Gennaro Cuofano's Blog, page 208

April 19, 2020

What Is Innovation? Types Of Innovation And A Historical Perspective

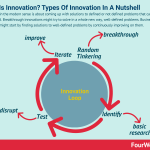

Innovation in the modern sense is about coming up with solutions to defined or not defined problems that can create a new world. Breakthrough innovations might try to solve in a whole new way, well-defined problems. Business innovation might start by finding solutions to well-defined problems by continuously improving on them.

Innovators as heroes of our times

Innovation is at the center of the debate in many endeavors. From business to medicine, and politics. In any of those fields, you will listen to the interviewed experts emphasizing how “innovation” led to the evolution of the field.

As you will learn, innovation became an integral part of today’s public dialogue, and it acquired a positive meaning only in modern times. Indeed, during the past innovation wasn’t coupled with evolution or betterment of things.

Today when we think of innovation we usually refer to technological (or more precisely IT) innovation. However, that is only one facet of a concept that can have multiple meanings and applications.

As a result, innovation has become an empty concept, meaningless, and used by many but understood by a few.

On FourWeekMBA, I’ve been looking at hundreds of organizations that dominate our times to understand the several facets of innovation, and as we’ll see, companies can evolve, based on several types of innovation, each with its own features.

When “innovation” meant a death penalty

“E pur si muove” (and yet it moves), Galileo Galilei

In 1633, when the Italian mathematician, physicist, and philosopher Galileo Galilei whispered “e pur si muove” (and yet it moves) he could not help but keep defending his theory for which was not the Sun to move around the Earth, but the opposite. The Earth was not, anymore, at the center of the Universe.

That was a breakthrough idea that would lead to a scientific revolution in the centuries to come. And yet it was not well accepted, to say the least. The innovator, just like in Galileo‘s story was a heretic.

The years in which innovation would become synonymous with betterment were still far to come.

The more those people, usually mavericks, outsiders and in many cases individual explorers, built things which were extremely new (what we would later call “breakthrough”) the more innovators went from impostors to heroes.

Until from Marx to Schumpeter, the whole concept of creative destruction became widely accepted.

Fordism, mass production, process innovation and assembly lines (1930s-1970s)

“Any customer can have a car painted any color that he wants so long as it is black.” Henry Ford

When Ford’s Model T got introduced in 1908 that was almost ready for mass production. And yet Ford would say “When I’m through, about everybody will have one.”

A few years later, in 1913, he installed the first moving assembly line. That would be the apex of mass production. According to history.com, “it took (Ford) to build a car from more than 12 hours to two hours and 30 minutes.”

Fordism is well represented by the quote “Any customer can have a car painted any color that he wants so long as it is black.“

And it would become a core paradigm for most of the first and second part of the 20th century. And it would be applied to many industries.

A standardized product improved primarily through the manufacturing processes and division of labor to make it possible to scale and be mass-produced.

Ford combined the car (made for the first time by Karl Benz by the and of the 1800s) and improved on top of the idea of the assembly line (an idea which started to be developed centuries before) for the mass production of cars.

The car would no longer be a product in the hands of a few, rich people.

A mass product needed to be cultural manufacture first. For that, it needed to be functional, affordable but also desirable.

That is how you developed a competitive advantage, and it was also the force that enabled mass production.

When Ray Kroc took over McDonald’s, he leveraged on the existing “Speedy Service System” developed by the McDonald’s brothers (what we would later call “fast food”) which was an incredible process development able to provide an improved product at a faster pace as recounted in digital business models map.

For decades the process, plus the product and the mass appeal would become the dominant mode to transform small businesses in mass manufacturers.

The lean manufacturing years and the optimization of the supply chain (the 1970s-1990s)

“The Japanese auto industry should] catch up with America in three years. Otherwise the Japanese auto industry will never stand on its own.” Kiichiro Toyoda (1945), quoted in: Kazuo Sato (2010), The Anatomy of Japanese Business, p. 135, source wikiquote

Born in Japan the lean manufacturing model became dominant also in the western world as Japanese companies (Toyota would be the bedrock for this model starting 1930s) proved their ability to scale nonetheless their small size.

That happened through the application of the Kaizen or a process of continuous improvement of the supply chain where wasted resources would be gradually reduced to reach a point of perfection.

Lean manufacturing would further help organizations introduce gradual improvements, but quickly, with a process that would be iterative, and fast.

It dominated the western world throughout the 1970s to the end of the 1990s which represented the peak for lean manufacturing.

To be sure lean manufacturing is still a popular operating model today and methodologies built on top of it (like Lean Six Sigma) are still popular in the management world.

In the peak era of mass production and lean manufacturing competitive advantage would be achieved through the optimization of supply-side processes.

The years of financial innovation, private equity, and leveraged buyouts

“What’s worth doing is worth doing for money.” Gordon Gekko in Wall Street, source: imdb.com

While the private equity industry was born in the late 1940s, for most of its years it had been in the shadow. But when the 1980s came, a “financial innovation”called leveraged buyout would become the prime mode of domination.

In short, private equity firms would take over companies with a mixture of equity and debt (primary debt), thus leveraging on what at the time was seen as a financial optimization model.

The private equity fund would take over a company by pumping massive debt. The debt would be issued on the market as a bond, that given its risky features and low credit quality would also get the name of junk bond.

This new financial model, which would become the bedrock for private firms over the years, worked something along these lines:

The private equity firm uses the target company assets as collateral for the leveraged buyout.It starts with a listed, public company that gets delisted.The private equity firm pumps debt, which gets issued as obligations (what over the years would be called junk bonds) to repay the debt used in the operation.At the same time, the private equity firm aggressively performs cuts to make the balance sheet looks good.The cash flow generated by the target company gets used to repay back the debt.And the debt itself carries (in theory, as in practice many. of those LBOs would bankrupt target companies) smaller costs, compared to equity, as the company could expense its interest at costs, thus reducing the taxable income (the so-called tax shield).The private equity firm would eventually (if the LBO would turn successful) exit with a massive return with a sales of the target company or the listing.

LBOs became very aggressive during the 1980s, culminating in the take over of RJR Nabisco, Inc., an American conglomerate, with. a battle for its control that would be recounted in the book “Barbarians at the Gate: The Fall of RJR Nabisco,” later turned in a popular HBO movie.

During that time, financial structure optimization would be used as a competitive advantage.

To be sure, leverage buyout would also continue throughout the 2000s, and after the explosion of the dot-com bubble.

However, the 1980s represented the apex of this era. And in the meantime another form of private equity financing would dominate after the 1990s: venture capital.

Dot-com bubble: a technological Cambrian explosion

“Great markets make great companies.” Sequoia’s Don Valentine, source: somethingventured.com

As a form of private equity financing, venture capital also got a start during the 1950s. However, it would show its potential when a few capital firms financed a whole industry that would become multi-billion dollar markets (Computer first, Internet later).

During the 1970s venture, capital firms like Kleiner Perkins and Sequoia Capital were born, and over the years the number of venture capital firms would skyrocket.

Venture capital initial rise in the private equity industry

If you recall though, during the 1980s another form of private equity financing would be quite popular (leveraged buyout) and venture capital firms would primarily focus on small technological firms (at the time those were the outsiders), that over the years became the first tech giants.

Venture capital firms developed at a different model focused on the so-called “startup.” Indeed, venture capitalists would finance those startups along several stages of their journey (from idea validation to aggressive growth).

But the impact of venture capital would become even more apparent when, in the middle 1990s, a new technology would prove commercially viable: the Internet.

Silicon Valley would become the center of that revolution. Venture capital firms would double down on the bets placed on internet companies.

In the end, missing a small bet would have meant losing the next tech venture going for a trillion-dollar market.

That gold rush brought to the dot-com bubble.

The new gold rush

The apex of that bubble was a company called Webvan. The first e-commerce company for groceries, Webvan was a brilliant idea backed by the smartest venture capitalists.

The company had acquired almost a billion in venture capital funds, and it was ready to roll. Webvan IPO’d in 1999, just to blow up in 2001 when the dot-com bubble exploded.

Indeed, Webvan’s idea was great. In 2007, Amazon would start AmazonFresh and in 2017, Jeff Bezos’ would further complete the acquisition of Whole Foods. Today the integration between AmazonFresh and Whole Foods is proving brilliant and viable.

But was it just a matter of timing? Indeed, timing mattered, and yet Webvan did have a customer base. Yet it was burning cash at incredible speed.

A viable business model is needed

If the company had iterated with a viable business model, it could have survived the bubble and slowly built a viable company.

Yet Webvan, endowed with massive amounts of capital allocated for market domination (there was no market yet at the time) went all-in with a strategy intended to appeal to everyone, building a massive infrastructure with huge operating costs.

As Webvan highlighted in its financial statements in 2000:

Webvan's facilities do not currently operate at or near their originally designed capacity. Webvan does not expect any of its facilities to operate at designed capacity in the foreseeable future. Webvan cannot assure you that any facility will ever operate at or near its designed capacity.

Webvan ran ahead of its business plan without a reality check. It wasn’t just the peak of the gold rush in Silicon Valley and the fall of the dot-com.

It also showed the weakness of a venture capital model that was trying to dominate the upcoming Internet era based on capital alone.

In this era, the competitive advantage would be achieved with growth capital, aggressive growth, and speed over efficiency (which LinkedIn’s co-fonder called Blitzscaling).

Software ate the world, super angels on the rise

“Software is eating the world” Marc Andreessen

As the dot-com bubble burst, the survived venture capital firms would pick up from there. For all, the dot-com bubble had brought a lot of attention to the potential commercial applications of the Internet.

And when the bubble bust all those interested in the short gains also got kicked out. The few (both venture capital firms and companies) who survived were craving to focus on the few “killer commercial applications” (e-commerce, media and advertising) that were proving extremely viable.

In those times, super angels acted as “smart money” counteracting upon the previous madness of the dot-com bubble where a lot of “dumb money” had entered the game.

As reported in a 2010 article from FastCompany:

Super angels give startups much less money than VCs, but they expect a lot less in return. Typically, they don’t take a seat on the startup’s board; they take a small stake in the firm and hand over their funds in weeks rather than months. This frees up entrepreneurs to work on building great products rather than worry about satisfying their funders — which, after all, is the only way they’ll succeed.

The whole venture capital game would be shaped by that, and it would become more agile as a consequence.

In this era, growth capital was allocated to that product who was prone to product-market fit.

Lean startup and the birth of demand-side optimization frameworks

“It’s a methodology called the “lean start-up,” and it favors experimentation over elaborate planning, customer feedback over intuition, and iterative design over traditional “big design up front” development.” Steve Blank in Why the Lean Start-Up Changes Everything

Lean startup represents the first application of the principles of lean manufacturing to the demand side.

Where previous models and frameworks looked at optimizing business processes to bring products to market more quickly, or perhaps more efficiently.

During the startup age, where “software was eating the world” many products turned into bits and codes. Thus, (potentially) requiring less time to build, making it possible to release them, even when not perfect.

From physical to digital the whole playbook changed.

In short, the lean startup methodology wouldn’t look anymore at the optimization to reduce waste in terms of the supply chain (software has no additional marginal cost), instead, it becomes a process of iteration where customers need to be brought early on, in the product development process.

That’s because the primary risk isn’t any more time to market or the ability to produce a product at scale, but rather making sure to build something people want.

Where lean software development took inspiration from lean manufacturing. The lean startup methodology would take this further into the business world.

The lean startup practitioner doesn’t spend months in crafting a business plan. Instead, the lean startupper focuses on testing the few untested hypotheses about the business, quickly.

This implies that customers or potential customers needed to be brought in the loop early own in the product development cycle. Thus, making it possible to build a valuable product for a set of customers.

At the core of this methodology sits the customer development process, where several stakeholders (from customers to partners) can give their feedback to help the entrepreneur build a viable business model made of nine building blocks represented in the business model canvas.

During this iterative (or at times abrupt) process of change, entrepreneurs could build their business model and gain a competitive advantage.

From there strategy moved from a primarily externally-driven framework (see Porter’s Five Forces) to an internally-driven framework (Osterwalder’s Business Model Canvas).

From the encounter of agile/lean product development, customer development an MVP (minimum viable product) would be released early on, and from there build a viable business model on top of it.

This brings us to the era of demand-side business frameworks, where all that mattered was whether customers wanted it, in the first place.

Welcome in the era of demand-side business frameworks and customer-centrism (customer obsession)

[image error]Customer obsession goes beyond quantitative and qualitative data about customers, and it moves around customers’ feedback to gather valuable insights. Those insights start by the entrepreneur’s wandering process, driven by hunch, gut, intuition, curiosity, and a builder mindset. The product discovery moves around a building, reworking, experimenting, and iterating loop.

At the turn of the century, Amazon was among the company that survived the dot-com bubble, lucky or not, it had to master a new business playbook.

As Jeff Bezos highlighted in Amazon‘s 2018 Shareholders’ Letter:

Much of what we build at AWS is based on listening to customers. It’s critical to ask customers what they want, listen carefully to their answers, and figure out a plan to provide it thoughtfully and quickly (speed matters in business!). No business could thrive without that kind of customer obsession. But it’s also not enough. The biggest needle movers will be things that customers don’t know to ask for. We must invent on their behalf. We have to tap into our own inner imagination about what’s possible.

In this era, a competitive advantage is achieved via a customer-centered approach, where your loyal customers/users base became the most important asset.

Types of innovation

[image error]

Innovation can come in several formats, depending on whether it uses the past as a foundation for building up the future. And in that case, the process of innovation might be following a gradual, and organic path.

In other cases, innovation follows a whole new set of principles, no longer attached to the past, and in some cases contrasting with that (see how Galileo refuted the previous paradigm).

Another way to look at the types of innovation is highlighted by Greg Satell in the Innovation Matrix by looking on whether a problem is well defined, and whether the domain where this problem might apply is well defined.

As we move in a well defined problem and domain we move in the domain of sustaining innovation. As we move in a context where both the problem and domain are not well defined we have basic research.

This makes us look into four kinds of innovation:

Basic research

In basic research, according to the Innovation Matrix, both the problem and the domain where the problem needs to be solved are not well defined.

Disruptive

the Godfather of Disruptive Innovation, Clayton Christensen defined it as when new products or services enter at the bottom of a market and overtime move up, thus displacing established incumbents.

Breakthrough

While a breakthrough innovation takes a leap forward, it might start with a well-defined problem, which is extremely hard to solve (the domain is not well defined).

Continuous/sustaining/incremental

As an iterative process, in this case, innovation builds up over time, gradually. There is a pretty clear idea of what problems need to be solved and what skill domains are required to solve them.

From technological innovation to business model innovation

In today’s context when we hear the term innovation most probably the reference is at IT innovation. That’s not a surprise. The PC, then the Internet and all the platforms born on top of it enabled technological innovation to become ubiquitous.

Companies that didn’t exist at the turn of the century, became the tech giants we know today. As we’ll see throughout the guide this is a misconception.

Technological innovation does provide the ground for business model innovation, but that isn’t always the case.

When in 1996, Google (still an academic project is known as BackRub) built a new way to index the web, its search engine took off. Yet, by 1999, Google still hadn’t figured out a whole business model that would also enable revenue traction (it would come a couple of years later with Google AdWords).

It was the combination of technological innovation with a business model innovation (Google would redefine the way advertising was delivered making it relevant and almost invisible to the average user), which made the company scale from a business standpoint.

Is business model innovation the future?

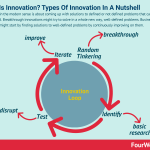

[image error]Business model innovation is about increasing the success of an organization with existing products and technologies by crafting a compelling value proposition able to propel a new business model to scale up customers and create a lasting competitive advantage. And it all starts by mastering the key customers.

A business model is an holistic concept to describe an organization, and also help it shape the overall business (from product up to profit formula) to evolve in the marketplace.

Business model (or business) innovation comes in many forms. In some cases, that is a recombination of several known business patterns. Those patterns have proved successful in other domains and industries, or for other players in the same industry.

Therefore, a business can experiment with those patterns almost like a chef experiment with ingredients and how by changing the dosage of an ingredient changes the final output.

Handpicked related resources:

Business Model InnovationBusiness ModelsDigital Business ModelsBusiness StrategyValue PropositionMarketing Strategy

The post What Is Innovation? Types Of Innovation And A Historical Perspective appeared first on FourWeekMBA.

What Is Innovation? Types Of Innovation And A Historic Perspective

Innovation in the modern sense is about coming up with solutions to defined or not defined problems that can create a new world. Breakthrough innovations might try to solve in a whole new way, well-defined problems. Business innovation might start by finding solutions to well-defined problems by continuously improving on them.

Innovators as heroes of our times

Innovation is at the center of the debate in many endeavors. From business to medicine, and politics. In any of those fields, you will listen to the interviewed experts emphasizing how “innovation” led to the evolution of the field.

As you will learn, innovation became an integral part of today’s public dialogue, and it acquired a positive meaning only in modern times. Indeed, during the past innovation wasn’t coupled with evolution or betterment of things.

Today when we think of innovation we usually refer to technological (or more precisely IT) innovation. However, that is only one facet of a concept that can have multiple meanings and applications.

As a result, innovation has become an empty concept, meaningless, and used by many but understood by a few.

On FourWeekMBA, I’ve been looking at hundreds of organizations that dominate our times to understand the several facets of innovation, and as we’ll see, companies can evolve, based on several types of innovation, each with its own features.

When “innovation” meant a death penalty

“E pur si muove” (and yet it moves), Galileo Galilei

In 1633, when the Italian mathematician, physicist, and philosopher Galileo Galilei whispered “e pur si muove” (and yet it moves) he could not help but keep defending his theory for which was not the Sun to move around the Earth, but the opposite. The Earth was not, anymore, at the center of the Universe.

That was a breakthrough idea that would lead to a scientific revolution in the centuries to come. And yet it was not well accepted, to say the least. The innovator, just like in Galileo‘s story was a heretic.

The years in which innovation would become synonymous with betterment were still far to come.

The more those people, usually mavericks, outsiders and in many cases individual explorers, built things which were extremely new (what we would later call “breakthrough”) the more innovators went from impostors to heroes.

Until from Marx to Schumpeter, the whole concept of creative destruction became widely accepted.

Fordism, mass production, process innovation and assembly lines (1930s-1970s)

“Any customer can have a car painted any color that he wants so long as it is black.” Henry Ford

When Ford’s Model T got introduced in 1908 that was almost ready for mass production. And yet Ford would say “When I’m through, about everybody will have one.”

A few years later, in 1913, he installed the first moving assembly line. That would be the apex of mass production. According to history.com, “it took (Ford) to build a car from more than 12 hours to two hours and 30 minutes.”

Fordism is well represented by the quote “Any customer can have a car painted any color that he wants so long as it is black.“

And it would become a core paradigm for most of the first and second part of the 20th century. And it would be applied to many industries.

A standardized product improved primarily through the manufacturing processes and division of labor to make it possible to scale and be mass-produced.

Ford combined the car (made for the first time by Karl Benz by the and of the 1800s) and improved on top of the idea of the assembly line (an idea which started to be developed centuries before) for the mass production of cars.

The car would no longer be a product in the hands of a few, rich people.

A mass product needed to be cultural manufacture first. For that, it needed to be functional, affordable but also desirable.

That is how you developed a competitive advantage, and it was also the force that enabled mass production.

When Ray Kroc took over McDonald’s, he leveraged on the existing “Speedy Service System” developed by the McDonald’s brothers (what we would later call “fast food”) which was an incredible process development able to provide an improved product at a faster pace as recounted in digital business models map.

For decades the process, plus the product and the mass appeal would become the dominant mode to transform small businesses in mass manufacturers.

The lean manufacturing years and the optimization of the supply chain (the 1970s-1990s)

“The Japanese auto industry should] catch up with America in three years. Otherwise the Japanese auto industry will never stand on its own.” Kiichiro Toyoda (1945), quoted in: Kazuo Sato (2010), The Anatomy of Japanese Business, p. 135, source wikiquote

Born in Japan the lean manufacturing model became dominant also in the western world as Japanese companies (Toyota would be the bedrock for this model starting 1930s) proved their ability to scale nonetheless their small size.

That happened through the application of the Kaizen or a process of continuous improvement of the supply chain where wasted resources would be gradually reduced to reach a point of perfection.

Lean manufacturing would further help organizations introduce gradual improvements, but quickly, with a process that would be iterative, and fast.

It dominated the western world throughout the 1970s to the end of the 1990s which represented the peak for lean manufacturing.

To be sure lean manufacturing is still a popular operating model today and methodologies built on top of it (like Lean Six Sigma) are still popular in the management world.

In the peak era of mass production and lean manufacturing competitive advantage would be achieved through the optimization of supply-side processes.

The years of financial innovation, private equity, and leveraged buyouts

“What’s worth doing is worth doing for money.” Gordon Gekko in Wall Street, source: imdb.com

While the private equity industry was born in the late 1940s, for most of its years it had been in the shadow. But when the 1980s came, a “financial innovation”called leveraged buyout would become the prime mode of domination.

In short, private equity firms would take over companies with a mixture of equity and debt (primary debt), thus leveraging on what at the time was seen as a financial optimization model.

The private equity fund would take over a company by pumping massive debt. The debt would be issued on the market as a bond, that given its risky features and low credit quality would also get the name of junk bond.

This new financial model, which would become the bedrock for private firms over the years, worked something along these lines:

The private equity firm uses the target company assets as collateral for the leveraged buyout.It starts with a listed, public company that gets delisted.The private equity firm pumps debt, which gets issued as obligations (what over the years would be called junk bonds) to repay the debt used in the operation.At the same time, the private equity firm aggressively performs cuts to make the balance sheet looks good.The cash flow generated by the target company gets used to repay back the debt.And the debt itself carries (in theory, as in practice many. of those LBOs would bankrupt target companies) smaller costs, compared to equity, as the company could expense its interest at costs, thus reducing the taxable income (the so-called tax shield).The private equity firm would eventually (if the LBO would turn successful) exit with a massive return with a sales of the target company or the listing.

LBOs became very aggressive during the 1980s, culminating in the take over of RJR Nabisco, Inc., an American conglomerate, with. a battle for its control that would be recounted in the book “Barbarians at the Gate: The Fall of RJR Nabisco,” later turned in a popular HBO movie.

During that time, financial structure optimization would be used as a competitive advantage.

To be sure, leverage buyout would also continue throughout the 2000s, and after the explosion of the dot-com bubble.

However, the 1980s represented the apex of this era. And in the meantime another form of private equity financing would dominate after the 1990s: venture capital.

Dot-com bubble: a technological Cambrian explosion

“Great markets make great companies.” Sequoia’s Don Valentine, source: somethingventured.com

As a form of private equity financing, venture capital also got a start during the 1950s. However, it would show its potential when a few capital firms financed a whole industry that would become multi-billion dollar markets (Computer first, Internet later).

During the 1970s venture, capital firms like Kleiner Perkins and Sequoia Capital were born, and over the years the number of venture capital firms would skyrocket.

Venture capital initial rise in the private equity industry

If you recall though, during the 1980s another form of private equity financing would be quite popular (leveraged buyout) and venture capital firms would primarily focus on small technological firms (at the time those were the outsiders), that over the years became the first tech giants.

Venture capital firms developed at a different model focused on the so-called “startup.” Indeed, venture capitalists would finance those startups along several stages of their journey (from idea validation to aggressive growth).

But the impact of venture capital would become even more apparent when, in the middle 1990s, a new technology would prove commercially viable: the Internet.

Silicon Valley would become the center of that revolution. Venture capital firms would double down on the bets placed on internet companies.

In the end, missing a small bet would have meant losing the next tech venture going for a trillion-dollar market.

That gold rush brought to the dot-com bubble.

The new gold rush

The apex of that bubble was a company called Webvan. The first e-commerce company for groceries, Webvan was a brilliant idea backed by the smartest venture capitalists.

The company had acquired almost a billion in venture capital funds, and it was ready to roll. Webvan IPO’d in 1999, just to blow up in 2001 when the dot-com bubble exploded.

Indeed, Webvan’s idea was great. In 2007, Amazon would start AmazonFresh and in 2017, Jeff Bezos’ would further complete the acquisition of Whole Foods. Today the integration between AmazonFresh and Whole Foods is proving brilliant and viable.

But was it just a matter of timing? Indeed, timing mattered, and yet Webvan did have a customer base. Yet it was burning cash at incredible speed.

A viable business model is needed

If the company had iterated with a viable business model, it could have survived the bubble and slowly built a viable company.

Yet Webvan, endowed with massive amounts of capital allocated for market domination (there was no market yet at the time) went all-in with a strategy intended to appeal to everyone, building a massive infrastructure with huge operating costs.

As Webvan highlighted in its financial statements in 2000:

Webvan's facilities do not currently operate at or near their originally designed capacity. Webvan does not expect any of its facilities to operate at designed capacity in the foreseeable future. Webvan cannot assure you that any facility will ever operate at or near its designed capacity.

Webvan ran ahead of its business plan without a reality check. It wasn’t just the peak of the gold rush in Silicon Valley and the fall of the dot-com.

It also showed the weakness of a venture capital model that was trying to dominate the upcoming Internet era based on capital alone.

In this era, the competitive advantage would be achieved with growth capital, aggressive growth, and speed over efficiency (which LinkedIn’s co-fonder called Blitzscaling).

Software ate the world, super angels on the rise

“Software is eating the world” Marc Andreessen

As the dot-com bubble burst, the survived venture capital firms would pick up from there. For all, the dot-com bubble had brought a lot of attention to the potential commercial applications of the Internet.

And when the bubble bust all those interested in the short gains also got kicked out. The few (both venture capital firms and companies) who survived were craving to focus on the few “killer commercial applications” (e-commerce, media and advertising) that were proving extremely viable.

In those times, super angels acted as “smart money” counteracting upon the previous madness of the dot-com bubble where a lot of “dumb money” had entered the game.

As reported in a 2010 article from FastCompany:

Super angels give startups much less money than VCs, but they expect a lot less in return. Typically, they don’t take a seat on the startup’s board; they take a small stake in the firm and hand over their funds in weeks rather than months. This frees up entrepreneurs to work on building great products rather than worry about satisfying their funders — which, after all, is the only way they’ll succeed.

The whole venture capital game would be shaped by that, and it would become more agile as a consequence.

In this era, growth capital was allocated to that product who was prone to product-market fit.

Lean startup and the birth of demand-side optimization frameworks

“It’s a methodology called the “lean start-up,” and it favors experimentation over elaborate planning, customer feedback over intuition, and iterative design over traditional “big design up front” development.” Steve Blank in Why the Lean Start-Up Changes Everything

Lean startup represents the first application of the principles of lean manufacturing to the demand side.

Where previous models and frameworks looked at optimizing business processes to bring products to market more quickly, or perhaps more efficiently.

During the startup age, where “software was eating the world” many products turned into bits and codes. Thus, (potentially) requiring less time to build, making it possible to release them, even when not perfect.

From physical to digital the whole playbook changed.

In short, the lean startup methodology wouldn’t look anymore at the optimization to reduce waste in terms of the supply chain (software has no additional marginal cost), instead, it becomes a process of iteration where customers need to be brought early on, in the product development process.

That’s because the primary risk isn’t any more time to market or the ability to produce a product at scale, but rather making sure to build something people want.

Where lean software development took inspiration from lean manufacturing. The lean startup methodology would take this further into the business world.

The lean startup practitioner doesn’t spend months in crafting a business plan. Instead, the lean startupper focuses on testing the few untested hypotheses about the business, quickly.

This implies that customers or potential customers needed to be brought in the loop early own in the product development cycle. Thus, making it possible to build a valuable product for a set of customers.

At the core of this methodology sits the customer development process, where several stakeholders (from customers to partners) can give their feedback to help the entrepreneur build a viable business model made of nine building blocks represented in the business model canvas.

During this iterative (or at times abrupt) process of change, entrepreneurs could build their business model and gain a competitive advantage.

From there strategy moved from a primarily externally-driven framework (see Porter’s Five Forces) to an internally-driven framework (Osterwalder’s Business Model Canvas).

From the encounter of agile/lean product development, customer development an MVP (minimum viable product) would be released early on, and from there build a viable business model on top of it.

This brings us to the era of demand-side business frameworks, where all that mattered was whether customers wanted it, in the first place.

Welcome in the era of demand-side business frameworks and customer-centrism (customer obsession)

[image error]Customer obsession goes beyond quantitative and qualitative data about customers, and it moves around customers’ feedback to gather valuable insights. Those insights start by the entrepreneur’s wandering process, driven by hunch, gut, intuition, curiosity, and a builder mindset. The product discovery moves around a building, reworking, experimenting, and iterating loop.

At the turn of the century, Amazon was among the company that survived the dot-com bubble, lucky or not, it had to master a new business playbook.

As Jeff Bezos highlighted in Amazon‘s 2018 Shareholders’ Letter:

Much of what we build at AWS is based on listening to customers. It’s critical to ask customers what they want, listen carefully to their answers, and figure out a plan to provide it thoughtfully and quickly (speed matters in business!). No business could thrive without that kind of customer obsession. But it’s also not enough. The biggest needle movers will be things that customers don’t know to ask for. We must invent on their behalf. We have to tap into our own inner imagination about what’s possible.

In this era, a competitive advantage is achieved via a customer-centered approach, where your loyal customers/users base became the most important asset.

Types of innovation

[image error]

Innovation can come in several formats, depending on whether it uses the past as a foundation for building up the future. And in that case, the process of innovation might be following a gradual, and organic path.

In other cases, innovation follows a whole new set of principles, no longer attached to the past, and in some cases contrasting with that (see how Galileo refuted the previous paradigm).

Another way to look at the types of innovation is highlighted by Greg Satell in the Innovation Matrix by looking on whether a problem is well defined, and whether the domain where this problem might apply is well defined.

As we move in a well defined problem and domain we move in the domain of sustaining innovation. As we move in a context where both the problem and domain are not well defined we have basic research.

This makes us look into four kinds of innovation:

Basic research

In basic research, according to the Innovation Matrix, both the problem and the domain where the problem needs to be solved are not well defined.

Disruptive

the Godfather of Disruptive Innovation, Clayton Christensen defined it as when new products or services enter at the bottom of a market and overtime move up, thus displacing established incumbents.

Breakthrough

While a breakthrough innovation takes a leap forward, it might start with a well-defined problem, which is extremely hard to solve (the domain is not well defined).

Continuous/sustaining/incremental

As an iterative process, in this case, innovation builds up over time, gradually. There is a pretty clear idea of what problems need to be solved and what skill domains are required to solve them.

From technological innovation to business model innovation

In today’s context when we hear the term innovation most probably the reference is at IT innovation. That’s not a surprise. The PC, then the Internet and all the platforms born on top of it enabled technological innovation to become ubiquitous.

Companies that didn’t exist at the turn of the century, became the tech giants we know today. As we’ll see throughout the guide this is a misconception.

Technological innovation does provide the ground for business model innovation, but that isn’t always the case.

When in 1996, Google (still an academic project is known as BackRub) built a new way to index the web, its search engine took off. Yet, by 1999, Google still hadn’t figured out a whole business model that would also enable revenue traction (it would come a couple of years later with Google AdWords).

It was the combination of technological innovation with a business model innovation (Google would redefine the way advertising was delivered making it relevant and almost invisible to the average user), which made the company scale from a business standpoint.

Is business model innovation the future?

[image error]Business model innovation is about increasing the success of an organization with existing products and technologies by crafting a compelling value proposition able to propel a new business model to scale up customers and create a lasting competitive advantage. And it all starts by mastering the key customers.

A business model is an holistic concept to describe an organization, and also help it shape the overall business (from product up to profit formula) to evolve in the marketplace.

Business model (or business) innovation comes in many forms. In some cases, that is a recombination of several known business patterns. Those patterns have proved successful in other domains and industries, or for other players in the same industry.

Therefore, a business can experiment with those patterns almost like a chef experiment with ingredients and how by changing the dosage of an ingredient changes the final output.

The post What Is Innovation? Types Of Innovation And A Historic Perspective appeared first on FourWeekMBA.

April 18, 2020

Business Innovation: How Companies Are Reinventing Their Business Models

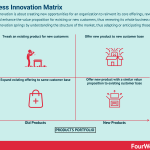

Business innovation is about creating new opportunities for an organization to reinvent its core offerings, revenue streams, and enhance the value proposition for existing or new customers, thus renewing its whole business model. Business innovation springs by understanding the structure of the market, thus adapting or anticipating those changes.

Business vs. technological innovation

The primary misunderstanding about business innovation, which leads to inaction is believing that reinventing or innovating your business starts from technical implementations.

Innovating in business means redefining value for your existing customers to understand how to enhance it. Or determining what new value can be delivered to new customers with similar needs. Or yet, defining a whole new set of values to be delivered to a new customer base.

We can start the process by mapping our business boundaries.

Define the value customers get and your business boundaries

In order for you to redefine and innovate, you need to understansd first the current value your provide.

For instance, if you have a barbershop, are people just coming to you to cut their beards? Not really, many of those people might come to you for several reasons:

They want to look goodThe place is near to their homeThe environment is good They like to talk to you

Based on the reasons above you can develop a whole offering of services and products. For instance, if you’re just cutting hair, why not sell some of the products you select to your customer base?

Understanding the needs of your customers help you structure an offering:

Sell-related products Add-on offerings for related services Simple offering with a flat feeSubscription-service kit with curated products

Within and beyond your business boundaries

By setting the boundaries of your business and existing customer base, you can also define those experiments that would provide further value and enable your business to transform.

This also means being able to experiment with:

Providing more value to existing customers with an expanded offeringCreate a whole new product for an existing customer baseTweak an existing product to serve new customersOr build a whole new product for a new customer base

Let’s see now some case studies and examples from how companies are reinventing or surviving difficult times.

Redefining value: case studies

[image error]A value proposition is about how you create value for customers. While many entrepreneurial theories draw from customers’ problems and pain points, value can also be created via demand generation, which is about enabling people to identify with your brand, thus generating demand for your products and services.

Google content hub

[image error]When you type “COVID” on Google you will find a whole content hub, which gives local news about the virus. Official national news. And also official medical advice on symptoms. Google transformed the whole intent-based search around COVID in a separate platform to help people deal with this crisis.

In some cases, a tweak of an existing product or platform can provide much more value to the existing user base. In the case above, Google has built a temporary platform on top of its search capabilities.

Airbnb virtual experiences

[image error]The new Online Host Experience by Airbnb

Airbnb is experimenting with a new form of experience on the platform. By leveraging on its existing base of hosts, the company is inviting existing and new hosts to structure their online, and virtual experiences on the platform.

Uber’s work hub

[image error]How Uber leveraged its platform trying to support or perhaps engage the community of drivers which is a core element of Uber’s platform success (source: uber.com/blog/work-hub/)

As highlighted on Uber’s website “Uber Works, connects people to shift work like food production, warehouse, and customer service in Chicago, Dallas, and Miami.“

Uber is experimenting with this program to sustain its drivers’ user base.

Beachwear making masks

[image error]How several brands are converting their production of beachwear into fashion face masks (source: hedleyandbennett.com/pages/wakeupandf...)

In some cases, you don’t need to reconvert the whole business model to make it survive in difficult times. All you need is to levarage on the existing capabilities of the business to come up with a product that people need.

That is how many beachwear fashion brands are converting their products into fashionable face masks, which will help the conversion of the business, while incentivizing people to wear masks.

From cars to ventilators

Car companies, from Tesla, to GM and Ford are reconverting part of their facilities to manufacture ventilators.

Car companies or companies, in general, are converting existing facilities to produce something in high demand right now.

From restaurant parking lot to drive-in cinema

What used to be the most valuable area of the business (the eating area) is becoming less so for many restaurant businesses.

Indeed, many restaurants around the world are figuring that their parking lot, indeed, can be used as a new business unit.

And in some cases, restaurants are partnering up with Cinemas to create a new experience, where people can drive in with their cars and watch shows in the parking lot. Here an interesting case study.

From valet service to drive-in click and collect

Where the business cannot be run physically, why don’t you convert that digitally? That is what some valet services are doing by introducing drive-through click and collect services.

3D printing COVID equipment

Decentralized manufacturing might become among the most important commercial use cases in an era where travel is restricted. That is why 3D printing companies are pushing to produce equipment needed during these times.

From co-working to virtual co-working

Co-working spaces are among the most hit by this crisis, and it’s hard to understand at this stage how to convert a business heavily invested in real estate to virtual, or semi-virtual.

It’s fundamental to ask “what value can we provide?” and redefine the services they offer.

People, like Seth Godin, are already experimenting with this new format with the launch of the Akimbo Virtual Coworking.

Now a service that might be offered for free, it might be leveraged by co-working companies to redefine their businesses.

Virtual concerts

The Group called Real Estate launched Quarantour, a way for people to experience a sort of virtual music tour from the band on their phones.

From hotel rooms to quarantine rooms

Many Hotels are utilizing their spaces to accomodate people for quarantine. With restrictions in place, and people not ready to travel, hotel businesses are reorganizing their spaces to support the crisis.

Macrotrends

What macrotrends is this scenario pusring forward? For sure, that is acceleraging the development of industries that otherwise would have taken still years to develop.

Some of these areas go from e-commerce to blockchain and crypto.

E-commerce and forced digitalization

As we help thousands of businesses to move online, our platform is now handling Black Friday level traffic every day!

It won’t be long before traffic has doubled or more.

Our merchants aren’t stopping, neither are we. We need

April 17, 2020

Facebook, Apple, Amazon, Microsoft, Netflix, And Google Business Models: How They Work & Make Money

[image error]

FAANG is an acronym that comprises the hottest tech companies’ stocks in 2019. Those are Facebook, Amazon, Apple, Netflix and Alphabet’s Google. The term was coined by Jim Cramer, former hedge fund manager and host of CNBC’s Mad Money and founder of the publication TheStreet.

In this video, more than FAANG we look at FAAMNG (Microsoft added to the mix) to understand how the business models of Facebook Amazon, Apple, Microsoft, Netflix and Google work and how the boundaries of today’s business world are more blurred than they used to be in the past.

And that creates a whole new way to look at business strategy.

Read next:

Facebook Business ModelAmazon Business ModelApple Business ModelMicrosoft Business ModelNetflix Business Model Google Business Model

Learn more:

FAANG Companies

Flagship Course:

Business Model Innovation Flagship Course

The post Facebook, Apple, Amazon, Microsoft, Netflix, And Google Business Models: How They Work & Make Money appeared first on FourWeekMBA.

April 14, 2020

What Is Coopetition? Coopetition In A Nutshell

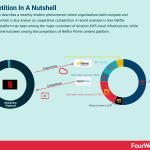

Coopetition describes a recently modern phenomenon where organizations both compete and cooperate, which is also known as cooperative competition. A recent example is how Netflix streaming platform has been among the major customers of Amazon AWS cloud infrastructure, while Amazon Prime has been among the competitors of Netflix Prime content platform.

The Netflix case study

As highlighted on Amazon AWS website:

Online content provider Netflix can support seamless global service by using Amazon Web Services (AWS). AWS enables Netflix to quickly deploy thousands of servers and terabytes of storage within minutes. Users can stream Netflix shows and movies from anywhere in the world, including on the web, on tablets, or on mobile devices such as iPhones.

Handpicked related resources:

What Is Business Model InnovationWhat Is a Business ModelWhat Is Business DevelopmentWhat Is Business StrategyWhat Is a Value PropositionWhat Is a Lean StartupWhat Is Market SegmentationWhat Is a Marketing StrategyWhat is Growth Hacking

The post What Is Coopetition? Coopetition In A Nutshell appeared first on FourWeekMBA.

April 13, 2020

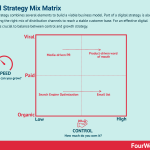

The Digital Strategy Mix Matrix To Build A Solid Business

Distribution is one of the key elements to build a viable business model. Indeed, Distribution enables a product to be available to a potential customer base; it can be direct or indirect, and it can leverage on several channels for growth. Finding the right distribution mix also means balancing between owned and non-owned channels.

Distribution is a key asset

If you’re trying to digitalize your business or to build a digital business, it might be easy to get lost in the plethora of platforms and available channels.

How do you make order to that?

[image error]A distribution channel is the set of steps it takes for a product to get in the hands of the key customer or consumer. Distribution channels can be direct or indirect. Distribution can also be physical or digital, depending on the kind of business and industry.

A business distribution (being able to match customers with your product) is a vital asset. Without distribution the business will always be fragile.

But how do you build a strong distribution strategy?

Getting lost in the plethora of digital channels

[image error]A digital channel is a marketing channel, part of a distribution strategy, helping an organization to reach its potential customers via electronic means. There are several digital marketing channels, usually divided into organic and paid channels. Some organic channels are SEO, SMO, email marketing. And some paid channels comprise SEM, SMM, and display advertising.

There isn’t a single way to build a distribution strategy, and in many cases, it will depend on factors like what channels might be more suited for your product, what channels enable faster growth, and those distribution channels that are also stable over time.

Lastly, distribution is also a matter of choice. Indeed, some companies (also based on their vision and culture) prefer certain distribution channles over others.

So how do you find the right mix?

We need to look at two key elements.

The key elements of a distribution strategy

When building up a distribution strategy, there are many factors to take into account. For the sake of this guide we’ll look at two primary, major factors, that affect a business over time:

Control: how much do you own that distribution channel? Growth: what kind of growth does the channel unlock?

Let’s look at them.

Control: Owned vs. non-owned distribution channels

When building up a business from scratch, chances are, none will know you. There is no customer base. There is no product recognition. So how do you unlock growth?

Usually, companies tap into existing distribution networks, where they have none, or little control over how the product will be delivered to customers.

This might dilute the customer experience. However, it will enable the first traction of growth. As the business grows and it acquires its customer base, the same company might start investing on its own platform, thus asserting more control over how the product gets distributed.

For instance, if you take a company like Apple, it leverages both on a direct (controlled) distribution strategy where it sells its products via its stores. And an indirect (partially controlled thanks to Apple’s branding power) distribution strategy.

[image error]When looking at the Apple Business Model, it is easy to assume that it is solely a product company, which sells devices that are beautifully crafted. However, there would have been no success for the Mac without its OS operating system. There would not have been iPod success without iTunes. And no success for iPhones without the Apple Store. What’s next for Apple’s success?

[image error]

While some businesses thrive in the long-term without building a mix between controlled (owned) distribution and non-controlled distribution, by solely relying on one or the other.

A solid distribution strategy needs to leverage on both for several reasons:

Diversify the product distribution Enhance and amplify the product Scale customer base by keeping a good customer experience

Growth type: Organic, paid and viral channels

On the other end, when building a distribution strategy, you might want to consider the kind of growth strategy to adopt. In this guide, we take into account three main types of growth:

Organic: this kind of growth is built over a long period of time, and it’s bottom-up. As more customers join, they give slow but less noisy feedback on the product.Paid: in a paid growth strategy the company allocates resources to push its products in the hands of potential customers. In this case, the budget allocated for growth is primarily used to distribute the existing product to as many potential customers as possible.Viral: in a viral growth strategy (usually the less expensive but also the riskier) a brand leverages the features of its product to push it in the hands of as many users as possible, independently from the fact that those will convert in paying customers. As a classic example, think of a freemium strategy.

Distribution mix matrix

From the balance between a controlled and non-controlled channel and the growth strategy (organic, paid and viral) we can find the right mix.

A solid distribution strategy will leverage on both controlled and non-controlled channel. And at the same time those who are organic, paid and viral.

As you build up your distribution strategy you want to move from non-controlled to controlled distribution channels to build a solid company.

Some examples below.

Media-driven PR

A media-driven PR growth strategy is a viral strategy where you have not much control. You can changes the message to fit the market and as you do that you might get some good media coverage.

This is a viral strategy as it is usually inexpensive. At the same time, you’re not changing the underlying characteristics of the product.

While you’re working on the perception of the product you want to make sure also to develop the core parts of it in line with its new perceived value.

Which leads us to a product-driven word of mouth strategy.

Product-driven word of mouth

In a product-driven word of mouth strategy, you iterate on the core features of the product to make it more appealing to a wider customer base. As those features will gain traction through word mouth that will also make your brand known.

With this strategy the product will evolve to fit the market needs. Therefore, you can push it further also at PR level, as a solid product, can scale in terms of attention and users’ base without too much risk.

Beware though, as many people get to know your product the more your product will need to evolve.

SEO

Search engine optimization (rank your pages on Google organic results) is an organic growth strategy, which do not control. While you can structure content to be picked up by Google’s algorithm, a change in those core algorithms might cause your website to lose traffic (and customers) over night.

While SEO rankings might be stable over time. You still want to diversify this organic growth strategy that you do not control, with a growth strategy where you have more control.

Email list

As you build up an organic audience via search engine optimization, building an email list from the contacts that reach you organically, is a great way to move from a channel where you have little control, to another where you have more control.

Key takeaway

Distribution is a core asset of any business. That is why it’s important to find the right mix to build a solid business.While building up a distribution strategy we can take into account the amount of control you have on that channel, and the growth strategy adopted (organic, paid, viral).As the business grows, you can develop a distribution steered toward more control, and less dependent on channels you do not control.

Handpicked related resources:

What Is Business Model InnovationWhat Is a Business ModelWhat Is Business DevelopmentWhat Is Business StrategyWhat is BlitzscalingWhat Is a Value PropositionWhat Is a Lean Startup CanvasWhat Is Market SegmentationWhat Is a Marketing StrategyWhat is Growth Hacking

The post The Digital Strategy Mix Matrix To Build A Solid Business appeared first on FourWeekMBA.

April 12, 2020

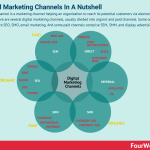

Digital Marketing Channels Types And Platforms

A digital channel is a marketing channel, part of a distribution strategy, helping an organization to reach its potential customers via electronic means. There are several digital marketing channels, usually divided into organic and paid channels. Some organic channels are SEO, SMO, email marketing. And some paid channels comprise SEM, SMM, and display advertising.

Quick intro do digital marketing channels

To build a successful distribution strategy companies need to leverage on digital channels to reach their potential customers.

Whether a company sells a physical or digital product, digital marketing channels can be an incredible source of continuous growth for the business, thus enabling to build a viable business model.

However, each channel type will require an understanding of the underlying platform, the kind of incentives created for users on those platforms and how users interact.

Organic vs. paid

A first distinction is between organic vs. paid channels. Organic channels are those who do not require to pay for attention. That doesn’t mean organic channels are less expensive. Indeed, a way to grow organically is through content developemtn.

Producing great content can be quite expansive. Therefore, organic simply means that you can gain visibility and interests from potential customers without paying a third-party platform to be featured.

An example is an SEO, or search engine optimization, where a platform like Google ranks your content because it perceives it as high quality. Thus, enabling users to get through you continuously through that content.

A paid channel instead, requires a budget to enable a third-party platform to feature that content to users. When budget is over so the content will run out of visibility. An example is search engine marketing. You pay Google on a pay-per-click basis to feature your content on top of its listings.

Direct vs. indirect

A direct digital marketing channel enables potential customers to get to you without middlemen. One example is people who type directly your website name on their browser, thus coming to your site.

An indirect channel example is someone finds you through a social media post, which gets featured by Facebook’s algorithms on the users’ feed. If Facebook pushes down the reach of that same post none will find you anymore.

In the former case, potential customers get direct access to your brand. In the latter, users get to know you via a third-party platform.

Digital marketing channels

Let’s look now at some of the key digital marketing channels:

Direct

In a direct digital marketing channel potential customers get directly to your product. Some examples include:

Customer base: an existing set of customers with whom you have direct contact. Email list: a list of contacts built over the years which you can contact directly.Website direct traffic: a portion of website traffic comes from people directly young (or having your site saved as a favorite) thus bypassing search engines.Push notifications: in some instances websites also collect contacts by enabling push notifications. In that case, when content is out it will reach directly those contacts.

Referral

Referrals are channels used to bring visibility to your business beyond search, or social media. Some examples include:

Affiliate, parters’ websites: you can incentivize other websites and partners to bring traffic or conversions back to your business by structuring partnerships or revenue share. PR campaigns: if a media website features your product you will gain traffic as a result. Backlinks: if your content is great, other websites might link to it, thus bringing it traffic.

SEO

Search engines like Google, Bing, Yahoo or DuckDuckGo, still have a large portion of their listings based on organic results (websites featured without paying on a performance basis).

This is at the core of search engine optimization activities.

SEM

Search engines like Google, Bing, Yahoo or DuckDuckGo primarily make money via advertising revenues. Thus, companies pay them to be featured on top of their search results (there are also other factors affecting paid rankings).

A search engine marketing strategy looks at sponsoring your content by – usually – paying on a performance basis.

Platforms like Google Ads help with that.

SMO

In social media optimization companies curate their pages and content on social media platforms (Facebook, Instagram, TikTok, Twitter, Pinterest, Snapchat) to gain organic (unpaid) visibility by building a loyal audience over time.

SMM

The same social media platforms we saw above primarily make money via paid advertising. Companies like Facebook, Instagram, Pinterest have built advanced advertising platform which give companies the ability to segment their audiences in many ways.

Key takeaways

Digital marketing channels are electronic ways to reach potential customers. There are different digital channels (organic vs. paid, or direct vs. indirect) and they also change according to the ever-evolving digital landscape.An organic channel is usually earned through developing quality content that gets a continuous flow of traffic. Paid channels enable companies to push their products via third-party platforms. Direct channels enable companies to reach directly their existing or potential customers. Indirect channels instead enable an organization to reach potential customers via a third-party distribution platform. Some of the digital marketing channels comprise SEO, SEM, SMO, and SMM.

Handpicked related resources:

What Is Business Model InnovationWhat Is a Business ModelWhat Is Business DevelopmentWhat Is Business StrategyWhat is BlitzscalingWhat Is a Value PropositionWhat Is a Lean Startup CanvasWhat Is Market SegmentationWhat Is a Marketing StrategyWhat is Growth Hacking

The post Digital Marketing Channels Types And Platforms appeared first on FourWeekMBA.

April 9, 2020

How AI is Improving Customer Management in the Hospitality Industry

Artificial intelligence is improving customer management across the board at the expense of gainful employment for a growing number of workers in the labor economy. But all is not lost; every industry that’s closing doors due to automation is also opening a window for new opportunities.

The hospitality industry is one such job market that’s being overturned –low wage jobs are being replaced by future-proof higher wage cybersecurity and computer science jobs.

In this article, we’ll look at how AI is improving customer management in the hospitality industry to help them build alternative business models while making a case for the world’s next generation of workers to get a degree in cybersecurity.

Their Loss, Your Gain

It’s no secret that AI is rapidly changing the world, and in many ways, it’s doing it for the better. But no one can deny this one negative reality; physical labor jobs are disappearing.

In spite of these emerging changes, most job markets shedding positions are also creating new AI-centric openings.

Perhaps the hospitality industry is one of the hardest hit –with its electronic ordering kiosks and soon-to-be unleashed food making machines. And as more data is being created and put online, these businesses will be hiring capable staff to manage and secure it.

It’s not just big tech that’s in dire need of technology-focused graduates. Even the hospitality industry is looking for top talent in the cybersecurity industry. This is something to keep in mind as you keep reading.

AI and the Hospitality Industry

So, how is artificial intelligence affecting the hospitality industry? Let’s take a look!

1. Identifying Trends

Travel and hospitality are more competitive today than ever; Millennials and Baby Boomers agree on one thing –travel and hospitality are top priorities come payday.

With increased competition and growing industry, creating, monitoring, and understanding large pools of customer data is of paramount importance. AI can crunch data decades faster than a human, and all businesses in these cojoined niches have taken notice.

Simply put, AI is a massive competitive advantage.

2. Customer Communication

AI provides an automated method of two-way communication with customers. Whether it’s answering questions or deciding which customer is worthy of a free room upgrade, AI delivers.

And this isn’t to say that these conversations need to happen online –the Hilton has proven that artificial intelligence can also be used to serve clients in person. Connie, an AI-powered robot employed by the Hilton can answer questions, make changes to bookings, and operate as a concierge.

AI can help physical robots identify customers with biometric markers fed into systems via an app on their smartphone — digital identity affecting consumers, seamlessly.

3. Augmented Reality

Everyone will remember the clipboard or cardboard notice sitting on the desk in every hotel room. On it are directions to nearby tourist attractions, instructions on how to order room service, or where to find the ice machine.

With augmented reality, visitors can now get a virtual tour of any space or get instructions from a virtual host. The opportunities are endless, and this is one area that will continue to expand.

4. Smooth Operations

Whether it’s putting food orders in the best sequence to ensure meal courses arrive at the right time, or automatically sending visitors the appropriate “key” to their room via their cell phone and NFC chip –AI can automate numerous tasks to lower the burden on staff while streamlining experiences for guests.

AI is Win/Win

AI provides customers with a more comprehensive customer service experience while arming the workforce with customer management tools to be more efficient. And with the right education, where some jobs disappear others are created.

All of these digital touchpoints require connectivity, and they also introduce new security risks. To keep abreast of these sweeping changes, those with a career in cybersecurity are best suited to address this growing job market.

Other handpicked resources:

Business Strategy: Definition, Examples, And Case StudiesWhat Is a Business Model? 30 Successful Types of Business Models You Need to KnowWhat Is a Business Model Canvas? Business Model Canvas ExplainedBlitzscaling Business Model Innovation Canvas In A NutshellWhat Is a Value Proposition? Value Proposition Canvas ExplainedWhat Is a Lean Startup Canvas? Lean Startup Canvas ExplainedHow to Build a Great Business Plan According to Peter ThielHow To Create A Business ModelWhat Is Business Model Innovation And Why It MattersWhat Is Blitzscaling And Why It Matters

The post How AI is Improving Customer Management in the Hospitality Industry appeared first on FourWeekMBA.

A Critique Of Landing Pages Across Industries

Getting your landing page right can require several rounds of trial and error and that is a key element of having a continuous stream of customers and build a viable business model.

Some studies claim that long landing pages can generate 220% more leads than those with ‘above-the-fold’ CTAs. At the same time, other studies have found that merely reducing the number of input fields from 11 to 4 can increase conversions by 120%. What works for one business or product category may not work for another.

Optimizing your landing page for conversions is thus a process of studying how various businesses use landing pages for their businesses and the possible lessons one can gain from them.

In this article, we will attempt to study landing pages across different industries, product categories and price ranges to see what strategies are common.

CRM landing page example

Subscription tools in general, or SaaS in particular, have been prolific spenders on online advertising. As such, these applications have landing pages that adhere to all the best practices. Take the following example of a CRM application from Freshworks.

[image error]Source: Freshsales CRM

The top-fold of this landing page has two CTAs (Call To Action) that a potential buyer would expect to have – the ability to try your product for free, or at least check out a demo. But a first-time visitor would want to have more information about the product before they give away any of their personal information.

The rest of this landing page is a set of visually appealing modules that try to educate and warm up a first time visitor – this includes a graphic that shows how the product is different from competitors, a video message from the founder, a bunch of popular brand names that use the product, and testimonials.

These visuals tend to warm up the lead and make them ready to convert. The only thing that remains is what plan to sign them up for – hence the CTA at the bottom fold of the page takes the user to the pricing page from where the visitor can sign up for a free trial of the pricing plan that appeals to them the most.

[image error]Source: Freshsales CRM

Notice the live chat icon at the bottom right of the page? Studies show that live chat widgets contribute as much as 30% to the conversion rate of a landing page.

This page has one controversial element however – the use of navigational menus on both the first and bottom fold of the page. Navigational elements can tend to take a visitor’s focus away from the CTAs and can thus bring conversion rates down. It will be interesting to see if they do have an impact on the conversion rate of this page.

Email Marketing landing page example

Email marketing is a highly competitive industry with average CPC rates hovering between $22 to $55 per click. As such, the landing page must strive for high conversion rates to make up for the insane acquisition costs.

Not surprisingly then, most businesses in the email marketing industry tend to have very low barriers to sign ups. Take a look at this example below.

[image error]Source: Moosend

This landing page ticks most of the boxes when it comes to an ideal top-fold – There are no lengthy forms to fill. The user only has to enter their email address to get started. There is a live chat widget for visitors who need to know more. Most importantly, the top strip of the landing page lets users sign up to a free plan right away without much fuss.

But like we saw with the Freshsales page, this landing page also has navigational elements in its design. This is perhaps inevitable for pages that are trying to rank on Google Search (as opposed to acquiring visitors through ads).

If we have to nitpick on the design, the other element that might need a rethink is on the secondary folds of the landing page – there are ‘Read more’ buttons spread throughout the entire stretch that can take a visitor’s eyes away from conversion. This is however a compromise to make when your landing page needs to rank on Google Search. These ‘Read more’ buttons take the visitor to various product features that are independently searched for by users.

For instance, there are close to 10,000 searches each month for the keyword ‘Email marketing templates’ and a link from this section to the Templates page is a great way to ensure that your product ranks for these relatively smaller keywords.

Insurance landing page example

Now let us compare the above pages with a landing page from another highly competitive industry like Insurance. Unlike the email marketing example discussed above, insurance landing pages typically require visitors to enter tons of personal information. This brings down conversion rates quite dramatically.

However, take a look at the example below.

[image error]Source: Coverwallet

This landing page has managed to do away with the lengthy form and has replaced it with a more ‘visible’ and easy-to-understand CTA. Also, clicking the button opens a pop-over where the visitor is only asked for their email address before they are taken to the insurance comparison page.

This strategy is likely to be highly effective since a lot of competing pages that appear in Search have lengthy forms to fill. A prospective customer is more likely to input their details here than they would on the competing pages.

Online services landing page example