Gennaro Cuofano's Blog, page 205

May 18, 2020

Is Tesla Overvalued? Tesla SWOT Analysis In A Nutshell

Among the most recognized car manufacturers, Tesla is valued more than the combined market capitalization of GM and Ford. While the company’s direct distribution is a strength, its lack of financial viability is a weakness. Competition is a future threat. However, if Tesla defines a new market for car manufacturing its potential growth will be massive.

Tesla’s strengths

[image error]Tesla is vertically integrated. Therefore, the company runs and operates the Tesla’s plants where cars are manufactured and the Gigafactory which produces the battery packs and stationary storage systems for its electric vehicles, which are sold via direct channels like the Tesla online store and the Tesla physical stores.

Strong brand: Tesla has been able in the last decade to become among the most recognized brand, also thanks to its rockstar CEO, Elon Musk. A single tweet from Elon Musk is worth more of a hundred press releases from major publications. And that helped. Direct distribution: Tesla benefits from a direct distribution model, where the cars are primarily sold in its store or online, and thus Tesla is able to cut the middlemen, thus still able to offer the car at an attractive price (at least the Model 3). Manufacturing: Tesla has been investing massive resources in building up its own manufacturing facilities, which will be the company’s most important assets for years to come.

Tesla’s weaknesses

[image error]Tesla made over $24.5 billion in revenues, and it lost $69 million from operations, while its net losses were $862 million. In Q4 2019, Tesla turned a profit for the first time. And its main market is still the US.

Single-sourced supply chain: while the company still sources most of the components from multiple suppliers, there are still certain, important components that are single-sources. This is in part normal in the car manufacturing space. Yet Tesla tries to prevent the risk of being without the proper stock to assemble the cars by piling stocks of components that are single-sources. Financially not viable: Tesla is still financially not viable, as, in 2019, the company generated a net loss. Yet the positive aspect is that for the first time in Q4 2019, the company generated a profit.

Tesla’s threats

Competition from leading brands: while Tesla is a recognized brand, it’s still a small player in a niche (electric cars) in the automotive industry. This makes Tesla easily attacked by dominating existing brands.Lack of electrical vehicle adoption: Tesla is surfing the growth of the electric car industry growth. If that becomes an industry larger than the current automotive industry, then Tesla will be well-positioned for that. However, if that doesn’t happen Tesla won’t be as much value. And while the company can control part of this process, another part cannot be controlled. Delays or other complications in the design, manufacture, launch, and production: if Tesla fails in its go-to-market strategy this can result in big, substantial losses. Therefore, the company will need to make sure to be able to reach its targets in terms of manufacturing and also in developing the proper capability for its manufacturing facilities.

Tesla’s opportunities

[image error]

Tesla has become among the most recognized car manufacturers. Although, players like GM and Ford delivered more than 2mln cars, compared to Tesla’s over 367K vehicles. Yet Tesla is valued three times more than the combined market capitalization of GM and Ford as the market sees the potential of a market that might become much bigger than the current one.

This huge market potential is reflected in Tesla’s valuation, and the company able to develop new products categories in the space can become a “price setter” where its products will be so much differentiated that the company might enjoy good margins for a long time!

Read next: Tesla Business Model

Read more: What Is A SWOT Analysis

More resources:

50 Successful Types of Business Models You Need to KnowDigital Business Models MapBusiness Strategy: Definition, Examples, And Case Studies

The post Is Tesla Overvalued? Tesla SWOT Analysis In A Nutshell appeared first on FourWeekMBA.

May 17, 2020

The Gatekeeper Hypothesis

In a world driven by tech giants that locked-in the digital distribution pipelines to reach billions of people across the globe, the gatekeeper hypothesis states that small businesses will need to pass through those nodes to reach key customers. Thus, those gatekeepers become the enablers (or perhaps deterrent) for small businesses across the globe.

In a first wave of the Internet, large dominating players (with their walled gardens), were disrupted by once smaller digital players, turned into tech giants.

In this wave, these tech giants (now consolidating their walled gardens) have become the gatekeepers of distribution. Just like Google in the early years, surfed AOL to grow. Today, your small business can reach potential customers by going through those gatekeepers (Google, Amazon, Facebook, Netflix, Apple, and a few others).

As those digital companies turned tech giants, what’s next? Those tech giants are now transitioning into AI companies. That makes them still able to quickly iterate, or perhaps devour those small players trying to grow at their expenses.

However, once this wave is over, and if regulation will act to slow those tech giants, new AI companies, able to leverage on speed, and faster feedback loop might gain traction so quickly that tech giants will not be able to contrast them, nonetheless their distribution power.

Those AI companies will be able to tap on new or existing channels, yet grow so quickly to become massive overnight. A good example is TikTok, for now unstoppable, also by giants like Facebook.

Read next:

What Is Business Model InnovationWhat Is a Business ModelWhat Is Business DevelopmentWhat Is Business StrategyWhat is BlitzscalingWhat Is Market SegmentationWhat Is a Marketing StrategyWhat is Growth Hacking

The post The Gatekeeper Hypothesis appeared first on FourWeekMBA.

Apple SWOT Analysis In A Nutshell

Apple can leverage a strong consumer brand and set of successful products as a strength. Yet the company is still too reliant on the iPhone as a primary revenue stream. Though Apple is working to open up new markets as an opportunity, it has to make sure to sustain its stores’ sales.

Strengths

[image error]

[image error]As of October 2019, Apple was worth over trillion dollars. Compared to other tech giants like Amazon, valued at over $869B, Google valued at 863B and Facebook valued at over $530 billion, Apple is primarily a product company, which made 63% of its revenues from the iPhone in 2018.

Brand: Apple is among the most valuable recognized consumer brands in the world. With the ability to launch new, breakthrough successful products in the last two decades, Apple devices have become for millions of people part of their daily lives. This alone can make Apple still a viable company in the next decade.Products: Apple products are still among the most innovative companies. It opened up new markets when it launched the iPod, the iPad, and the iPhone. And now it’s redefining the boundaries of new markets with other devices like wearables (Apple Watch) and other accessories (AirPods and glasses). If any of those products will turn out to be successful Apple can once again create a whole new category.

[image error]Apple is a tech giant, and as such, it encompasses a set of value propositions that make Apple’s brand recognized, among consumers. The three fundamental value propositions of Apple’s brand leverages on the “Think Different” motto; reliable tech devices for mass markets; and in 2019, Apple also started to emphasize more and more about privacy to differentiate from other tech giants.

[image error]Apple’s mission is “to bringing the best user experience to its customers through its innovative hardware, software, and services.” And in a manifesto dated 2009 Tim Cook set the vision specified as “We believe that we are on the face of the earth to make great products and that’s not changing.”

Weaknesses

iPhone saturation: the iPhone has been an incredible success for Apple, however, it also is the primary revenue stream. And if the primary revenue stream slows down that affects the whole company. That is what’s happening as sales of the iPhone have reached saturation. Lack of revenue diversification: the iPhone represented more than 50% of Apple revenues as of 2019, and while Apple sells other devices (Mac, iPad, iPod, and accessories), the company’s bottom line is still too skewed toward the iPhone. However, Apple has been able to diversify its revenues in the last few years.

[image error]In this infographic, you can appreciate the evolution of Apple by looking at how the sales of its central products evolved in the decade 2008-18.

Opportunities

[image error]When looking at the Apple Business Model, it is easy to assume that it is solely a product company, which sells devices that are beautifully crafted. However, there would have been no success for the Mac without its OS operating system. There would not have been iPod success without iTunes. And no success for iPhones without the Apple Store. What’s next for Apple’s success?

New strong accessory market: Apple’s revenues in accessories have been among the fastest-growing. This creates massive short-term opportunities for Apple, as the company keeps monetizing the customer base developed on top of the iPhone. Other revenue streams with high potential growth: Beyond accessories, wearables might become also a segment with extremely high growth potential. Opening adjacent markets with high potential: A whole new set of products, like Apple Glasses or accessories able to monitor the biometrical data of users, might become a whole new category for the company, thus opening great opportunities.

Threats

[image error]

Competition, markets for the Company’s products and services are highly competitive and Apple is in the midst of aggressive competition in all areas of its business.Supply of Components can also represent a risk. True, most of Apple’s product components are generally available from multiple sources, however, certain components are available from a single-source. This might make the production of new devices slower, less reliable and in any case, increase the cost of production. Intellectual Property: If the company fails to protect its intellectual properties that can also become a future threat. Performance of carriers, wholesalers, retailers, and other resellers: a major chunk of Apple’s distribution goes through indirect channels like carriers and resellers. Changed agreements or inability to fuel this channel might result in massive losses in terms of product distribution and sales. Performance of direct stores: Apple has built over the years also a direct distribution system, where customers could purchase directly from those stores. While those stores have been te temples of Apple’s success. If the company will fail in attracting a continous flow of customers in those same stores, they might become an unbearable cost, thus making them transition from temples to cathedrals in the desert.

Read more: What Is A SWOT Analysis

Read next:

Apple Business ModelThe Power of Google Business Model in a NutshellHow Does Google Make Money? It’s Not Just Advertising!How Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedHow Amazon Makes Money: Amazon Business Model in a NutshellHow Does Netflix Make Money? Netflix Business Model ExplainedHow Does Spotify Make Money? Spotify Business Model In A NutshellThe Trillion Dollar Company: Apple Business Model In A NutshellDuckDuckGo: The [Former] Solopreneur That Is Beating Google at Its GameHow Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

Other resources for your business:

What Is a Business Model? 50 Successful Types of Business Models You Need to KnowDigital Business Models MapBusiness Strategy: Definition, Examples, And Case Studies

The post Apple SWOT Analysis In A Nutshell appeared first on FourWeekMBA.

Netflix SWOT Analysis In A Nutshell

Netflix is among the most popular streaming platforms, with a subscription-based business model. The brand, platform, and content are strengths. The volatility of content licensing and production are weaknesses. The streaming market is a potential blue ocean. Inability to attract and retain premium members, and its fixed long-term costs are threats to its business model.

Strengths

[image error]Binge-watching is the practice of watching TV series all at once. In a speech at the Edinburgh Television Festival in 2013, Kevin Spacey said: “If they want to binge then we should let them binge.” This new content format would be popularized by Netflix, launching its TV series all at once.

Brand: Netflix has become one of the stranger consumers brands of our times, and one of the digital business models, who reached the status of a tech giant. This is a crucial ingredient for Netflix’s success, as Hollywood moved to Silicon Valley.Platform: The content on the platform, combined with Netflix algorithms for content recommendation makes it among the stickiest tech platforms, where members spend hours binge-watching.Content: Netflix’s selection and production of content also make it among the platforms with a wide variety. The content is both licensed and produced by Netflix.

Read more: Binge-Watching And The Netflix Effect

Weaknesses

[image error]Netflix is a profitable company. It generated over $1.2 billion in 2018, a 116% increase compared to 2017, primarily driven by substantial growth in paid memberships. However, Netflix has negative cash flows as it invests massively on content license agreements and original content.

Content licensing:

Netflix runs a subscription-based business model where, in the past, content got licensed to make it available on the platform. The licensing agreement makes Netflix pay in advance for content that will be available on the platform for the millions of premium members to watch. This means that Netflix has to make sure to have at each time a wide variety of content to make its value proposition compelling for the premium members. This also results in a cash-flow negative financial model, where the company has to anticipate content licensing fees to make the platform running in the first place.

Content production

For a few years, Netflix also started to invest in producing its own content. While in the long-term this will make Netflix business model less reliant on licensed content, in the short-term (3-5 years) it still poses substantial strains on the company’s liquidity and ability to expand.

Read more: Is Netflix Profitable?

Opportunities

Blue ocean : the streaming market is still in its infancy, and the next wave might open up to new formats, and therefore larger and less competitive markets, for those able to grab them. Netflix is well-positioned for that.

Threats

Inability to attract and retain members: if Netflix will not effectively attract new users. And retained existing premium members, the negative cash-flow platform might incur substantial losses and shrink its business.

Piracy-based video offerings: piracy services, even though illegal, still represent a big threat as it becomes hard to track and keep up with them. This poses a serious threat to the overall Netflix business model.

Fixed cost of content commitments: as already highlighted, content licensing is key to the Netflix business model, yet it also represents a weakness. In the long-term, that also represents a threat- That’s because Netflix has to enter multi-year commitments with content providers, part of which are noncancelable. So if part of that content will end up unused on the platform, Netflix will still pay for it.

Read next: Netflix Business Model, Netflix Profitability, SWOT Analysis

More resources:

What Is A SWOT AnalysisBusiness Strategy: Definition, Examples, And Case StudiesWhat Is a Business Model? 48 Successful Types of Business Models You Need to KnowBlitzscaling Business Model Innovation Canvas In A NutshellHow To Create A Business ModelWhat Is Business Model Innovation And Why It MattersWhat Is Blitzscaling And Why It Matters

Other business model case studies:

Amazon Business ModelGoogle Business ModelUber Business ModelLyft Business ModelDuckDuckGo Business ModelApple Business ModelSlack Business ModelPinterest Business ModelTelegram Business Model

The post Netflix SWOT Analysis In A Nutshell appeared first on FourWeekMBA.

The Aggregator Business Model In A Nutshell

An aggregator business model can be classified as a sort of platform business model, however, with its specific features. For instance, the aggregator might act as a middleman. Still, it monetizes the eyeballs on the platform (advertisers subsidize the aggregator) while keeping a tight control on the whole experience of users.

The birth of the aggregator

There isn’t a single way to define aggregator business models. The person who most popularized this term was Ben Tompson from stratechery.com, as he explained in the graphic below:

Aggregation theory explained visually by Ben Thompson of stratechery.com

Aggregation theory explained visually by Ben Thompson of stratechery.com This is a great way to classify aggregator business models.

In this guide, we’ll look at a few key differentiators, to define an aggregator business model, but also to distinguish it with the platform business model based on my observations.

Is the aggregator a platform?

Before looking at how an aggregator might be different from a platform, let’s specify that the aggregator can be comprised within the platform business model, however, it has very specific features.

Middleman vs. invisible hand: intermediation rather than interactions

In an aggregator business model, the company which acts as the aggregator doesn’t work to make users on the platform interact freely. Rather it has tight central control. In short, the aggregator controls how the company will scale.

Therefore, while in a pure platform business model the platform scales by becoming invisible (a smooth experience is one of the keys to trigger network effects).

In an aggregator model, it’s the aggregator that keeps interacting with the two or more parties involved (Google shows users a search result page, and the same Google handles the ad inventory; users and advertisers don’t interact with each other to set the price).

For instance, Google as a search engine is more of an aggregator, where the company centrally enriches its index and builds up its rankings. As a side effect, there is still an ecosystem of publishers and advertisers born as a result of this aggregation process but it’s not proximate.

Therefore, the aggregator acts like a middleman but rather than monetizing directly by getting a cut it might monetize via advertising.

Central control vs. Network effects: top-down vs. bottom up

One of the key elements of platform business models is network effects. Or put it shortly, for each additional user joining the platform, that becomes more valuable to the next one.

While in a platform business model this is the essence, in an aggregator business model instead, it’s the aggregator that centrally scales up the platform. Going back to Google’s case, the company performs wide and core algorithms change to substantially influence how the search engine will give back results, at scale.

Subsidized and asymmetric vs. taxed and symmetric

The aggregator might leave the service free forever, and sell the eyeballs through a sort of attention-based model. Thus, advertisers or companies pay to get visibility on top of the aggregator’s platform.

The pure platform instead acts like a government, getting a tax on each transaction. While the aggregator makes the service subsidized by a key customer (companies paying for visibility on the platform) and the service is free.

A platform business model by acting more like a state – once it makes sure some key guidelines are followed (safety of the network, lack of spam on the platform, stable and liquid infrastructure, and so on) – the rest is left to the key players’ interactions.

Key takeaways

It’s not always easy to differentiate between aggregators and platforms and in some cases, the two might overlap. Indeed, an aggregator is a platform, but with specific features. An aggregator might act more like a middleman, however, rather than monetizing directly by getting a cut, it might monetize the eyeballs on the platform. A pure platform business model instead acts more like a state, and as such it will collect a tax for enabling the key players to interact almost freely (key guidelines are set by the central platform).

Other resources:

What Is a Business ModelWhat Is Business Model InnovationGrowth StrategiesWhat Is Business StrategyWhat is BlitzscalingWhat Is Market SegmentationWhat Is a Marketing StrategyWhat is Growth HackingSpeed-Reversibility MatrixAnsoff MatrixInnovation MatrixDigital Growth Matrix

The post The Aggregator Business Model In A Nutshell appeared first on FourWeekMBA.

Zooming Into The Freeterprise Business Model

A freeterprise is a combination of free and enterprise where free professional accounts are driven into the funnel through the free product. As the opportunity is identified the company assigns the free account to a salesperson within the organization (inside sales or fields sales) to convert that into a B2B/enterprise account.

“Zooming” into the freeterprise model

[image error]Zoom is a video communication platform, which mission is to “make video communications frictionless.” Leveraging on the viral growth from its freemium model, Zoom then uses its direct sales force to identify the opportunity and channel those in B2B and enterprise accounts.

As consumer brands showed the freemium model could be both a great go-to-market strategy and generate a continuous flow of qualified leads (however, only after the whole organization would be organized around identifying those opportunities), other B2B/Enterprise companies (those primarily selling to other companies or larger corporations) also mastered the freemium model but on a B2B scale.

That is why I like to call that “Freeterprise.” Companies like Slack and Zoom are great examples of how you can build a valuable business with a Freeterprise model.

This sort of looks like magic, as you can start from a single free professional account, and pull a whole organization into that, to transform it into an enterprise

As I explained in Zoom business model though, the whole organizaiton needs to be structured around the freeterprise model, where on the one end the company seamlessy uses teh fee product as entry point within companies.

And on the other end, sales people with the ability to built strong relationship with the account can get the whole company onboard, thus transforming a free professional account into a potential enterprise customer.

Of course, this leads the organization to skew its resources toward building an army of qualified salespeople to handle the volume of leads generated by the free offering (in 2019 Zoom spent 54% of its revenues primarily in salespeople headcounts).

Other case studies:

Zoom business modelSlack business modelDropbox business model

Other resources:

What Is Business Model InnovationGrowth Strategies To Expand, Extend, Or Reinvent Your Business ModelWhat Is a Business ModelWhat Is Business StrategyWhat is BlitzscalingWhat Is Market SegmentationWhat Is a Marketing StrategyWhat is Growth HackingSpeed-Reversibility MatrixAnsoff MatrixInnovation MatrixDigital Growth Matrix

The post Zooming Into The Freeterprise Business Model appeared first on FourWeekMBA.

May 16, 2020

How Does Zoom Make Money? Zoom Freeterprise Business Model In A Nutshell

Zoom is a video communication platform, which mission is to “make video communications frictionless.” Leveraging on the viral growth from its freemium model, Zoom then uses its direct sales force to identify the opportunity and channel those in B2B and enterprise accounts.

Zoom culture in a nutshell

As pointed out on its financial prospectus Zoom culture is about “delivering happiness” which drives its mission, vision, and values.

How does Zoom interpret its “delivering happiness” seemingly empty motto?

Zoom Mission Statement

Our mission is to make video communications frictionless

Indeed, this aspect is critical. Zoom has been able to grow so quickly thanks to its freemium model where it managed to attract a large number of users and convert them in paying customers. Zoom has been able also to distinguish itself for its ease of use and setup, which helped it trigger viral growth.

Understanding its mission is critical to understand what Zoom prioritizes in developing its products, not only from the engineering standpoint but also from the sales and marketing standpoint. Thus, the word “frictionless” isn’t just a concept, but a mindset that pervades the whole organization.

Zoom Vision Statement

Our vision is to empower people to accomplish more through video communications

Video communication is at the core of what Zoom does. However, its vision is to “empower people.” As a new form of working is on the rise (especially remote working) people need more and more ways to communicate via video. Zoom surfed that way to build a successful company very quickly.

Zoom Values

We care for our community, our customers, our company, our teammates and ourselves

Understanding the values of the organization helps us understand who are the key partners in the Zoom business model.

This is also shown in the way Zoom communicates its product:

We provide a video-first communications platform that delivers happiness and fundamentally changes how people interact.

And its ambition of what the product can achieve:

We believe that rich and reliable communications lead to interactions that build greater empathy and trust. We strive to live up to the trust our customers place in us by delivering a communications solution that “just works.” Our goal is to make Zoom meetings better than in-person meetings.

As you might notice Zoom audacious goal is to make “Zoom meetings better than in-person meetings.”

This kind of focus leads the product development and it helps Zoom employees to focus on a single, audacious goal.

The challenge is that of allowing organizations to still build a culture even though those are primarily made of employees working remotely. Therefore, more than just a product, Zoom is promoting a movement or a way of thinking.

This is a critical step to understand, as this kind of vision also helps your own customer to better understand the value of the product.

Indeed, as highlighted by Zoom on its financial prospectus:

A technology customer with approximately 1,000 employees has been able to grow and maintain its culture even with anall-remoteemployee base by running all of its meetings on Zoom.

What makes Zoom different?

While many other digital businesses are launching their own video chat applications, some of the factors that helped Zoom gain traction werE:

Both Free and Premium, Reliable, high-quality communications

Easy to use

Easy to deploy and manage

Zoom Competitive Strengths

Video-first cloud architecture

A recognized market leader

Viral demand

Multipronged go-to-market strategy where the company leverages on its freemium to build a continuous flow of paying customers

How does Zoom make money?

Zoom primarily makes money via its Meetings platform. Around that Zoom has developed a suite of products and features “designed to give users a frictionless communications experience.“

Users are comprised of two categories:

Hosts who organize video meetings

And the individual attendees who participate in those video meetings

[image error]

Zoom products (source: Zoom 10K, 2020)

Zoom enjoys thousands of customers of all sizes across industry verticals and geographies. As of January 2020, Zoom recorded over $622 million in revenues, over $500 million in gross profit, and over $12 million in net income.

As the company scaled its revenues it also scaled its sales and marketing expenses in an attempt to enable its sales force to convert the continuous streams of accounts using Zoom for free as paying customers.

[image error]How Zoom scaled its revenues from 2017 to 2020 (source: Zoom 10K)

The multipronged go-to-market strategy

Zoom defines its sales model as a “multipronged go-to-market strategy for optimal efficiency.” It starts with “viral enthusiasm” triggered by users as they join the platform for free.

The good experience is channeled by sales efforts to identify customers opportunities, such to transform a non-paying user into an enterprise customer.

For instance, as pointed out by Zoom in its 2019, 10K “back in 2019, 55% of the 344 customers that contributed more than $100,000 of revenue started with at least one free host prior to subscribing.”

Therefore, the sales model combines the viral demand generation from the free Zoom Meeting plan with direct sales looking for potential customer opportunities.

The Zoom direct sales force includes:

field sales inside sales

Those are organized by customer employee count and vertical.

Zoom’s Freeterprise model unveiled

I like to call the Zoom model, a freeterprise, as the company has been able to scale its revenues, by leveraging on a free product (usually working pretty well in the B2C space) yet to acquire B2B/Enterprise customers.

Thus, the freeterprise works as a powerful way to transform free professional single accounts, in enterprise accounts. To do so the company has to use a sort of barbell strategy, where the free product offering a great experience works as a seamless entry-point.

Yet, on the other hand, the highly specialized sales person (usually a field sales) build a strong relationship to bring in the whole enterprise account onboard!

Of course, this leads the organization to skew its resources toward building an army of qualified salespeople to handle the volume of leads generated by the free offering (in 2019 Zoom spent 54% of its revenues primarily in salespeople headcounts).

Other resources:

What Is Business Model InnovationGrowth Strategies To Expand, Extend, Or Reinvent Your Business ModelWhat Is a Business ModelWhat Is Business StrategyWhat is BlitzscalingWhat Is Market SegmentationWhat Is a Marketing StrategyWhat is Growth HackingSpeed-Reversibility MatrixAnsoff MatrixInnovation MatrixDigital Growth Matrix

The post How Does Zoom Make Money? Zoom Freeterprise Business Model In A Nutshell appeared first on FourWeekMBA.

May 15, 2020

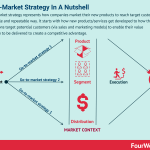

What Is A Go-To-Market Strategy? Go-To-Market Strategies Examples

A go-to-market strategy represents how companies market their new products to reach target customers in a scalable and repeatable way. It starts with how new products/services get developed to how these organizations target potential customers (via sales and marketing models) to enable their value proposition to be delivered to create a competitive advantage.

What do you take into account in a go-to-market strategy?

When launching new products successfully there are a few elements to take into account:

Product Development:

In today’s digital landscape, when it comes to digital products or physical products that have digital components, built-in growth features enable a successful go-to-market strategy.

For instance, frameworks like growth hacking; engineering, data analysis, and marketing come together to enable a successful product launch.

That’s because product features can switch on the viral growth engine, thus speeding up adoption. Companies like Dropbox, Slack, and Zoom know that pretty well.

Marketing, segmentation, and pricing:

Other elements like market segmentation (where do we start? who do we target?), and pricing can be critical elements to build up momentum. For instance, Facebook started from specific niches, at selected campuses across the US, before opening up to anyone else.

Market context and distribution

A great product without proper distribution won’t go far, or too far. Distribution can be built in several ways. And based on the kind of product, you will structure your organization’s go-to-market strategy.

For instance, for the kind of product type and whether the market is ready or not for that, do you need a sales force able to deal with large enterprise customers? Or rather marketing power to push through a larger number of people?

For that, it will be extremely important to understand the market context:

[image error]A market type is a way a given group of consumers and producers interact, based on the context determined by the readiness of consumers to understand the product, the complexity of the product; how big is the existing market and how much it can potentially expand in the future.

And from there elaborate a growth strategy:

[image error]In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).

Zoom Multipronged go-to-market strategy

[image error]Zoom is a video communication platform, which mission is to “make video communications frictionless.” Leveraging on the viral growth from its freemium model, Zoom then uses its direct sales force to identify the opportunity and channel those in B2B and enterprise accounts.

Zoom defines its go-to-market as a “multipronged go-to-market strategy for optimal efficiency.” It starts with “viral enthusiasm” triggered by users as they join the platform for free.

The good experience is channeled by sales efforts to identify customers opportunities, such to transform a non-paying user into an enterprise customer.

For instance, as pointed out by Zoom in its 2019, 10K “back in 2019, 55% of the 344 customers that contributed more than $100,000 of revenue started with at least one free host prior to subscribing.”

Therefore, the sales model combines the viral demand generation from the free Zoom Meeting plan with direct sales looking for potential customer opportunities.

The Zoom direct sales force includes:

Inside sales Field sales

Those are organized by customer employee count and vertical.

In short, Zoom the workflow looks like he following:

Free accounts are channeled through the right sales representative.SMBs opportunities will be assigned to an inside sales team member for the acquisition of the paid account.Larger SMBs accounts or potential enterprise accounts are assigned to field sales.

This sort of go-to-market is skewed toward product and distribution.

OYO octopus go-to-market strategy

[image error]OYO business model is a mixture of platform and brand, where the company started primarily as an aggregator of homes across India, and it quickly moved to other verticals, from leisure to co-working and corporate travel. In a sort of octopus business strategy of expansion to cover the whole spectrum of short-term real estate.

The process of standardization of the experience starts with what OYO claims to be a 150 point checklist that goes from the booking experience to the support center and the on-ground Cluster Managers, ready to solve any problem it might arise during the experience of guests.

Thus the go-to-market (expansion) strategy looks like the following:

Identification of the next opportunity/area/vertical to tackle. Acquisition via a growth representative expert in building up partnerships. The expansion team will apply the 150 point checklist to make the property in line with the OYO standard.Support and assistance provided by ad hoc OYO’s representatives. The expansion process ends when the company is able to properly manage the end-to-end customer experience.

This sort of go-to-market is skewed toward distribution.

Partnerships as a go-to-market strategy

[image error]With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market.

In some other cases, a successful go-to-market strategy can be primarily about finding the platform or the partner that can help your product to gain he right amount of traction.

This sort of go-to-market is a mixture of product, segmentation and distribution.

Other resources:

What Is Business Model InnovationGrowth Strategies To Expand, Extend, Or Reinvent Your Business ModelWhat Is a Business ModelWhat Is Business StrategyWhat is BlitzscalingWhat Is Market SegmentationWhat Is a Marketing StrategyWhat is Growth HackingSpeed-Reversibility MatrixAnsoff MatrixInnovation MatrixDigital Growth Matrix

The post What Is A Go-To-Market Strategy? Go-To-Market Strategies Examples appeared first on FourWeekMBA.

May 14, 2020

How Does Zoom Make Money? Zoom Business Model In A Nutshell

Zoom is a video communication platform, which mission is to “make video communications frictionless.” Leveraging on the viral growth from its freemium model, Zoom then uses its direct sales force to identify the opportunity and channel those in B2B and enterprise accounts.

Zoom culture in a nutshell

As pointed out on its financial prospectus Zoom culture is about “delivering happiness” which drives its mission, vision, and values.

How does Zoom interpret its “delivering happiness” seemingly empty motto?

Zoom Mission Statement

Our mission is to make video communications frictionless

Indeed, this aspect is critical. Zoom has been able to grow so quickly thanks to its freemium model where it managed to attract a large number of users and convert them in paying customers. Zoom has been able also to distinguish itself for its ease of use and setup, which helped it trigger viral growth.

Understanding its mission is critical to understand what Zoom prioritizes in developing its products, not only from the engineering standpoint but also from the sales and marketing standpoint. Thus, the word “frictionless” isn’t just a concept, but a mindset that pervades the whole organization.

Zoom Vision Statement

Our vision is to empower people to accomplish more through video communications

Video communication is at the core of what Zoom does. However, its vision is to “empower people.” As a new form of working is on the rise (especially remote working) people need more and more ways to communicate via video. Zoom surfed that way to build a successful company very quickly.

Zoom Values

We care for our community, our customers, our company, our teammates and ourselves

Understanding the values of the organization helps us understand who are the key partners in the Zoom business model.

This is also shown in the way Zoom communicates its product:

We provide a video-first communications platform that delivers happiness and fundamentally changes how people interact.

And its ambition of what the product can achieve:

We believe that rich and reliable communications lead to interactions that build greater empathy and trust. We strive to live up to the trust our customers place in us by delivering a communications solution that “just works.” Our goal is to make Zoom meetings better than in-person meetings.

As you might notice Zoom audacious goal is to make “Zoom meetings better than in-person meetings.”

This kind of focus leads the product development and it helps Zoom employees to focus on a single, audacious goal.

The challenge is that of allowing organizations to still build a culture even though those are primarily made of employees working remotely. Therefore, more than just a product, Zoom is promoting a movement or a way of thinking.

This is a critical step to understand, as this kind of vision also helps your own customer to better understand the value of the product.

Indeed, as highlighted by Zoom on its financial prospectus:

A technology customer with approximately 1,000 employees has been able to grow and maintain its culture even with anall-remoteemployee base by running all of its meetings on Zoom.

What makes Zoom different?

While many other digital businesses are launching their own video chat applications, some of the factors that helped Zoom gain traction werE:

Both Free and Premium, Reliable, high-quality communications

Easy to use

Easy to deploy and manage

Zoom Competitive Strengths

Video-first cloud architecture

A recognized market leader

Viral demand

Multipronged go-to-market strategy where the company leverages on its freemium to build a continuous flow of paying customers

How does Zoom make money?

Zoom primarily makes money via its Meetings platform. Around that Zoom has developed a suite of products and features “designed to give users a frictionless communications experience.“

Users are comprised of two categories:

Hosts who organize video meetings

And the individual attendees who participate in those video meetings

[image error]

Zoom products (source: Zoom 10K, 2020)

Zoom enjoys thousands of customers of all sizes across industry verticals and geographies. As of January 2020, Zoom recorded over $622 million in revenues, over $500 million in gross profit, and over $12 million in net income.

As the company scaled its revenues it also scaled its sales and marketing expenses in an attempt to enable its sales force to convert the continuous streams of accounts using Zoom for free as paying customers.

[image error]How Zoom scaled its revenues from 2017 to 2020 (source: Zoom 10K)

Sales model: the multipronged go-to-market strategy

Zoom defines its sales model as a “multipronged go-to-market strategy for optimal efficiency.” It starts with “viral enthusiasm” triggered by users as they join the platform for free.

The good experience is channeled by sales efforts to identify customers opportunities, such to transform a non-paying user into an enterprise customer.

For instance, as pointed out by Zoom in its 2019, 10K “back in 2019, 55% of the 344 customers that contributed more than $100,000 of revenue started with at least one free host prior to subscribing.”

Therefore, the sales model combines the viral demand generation from the free Zoom Meeting plan with direct sales looking for potential customer opportunities.

The Zoom direct sales force includes:

field sales inside sales

Those are organized by customer employee count and vertical.

Other resources:

What Is Business Model InnovationGrowth Strategies To Expand, Extend, Or Reinvent Your Business ModelWhat Is a Business ModelWhat Is Business StrategyWhat is BlitzscalingWhat Is Market SegmentationWhat Is a Marketing StrategyWhat is Growth HackingSpeed-Reversibility MatrixAnsoff MatrixInnovation MatrixDigital Growth Matrix

The post How Does Zoom Make Money? Zoom Business Model In A Nutshell appeared first on FourWeekMBA.

May 13, 2020

How OYO Works: OYO Business Model In A Nutshell

OYO business model is a mixture of platform and brand, where the company started primarily as an aggregator of homes across India, and it quickly moved to other verticals, from leisure to co-working and corporate travel. In a sort of octopus business strategy of expansion to cover the whole spectrum of short-term real estate.

Octopus strategy: OYO multi-brand and multi-product strategy in action

OYO, thanks also to its $2.4 billion in fundings, managed to keep expanding its business strategy to comprise more products (to cover several markets, from traditional rental to vacation and co-working) and brands.

This sort of octopus strategy has seen the company quickly expanding over the years, by splitting its arms in several directions, to cover all the possible facets of the short-term real estate market.

OYO Townhouse: 25% Hotel, 25% Home, 25% Cafe and 25% Store

Announced on February 2017 :

It gives us great pleasure to introduce you to OYO Townhouse. Operating as 25% Hotel, 25% Home, 25% Cafe and 25% Store, these hotels are slated to become to the social hotspot of their neighbourhood. Every single element – from the breakfast menu to the booking process – has been re-engineered to deliver higher quality and better value. Also, unlike the lego-brick approach of traditional hotel chains, every OYO Townhouse is designed to complement its neighbourhood. The tastefully done properties are staffed with highly trained managers to deliver world-class and modern hospitality specially designed for millennials.

Thought for the higher end of the market OYO Townhouse, is steered toward a boutique hotel format. The company purchases real estate and tranforms it into boutique hotels, branded OYO Townhouse, which the company likes to call “‘the friendly neighborhood hotel’ or “a unique combination of a hotel, home, merchandise store and café and is targeted at millennial travellers aspiring premium economy accommodations.“

As the company pointed out this is the part of the business targeting higher-income millennials, with six features that make those Townhouses different from the other products (OYO emphasizes them as “6 leayrs of innovation:”

Smarter Rooms, Smarter Spaces, Smarter Menus, Smarter Buildings, Smarter Service, Smarter Locations

This formula, OYO claimes, improves over the old hotel formula.

OYO Home: fully managed by OYO

Source: OYO Rooms Blog

Source: OYO Rooms BlogThe company announced OYO Home in 2017:

I am excited to introduce OYO Home, our newest initiative in continuing to provide high quality living spaces at diverse locations at a range of prices. OYO is partnering with hundreds of owners across India to unlock, maintain and manage all forms of homes. Everything from villas, apartments, bungalows to farmhouses. Everywhere from Goa, Manali, Shimla, Nainital to Pondicherry.

As the company highlighted back then, there were two main pain pointes t o be solves:

Guests: “concerns regarding infrastructure quality and the check-in/check-out experience.”Hosts/home-owners: “The lack of a trusted partner who will take over the responsibility of maintaining the home.”

Thus, this is wat OYO Rooms addressed.

OYO Vacation Homes

At OYO Vacation Homes, we are utilizing the power of data to understand our customers better. Carefully analyzing customer behaviour has given us insights that are significant for business growth. With the help of data analytics, we are able to solve some of the biggest hurdles faced by homeowners, for example, seasonality or low bookings during certain times of the year. It’s data that has helped us understand the impact of a swimming pool or sauna on the occupancy of a particular home. It is also data that highlights that pet-friendly homes witness higher occupancy!

[image error]The brands part of the OYO Vacation Homes varying from self-service to full-service.

[image error]The services offered by OYO Vacation Homes

This segment of the business primarily comprises brands dealing with vacation renal management services, and here OYO expanded also in Europe.

SilverKey: for corporate travelers

[image error]The key features of the SilverKey corporate accommodations as recounted by OYO

(source: OYO Official Blog)

Back in April 2019, OYO highlighted “At OYO, our mission is to provide the perfect space in every place. Corporate travel segment is a key engine of our growth for the year and we are stepping up engagement in this segment.”

OYO Workspaces: co-working segment

[image error]

After the acquisition of Innov8, OYO entered also the co-working industry with three main products:

Innov8 – “Premium Workspace Designed To Help You Create and Innovate“Powerstation– “Vibrant yet professional Coworking Solutions” (fully managed by OYO Workflo – “budget-friendly, functional co-working solutions”

Capital O Collection

This brand targets “new age corporate travelers who are in search for quality and affordable accommodations while meeting their professional and personal requirements.“

Other products in leisure, corporate travel, and student housing

Other products comprise:

Palette primarily covering the leisure segment. Collection O as the product focusing on the higher-end of the corporate travel space. OYO LIFE, targeting millennials and student housing.

OYO end-to-end experience

OYO objective is to cover the hospitality experience end-to-end.

OYO objective is to cover the hospitality experience end-to-end. Image Source: Official OYO Blog

A lot goes into delivering what we promise and we never shy away from going the extra mile to give the guests an unforgettable experience.

The OYO Team

The process of standardization of the experience starts with what OYO claims to be a 150 point checklist that goes from the booking experience to the support center and the on-ground Cluster Managers, ready to solve any problem it might arise during the experience of guests.

OYO and the era of Hyper Agile

Ajay Shrivastava, former head of technology at OYO, back in 2016coined the term “Solver Team” as a sort of Hyper Agile approach based on his experience at OTO.

As he highlighted:

Early last year at OYO, we experimented a new model of collaboration in software development called the “Solver Teams”. Over the year we shipped dozens of products and hundreds of features using this methodology. It’s an impactful execution mechanism, that churns out multiple features every week at a very high speed, while having a positive synergy and camaraderie in environment across business, product, design and technology teams.

As he highlighted in the old model, the starting point of a product development would start from the business going down product, design, engineering and testing/release.

The issue with this sort of approach is well explained in the graphic below by

Source: Ajay Shrivastava, on “Solver Teams — Hyper Agile & Well Oiled Execution”

Source: Ajay Shrivastava, on “Solver Teams — Hyper Agile & Well Oiled Execution”In a Solver Team approach (or hyper agile) self-sufficient teams come together, so that different functions are comprised in the same team:

Solver Team (ST) = Business + Product + Design + Tech members. Self-sufficient group of experts from different functions who work together on a specific problem end-to-end.

Some of the key advantages of this approach are:

Deep understanding of end-to-end flowsVery high speed of executionStrong sense of ownership

Going “Glocal”: from top-down, to bottom-up

Source: Hotel Ratings OYO Official Blog

Source: Hotel Ratings OYO Official BlogAs highlighted by OYO engineering team back in 2018, they launched an important update related to the Hotel Rating:

When a user visits the OYO Mobile App, Mobile or Desktop Website, hotel ratings are displayed alongside all the properties with essential details on the hotel listing page and hotel details page. If the total count of rating is less than 10, then a ‘New’ tag appears on the hotel. Upon clicking on a hotel rating, it expands to show a more detailed review and displays a happiness index (out of 100) on amenities and core promises. Hotel ratings are collected post check-out via mobile app, customer care and emails.

For aggregator websites like OYO, mechanisms like Hotel Ratings are crucial as they flipped the market upside down. Where conventional rating mechanisms, in the previous era (where digital business models didn’t take over yet) were primarily top-down.

Large scale algorithms and platforms made consumers the raters, thus enabling a bottom-up approach, with a social-media like mechanism, and user-generated content, repackaged in the form of synthetic ratings (what OYO calls the happiness index) that enable the platform to show hotel ratings on scale.

Key takeaways

OYO business model is a mixture of platform and brand with an aggressive expansions strategy that looks like a sort of continuous blitzscaling.The company expanded in several verticals in the short-term rental real estate and it managed to build several products and to acquire several brands.This stot of business strategy while working extremely well to dominate the market, might also get very risk when the market contracts.

The post How OYO Works: OYO Business Model In A Nutshell appeared first on FourWeekMBA.