Gennaro Cuofano's Blog, page 201

June 9, 2020

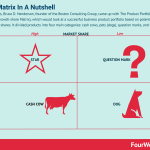

BCG Business Model In A Nutshell

It all started back in 1963 when Bruce D. Henderson founded the Boston Consulting Group (BCG) as part of The Boston Safe Deposit and Trust Company. The BCG became independent by the end of the 1970s, and it started an expansion process. In 2019, BCG made over $8.5 billion in revenues.

The Product Portfolio (the BCG trademark)

[image error]In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.

BCG has been able to expand globally also thanks to its recognised brand, and the ability of its founder (Bruce Henderson) to leverage on a model where ownrship was distributed, thus enabling a fast expansion. At thesame time, the BCG trademarks and ideas shaped the consulting world for decades.

Among its most recognised trademark ideas, and one of those concepts that you find persistently at busienss school, there is the BCG Matrix.

[image error]

According to that success is achieved when a company is able to divert part of its cash and resources toward products that can turn into cash cows in the long-run.

[image error]

While failure is guaranteed when the cash generated from cash cows or star product is diverted into products, that over time will become dogs.

Origin and evolution of BCG

Bruce Henderson, the founder of BCG, was an innovator that back in the 1960s proposed alternative business ideas, that also became part of its trademark. Ideas like The Product Portfolio (aka BCG Matrix or growth-share matrix) and time-based compensation, would become sort of the main trademarks of itsthebrand.

In the 1960s, BCG established itself as a consulting firm which was proposing alternative ideas compared to companies that were applying best pracitces and acting according to the strategy rules of the previus era.

It helped the fact that post-war European and Japanese markets were recovering, thus enabling BCG to expand globally. By 1968, BCG counted 68 consultants between New York and Tokyo, and its BCG Matrix would have become its trademark.

By the 1970s, BCG now a prominent consulting firm, would start its expansion in Europe, gaining an important share of the consulting market. The company had tripled by the 1970s, with 277 consultants, and seven offices across the world.

Bruce Henderson would compare strategy with a “bucketful of marbles:”

By the 1980s, BCG had reached 524 consultants and 14 total offices across the world. In those years and decades, BCG started on helping companies optimize their processes, which would become its trademark in the 1990s.

By the 1990s, all the big brands and companies were relying on BCG to execute complex projects, from post-merger integrations, process optimization, and the restructuring of IT systems.

By the 2000s, change management becomes the most requested service. As the dot-com bubble bust, by 2001, BCG helped companies restructure their operations.

How does BCG make money today?

By 2019, BCG reached $8.5 billion in revenues. To gain a bit of context, Accenture and Deloitte would reach $43.2 and $46.2 billion, while smaller management consulting firms like Bain and Companyh and Kearney reached $4.5 billion and $1.3 billion respectively.

As reported by BCG, “from 2009 to 2019, global sales grew from $2.75 billion to $8.5 billion” and from 6,900 to 21,000 employees worldwide. Therefore tripling in size in a decade.

While, revenues kept growing, the question on whether BCG’s approach is still relevant in today’s world, is still open, which forced the iconic consulting firm to rush a set of acquisitions to stay on top of its game.

The rushed acquisitions to stay relevant in a new world

What drove growth throughout this decade? CEO Rich Lesser noted that “more than ever before, clients turn to BCG for new solutions to the challenges of our times” while its focus on “digitizing and embedding AI in core processes, building “bionic” organizations, and supporting large-scale change efforts to accelerate performance, even in challenging environments.”

As of 2020, the BCG management consulting services are broken down in a few main areas.

There used to be a time when management consulting firms were seen by large corporations as the ones to call to help them solve important problems, related to innovation.

That time though was gone, when the web took over, those management consulting firms also lost some of their relevance and while their bottom lines have still grown, as those companies still have major corporate clients.

Source: sifted.eu

Source: sifted.euManagement consulting firms, BCG as well, have been rushing to acquire small innovative management consulting firms, in an attempt to stay relevant in a market that has completely shifted.

Therefore, now BCG has been integrating those consulting firms within the BCG global team, which now offer a few “innovative” services, as part of this acquisition process:

BCG Digital Ventures: helping companies to research, design, and launch new products and services.BCG GAMMA: the data science, AI, and analytics arm. BCG Platinion primarily about IT processes focused on digital transformation. BCG Omnia: offering strategy and data solutions.BrightHouse: a global creative consultancy firm.Expand: offering research and syndicated benchmarking for the world’s leading financial institutions. INVERTO: an international supply chain and procurement consultancy side.

How will BCG stay relevant in the coming decade?

In this new era, where data is available anywhere, the primary job of companies like BCG will be in helping, especially larger brands to figure what to do with that data, in the first place.

For instance, in 2019, BCG acquired Kernel Analytics and it integrated it within its BCG Gamma services. As BCG CEO, Rich Lesser said at the time “BCG GAMMA is one of the most exciting parts of our business, and we expect the market for tailored AI solutions to continue growing rapidly. As we further expand our capabilities, this acquisition will help us to continue enabling our clients to deliver on their ambitions,”

The GAMMA team comprises profiles such as Analytics Software Engineers, Machine Learning Engineers, Analytics Architects and many other profiles able to handle and interpret large amount of data.

In fact, most of the GAMMA’s team are people on the engineering side, rather than sales or marketing. Therefore, those are more Phd. rather than MBA and as pointed out by a GAMMA engineer, back in 2018, they “deliver custom data science-based solutions (machine learning, numerical optimization…) to clients to allow them to take advantage of the huge impact data analytics and AI are having on the business world: pricing optimization, personalized marketing, more dynamic logistic, etc.. they create the data science models, program the software (in Python or R essentially) and deliver working solutions, not only advices and slide decks. To build those solutions we need to understand both data science and business.”

Read next:

Types Of Business ModelsBusiness Strategy ExamplesDigital Business ModelsBCG MatrixAnsoff MatrixAida ModelGrowth MatrixDigital Strategy MatrixSpeed-Reversibility Matrix

The post BCG Business Model In A Nutshell appeared first on FourWeekMBA.

Franchained Business Model In A Nutshell

In a franchained business model (a short-term chain, long-term franchise), the company deliberately launched its operations by keeping tight ownership on the main assets, while those are established, thus choosing a chain model. Once operations are running and established, the company divests its ownership and opts instead for a franchising model.

Coca-Cola

[image error]Coca-Cola follows a business strategy (implemented since 2006) where through its operating arm – the Bottling Investment Group – it invests initially in bottling partners operations. As they take off, Coca-Cola divests its equity stakes, and it establishes a franchising model, as long-term growth and distribution strategy.

Read: Coca-Cola Business And Distribution Strategy

McDonald’s

[image error]McDonald’s is a heavy-franchised business model. In 2018, of McDonald’s total restaurants, 93% were franchised. The long-term goal of the company is to transition toward 95% of franchised restaurants. The company’s operating income in 2018 was $8.8 billion compared to $9.55 in operating income for 2017.

Read: McDonald’s Business Model

Read next:

Types Of Business ModelsBusiness Strategy ExamplesDigital Business Models

The post Franchained Business Model In A Nutshell appeared first on FourWeekMBA.

June 8, 2020

Coca-Cola’s Business And Distribution Strategy In A Nutshell

Coca-Cola follows a business strategy (implemented since 2006) where through its operating arm – the Bottling Investment Group – it invests initially in bottling partners operations. As they take off, Coca-Cola divests its equity stakes, and it establishes a franchising model, as long-term growth and distribution strategy.

The secret isn’t in the secret formula but its distribution strategy

The Coca-Cola Company business model is based on five large independent bottling partners. In 2019, these five bottling partners combined represented 40 percent of the total unit case volume the company sold.

Coca-Cola has separate agreements with bottling partners for both manufacturing and sales of the company’s products. As specified by Coca-Cola “the bottler’s agreements generally authorize the bottlers to prepare, package, distribute and sell Company Trademark Beverages in authorized containers in an identified territory. The bottler is obligated to purchase its entire requirement of concentrates or syrups for the designated Company Trademark Beverages from the Company or Company-authorized suppliers.”

Coca-Cola typically agrees to refrain from selling or distributing, or from authorized third parties to sell or distribute, the Company Trademark Beverages throughout the identified territory, to guarantee bottling partner exclusivity under that territory and product.

However, Coca-Cola typically reserves for itself the right manufacture and distribute its trademarked products and brands.

In exchange Coca-Cola also participates in the sales and marketing activities of its bottling partners. For instance, in 2019, Coca-Cola spent $4.4 billion in promotional and marketing programs with bottling partners.

Coca-Cola short-term chain, long-term franchise-model

The strategy of Coca-Cola when it comes to building, growing, and maintaining its distribution system is pretty fluid. Indeed, in most cases, Coca-Cola leverages a network of independent bottling partners.

In some cases, Coca-Cola places strategic investments in some of the bottling partners’ operations. It does that either to enable the entry in a local market, by leveraging on Coca-Cola’s group resources or to maintain control on the bottling partner.

In the long-term Coca-Cola will divest its stake as the bottling partner operations take off, thus enabling Coca-Cola to keep its capital requirements low, while keeping a minor stake in the bottling partner, thus guaranteeing control and cooperation.

Therefore, the distribution system and the bottling partners are organized as a hybrid approach between chain and franchise. Where in the short-term Coca-Cola acts as a chain of bottling companies. In the long-term, it acts more like franchising, where bottling partners are kept mostly independent, yet tied to the Coca-Cola brand.

This mixed distribution system of owned and non-owned bottling partners is the Coca-Cola system which sold 30.3 billion unit cases by 2019. Trademark Coca-Cola accounted for 43 percent of U.S. unit case volume.

Re-franchising or “going franchise”

For instance, in 2019, Coca-Cola acquired the controlling interests in bottling operations in Zambia, Kenya, and Eswatini. As those bottling operations will become stable and established over time Coca-Cola will re-franchise them.

Therefore, it will sell its controlling stake, having a franchisor-franchisee relationship with those bottling partners, and in some cases, it might keep a minor equity stake to keep more control over the operations.

In 2018, for instance, Coca-Cola had a few hundred million in proceeds as it re-franchised its Canadian and Latin American bottling operations. This is how Coca-Cola keeps its CAPEX low, while still keeping control of the bottling operations, and yet enabling expansion and capillary distribution!

This is how Coca-Cola represents its system:

The Coca-Cola distribution system (source: Coca-Cola Company)

The Coca-Cola distribution system (source: Coca-Cola Company)While in the directly owned bottling facilities Coca-Cola sells directly, in the concentrate operations, independent bottling partners manage distribution. Therefore, Coca-Cola makes money by selling its concentrate to bottling partners (they must place a full order for the concentrate available in that territory as part of the bottling agreement).

To handle those operations, Coca-Cola introduced in 2006 the Bottling Investment Group, which managed the acquisition, divestment, and re-franchising of the bottling operations.

The graphic below gives a good picture of the overall process and strategy which has been implemented since 2006:

Coca-Cola investment arm (Bottling Investment Group) was created to manage the purchase and re-franchisee of bottling operations across the world. As those bottling operations get established, Coca-Cola, through the BIG sells its stakes, keeps a minority equity stake, and keeps in some cases a minor equity stake in the bottling operations.

Coca-Cola investment arm (Bottling Investment Group) was created to manage the purchase and re-franchisee of bottling operations across the world. As those bottling operations get established, Coca-Cola, through the BIG sells its stakes, keeps a minority equity stake, and keeps in some cases a minor equity stake in the bottling operations. Key takeaways

An ingenious distribution network and system, drive the Coca-Cola business model. Beginning in 2006, Coca-Cola established the Bottling Investment Group, which invests initially in bottling companies by bringing them under the control and ownership of Coca-Cola.As local operations are established, marketing and distribution activities run efficiently, Coca-Cola divests its controlling stakes, thus forming a franchising relationship with its bottling partners.Bottling partners keep an exclusivity agreement from other third-parties bottling companies to produce or distribute under the territories those bottling partners control. For the products, they bottle up, yet Coca-Cola also reserves its right to manufacture and distribute its products. Coca-Cola, in turn, sells concentrate to those bottling companies, which act as franchisees for the branded Coca-Cola products.

Read next:

Coca-Cola Business ModelCoca-Cola vs. Pepsi Distribution ChannelsBusiness ModelsBusiness Strategy Examples

The post Coca-Cola’s Business And Distribution Strategy In A Nutshell appeared first on FourWeekMBA.

June 7, 2020

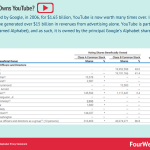

Who Owns YouTube? The Most Successful Acquisition Of Alphabet’s Google

Acquired by Google, in 2006, for $1.65 billion, YouTube is now worth many times over. In 2019, YouTube generated over $15 billion in revenues from advertising alone. YouTube is part of Google (now named Alphabet) and as such, it is owned by the main Google’s Alphabet shareholders.

[image error]

[image error]The most prominent institutional shareholders are BlackRock, Fidelity (entities affiliated with it), and the Vanguard Group. Larry Page and Sergey Brin together have 51% of the voting power. Then we have other individual shareholders comprising John Doerr, venture capitalist and early investor in Google, and Sundar Pichai, the current company’s CEO.

[image error]Google has a diversified business model, primarily making money via its advertising networks that, in 2019, generated over 83% of its revenues, which also comprise YouTube Ads. Other revenue streams include Google Cloud, Hardware, Google Playstore, and YouTube Premium content. In 2019 Google made over $161 billion in total revenues.

Read next:

Who Owns GoogleGoogle Business ModelYouTube Business ModelBusiness ModelsBusiness Strategy Distribution

The post Who Owns YouTube? The Most Successful Acquisition Of Alphabet’s Google appeared first on FourWeekMBA.

June 6, 2020

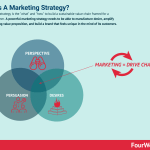

The Ultimate Marketing Strategy Guide And Examples

A marketing strategy is the “what” and “how” to build a sustainable value chain framed for a target customer. A powerful marketing strategy needs to be able to manufacture desire, amplify the underlying value proposition, and build a brand that feels unique in the mind of its customers.

How has marketing changed in the digital era?

Marketing has changed over the years, and it has undergone a profound change in the last two decades due to forces that have changed the business world.

Some of those forces can be summarized as:

Digitalization.

Globalization.

Technological Innovation.

Moore’s Law.

Business Model Innovation.

As we’ll see those forces have changed the way we do marketing. However, the underlying psychological forces that shape our minds are still the foundation of a powerful and effective marketing strategy.

And we’ll see how they affect and need to be taken into account, especially in today’s marketing, where engineering trying to rationalize it might make it ineffective.

The impact of digitalization on marketing strategy

[image error]A digital business model might be defined as a model that leverages digital technologies to improve several aspects of an organization. From how the company acquires customers, to what product/service it provides. A digital business model is such when digital technology helps enhance its value proposition.

Digital businesses have become critical players in the marketplace, which has also, in part, changed the logic of business itself.

Where in the past, a good marketing strategy might have meant developing a good product or service. Nowadays, with the rise of customer-centric platforms, having must-have products is really the baseline.

In the era of mass-media marketing (driven by TV and Radio) it was possible to manufacture desire, by creating cultural stereotypes to generate demand for products.

While a few companies like Nike have successfully transitioned through the digital age, by using strategies like influencer marketing to stimulate the demand of its products, by leveraging on cultural memes.

Digital platforms, with a customer-centric approach, have changed the way we conceive marketing. Thus, a platform to be successful has to push as much as possible on customer experience through engineering and product development. Thus, the common mantra today is that if you can build a product sticky enough, people will get back.

However, while digital platforms have changed the way we can interact with potential customers. Better customer experience is indeed the domain of manufacturing design, and aligning those design with your brand.

In short, a brand that drives growth by the sheer force of engineering might gain traction in the short-term, but it might not be strong enough to survive in the long-run

In consumers’ industries, while offering lower prices, comparisons, and options are the ways in which digital platforms are mostly breaking down the traditional trade-off between value (you charge more by offering more) and cost advantage (you charge less by offering a standardized service), what can be defined as a blue ocean strategy.

Today, digital platforms can also offer more at a lower cost. That’s because digital platforms usually don’t own the assets they sell (a classic example is how Airbnb doesn’t own the homes it rents).

In this era, marketing becomes integrated more and more in product development, and engineering processes (disciplines like Growth Hacking look at breaking down the silos in traditional department structures so that engineers and marketers can work together as a growth team).

But it’s important to highlight that marketers are also required to be able to deeply understand the customers they want to talk to.

And as new tools for audience segmentation become available those same marketers can deliver the message to specific intents and smaller and smaller segments. But those messages need to be framed to be understood by the target audience.

In other words, marketers have powerful weapons which if used sparingly can have a big impact on a company’s long-term value.

Globalization’s impact on marketing strategy

Globalization has might have accelerated in the last two decades as well. A marketing strategy that doesn’t take into account globalization might be short-sighted.

A media business that publishes an article, which is an instant has the potential to reach hundreds of countries across the world, it has also to be able to deliver that message to each of those locations.

At the same time, the potential access to a global community might give the impression that distribution has become an easy game in the digital era. That is just that, an impression. Building up a proper distribution strategy is just as hard as it has always been.

A message can get easily lost into the Facebook algorithm. A piece of content properly written can get easily lost into Google’s ranking algorithms. And a product distributed across an existing platform can become easily commoditized (think of how users can easily compare products on Amazon).

In short, Globalization works as a double-edged sword, where on the one hand requires a deeper (not provincial) understanding of your potential audience.

While on the other hand, it requires a powerful distribution strategy to get your message across and make sure that in the billions of users available on the web you reach those few hundreds to which your message can resonate.

In this era, it is also important how to frame a message to make it fit the platform desired format. For instance, in an era where platforms like Google, Instagram, TikTok, and others compete for snippets of our attention, understanding what formats work best for each platform is a critical element to give the message maximum amplification.

Technological innovation and consumer behavior

If you haven’t realized it yet, technologies affect our behaviors or more precisely certain behaviors can be amplified through technologies. As a thought experiment, what’s the first thing you do in the morning, as soon as you open your eyes?

Chances are you’ll probably pick up your smartphone, to either go on social media or engage with someone in a digital manner. That might sound trivial. Yet just a couple of decades ago that was unthinkable.

One of the effects of those technologies is to change our habits and the way we do things. If we used to consume most content on a TV screen, now for younger generations might feel normal to consume content on devices that are a few inches wide.

That makes the experience different and also its perception. Armed with that the marketer needs to know how to deliver a message in the format that fits the medium and thus its audience.

That is why among the most effective marketing strategies, that of creating several formats to spread a message might work. For instance, if you wrote an article for the blog, if that article has proved successful why not make an audio version for that or a video that might get more easily shared on social media.

By repurposing the same content on several formats you can also fit it into several media and make sure you give people options to consume content as they like.

For instance, I personally love reading.

But I also realize not anyone does like reading, or find reading efficiently. Therefore, I also launched my own podcast and an online business school that can help people consume content at their own pace, and in the formats, they like the most.

Again if you’re a marketer you might want to create options for your audience. The foundation is great content. And if that content can be delivered in several formats, and delivered across different channels without it losing its intrinsic quality that you’re also creating more options for your audience.

In short, technological innovation changes the way people behave and consume content, thus the way we might need to communicate. But it also creates for us more opportunities to reach our desired audience.

But once again, you need to make sure not to forget that as a marketer you need to make the message compelling, and unique, so that the story told by your brand resonates.

Moore’s Law impact on marketing strategy

Gordon Moore, co-founder of Intel, in a paper, back in 1965 foresee how in the coming decade the numbers of components would double every year. Just to confirm this prediction a decade later, but this time the doubling rate would be every two years.

This heuristic would prove quite powerful. And this is also one of the reasons why computers kept becoming more and more powerful in the digital age. And that also affected the rise of certain business models.

For instance, before Netflix would be able to roll out the on-demand content consumption model its founder had in mind, the company had to wait a decade before technology would pick up to that.

But once it did, Netflix became a streaming content company in a blink of an eye and outside its optimistic forecasts.

When new technologies become mature enough they also enable marketers new ways to communicate, which makes more and more options available. That availability of options might make markets lose focus and dilute their strategy.

However, a focused marketer can take advantage of those new media to spread the message effectively.

Business model innovation impact on marketing strategy

[image error]Business model innovation is about increasing the success of an organization with existing products and technologies by crafting a compelling value proposition able to propel a new business model to scale up customers and create a lasting competitive advantage. And it all starts by mastering the key customers.

The web-enabled new ways of doing business. Business modeling once a sleepy beast, it woke up suddenly when the web became commercially viable. Companies like Google and Amazon proved that by building tech empires.

The most important takeaway for business model innovation is how it demands a new business playbook. The web wasn’t just a new distribution or marketing channel. It required a new mindset.

While using the same marketing strategy and bring it on several channels might amplify the message. Its impact on your business might be limited in the long-run.

As with a new business playbook, you would need also a fresh perspective when it comes to marketing strategy.

For instance, take the case of a platform business model, which relies on network effects to grow. A marketer to enable a successful strategy should execute that on top of the platform developed by the company’s engineering team.

While marketers need to know how to work with engineers to build growth tools that make the brand go viral. Those same marketers also need to make sure to preserve their discipline by keeping creativity at the center.

Creativity is about loosely held assumptions, tested quickly, and sometimes with what might seem to engineers as “clumsiness” and as counterintuitive, yet for that reason effective.

Marketing strategy vs. marketing plan

From a marketing strategy, a marketing plan can be derived. However, where the marketing strategy might be defined as the “what” of an organization, a marketing plan is the “how-to” get that marketing strategy into action.

Thus, a marketing plan takes the form of a document laying to the activities to undertake in the short, medium-term to implement and execute a marketing strategy.

Therefore, a marketing strategy will have a broader understanding and a long-term view compared to a marketing plan. The marketing strategy allows the creation of a value proposition and all the elements that characterize a brand, which by nature have a longer life span.

[image error]A value proposition is about how you create value for customers. While many entrepreneurial theories draw from customers’ problems and pain points, value can also be created via demand generation, which is about enabling people to identify with your brand, thus generating demand for your products and services.

Indeed, while a company might change its essential elements and value proposition to adapt to market changes, those market changes depending on the industry might happen every few years to a decade.

Therefore, the primary difference between the marketing strategy and the marketing plan can be generalized to the broader difference between a strategy and a plan. The strategy informs the “what” and investigates the “why.” A plan is all about the “how-to” get there.

From the “what” and “how” the implementation and execution phase takes traction. Indeed, if you had the proper strategy and derived from it an adequate plan, this should make it way easier to take action.

Key forces behind an effective marketing strategy

[image error]An effective communication strategy starts with a clear brand identity, by defining clear boundaries and compromises your brand will not take in the marketplace. Based on that, understanding, whether context, formats, and scale are in line with your business message to prevent a loss of identity.

A marketing strategy and a marketing plan might dissolve to the same primary functions. In my opinion, a marketing strategy is driven by a few key forces.

Focused but authentic

In many cases, the failure of a strategy might be due to a lack of focus. A marketing strategy informs a marketing plan that narrows down its focus to a target that can be hit with the maximum precision.

Rather than boil the ocean, a good marketing strategy will allow you to identify the small pond where you can be a big fish. Once you’ve dominated that small pond, you can move to a bigger one.

This kind of approach works for startups and companies with a minimum marketing budget. Once you scale, and you have a substantial marketing budget, that is when it becomes critical to manufacturing desire.

Being focused doesn’t mean you don’t have to work on your brand story. Quite the opposite. As you’re a small player you won’t need to spend huge marketing budgets for your story to be appreciated by your potential audience.

Large companies and tech giants need to spend billions on distribution and to make millions or billions of people “believe” their brand story.

Companies like Google and Amazon seemingly engineering-driven spent respectively $16.3 billion in sales and marketing and $13.8 billion in marketing alone for 2018.

As a niche player, you can be authentic, as your values, your organization values, and your customers’ values are aligned.

Specific but flexible

A marketing plan, derived from a focused marketing strategy should have specific goals and actions.

That is also why often marketing plans include situation analyses (like SWOT). Also, you want to be very specific in identifying a target market. And you want to make sure to set up clear objectives.

However, flexibility is essential, as actions identified might not work out in the real world, you want to allow tests, experiments, and actions that have a wide spectrum, as you might be surprised to find out that something completely counter-intuitive works.

Measurable but not metric-enslaved

Metrics are helpful to assess whether a strategy is working or not. However, it’s important not to fall into measuring vanity metrics (metrics that don’t have any impact on the business) or misleading metrics.

Indeed, each time you’re using a new metric you need to make sure it impacts the business. For that matter, two or three key metrics might do the job, rather than having dozens of useless metrics.

At the same time, even a simpler approach where you measure impact (a 10X approach on results for tests and experiments you perform) might solve any doubt on whether or not a strategy is working.

What other threats you might want to be aware of?

Beware of the “data scientist mindset” (do not try to make marketing too “SMART”)

In a digital world, where, so far engineering and programming are the protagonists, marketing becomes relegated to being S.M.A.R.T. (specific, measurable, attainable, relevant, and timely), as marketers try to become data scientists.

Those approaches and methodologies try to reduce marketing to a linear process to follow. Yet human behavior, the pillar of any marketing activity, is not linear. It follows a logic that goes beyond logic itself.

In an interview for MarketingWeek, sports brand’s global media director, Simon Peel explained how Adidas overinvested in digital advertising channels, as those were easy to track in terms of performance.

In short, Adidas, like many other companies assumed that digital channels, as trackable would enable it to drive most of its sales.

Yet by looking at the data with a more holistic approach, Adidas found out that in reality was the brand activities that drove Adidas sales across wholesale, retail, and e-commerce. As Simon Peel highlighted for MarketingWeek:

The reason for that is short-termism because we are trying to grow sales very quickly,

And he also added:

We had a problem that we were focusing on the wrong metrics, the short-term, because we have fiduciary responsibility to shareholders.

Adidas had used an attribution model borrowed from digital platforms (like Goole Ads, or Facebook Ads) which primarily tracked the last mile the consumer wen through, as this is the easiest to track, which led to short-termism.

That doesn’t mean digital channels can’t be used to build a brand, but when you focus on the wrong metrics (most of the metrics which are easily available to measurement) that is how your marketing becomes ineffective, irrelevant, and your brand gets diluted.

As such, the great marketer will need to treasure creativity as the most important asset. Where most marketers in the digital world convert in data scientists, those that keep an artistic profile will make a difference in the business world.

Marketers are persuaders

It might sound like an exaggeration, and after all, some digital marketing channels (take a technical marketing activity, like SEO) might not seem suited to generate dreams and drive action. However, you don’t need to lose focus on what marketing is.

On that Seth Godin can help us:

If you need to persuade someone to take action, you’re doing marketing.

Distribution is the volume of your message

In order for a message to be heard it needs to be amplified. Distribution is the volume. While in many cases you don’t need a higher volume to make your message resonate (sometimes whispered messages might work more effectively).

In a crowded space, you have two options to increase the volume or change the frequency. If you don’t have a choice you might want to increase the volume. If you do have a choice it’s important to find the distribution channel that can vehicle your message effectively.

The Context is the message

A marketing message to work has to be in fit with the context. A message that makes sense in a context, might not in another. Understanding the context in which your audience is when experiencing the message is critical.

That is why today’s technology is powerful. It enables marketers to feel the context of the audience. Where mass media required marketers to frame messages that could be compelling for all, but for such reason ineffective. Today’s marketers can frame a message to make it resonate.

Perspective and frame of mind

In life, perspective is all we got. The same event happening to different people, interpreted – thus framed in a different way, can bring wholly different outcomes. There might be a few things that are objectively bad.

For all the rest perspective and framing help us go through anything. As a marketer, you have the power of framing in your hands. If you know how to use it, you can help your customers frame their life for the better, that is how you become a source of inspiration for them. Framing though is a powerful weapon, and as a marketer, you must use it ethically!

Types of marketing strategies and channels

There are as many types of marketing strategies as businesses out there. However, we’ll focus here on a primary marketing strategy: digital marketing.

Digital marketing consists of taking actions and crafting a value proposition that gets delivered via digital devices (smartphones, computers, and any other digital device).

Within digital marketing, there are many other types of marketing channels to experiment with. For instance, in the Bullseye framework, and in the book Traction, Gabriel Weinberg highlights 19 primary channels for creating a distribution, delivering your message, and execute your marketing strategy.

In the book, these are the identified 19 channels for growth:

Targeting Blogs

Publicity

Unconventional PR

Search Engine Marketing

Social and Display Ads

Offline Ads

Search Engine Optimization

Content Marketing

Email Marketing

Viral Marketing

Engineering as Marketing

Business Development

Sales

Affiliate Programs

Existing Platforms

Trade Shows

Offline Events

Speaking Engagements

Community Building

Those are just some of the types of existing channels and I’m sure that we can find several classification methods, and lists.

Byt the key point here is about making sure to communicate properly your value proposition and in a way that gets through your desired audience.

Each of these types of marketing requires a specific strategy and execution. However, it is important not to get bogged down in details and focus on the types of marketing that can connect your business to its customers.

Marketing strategies examples

We’ll look at several cases where a marketing strategy is built into a business model.

TOMS: when the one-for-one becomes an effective marketing strategy

[image error]

The TOMS one-for-one business model is also a marketing strategy. As its value proposition is delivered through its business model. In short, the one-for-one works as a powerful trademark for the brand, which not only helps TOMS delivers its value proposition more powerfully. It also helps it save on marketing expenses, as the brand is pushed forward by its one-for-one model.

Brunello Cucinelli: when humanism becomes a powerful trademark

[image error]Brunello Cucinelli is an Italian luxury and casual-chic brand, which built its success around cashmere clothing. Brunello Cucinelli built its business around the Humanistic Enterprise model, which revolves around Italian Craftsmanship, Sustainable Growth, and Exclusive Positioning and Distribution. More than 50% of the company revenues come from the retail mono-brand, directly managed by the company.

Also, Brunello Cucinelli Humanistic Enterprise isn’t only a business model but within that, there is built a powerful marketing strategy. That shouldn’t surprise you, as among the critical elements of a business model there is its value proposition and how it gets delivered.

Amazon: how a financial model translates into a growth/marketing strategy

[image error]The cash conversion cycle (CCC) is a metric that shows how long it takes for an organization to convert its resources into cash. In short, this metric shows how many days it takes to sell an item, get paid, and pay suppliers. When the CCC is negative, it means a company is generating short-term liquidity.

Also Amazon business model made it possible for the company to offer a wide variety of goods at a lower price, while still generating cash to sustain and quickly grow its operations.

This came through its cash conversion cycle strategy. While this is a financial strategy, integrated into its business model, it became very powerful over the years. In this case, Amazon better marketed itself by unlocking liquidity to grow the operational efficiency of the business.

Apple: when stores become the cathedrals of the brand

[image error]

Over the years, Apple has built its stores across the world, in central locations. Many of those stores are now iconic monuments. And yet, most of the sales Apple make is though indirect distribution channels (third-party stores, carriers, and cellular networks).

So why does Apple built its stores? While this is a quite expensive branding strategy, and yet very effective, other reasons for having those stores is the ability of Apple to develop its own line of services on top of its products and in part, to control also the overall experience of customers across the world.

Key takeaway

Marketing is changing and it’s is getting shaped by forces such as digitalization, globalization, and business model innovation. That also implies an understanding of the current landscape to anticipate how the business world might be changing as well.

For that matter, a proper marketing strategy has to be able to inform a marketing plan that helps a company to focus on a target market and conquer it, quickly.

However, marketing is primarily about understanding hidden psychological levers, to manufacture desires, and build a strong brand that is unique for your tribe.

Marketers that lose sight of that are leaving immense opportunities to build a valuable brand that drives change for its tribe.

Business resources:

What Is Business Model Innovation And Why It Matters

Types of Business Models You Need to Know

The Complete Guide To Business Development

Business Strategy Examples

What Is a Business Model Canvas? Business Model Canvas Explained

Blitzscaling Business Model Innovation Canvas In A Nutshell

What Is a Value Proposition? Value Proposition Canvas Explained

What Is a Lean Startup Canvas? Lean Startup Canvas Explained

What Is Market Segmentation? the Ultimate Guide to Market Segmentation

Marketing Strategy: Definition, Types, And Examples

Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

How To Write A Mission Statement

What is Growth Hacking?

Growth Hacking Canvas: A Glance At The Tools To Generate Growth Ideas

What is a marketing strategy?

A marketing strategy is the “what” and “how” to build a sustainable value chain framed for a target customer. A powerful marketing strategy needs to be able to manufacture desire, amplify the underlying value proposition, and build a brand that feels unique in the mind of its customers.

What are examples of marketing strategies?

Nike shoes and how those are branded it’s a great example of marketing strategy and how the company differentiates its product through its communication. For instance, Nike has an entire budget dedicated to demand generation, which is a key branding element helping the company be a recognized brand across the globe.

What is the most effective marketing strategy?

There isn’t a size-fits-all marketing strategy. And it will highly vary from the context in which it gets applied. A successful example is how Apple managed to differentiate its products on the marketplace by creating a whole line (iPhone) that opened up a new market, with no competition.

A marketing strategy is the \"what\" and \"how\" to build a sustainable value chain framed for a target customer.build a brand that feels unique in the mind of its customers.

The post The Ultimate Marketing Strategy Guide And Examples appeared first on FourWeekMBA.

June 5, 2020

BCG Matrix: The Growth-Share Matrix In A Nutshell

In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.

The Product Portfolio origin story

It all started back in the 1970s, when Bruce D. Henderson, the American businessman, founded the Boston Consulting Group (BCG) in 1963 as part of a bank, The Boston Safe Deposit and Trust Company. The BCG became independent by the end of the 1970s, and by then Bruce Henderson had come up with The Product Portfolio (aka BCG Matrix or growth-share matrix).

The idea was that of determining the share of cash to allocate for each product, based also on how much future cash potential each product had.

Assumptions underlying the Product Portfolio theory

According to The Product Portfolio theory, it’s fundamental to look at cash flows, to build up a successful portfolio, and this is based on four primary rules:

Rule 1: High market shares bring high margins and cash flows.Rule 2: Growth requires cash to be maintained.Rule 3: High market share will be either earned or bought.Rule 4: No product market can grow forever.

Cash cows

Cash cows are products with high market share and slow growth. They generate cash in excess for what it takes to maintain the market share. According to The Product Portfolio theory, cash should be invested back in cash cows only to maintain them, but most of the excess cash produced by cash cows should be invested in new products (question marks, see below), which have the potential to become cash cows in the future.

Pets (dogs)

Dogs are products with low market share and slow growth. Pets are those products that don’t have growth potential, and they don’t generate enough cash to be sustained.

As Bruce Henderson explained in his piece, all products either become cash cows or pets.

Question marks

Question marks are low market share, high growth products.

They require far more cash than they can generate, otherwise, they will die. The only way out is if they become stars, otherwise, they will decay into dogs.

Star

Stars are high share, high growth products.

While they are leaders, they generate substantial cash. Yet, they will become large cash generators only when they will turn into cash cows, as their growth rate will slow down. However, they will have high market shares, thus becoming more stable products, requiring diminishing investments and high cash generation.

The Success Sequence

Bruce Henderson, founder of BCG, in his Product Portfolio, explained how in a successful sequence of cash allocation, stars over time become cash cows. And the abundant cash generated by cash cows will be invested back in question marks, that will need, over time, to become stars, to trigger a positive loop.

[image error]

In short, stars over time become cash cows, due to market dominance and saturation, thus creating a condition of a product with a slower growth rate, and yet high margins and cash flows. The cash flows generated by cows will need to get invested back to question marks, that for the time being, will make substantial cash. To triggering a positive loop, those question marks will need to be turned into cash cows, or else they will decay and turn into dogs.

The Disaster Sequence

Bruce Henderson, founder of BCG, in his Product Portfolio, explained how in a disaster sequence of cash allocation, excess cash from stars is invested in question marks, that turn into dogs. And how excess cash from cash cows invested in dogs turns a negative loop.

[image error]

In a disaster sequence the cash generated gets invested inefficiently, thus either using the excess cash from cash cows into products that will turn into dogs. Or the excess cash from stars into question marks, that will decay into dogs.

Key takeaways

Back in the 1970s, Bruce Henderson, founder of the BCG consulting produced a cornerstone piece called The Product Portfolio, which would become the foundation of what is also known as the BCG Matrix or Growth-Share matrix.The BCG Matrix assumes that the success of a portfolio of business products will highly depend on how the cash will be allocated over those same products. More precisely high market shares products will also bring high margins and cash and vice versa. The matrix divides the products into four main categories: cash cows, dogs, question marks, and stars. In a success sequence, stars generate cash and over time they will turn into cash cows. Cash cows have low growth but high market share and as such generate large cash flows to be invested in question marks, to turn them in stars, that over time will become cash cows, and trigger again this positive loop. In a disaster sequence, the excess cash from stars is invested in question marks that decay into dogs. And the excessive cash from cash cows is invested back into cash cows that over time decay into dogs.

Read next:

Ansoff MatrixAida ModelGrowth MatrixDigital Strategy MatrixSpeed-Reversibility Matrix

Other resources:

Types Of Business ModelsPlatform Business ModelsDigital Business ModelsBusiness Strategy ExamplesGoogle Business Model

The post BCG Matrix: The Growth-Share Matrix In A Nutshell appeared first on FourWeekMBA.

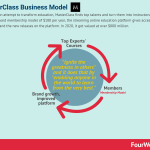

MasterClass Business Model In A Nutshell

Started as an attempt to transform education, MasterClass finds top talents and turn them into instructors. With a straightforward membership model of $180 per year, the streaming online education platform gives access to all its courses and the new releases on the platform. In 2020, it got valued at over $800 million.

Origin story

In an interview for 7×7 Aaron Rasmussen and David Rogier, highlighted their feelings about the education world:

I had been speaking with people in education, both in and outside the traditional school system, and found that people felt they were getting ripped off.

From there they started to redefine the concept of educaiton. During the web era, several companies have approached the change in education is several ways. MasterClass philosophy was that of enabling top talents to bcome instructors.

As they pointed out in the same interiew:

What does the most ideal online education look like? Learning from well-known instructors who have mastered a particular skill on one seamless platform. We’ve been working on MasterClass ever since!

So how did they convince the first celebrities to produce a class on their platform, when none knew them? David Rogier explained: “Honestly, lots of cold calling, persistence, great advisors and a little bit of luck.”

They also used some of the connections they had but as the founders reported the key ingredient was timing and the willingness of the top-class expert to wanting. todo it.

For instance, David Rogier reported how Kevin Space said he felt like it was his responsibility to “send the elevator down” for the next generation of actors.”

Of course, it helped the fact that, after initial traction, MsterClass also got well funded. Which definitely helped convince top experts to join the platform. As Hollywood Reported explained, “instructors make about $100,000 upfront when they begin working with MasterClass and receive 30 percent of the revenue their classes generate.“

This was back in 2017 when the platform was still at the beginnings. We can imagine that depending on the instructor and celebrity MasterClass has several levels of deals, to make it attractive for them to contribute a course on the platform.

Idea validation

David Rogier highlighted on Quora that when they were launching, to reduce the risk of failure, or perhaps to avoid spending years of their life and massive financial resources, they went through a process of idea validation, which consisted in asnwering four questions.

Those for questions can be used really, as a sort of business model framework to launch the business:

Hypothesis/Question: Could we get the best in the world to teach? Test/Expected Result to Validate The Hypothesis: get one to say yes (Dustin Hoffman) Hypothesis/Question : Could we make great classes? Test/Expected Result to Validate The Hypothesis : make a test one (they filmed their parents teaching quilting and divorce tips — David Rogier’s dad was a family law attorney) Hypothesis/Question : Would people want to take the classes? Test/Expected Result to Validate The Hypothesis : surveys, user interviews, and market comps. Hypothesis/Question : Would all the math work (e.g. would CAC be at least less than Net Revenue)? Test/Expected Result to Validate The Hypothesis : try to sell an online class on how to CACs look. We tested everything we could (and still do)!

MasterClass’s mission and strategy

MasterClass’s mission is “to ignite the greatness in others” and it does that by “enabling anyone in the world to learn from the very best.”

MasterClass philosophy and strategy is skewed toward finding the top talents in several areas and transform them in instructors for the masses, where the educational experience is kept as much as possible as “one-to-one” meaning MasterClass tries to make it interactive via developing also online tools that help students learn better.

For instance, at once Rogier recounted how when developing the course with Christina Aguilera they had the chance to develop a proprietary technology to evaluate and measure the pitch of the voice, thus practice during the course.

How does MasterClass make money?

MasterClass is a streaming platform, that has a simple membership revenue model. The annual membership is $180 per year and provides unlimited access to all classes and new classes as they launch with a 30-day free trial.

As TechCrunch reported back in 2018, sales had more than doubled from 2016 to 2017, reaching probably the 50-100 million range, and probably this growth apace has kept growing also in 2019.

Given the new funding round in 2020, the company might be worth more than $800 million.

Key takeaways

Started as an attempt to enable a different format of education, where top experts are turned as instructors to teach a large number of people, MasterClass is a streaming platform, with a simple subscription model. The site grew as the founders managed to get in the first celebrities to offer their courses on the platform, from there it also got funding allocated for growth.

Read next:

Platform Business ModelApple Business ModelDigital Business ModelsTypes Of Business ModelsBusiness Strategy Examples

Read also:

Udemy Business ModelFreemium Business ModelSlack Business ModelYouTube Business modelVenmo Business ModelCraiglist Business modelAmazon Business ModelGoogle Business Model

The post MasterClass Business Model In A Nutshell appeared first on FourWeekMBA.

June 4, 2020

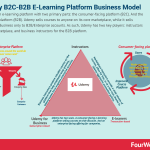

The Udemy Business Model In A Nutshell

Udemy is an e-learning platform with two primary parts: the consumer-facing platform (B2C). And the enterprise platform (B2B). Udemy sells courses to anyone on its core marketplace, while it sells Udemy for Business only to B2B/Enterprise accounts. As such, Udemy has two key players: instructors on the marketplace, and business instructors for the B2B platform.

Origin story

Eren Bali had grown up in a small Turkish village, and as such he had limited learning opportunities, until he got a computer.

Source: Udemy

Source: UdemyOver the years, thanks to the learning resources acquired online, for free, Eren also won a silver medal at the International Math Olympiad.

Later on, Eren Bali, partnered with Oktay Caglar and Gagan Biyani to get Udemy off the ground, but the idea didn’t seem to find the approval of venture capitalists. Indeed, as Gagan Biyani explained back in 2010, they pitched over 30 investors, and they got severely rejected.

As Biyani explained “We then went out to pitch our startup and got rejected by 30 of the best investors you ever heard of. It was brutal, but we were fortunate enough to bounce back.”

They had to retweak their strategy and bootstrap instead. They first realized they needed some traction at least in terms of either users or money. Therefore, they opened the platform, make it freely accessible and within a few months they had a thousand instructors that had produced two thousand courses.

Initially, as the site launched, they primarily uploaded University courses freely available on the platform. That enabled the site to have an initial critical mass, to at least launch and make the site interesting for a decent number of users.

[image error]Some of the courses availale as Udemy launched the site (source WayBackMachine)

Therefore, as initial traction, the platform uploaded more than 600 video courses from free sources such as MIT’s Online Courseware project. While that seemed quite the opposite of its mission, to transform anyone into a potential instructor, beyond academic credentials, that initial strategy gave Udemy the ability to gain its first users, thus then become more attractive to investors.

Udemy the “mashup of “you” and “academy”” would finally gain traction and pitch again only to get the funding it needed to further grow its user base.

Udemy also mastered the mechanism of getting venture capital to be allocated for growth. And over the years, Udemy would get over $223 million in funding.

As any marketplace/platform, Udemy had to figure the chicken and egg problem. As it would later explain on TechCrunch:

“When we first started it was very difficult, because if you were a teacher why would you want to teach on Udemy; there were no students. If you were a student why would you want to go to Udemy, because there was nobody teaching there, right. So you really had to just grind it out, and build it brick by brick, inch by inch.”

Udemy two-sided value proposition

While Udemy started with the idea to become primarily a consumer platform, today it has two core customer profiles:

People who are looking to improve their skills for whatever reason, from professional to personal development.To employees in medium, large organizations that want to quickly gain access to a vast library of courses so they can keep up with their teams.

It’s important to understand this difference as it will also change the way those two customers are targeted. Where, in general customers on the platform will be acquired via marketing activities and a platform that has many courses for free, which will be prompted to purchase premium courses (a sort of freemium).

On the B2B/Enterprise side, the acquisition will happen through a dedicated sales force which aim is to acquire a large client with a more structured plan, which as we’ll see is a library comprised of thousands of courses.

For that reason, Udemy has two core products:

Udemy courses for everyone.And Udemy for Business.

Udemy’s mission, and vision

Udemy’s mission is “to make quality education more accessible and improve lives through learning.”

As Biyani explained back in 2012, “We only make money if our instructors make money,” as Udemy make a cut on the sale of all paid courses. Biyani also explained the vision of Udemy “to let anyone enter that marketplace, in the same way that blogging let anyone with a computer publish online.”

Therefore, over the years, Udemy transformed thousands of people in online instructors with its platform.

On the B2B/Enterprise side, Udemy’s mission is “to help employees around the world do whatever comes next… Udemy is where employees and companies choose to learn. Organizations can also host and distribute their own proprietary content within their unique Udemy for Business account.”

Udemy business strategy

Where other edtech companies (like Courser and EdX) have helped academic institutions get online. Udemy has followed the opposite path, that of helping anyone become an instructor and make money with that.

Therefore, when Udemy started, it worked as a sort of CMS for online courses, where it was effortless to set up an online course and start selling it thus making additional income online.

On the other hand, over the years, Udemy also built up its B2B/enterprise platform, with Udemy for the Business offering, which targeted a completely different customer.

Key partner: Instructors

With over a hundred million visits each month on the platform, no doubt that Udemy is among the most known educational marketplaces. Therefore, if the platform wasn’t that popular it would not be that interesting either for instructors.

Another thing that makes Udemy interesting to instructors is its simple revenue-share structure divided into three areas:

Instructor Promotion: here Udemy acts as a CMS, where it gets a 3% administrative processing fee, while 97% is given to the instructor. Udemy Organic: If the sales come through Udemy organic traffic the revenue is split 50/50.Paid User Acquisition Channel Sales: If Udemy has pushed the course through its paid acquisition strategies (promotion and affiliations), 25% goes to instructors.Udemy for Business: In addition, Udemy allocates 25% of monthly subscription revenue from Udemy for Business customers for payments to Udemy for Business instructors.

It is fundamental for Udemy’s continued growth to have a sustainable Instructors’ community that keeps producing quality courses for the platform. And this all starts by enabling them to earn enough revenues through the platform.

Key customer: Udemy For Business

[image error]

While Udemy is a platform that reaches millions of people, with its inexpensive, and often free courses. In reality, Udemy has been pushing its Udemy for Business comprising:

Unlimited access to the top 4,000+ courses selected from Udemy.com – anytime, on any deviceFresh content taught by 1,500+ experts and real-world practitioners – for any learning styleActionable learning insights and admin functionality

Where the Udemy platform targets mostly consumers and B2C, and many of its courses are free. Udemy for Business instead attracts companies to offer a complete e-learning plan for the organization.

How does it make money? Two-sided revenue modeling

Consumer-facing platform: on its core marketplace, Udemy adopts a strategy of aggressive promotion where courses get periodically and widely discounted. This enables the platform to reach a large number of potential customers, and convert many of the free users in paying customers. The transaction is mostly one-time. And customers can buy more courses, thus turning into repeat customers.Business/enterprise SaaS platform: at an enterprise level, Udemy for Busines is sold more as a sort of software as a service. The learning platform gives access to thousands of courses to team members.

As highlighted on Udemy’s website “The Udemy for Business instructor revenue model is different from the Udemy marketplace instructor revenue model.”

“While marketplace instructor revenue is calculated on the volume of course purchases and students’ lead sources for a given course, Udemy for Business instructor revenue is based on learner engagement or the total number of minutes consumed within an instructor’s course(s).”

In 2020, Udemy raised another $50 million in funding by the Japanese publishing house, Benesse, which valued the company $2 billion. As the CEO, Gregg Coccari highlighted “Udemy is on a mission to improve lives through learning, and so is Benesse. 2020 will be a milestone year where we serve millions of more students and enable thousands of businesses and governments to upskill their employees.”

Therefore, Udemy’s two-souls will widen in the coming years. On the one end, the consumer-facing platform, which is a critical element of Udemy’s overall success as a brand. A freemium-like model drives this. And its enterprise side, driven by Udemy for Business, which follows more a SaaS model.

Key takeaways

Started as an e-learning platform, initially, Udemy had to upload University courses to kick off its website, which gave some traction, and it enabled it to get funding and capital allocated for growth. As it grew, the Udemy marketplace became a popular consumer educational platform. However, many courses on the platform are still free or offered at widely discounted prices. As Udemy evolved, it also launched its enterprise platform, which follows a substiptio..absed revenue model, where the sales force is driving enterprise accounts. Udemy, therefore, is a hybrid platform, both consumer-facing and enterprise, with the former running on a transaction-based model and the later on a subscription-based model.As Udemy got tits latest funding, it also explained its strategy to keep growing its B2B segment in the coming years.

Read next:

Platform Business ModelApple Business ModelDigital Business ModelsTypes Of Business ModelsBusiness Strategy Examples

Read also:

Freemium Business ModelSlack Business ModelYouTube Business modelVenmo Business ModelCraiglist Business modelAmazon Business ModelGoogle Business ModelNetflix Business Model

The post The Udemy Business Model In A Nutshell appeared first on FourWeekMBA.

Business Platform Theory: The Platform Platforms’

In today’s tech-driven business world, the term “platform” gets used in several contexts. It can mean a tech platform, intended as the place where software is executed in conjunction with a hardware, or perhaps the digital space where it gets embedded.

In the business context, instead, the platform is a company that runs a model where, rather than offering a specific product, it enables the interactions between two or more players on that. One of the distinctive elements of platform businesses is network effects. Or the ability of the platform to get better for the next user as the previous user joins it.

I argue, there is a third type of platform that we can call “business platform” that is the platform platforms’, or the container of both the tech platform and the several platform businesses formed on top of that, combined with a new monetization and distribution model.

Proprietary and cloed

Would you think your smartphone is as useful as it is if it didn’t have its apps inside? Apple was the first company to stumble on a “Mobile Business Platform” made of the encounter of the iPhone, plus its software, which enables also the development of applications.

The hardware, though, works as the “physical platform” or the foundation for the software side to develop. The hardware, in this case, is closed and proprietary.

Platforms and Policies

The software built on top of the hardware is the foundation of the tech platform. Usually, there is a part of it, which is closed (like the operating system) and another open part (like the store or marketplace, on top of which third-party developers can build applications).

On the open side, the company owning the tech platform will set the rules, and the policies for third-parties to respect to keep the tech platform in line with the core business while allowing it to grow as it adds functionalities via third-party applications.

Developer’s Community

On top of the partially-open side, third-party developers will be able to build their own applications, which will become the add-ons and tools to expand the hardware and built-in software. Just like the iPhone has apps that make it more useful, so the developer’s community expands the ability of the hardware and software built on it.

Distritbution and Monetization

As the tech platform develops, and the developers’ community grows, it will also bring with itself a few distribution and monetization strategies, which are intrinsic to the business platform.

For instance, on the App Store, developers know they can make money in a few ways (advertising, in-app purchases, premium products, and more). This sort of distribution and monetization creates the basis for an entrepreneurial ecosystem to become viable.

Entrepreneurial Ecosystem

As the entrepreneurial ecosystem becomes self-sustained, as a side effect will enable the solid growth of the tech platform and, with it, the whole distribution model associated with it. From there, the platform platforms’ will build up.

Platform Platforms’

Once the conditions above are met, the Business Platform (or the Platform Platforms’) will become the foundation of the business success.

As a conclusive example, when Apple launched the iPhone, that was just hardware and proprietary software. It was a great device, but still not as interesting. As Apple launched its App Store, the iPhone turned into a tech platform, where those apps could expand its functionalities many times over.

As the App Store grew, it also consolidated distribution and monetization models that enabled. That is when the iPhone turned, from hardware to “Mobile Business Platform” which after a decade is still alive and thriving.

[image error]

Read next:

Platform Business ModelApple Business ModelDigital Business ModelsTypes Of Business ModelsBusiness Strategy Examples

The post Business Platform Theory: The Platform Platforms’ appeared first on FourWeekMBA.

June 2, 2020

Luisa Via Roma Business Model In A Nutshell

LuisaViaRoma is a physical fashion store in Florence, which successfully turned into e-commerce by the early 2000s. By 2019, LuisaViaRoma made more than $130 million in revenues, of which 90% coming from e-commerce.

Origin story

LuisaViaRoma is among the most successful fashion e-commerce businesses.

The most interesting part of LuisaViaRoma case is how the company converted successfully from physical to digital to build among the most successful e-commerce sites on earth.

Its story started at the end of the 1800s when – as mentioned on the company’s website – French hat designer Luisa Jaquin open a small boutique selling straw hats in Paris. In 1929, the daughter, Olga, married Lido Panconesi and together they opened the LUISA boutique in Florence.

Starting in 1968, LuisaViaRoma business model primarily consisted of closing deals with established brands (they started with Balenciaga, Balmain, Givenchy, and Saint Laurent) to showcase and sell them in Florence’s store.

The business model change

In 1999, as the Internet was finding its commercial applications, LuisaViaRoma built its online store. As highlighted by Panconesi, CEO of LuisaViaRoma:

I didn’t know about the web at all. Just because of my curiosity, I wanted to learn everything about it as quickly as possible. As soon as I realized the potential of the web—that it could put me in touch with all our clients at the same time, all over the world—I just put myself in it and started investing. First, in engineers to write our website from scratch. At that time, imagine: Google [just emerged from the beta stage] and Facebook arrived in 2004. So staffing, especially in Italy, was zero. In Italy, the infrastructure did not exist at that time. Nobody was accustomed to buying by catalog, so there was no business in Italy. But Italy became our first market.

What makes the company so successful?

As recounted by Panconesi in the same interview, one of the greatest teachings he got from his grandmother was “Make yourself up a good name and then you can rest,’ which basically means, ‘Invest in the brand,’ in business words. That’s what we’re doing: investing in our brand, LuisaViaRoma.”

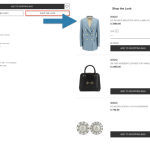

LuisaViaRoma digital distribution

[image error]LuisaViaRoma traffic and digital metrics.

[image error]LuisaViaRoma International Presence.

[image error]

[image error]The e-commerce personalizations and shopping prefenreces.

[image error]The suggestion algorithm.

[image error]The outfit suggestion engine.

[image error]

[image error]The “shop the look” feature that prompts customers to shop related items.

How much does LuisaViaRoma make?

According to pambianconews, LuisaViaRoma closed 2019 with revenues for 123 million euros ($137 millin) of which 90% made online (LuisaViaRoma also has a physical store in Florence).

Read next:

LVMH Business ModelLuxottica Business ModelPrada Business ModelKering Business Model

Handpicked resources:

What Is Business Model InnovationWhat Is a Business ModelBusiness Strategy ExamplesWhat Is Market SegmentationWhat Is a Marketing Strategy

The post Luisa Via Roma Business Model In A Nutshell appeared first on FourWeekMBA.