Gennaro Cuofano's Blog, page 198

July 11, 2020

Gross Margin In A Nutshell: Gross Margins vs. Moats

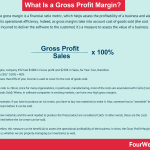

The gross margin is a financial ratio metric, which helps assess the profitability of a business and also its operational efficiency. Indeed, as gross margins take into account cost of goods sold (the cost incurred to deliver the software to the customer) it’s a measure to assess the value of a business.

Gross margin in a nutshell

This is the relationship between Goss Profit and sales, and it is expressed in percentage:

(Gross Profit (Revenue – CoGS) / Sales) x 100%

Imagine, company XYZ had $100K in Gross profit and $250K in Sales, for Year-Two, therefore:

(100/250) * 100% = 40%

It means that 60% of your income is used to cover for the cost of goods sold. This ratio is critical, since for many organizations, in particular, manufacturing, most of the costs are associated with CoGS (Cost of Goods Sold).

For example, if you have to produce an Ice cream, you have to buy raw materials to make it. Also, someone has to “assemble” the Ice cream before it can be sold.

Well, the raw materials and the work needed to produce the final product are considered CoGS. In other words, those are the costs required before the Ice cream can be sold.

Therefore, this measure can be beneficial to assess the operational profitability of the business.

Why gross margins matter

David George and Alex Immerman, partners at the venture capital firm a16z highlighted, “A high gross margin is a preferred business feature. Higher gross margins allow for more percentage points of revenue to be spent on growth and product development.”

This is a critical element to understand, as software companies, while usually carrying higher gross margins than traditional organization, more focused on physical infrastructure.

Those same software companies’ products also might become outdated quickly, as technology evolves. In addition, in order to distribute a software and enable its continuous growth, it requires massive investments in marketing and sales.

For instance, Salesforce, among the most valuable software companies, in terms of market cap, by 2020 spent more than 46% of its revenues in sales and marketing. Compared to 25% in total for cost of goods sold, and 16% for product research and development (FourWeekMBA Analysis).

As David George and Alex Immerman, further pointed out “higher gross margins also tend to translate to higher cash flow margin, and in a world where ‘how much runway do you have’ has become a (if not, the) preeminent question, cash is paramount. For these reasons, high gross margin companies typically have higher revenue multiples than their low gross margin counterparts.“

Less risk aversion more gross margins

As Fred Wilson, from AVC pointed out in “The Great Public Market Reckoning,”

If you look at the class of companies that have come public in the last twelve months, many of the stocks that have performed the best are software companies with software margins. One notable exception to that is Beyond Meat.

He mentioned examples like Zoom, Cloudfare, and Datadog. Where other companies, like Uber, Lyft and Peloton were losing value. In short, he pointed out how in times where investors are more risk averse gross margins become secondary.

However, where there is more market risk aversion, gross margins become extremely important.

Gross margins vs. moats

David George and Alex Immerman also point out how looking at gross margins alone is misleading, as it makes you forget what really drives business value.

As they further point out “business quality is about defensibility. Defensibility comes from moats.”

In short, if a company is focusing on higher gross margins at the expense of business defensibility that might over time translate in lost of competitiveness of the business.

As they pointe out, companies like Apple, Walmart, Netflix and others, have much lower margins compared to software companies, and yet, those are among the most valuable brands in the world.

But what makes up a moat? There are several ways to build moats and some of them are:

Economies of scale: which enables companies to improve efficiency and profitability as the company scales (beware though of diseconomies of scale).Differentiated technology: in a software world where hundreds of new products are launched to market everyday, building up differentiation (in terms of features, technology and value proposition) is a key element. Network effects: this is true for platform business models. Where in economies of scale the company gains in efficiency and profitability as it grows (it lowers its per cost unit). In network effects, the platform becomes more valuable as its per user value grows as more users join (beware of negative or reverse network effects). Direct brand: one of the most powerful business defences is the brand, or the direct access to your customer base. For instance, if you take Facebook, it’s still among the most valuable websites on earth, because people recognize its brand. There is no intermediary, people access their Facebook app, or go directly on the Facebook login page. This is critical, as over time it defends against disintermediation. If, let’s say, Facebook depended solely on traffic coming from Google, the day Google had launched its social network, it would have killed Facebook. Yet, as the product and brand was recognized and people got straight to the source, it didn’t need any intermediary. Distribution: while strong products and brands can draw directly from their user or customer base. Having a strong distribution network is also a key element. As highlighted in the Google TAC and if we look at the costs associated to the money invested into distribution of some of the most valuable brands, this goes in the multi-billion dollar mark. Value proposition and perception: understand what’s the killer use case that makes your product valuable in the hands of several types of customers is another key ingredient. While this might go beyond the engineering world, and as such it might seem more foggy, it is though one of those elements that make a long-term difference. In short, are you willing to test, and experiment with your product to find value propositions that fit the market? If so, you product will evolve contextually, to create moats.

Those factors combined are all part of your business model recipe, and it often becomes evident only in hindsight. And it takes years to build. What’s left is a lot of business experimentation, a strong long-term vision.

Read next:

Financial Ratios Accounting Equation Financial Accounting Business Models

The post Gross Margin In A Nutshell: Gross Margins vs. Moats appeared first on FourWeekMBA.

July 10, 2020

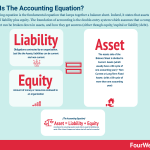

Accounting Equation And Why It Matters In Business

The accounting equation is the fundamental equation that keeps together a balance sheet. Indeed, it states that assets always equal liability plus equity. The foundation of accounting is the double-entry system which assumes that a company balance sheet can be broken down in assets, and how they get sources (either though equity/capital or liability/debt).

Case study: Imagine you are starting a company, which manufactures biscuits. Beside the cost to run the operations, you need the machine to produce them.

In total, for the machine you need $100,000.

The purchase is financed: 80% through equity and 20% through debt.

Even though this transaction is one step in the real world, it becomes three steps in the accounting world:

Step 1: Initially your balance sheet will show $80K under cash and equity, since remember that you will contribute 80% of $100K to buy the machine. The transaction will look like the following:

Step 2: Next, you will borrow $20K from the Bank as long-term loan, since 20% will be financed with debt. It means, you will show $100K under cash now ($80K + $20K). On the other side, you will show $80K under equity and $20K under liability. The transaction will look like the following:

Step 3: With the resources acquired you will buy the machine that will cost you $100K. The machine will show as a long-term asset on the balance sheet. This asset, financed with $20K as a long-term liability and $80K as Equity. See below:

Core principles of the accounting equation and double-entry system

First, Assets always equals Liabilities + Equity.

Second, what is a one step transaction in the real world becomes a three steps transaction in the accounting world. I am sure at this point you are thinking of accounting as of “the art of making easy things hard”.

Although, I can assure you that once you internalize the two principles above you will see the light. To develop an accountant mindset you must always ask yourself “What is behind this transaction?”

Indeed, in today’s world accounting software do not allow you to understand what is going on behind the scenes. Thereby, once you keep in mind the two principles above, transactions that before you did not understand will suddenly reveal to your eyes.

At that point you will understand what I mean when I say that accounting is simple. Once you reach that enlightenment level the whole financial world will unravel to your eyes.

Suddenly, this deeper level of understanding will make you love the subject. You will no longer be like a car designer who does not know how the engine works. Therefore, each time the designer has to add a feature to the car skeleton he has to stop and wait for the engineer approval.

Key takeaway

In conclusion, the balance sheet is divided in two main parts. The first part is the one dedicated to Assets. Within it you will find two sub-sections:

Current Assets.Long-Term Assets.

On the other hand, the second part is dedicated to liabilities and equity (sources of finance). Within that you will find two sub-sections:

Liabilities: Current and Non-Current or Long Term Liabilities.Equity.

Keep in mind the balance sheet is a picture of the business in that moment. Where, the P&L is like a collage of pictures taken in the whole year.

Read next:

How To Read A Balance Sheet Like An Expert

Other business resources:

Financial Ratio GuideFinancial Options GuideTypes of Business Models You Need to KnowBusiness Strategy ExamplesBlitzscaling Business Model Innovation Canvas In A NutshellWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And ExamplesWhat is Growth Hacking?

The post Accounting Equation And Why It Matters In Business appeared first on FourWeekMBA.

July 5, 2020

Who Owns TikTok? Inside The Chinese Tech Giant

TikTok is owed by ByteDance, a Chinese internet technology company owning several content platforms across the world (Douyin, Toutiao, Xigua Video, Helo, Lark, Babe). Bytedance passed the $100 billion private market valuation by 2020, and making over $17 billion in revenue and over $3 billion in profits.

Bytedance corporate structure

[image error]Source: ByteDance

Based on the several products the company has, its holding company is a Cayman corporation, keeping control, of other subsidiaries, from TikTok Ltd., which is the Cayman holding, owning TikTok LLC (in US), TikTok KK, in Japan, TikTok Pte. Ltd. in Singapore, and TikTok Information Technologies UK Ltd. in the UK.

[image error]Source: ByteDance

The leadership team is comprised of Yiming Zhang, founder and CEO, followed by the other board of directors.

[image error]Source: ByteDance

ByteDance started its international growth, in the western world, when in August 2018, it merged Music.ly with TikTok, and from there the International expansions accelerated.

[image error]Source: ByteDance

Within ByteDance there are other investors, comprising private equity and venture capital firms like Sequoia, KKR, and SoftBank.

TikTok business model is quite interesting as it goes beyond the traditional social media format.

[image error]TikTok is the Chinese creative social media platform primarily driven by short-form video content. It launches challenges of various types to tap into the creativity of its users and generate engaging (if not addicting content) accessible via an infinite feed. TikTok primarily makes money through advertising, thus making it an attention-based business model.

Other products part of ByteDance

Douyin China’s leading destination for short-form mobile videos. (TikTok in China).Toutiao one of the most popular content discovery platforms in China.TikTok leading destination for short-form mobile video.Xigua Video one of China’s most popular video applications that enable users to discover, enjoy and share a wide range of video stories, both short-form and long-form.Helo India’s leading social media platforms.Lark collaboration tools in a single interconnected platform, including chat, calendar, content creation, cloud storage, and app management.Babe Indonesia’s leading news and content app.

Read next:

TikTok Business Model How To Integrate TikTok In Your Digital Marketing StrategyThe Rise of Super PlatformsPlatform Business ModelsTypes of Business Models You Need to KnowBusiness Strategy: Definition, Examples, And Case StudiesWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And ExamplesMarketing vs. Sales: How to Use Sales Processes to Grow Your Business

The post Who Owns TikTok? Inside The Chinese Tech Giant appeared first on FourWeekMBA.

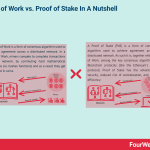

Proof of Work vs. Proof of Stake In A Nutshell

Proof of Work and Proof of Stake are the two primary philosophies and consensus algorithms behind the Blockchain protocols, since the inception of Bitcoin. For instance, Bitcoin still runs through Proof of Work. While other protocols, like Ethereum moved toward Proof of Stake.

Proof of Stake in a nutshell

[image error]A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency.

A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum‘s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency.

Proof of Work in a nutshell

[image error]A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins.

A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum‘s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency.

Key takeaways

Consensus algorithms help Blockchain Protocols reach agreement among a distributed network. Among those consensus algorithm there are two main philosophies: Proof of Stake and Proof of Work.

The Proof of Stake determines the consensus based on the stake of each user in the network.

In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins.

Proof of Work In A NutshellProof of Stake In A Nutshell Blockchain EconomicsBlockchain Business ModelsSteemit Business ModelThe Rise of Super PlatformsPlatform Business Models

Read also:

Types of Business Models You Need to KnowBusiness Strategy: Definition, Examples, And Case StudiesWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And ExamplesMarketing vs. Sales: How to Use Sales Processes to Grow Your Business

The post Proof of Work vs. Proof of Stake In A Nutshell appeared first on FourWeekMBA.

What Is A Proof of Work And Why It Matters In Business

A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins.

Proof of Work in a nutshell

As Ethereum points out, “in proof of work (PoW) based public blockchains (e.g. Bitcoin and the current implementation of Ethereum), the algorithm rewards participants who solve cryptographic puzzles in order to validate transactions and create new blocks (i.e. mining).”

Proof of Work explained in the original Bitcoin‘s White Paper:

The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.

As the White Paper explains, the several steps to run the network are:

1) New transactions are broadcast to all nodes.

2) Each node collects new transactions into a block.

3) Each node works on finding a difficult proof-of-work for its block.

4) When a node finds a proof-of-work, it broadcasts the block to all nodes.

5) Nodes accept the block only if all transactions in it are valid and not already spent.

6) Nodes express their acceptance of the block by working on creating the next block in thechain, using the hash of the accepted block as the previous hash.

The longest chain wins. When new proof-of-work are found, and a branch becomes longer, all the other nodes converge into the lowest blocks.

Origin story of Bitcoin

January 10th, 2009, a guy named Satoshi Nakamoto (it was only a pseudonym) sent an email to Hal Finney, a man from Santa Barbara:

“Normally I would keep the symbols in, but they increased the size of the EXE from 6.5MB to 50MB so I just couldn’t justify not stripping them. I guess I made the wrong decision, at least for this early version.

I’m kind of surprised there was a crash, I’ve tested heavily and haven’t had an outright exception for a while. Come to think of it; there isn’t even an exception print at the end of debug.log. I’ve been testing on XP SP2, maybe SP3 is something.

I’ve attached bitcoin.exe with symbols. (gcc symbols for gdb, if you’re using MSVC I can send you an MSVC build with symbols)

Thanks for your help!”

Source : online.wsj.com

The subject of the email was Crash in bitcoin 0.1.0. That man, Satoshi Nakamoto was explaining to Hal Finney how to use a Bitcoin.

Therefore, computers mining coins, solve harder and harder cryptographic puzzles, which work as a proof, thus making them rewarded with coins.

Proof of Work types

There are several types of Proof of Work. From hash functions to puzzles (cryptograms), sequences, hard inversions and many others. The key aspect here is in order for blocks to be validated computers mining to confirm transitions and produce new blocks. As those miners competing with each others, add blocks to the chain, as result they earn rewards (coins).

Distributed consensus

The whole point of Proof of Work, just like in the Proof of Stake is about enabling consensus in a distributed network.

Where Proof of Stake validates the network’s blocks based on proved stake of the validators.

In a Proof of Work, miners, pool up to generate coins for the network by solving harder and harder mathematical problems, and as a reward they get coins.

Advantages of Proof of Work

The original consensus algorithm in a Blockchain network was designed on proof-of-work. Thus, this, overall proved a solid consensus algorithm.

However, it has some drawbacks.

Drawbacks

Some of the drawbacks of proof of work are:

“Mining monopolies” Indeed, as the proof-of-work based Blockchain protocol grows, the computing power needed to complete new blocks might require higher efficiency. Therefore, miners tend to pool up and the ones becoming bigger will also become the ones able to mine more blocks, and therefore get more rewards. Those rewards if invested further in mining equipment it makes them further mine larger and larger portions of the network, thus creating a sort of pool monopoly. Reduced decentralization: Decentralization is the main reason for the Blockchain existence. However, as the proof-of-work-based Blockchain protocol grows, it also becomes more concentrated, and therefore centralized. Security: Large mining pools could, at least in theory, launch a 51% attack to take over or cause chaos on the network.

Key takeaways

Proof of Work is among the consensus algorithms used on Blockchain protocols. It is perhaps the consensus algorithm used on the first cryptocurrency, the Bitcoin.

The Bitcoin still works with a Proof of Work consensus algorithm, where Ethereum, for instance, is transitioning toward Proof of Stake.

Cryptocurrencies are serving as incredible lab for those various consensus algorithms and all the other systems built on top of them to be tested, validated and determined whether they can work at larger and larger scale.

Blockchain EconomicsBlockchain Business ModelsSteemit Business ModelThe Rise of Super PlatformsPlatform Business Models

Read also:

Types of Business Models You Need to KnowBusiness Strategy: Definition, Examples, And Case StudiesWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And ExamplesMarketing vs. Sales: How to Use Sales Processes to Grow Your Business

The post What Is A Proof of Work And Why It Matters In Business appeared first on FourWeekMBA.

What Is A Proof Of Stake And Why It Matters In Business

A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum‘s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency.

How does Proof of Stake work?

As pointed out on Ethereum:

Proof of Stake (PoS) is a category of consensus algorithms for public blockchains that depend on a validator’s economic stake in the network.

In short, in a PoS-based blockchain, the weight of each validator taking turn proposing and voting might depend for instance on the size of its deposit (the stake.

The workflow is:

The blockchain keeps track of a set of validators (someone responsible for verifying transactions within a blockchain).Holding ether (the Ethereum’s cryptocurrency) gives the chance to be a validator. When a special type of transaction is locked up into a deposit that determines a validator.Validators participate in the consensus algorithm to reach majority.

The philosophy behind Proof of Stake

As pointed out on Ethereum the key advantages of a Proof of Stake are:

No need to consume large quantities of electricity in order to secure a blockchain.The supply goes down over time as there is not as much need to issue as many new coins in order to motivate participants to keep participating in the networkReduced centralization risks.

Disadvantages of a Proof of Stake

The main argument against Proof of Stake is the risk that the Blockchain protocol might be taken over by someone with a substantial stake in the protocol. While the protocol might have rules to prevent that, if those rules fail they make the network potentially centralized, thus prone to take overs.

As explained in the Steemit business model, as the network was taken over, and the way for the community to decentralize it was though a hard fork, which created a new protocol, called Hive.

As Vitalik Buterin pointed out, when the take over of Steemit happened:

[image error]

One way to prevent this, of course, is to use hybrid models, that combine Proof of Stake with Proof of Work.

Or have a set of mechanisms to enable distribution of coins, prevent monopolizzano and 51% attacks (take overs).

Distributed consensus

The whole point of proof of stake is about enabling consensus in a distributed network, a Blockchain Protocol.

Types of Proof of Stakes

While there are many types of consensus algorithms. When it comes to Blockchain and Proof of Stakes, two main kinds have found applications:

Chain-based Proof of Stake

As pointed out on Ethereum, in a Chain-based Proof of Stake, “the algorithm pseudo-randomly selects a validator during each time slot (eg. every period of 10 seconds might be a time slot), and assigns that validator the right to create a single block, and this block must point to some previous block (normally the block at the end of the previously longest chain), and so over time most blocks converge into a single constantly growing chain.“

BFT-style (Byzantine fault) Proof of Stake

In a BFT-style (Byzantine fault) proof of stake for to proof of stake to be reliable, there has to be some fault tolerance of a system where, even though some of the parties, are not in agreement or act against the network’s rules, the network can still reach agreement and move on.

This mechanic draws from the Byzantine Generals Problem.

As the original paper on The Byzantine Generals Problem, of 1982, states:

Reliable computer systems must handle malfunctioning component that give conflicting information to different parts of the system. This situation can be expressed abstractly in terms of a group of generals of the Byzantine army camped with their troops around an enemy city. Communicating only by messenger, the generals must agree upon a common battle plan. However, one or more of them may be traitors who will try to confuse the others. The problem is to find an algorithm to ensure that the loyal generals will reach agreement. It is shown that, using only oral messages, this problem is solvable if and only if more than two-thirds of the generals are loyal; so a single traitor can confound two loyal generals.With unforgeable written messages, the problem is solvable for any number of generals and possible traitors.

In short, as long as the number of disloyal generals is less than one third of the generals. The impossibility of dealing with one-third or more traitors ultimately reduces to proving that the one Commander and two Lieutenants problem cannot be solved, if the Commander is traitorous.

Key takeaways

Consensus algorithms help Blockchain Protocols reach agreement among a distributed network. Among those consensus algorithm there are two main philosophies: Proof of Stake and Proof of Work. The Proof of Stake determines the consensus based on the stake of each user in the network.

The Proof of Stake solved an important problem, as it enabled an alternative mechanism to Proof of Work, primarily based on mining, with an impressive energy consumption.

Proof of Stake would enable the network to function even without much energy consumption, as the network can grow based on the stake of coins of each player in the network.

At the same time as the Steemit case showed, the network is vulnerable from take overs, thus risking to get centralized, which is what a Blockchain Protocol wants to prevent in the first place.

Blockchain Economics Blockchain Business ModelsSteemit Business ModelThe Rise of Super PlatformsPlatform Business Models

Read also:

Types of Business Models You Need to KnowBusiness Strategy: Definition, Examples, And Case StudiesWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And ExamplesMarketing vs. Sales: How to Use Sales Processes to Grow Your Business

The post What Is A Proof Of Stake And Why It Matters In Business appeared first on FourWeekMBA.

July 4, 2020

What Is Coupling And Why It Matters In Business

As startups gain control of new markets. They expand in adjacent areas in disparate and different industries by coupling the new activities to benefits customers. Thus, even though the adjunct activities might see far from the core business model, they are tied to the way customers experience the whole business model.

Amazon Prime case study

[image error]

Example of how Amazon expanded in an adjacent area, like media and content with Amazon Prime. At first sight that might seem completely unrelated to the Amazon business model.

Amazon Prime offers premium content available on its streaming platform. And yet, it also bundles up free delivery, which makes the repeat purchases on Amazon e-commerce much more convenient. Thus enhancing its overall business model.

Similar business phenomena

Unbundling

[image error]Unbundling is a business process where a series of products or blocks inside a value chain are broken down to provide better value by removing the parts of the value chain that are less valuable to consumers and keep those that in a period in time consumers value the most.

Disintermediation

[image error]According to the book, Unlocking The Value Chain, Harvard professor Thales Teixeira identified three waves of disruption (unbundling, disintermediation, and decoupling). Decoupling is the third wave (2006-still ongoing) where companies break apart the customer value chain to deliver part of the value, without bearing the costs to sustain the whole value chain.

Decoupling

[image error]According to the book, Unlocking The Value Chain, Harvard professor Thales Teixeira identified three waves of disruption (unbundling, disintermediation, and decoupling). Decoupling is the third wave (2006-still ongoing) where companies break apart the customer value chain to deliver part of the value, without bearing the costs to sustain the whole value chain.

What is Unbundling What is Disintermediation What is DecouplingPlatform Business Models In A NutshellNetwork Effects In A NutshellWhat Are Diseconomies Of Scale And Why They Matter

Other resources for your business:

Types of Business Models You Need to KnowBusiness Strategy: Definition, Examples, And Case StudiesWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And ExamplesMarketing vs. Sales: How to Use Sales Processes to Grow Your BusinessHow To Write A Mission StatementWhat is Growth Hacking?

The post What Is Coupling And Why It Matters In Business appeared first on FourWeekMBA.

What Is Decoupling And Why It Matters In Business

According to the book, Unlocking The Value Chain, Harvard professor Thales Teixeira identified three waves of disruption (unbundling, disintermediation, and decoupling). Decoupling is the third wave (2006-still ongoing) where companies break apart the customer value chain to deliver part of the value, without bearing the costs to sustain the whole value chain.

Understanding the Customer Value Chain

[image error]In the book Unlocking The Customer Value Chain, professor Thales Teixeira explains it as a framework of all the steps or activities that customers have to go through to acquire products and services. The customer value chain then helps to map the journey of our customers from their viewpoint.

The customer value chain primarily represents all the steps customers take in order to get the product or service. Thus, that represents a journey, but from the customers’ perspective and what kind of value the customer gains at each step.

In short, at each step of the experience customers gain a different set of values which make up the whole customer value chain. For instance, if I walk into a local book store, the whole experience will have different sub-values I gain as a customer.

As I enter the store, the value I get is the immersive experience of being able to feel, touch and walk through the store to find the book I need. As I see various books, I can open them, have a quick glance within, and why not, also read some chapters.

While I might be able to do the same on my Kindle, the immersive experience of the bookstore, makes it very attractive for a voracious reader. And yet, as I’m about to buy a few books, I might have to find them in various local bookstores.

Or I could, for instance, check if they are all available on Amazon at a lower price. On Amazon I’ll be able to find them all and at a lower price (Amazon’s mission it’s all about variety and convenience).

While initially, as a customer I get the most of the experience. I can use any local bookstore to evaluate and choose the books I need, and yet finalize the purchase on Amazon, as I get convenience.

Over time, I might end up doing the whole process on my Kindle, as I can have right away books I need.

This is, perhaps, how Amazon decoupled the bookstores’ customer value chain. Where in disintermediation, the company disrupts the distribution process, by cutting out intermediaries.

In decoupling, it’s primarily about value and how it’s delivered to customers. So part of the experience is redesigned, and the decoupler identifies a core part of the value chain where it will add much more value compared to existing players.

The decoupler then, in theory, enhances the part of the value chain where there is the most business value (Amazon didn’t have to maintain physical stores) as it carries high margins and it is highly scalable (the whole experience can happen online).

This is an asymmetry which digital business models and platform business models have leveraged on to build multi-billion dollar companies.

Breaking down Decoupling

As discussed with Thales Teixeira: “Decoupling is this idea that I’ve observed across all these industries and these startups that I noticed is that they weren’t trying to really steal customers from what we call the incumbents, the large established companies.”

In short, as he pointed out “Airbnb wasn’t really trying to steal the customer in the traditional sense from all the hotels in the world. If it was trying to do that, it would create hotels and maybe build it and get hotel rooms and then steal customers from Marriott or from the Ritz Carlton or from any other hotel.”

Instead, what Airbnb wanted to do was just “improve the matchmaking between people that had homes to rent and people that were trying to find, and not just hotel rooms, but actually a different experience to stay in somebody else’s home for a while.” And so that key activity of matchmaking is what Airbnb decided to do.

Birchbox case study

An example is how Birchbox manufactured a different experience compared to Sephora, already a massive player in the beauty industry.

Birchbox, helped women sample beauty product more conveniently and with a subscription-based business model.

Thus, with a $10 per month the customer get five samples beauty products, delivered at home. Convenience, price and different kind of experience drove the Birchbox business model.

Therefore, Birchbox removed the hassle for customers to having to go to Sephora to source beauty products. While also pricing it at a convenient price, and delivered at home.

By identyiing the key activities Sephora customers have to go through. Birchbox understood they wanted to focus on sampling beauty product, as the most valuable part of the customer value chain.

And they specialized in that.

Initially, startups entering several markets choose to decouple as this makes them focus on one core and key activity in the value chain, which makes them grow more quickly and be identified with that .

How to decouple

To decouple you might want to ask a few questions:

Why do people want to buy it? What do they want to buy the most? What is the most difficult part of the experience and yet the most valuable?

Usually, the decouplers to offer a better alternative, and gain traction quickly might enter the market with a sort of Blue Ocean Strategy, where they offer more, for less.

[image error]A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.

For that, we need to look at the three main currencies people use throughout the value chain.

The three customers’ currencies

Let’s take into account three main currencies:

Monetary currency: (money).Time currency.And effort currency.

As a decoupler if you can reduce costs for customers, time and effort taken, this might unlock major disruptive changes. Airbnb reduced these three costs. Uber reduced these costs. Amazon did the same.

[image error]Airbnb is a platform business model making money by charging guests a service fee between 5% and 15% of the reservation, while the commission from hosts is generally 3%. Due to the pandemic, Airbnb is stretching its business model and experimenting with new formats like online experiences to transition toward fully digital experiences.

Key takeaways

Disruption moves in waves. Unbundling helped to break apart existing products to offer only the most valuable parts of them. Thus, it worked at product level.

[image error]Unbundling is a business process where a series of products or blocks inside a value chain are broken down to provide better value by removing the parts of the value chain that are less valuable to consumers and keep those that in a period in time consumers value the most.

Disintermediation, cut many intermediaries from the supply chain, thus working at supply chain level.

[image error]Disintermediation is the process in which intermediaries are removed from the supply chain, so that the middlemen who get cut out, make the market overall more accessible and transparent to the final customers. Therefore, in theory, the supply chain gets more efficient and, all in all can produce products that customers want.

Decoupling instead, works at customer level. Where the customer experience (the customer value chain) gets broken down, and the decoupler focuses only on a few key value customers get to enter the market and quickly grow.

By reducing costs, improving convenience in terms of time and effort, the decoupler makes it a no brainer for the customer to go through this redesigned customer value chain, where the most valuable part, according to the customer, is offered at better convenience.

What is Unbundling What is Disintermediation Platform Business Models In A NutshellNetwork Effects In A NutshellWhat Are Diseconomies Of Scale And Why They Matter

Other resources for your business:

Types of Business Models You Need to KnowBusiness Strategy: Definition, Examples, And Case StudiesWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And ExamplesMarketing vs. Sales: How to Use Sales Processes to Grow Your BusinessHow To Write A Mission StatementWhat is Growth Hacking?

The post What Is Decoupling And Why It Matters In Business appeared first on FourWeekMBA.

July 3, 2020

What Is A Bitcoin And Why It Matters In Business

Bitcoin was the first digitalized and decentralized cryptocurrency, released as open source software in 2009. It uses an underlying technology called Blockchain, which works as digital, distributed ledger, that can be used as a mechanism for disintermediating trust in transactions. The Blockchain Technology, underlying Bitcoin is enabling new business models to emerge.

Who is Satoshi Nakamoto?

Back in 2008 when Satoshi Nakamoto sent the first email to Hal Finney, his identity was private. He was trying to explain how to get Bitcoin up and running. That is the first email ever between Satoshi Nakatomo and Bitcoin first user, Hal Finney:

Normally I would keep the symbols in, but they increased the size of the EXE from 6.5MB to 50MB so I just couldn’t justify not stripping them. I guess I made the wrong decision, at least for this early version. I’m kind of surprised there was a crash, I’ve tested heavily and haven’t had an outright exception for a while. Come to think of it, there isn’t even an exception print at the end of debug.log. I’ve been testing on XP SP2, maybe SP3 is something.

I’ve attached bitcoin.exe with symbols. (gcc symbols for gdb, if you’re using MSVC I can send you an MSVC build with symbols)

Thanks for your help!

The communication among the people part of the Bitcoin community was private, and many of them didn’t meet in person for a few years. Yet none ever met Satoshi Nakamoto.

In fact, on April 23rd, 2011, he left anyone baffled with this short and concise message:

I’ve moved on to other things. It’s in good hands with Gavin and everyone.

As of today we don’t know exactly who is Satoshi Nakamoto, and whether that is a person or a group of people.

Did you know Satoshi Nakamoto was nominated for the Nobel Price in economics in 2015?

Satoshi Nakamoto might be the first fictional character to go close to win the Nobel Memorial Prize in Economic Sciences.

The Prize was proposed by Bhagwan Chowdhry as explained in this tweet:

Why I am nominating Satoshi Nakamoto for the #NobelPrize in Economics https://t.co/iEYdyRslJp #bitcoin @StellarOrg @ethereumproject

— Bhagwan Chowdhry (@bhagwanUCLA) November 6, 2015

Bitcoin is decentralized, what does it all mean?

That means that none controls, neither guarantees for the system. In a traditional financial order, a central authority, like a bank or a government are necessary to make the system work.

Instead, with a Blockchain-based system, like Bitcoin, the central authority isn’t needed, because the whole system relies on a technology called Blockchain.

In short, that is a distributed ledger made of millions of computers, each of which plays a role in ensuring that the ledger’s transactions are approved in block (that is why Block-chain).

In fact, for each block of operations, a lottery gets to run among a set of machines that have to solve for math problems to approve those transactions. This mechanism is at the core of the Bitcoin’s underlying philosophy, proof of work.

[image error]A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins.

Once the computers in the chain approve the transactions, the blocks get recorded in the Blockchain forever.

To pass a block of transactions the majority principles applies. If 50% + 1 of computers approve a transaction, while the remaining do not, the majority wins.

At that stage, the only way to change drastically a Blockchain protocol, or the set of underlying rules that make it up, will be through an hard fork.

Those computers taking part in achieving consensus are called miners, and as rewards for helping the Blockchain Protocol to achieve consensus, they get Bitcoins.

What is the Blockchain foundation? That is a function, called SHA256.

What is SHA256?

SHA256 is a particular type of algorithm, a Cryptographic Hash Algorithm. In short, you input value and the algorithm spits out a 256-bit code, which can’t be reversed. Therefore, you cannot get the initial input. In this way, none knows who this code belongs to. That is how privacy is insured.

For instance, let’s say I input into SHA256 “Gennaro” and I get back the following code:

5b77b0b0984e51447faac5ab0dd46491501d73a8e985d12f2a7159ef3bddd854

Thi code cannot be decrypted back to find out my name. In short, it works only in one-way!

Is Bitcoin really redistributing wealth?

As anything that starts with a visionary attempt to change the world might become just another way to create a cluster of wealth, that might be true for Bitcoin as well.

Over the years, the Bitcoin’s primary philosophy, proof of work, also brought to the centralization of the network. This is true, especially on the mining side.

As proof of work assigns Bitcoins, based on the ability of mining pools to solve for harder and harder problems, those mining pools that over the years invested in computing equipment, also monopolised the network.

As of 2020, five mining entities (AntPool, BTC.com, BTC.top, F2 Pool and ViaBTC) all of them based in China, control 49.9% of all computing power on the network.

What is the Market Cap of Bitcoin?

As of July 2020, the Market Cap for Bitcoin is over $160 billion, The price of Bitcoin is quite volatile and by the end of December 2017, it had peaked to almost $300 billion of capitalization.

How much can a Bitcoin be Worth?

Wences Casares, CEO of bitcoin wallet Xapo and member of PayPal’s board of directors, was one of the first Silicon Valley investors to believe in the potential of Bitcoin.

As reported by the book Digital Gold, Bitcoin could be worth as much as a half million dollars. This computation was based on a simple assumption. Given all the value of gold in the world at around 7 trillion dollars. Like gold needed to be mined, so Bitcoin does.

In fact, to create new Bitcoins, computers dedicated to mining, must solve for complex math calculations.

The more the mining gets closer to the limit of Bitcoin that can be mined (set at 21 million), the more it gets hard to mine new Bitcoins.

Until the problems computers are required to solve in order to mine blocks, will become unsolvable, thus making the supply of Bitcoin reach its highest limit.

What is going to happen next?

In theory, the limit should be kept to guarantee Bitcoin value stays stable. In practice, that limit might be changed as well.

Like money back in the 60s was supposed to be tied to the reserve of gold. On August 15, 1971, President Nixon announced the end of the so-called Gold Standard.

The US currency, the dollar, was finally free to be printed, without the need to have a correspondent reserve of gold.

The Federal Reserve together with the US government became the guarantors of the system.

Could the same happen to Bitcoin?

Who controls the mining of Bitcoins?

Mining requires complex math calculations that can only be handled by machines. The more the mining gets closer to the limit of 21 million Bitcoins available on the market the more it gets hard for those devices to mine new Bitcoins.

What that means is that those machines now need to be more and more efficient in solving calculations. It also means that they need way more electricity to be run properly.

Not that surprisingly China controls the mining of Bitcoins.

The energy consumption, the centralization of the network over time, and the security problems that come with it, also brought to the evolution of Ethereum’s proof of stake consensus.

How long it takes before a new block of Bitcoins is solved?

There is a time limit for each block of coins to be solved, that is ten minutes. Why?

As reported on a bitcoin.stackexchange.com discussion:

Ten minutes was specifically chosen by Satoshi as a tradeoff between first confirmation time and the amount of work wasted due to chain splits. After a block is mined, it takes time for other miners to find out about it, and until then they are actually competing against the new block instead of adding to it. If someone mines another new block based on the old block chain, the network can only accept one of the two, and all the work that went into the other block gets wasted. For example, if it takes miners 1 minute on average to learn about new blocks, and new blocks come every 10 minutes, then the overall network is wasting about 10% of its work. Lengthening the time between blocks reduces this waste.

As a thought experiment, what if the Bitcoin network grew to include Mars? From the farthest points in their orbits, it takes about 20 minutes for a signal to travel from Earth to Mars. With only 10 minutes between new blocks, miners on Mars would always be 2 blocks behind the miners on Earth. It would be almost impossible for them to contribute to the block chain. If we wanted collaborate with those kinds of delays, we would need at least a few hours between new blocks.

In short, to make the Blockchain efficient, ten minutes seemed to be the right timing to allow all the machines in a blockchain align without wasting too much work.

Is the blockchain allowing the emergence of innovative business models?

[image error]The emergence of the Blockchain has also favored the development of new business models. It is essential to understand the implication of these new business models from a different standpoint. According to Joel Monegro, from USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain, where the apps built on top of it will have a fraction of the value.

The Blockchain is not a unique protocol. There are many out there.

What protocol will turn out to be the most successful we don’t know yet.

However, by looking at the current landscape it is clear that the blockchain is allowing new business models to spring up.

To understand the Bitcoin and the Blockchain you need to understand the key principles from its White Paper and the new economic drivers of a Blockchain-based economy system:

[image error]According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum). However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner. Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability!

A glance at Bitcoin key principles

Bitcoin has been built upon a technology called Blockchain. This technology allows decentralizing transactions or interactions among parties without the need of a middleman and without necessarily relying on trust but math and probability. Since then, new blockchains protocols are in use and have been proved effective so far to offer alternative business models. For instance, the Steem Blockchain allows online publishers to monetize their content. In this article, I want to show you a few key takeaways from Bitcoin White Paper by Satoshi Nakamoto.

Cut off the middleman

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

One critical aspect of the blockchain thought by Satoshi Nakamoto is cutting off the middleman.

The proof-of-work as a central concept

The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.

What makes the whole blockchain system thick is the proof-of-work. In fact, to deter service abuse, the protocol requires a computer to performing computational work.

Business with less data

Merchants must be wary of their customers, hassling them for more information than they would otherwise need.

A certain percentage of fraud is accepted as unavoidable.

Today businesses like Facebook and Google have built a fortune thanks to the data of their users. However, this business model is asymmetric and lacks transparency. Instead, with the blockchain, a transaction can occur with a few information.

Trust the cryptographer

system based on cryptographic proof instead of trust,

Another compelling aspect of the blockchain is the fact that it relies on math and probability rather than human trust. This is true to a certain extent. In fact, as the network grows the more effective, it should become.

The collective is good

The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes.

Another assumption of the blockchain which is connected to the previous one is that for it to work, honest nodes have to control more CPU power compared to attacker nodes. We will see why this is the case – from the probabilistic standpoint – when the blockchain reaches a critical mass.

The fragility of centralization

The problem with this solution is that the fate of the entire money system depends on the company running the mint, with every transaction having to go through them, just like a bank.

Centralization works but it’s quite fragile, and it creates a bunch of side effects. For instance, if we think about governments and banks substantial transactions fees, frauds and corruptions are some of those. Also, an asymmetric system, where one authority has power over a large number of people by controlling their data.

The blockchain avoids just that. Of course, as the blockchain is based on a private key that if stolen or lost cannot be either replaced nor generated again third parties that secure private keys have become the norm. This makes Bitcoin less decentralized as it seems.

How does the blockchain transaction process work?

1) New transactions are broadcast to all nodes.

2) Each node collects new transactions into a block.

3) Each node works on finding a difficult proof-of-work for its block.

4) When a node finds a proof-of-work, it broadcasts the block to all nodes.

5) Nodes accept the block only if all transactions in it are valid and not already spent.

6) Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash.

Majority rules

Nodes always consider the longest chain to be the correct one and will keep working on extending it

The blockchain process for approving transactions is based on the fact that the longest chain is assumed to be the correct one. So if a shorter chain finishes first, the longest chain will still win over the shortest.

Privacy is in the master key

The traditional banking model achieves a level of privacy by limiting access to information to the parties involved and the trusted third party. The necessity to announce all transactions publicly precludes this method, but privacy can still be maintained by breaking the flow of information in another place: by keeping public keys anonymous.

As the private key is anonymous, so the privacy of the person that holds is kept so. This is a central principle of the blockchain.

Honest nodes win (in the long-run)

We consider the scenario of an attacker trying to generate an alternate chain faster than the honest chain. Even if this is accomplished, it does not throw the system open to arbitrary changes, such as creating value out of thin air or taking money that never belonged to the attacker. Nodes are not going to accept an invalid transaction as payment, and honest nodes will never accept a block containing them. An attacker can only try to change one of his own transactions to take back money he recently spent.

and it continues:

Given our assumption that p > q, the probability drops exponentially as the number of blocks the attacker has to catch up with increases. With the odds against him, if he doesn’t make a lucky lunge forward early on, his chances become vanishingly small as he falls further behind.

There is a probabilistic reason why honest nodes win against attackers and that is what makes the blockchain thick.

Proof of Work In A Nutshell

Proof of Stake In A Nutshell

Blockchain Economics

Blockchain Business Models

Steemit Business Model

The Rise of Super Platforms

Platform Business Models

Network Effects

Free resources for your business:

Types of Business Models You Need to Know

Business Strategy: Definition, Examples, And Case Studies

What Is Market Segmentation? the Ultimate Guide to Market Segmentation

Marketing Strategy: Definition, Types, And Examples

Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

The post What Is A Bitcoin And Why It Matters In Business appeared first on FourWeekMBA.

How Does Airbnb Make Money? Airbnb Business Model Reinvention

Airbnb is a platform business model making money by charging guests a service fee between 5% and 15% of the reservation, while the commission from hosts is generally 3%. Due to the pandemic, Airbnb is stretching its business model and experimenting with new formats like online experiences to transition toward fully digital experiences.

How much money does Airbnb make?

The digitalization that happened in the last two decades has facilitated the creation of peer to peer platforms in which business models disrupted the hospitality model that was created in the previous century by hotel chains like Marriott, Holiday Inn, and Hilton.

Airbnb made $93 million in profits on a $2.6 billion revenues. This means the company’s net margin was 3.58%. That seems a low net margin compared to 9% from the hospitality industry.

However, Airbnb is a startup gaining traction and market share over traditional players. Also, its business model is based on the growth of its user base.

How much Airbnb used to be worth?

In March 2017 the company was valued $31 billion. As of that date, the company had $5 billion at the bank, and it rejected an investment offer by SoftBank. Airbnb might be the biggest tech unicorn IPO in 2018.

How much is Airbnb worth today?

As the pandemic hit hard on the Airbnb business model, based on travel and short-term rentals, the company valuation plummeted. Airbnb, in 2019 was in list to be among the most successful IPOs of the last decade, it eventually had to lay-off 25% of its employees by May 2020.

As the company successfully secured an additional $1 billion in debt financing to survive the forced economic downturn caused by the pandemic, the company valuation fell to $18 billion.

What are the key partners for Airbnb?

There are three key strategic partners:

Hosts

Guests

Freelance photographers (who played a key role in the initial traction of the platform)

There are also other partners, from which it depends on the platform’s success, like IT experts, and interior designers.

Guests (travelers) can easily find hosts (pretty much anyone with a private home for rent) through the Airbnb marketplace.

Also, Real estate agencies that have vacant units can use Airbnb as a way to rent the excess properties they were not able to rent on the market. Instead, freelance photographers can earn a living by joining Airbnb as independent contractors.

Airbnb mission and vision

Airbnb’s mission is to create a world where people can belong through healthy travel that is local, authentic, diverse, inclusive and sustainable.

This is how Airbnb describes its mission. And it continues:

Airbnb uniquely leverages technology to economically empower millions of people around the world to unlock and monetize their spaces, passions and talents and become hospitality entrepreneurs.

The key element of a platform and peer-to-peer business model like Airbnb is the creation of a viable ecosystem. In this case, Airbnb becomes a platform for other entrepreneurs or aspiring hospitality entrepreneurs:

Airbnb’s people-to-people platform benefits all our stakeholders, including hosts, guests, employees and the communities in which we operate.

Airbnb organizational structure

According to LinkedIn, of the over fourteen thousand employees connected on the professional network, most of them work in arts and design, operations, engineering.

And another good chunk work in business development, media, and communication, sales, and marketing.

Airbnb value proposition to its key partners

There are several value propositions for both hosts and guests. And for freelance photographers.

Hosts

hosts to can earn an extra buck by renting additional space they have at home

hosts are provided with insurance and liability coverage, the “Host Protection Coverage.”

Guests

The booking process is straightforward and the digital platform very effective

travelers have affordable prices

guests can have unique experiences

For both hosts and guests

The review system for both hosts and guests guarantee standards of quality

For freelance photographers

Extremely flexible schedule, easy money

What is the revenue generation model?

Airbnb makes money in two ways:

1. It collects a commission from property owners, which is generally 3%. While it collects a commission fee from the same owners offering experiences, which is generally 20%.

2. It collects a transaction fee from guests of between 5% and 15% of the reservation subtotal

What are two key challenges to Airbnb’s success and further scale?

There are two main issues Airbnb has to face:

Trust

When hosts are listing their rooms and homes, they’re trusting the platform to put them in touch with good people. The same applies to guests. Would this trust be eroded over time so will be the value of the marketplace.

Customer retention

Travelers nowadays have plenty of options. If they revert back to hotels or other solutions, Airbnb loses momentum. Also, another risk might be that of losing guests that make friends with hosts. In fact, they might choose to organize their next transaction privately.

The paradox then is that Airbnb rather than strong incentive tie between hosts and guests. It has to create an experience so that both parties can trust each other enough to make the transaction but not so much to get out of the Airbnb marketplace.

Airbnb through the pandemic

Airbnb has been among the most hit companies though the pandemic, as its business model was fine-tuned around global travel, and short-term stays and experiences.

In May 2020, this is how Brian Chesky, CEO, and co-founder of Airbnb explained the current scenario:

Let me start with how we arrived at this decision. We are collectively living through the most harrowing crisis of our lifetime, and as it began to unfold, global travel came to a standstill. Airbnb’s business has been hit hard, with revenue this year forecasted to be less than half of what we earned in 2019. In response, we raised $2 billion in capital and dramatically cut costs that touched nearly every corner of Airbnb.

He also explained how uncertain the situation is at a global level:

We don’t know exactly when travel will return.

When travel does return, it will look different.

Airbnb which was among the companies that most surfed the change in the travel and real estate industry, of the last decade, can also give us a better perspective of what might happen in the coming years for this industry.

Airbnb new business strategy based on a sustainable cost model

Travel in this new world will look different, and we need to evolve Airbnb accordingly. People will want options that are closer to home, safer, and more affordable. But people will also yearn for something that feels like it’s been taken away from them — human connection. When we started Airbnb, it was about belonging and connection. This crisis has sharpened our focus to get back to our roots, back to the basics, back to what is truly special about Airbnb — everyday people who host their homes and offer experiences.

As Airbnb moves forward in this new normal, it looks at a few core elements:

Local travel

Safety

Affordability

At the same time, the company is focusing back on its core, and yet converting from physical experiences to online experiences.

Airbnb stretching its business model

[image error]In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling the whole new problems for new customers (reinvent mode).

As Airbnb knows the travel industry might not look as it used to, it’s now trying to redefine the boundaries of its business model, by leveraging on its tech platforms, an existent global audience, that used to be interested in physical experiences.

By stretching and extending its business model, Airbnb is trying to diversify it while the global pandemic will be over:

[image error]

Example of the new section available on the Airbnb platform: Online Experiences

By leveraging on its audience Airbnb can test quickly a new product:

[image error]

[image error]

Example of an online experience where the “digital hosts” provide the format of the experience and the “digital guests” take part to it.

[image error]

The online experience can take also the form of a private group where a limited number of “digital guests” can join by paying a premium price.

Will this platform be able to supplant, and integrate part of Airbnb’s revenues while the pandemic is over and the company can redesign also physical travel experiences?

Key lessons in redefining travel experiences and changing a whole business strategy, fast!

Back in March 2017, Airbnb was valued at $31 billion. Then by May 2020, due to the pandemic, the company valuation fell to $18 billion.

While its core business model is still sustained by two key strategic partners: hosts, guests. Airbnb has been also testing the expansion of its business model toward online experiences.

In an interview in late June 2020, Airbnb’s CEO remarked a few key findings for the future of the company and of the overall travel industry.

He explained how he learned “not to try to get in the business of predicting the future.” And the only way to do that is to run a super lean organization (Airbnb cut over a billion in marketing expenses throughout the pandemic).

This key lesson came as Airbnb risked to lose it all in the space of a few weeks. While Aibnb’s CEO remarked the trend in travel was still very strong. He also explained how things had changed for Airbnb.

Safety comes first, this makes still people concerned about getting on planes, or traveling to crowded cities. Instead, as he explained “they are willing to do is to get in a car and drive a couple hundred miles to a small community where they are willing to stay in a house.”

Airbnb’s CEO explained how “one trend that is going to happen is that travel as we knew it is over. It doesn’t mean travel is over, just the travel we knew is over… and it’s never coming back. It’s just not.”

And he continued, “Instead of the world’s population traveling to only a few cities and staying in big tourist districts we are going to see a redistribution of where people travel. They’re going to start traveling because they are going nearby to thousands of local communities.”

That changes the whole Airbnb strategy. Skewed more toward digital experiences and local expansion, rather than just growing quickly in large crowded cities.

Airbnb first-ever pitch deck

Handpicked related articles:

50 Successful Types of Business Models You Need to Know

What Is a Business Model Canvas? Business Model Canvas Explained

How Does PayPal Make Money? The PayPal Mafia Business Model Explained

How Does WhatsApp Make Money? WhatsApp Business Model Explained

How Does Google Make Money? It’s Not Just Advertising!

How Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

The Google of China: Baidu Business Model In A Nutshell

Accenture Business Model In A Nutshell

Salesforce: The Multi-Billion Dollar Subscription-Based CRM

How Does Twitter Make Money? Twitter Business Model In A Nutshell

How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

How Amazon Makes Money: Amazon Business Model in a Nutshell

How Does Netflix Make Money? Netflix Business Model Explained

The post How Does Airbnb Make Money? Airbnb Business Model Reinvention appeared first on FourWeekMBA.