Gennaro Cuofano's Blog, page 207

May 2, 2020

Quick Glance At Amazon Q1 Profits For 2020

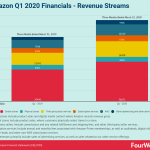

In Q1 2020, Amazon‘s net sales increased by 26.3%. Yet its operating income decreased by 9.7% primarily due to a higher cost of sales (30% increase), incurred by Amazon due to the COVID, due to increased shipping and fulfillment costs and marketing expenses.

What are the key Amazon revenue streams as of Q1 2020?

The Amazon business model is comprised of the following revenue streams:

Online stores include product sales and digital media content where Amazon records revenue gross.Physical stores Include product sales, where customers physically select items in a store.Third-party sellers Include commissions and any related fulfillment and shipping fees, and other third-party seller services.Subscription services Include annual and monthly fees associated with Amazon Prime memberships, as well as audiobook, digital video, digital music, e-book, and other non-AWS subscription services.Other revenues primarily include sales of advertising services, as well as sales related to our other service offerings.

Why did Amazon spend more?

Due to increased product and shipping costs resulting from increased sales. Amazon projects the increase in costs through at least Q2 2020 due to COVID-19 related increases in shipping costs.Shipping costs, which include sortation and delivery centers and transportation costs, were $7.3 billion and $10.9 billion in Q1 2019 vs Q1 2020. Amazon expects the cost of shipping to continue to increase to the extent as customers accept and use shipping offers at an increasing rate, and Amazon further reduces shipping rates.Amazon offers more expensive shipping methods, including faster delivery, and additional services.Costs of shipping over time might be offset in part by achieving higher sales volumes, optimizing fulfillment network, negotiating better terms with suppliers, and achieving better-operating efficiencies.

Read next:

Google Vs. Amazon: The Latest Move For World DominationGoogle Q1 Profit 2020: Mobile Traffic, Youtube Ads, Youtube Memberships, And Cloud Saved The Day (For Now)Third-Party Sellers And Amazon’s Platform-First Business, Will It Last?

Read more:

Google Business ModelHow Does Google Make Money?Hidden Revenue Generation

More about Amazon business model:

Amazon Business ModelWhat Is the Receivables Turnover Ratio? How Amazon Receivables Management Helps Its Explosive GrowthAmazon Case Study: Why from Product to Subscription You Need to “Swallow the Fish”What Is Cash Conversion Cycle? Amazon Cash Machine Business Model ExplainedWhy Is AWS so Important for Amazon Future Business Growth?Amazon Flywheel: Amazon Virtuous Cycle In A NutshellAmazon Value Proposition In A NutshellWhy Amazon Is Doubling Down On AWSThe Economics Of The Amazon Seller Business In A NutshellHow Much Is Amazon Advertising Business Worth?What Is the Cost per First Stream Metric? Amazon Prime Video Revenue Model ExplainedJeff Bezos Teaches You When Judgment Is Better Than Math And DataAlibaba vs. Amazon Compared in a Single InfographicAmazon Mission Statement and Vision Statement In A Nutshell

More useful resources:

What Is a Business Model?What Is Business Model Innovation And Why It Matters

The post Quick Glance At Amazon Q1 Profits For 2020 appeared first on FourWeekMBA.

May 1, 2020

How Does WhatsApp Make Money? Why WhatsApp Will Become A Super App

Founded in 2009 by Brian Acton, Jan Koum WhatsApp is a messaging app acquired by Facebook in 2014 for $19B. In 2018 WhatsApp rolled out customers’ interaction services. WhatsApp might be transitioning toward a set of features from video chats to social commerce that might transform WhatsApp into a Super App.

WhatsApp origin story

Brian Acton and Jan Koum who had previously spent 20 years combined at Yahoo founded WhatsApp in 2009.

As reported on CNBC Jan Koum affirmed:

“It started with me buying an iPhone; I got annoyed that I was missing calls when I went to the gym.”

That’s how they managed to build an app that made them show their status, and he added: “We didn’t set out to build a company. We just wanted to build a product that people used.“

In 2009 WhatsApp got its first seed round for $250k. In a few years, WhatsApp became a hit and in 2011 and 2013 WhatsApp got $60 million from Sequoia Capital with the first round of $8 million and the second round of $52 million.

The name WhatsApp is a pun on the phrase What’s Up, and it started as an alternative to SMS.

Advertising as a broken business model according to its founders

As reported on the WhatsApp blog by its founders Koum and Brian Acton:

When we sat down to start our own thing together three years ago we wanted to make something that wasn’t just another ad clearinghouse. We wanted to spend our time building a service people wanted to use because it worked and saved them money and made their lives better in a small way. We knew that we could charge people directly if we could do all those things. We knew we could do what most people aim to do every day: avoid ads.

Advertising isn’t just the disruption of aesthetics, the insults to your intelligence and the interruption of your train of thought. At every company that sells ads, a significant portion of their engineering team spends their day tuning data mining, writing better code to collect all your personal data, upgrading the servers that hold all the data and making sure it’s all being logged and collated and sliced and packaged and shipped out… And at the end of the day the result of it all is a slightly different advertising banner in your browser or on your mobile screen.

Remember, when advertising is involved you the user are the product.

This showed how reluctant they were about advertising as a business model. The paradox though is that in a couple of years the company would be acquired by the largest digital advertising network, after Google.

The Facebook acquisition

It was June 18, 2012, almost two years before WhatsApp got sold to the most profitable advertising network on earth, Facebook Inc.

In a previous post they said:

So first of all, let’s set the record straight. We have not, we do not and we will not ever sell your personal information to anyone. Period. End of story. Hopefully this clears things up.

On February 19, 2014, when Facebook acquired WhatsApp. As reported on Facebook financial statements Facebook “paid approximately $4.6 billion in cash and issued 178 million shares of Class A common stock in connection with the acquisition of WhatsApp” this is how it was announced on WhatsApp blog:

Almost five years ago we started WhatsApp with a simple mission: building a cool product used globally by everybody. Nothing else mattered to us.

Today we are announcing a partnership with Facebook that will allow us to continue on that simple mission. Doing this will give WhatsApp the flexibility to grow and expand, while giving me, Brian, and the rest of our team more time to focus on building a communications service that’s as fast, affordable and personal as possible.

Here’s what will change for you, our users: nothing.

WhatsApp will remain autonomous and operate independently. You can continue to enjoy the service for a nominal fee. You can continue to use WhatsApp no matter where in the world you are, or what smartphone you’re using. And you can still count on absolutely no ads interrupting your communication. There would have been no partnership between our two companies if we had to compromise on the core principles that will always define our company, our vision and our product.

WhatsApp founders remarked once again that its business model would not change toward anything related to third-party ads. Things would start to change in a couple of years.

The freemium growth model

[image error]The freemium is usually a growth and branding strategy rather than a business model. A free service is provided to a majority of users, while a small percentage of those users convert into paying customers through either marketing or sales funnel. The free users not converting in customers help spread the brand.

Once WhatsApp had financial support to keep growing, it started to leverage the freemium model to gain traction even more. As explained on their blog:

That’s why we’re happy to announce that WhatsApp will no longer charge subscription fees. For many years, we’ve asked some people to pay a fee for using WhatsApp after their first year. As we’ve grown, we’ve found that this approach hasn’t worked well. Many WhatsApp users don’t have a debit or credit card number and they worried they’d lose access to their friends and family after their first year. So over the next several weeks, we’ll remove fees from the different versions of our app and WhatsApp will no longer charge you for our service.

Naturally, people might wonder how we plan to keep WhatsApp running without subscription fees and if today’s announcement means we’re introducing third-party ads. The answer is no. Starting this year, we will test tools that allow you to use WhatsApp to communicate with businesses and organizations that you wantto hear from. That could mean communicating with your bank about whether a recent transaction was fraudulent, or with an airline about a delayed flight. We all get these messages elsewhere today – through text messages and phone calls – so we want to test new tools to make this easier to do on WhatsApp, while still giving you an experience without third-party ads and spam.

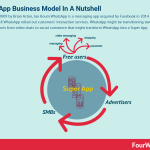

WhatsApp started to focus more on communication between businesses and its users to create a line of products that could be monetized by selling services to companies using WhatsApp features.

Facebook takes over

[image error]The digital advertising industry has become a multi-billion industry dominated by a few key tech players. While the industry advertising dollars are also fragmented across several small players and publishers across the web. Most of it is consolidated within brands like Google, YouTube, Facebook, Instagram, Amazon, Bing, Twitter, and Pinterest.

The time came when Facebook finally started to take advantage of WhatsApp data to sell more of its ads. As reported on the WhatsApp blog:

The updated documents also reflect that we’ve joined Facebook and that we’ve recently rolled out many new features, like end-to-end encryption, WhatsApp Calling, and messaging tools like WhatsApp for web and desktop.

But as we announced earlier this year, we want to explore ways for you to communicate with businesses that matter to you too, while still giving you an experience without third-party banner ads and spam. Whether it’s hearing from your bank about a potentially fraudulent transaction, or getting notified by an airline about a delayed flight, many of us get this information elsewhere, including in text messages and phone calls. We want to test these features in the next several months, but need to update our terms and privacy policy to do so.

That policy change created a set of backlashes that remain as concerns. As pointed out on Facebook financials for 2017:

The Irish Data Protection Commissioner has challenged the legal grounds for transfers of user data to Facebook, Inc., and the Irish High Court has agreed to refer this challenge to the Court of Justice of the European Union for decision. We also face multiple inquiries, investigations, and lawsuits in Europe, India, and other jurisdictions regarding the August 2016 update to WhatsApp’s terms of service and privacy policy and its sharing of certain data with other Facebook products and services, including a lawsuit currently pending before the Supreme Court of India. If one or more of the legal bases for transferring data from Europe to the United States is invalidated, if we are unable to transfer data between and among countries and regions in which we operate, or if we are prohibited from sharing data among our products and services, it could affect the manner in which we provide our services or adversely affect our financial results

It is important to remark that the terms of service changes applied to things like:

Enable you to communicate with businesses on WhatsApp. For example, if you visit a business’s Facebook page, you might see a button that lets you easily open a WhatsApp chat with them.

However, it is undeniable that in 2016 it finally started a process of monetization that revolved around data sharing between WhatsApp and Facebook products.

In 2017 the WhatsApp founders left Facebook and $1.3B in stock options, presumably because desperate to leave the company. As reported by bizjournals, “Jan Koum and Brian Acton have more recently clashed with Facebook CEO Mark Zuckerberg and COO Sheryl Sandberg, and quit the company, leaving hundreds of millions of dollars worth of unvested stock options on the table. Acton, who quit in November 2017, walked away from $900 million in unvested shares, while Koum, who will exit Facebook in August, will leave $400 million in unvested shares, the Wall Street Journal reports.”

Following Cambridge Analytica scandal, in March 2018, Brian Acton also launched a hashtag campaign – #deletefacebook – which in a way backfired on him:

It is time. #deletefacebook

— Brian Acton (@brianacton) March 20, 2018

WhatsApp becomes a solution provider: A quick glance at customers’ interactions management

In August 2018 on its blog, WhatsApp reported the creation of new tools to allow businesses to connect to users which included three kinds of interactions:

Request helpful information

Start a conversation

Get support

In this way, businesses will start paying for certain interactions with users to manage their customers’ interactions.

As reported on the WhatsApp website:

From time to time, a business may use a solution provider to help provide the tools it needs to send and receive messages from you. Businesses rely on these solution providers to store, read and respond to your messages.

The business you’re communicating with has a responsibility to ensure that it handles your messages in accordance with applicable law and its privacy policy. For more information on the provider’s privacy policy, please contact that business directly.

[image error]

While the app is free of charges, some services will be paid. For instance, if a business that uses WhatsApp will reply to a customer later than 24 hours, it will pay a fixed charge based on the country.

As pointed out on theverge.com, “WhatsApp Business lets business owners set up a profile to share company details like their email or store address, and also have access to greetings and away messages to manage interactions with customers (who contact them using the standard WhatsApp client).”

In April 2019, WhatsApp rolled out officially the launch of its WhatsApp business.

Will ads come to WhatsApp?

[image error]Facebook is an attention-based business model. As such, its algorithms condense the attention of over 2.4 billion users as of June 2019. Facebook advertising revenues accounted for $31.9 billion or 98.66% of its total revenues. Facebook Inc. has a product portfolio made of Instagram, Messenger, WhatsApp, and Oculus.

In August 2018, Facebook announced on its blog the WhatsApp Business API:

You can use the WhatsApp Business API to sendcustomised notificationswith relevant, non-promotional content such as shipping confirmations, appointment reminders or event tickets. These messages will be charged at a fixed rate for confirmed delivery.

As Facebook highlighted:

We’ve been testing ways to help people start a WhatsApp chat from ads they see on Facebook.

[image error]

Example of a Facebook Ads prompting a WhatsApp conversation as shown on Facebook Blog, when the company announced this new feature within its ads platform.

However as pressure grew on the Facebook business model, the company announced it would give up, for now, the ads revenue model for WhatsApp (at least for now) as reported by WSJ.

Will WhatsApp ever make meaningful revenues for Facebook?

In the 2019 annual report Facebook highlighted:

We have also invested, and expect to continue to invest, significant resources in growing our WhatsApp and Messenger products to support increasing usage of such products.

And it continued:

We have historically monetized messaging in only a limited fashion, and we may not be successful in our efforts to generate meaningful revenue or profits from messaging over the long term.

If Facebook isn’t planning to monetize WhatsApp directly in the long term. What are the plans and how will it integrate with its overall products in the long run?

A payment platform for Calibra?

As highlighted on the 2019 annual reports:

We also intend to launch certain payments functionality on WhatsApp and have announced plans to develop digital payments products and services, which may subject us to many of the foregoing risks and additional licensing requirements.

As part of this plan, in June 2019, Facebook launched Libra Association, and as part of it, Calibra, a digital wallet for Libra. And WhatsApp together with Messenger, might work as platforms for the launch of Calibra.

Interoperability and products’ integrations

While WhatsApp revenues might not be substantial in terms of direct monetization. WhatsApp is part of the family of products that Facebook Inc. acquired over the years and that made the company able to easily transition from the desktop to the mobile era.

How will the WhatsApp business model look like in the coming years?

In Q1 2020, Mark Zuckerberg highlighted:

Video calling is when you actually ring a person’s phone or computer. It’s by far the most used type of video chat. Between WhatsApp and Messenger, there are more than 700 million daily actives participating in calls. We’re doubling the size of WhatsApp video calls from 4 to 8. This is important because WhatsApp is the most popular end-to-end encrypted calling service, so if you care about privacy and encryption and you want to be able to reach anyone, you’re probably using WhatsApp. Now you’re going to be able to get your whole family or a larger group together on calls.

As the pandemic hit, from a simple chat application, WhatsApp muted more and more into a group video conference for consumers. While this might be the next killer app for WhatsApp to make it as sticky as possible.

Future revenue generation will be about social commerce.

WhatsApp, social commerce, catalogs, and new messaging ad formats

Social commerce will be an integral piece of the WhatsApp business model. Indeed, with payments (integrated between the various Facebook products) and social commerce the WhatsApp business model will take a different shape:

So we’ve started rolling out things like catalogs in WhatsApp. We’re working on payments to be able to complete transactions. And we’ve rolled out a new ad format click to messaging ads, where basically a lot of small businesses and different businesses are finding that their message threads with people perform better for driving sales than their websites or other presences.

How might catalogs be integrated with the Facebook Ads system? Zuckerberg explained it:

They basically buy ads inside Facebook or Instagram that send people to chat threads. And then as we build out all these tools around that — around making those threads more valuable, we think that those ads will only increase in value, which is the way we’re currently thinking about that business.

Why the Facebook-Jio deal is about transforming WhatsApp into a Super App

In April 2020, Facebook acquired a substantial stake in Jio, owned by the Indian conglomerate Reliance Industries.

The deal will create a digital giant in India, able to transform WhatsApp into a Super App. As Zuckerberg highlighted:

In India, with Jio, Jio has had this vision for a while. I want to be careful not to put words in their mouth, but just from what they’ve basically described both to us and publicly, about their Jio Mart vision, is there are millions of small businesses and shops across India, and they want to try to help get them onto a single network that you’ll be able to communicate with through WhatsApp and do payments online through WhatsApp.

Key takeaways

WhatsApp started as an alternative app that could be used to give status updates and messages. It gained traction until it was acquired for $19B by Facebook.

Starting in 2016 WhatsApp changed its terms of service to integrate its services with Facebook business products.

That created some concerns about the data shared between WhatsApp and Facebook. In 2018 both WhatsApp founder presumably left Facebook due to conflicts with Mark Zuckerberg.

In 2018, WhatsApp launched a new service that allowed businesses to reply to customer support requests for free for the first 24 hours. After that, the company would be charged.

In 2020, WhatsApp is transitioning toward video chats and business catalogs. In addition, payment functionalities might be added to the product. This will potentially give businesses the ability to communicate with potential customers with new ad messaging formats.

In addition, in 2020, Facebook is acquiring the social platform Jio, with the objective of presumably transforming WhatsApp into the first western Super App.

Other handpicked related business models:

What Is a Business Model? 30 Successful Types of Business Models You Need to Know

What Is a Business Model Canvas? Business Model Canvas Explained

The Power of Google Business Model in a Nutshell

How Does Google Make Money? It’s Not Just Advertising!

How Does PayPal Make Money? The PayPal Mafia Business Model Explained

How Does WhatsApp Make Money? WhatsApp Business Model Explained

How Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

The Google of China: Baidu Business Model In A Nutshell

How Does Twitter Make Money? Twitter Business Model In A Nutshell

How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

The post How Does WhatsApp Make Money? Why WhatsApp Will Become A Super App appeared first on FourWeekMBA.

April 29, 2020

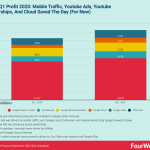

Google Q1 Profit 2020: Mobile Traffic, Youtube Ads, Youtube Memberships, And Cloud Saved The Day (For Now)

Google Ads was driven by mobile traffic, yet changed users’ behaviors and reduced advertising budget slowed it down: The overall growth Q1 was primarily driven by increases in search queries (given the increased user adoption and usage during COVID-19) especially on mobile devices, growth in advertiser activity, and improvements in ad formats and delivery. Revenue declined in March driven by a change in behaviors of users, shifted to less commercial topics, and reduced advertisers’ spending. YouTube Ads was driven by brand advertising: Growth was driven by the direct response and brand advertising products, thanks to improved ad formats and delivery and increased advertiser spending. March was slower due to the impact of COVID-19.Network members’ revenues were driven by AdMob: The mobile platform AdMob primarily drove revenue grown nonetheless the decline in revenues in March due to COVID-19.GPC drove Google Cloud revenues: Google Cloud, primarily comprises of Google Cloud Platform (“GCP”) made of infrastructure, data, analytics, and other services; G Suite productivity tools; and other enterprise cloud services. The growth was primarily driven by continued strength in our GCP and G Suite offerings. Google’s other revenues were primarily driven by YouTube subscriptions and Google Play

What’s happening next?

Google core business model is primarily driven by advertising, therefore:

We might see the further impact of the pandemic on Q2 financialsThe data so far confirms increased traffic and searches, yet also reduced advertisers’ spending and changed users’ behaviors (queries might be less commercial)That is why Google has announced aggressive cuts to its marketing budget to focus on strategic activitiesIt has also announced the opening of its Google Shopping to (to prevent users to fly on other e-commerce platforms and to prevent to lose the forced e-commerce wave we’re living)

Read next:

Google Vs. Amazon: The Latest Move For World DominationThird-Party Sellers And Amazon’s Platform-First Business, Will It Last?

Learn more:

Google Business ModelHow Does Google Make Money? Hidden Revenue Generation

The post Google Q1 Profit 2020: Mobile Traffic, Youtube Ads, Youtube Memberships, And Cloud Saved The Day (For Now) appeared first on FourWeekMBA.

April 28, 2020

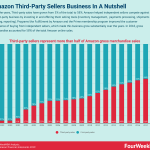

Third-Party Sellers And Amazon’s Platform-First Business, Will It Last?

A platform business model is one of the most interesting models arose throughout the web era. Some of the components that make platform business models interesting are their scalability and the fact those platforms can leverage network effects and flywheel models to gain traction.

[image error]A platform business model generates value by enabling interactions between people, groups, and users by leveraging network effects. Platform business models usually comprise two sides: supply and demand. Kicking off the interactions between those two sides is one of the crucial elements for a platform business model success.

When can we call a business model a platform?

[image error]A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.

To answer this question we can look at the Amazon case study and how it transitioned over the years from e-commerce to a platform-first business model.

And how that platform business spurred the growth of other business units (AWS, advertising, third-party services, Prime) who might have not been possible without a solid platform business in the first place, and it all starts with building up critical mass to enable network effects.

Amazon platform-first business today

[image error]

In 2018, independent third-party sellers (mostly small– and medium-sized businesses) sold 58% of the merchandise on the Amazon platform.

Opposed to Amazon retail’s own first-party sales with the remaining 42%. As Amazon has put it “Third-party sellers are kicking our first-party butt. Badly.“

What are some elements to take into account to understand how Amazon transitioned toward a platform-first business model?

Amazon selling tools and the power of free tools

Amazon favored the transition toward a platform business model by building the selling tools (inventory management, processing payments, tracking shipments, reports) which made Amazon‘s website, not just e-commerce where they could distribute their product, but a management system they could rely on.

Fulfillment, Prime and the flywheel effect

When launching a platform business model that relies on third-party sellers, there are two major issues (among others).

First, you can’t guarantee the quality of the service (in this case delivery) if you don’t control the process.

Second, in the long-run, it becomes hard to have loyal customers, as transaction costs might make the repeat purchase not convenient to those shoppers, thus making a digital platform lose its initial competitive advantage over physical pairs.

How did Amazon, over the years, face those issues?

After many trials and errors, two programs in combination helped Amazon transition toward a successful platform model.

Fulfillment by Amazon and Prime in combination substantially improved the customer experience of buying from independent sellers, thus spinning the Amazon flywheel.

[image error]

As Amazon highlighted in its 2018 shareholders’ letter, at the time it was not an easy decision to make, as both programs implied huge investment and financial risks and those went through many internal debates and discussions, so at the time their success was not given for granted.

As explained in Amazon leadership principles, and how Jeff Bezos made decisions at the time, the Amazon leadership team used “intuition and heart, nourished with optimism” to make such a decision, which in hindsight seems almost trivial.

Will Amazon keep its platform business model as it is?

A platform business model was extremely effective to help Amazon scaling up in an era where the web was still an early-stage ecosystem.

Thus, a platform business back then (the late 1990s) up to the 2010s has proved an incredible model for traction, scale, and domination.

Whether Amazon will keep its platform as primarily serving third-party sellers we can’t know for sure.

For instance, Amazon might be able to revert this process by internalizing more brands.

In fact, as third-party sellers provided over the years incredible data about what people want, Amazon, in theory, has the power to have those items manufactured and sold with Amazon’s brand, thus increasing again the portion of first-party products.

Will this happen in the coming years? We’ll see.

Is a platform business model still the most viable solution today?

We’re living in an era where arising competition on the web, its growing maturity, and penetration to the whole world, have also changed the whole digital business landscape.

Building a platform business today might not be an easy option as the consolidated platforms (Google, Amazon, Apple, Facebook, and a few other brands) are acting as winners who took it all, thus locking-in distribution pipelines with their algorithms, and working as gatekeepers.

In this scenario, building up a successful platform business might have become a risky option, initially.

Thus, a cheaper option is to bootstrap the business to product-market fit first, then evaluate whether a platform business helps better serve existing customers, and at the same time expand the customer base.

In the end, Amazon itself took years to transition to a full-fledged platform business.

Will Amazon convert in a private label platform?

The list of Amazon-owned labels and brands grows. As Amazon is both the gatekeeper and the owner of those brands, concerns arise about the ability of the platform to be neutral toward third-party sellers.

The list of Amazon-owned labels and brands grows. As Amazon is both the gatekeeper and the owner of those brands, concerns arise about the ability of the platform to be neutral toward third-party sellers.As a platform business model, a lot of value is in the data and knowledge acquired by the platform over the years.

As Amazon has grown as a platform over the years, it has become tempting to make its own brands prevail on the platform. Yet, Amazon’s mission is also about price, convenience and variety.

Therefore, we could argue that the third-party sellers’ ecosystem is what made Amazon successful. Thus, the balance to keep the platform successful is also about making this ecosystem survive.

The balance is tricky and can be broken easily. That can put Amazon in a difficult position. First, because third-party sellers might migrate on other platforms that do not have interests (for now) in owning brands because it’s not their core business model (see the Google move in opening its Shopping Platform).

Second, regulators might decide to break up the platform from the brands. Just like in telecommunication, if you own the pipeline, you can’t sell the product, unless of course, those are two separate businesses. Amazon as a platform might become a separate entity compared to Amazon as a set of owned brands.

Why then Amazon is pushing on its private labels over the years? As a platform grows into an established brand, it becomes a key element of its long-term success the ability to be recognized as such.

Some elements that make this strategy appealing to Amazon are:

Control: as a company grows into an established brand, the risk of doing business is much much greater. This requires more control over the products offered, trying to craft an end-to-end experience (other former platforms turned gatekeepers are becoming brands). In short, part of the attempt of Amazon to offer its own products is legitimate as the company can guarantee higher quality standards (from sourcing to delivery).Margins: it’s also financially attractive to have owned brands, as Amazon can gain higher margins, while still practicing a low-price, as there is no revenue split with third-party sellers. Branding: being successful in the long-run for a company tied to a consumer’s business is also about making sure its brand can be recognized. Amazon brands, like Amazon Basics, has become a whole category of products going from home to office and travel. And this makes people more and more aware of Amazon, not just as the place where they can find pretty much anything, but also as a brand that fills their homes with useful objects in their daily lives.

[image error]

Key takeaways

Amazon converted into a platform business model over the years by incentivizing third-party sellers to join the platforms. This helped Amazon achieve it mission to offer a wide variety of products at a low price. As Amazon has grown into a platform business model, it has also developed a set of related services that pushed even more third-party sellers to join the platform.By growing, Amazon has also become the gatekeeper between consumers and small businesses featuring their products on the platform. And over the years, Amazon has expanded its brands. The question remains open on whether Amazon will keep its brands limited, or it will expand them further. Yet, this raises the question of Amazon’s neutrality as a platform and opens up potential breakups. On the other end, it becomes attractive for Amazon to expand its own brands because that gives it more control, distribution, margins and brand recognition.The balance is tricky as the ecosystem of third-party sellers which made Amazon successful in the first place might also help it break up if those third-party sellers would move en masse on other e-commerce (neutral) platforms and if regulators might think it’s time to break Amazon’s in two businesses (platform & private brands).

References: Amazon Financial Statements and Amazon Shareholders’ Letters

Read next:

Amazon Business ModelWhat Is the Receivables Turnover Ratio? How Amazon Receivables Management Helps Its Explosive GrowthAmazon Case Study: Why from Product to Subscription You Need to “Swallow the Fish”What Is Cash Conversion Cycle? Amazon Cash Machine Business Model ExplainedWhy Is AWS so Important for Amazon Future Business Growth?Amazon Flywheel: Amazon Virtuous Cycle In A NutshellAmazon Value Proposition In A NutshellWhy Amazon Is Doubling Down On AWSThe Economics Of The Amazon Seller Business In A NutshellHow Much Is Amazon Advertising Business Worth?What Is the Cost per First Stream Metric? Amazon Prime Video Revenue Model ExplainedJeff Bezos Teaches You When Judgment Is Better Than Math And DataAlibaba vs. Amazon Compared in a Single InfographicAmazon Mission Statement and Vision Statement In A Nutshell

Related resources:

What Is a Business Model? 30 Successful Types of Business Models You Need to KnowBlitzscaling Business Model Innovation Canvas In A NutshellWhat Is a Value Proposition? Value Proposition Canvas ExplainedWhat Is a Lean Startup Canvas? Lean Startup Canvas ExplainedThe Rise of the Subscription EconomyThe Era Of Paywalls: How To Build A Subscription Business For Your Media OutletWhat Is Business Model Innovation And Why It MattersWhat Is Blitzscaling And Why It Matters

The post Third-Party Sellers And Amazon’s Platform-First Business, Will It Last? appeared first on FourWeekMBA.

April 25, 2020

FourWeekMBA Tool Review: The Meister Suite

The Meister Suite is a set of web-based collaboration tools designed to make teamwork fun. This year, I’m partnering with Meister, the German software company that develops these tools, because I’ve first got to know them when I was looking for ways to order my ideas visually.

Their MindMeister tool helped me to sketch business models visually.

MindMapping is an extremely helpful way to clarify your ideas, and MindMeister provides a great tool that simplifies your thinking process, and as we’ll see you can also share your thoughts easily with others.

Meister currently offers two software tools, both of which use the freemium business model:

MindMeister , an online mind mapping tool that allows for real-time collaboration between multiple users. MeisterTask , a collaborative task management tool using the Kanban format and smart automation to help teams work together more efficiently.

A closer look at MindMeister

MindMeister launched in 2007 (see the full story here) as the very first completely web-based mind mapping app on the market. The app quickly went viral due to a number of factors, including:

The freemium business model: Users were (and still are) able to create a free account with limited storage and features for their maps.Easy sharing: MindMeister allows users to share their maps via email or link for easy collaboration. User-generated content: Users are able to make their maps public, share them on social media, and embed them on their own websites.Affiliate marketing: The company has built a successful affiliate system with cash commissions for referrals.

By now, the app is used by more than 12 million people worldwide and continues to grow rapidly, partly due to the increased demand in remote work and learning.

Features and uses

Aside from MindMeister’s web-app, which can be accessed through any standard web browser, the tool offers native mobile apps for iOS and Android, allowing users to work on their maps wherever they are. Meister puts a lot of focus on the app’s user interface with the aim to make the mapping process as easy and intuitive as possible.

As opposed to paper mind maps, users can enrich their creations with dynamic content such as gifs, videos, and links, turning them into rich knowledge maps. The app also offers a built-in presentation mode which lets users turn their mind maps into slideshows with a few clicks.

Aside from brainstorming, note-taking, and outlining things like strategies and business models, the app is mainly used for project planning.

According to Meister’s founders, this was one of the reasons they decided to develop their second tool, MeisterTask. Many users left MindMeister after their project planning phase was completed, as they needed a more sophisticated project management tool to turn their plans into action.

To create a seamless transition between the tools, the company built an integration, allowing users to turn their mapped ideas directly into tasks and export them to their project boards.

The integration helped MeisterTask gain exposure after its launch in 2015, as the company was able to market it directly to its existing user base as an extension of MindMeister’s functionality.

A closer look at MeisterTask

MeisterTask was released in 2015 and entered a highly competitive market already filled with dozens of task management tools. Unlike MindMeister, the app didn’t have the advantage of being the first in its niche.

Additionally, MeisterTask lacked some of the other features that helped MindMeister go viral, such as the user-generated content and affiliate program (although they do offer one now).

In spite of this, MeisterTask can now be found in the top ten lists of task management apps across the web and is growing at a healthy speed.

The founders attribute this to their tested recipe of simplicity, usability, and a beautiful design.

Unlike most of its competitors, the app specifically targets companies who are in the beginning stages of their digital transformation and are looking for simple tools that don’t require a lot of training to get started with.

Features and uses

Just like MindMeister, MeisterTask can be used directly in the browser and offers mobile apps for working on the go. Collaboration happens in shared Kanban boards, which provide project members with a simple, visual platform to track tasks through to completion and discuss questions and issues as they arise.

Although designed for teamwork, the tool is also widely used for personal organization and offers a dedicated space, called Agenda, for users to create their own perfect workflow.

Users are able to ‘pin’ tasks from any project they are involved in their Agenda, to keep track of their personal to-dos and any other tasks that might be relevant to them.

To increase efficiency and minimize mistakes, MeisterTask also lets users automate recurring steps in their workflow — both inside the app and through integrations with other software tools.

I’m happy to partner with Meister this year and highlight some of the ways their tools can be helpful to the FourWeekMBA audience with the development of a set of contents (from how-to articles, startup stories where they help you understand the challenges of growing a digital business and tool reviews to help you understand how you can use those tools to grow your own business).

You can take a look at my recent article on how to use mind maps to sketch a business model, and the in-depth interview with Michael Hollauf and Till Vollmer, Meister’s founders, which lessons are extremely valuable to anyone who is building or growing a digital business, or a SaaS company.

The post FourWeekMBA Tool Review: The Meister Suite appeared first on FourWeekMBA.

How To Build A Successful SaaS Business Model With MeisterTask Founders

In this interview, Michael Hollauf, co-founder of MeisterTask and MindMeister, explains the process and the story behind a SaaS company close to €10 Million in ARR. The struggles, processes, and lessons learned over the years of a journey started in 2006.

Meister, the German software company that develops these tools is a FourWeekMBA 2020 parter, and with them, we explore their journey. As we’ll see there are several lessons that founders or other business people can learn from this story!

[image error]Michael Hollauf, co-founder of Meister is telling us the story behind the company making about €10 Million in ARR as of 2020.

Meister’s mission is to “inspire creativity in business, education, and daily life by developing the most innovative and easy to use software tools.”

The first tool you launched to execute your mission was MindMeister, which has become a world-leading mind mapping solution.

Was there any specific problem you had experienced yourself?

Yes, actually we were trying to fulfil a need that both Till Vollmer, the other co-founder of MindMeister, and I had at work. In 2006, we were working together at a tech company and using a tool called MindManager. It was the only real mind mapping software at the time, and we used it to brainstorm products, organize meetings and conduct presentations with customers.

MindManager was a useful tool but it had some limitations. It was a standard, locally-installed OS-dependent program, licensed for about $300.

That meant that we couldn’t share our mind maps with anyone who didn’t purchase and install the program. Even if you could share, you couldn’t collaborate, which we saw as crucial for a brainstorming tool.

Around that time, Google announced that they were acquiring a company called Writely. They turned it into what is now Google Docs, which we immediately started using to collaborate on work projects.

So, between using this great, new, collaborative word-processing tool, Google Docs, and the static, install-only mind mapping tool, MindManager, we wondered if we couldn’t get the best of both worlds: a collaborative, web-based, mind mapping tool. That was the genesis of MindMeister.

How did you decide whether to raise capital or bootstrap your company?

Till and I were running a small outsourcing company in Romania when we decided to start working on the prototype for MindMeister. Since we were making good money with the outsourcing business, we decided to cross-fund MindMeister with that profit.

But after a year we felt the need to put more resources into MindMeister’s development. And we knew we wouldn’t be able to do that if we only kept it as a side project to the outsourcing company. We saw a real opportunity with MindMeister and knew it could take off if we devoted time and people to it.

So, we decided to take an angel investment of US $600,000 to accelerate development and rollout. This is the only investment we ever took. Soon after, we started making a profit.

Today we are close to 10 Million ARR and doing very well. We do still consider what we would be able to do with another investment round and how much we could achieve with it. So, it’s still in the back of our minds.

What traction model did you use in the early days? In short, how did you manage to grow?

In the very beginning, we sent 200 invitations to friends and business contacts. We thought they might be interested in a web-based mind mapping solution, and we were right. They loved it and spread the word. One of those first users posted a review on Delicious, which was the equivalent of Product Hunt at that time. The review made it to the front page and soon people were writing to us, asking to be invited.

By the time we made it to the product launch on February 7, 2007, 1,000 people were already using MindMeister. With the release of the beta version to the public, that number shot up to 10,000 users.

The number of users grew even faster once the invite-only phase came to an end. At that time, MindMeister was completely free, but we had a payment option built-in. We told users that someday we would start charging, but that they could use it for free until then.

There were a number of factors that helped us grow over the following years. We created an Affiliate program, which encouraged users to spread the word about us online.

We also created an option for people to publish their mind maps, and share them on social media or embed them on their own websites (although the latter caused some significant trouble for us when Google suddenly decided to penalize the backlinks created by embedded maps).

Aside from all this, we’ve always put a lot of effort into making sure that we’re discoverable, both through SEO and, of course, paid ads.

What challenges did you have in the first growth stages?

Our first big challenge was one that sticks with us even today: getting our users to trust in the safety of the cloud.

Mind maps by nature contain intellectual property in the form of ideas and thoughts.

And, of course, those should be protected! That’s why I think this issue is so prominent for us and why we give such importance to our security at MindMeister.

Do you think using a freemium model was a key growth driver?

Absolutely. The freemium model lowers the entry barrier for potential users, and those who never turn into paying customers still help us grow by recommending us to friends and colleagues. Of course, the freemium model also comes with certain difficulties and drawbacks. For example, many sales and marketing automation tools, which would help us work more efficiently, only offer pricing plans based on the number of users i.e. leads you want to manage with them. Since we have millions of users, but only a small percentage of them generates revenue for us, the cost of such tools is often too high.

What business model frameworks (if any) do you use to review your company’s growth?

To be honest, I just had to Google “Business Model Framework.” I guess that says it all! No, we don’t use any — the closest thing we’ve done is introduce the OKR system this year. We’re using it to manage our goals and align the entire company towards them.

In terms of product development, is there any specific framework that proved effective for your organization?

Like many SaaS startups, we started out as an agile company. Not necessarily because we knew so much about the framework and its benefits, but because it suited the way we worked: no specs, try something out and test it, and, if not, iterate.

The bigger we got, the more we started to work with specs, use cases, and things like that. These days I’m not sure if we could really call ourselves agile anymore.

We still work in two-week sprints though, our other product, MeisterTask, uses the Kanban methodology, and we use some elements of SCRUM as well.

And what about the team management, is there a specific framework that helps you scale?

Probably the aforementioned OKR system.

[image error]Andy Grove, helped Intel become among the most valuable companies by 1997. In his years at Intel, he conceived a management and goal-setting system, called OKR, standing for “objectives and key results.” Venture capitalist and early investor in Google, John Doerr, systematized in the book “Measure What Matters.”

We’re just two quarters into using it but it seems to already be paying off.

It’s a lot of management work but we can see that the different teams are much more focused on our quarterly objectives, and it’s clear to everyone what the priorities are.

How do you see your business model evolving?

We’re constantly thinking about trying out slight adaptations of the business model, such as allowing trials, or at least trials of some larger paid features.

We might even give full premium plans with a 14-30 day free trial.

I don’t see that happening in the near future though because it is a big change that could have drastic effects on business. While we do need to tread carefully, we’re always open to new ideas.

Some key Lessons

From the interview, there are many lessons, that thanks to Michael Hollauf and Till Vollmer, we can learn. They had to go through an iterative process since 2007, and this article shows how hard it’s to grow a SaaS business from scratch.

Some key points are:

Growth and traction at a certain stage require focus, and having capital allocated for product development and growth might make a big difference. Initially, MindMeister followed a gradual rollout. Where the product was first released to a closed group of 200 contacts. Then it grew to ten thousand users and it kept opening up to larger groups of users. This enabled the company to gather feedback gradually, and also understand how to make the product and platform more scalable as they grew.SEO was also an important channel for growth and distribution. And MindMeister had found an extremely smart way to build backlinks from free users who were using the embedding feature. As we’ll see though, the reliance on a single growth channel makes sense to build initial traction. But it can be risky in the long term.As I stressed here, freemium is an effective growth tool (as we’ll see not necessarily a great revenue generation strategy) and the growth of the user base is the first step toward building a viable business model. As Google changed its algorithms, it also demolished MindMeister’s digital distribution from one day to the next. From there a solid backup plan is to have a direct channel of communication with your core user base.The tool also gained traction with a freemium model but the freemium model also becomes expensive to maintain over time, as it’s complex to build a solid funnel on top of it. So when implementing a growth strategy, make sure also to take into account alternatives to the freemium model. Building a repeatable funnel where free users are converted into paying customers can be tricky. Companies like Slack also have a whole sales force dedicated to turning qualified free accounts in potential enterprise accounts. Michael Hollauf and Till Vollmer didn’t use any particular business model framework, they started from a problem they knew it needed to be solved. From there they started to add a building block at the time. So it’s not about the framework you use, rather the process and the speed of learning.Systems like OKR, at a certain stage, can be useful to achieve further scale, as they align the team around a few ambitious goals.

More handpicked resources:

Business Model InnovationBusiness ModelsDigital Business ModelsBusiness StrategyValue PropositionMarketing Strategy

The post How To Build A Successful SaaS Business Model With MeisterTask Founders appeared first on FourWeekMBA.

April 24, 2020

Business Innovation To Reinvent Your Business Model In Time Of Pandemic

Business innovation is about creating new opportunities for an organization to reinvent its core offerings, revenue streams, and enhance the value proposition for existing or new customers, thus renewing its whole business model. Business innovation springs by understanding the structure of the market, thus adapting or anticipating those changes.

Business vs. technological innovation

The primary misunderstanding about business innovation, which leads to inaction is believing that reinventing or innovating your business starts from technical implementations.

Innovating in business means redefining value for your existing customers to understand how to enhance it. Or determining what new value can be delivered to new customers with similar needs. Or yet, defining a whole new set of values to be delivered to a new customer base.

We can start the process by mapping our business boundaries.

Define the value customers get and your business boundaries

In order for you to redefine and innovate, you need to understansd first the current value your provide.

For instance, if you have a barbershop, are people just coming to you to cut their beards? Not really, many of those people might come to you for several reasons:

They want to look goodThe place is near to their homeThe environment is good They like to talk to you

Based on the reasons above you can develop a whole offering of services and products. For instance, if you’re just cutting hair, why not sell some of the products you select to your customer base?

Understanding the needs of your customers help you structure an offering:

Sell-related products Add-on offerings for related services Simple offering with a flat feeSubscription-service kit with curated products

Within and beyond your business boundaries

By setting the boundaries of your business and existing customer base, you can also define those experiments that would provide further value and enable your business to transform.

This also means being able to experiment with:

Providing more value to existing customers with an expanded offeringCreate a whole new product for an existing customer baseTweak an existing product to serve new customersOr build a whole new product for a new customer base

Let’s see now some case studies and examples from how companies are reinventing or surviving difficult times.

Redefining value: case studies

[image error]A value proposition is about how you create value for customers. While many entrepreneurial theories draw from customers’ problems and pain points, value can also be created via demand generation, which is about enabling people to identify with your brand, thus generating demand for your products and services.

Google content hub

[image error]When you type “COVID” on Google you will find a whole content hub, which gives local news about the virus. Official national news. And also official medical advice on symptoms. Google transformed the whole intent-based search around COVID in a separate platform to help people deal with this crisis.

In some cases, a tweak of an existing product or platform can provide much more value to the existing user base. In the case above, Google has built a temporary platform on top of its search capabilities.

Airbnb virtual experiences

[image error]The new Online Host Experience by Airbnb

Airbnb is experimenting with a new form of experience on the platform. By leveraging on its existing base of hosts, the company is inviting existing and new hosts to structure their online, and virtual experiences on the platform.

Uber’s work hub

[image error]How Uber leveraged its platform trying to support or perhaps engage the community of drivers which is a core element of Uber’s platform success (source: uber.com/blog/work-hub/)

As highlighted on Uber’s website “Uber Works, connects people to shift work like food production, warehouse, and customer service in Chicago, Dallas, and Miami.“

Uber is experimenting with this program to sustain its drivers’ user base.

Beachwear making masks

[image error]How several brands are converting their production of beachwear into fashion face masks (source: hedleyandbennett.com/pages/wakeupandf...)

In some cases, you don’t need to reconvert the whole business model to make it survive in difficult times. All you need is to levarage on the existing capabilities of the business to come up with a product that people need.

That is how many beachwear fashion brands are converting their products into fashionable face masks, which will help the conversion of the business, while incentivizing people to wear masks.

From cars to ventilators

Car companies, from Tesla, to GM and Ford are reconverting part of their facilities to manufacture ventilators.

Car companies or companies, in general, are converting existing facilities to produce something in high demand right now.

From restaurant parking lot to drive-in cinema

What used to be the most valuable area of the business (the eating area) is becoming less so for many restaurant businesses.

Indeed, many restaurants around the world are figuring that their parking lot, indeed, can be used as a new business unit.

And in some cases, restaurants are partnering up with Cinemas to create a new experience, where people can drive in with their cars and watch shows in the parking lot. Here an interesting case study.

From valet service to drive-in click and collect

Where the business cannot be run physically, why don’t you convert that digitally? That is what some valet services are doing by introducing drive-through click and collect services.

3D printing COVID equipment

Decentralized manufacturing might become among the most important commercial use cases in an era where travel is restricted. That is why 3D printing companies are pushing to produce equipment needed during these times.

From co-working to virtual co-working

Co-working spaces are among the most hit by this crisis, and it’s hard to understand at this stage how to convert a business heavily invested in real estate to virtual, or semi-virtual.

It’s fundamental to ask “what value can we provide?” and redefine the services they offer.

People, like Seth Godin, are already experimenting with this new format with the launch of the Akimbo Virtual Coworking.

Now a service that might be offered for free, it might be leveraged by co-working companies to redefine their businesses.

From stage to virtual concerts

The Group called Real Estate launched Quarantour, a way for people to experience a sort of virtual music tour from the band on their phones.

From hotel rooms to quarantine rooms

Many Hotels are utilizing their spaces to accomodate people for quarantine. With restrictions in place, and people not ready to travel, hotel businesses are reorganizing their spaces to support the crisis.

From WFH to hotel rooms as offices

As working from home for many is impossible due to several reasons (small home, crowded family, too many children around) hotel rooms might become a sort of productivity heaven. Thus, some hotels might reorganize to offer those rooms as an alternative to offices.

So we move from co-working to hotel rooms as offices.

From influencers to infludancers

As the Chinese app TikTok, owned by ByteDance, gains traction. More and more people join in. And in this era of forced isolation, people rather than spending time to rethink their lives, spend time crafting from basic to advanced dances, which are very popular memes on the platform.

As those “infludancers” gain more and more attention, they might make the past made of influencers look something of the past. And they are figuring how to monetize the attention gained on this highly contagious platform.

Macrotrends

What macrotrends is this scenario pusring forward? For sure, that is acceleraging the development of industries that otherwise would have taken still years to develop.

Some of these areas go from e-commerce to blockchain and crypto.

E-commerce and forced digitalization

As we help thousands of businesses to move online, our platform is now handling Black Friday level traffic every day!

It won’t be long before traffic has doubled or more.

Our merchants aren’t stopping, neither are we. We need

April 22, 2020

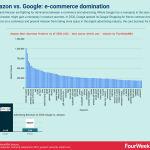

Google Vs. Amazon: The Latest Move For World Domination

Google and Amazon are fighting for dominance between e-commerce and advertising. Where Google has a monopoly in the search market. Amazon might gain a monopoly in product searches. In 2020, Google opened its Google Shopping for free to contrast Amazon’s dominance on e-commerce and prevent Amazon from taking more space in the digital advertising industry, the core business for Google.

Yesterday Google dropped one of the most important business announcements of the latest years, which shook the whole digital business industry!

In short, for the first time, in light of the COVID emergency, Google is opening up its Google Shopping Tab to all the merchants who will want to take part.

As highlighted, “we’re advancing our plans to make it free for merchants to sell on Google. Beginning next week, search results on the Google Shopping tab will consist primarily of free listings, helping merchants better connect with consumers, regardless of whether they advertise on Google.”

Why is this such a big deal?

[image error]Source Google: how the Google Shopping tab looks like.

It can have a big impact on those retailers able to be featured there. And it’s another move of Google inside another vertical. Where in the last two decades Google worked primarily as search engine sending traffic to other platforms able to give a better experience on those verticals. Yet Google is now making big moves from Travel to e-commerce to control the whole end-to-end experience for users, who in turn get all they need in one place.

Before, you could get featured in the Google Shopping tab only if you paid to be featured there. Instead, right now, Google is enabling everyone to be listed, assuming they know how to rank their products.

So why did Google make this move?

Of course, let’s give Google some credit for helping small businesses.

But beyond that, we know there are several business reasons for that.

Opening up the Google Shopping tab to everyone means a boost in the availability of content with high commercial intent. In short, Google will want to contrast Amazon’s domination.

Where Amazon has also become a significant player in the digital advertising space, that threatens Google‘s core business model.

And for years, Google has been sending free traffic to Amazon just because it lacked a free organic product listing that could compete with that.

[image error]Amazon vs. Google traffic comparison, by SimilarWeb. Where Amazon is still small compared to Google in terms of total traffic. Most of the traffic on the platform has a high commercial value (meaning people look for products not information). That means Amazon has still a lot of space to grow and get more of the digital advertising cake, which is Google’s primary business model.

In short, if you hadn’t realized, this is just the next move in the massive war going on between Google and Amazon for world domination!

What’s next?

For retailers, this change means free exposure to millions of people who come to Google every day for their shopping needs. For shoppers, it means more products from more stores, discoverable through the Google Shopping tab. For advertisers, this means paid campaigns can now be augmented with free listings. If you’re an existing user of Merchant Center and Shopping ads, you don’t have to do anything to take advantage of the free listings, and for new users of Merchant Center, we’ll continue working to streamline the onboarding process over the coming weeks and months.

For Google to be able to funnel its users ad cover the end-to-end journey has become a necessity.

The current business landscape isn’t fragmented as it used to be. Instead, we have a few tech players trying to do it all. In this scenario, those – once startups – have now become the incumbents.

And business strategy becomes a place where boundaries are blurred.

Read next:

Amazon Business ModelGoogle Business Model

Resources:

Business Model InnovationBusiness ModelsDigital Business ModelsBusiness StrategyValue PropositionMarketing Strategy

The post Google Vs. Amazon: The Latest Move For World Domination appeared first on FourWeekMBA.

April 21, 2020

Free Finance Course By FourWeekMBA

In this course you will learn the basics of financial analysis. And at the end you have an index to follow that leads to our financial ratio complete guide.

Why Ratio Analysis?Financial Ratio Analysis and interpretationKey financial ratiosTypes of financial ratiosWhat is liquidity?What are the main liquidity ratios?Current RatioQuick Ratio (Acid or Liquid Test)Absolute RatioWhat is profitability?What are the main profitability ratios?Gross Profit MarginOperating Profit MarginReturn on capital employedReturn on EquityWhat is Solvency?What are the main solvency ratios?Debt to equity ratioInterest Coverage RatioDebt to Assets RatioWhat is efficiency?What are the main efficiency ratios?Inventory TurnoverAccounts Receivable Turnover or collection periodAccounts Payable Turnover RatioWhat is valuation?What are the main valuation ratios?Earnings Per SharePrice/Earnings RatioDividend YieldPayout RatioHow, why and when to use financial ratios What is a financial ratio?What are the different financial ratios?What are the most important financial ratios?

The post Free Finance Course By FourWeekMBA appeared first on FourWeekMBA.

The Free Business Course By FourWeekMBA

In this course, you will learn basic to advanced concepts related to business modeling, and how digital businesses work. You will also learn how to analyze those businesses.

Premium Business Course: Business Model Innovation Flagship Course.

Lecture One: Understanding Business Models

[image error]A business model is a framework for finding a systematic way to unlock long-term value for an organization while delivering value to customers and capturing value through monetization strategies. A business model is a holistic framework to understand, design, and test your business assumptions in the marketplace.

Lecture Two: Inside Platform Business Models

[image error]A platform business model generates value by enabling interactions between people, groups, and users by leveraging network effects. Platform business models usually comprise two sides: supply and demand. Kicking off the interactions between those two sides is one of the crucial elements for a platform business model success.

Lecture Three: Inside The Tech Giants Business Models

[image error]FAANG is an acronym that comprises the hottest tech companies’ stocks in 2019. Those are Facebook, Amazon, Apple, Netflix and Alphabet’s Google. The term was coined by Jim Cramer, former hedge fund manager and host of CNBC’s Mad Money and founder of the publication TheStreet.

Lecture Four: A Deeper Look At Google Business Model

[image error]Google has a diversified business model, primarily making money via its advertising networks that, in 2019, generated over 83% of its revenues, which also comprise YouTube Ads. Other revenue streams include Google Cloud, Hardware, Google Playstore, and YouTube Premium content. In 2019 Google made over $161 billion in total revenues.

Lecture Five: A Deeper Look At Amazon Business Model

[image error]Amazon runs a platform business model as a core model with several business units within. Some units, like Prime and the Advertising business, are highly tied to the e-commerce platform. For instance, Prime helps Amazon reward repeat customers, thus enhancing its platform business. Other units, like AWS, helped improve Amazon’s tech infrastructure.

Lecture Six: A Deeper Look At Apple Business Model

[image error]Apple is a product-based company fueled by platform business models (like Apple Store), in which sales still primarily come from the iPhone. However, the company has also transitioned toward a service company (with Apple Store, iTunes now called Apple Music) and as a wearable product company, which is the fastest-growing segment.

Lecture Seven: How Has Strategy Changed?

[image error]A business strategy is a deliberate plan that helps a business to achieve a long-term vision and mission by drafting a business model to execute that business strategy. A business strategy, in most cases, doesn’t follow a linear path, and execution will help shape it along the way.

Lecture Eight: Quick Glance At Apple’s Distribution Model

[image error]

Lecture Nine: How Do You Select Comparable Companies

[image error]A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company. To find comparables you can look at two key profiles: the business and financial profile. From the comparable company analysis it is possible to understand the competitive landscape of the target organization.

Lecture Ten: How Do You Analyze Financial Statements

[image error]In corporate finance, the financial structure is how corporations finance their assets (usually either through debt or equity). For the sake of reverse engineering businesses, we want to look at three critical elements to determine the model used to sustain its assets: cost structure, profitability, and cash flow generation.

Handpicked related resources:

Business Model InnovationBusiness ModelsDigital Business ModelsBusiness StrategyValue PropositionMarketing Strategy

The post The Free Business Course By FourWeekMBA appeared first on FourWeekMBA.