Gennaro Cuofano's Blog, page 200

June 22, 2020

Who Is An Intrapreneur? The Intrapreneur In A Nutshell

The intrapreneur is an employee which is usually assigned to innovative projects that can impact the company’s future success. As such, the intrapreneur is an employee that acts like an entrepreneur within the organisation. While the intrapreneur has access to the resources of the organisation she does not bear the risks connected to it.

How does Intrapreneurship work?

Intrapreneurs get assigned to special projects, that are extremely innovative. That is also why they are usually given the freedom to pursue them, which means the intrapreneur is extremely independent within the organisation.

Therefore, intrapreneurs can access resources from the organisation, thus organizing and working with those resources on innovative projects. At the same time the financial risks associated with the project stays with the organisation.

Intrapreneur vs. Entrepreneur

The primary difference is in risk-taking and ownership. Where the Intrapreneur does not own the company and does not take the financial risks associated with the project. The entrepreneur does.

That makes the entrepreneur more conservative, and risk avoidant. And the intrapreneur more risk-prone and in theory willing to take bolder steps that can make processes within an organisations obsolete. Thus, looking at innovations that can impact the whole organisation.

Good, in theory, what in practice?

While the concept of intrapreneurship is compelling and perhaps many companies have leveraged on it to keep innovating. At the same time the question stays open on whether the intrapreneur without skin in the game can really give a good contribution to the organisation.

Intrapreneurship example: Google’s 20% Project

Google is one of the companies that took advantage of intrapreneurs to build wildly successful products. As Brin and Page highlighted back in the 2004:

“We encourage our employees, in addition to their regular projects, to spend 20% of their time working on what they think will most benefit Google…This empowers them to be more creative and innovative. Many of our significant advances have happened in this manner.”

From this 20% project allocation, where employees could pursue the projects they felt compelled about, products like Google News, Gmail and AdSense were built.

Read Next:

Niche MarketingMicroniche

Read more:

Business Strategy ExamplesTypes of Business Models You Need to KnowBlitzscaling Business Model InnovationWhat Is a Value Proposition?What Is Business Model Innovation And Why It MattersPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Who Is An Intrapreneur? The Intrapreneur In A Nutshell appeared first on FourWeekMBA.

The Minimum Viable Audience In A Nutshell

The minimum viable audience (MVA) represents the smallest possible audience that can sustain your business as you get it started from a microniche (the smallest subset of a market). The main aspect of the MVA is to zoom into existing markets to find those people which needs are unmet by existing players.

Inside the Minimum Viable Audience

The entrepreneur looking into the concept of Minimum Viable Audience, will be more like an artist. As Seth Godin defined it:

The smallest group that could possibly sustain you in your work…

Seth Godin also further explains:

If you could pick them and needed to delight them because you had no one else available, would your product or service improve? If you had no choice but to ignore the naysayers (they’re not in the group) or the people who don’t think they need you or your work, would that force you to stop compromising and start excelling?

A simple case study to find your Minimum Viable Audience

Let’s apply this concept back to the entrepreneurial world, and let’s search for our MVA.

As a simple example, imagine the case you’re staring a bookstore online. None would find that interesting. At least not today. This idea was already proved commercially viable by Amazon, at the and of the 1990s.

Therefore, you will need to zoom into the publishing industry and curve out your own niche first.

[image error]

For that, the major gatekeeper in the publishing industry can help you out. You can use Amazon search engine to identify your own category. This is only the first step.

To make the exercise of finding your micro-category viable you need to drill down at least three times to what you might think is a viable audience.

Drilling down at least three times

Thus, if you start from fiction, this is the process:

Within the several possible categories, pick yours. What about starting from fiction? Within fiction you will look for a specific sub-category, perhaps historic fiction.Within historic fiction, you will look for another specific sub-category, what about historic fiction, focused on Renaissance?

Now you found your microniche. What about building up the best website/blog about Renaissance Historic Fiction?

How do you know there is a viable audience for that?

One simple way, perhaps, is to look at the volume of search in that category, especially for the most known authors (you might be surprised to find out there are micro-stars also within that microniche).

For instance, Johanna Lindsey is a great example of an author that has an incredible engaged following in a microniche. This is an example of how you kick things off and find your Minimum Viable Audience.

[image error]

Key takeaways

In today’s gatekeeping era, there are many approaches to enter the business world. One way is through the Minimum Viable Audience. With the Minimum Viable Audience, rather than try to do something for everyone, we’ll try to build something exceptional for a small group of people, which needs are unmet by the current market. Contrary to what happens in other markets, finding your Minimum Viable Audience means having a group of people that are willing to sustain and preserve your business as this adds so much value to them.

Read Next:

Niche MarketingMicroniche

Read more:

Business Strategy ExamplesTypes of Business Models You Need to KnowBlitzscaling Business Model InnovationWhat Is a Value Proposition?What Is Business Model Innovation And Why It MattersPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post The Minimum Viable Audience In A Nutshell appeared first on FourWeekMBA.

June 19, 2020

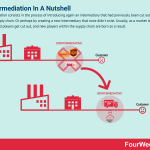

What Is Reintermediation? Reintermediation In A Nutshell

Reintermediation consists in the process of introducing again an intermediary that had previously been cut out from the supply chain. Or perhaps by creating a new intermediary that once didn’t exist. Usually, as a market is redefined, old players get cut out, and new players within the supply chain are born as a result.

Case study: Amazon last-mile delivery

[image error]Last-mile delivery consists of the set of activities in a supply chain that will bring the service and product to the final customer. The name “last mile” derives from the fact that indeed this usually refers to the final part of the supply chain journey, and yet this is extremely important, as it’s the most exposed, consumer-facing part.

As Amazon tried to figure out last-mile delivery, the company might also over time disintermediate the old delivery industry, which suddenly might be cut out from the supply chain.

[image error]Disintermediation is the process in which intermediaries are removed from the supply chain, so that the middlemen who get cut out, make the market overall more accessible and transparent to the final customers. Therefore, in theory, the supply chain gets more efficient and, all in all can produce products that customers want.

As this process happens, and the new market is defined by Amazon, new intermediaries, that have learned to play according to Amazon rules will form.

Creating a whole new intermediary

For instance, as Amazon has been figuring out the last-mile problem it also approached it with a new program, launched in 2018, called Delivery Service Partner.

Or simply put, a startup that gets helped by Amazon to become an independent contractor (under the rules of Amazon) that delivers packages for the company. Thus, Amazon disintermediates the old carriers, builds up a new system, which is comprised of new intermediaries.

Yet those will follow Amazon‘s rules and policies.

The loop of intermediation and disintermediation

The evolution of the Internet moves from phases of disintermediation, extremely helpful to remove old logic, that does not work anymore in current market conditions, to establish new systems.

As those new systems are established though, reintermediation might take place for several reasons. First, it might be the key player, once disintermediating, now to incentivize reintermediation, to gain more control over the market. Second, as the market adjusts to this new reality new intermediaries learn the logic of this new market and try to capture some value within the supply chain.

Hand-picked resources:

Business Strategy ExamplesTypes of Business Models You Need to KnowBlitzscaling Business Model InnovationWhat Is a Value Proposition?What Is Business Model Innovation And Why It MattersPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post What Is Reintermediation? Reintermediation In A Nutshell appeared first on FourWeekMBA.

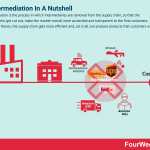

What Is Disintermediation? Disintermediation In A Nutshell

Disintermediation is the process in which intermediaries are removed from the supply chain, so that the middlemen who get cut out, make the market overall more accessible and transparent to the final customers. Therefore, in theory, the supply chain gets more efficient and, all in all can produce products that customers want.

How the web disintermediated the old world

“Your margin is my opportunity,” this quote apparently attributed to Jeff Bezos, explains well the process of disintermediation that has been going on with the advent of the web.

One of the core premises of the web was the concept of decentralization and as a result intermediation. Companies like Amazon, Google, Facebook, Netflix, Uber, Spotify, Shopify and many other startups born in the web era, have all grown with the purpose of dismantling the old distribution pipelines, thus unlocking distribution.

Amazon has been disintermediating a whole supply chain for e-commerce and now it’s looking into last-mile delivery to cut out from the supply chain traditional large carriers (DHL, UPS, FedEx) to realize its dream of customer obsession.

Netflix has been for over a decade disintermediating the entertainment industry.

Google and Facebook unlocked branding and marketing at first. In the previous era, if you wanted to get brand exposure you had to go through the classical ad agency or a set of intermediaries that kept tight control over the industry and their marketing budgets.

As Google first, Facebook later, came up with a massive, mostly automated digital advertising machine, they first targeted a different segment of the ad industry (not that interesting to those who were used to the old way of advertising).

Indeed, Google itself proselytized a set of new marketers who learned to believe in the only god of performance-based marketing. No more branding or marketing, done without data, measuring, and clear ROI.

The engineering approach of Google first, Facebook later, made the whole deal look promising to those companies (especially startups) who didn’t have the budgets to invest in TV advertising.

Those digital marketers started to look for what we might define last-mile advertising, where it gets easy to track the click from and therefore measure the impact of marketing.

With that simple, yet powerful promise Google and Facebook created a digital advertising industry that, initially grabbed those who were all about performance, and therefore didn’t need an ad agency.

And later on, digital advertising would transition and become much more complete. As those companies evolved, both brand and performance advertising on Google and Facebook were covered up, and this process of disintermediation brought to the end of the traditional ad agency.

Yet, all in all, as those companies turned into tech giants, it started – I argue – a process of reintermediation. Before going there, let’s also look at the process of intermediation that happened after the consolidation of a new era, turning mature.

Reintermediation

As companies like Google and Facebook disintermediated the advertising industry. At the same time, the market has been adjusting to the new industry created by those players.

As marketing itself got redefined through the lenses of data and measurement, once ad agencies turned into digital marketing agencies. Today the whole industry of consultancy companies born as a result of the SEO/SEM and SMO/SMM industries has seen the rise of digital agencies managing budgets for clients.

So after all, after the first stage of actual disintermediation. The market adjusted, and the dream of disintermediation, transformed in something else.

Enter the gatekeeper’s hypothesis

[image error]In a world driven by tech giants that locked-in the digital distribution pipelines to reach billions of people across the globe, the gatekeeper hypothesis states that small businesses will need to pass through those nodes to reach key customers. Thus, those gatekeepers become the enablers (or perhaps deterrent) for small businesses across the globe.

Those once startups turned gatekeepers. The old markets that crashed under the pressure of new industries, also matured. That might have created a process of dominance, where winner-take-all effects took over.

And markets once fragmented by many intermediaries, turned into new markets primarily dominated by a few central players, setting the rules of the game. According to what I called the “Gatekeeping Hypothesis” we sort of went back to an era of blocked distribution by a few key players, with some critical differences.

First, this time algorithms defined the rules to follow, even though at central levels, a few key people (usual engineers following the executives’ instructions made those rules in the first place).

Second, this era is primarily customer-centered. Where in the past, it was all about keeping a tight control on the supply chain and distribution, so that over time consumers wold get used to whatever it got sold to them (standardized mass-marketing helped indeed). To an era where those tech giants are stubborn and obsessed with customer experience.

When Google sets the rules for websites to follow, it does that by keeping as North Start, the user experience (of course defined a la Google), and those who do not conform to that are out from the walled garden.

Third, consolidation and asymmetry took over. Where many more intermediaries might have controlled fragmented industries. The new players learned that domination is what matters and they set for it.

In addition, most processes are now asymmetric. When the user gives data to Facebook, the value it gets back is much lower compared to what Facebook can and will do with that data. Both in terms of usage and monetization. In short, Facebook will be way better by getting the data of the user, as this will add up to its network effects. Compared to what the user gets back (some form of entertainment).

Therefore, winner-take-all effects created a few, super large players that became the main intermediaries.

Super platforms and super gatekeepers

[image error]

Let’s add to that, those gatekeepers have been stretching their tentacles to cover more and more parts of the user experience, thus generating potential for the rise of super gatekeepers.

Blockchain and the renewed dream of decentralization at scale

[image error]

There isn’t a single way for the web to evolve. And renewed dreams of scaled decentralization took place with the Blockchain and its potential commercial applications. Whether this will be a permanent effect, we can’t be sure.

However, for one thing, Blockchain might get us to the rise of a new form of organization, something that goes beyond the classic corporation and take the form of a super, decentralized company, made of many companies combined, and all joining a shared protocol.

Key takeaways

Disintermediation is the process of cutting out intermediaries from the supply chain. The web has been a critical driver of this process, by disintermediating old industries to create whole new market opportunities for all.The wave of disintermediation is still going on (see Amazon last-mile). At the same time as those companies created new markets that are becoming more mature, a process of reintermediation (where new intermediaries are born as a result).As former startups, turned tech giants, those became gatekeepers and winner-take-all/intermediaries at large scale. The Blockchain brings back the dreams of disintermediation and decentralization at large scale. Whether this will happen, be permanent we don’t know yet, and can’t be sure either.

Hand-picked resources:

Business Strategy ExamplesTypes of Business Models You Need to KnowBlitzscaling Business Model InnovationWhat Is a Value Proposition?What Is Business Model Innovation And Why It MattersPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post What Is Disintermediation? Disintermediation In A Nutshell appeared first on FourWeekMBA.

Last-Mile Delivery: The Anti-Network Effects And Why It’s Such A Hard Problem

Last-mile delivery consists of the set of activities in a supply chain that will bring the service and product to the final customer. The name “last mile” derives from the fact that indeed this usually refers to the final part of the supply chain journey, and yet this is extremely important, as it’s the most exposed, consumer-facing part.

Quick intro to last-mile logistics and why it matters so much

Last-mile logistics, or the so-called “last-mile” comprises the activities that need to be done in order to provide a service to the final customer. The last-mile problem is a very hard one, now on the priority list for many organizations (Amazon, Uber Eats, Instacart, Grubhub and many others).

Each of those companies is trying to solve the last-mile problem in different ways, and industries. And yet, once tackled this can change the whole supply chain for good. That is why last-mile delivery is so important and strategic.

Let’s see what are some of the components that make up the so-called last-mile problem.

Outside the network

In a platform business model, or in an organization managing a vast supply chain, there are advantages of scale. Those advantages of scale usually come from the fact that the whole platform or supply chain network benefits from managing things at scale.

There is an exception to this rule, and that’s the last mile. Indeed, the last-mile falls outside the network, as it is the last leg of the supply chain and the point of connection with the final customer, that last mile is not scalable (at least not in conjunction with the network itself) and it falls in a logic that can’t be comprised in the overall network.

Imagine the simple example, of a set of packages that have gone through an extremely well-organized sorting, and storing center, where, perhaps, packages have been shipped even before the expected time, in the center outside the urban area, and are now ready to be delivered to the final customers.

The delivery person – which is usually in charge of the last mile – has to ship several packages in an urban location, perhaps in the center of an extremely busy city. All can happen in that last mile: delays, traffic jams, accidents, and worse.

Thus, for as much the supply chain has been organized to run at an optimal level. The last-mile will have the potential to disrupt the whole supply chain, as it might cause substantial delays to the final shipment to customers.

Consumer-facing

One of the key elements of last-mile logistics is also the fact that this is the consumer-facing part of the supply chain. As such, customers might attribute most of their experience to that single touchpoint.

Therefore, if the delivery person will, for any reason, get to the final customer later than expected, or to say, deliver the wrong package, the whole experience would be ruined.

The most expensive part

The last-mile is also the most expensive part of the supply chain. As organizations can’t leverage on economies of scale, the last-mile poses important challenges to the overall supply chain.

Therefore, as highlighted so far, the primary reason last-mile logistics gets counterintuitive as it usually does not benefit from economies of scale. Therefore, the last mile sits outside the network effects created by the organization, as the last step – required to get to the final customer – is disconnected from the rest of the network.

The consequence is that the last-mile is the most expensive (most of the costs of the supply chain lie in that last mile), hard to tackle (it requires a degree of customization that can’t be canceled out), and yet extremely important (consumers see the face of the delivery person as the only “physical connection” with the company).

Let’s see now, how are companies trying to figure out the last-mile problem.

Decentralizing the last-mile

Amazon has been among the companies trying to figure out the last-mile problem. That strategy for a company that founded its success on customer obsession.

Amazon Flex

Amazon has been trying to tackle this problem in several ways. With Amazon Flex it tried to crowdsource delivery by tapping into gig workers at local level:

[image error]

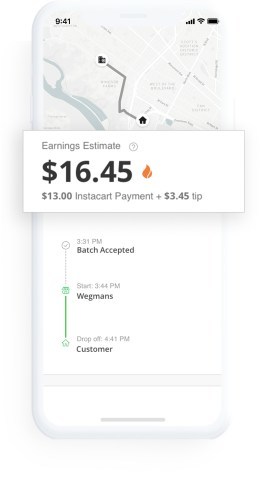

As Amazon Flex highlights “most drivers earn $18-25 an hour,” the mechanism of Amazon flex is pretty much similar to how other companies have been tackling the same problem in other industries.

Where Uber and Lyft applied the last-mile problem to ride-sharing. Grubhub, DoorDash, Instacart, and Uber Eats applied it to food delivery, Amazon applied it to the delivery of everything.

Indeed, Amazon Flex comprises the delivery of all the items coming from Amazon.com, Prime Now and Amazon Fresh, Store Orders, Instant Offers, and else.

While the concept seemed quite interesting, it also posed substantial pressures on the last-mile flex workers (which only enriched the militia of gig workers born in the platform era).

Amazon DSP

Yet, this system didn’t seem to work extremely well and Amazon instead doubled down on its Delivery Service Partners. As Amazon explains:

DSP owners are responsible for hiring, training, developing, and retaining a team of 100 high-performing, hardworking employees, operating with up to 10-40 vans. We are looking for candidates who love building and growing a team, have the grit and leadership required to roll up their sleeves to get work done, enjoy operating as a part of a larger community, and have a can-do attitude that inspires their team to handle labor-intensive delivery work. We look at a wide range of information on each applicant, including work history, education, and financial information, to determine eligibility for the program. Please note that this is a highly competitive program with a limited number of available openings.

Therefore, instead of turning directly to drivers, Amazon is trying to solve the last-mile problem by helping to start delivery businesses that will handle drivers locally. A decentralized approach, which is local enough to make it manageable and yet cheap for Amazon, as those companies would run their own P&L, independently.

This works as a sort of a franchise model, where Amazon helps in the initial set-up and it guarantees business to its franchisee business owners, as long as they meet the quality standards set by Amazon.

Yet those are independent contractors.

Amazon Prime Air

Another solution that will help tackle, part of, the last-mile problem is the use of drones, where for objects with specific characteristics and in certain areas (rural areas perhaps) the drones are already in use as a valid test to tackle the last-mile problem.

Autonomous vehicles

Another solution that might help solve, part of, the last-mile problem is the use of autonomous vehicles. Amazon itself has been looking into the possibility of acquiring and expanding more and more into the autonomous vehicle space, which also would help solve part of the problem in the next decade.

Key takeaways

The last-mile is the final step in the supply chain and yet critical as it’s consumer-facing, thus, often, the only physical touchpoint between the consumer and the company. At the same time, this is also extremely expensive, inefficient, and hard to scale.The last-mile delivery then poses a last-mile problem that several companies are trying to tackle, as this is the key to unlock online-to-offline experiences and create a consistent end-to-end journey.Companies like Amazon have been trying different solutions. For instance, Amazon tried Flex, a formula that enabled anyone to become a delivery person. Amazon, however, started to abandon that program in favor of Amazon Service Partners, which attempts to create a whole new ecosystem of independent startups that run their business on top of Amazon’s last-mile supply chain. If this model works, it might, in part, solve the hard problem of last-mile delivery.Other potential solutions are the use of drones and autonomous vehicles. While those seem technically viable, they pose substantial regulatory challenges that might make them viable in the coming decade.

Read next:

Business Strategy ExamplesTypes of Business Models You Need to KnowBlitzscaling Business Model InnovationWhat Is a Value Proposition?What Is Business Model Innovation And Why It MattersPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Last-Mile Delivery: The Anti-Network Effects And Why It’s Such A Hard Problem appeared first on FourWeekMBA.

June 18, 2020

How Does DoorDash Make Money? DoorDash Business Model In A Nutshell

DoorDash is a platform business model that enables restaurants to set up at no cost delivery operations. At the same time, customers get their food at home and dashers (delivery people) earn some extra money. DoorDash makes money by markup prices through delivery fees, memberships, and advertising for restaurants on the marketplace.

Origin story

June 17, 2020

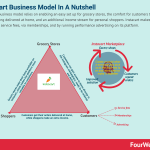

How Does Instacart Make Money? Instacart Business Model

Instacart’s business model relies on enabling an easy set up for grocery stores, the comfort for customers to get their shopping delivered at home, and an additional income stream for personal shoppers. Instacart makes money by charging service fees, via memberships, and by running performance advertising on its platform.

The Amazon of grocery: an old idea that burned almost a billion at the apex of the dot-com bubble, become commercially viable

It was June 2001, right at the burst of the dot-com bubble. A company that seemed positioned to conquer the world had filed for bankruptcy. To gain a bit of context, at the apex of its operations Webvan had reached over 3500 employees.

It was extremely well funded, with over eight hundred million dollars in capital to kick off its operations. To be sure, Webvan fundamental idea was brilliant. Become a grocery shop online, that is also why it got backed by smart money.

It IPOed in 1999, just to blow up by 2001 when the dot-com bubble burst.

It didn’t help neither that by 2000 Webvan had accumulated a net loss of over $453 million, and an accumulated deficit of $617 million.

Indeed, Webvan’s overall idea was great. How so? By 2007, Amazon would start AmazonFresh and in 2017, Jeff Bezos’ would further complete the acquisition of Whole Foods. Today the integration between AmazonFresh and Whole Foods is proving viable.

But was it just a matter of timing? Indeed, timing mattered, and yet Webvan did have a customer base. Yet it was burning cash at incredible speed.

During the dot-com bubble many companies bet on the advent of the Internet. Yet they followed the old playbook (sketch an ambitious business plan, get funding and expand at all cost).

Webvan business plan was brilliant, its venture funds looked incredibly solid (over eight hundred million dollar from major investors). And yet, Webvan failed miserably.

Bad timing, bad execution framework (money spent upfront without validating the market by time to time) did the trick. Startups, by nature have low chance of success. And a key to increase those chances is to stay alive, long enough.

That calls for a gradual market validation, where a company needs to start from where the market already exists. Many successful startups that survived bad timing, had started with a market-entry and go-to-market strategy where they validated a smaller market first, then expanded on it slowly, as a new ecosystem would form.

Business platforms take years to build up, and the business platform that would have helped Webvan to reach its vision would come only in 2007, when on a Cupertino stage, Steve Jobs announced, “what we want to do is to make a leapfrog product, that is way smarter that any mobile device has ever been, and super easy to use, this is what iPhone is.”

[image error]

That business platform, would set the stage for Instacart.

Origin story

The lessons learned through the web era would become the business playbook for startups for decades to come. The execution of this playbook brought to the development of platform business models. Platforms are initially asset light, as all they care about is to master a core interaction and grow from there.

This lean playbook would help Instacart slowly validate a market, that was ready, by 2012, for the concept of grocery online. And while Instacart could have spent its resources in building massive warehouses, it instead started from the simplest possible way: build an App that connected customers with established retailers.

Instacart would make a slight markup, by charging a delivery fee. As the story goes, its founder, Mehta, had the idea from Instacart when he was a kid in Canada, where he had to take the bus in the cold Canadian winter to pick up groceries.

Mehta would later move to Seattle where he worked for several companies, until by 2008-2010 he worked as Fulfillment Optimization for Amazon where he worked to deliver packages quickly and efficiently to customers.

As he got bored by the experience, after two years in the job, he resigned and set out to build his own company. Yet, in those two years, where he had moved to San Francisco, Mehta claimed he had started 20 companies, none of which succeeded.

At a certain point he also tried to build an ad network for social gaming companies, and spent a year developing a social network for lawyers, which eventually left behind, as he lost interest in the project.

By 2012, as the web had become fully viable, Mehta had developed this app to connect customers to popular established retailers. It was time to push on growth.

Back in June 2012, Apoorva Mehta was two months late in the application deadline for the Y-Combinator acceleration program. So he needed a plan to get in, even though the deadline was well passed.

To hack his way through the program, Mehta started to reach out to Y-Combinator (YC) partners, to see if any of them would be interested in his idea, and perhaps let him in, late. Yet, as the story goes, none let him in.

And one of the YC partners, Garry Tan, told him “You could submit a late application, but it will be nearly impossible to get you in now.”

What to do? Mehta had an idea. Rather than pitch Instacart, he sent a six pack of beers to Garry Tan, which unbeknownst to him was trying the app built by Mehta. When he received it, Garry Tan set up a meeting with Mehta to understand how Instacart worked.

As Mehta presented Instacart to YC partners, he would be finally accepted into the program. It was the only case ever accepted, even though application deadlines had passed. That is how Instacart started its growth journey.

Amazon takes over Whole Foods and goes all in with Amazon Fresh

The future took an interesting turn, when Mehta’s Instacart, at the height of its expansion, would find as the toughest competitor, his once employer, Amazon.

To gain a bit of context, Instacart’s most important customer and partner was Whole Foods. Indeed, in 2016, Whole Foods would announce a multi-year delivery deal with Instacart, where as effect of the deal, that made “Instacart the exclusive delivery partner for Whole Foods’ perishables business.”

However, by 2017, Amazon would make a big move, as it bought Whole Foods for almost $14 billion. As Amazon sneaked in, it also slowly removed Instacart from Whole Foods partnership.

The paradox is that as Amazon took over the grocery market, it also created a sense of urgency for executives in the industry, thus prompting many of them to jump on the Instacart’s boat. Among those, players like Costco and Walmart jumped on board.

Instacart mission, key players and value propositions

Instacart’s mission “is to create a world where everyone has access to the food hey love and more time to enjoy it together.” In the Instacart’s business model a variety of grocery stores are enrolled in the platform, that give access to customers to a variety of perishable products.

At the same time, Instacart leverages personal shoppers who pick and delivers items for customers.

Instacart key players and value propositions

In order to understand Instacart’s set of value propositions, we need to look. at each of the players that make its business model viable:

Customers

Customers shopping via Instacart love primarily the comfort of having the groceries delivered at home.

As a user reviewing the app put it “I love ordering from my phone. The cost of delivery and tip is worth me not having to leave house and put miles on my vehicle or deal with aggravation of crowded stores.”

At the same time, as Instacart makes money also via service charges is not always more convenient to shop on Instacart as prices might be higher for what you actually pay in the retail stores.

Grocery stores, retailers

Grocery stores and retailers might use Instacart as they can get more exposures for their products, and if they don’t have a dedicated last mile delivery service organized internally, with Instacart they can set it up cheaply and quickly.

Understanding the role of Shoppers

Instacart has two main categories of shoppers for which the value proposition is that of earning some extra bucks, while working flexibly.

Just as platforms like Uber enable anyone to become a driver. Instacart incentivizes people to become personal shoppers, as an opportunity to work flexibly to earn some extra income.

[image error]

In-Store Shoppers

In shot, in-store shoppers receive Instacart customers’ orders through an app on their smartphone and then shop and stage the groceries in-store.

Full-Service Shopper

Full-service shoppers receive orders from Instacart’s through an app on their smartphone, then shop and deliver groceries to the customer’s door.

How does Instacart make money?

[image error]

The customers’ workflow is straightforward:

They can shop to their favorite local grocery store.Schedule a delivery.Get groceries delivered.

As Instacart closes deals and partnerships with retail partners, those partners price their products on the Instacart marketplace. Instacart will make money in a few ways.

Fees

In terms of fees Instacart has a few kinds of fees.

Delivery Fee

[image error]Dynamic pricing is the practice of having multiple price points based on several factors, such as customers segments, peak times of service and time-based consumption that allow the company is applying dynamic pricing to expand its revenue generation.

Delivery fees will change based on the time the order needs to be delivered, and how large the order is. Delivery fees are higher during busy times. Delivery fees start at $3.99. Instacart Express members get free delivery on orders over $35.

Heavy fee

The heavy order fee applies when certain heavy items (like cases of beverages and pet food) are applied.

Service fee

There is a 5% (or $2 minimum) service fee that applies to non-alcohol items for non-Express customers.

Alcohol service fee

The fee covers the additional cost associated with ensuring compliant delivery of alcohol products and ID verification applying

Instacart Express Membership

Instacart Express is a membership option for customers who want to use Instacart regularly. With a flat annual cost or a low monthly fee, customers have unlimited free deliveries for all orders over $35.

Instacart Express benefits comprise:

$0 delivery fees on orders of $35 or more (typically $3.99-$7.99 for non-Express).Reduced service fees (typically 5% for non-Express).No busy pricing fees during peak delivery hours.Shop at a variety of stores with free delivery on the entire order.

The annual membership is $99.

Advertising

As the story goes, once a partner asked what would cost to be featured on the platform, and from there they realized Mehta realized Instacart could make an extra revenue stream with advertising on the platform.

[image error]

With a new funding round on June 2020, Instacart got valued at about $14 billion. Making it a decacorn.

Key takeaways

Instacart was founded as a attempt to finally enable grocery shopping online. And this idea would became viable by the 2010s, when Mehta, a former Amazon employee, eventually built an app to connect customers with retail groceries.As Instacart grew it also proved how viable was the idea, and among its key client there was Whole Foods. However, as Amazon bought Whole Foods by 2016, it also slowly pushed out Instacart.Instacart’s business model relies on enabling an easy set up for grocery stores, the comfort for customers to get their shopping delivered at home, and an additional income stream for personal shoppers. Instacart makes money by charging service fees, via memberships, and by running performance advertising on its platform.

Other hand-picked related resources:

Business Strategy ExamplesTypes of Business Models You Need to KnowBlitzscaling Business Model InnovationWhat Is a Value Proposition?What Is Business Model Innovation And Why It MattersPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post How Does Instacart Make Money? Instacart Business Model appeared first on FourWeekMBA.

June 16, 2020

How Does Vroom Work And Make Money? Vroom Business Model

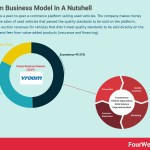

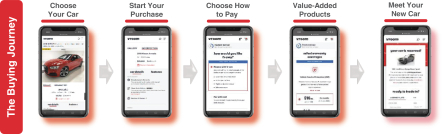

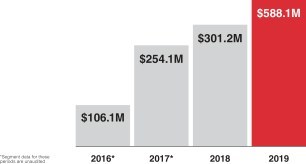

Vroom runs a peer-to-peer e-commerce platform selling used vehicles. The company makes money through the sales of used vehicles that passed the quality standards to be sold on the platform; Wholesale auction revenues for vehicles that didn’t meet quality standards to be sold directly on the platform; and fees from value-added products (insurance and financing).

Vroom vision and mission

Vroom’s vision is to “build the world’s premier platform to research, discover, buy, and sell vehicles.”

More precisely, Vroom built an end-to-end e-commerce platform to buy and sell used vehicles.

Vroom value proposition

What makes Voom interesting? As a two-sided e-commerce platform Vroom has two key players: buyers and sellers. Each of those get a different value from the platform.

Vroom value proposition for buyers

Vroom offers a “differentiated buying experience” compared to traditional auto dealers and the peer-to-peer market.

Customers can easily browse the Vroom’s inventory, look for financing alternatives, and also look for additional value-added products. The end-to-end experience also enables buyers to schedule and coordinate the delivery of the purchased vehicle to a location of their choice.

Customers can easily browse the Vroom’s inventory, look for financing alternatives, and also look for additional value-added products. The end-to-end experience also enables buyers to schedule and coordinate the delivery of the purchased vehicle to a location of their choice.Therefore Vroom streamlines the entire buying process, from discovery through financing to delivery:

Wide inventory selection.Enriched with higher-quality inventory (the Vroom-reconditioned vehicles).Comprehensive and transparent vehicle information.Customized vehicle search and discovery.Competitive, market-based pricing.Customer support.On-demand shopping and contact-free delivery.Value-added products. Vroom 7-Day Return Policy.

Vroom value proposition for sellers

Sellers can, through the platform:

Submit basic vehicle information to also get on-demand appraisals.A guaranteed, real-time price on every vehicle.Contact-free at-home vehicle pick-ups.Hassle-free loan pay-offs.

How does the platform work?

Vroom two-sided (peer-to-peer) e-commerce platform is made of three main parts:

Ecommerce

This offers to buyers a personalized and intuitive e-commerce interface to research and select from thousands of fully reconditioned vehicles and to sellers market-based pricing, real-time, purchase offers, and convenient, contact-free at-home vehicle pick-up.

Vehicle Operations

The Vroom business model is vertically integrated as the company sources inventory from auctions, consumers, rental car companies, and dealers. After sourcing, those vehicles get reconditioned to meet quality standards and sold on the platform.

Vroom’s overall operational strategy is a hybrid between ownership and third-party partnership to balance the overall capital requirements to run the business.

Data Science and Experimentation

Vroom leverages data science on all its process, from sourcing to marketing on the platform, to optimize its processes as much as possible.

As a platform in a fragmented market, mostly operated by old business models, Vroom end-to-end contact-less experience between buyers and sellers make it much easier for those players to transact on the platform.

Vroom Flywheel

The Vroom flywheel starts from:

The growth and quality of its inventory. This inventory is marketed with a multi-channel strategy, where the company runs both national marketing campaigns, and digital marketing campaigns, based on performance. This combination of branding and performance makes helps improve brand awareness while improving the conversions of its targeted ads. Once users are brought back on the platform, they can easily discover and find the vehicles they need, together with the financing, and for sellers, to have a quick evaluation and contact-free selling of the vehicle. This customer experience makes those buyers and sellers use the platform to finalize the transaction. Throughout the journey, Vroom runs multiple tests to optimize the conversion of customers on the platform.

How does Vroom drive profitability?

There are a few main levers the company uses to move toward profitability(as of 2020, the company runs at a net loss):

Optimize Vehicle Acquisition and Pricing.Increase Reconditioning Capacity.Expand Value-Added Products to add multiple revenue streams (training, merchandising and technology enhancements, auto insurance, complimentary services such as entertainment and location-based services).Develop Logistics Network third-party carriers for inbound and outbound vehicle transport will also be coupled with strategic and proprietary logistics.Expansion to Additional Products and Markets: expansion into additional areas of technology-enabled commerce, such as adjacent transportation and vehicle markets, global geographic markets, and B2B business models.

How does Vroom make money?

Vroom’s revenues come through:

E-commerce: The sale of used vehicles and value-added products. Vehicles are sold directly to consumers primarily through the E-commerce segment. Indeed, the e-commerce represented 49.3% of the revenues in 2019, it keeps growing at fast speed.

Wholesale: At the same time Vroom makes money by selling vehicles that do not meet its sales criteria to wholesale auctions.

TDA: this comprises the retail sales of used vehicles and fees earned on sales of value-added products associated with those vehicle sales. In 2015, Vroom acquired Houston-based Texas Direct Auto (“TDA”), which included the proprietary vehicle reconditioning center (“Vroom VRC”), and the sole physical retail location and the Vroom’s Sell Us Your Car centers. Together they make up the TDA segment.

Breaking down the Vroom unit economics

Vroom gross profit per unit is given by:

The Vehicle selling price

– The acquisition cost of the vehicle

+ The fees earned from the buyer

– The costs related to shipping to reconditioning center and the spending on mechanical and cosmetic reconditioning on the vehicle.

+ How Vroom’s fees on the financing arrangement

+ The the value-added product sold

That is how the gross profit per unit is computed.

The Vroom system explained

Vroom’s whole system moves around four key pillars:

Inventory sourcing (hybrid model): Vroom sources vehicle inventories from a variety of channels, including auctions, consumers, rental car companies and dealers. Vroom evaluates by time to time the optimal mix of sourcing channels to generate the highest sales margins and shortest inventory turns.Vehicle Reconditioning (hybrid model): Before a vehicle is listed for retail sale, it undergoes a reconditioning process in order to meet Vroom’s retail sales criteria. The vehicles that do not pass this successfully get sold to wholesale auctions. To recondition vehicles, Vroom relies on a combination of Vroom VRC (its reconditioning center) along with a network of VRCs owned and operated by third parties. Logistics Network (third-party): Vroom primarily uses third-party carriers. Going forward Vroom is also developing a hybrid strategy to build out its proprietary logistics network. Value-Added Products (third-party): earning fees for selling value-added products to customers in connection with vehicle sales. Third-party value-added product offering consists of finance and insurance products, including financing from third-party lenders on vehicle purchases, as well as sales of extended warranty contracts, GAP insurance policies, and tire and wheel insurance policies.

Across the whole chain, Vroom runs a hybrid model, mixing proprietary operations with third-party partnerships to keep and balance out its business model and reduce the capital requirements needed to run it.

As it moves forward Vroom will increase the proprietary part on strategic operations (inventory, reconditioning, and logistics) while increasing the third-party approach on less strategic parts, which though enhance its revenue streams (wholesale auctions, value-added products).

Vroom multi-channel marketing strategy

Vroom multi-channel marketing strategy includes both national brand and digital performance, marketing. Vroom also leverages digital performance channels, including automotive aggregator sites, to generate demand for Vroom inventory.

Vroom also runs a national brand campaign through TV and online media, which more than doubled total brand leads to Vroom website, with direct access of customers to the Vroom’s website.

Thus brand advertising helps create direct access of consumers to the brand, and digital marketing campaigns, enhance the bottom of the funnel.

Key takeaways

Vroom is an end-to-end e-commerce platform where customers can buy and sell used vehicles. The company makes money by selling used vehicles that meet the quality standards to be sold on the platform. It also makes money by selling vehicles at wholesale auctions for those vehicles that do not meet quality standards to be sold on its platform. In addition, Vroom makes money by selling vale added products provided by third-party partners for which Vroom earns a fee and commission. Vroom is a digital platform, but it also runs physical operations, as it sources and purchases used vehicles to be sold on the platform. At the same time, Vroom balances part o its processes with third-party partnerships to lower the capital requirements to run the business (especially on logistics and value-added products). Vroom runs a multi-channel marketing strategy where it leverages both on TV, brand advertising, and digital marketing activities focused on performance and conversion rate optimization.

Other hand-picked related resources:

Business Strategy ExamplesTypes of Business Models You Need to KnowBlitzscaling Business Model InnovationWhat Is a Value Proposition?What Is Business Model Innovation And Why It MattersPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post How Does Vroom Work And Make Money? Vroom Business Model appeared first on FourWeekMBA.

June 14, 2020

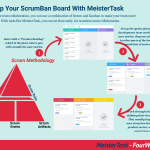

Project Management Framework: How To Set Up Your ScrumBan Board With MeisterTask

The Agile Manifesto, with its core twelve principles, set the stage for what would eventually become the Agile Software development framework used by most companies across the world.

As software companies have taken over many industries, other business units within those organizations also adapted to the Agile Manifesto.

In short, where in the past the Agile Development Methodology was primarily used by software engineers. Today, also other business units can leverage this methodology.

[image error]The twelve core and foundational principles underlying Agile Software development methodologies, within the Agile Manifesto, as set in the agilemanifesto.org

Scrum in a nutshell

[image error]Scrum is a methodology co-created by Ken Schwaber and Jeff Sutherland for effective team collaboration on complex products. Scrum was primarily thought for software development projects to deliver new software capability every 2-4 weeks. It is a sub-group of agile also used in project management to improve startups’ productivity.

Scrum moves around three key profiles:

The Product Owner, managing the completed increments of work.The ScrumMaster, helping the team perform at the highest level.The Development Team: usually organized around a flat structure, where there is no boss.

The Scrum process is also made of five main events:

The Sprint: 2-4 weeks period.Sprint Planning, meetings to assess which part of the product can be completed.The Daily Stand-up: a short meeting of no more than 15 minutes to evaluate the progress of the project.The Sprint Review: a demonstration to present the work completed during the sprint.The Retrospective: final team meeting to assess what worked and what didn’t to improve the process.

Another key element of the Scrum are its artifacts or:

Product Backlog, usually a to-do list consisting of work itemsSprint Backlog comprising things to be completed during the sprintIncrement, comprising items completed after the last software release

All this will be accompanied by a set of rules defined by the whole team.

How do you set up your ScrumBan Board?

The Meister Suite is a set of web-based collaboration tools designed to make teamwork fun. This year, I’m partnering with Meister, the German software company that develops these tools, because I’ve first got to know them when I was looking for ways to order my ideas visually.

Their MindMeister tool helped me to sketch business models visually.

You can use the other suite, MeisterTask to build a Scrum-based board, which also leverages on Kanban, to make your team work extremely effectively.

For seamless team collaboration, you might want to use the Scrum methodology in combination with Kanban (ScrumBan). The MeisterTask team explains how.

Start from a product backlog

A Kanban board can start with a “Product Backlog” which is the place where you will compile the user stories, so that product owners can work and have an overview of those stories.

Move along the sprint events

At the same time you can set up the sprint plans, and as the development team works through the user stories they can add those cards in other parts of the boards to plan completion of each user story.

Development teams can move cards from “Sprint Plan” to “In Progress” as they get going with the project

Development teams can move cards from “Sprint Plan” to “In Progress” as they get going with the projectClose user stories and move on

Once gone through this process developers can work through the user stories, by defining their level of completion, which usually happens when the user story has been demoed to the product owner, and the product owner has accepted it!

With this simple process you can build up a project management board that helps your team to be more productive.

Key takeaways

The Agile Manifesto comprising twelve core principles has become the foundation of methodologies like Scrum and Kanban, which laid the foundation for many software companies’ success.As more organizations turned into software companies, Agile methodologies also started to permeate other business units. So, not only development teams but also other internal teams can use them to be more effectiveFor an effective project management board, a combination of Scrum and Kanban can help make your team super productive. We saw how to set that up with MeisterTask.

The post Project Management Framework: How To Set Up Your ScrumBan Board With MeisterTask appeared first on FourWeekMBA.

June 13, 2020

What Is A Go-To-Market Strategy? Go-To-Market Strategy Examples

A go-to-market strategy represents how companies market their new products to reach target customers in a scalable and repeatable way. It starts with how new products/services get developed to how these organizations target potential customers (via sales and marketing models) to enable their value proposition to be delivered to create a competitive advantage.

What do you take into account in a go-to-market strategy?

When launching new products successfully there are a few elements to take into account:

Product Development

In today’s digital landscape, when it comes to digital products or physical products that have digital components, built-in growth features enable a successful go-to-market strategy.

For instance, frameworks like growth hacking; engineering, data analysis, and marketing come together to enable a successful product launch.

That’s because product features can switch on the viral growth engine, thus speeding up adoption. Companies like Dropbox, Slack, and Zoom know that pretty well.

Marketing, segmentation, and pricing

Other elements like market segmentation (where do we start? who do we target?), and pricing can be critical elements to build up momentum. For instance, Facebook started from specific niches, at selected campuses across the US, before opening up to anyone else.

Market context and distribution

A great product without proper distribution won’t go far, or too far. Distribution can be built in several ways. And based on the kind of product, you will structure your organization’s go-to-market strategy.

For instance, for the kind of product type and whether the market is ready or not for that, do you need a sales force able to deal with large enterprise customers? Or rather marketing power to push through a larger number of people?

For that, it will be extremely important to understand the market context:

[image error]A market type is a way a given group of consumers and producers interact, based on the context determined by the readiness of consumers to understand the product, the complexity of the product; how big is the existing market and how much it can potentially expand in the future.

And from there elaborate a growth strategy:

[image error]In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).

Zoom Multipronged go-to-market strategy

[image error]Zoom is a video communication platform, which mission is to “make video communications frictionless.” Leveraging on the viral growth from its freemium model, Zoom then uses its direct sales force to identify the opportunity and channel those in B2B and enterprise accounts.

Zoom defines its go-to-market as a “multipronged go-to-market strategy for optimal efficiency.” It starts with “viral enthusiasm” triggered by users as they join the platform for free.

The good experience is channeled by sales efforts to identify customers opportunities, such to transform a non-paying user into an enterprise customer.

For instance, as pointed out by Zoom in its 2019, 10K “back in 2019, 55% of the 344 customers that contributed more than $100,000 of revenue started with at least one free host prior to subscribing.”

Therefore, the sales model combines the viral demand generation from the free Zoom Meeting plan with direct sales looking for potential customer opportunities.

The Zoom direct sales force includes:

Inside sales Field sales

Those are organized by customer employee count and vertical.

In short, Zoom the workflow looks like he following:

Free accounts are channeled through the right sales representative.SMBs opportunities will be assigned to an inside sales team member for the acquisition of the paid account.Larger SMBs accounts or potential enterprise accounts are assigned to field sales.

This sort of go-to-market is skewed toward product and distribution.

OYO octopus go-to-market strategy

[image error]OYO business model is a mixture of platform and brand, where the company started primarily as an aggregator of homes across India, and it quickly moved to other verticals, from leisure to co-working and corporate travel. In a sort of octopus business strategy of expansion to cover the whole spectrum of short-term real estate.

The process of standardization of the experience starts with what OYO claims to be a 150 point checklist that goes from the booking experience to the support center and the on-ground Cluster Managers, ready to solve any problem it might arise during the experience of guests.

Thus the go-to-market (expansion) strategy looks like the following:

Identification of the next opportunity/area/vertical to tackle. Acquisition via a growth representative expert in building up partnerships. The expansion team will apply the 150 point checklist to make the property in line with the OYO standard.Support and assistance provided by ad hoc OYO’s representatives. The expansion process ends when the company is able to properly manage the end-to-end customer experience.

This sort of go-to-market is skewed toward distribution.

Partnerships as a go-to-market strategy

[image error]With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market.

In some other cases, a successful go-to-market strategy can be primarily about finding the platform or the partner that can help your product to gain the right amount of traction.

Tesla’s sports’ car go-to-market strategy

[image error]Tesla’s vision is to “create the most compelling car company of the 21st century by driving the world’s transition to electric vehicles,” while its mission is “to accelerate the advent of sustainable transport by bringing compelling mass-market electric cars to market as soon as possible.” Tesla used a transitional business model as its ecosystem grows.

From Tesla’s mission, it’s clear that the company wants to become in the long-run a mass-adopted car company. Yet, when it launched, it was all but a mass-market organization. An outside looker might have had the impression that Tesla was just a sports car company, coming up with a great electric alternative.

[image error]

However, that was just a go-to-market strategy used by Tesla to enter an extremely competitive market, which required massive capital to survive in the first place. Tesla, instead of going for a model that would compete with all the other sedan car companies in the middle and lower segment of the market.

The company opted for a go-to-market strategy that was the only feasible at the time. It built a sport’s car, that was interesting only to a relatively small audience, and yet it was competitive.

Sport’s cars have much higher prices compared to other models (like sedan), and perhaps the person buying that type of car might be less sensitive to price itself. That is how Tesla slowly built up its strategy to cover larger spaces within the car industry.

And while Tesla is still a smaller player in terms of volume of car produced, as of 2020, compared to companies like Ford and GM, it is rolling out its strategy to become a mass-market electric car company. As this is a complete market change, it will still require a few years for this strategy to roll out successfully.

Netflix DVD-rental go-to-market strategy

[image error]

When Netflix started its operations, it did that in the most feasible way at the time, as a DVD-rental company.

That was the most viable way to start a business that could compete with existing players like Blockbuster. Netflix could have tried to play it bigger. Netflix had known for years that being a competitive player in the DVD-rental space, was “just the beginning of something else.”

Yet the first time “streaming” was announced on Netflix plan was in the 2007 annual report, presented in 2008, and by 2009 annual report the term “streaming” would be mentioned 88 times (FourWeekMBA analysis). That is when things started to pick up and Netflix moved away from its go-to-market strategy.

It took over a decade from its foundation, for Netflix, to see its strategy to roll out fully!

Airbnb, OPN go-to-market strategy

As the story goes, in 2007, Brian Chesky and Joe Gebbia couldn’t afford the rent on their San Francisco apartment that is why they decided to transform their loft in a lodging space.

Yet instead of relying on Craiglist, they built their site, which they called Airbed & Breakfast and leveraged on Craigslist to drive users back to their website,

[image error]

Source: GrowthHachers.com

Therefore, Airbnb, to gain initial traction, used what is known in growth marketing as OPN (or other people’s network). It surfed a giant at the time (and still), Craigslist.

To be sure, Airbnb didn’t just gain visibility on Craigslist. Instead, it surfed the site to push its platform. A platform business model to take off run into the so-called chicken and egg problem.

In short, a platform differently from a linear business, to gain initial traction has to kick off its operations on often different sides. For instance, for Airbnb, it was critical to enhance the listings available on the platform to make it valuable for users, and vice versa.

The more users joined, the more it would attract listings. Where to start? Back in 2010, Airbnb figured a mechanism and automation that enabled listings on the platform to be reposted on Craigslist, thus generating substantial traffic.

In addition, those who searched for listings on Airbnb were users looking for alternatives to Hotels, so a great target. By using this initial strategy Airbnb managed to solve its initial growth phase.

Other resources:

What Is Business Model InnovationGrowth Strategies To Expand, Extend, Or Reinvent Your Business ModelWhat Is a Business ModelWhat Is Business StrategyWhat is BlitzscalingWhat Is Market SegmentationWhat Is a Marketing StrategyWhat is Growth HackingSpeed-Reversibility MatrixAnsoff MatrixInnovation MatrixDigital Growth Matrix

The post What Is A Go-To-Market Strategy? Go-To-Market Strategy Examples appeared first on FourWeekMBA.