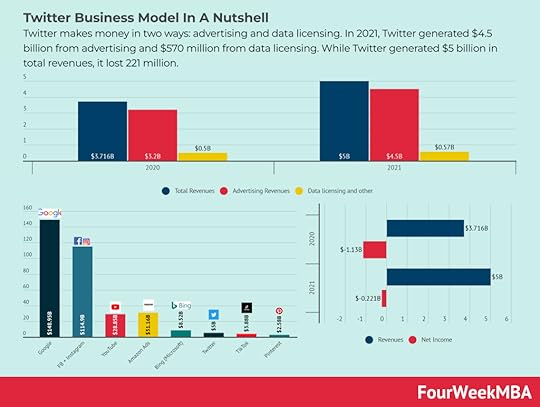

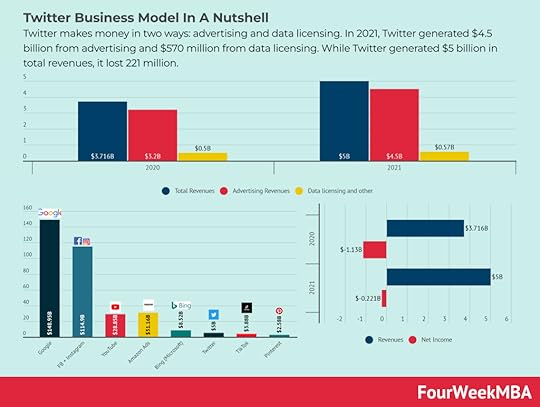

YouTube was acquired for almost $1.7 billion in 2006 by Google. It makes money through advertising and subscription revenues. YouTube advertising network is part of Google Ads, and it generated more than $28B in revenue by 2021. YouTube also makes money with its paid memberships and premium content. Twitter makes money in two ways: advertising and data licensing. In 2021, Twitter generated $4.5 billion from advertising and $570 million from data licensing. While Twitter generated $5 billion in total revenues, it lost 221 million.

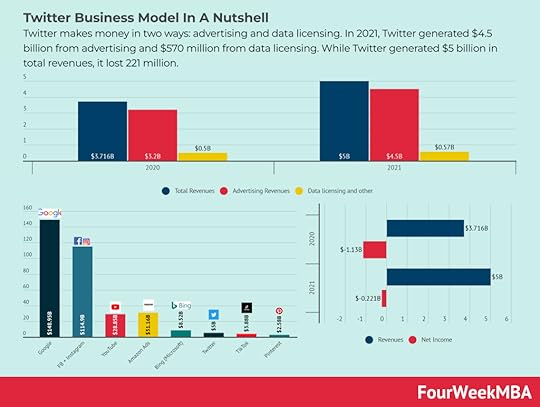

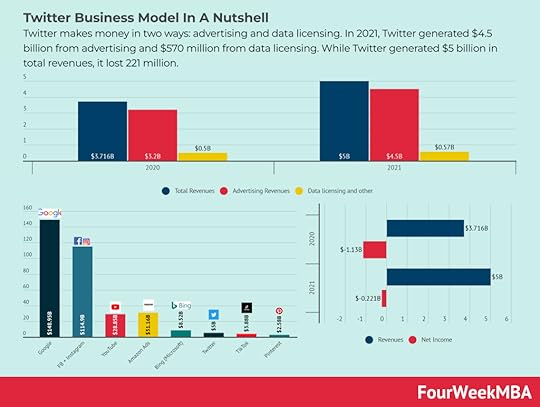

Twitter makes money in two ways: advertising and data licensing. In 2021, Twitter generated $4.5 billion from advertising and $570 million from data licensing. While Twitter generated $5 billion in total revenues, it lost 221 million.Read Also: Twitter Business Model, Digital Business Models, Platform Business Models, Attention-Based Business Models.

The post Facebook vs. Twitter Headcount appeared first on FourWeekMBA.

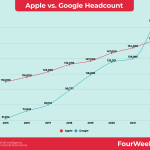

Apple vs. Google Headcount

YearApple’s HeadcountGoogle’s Headcount2015110,00061,8142016116,00072,0532017123,00080,1102018132,00098,7712019137,000118,8992020147,000135,3012021154,000139,9952022164,000186,779FourWeekMBA BI Intelligence – Source data: Financial Statements

YearApple’s HeadcountGoogle’s Headcount2015110,00061,8142016116,00072,0532017123,00080,1102018132,00098,7712019137,000118,8992020147,000135,3012021154,000139,9952022164,000186,779FourWeekMBA BI Intelligence – Source data: Financial StatementsRead Next: Apple Business Model, Google Business Model, Google Subsidiaries, What Happened To Google Glass?, What happened to Google Plus?, How does Google Maps make money?, Who Owns Google?, How Does YouTube Make Money?, History of Youtube, How Do YouTubers Make Money?

Related Case Studies A hidden revenue business model is a pattern for revenue generation that keeps users out of the equation, so they don’t pay for the service or product offered. For instance, Google’s users don’t pay for the search engine. Instead, the revenue streams come from advertising money spent by businesses bidding on keywords.

A hidden revenue business model is a pattern for revenue generation that keeps users out of the equation, so they don’t pay for the service or product offered. For instance, Google’s users don’t pay for the search engine. Instead, the revenue streams come from advertising money spent by businesses bidding on keywords. Google (now Alphabet) primarily makes money through advertising. The Google search engine, while free, is monetized with paid advertising. In 2021 Google’s advertising generated over $209 billion (beyond Google Search, this comprises YouTube Ads and the Network Members Sites) compared to $257 billion in net sales. Advertising represented over 81% of net sales, followed by Google Cloud ($19 billion) and Google’s other revenue streams (Google Play, Pixel phones, and YouTube Premium).

Google (now Alphabet) primarily makes money through advertising. The Google search engine, while free, is monetized with paid advertising. In 2021 Google’s advertising generated over $209 billion (beyond Google Search, this comprises YouTube Ads and the Network Members Sites) compared to $257 billion in net sales. Advertising represented over 81% of net sales, followed by Google Cloud ($19 billion) and Google’s other revenue streams (Google Play, Pixel phones, and YouTube Premium).Apple Business Model Evolution

Apple has a business model that is divided into products and services. Apple generated over $394 billion in revenues in 2022, of which $205.5 came from iPhone sales, $40 billion came from Mac sales, over $41 billion came from accessories and wearables (AirPods, Apple TV, Apple Watch, Beats products, HomePod, iPod touch, and accessories), $29.3 billion came from iPad sales, and $78.13 billion came from services.

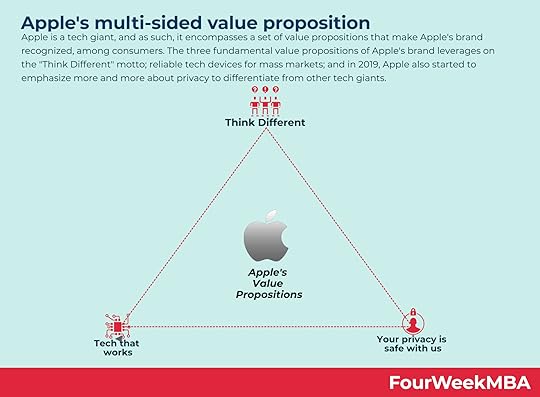

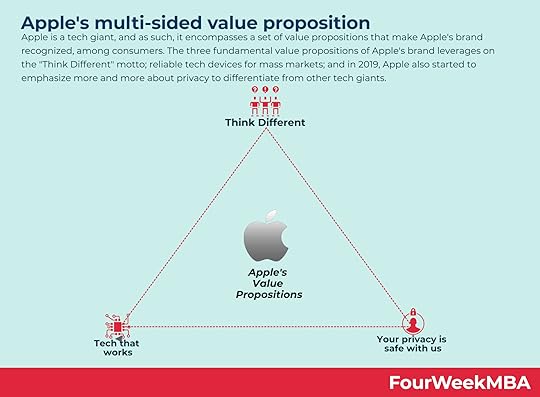

Apple has a business model that is divided into products and services. Apple generated over $394 billion in revenues in 2022, of which $205.5 came from iPhone sales, $40 billion came from Mac sales, over $41 billion came from accessories and wearables (AirPods, Apple TV, Apple Watch, Beats products, HomePod, iPod touch, and accessories), $29.3 billion came from iPad sales, and $78.13 billion came from services. Apple is a tech giant, and as such, it encompasses a set of value propositions that make Apple’s brand recognized among consumers. Apple’s brand’s three fundamental value propositions leverage the “Think Different” motto; reliable tech devices for mass markets. Starting in 2019, Apple also emphasized more privacy to differentiate itself from other tech giants.

Apple is a tech giant, and as such, it encompasses a set of value propositions that make Apple’s brand recognized among consumers. Apple’s brand’s three fundamental value propositions leverage the “Think Different” motto; reliable tech devices for mass markets. Starting in 2019, Apple also emphasized more privacy to differentiate itself from other tech giants. It costs Apple $501 to make an iPhone 14 Pro Max, and the company sells it at a base price of $1099. This makes Apple’s base markup on the latest iPhone model at 119% Apple is the only tech company able to sell its tech products at a such a premium, thanks to a combination of hardware, software and marketplace.

It costs Apple $501 to make an iPhone 14 Pro Max, and the company sells it at a base price of $1099. This makes Apple’s base markup on the latest iPhone model at 119% Apple is the only tech company able to sell its tech products at a such a premium, thanks to a combination of hardware, software and marketplace. It costs Apple $501 to make an iPhone 14 Pro Max, and the company sells it at a base price of $1099. This makes Apple’s base markup on the latest iPhone model at 119% Apple is the only tech company able to sell its tech products at such a premium, thanks to a combination of hardware, software, and marketplace.

It costs Apple $501 to make an iPhone 14 Pro Max, and the company sells it at a base price of $1099. This makes Apple’s base markup on the latest iPhone model at 119% Apple is the only tech company able to sell its tech products at such a premium, thanks to a combination of hardware, software, and marketplace. In 2022, most of Apple’s sales (62%) came from indirect channels (comprising third-party cellular networks, wholesalers/retailers, and resellers). These channels are critical for sales amplification, scale, and subsidies (to enable the iPhone to be purchased by many people). In comparison, the direct channel represented 38% of the total revenues. Stores are critical for customer experience, enabling the service business, and branding at scale.

In 2022, most of Apple’s sales (62%) came from indirect channels (comprising third-party cellular networks, wholesalers/retailers, and resellers). These channels are critical for sales amplification, scale, and subsidies (to enable the iPhone to be purchased by many people). In comparison, the direct channel represented 38% of the total revenues. Stores are critical for customer experience, enabling the service business, and branding at scale.

Apple Organizational Structure

Apple has a traditional hierarchical structure with product-based grouping and some collaboration between divisions.

Apple has a traditional hierarchical structure with product-based grouping and some collaboration between divisions.

Apple can leverage a strong consumer brand and set of successful products as a strength. Yet the company is still too reliant on the iPhone as a primary revenue stream. Though Apple is working to open up new markets as an opportunity, it has to make sure to sustain its stores’ sales.

Apple can leverage a strong consumer brand and set of successful products as a strength. Yet the company is still too reliant on the iPhone as a primary revenue stream. Though Apple is working to open up new markets as an opportunity, it has to make sure to sustain its stores’ sales.

Apps in the Apple Store follow five primary business model patterns: the free model, where the app might make money via paid ads. Freemium model where the app charges for premium features; subscription-based model, paid model, and paymium model is a mix of paid and freemium.

Apps in the Apple Store follow five primary business model patterns: the free model, where the app might make money via paid ads. Freemium model where the app charges for premium features; subscription-based model, paid model, and paymium model is a mix of paid and freemium.

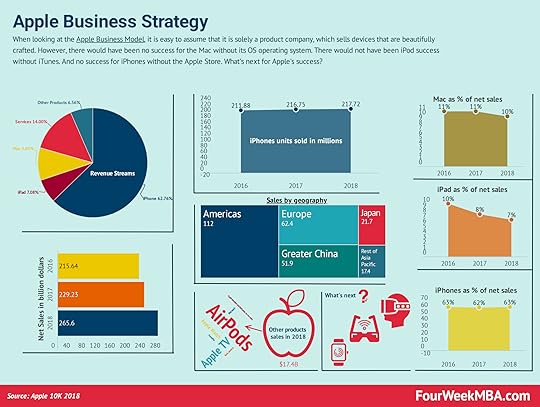

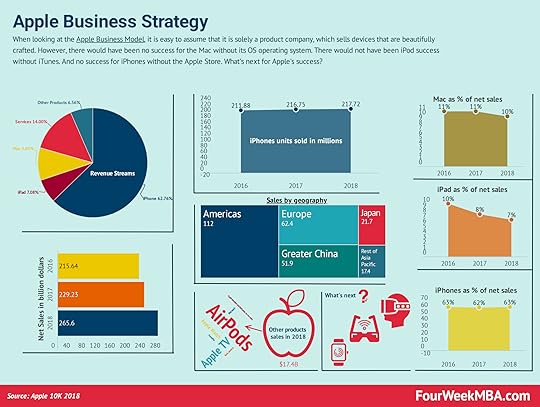

When looking at the Apple Business Model, it is easy to assume that it is solely a product company which sells devices that are beautifully crafted. However, there would have been no success for the Mac without its OS operating system. There would not have been iPod success without iTunes. And no success for iPhones without the Apple Store. What’s next for Apple’s success?

When looking at the Apple Business Model, it is easy to assume that it is solely a product company which sells devices that are beautifully crafted. However, there would have been no success for the Mac without its OS operating system. There would not have been iPod success without iTunes. And no success for iPhones without the Apple Store. What’s next for Apple’s success?The post Apple vs. Google Headcount appeared first on FourWeekMBA.

Tesla Employees Number

YearEmployees201410,161201513,058201617,782201737,543201848,817201948,016202070,757202199,290FourWeekMBA BI Intelligence – Source data: Financial StatementsRelated Case Studies

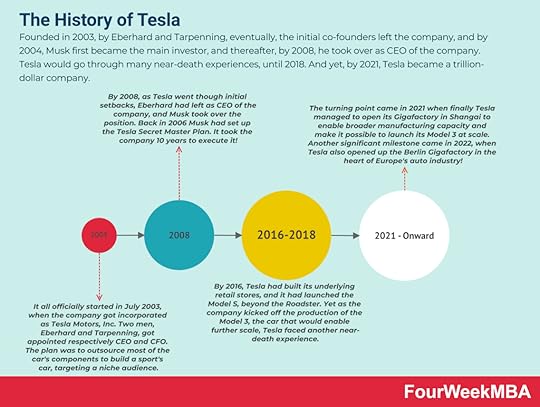

YearEmployees201410,161201513,058201617,782201737,543201848,817201948,016202070,757202199,290FourWeekMBA BI Intelligence – Source data: Financial StatementsRelated Case Studies Founded in 2003 by Eberhard and Tarpenning, eventually, the initial co-founders left the company, and by 2004, Musk first became the main investor, and after that, by 2008, he took over as CEO of the company. Tesla would go through many near-death experiences until 2018. And yet, by 2021, Tesla will become a trillion-dollar company.

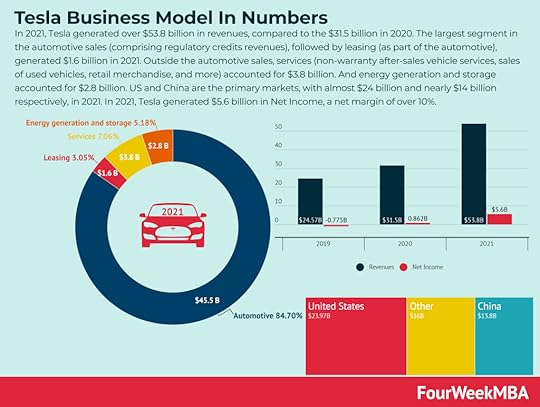

Founded in 2003 by Eberhard and Tarpenning, eventually, the initial co-founders left the company, and by 2004, Musk first became the main investor, and after that, by 2008, he took over as CEO of the company. Tesla would go through many near-death experiences until 2018. And yet, by 2021, Tesla will become a trillion-dollar company.  In 2021, Tesla generated over $53.8 billion in revenues, compared to $31.5 billion in 2020. The largest segment in automotive sales (comprising regulatory credits revenues), followed by leasing (as part of the automotive), generated $1.6 billion in 2021. Outside the automotive sales, services (non-warranty after-sales vehicle services, sales of used vehicles, retail merchandise, and more) accounted for $3.8 billion. And energy generation and storage accounted for $2.8 billion. US and China are the primary markets, with almost $24 billion and nearly $14 billion respectively, in 2021. In 2021, Tesla generated $5.6 billion in Net Income, a net margin of over 10%.

In 2021, Tesla generated over $53.8 billion in revenues, compared to $31.5 billion in 2020. The largest segment in automotive sales (comprising regulatory credits revenues), followed by leasing (as part of the automotive), generated $1.6 billion in 2021. Outside the automotive sales, services (non-warranty after-sales vehicle services, sales of used vehicles, retail merchandise, and more) accounted for $3.8 billion. And energy generation and storage accounted for $2.8 billion. US and China are the primary markets, with almost $24 billion and nearly $14 billion respectively, in 2021. In 2021, Tesla generated $5.6 billion in Net Income, a net margin of over 10%. Real-Time Insurance Business Model

A real-time insurance business model enables Tesla to build its insurance arm by dynamically adjusting the premiums based on real-time driving behavior. Reduced insurance premiums hooked with the leasing arm, will allow Tesla to scale its demand side of the business.

A real-time insurance business model enables Tesla to build its insurance arm by dynamically adjusting the premiums based on real-time driving behavior. Reduced insurance premiums hooked with the leasing arm, will allow Tesla to scale its demand side of the business. Tesla Organizational Structure

Tesla is characterized by a functional organizational structure with aspects of a hierarchical structure. Tesla does employ functional centers that cover all business activities, including finance, sales, marketing, technology, engineering, design, and the offices of the CEO and chairperson. Tesla’s headquarters in Austin, Texas, decide the company’s strategic direction, with international operations given little autonomy.

Tesla is characterized by a functional organizational structure with aspects of a hierarchical structure. Tesla does employ functional centers that cover all business activities, including finance, sales, marketing, technology, engineering, design, and the offices of the CEO and chairperson. Tesla’s headquarters in Austin, Texas, decide the company’s strategic direction, with international operations given little autonomy.  – SpaceX is a space transportation service and manufacturer of space rockets and other transport vehicles. Elon Musk founded it in 2002. – SpaceX makes money by charging governmental and commercial customers to send goods into space. These goods include ISS supplies, infrastructure, and people and satellites for various purposes. – SpaceX is also creating its Starlink network, designed to give every citizen access to fast and affordable internet.

– SpaceX is a space transportation service and manufacturer of space rockets and other transport vehicles. Elon Musk founded it in 2002. – SpaceX makes money by charging governmental and commercial customers to send goods into space. These goods include ISS supplies, infrastructure, and people and satellites for various purposes. – SpaceX is also creating its Starlink network, designed to give every citizen access to fast and affordable internet. Twitter makes money in two ways: advertising and data licensing. In 2021, Twitter generated $4.5 billion from advertising and $570 million from data licensing. While Twitter generated $5 billion in total revenues, it lost 221 million.

Twitter makes money in two ways: advertising and data licensing. In 2021, Twitter generated $4.5 billion from advertising and $570 million from data licensing. While Twitter generated $5 billion in total revenues, it lost 221 million.Read Also: Tesla Business Model, Elon Musk Companies, Who Owns Tesla, Transitional Business Models, Tesla Competitors.

Read Also: Who Is Elon Musk? The Elon Musk’s Story, How Does Elon Musk Make Money, Elon Musk Companies, Bill Gates Companies, Jeff Bezos Companies, Warren Buffett Companies.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post Tesla Employees Number appeared first on FourWeekMBA.

Twitter Employees Number

YearEmployees20153,89820163,58320173,37220183,92020194,90020205,50020217,500FourWeekMBA BI Intelligence – Source data: Financial Statements

YearEmployees20153,89820163,58320173,37220183,92020194,90020205,50020217,500FourWeekMBA BI Intelligence – Source data: Financial Statements As of April 25th, 2022, Elon Musk tried to take over Twitter. Musk tried to purchase the company at $54.20 per share, or about $44 billion. While the deal hasn’t closed, Elon Musk is still the largest shareholder with 9.5% stock ownership, followed by Jack Dorsey, with 2.3% ownership, as the second-largest individual shareholder.

As of April 25th, 2022, Elon Musk tried to take over Twitter. Musk tried to purchase the company at $54.20 per share, or about $44 billion. While the deal hasn’t closed, Elon Musk is still the largest shareholder with 9.5% stock ownership, followed by Jack Dorsey, with 2.3% ownership, as the second-largest individual shareholder.  Twitter makes money in two ways: advertising and data licensing. In 2021, Twitter generated $4.5 billion from advertising and $570 million from data licensing. While Twitter generated $5 billion in total revenues, it lost 221 million.

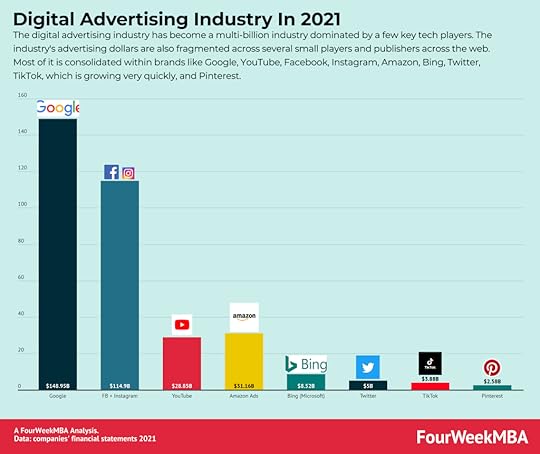

Twitter makes money in two ways: advertising and data licensing. In 2021, Twitter generated $4.5 billion from advertising and $570 million from data licensing. While Twitter generated $5 billion in total revenues, it lost 221 million. The digital advertising industry has become a multi-billion industry dominated by a few key tech players. The industry’s advertising dollars are also fragmented across several small players and publishers across the web. Most of it is consolidated within brands like Google, YouTube, Facebook, Instagram, Amazon, Bing, Twitter, TikTok, which is proliferating, and Pinterest.

The digital advertising industry has become a multi-billion industry dominated by a few key tech players. The industry’s advertising dollars are also fragmented across several small players and publishers across the web. Most of it is consolidated within brands like Google, YouTube, Facebook, Instagram, Amazon, Bing, Twitter, TikTok, which is proliferating, and Pinterest. Read Also: Twitter Business Model, Digital Business Models, Platform Business Models, Attention-Based Business Models.

The post Twitter Employees Number appeared first on FourWeekMBA.

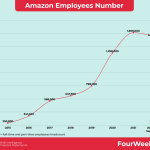

Amazon Employees Number

YearEmployees2015230,8002016341,4002017566,0002018647,5002019798,00020201,298,00020211,608,0002022 (as of September)1,544,000FourWeekMBA BI Intelligence – Source data: Financial Statements

YearEmployees2015230,8002016341,4002017566,0002018647,5002019798,00020201,298,00020211,608,0002022 (as of September)1,544,000FourWeekMBA BI Intelligence – Source data: Financial StatementsRead Next: Amazon Business Model (2022 Update), Amazon Flywheel, Amazon Mission Statement and Vision Statement, Is Amazon Profitable Without AWS?, Amazon Revenues Breakdown 2015-2021.

Connected to Amazon Business Model Amazon has a diversified business model. In 2021 Amazon posted over $469 billion in revenues and over $33 billion in net profits. Online stores contributed to over 47% of Amazon revenues, Third-party Seller Services, Amazon AWS, Subscription Services, Advertising revenues, and Physical Stores.

Amazon has a diversified business model. In 2021 Amazon posted over $469 billion in revenues and over $33 billion in net profits. Online stores contributed to over 47% of Amazon revenues, Third-party Seller Services, Amazon AWS, Subscription Services, Advertising revenues, and Physical Stores. Amazon’s mission statement is to “serve consumers through online and physical stores and focus on selection, price, and convenience.” Amazon’s vision statement is “to be Earth’s most customer-centric company, where customers can find and discover anything they might want to buy online, and endeavors to offer its customers the lowest possible prices.”

Amazon’s mission statement is to “serve consumers through online and physical stores and focus on selection, price, and convenience.” Amazon’s vision statement is “to be Earth’s most customer-centric company, where customers can find and discover anything they might want to buy online, and endeavors to offer its customers the lowest possible prices.”  In the Amazon Shareholders’ Letter for 2018, Jeff Bezos analyzed the Amazon business model, and it also focused on a few key lessons that Amazon as a company has learned over the years. These lessons are fundamental for any entrepreneur, of small or large organization to understand the pitfalls to avoid to run a successful company!

In the Amazon Shareholders’ Letter for 2018, Jeff Bezos analyzed the Amazon business model, and it also focused on a few key lessons that Amazon as a company has learned over the years. These lessons are fundamental for any entrepreneur, of small or large organization to understand the pitfalls to avoid to run a successful company! Amazon has a business model with many moving parts. With the e-commerce platform which generated over $222 billion in 2021, followed by third-party stores services which generated over $103 billion, Amazon AWS, which generated over $62 billion, Amazon advertising which generated over $31 billion and Amazon Prime which also generated over $31 billion, and physical stores which generated over $17 billion.

Amazon has a business model with many moving parts. With the e-commerce platform which generated over $222 billion in 2021, followed by third-party stores services which generated over $103 billion, Amazon AWS, which generated over $62 billion, Amazon advertising which generated over $31 billion and Amazon Prime which also generated over $31 billion, and physical stores which generated over $17 billion.

The Amazon Working Backwards Method is a product development methodology that advocates building a product based on customer needs. The Amazon Working Backwards Method gained traction after notable Amazon employee Ian McAllister shared the company’s product development approach on Quora. McAllister noted that the method seeks “to work backwards from the customer, rather than starting with an idea for a product and trying to bolt customers onto it.”

The Amazon Working Backwards Method is a product development methodology that advocates building a product based on customer needs. The Amazon Working Backwards Method gained traction after notable Amazon employee Ian McAllister shared the company’s product development approach on Quora. McAllister noted that the method seeks “to work backwards from the customer, rather than starting with an idea for a product and trying to bolt customers onto it.” The Amazon Flywheel or Amazon Virtuous Cycle is a strategy that leverages on customer experience to drive traffic to the platform and third-party sellers. That improves the selections of goods, and Amazon further improves its cost structure so it can decrease prices which spins the flywheel.

The Amazon Flywheel or Amazon Virtuous Cycle is a strategy that leverages on customer experience to drive traffic to the platform and third-party sellers. That improves the selections of goods, and Amazon further improves its cost structure so it can decrease prices which spins the flywheel. In the letter to shareholders in 2016, Jeff Bezos addressed a topic he had been thinking quite profoundly in the last decades as he led Amazon: Day 1. As Jeff Bezos put it “Day 2 is stasis. Followed by irrelevance. Followed by excruciating, painful decline. Followed by death. And that is why it is always Day 1.”

In the letter to shareholders in 2016, Jeff Bezos addressed a topic he had been thinking quite profoundly in the last decades as he led Amazon: Day 1. As Jeff Bezos put it “Day 2 is stasis. Followed by irrelevance. Followed by excruciating, painful decline. Followed by death. And that is why it is always Day 1.”The post Amazon Employees Number appeared first on FourWeekMBA.

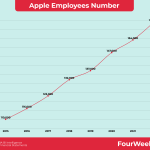

Apple Employees Number

YearEmployees2015110,0002016116,0002017123,0002018132,0002019137,0002020147,0002021154,0002022164,000FourWeekMBA BI Intelligence – Source data: Financial Statements

YearEmployees2015110,0002016116,0002017123,0002018132,0002019137,0002020147,0002021154,0002022164,000FourWeekMBA BI Intelligence – Source data: Financial StatementsRead: Apple Business Model.

Related to AppleApple Business Model Evolution

Apple has a business model that is divided into products and services. Apple generated over $394 billion in revenues in 2022, of which $205.5 came from iPhone sales, $40 billion came from Mac sales, over $41 billion came from accessories and wearables (AirPods, Apple TV, Apple Watch, Beats products, HomePod, iPod touch, and accessories), $29.3 billion came from iPad sales, and $78.13 billion came from services.

Apple has a business model that is divided into products and services. Apple generated over $394 billion in revenues in 2022, of which $205.5 came from iPhone sales, $40 billion came from Mac sales, over $41 billion came from accessories and wearables (AirPods, Apple TV, Apple Watch, Beats products, HomePod, iPod touch, and accessories), $29.3 billion came from iPad sales, and $78.13 billion came from services. Apple is a tech giant, and as such, it encompasses a set of value propositions that make Apple’s brand recognized among consumers. Apple’s brand’s three fundamental value propositions leverage the “Think Different” motto; reliable tech devices for mass markets. Starting in 2019, Apple also emphasized more privacy to differentiate itself from other tech giants.

Apple is a tech giant, and as such, it encompasses a set of value propositions that make Apple’s brand recognized among consumers. Apple’s brand’s three fundamental value propositions leverage the “Think Different” motto; reliable tech devices for mass markets. Starting in 2019, Apple also emphasized more privacy to differentiate itself from other tech giants. It costs Apple $501 to make an iPhone 14 Pro Max, and the company sells it at a base price of $1099. This makes Apple’s base markup on the latest iPhone model at 119% Apple is the only tech company able to sell its tech products at a such a premium, thanks to a combination of hardware, software and marketplace.

It costs Apple $501 to make an iPhone 14 Pro Max, and the company sells it at a base price of $1099. This makes Apple’s base markup on the latest iPhone model at 119% Apple is the only tech company able to sell its tech products at a such a premium, thanks to a combination of hardware, software and marketplace. It costs Apple $501 to make an iPhone 14 Pro Max, and the company sells it at a base price of $1099. This makes Apple’s base markup on the latest iPhone model at 119% Apple is the only tech company able to sell its tech products at such a premium, thanks to a combination of hardware, software, and marketplace.

It costs Apple $501 to make an iPhone 14 Pro Max, and the company sells it at a base price of $1099. This makes Apple’s base markup on the latest iPhone model at 119% Apple is the only tech company able to sell its tech products at such a premium, thanks to a combination of hardware, software, and marketplace. In 2022, most of Apple’s sales (62%) came from indirect channels (comprising third-party cellular networks, wholesalers/retailers, and resellers). These channels are critical for sales amplification, scale, and subsidies (to enable the iPhone to be purchased by many people). In comparison, the direct channel represented 38% of the total revenues. Stores are critical for customer experience, enabling the service business, and branding at scale.

In 2022, most of Apple’s sales (62%) came from indirect channels (comprising third-party cellular networks, wholesalers/retailers, and resellers). These channels are critical for sales amplification, scale, and subsidies (to enable the iPhone to be purchased by many people). In comparison, the direct channel represented 38% of the total revenues. Stores are critical for customer experience, enabling the service business, and branding at scale.

Apple Organizational Structure

Apple has a traditional hierarchical structure with product-based grouping and some collaboration between divisions.

Apple has a traditional hierarchical structure with product-based grouping and some collaboration between divisions.

Apple can leverage a strong consumer brand and set of successful products as a strength. Yet the company is still too reliant on the iPhone as a primary revenue stream. Though Apple is working to open up new markets as an opportunity, it has to make sure to sustain its stores’ sales.

Apple can leverage a strong consumer brand and set of successful products as a strength. Yet the company is still too reliant on the iPhone as a primary revenue stream. Though Apple is working to open up new markets as an opportunity, it has to make sure to sustain its stores’ sales.

Apps in the Apple Store follow five primary business model patterns: the free model, where the app might make money via paid ads. Freemium model where the app charges for premium features; subscription-based model, paid model, and paymium model is a mix of paid and freemium.

Apps in the Apple Store follow five primary business model patterns: the free model, where the app might make money via paid ads. Freemium model where the app charges for premium features; subscription-based model, paid model, and paymium model is a mix of paid and freemium.

When looking at the Apple Business Model, it is easy to assume that it is solely a product company which sells devices that are beautifully crafted. However, there would have been no success for the Mac without its OS operating system. There would not have been iPod success without iTunes. And no success for iPhones without the Apple Store. What’s next for Apple’s success?

When looking at the Apple Business Model, it is easy to assume that it is solely a product company which sells devices that are beautifully crafted. However, there would have been no success for the Mac without its OS operating system. There would not have been iPod success without iTunes. And no success for iPhones without the Apple Store. What’s next for Apple’s success?The post Apple Employees Number appeared first on FourWeekMBA.

November 7, 2022

Facebook Employees Number

YearEmployees201512,691201617,048201725,105201835,587201944,942202058,604202171,9702022 (as of September)87,314FourWeekMBA BI Intelligence – Source data: Financial Statements

YearEmployees201512,691201617,048201725,105201835,587201944,942202058,604202171,9702022 (as of September)87,314FourWeekMBA BI Intelligence – Source data: Financial StatementsRead Also: Facebook Business Model

Related Business Models Mark Zuckerberg is the principal shareholder of the company. Not only he retains ownership and control of the company. Facebook, like Google, has issued two kinds of common stocks, Class A and Class B. Where the holders of Class B common stocks are entitled to ten votes per share, and holders of our Class A common stocks are entitled to one vote per share. Mark Zuckerberg has a total voting power of 57.9%.

Mark Zuckerberg is the principal shareholder of the company. Not only he retains ownership and control of the company. Facebook, like Google, has issued two kinds of common stocks, Class A and Class B. Where the holders of Class B common stocks are entitled to ten votes per share, and holders of our Class A common stocks are entitled to one vote per share. Mark Zuckerberg has a total voting power of 57.9%. Attention-Merchants Business Model

In an asymmetric business model, the organization doesn’t monetize the user directly. Still, it leverages the data users provide and technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data and its algorithms sold to advertisers for visibility. This is how attention merchants make monetize their business models.

In an asymmetric business model, the organization doesn’t monetize the user directly. Still, it leverages the data users provide and technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data and its algorithms sold to advertisers for visibility. This is how attention merchants make monetize their business models.  In an asymmetric business model, the organization doesn’t monetize the user directly. Still, it leverages the data users provide and technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data and its algorithms sold to advertisers for visibility.

In an asymmetric business model, the organization doesn’t monetize the user directly. Still, it leverages the data users provide and technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data and its algorithms sold to advertisers for visibility.  Facebook, the main product of Meta, is an attention merchant. As such, its algorithms condense the attention of over 2.91 billion monthly active users as of June 2021. Meta generated $117.9 billion in revenues, in 2021, of which $114.9 billion was from advertising (97.4% of the total revenues) and over $2.2 billion from Reality Labs (the augmented and virtual reality products arm).

Facebook, the main product of Meta, is an attention merchant. As such, its algorithms condense the attention of over 2.91 billion monthly active users as of June 2021. Meta generated $117.9 billion in revenues, in 2021, of which $114.9 billion was from advertising (97.4% of the total revenues) and over $2.2 billion from Reality Labs (the augmented and virtual reality products arm).  The ARPU, or average revenue per user, is a key metric to track the success of Facebook – now Meta – family of products. For instance, by the end of 2021, Meta’s ARPU worldwide was $11.57. While in US & Canada, it was $60.57, in Europe, it was $19.68, in Asia $4.89, and in the rest of the world, it was $3.43.

The ARPU, or average revenue per user, is a key metric to track the success of Facebook – now Meta – family of products. For instance, by the end of 2021, Meta’s ARPU worldwide was $11.57. While in US & Canada, it was $60.57, in Europe, it was $19.68, in Asia $4.89, and in the rest of the world, it was $3.43.Facebook Organizational Structure

Facebook is characterized by a multi-faceted matrix organizational structure. The company utilizes a flat organizational structure in combination with corporate function-based teams and product-based or geographic divisions. The flat organizational structure is organized around the leadership of Mark Zuckerberg and the key executives around him. On the other hand, the function-based teams are based on the main corporate functions (like HR, product management, investor relations, and so on).

Facebook is characterized by a multi-faceted matrix organizational structure. The company utilizes a flat organizational structure in combination with corporate function-based teams and product-based or geographic divisions. The flat organizational structure is organized around the leadership of Mark Zuckerberg and the key executives around him. On the other hand, the function-based teams are based on the main corporate functions (like HR, product management, investor relations, and so on).

A hidden revenue business model is a pattern for revenue generation that keeps users out of the equation, so they don’t pay for the service or product offered. For instance, Google’s users don’t pay for the search engine. Instead, the revenue streams come from advertising money spent by businesses bidding on keywords.

A hidden revenue business model is a pattern for revenue generation that keeps users out of the equation, so they don’t pay for the service or product offered. For instance, Google’s users don’t pay for the search engine. Instead, the revenue streams come from advertising money spent by businesses bidding on keywords. TikTok is a Chinese creative social media platform driven by short-form video content enabling users to interact and generate content at scale. TikTok primarily makes money through advertising, and it generated $4.6 billion in advertising revenues in 2021, thus making it among the most popular attention-based business models or attention merchants.

TikTok is a Chinese creative social media platform driven by short-form video content enabling users to interact and generate content at scale. TikTok primarily makes money through advertising, and it generated $4.6 billion in advertising revenues in 2021, thus making it among the most popular attention-based business models or attention merchants. Instagram makes money via visual advertising. As part of Facebook products, the company generates revenues for Facebook Inc.’s overall business model. Acquired by Facebook for a billion dollars in 2012, today Instagram is integrated into the overall Facebook business strategy. In 2018, Instagram founders, Kevin Systrom and Mike Krieger left the company, as Facebook pushed toward tighter integration of the two platforms.

Instagram makes money via visual advertising. As part of Facebook products, the company generates revenues for Facebook Inc.’s overall business model. Acquired by Facebook for a billion dollars in 2012, today Instagram is integrated into the overall Facebook business strategy. In 2018, Instagram founders, Kevin Systrom and Mike Krieger left the company, as Facebook pushed toward tighter integration of the two platforms.  YouTube was acquired for almost $1.7 billion in 2006 by Google. It makes money through advertising and subscription revenues. YouTube advertising network is part of Google Ads, and it generated more than $28B in revenue by 2021. YouTube also makes money with its paid memberships and premium content.

YouTube was acquired for almost $1.7 billion in 2006 by Google. It makes money through advertising and subscription revenues. YouTube advertising network is part of Google Ads, and it generated more than $28B in revenue by 2021. YouTube also makes money with its paid memberships and premium content. Twitter makes money in two ways: advertising and data licensing. In 2021, Twitter generated $4.5 billion from advertising and $570 million from data licensing. While Twitter generated $5 billion in total revenues, it lost 221 million.

Twitter makes money in two ways: advertising and data licensing. In 2021, Twitter generated $4.5 billion from advertising and $570 million from data licensing. While Twitter generated $5 billion in total revenues, it lost 221 million.The post Facebook Employees Number appeared first on FourWeekMBA.

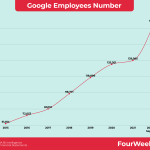

Google Employees Number

YearEmployees201561,814201672,053201780,110201898,7712019118,8992020135,3012021139,9952022 (as of September)186,779FourWeekMBA BI Intelligence – Source data: Financial Statements

YearEmployees201561,814201672,053201780,110201898,7712019118,8992020135,3012021139,9952022 (as of September)186,779FourWeekMBA BI Intelligence – Source data: Financial StatementsRead Next: Google Business Model, Google Subsidiaries, What Happened To Google Glass?, What happened to Google Plus?, How does Google Maps make money?, Who Owns Google?, How Does YouTube Make Money?, History of Youtube, How Do YouTubers Make Money?

A hidden revenue business model is a pattern for revenue generation that keeps users out of the equation, so they don’t pay for the service or product offered. For instance, Google’s users don’t pay for the search engine. Instead, the revenue streams come from advertising money spent by businesses bidding on keywords.

A hidden revenue business model is a pattern for revenue generation that keeps users out of the equation, so they don’t pay for the service or product offered. For instance, Google’s users don’t pay for the search engine. Instead, the revenue streams come from advertising money spent by businesses bidding on keywords. Google (now Alphabet) primarily makes money through advertising. The Google search engine, while free, is monetized with paid advertising. In 2021 Google’s advertising generated over $209 billion (beyond Google Search, this comprises YouTube Ads and the Network Members Sites) compared to $257 billion in net sales. Advertising represented over 81% of net sales, followed by Google Cloud ($19 billion) and Google’s other revenue streams (Google Play, Pixel phones, and YouTube Premium).

Google (now Alphabet) primarily makes money through advertising. The Google search engine, while free, is monetized with paid advertising. In 2021 Google’s advertising generated over $209 billion (beyond Google Search, this comprises YouTube Ads and the Network Members Sites) compared to $257 billion in net sales. Advertising represented over 81% of net sales, followed by Google Cloud ($19 billion) and Google’s other revenue streams (Google Play, Pixel phones, and YouTube Premium).The post Google Employees Number appeared first on FourWeekMBA.