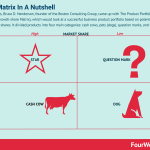

BCG Matrix: The Growth-Share Matrix In A Nutshell

In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.

The Product Portfolio origin story

It all started back in the 1970s, when Bruce D. Henderson, the American businessman, founded the Boston Consulting Group (BCG) in 1963 as part of a bank, The Boston Safe Deposit and Trust Company. The BCG became independent by the end of the 1970s, and by then Bruce Henderson had come up with The Product Portfolio (aka BCG Matrix or growth-share matrix).

The idea was that of determining the share of cash to allocate for each product, based also on how much future cash potential each product had.

Assumptions underlying the Product Portfolio theory

According to The Product Portfolio theory, it’s fundamental to look at cash flows, to build up a successful portfolio, and this is based on four primary rules:

Rule 1: High market shares bring high margins and cash flows.Rule 2: Growth requires cash to be maintained.Rule 3: High market share will be either earned or bought.Rule 4: No product market can grow forever.

Cash cows

Cash cows are products with high market share and slow growth. They generate cash in excess for what it takes to maintain the market share. According to The Product Portfolio theory, cash should be invested back in cash cows only to maintain them, but most of the excess cash produced by cash cows should be invested in new products (question marks, see below), which have the potential to become cash cows in the future.

Pets (dogs)

Dogs are products with low market share and slow growth. Pets are those products that don’t have growth potential, and they don’t generate enough cash to be sustained.

As Bruce Henderson explained in his piece, all products either become cash cows or pets.

Question marks

Question marks are low market share, high growth products.

They require far more cash than they can generate, otherwise, they will die. The only way out is if they become stars, otherwise, they will decay into dogs.

Star

Stars are high share, high growth products.

While they are leaders, they generate substantial cash. Yet, they will become large cash generators only when they will turn into cash cows, as their growth rate will slow down. However, they will have high market shares, thus becoming more stable products, requiring diminishing investments and high cash generation.

The Success Sequence

Bruce Henderson, founder of BCG, in his Product Portfolio, explained how in a successful sequence of cash allocation, stars over time become cash cows. And the abundant cash generated by cash cows will be invested back in question marks, that will need, over time, to become stars, to trigger a positive loop.

[image error]

In short, stars over time become cash cows, due to market dominance and saturation, thus creating a condition of a product with a slower growth rate, and yet high margins and cash flows. The cash flows generated by cows will need to get invested back to question marks, that for the time being, will make substantial cash. To triggering a positive loop, those question marks will need to be turned into cash cows, or else they will decay and turn into dogs.

The Disaster Sequence

Bruce Henderson, founder of BCG, in his Product Portfolio, explained how in a disaster sequence of cash allocation, excess cash from stars is invested in question marks, that turn into dogs. And how excess cash from cash cows invested in dogs turns a negative loop.

[image error]

In a disaster sequence the cash generated gets invested inefficiently, thus either using the excess cash from cash cows into products that will turn into dogs. Or the excess cash from stars into question marks, that will decay into dogs.

Key takeaways

Back in the 1970s, Bruce Henderson, founder of the BCG consulting produced a cornerstone piece called The Product Portfolio, which would become the foundation of what is also known as the BCG Matrix or Growth-Share matrix.The BCG Matrix assumes that the success of a portfolio of business products will highly depend on how the cash will be allocated over those same products. More precisely high market shares products will also bring high margins and cash and vice versa. The matrix divides the products into four main categories: cash cows, dogs, question marks, and stars. In a success sequence, stars generate cash and over time they will turn into cash cows. Cash cows have low growth but high market share and as such generate large cash flows to be invested in question marks, to turn them in stars, that over time will become cash cows, and trigger again this positive loop. In a disaster sequence, the excess cash from stars is invested in question marks that decay into dogs. And the excessive cash from cash cows is invested back into cash cows that over time decay into dogs.

Read next:

Ansoff MatrixAida ModelGrowth MatrixDigital Strategy MatrixSpeed-Reversibility Matrix

Other resources:

Types Of Business ModelsPlatform Business ModelsDigital Business ModelsBusiness Strategy ExamplesGoogle Business Model

The post BCG Matrix: The Growth-Share Matrix In A Nutshell appeared first on FourWeekMBA.