Gennaro Cuofano's Blog, page 212

January 26, 2020

A Quick Introduction To Design Thinking

Tim Brown, Executive Chair of IDEO, defined design thinking as “a human-centered approach to innovation that draws from the designer’s toolkit to integrate the needs of people, the possibilities of technology, and the requirements for business success.” Therefore, desirability, feasibility, and viability are balanced to solve critical problems.

Origin of the term design thinking

While design thinking has historic roots that date back to the 1950s, 1960s, when design methods started to be applied to business, it gained momentum in the early 2000s when the consultancy firm IDEO popularized it further.

[image error]How design thinking has grown in popularity starting the 50s, 60s and it gained momentum throughout the 2000s according to Google Books Ngram.

Today Design thinking has become even more predominant and popular throughout the 2010s when thinkers like Tim Brown, Tom and David Kelley from IDEO highlighted how design could be used as the primary force to balance out human needs with technological feasibility and viability.

[image error]The spike and explosive growth in interest in design thinking throughout the 2010s, when the founders of IDEO popularized the term.

What is design thinking?

As highlighted on IDEO, by Tim Brown, Executive Chair of IDEO:

Design thinking is a human-centered approach to innovation that draws from the designer’s toolkit to integrate the needs of people, the possibilities of technology, and the requirements for business success.

Tim Brown, Executive Chair of IDEO

At the base of design thinking, there is creative confidence. Tom and David Kelley put it in Reclaim Your Creative Confidence, back in 2012:

…creative confidence—the natural ability to come up with new ideas and the courage to try them out. We do this by giving them strategies to get past four fears that hold most of us back: fear of the messy unknown, fear of being judged, fear of the first step, and fear of losing control.

In an interview in 2012, on HBR about “The Four Fears Blocking You from Great Ideas” Tom and David Kelley explained what prevented people to unlock their creative power:

Fear of the messy unknown meant as fear of getting out from the office to gather firsthand observations that require the ability to deal with the uncertain. Fear of being judged.Fear of the first step.Fear of letting go connected to the fear of losing control.

In his TED talk, How to build your creative confidence, David Kelley explained how to use a process which psychologist, Bandura called “guided mastery” that enabled people to get comfortable with the unknown or the featured step-by-step.

With confidence built up gradually and deliberately, a renewed self-reliance comes, that Bandura called “self-efficacy,” or “the sense that you can change the world and that you can attain what you set out to do.”

Integrative thinking: The foundation of design thinking

Tim Brown, in 2009 TED Talk entitled “Designers – Think Big!” highlighted:

Roger Martin, the business school professor at the University of Toronto, calls integrative thinking. And that’s the ability to exploit opposing ideas and opposing constraints to create new solutions. In the case of design, that means balancing desirability, what humans need, with technical feasibility, and economic viability.

Tim Brown, in 2009 TED Talk

In short, according to Tim Brown, design thinking is born by balancing:

Desirability: do people want it?Technical feasibility: can we actually build it?Economic viability: is it sustainable? Should we do it?

The key ingredients of design thinking and its five stages

Design thinking moves around a few key ingredients such as problem-solving, human-centric (as Tim Brown, in 2009 TED Talk that means “It may integrate technology and economics, but it starts with what humans need, understanding culture and context before we even know where to start to have ideas“).

An effective design thinking process moves around five key stages:

Empathize: what do my users/customers need?Define: what core problem do they have?Ideate: craft and brainstorm creative ideas.Prototype: craft a possible solution for each core problem.Test: does the proposed solution fit and solve the problem?

Other business resources:

What Is Business Model Innovation And Why It MattersWhat Is a Business Model? 30 Successful Types of Business Models You Need to KnowWhat Is A Heuristic And Why Heuristics Matter In BusinessWhat Is Bounded Rationality And Why It MattersThe Complete Guide To Business DevelopmentBusiness Strategy: Definition, Examples, And Case StudiesBlitzscaling Business Model Innovation Canvas In A NutshellWhat Is a Value Proposition? Value Proposition Canvas ExplainedWhat Is a Lean Startup Canvas? Lean Startup Canvas ExplainedWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And ExamplesMarketing vs. Sales: How to Use Sales Processes to Grow Your BusinessWhat is Growth Hacking?

The post A Quick Introduction To Design Thinking appeared first on FourWeekMBA.

January 25, 2020

What Are Biases Really And Why We Got It All Wrong About Biases

The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman since 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty.

That is the conventional definition, let’s see what’s wrong about it and why we want to start from an alternative definition.

Why we got it all wrong about biases?

[image error]As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty.

In my previous article about heuristics, we saw why heuristics can be powerful thinking tools for business people dealing with uncertainty on a daily basis.

When I define heuristics though I’m not using the conventional definition (to be sure that is not the definition given by Kahneman) and we’ll see why that same definition is biased in the first place.

That makes us reconsider the whole thinking model business people, entrepreneurs, managers and all the practitioners out there have been influenced by (count me in).

That is why I decided to analyze the few flaws of the conventional way to look at biases and cognitive errors.

Let’s recap here some of the key points of what heuristics are really about and why those make sense for business people.

Then we’ll go through the core mistakes of the conventional view of biases and cognitive errors at the foundation of behavioral economics and much more.

Then we’ll ask the fundamental question: what’s next?

Context matters

When dealing with real-life scenarios we can relate to them based on the context we live. A Halloween custom wore during a casual Friday won’t look as odd as the same custom wore on a regular day.

Humans think in narrow contexts not because they are narrow-minded but primarily due to the fact that often a successful decision is based on surviving a specific situation.

At the same time, our minds are capable of understanding at a deep level (not logical, neither explainable) the subtleties of the real world, made of hidden costs, risks, and high uncertainty.

In this scenario, things that might seem irrational are not such if looked from a different perspective.

A classic example that gets cited often is about how humans are “loss averse” thus giving much more weight to a loss of $10 say compared to the same $10 gain.

For the modern psychologist, marketer or businessman that might seem irrational and a signal of the human mind’s limitations and stupidity.

However, in real-world scenarios, things are never so clean and clear. Often the problem is hidden, so hidden that being loss averse is just a natural, time-tested defense mechanism against possible screw-ups.

The whole Warren Buffett’s playbook can be summarized: “Rule No. 1: Never lose money. Rule No. 2: Don’t forget rule No. 1”.

The most amateur stock trader knows that losing money is way worse than gaining. If you start from a $100 investment and you lose 50% you end up with $50.

However, to go back to where you were, $100, you will need to gain 100%. In short, a 50% loss will call for a 100% to get back to the initial point.

Polymath Jared Diamond, in his book, The World Until Yesterday, talks about constructive paranoia.

He learned this concept when leaving with several tribes in New Guinea. For instance, those tribes had a cultural norm to avoid sleeping under big trees due to a seemingly irrational fear those might fall.

Indeed, there is a very low probability of that happening. However, if it does there is no way back, you’re dead.

In most real-life scenarios those potential losses carry hidden risks, which as they can’t be computed, are ignored by psychologists, but instead are not hidden to the human mind.

So better be paranoid than a dead smart person. Tribesmen know better while some modern psychologists have forgotten.

What if risk aversion is just a constructive paranoia? This is one of the many examples of how biases could be easily reframed.

A narrow definition of rationality

Modern psychologists have primarily looked at one side of rationality and assumed that’s all that is. This led to the mainstream acceptance of a distorted theory of mind, which focuses on the cognitive errors humans make devoid of any context which has led to an endless list of biases which, we stupid humans fall into.

While it is admirable to move from a psychological framework where humans are infallible to understanding and studying the flaws of our minds.

It is as bad to fall for the opposite thinking model, where the human mind is seen as just an artifact of an ancient time, which only carries errors because it can’t deal anymore with the modern world.

That is why in the last years one of the most used mantras in business, marketing, sales or any endeavor that deals with human behavior has been about “biases and cognitive fallacies” yet as we’ll see those fallacies are mostly rationality in the real world, applied contextually.

The fundamental Kanheman’s error

Scholars like Kahneman and Tversky have changed the way we think about how we think.

In the book “Thinking, Fast and Slow” Kahneman explains his whole career spent in understanding how humans deal with decision-making, especially in relation to uncertainty and whether humans are good “intuitive statisticians.”

As Kahneman’s work would show, people are not good intuitive statisticians, and a two-model thinking system drove our decision-making in the real world.

From these assumptions heuristics produced biases, and those biases, in turn, were systematic errors that made us irrational.

Later on, Kahneman would draw a more balanced view for which judgment and choices aren’t just based on heuristics but also on skills.

Thus, biases would also be the result of the expert overconfidence, or the fact that the more skills you acquire in certain fields the more you become confident about them, thus fall into cognitive biases.

Kahneman’s work has led to infinite lists of human irrationality, humans’ complete inadequacy in having a clear picture of the real world and our inability to deal with logic.

From psychology, straight into economics, decision-making and any other endeavor related to human behavior (marketing, sales, entrepreneurship and more) these have become the dominant thinking models.

Yet this view is extremely narrow and it leads to the opposite excess. Psychologists and practitioners become producers of an infinite list of biases that grow every day to show how irrational we are.

While this production has some literary value, it doesn’t carry any value for the business person trying to make things work in the real world. If at all, that view can be limiting and damaging.

Redefining biases

Some of the fundamental errors are the following:

Out of context: the problem of the currently dominant theories around biases is the focus on the behavioral aspects (how we say we would act in a certain hypothetical scenario or how we act in completely noncontextual scenarios) vs. how we really act in a specific real context. What is rationality, really? If we define rationality as the ability to follow logical rules, then we are all irrational. If we redefine rationality as the ability to survive specific context-driven situations, then something like risk aversion can be reframed as constructive paranoia. Therefore something that we used to see as a cognitive error, becomes a defense/survival mechanism given the asymmetry of risk-taking and the fact that certain hidden risks can’t be known, or can be known only in hindsight. Do skills really create biases? Another limited view is the fact that skills cause biases. I think the problem is not of skills but whether in certain domains skills can be acquired at all. In certain areas, think of sports, the more you train, and you do it in a deliberate way, the better you become. In other areas, like entrepreneurship and business in general, building skills is trickier. Each situation and scenario will have its own subtleties and experience (not skils) make us act in certain ways that we can’t even explain. Yet can we call that a skill? Are biases really biases? By following what’s above you can understand that biases aren’t so if looked through the lenses of a different definition of rationality.

If you agree with all the points above, does it still make sense to keep using this thinking model?

What’s next? Beyond the “bias bias” and into the real-world decision making

Gerd Gigerenzer, in “The Bias Bias in Behavioral Economics” explains how Kahneman’s work has led to the tendency to “spot biases even when there are none.”

As Gigerenzer explained people ” have largely fine-tuned intuitions about chance, frequency, and framing.”

Thus showing little evidence about the fact that biases lead to any cost at all. Therefore, each time you see a bias proposed by psychologists you might want to keep a skeptical eye and trust your fine-tuned intuition, and acquired experience as a business person!

References:

The Bias Bias in Behavioral Economics, Review of Behavioral Economics, 2018, Gerd GigerenzerHeuristic Decision Making, Gerd Gigerenzer and Wolfgang Gaissmaier, Annu. Rev. Psychol. 2011. 62:451–82Judgment Under Uncertainty, Heuristics, and Biases, Amos Tversky and Daniel KahnemanThinking, Fast and Slow, by Daniel KahnemanRisk Savvy: How to Make Good DecisionsBook by Gerd Gigerenzer

Read next:

What Is A Heuristic And Why Heuristics Matter In BusinessWhat Is Bounded Rationality And Why It Matters

Other resources:

What Is Business Model Innovation And Why It MattersWhat Is a Business Model? 30 Successful Types of Business Models You Need to KnowThe Complete Guide To Business DevelopmentBusiness Strategy: Definition, Examples, And Case StudiesBlitzscaling Business Model Innovation Canvas In A NutshellWhat Is a Value Proposition? Value Proposition Canvas ExplainedWhat Is a Lean Startup Canvas? Lean Startup Canvas ExplainedWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And ExamplesMarketing vs. Sales: How to Use Sales Processes to Grow Your BusinessHow To Write A Mission StatementWhat is Growth Hacking?

The post What Are Biases Really And Why We Got It All Wrong About Biases appeared first on FourWeekMBA.

January 22, 2020

Tesla Business Model In A Nutshell

Tesla is vertically integrated. Therefore, the company runs and operates the Tesla’s plants where cars are manufactured and the Gigafactory which produces the battery packs and stationary storage systems for its electric vehicles, which are sold via direct channels like the Tesla online store and the Tesla physical stores.

Where’s is Tesla Today?

For the first time in its history, in January 2020, Tesla has passed the $100 billion market capitalization. To gain a bit of context that is three times more the market capitalizaiton of Ford, in the same period.

Tesla founding story

The electric carmaker company is owned by entrepreneur/visionary Elon Musk. Tesla was founded by Martin Eberhard and Marc Tarpenning in July 2003. Elon Musk entered in Tesla in 2006, first as investor and chairman, then he took the role of CEO which he still holds today.

Related: What Is a Business Model? 30 Successful Types of Business Models You Need to Know

Elon Musk’s long-term vision for Tesla

Back in 2018, Elon Musk highlighted the long-term vision for Tesla:

Our goal is to become the best manufacturer in the automotive industry, and having cutting edge robotic expertise in-house is at the core of that goal. Our recent acquisitions of advanced automation companies have added to our talent base and are helping us increase Model 3 production rates more effectively. We don’t want to simply replicate what we have built previously while designing additional capacity. We want to continuously push the boundaries of mass manufacturing.

Tesla’s mission can be summarized as:

to accelerate the world’s transition to sustainable energy.

As the company highlights:

Tesla builds not only all-electric vehicles but also infinitely scalable clean energy generation and storage products. Tesla believes the faster the world stops relying on fossil fuels and moves towards a zero-emission future, the better.

Tesla revenue streams

Tesla has four main sources of income:

Automotive

Automotive leasing

Services and other

Energy generation and storage

[image error]

Based on the Tesla’s financial statements, in 2018 the company almost doubled its revenus while improving substantially its bottom line.

The most important revenue stream is the Automotive sales revenue (which includes revenues related to sale of new Model S, Model X and Model 3 vehicles, including access to Supercharger network, internet connectivity, Autopilot, full self-driving and over-the-air software updates, as well as sales of regulatory credits to other automotive manufacturers) with over $17 billion, followed by automotive leasing with over $880 millions and services and other with over £1.3 billion.

What’s Tesla’s value prososition

As highlighted in its financial statements, Tesla offers three core values to its customers:

Long Range and Recharging Flexibility

High-Performance Without Compromised Design or Functionality

Energy Ef iciency and Cost of Ownership

Tesla distribution strategy

Tesla is vertically integrated, as its pipeline goes from manufacturing to direct sales of its vehicles.

As highlighted by Tesla “the benefits we receive from distribution ownership enable us to improve the overall customer experience, the speed of product development and the capital efficiency of our business.”

Even though a vertical integrated network representd a substantial investment in terms of physical asset Tesla can keep control over the experience of its customers. While also being able to retain important feedbacks throughout the supply chain.

Indeed, in a model where the customer is reached via indirect distribution the company might lose control of the customer experience at the last mile, and the valuable feedback it can gather from the marketplace.

Tesla follows an unconventional distribution model compared to other car manufacturers where the final sale is made via car dealerships which not tied to the company.

Does Tesla spend nothing in marketing?

Musk is famous for his unconventional stunts. For instance, the stunts of the flamethrowers or the Tesla roadsters sent on space managed to reach hundreds of millions of people worldwide without a dollar spent on ads.

However, this also fueled the myth that Tesla doesn’t spend a dollar on advertising campaigns or marketing.

[image error]

Like any other company, Tesla has a marketing budget for advertising and marketing campaigns. In fact, as Tesla specified in its annual report for 2018, in the section related to “Marketing, Promotional and Advertising Costs:”

Marketing, promotional and advertising costs are expensed as incurred and are included as an element of selling, general and administrative expense in the consolidated statement of operations. We incurred marketing, promotional and advertising costs of $70.0 million, $66.5 million and $48.0 million in the years ended December 31, 2018, 2017 and 2016, respectively.

Thus, even though the former PayPal Mafia member Elon Musk is the master of unconventional PR, Tesla still needs advertising to push its sales.

However, if we compare that to the revenue figures for 2018 (over $21 billion), the spending in marketing activities is around 0,03% which is an incredibly low figure.

Who owns Tesla?

[image error]

If we look at Tesla’s proxy statement for 2019, Elon Musk holds over 38 million stocks, which gives him a 21.7% ownership in the company. Followed by investment management firm, Baillie Gifford & Co with 7.7% and other capital and venture capital firms like FMR LLC, and Capital Ventures International.

Therefore, based on a $100 billiom market capitalization, Musk’s value of its stake in Tesla is over $20 billion.

Is Tesla profitable yet?

Tesla turned a profit for the first time on the third quarter of 2019. Indeed the company posted $143 million in net profits. However, annualized the company still loses money.

Is Tesla worth more than GM?

In January 2020, Tesla passed for the first time in its history the market cap of $100 billion, twice the market cap of GM (about $50 billion) in the same period even though in 2018 GM had 6-7 times the revenues of Tesla. Tesla though is valued as a tech company, which in the future can capture a wider and wider market, thus becoming way more valuable.

Business resources:

The Ultimate Guide to Market Segmentation

What Is a Business Model? 30 Successful Types of Business Models You Need to Know

The Complete Guide To Business Development

Business Strategy: Definition, Examples, And Case Studies

What Is a Business Model Canvas? Business Model Canvas Explained

Blitzscaling Business Model Innovation Canvas In A Nutshell

What Is a Value Proposition? Value Proposition Canvas Explained

What Is a Lean Startup Canvas? Lean Startup Canvas Explained

Marketing Strategy: Definition, Types, And Examples

Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

How To Write A Mission Statement

What is Growth Hacking?

Growth Hacking Canvas: A Glance At The Tools To Generate Growth Ideas

Case studies:

How Does PayPal Make Money? The PayPal Mafia Business Model Explained

How Does Venmo Make Money? the Peer-To-Peer Payment App for Millennials

How Does WhatsApp Make Money? WhatsApp Business Model Explained

How Does Google Make Money? It’s Not Just Advertising!

How Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

The Google of China: Baidu Business Model In A Nutshell

Accenture Business Model In A Nutshell

Salesforce: The Multi-Billion Dollar Subscription-Based CRM

How Does Twitter Make Money? Twitter Business Model In A Nutshell

How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

How Amazon Makes Money: Amazon Business Model in a Nutshell

How Does Netflix Make Money? Netflix Business Model Explained

The post Tesla Business Model In A Nutshell appeared first on FourWeekMBA.

January 20, 2020

Asymmetric Business Models In A Nutshell

In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus have a key customer pay to sustain the core asset. For example, Google makes money by leveraging users‘ data, combined with its algorithms sold to advertisers for visibility.

Asymmetric business models explained

[image error]

[image error]Facebook is an attention-based business model. As such, its algorithms condense the attention of over 2.4 billion users as of June 2019. Facebook advertising revenues accounted for $31.9 billion or 98.66% of its total revenues. Facebook Inc. has a product portfolio made of Instagram, Messenger, WhatsApp, and Oculus.

A couple of core examples of asymmetric business models that are easier to understand as those are companies we all know are Google and Facebook.

Both are attention-based models, where users‘ data get sold to advertisers. It’s important to highlight that it isn’t necessarily the data which is sold directly but rather how the data is refined by those companies search algorithms (for Google) and social graph algorithms (for Facebook), repackaged and sold to advertisers.

The key point is not about the advertising business model but rather how monetization happens. In an asymmetric model user and customers are two different people.

The user is the most valuable stakeholder as it provides the data which gets used to refine the core asset of the company. Combined with technology that is how the core asset is sold to a key customer.

To go back to Google’s example, users search through Google providing valuable search intent data, but also behavioral data. When this gets refined by Google’s algorithms that is when the core asset becomes monetizable, as it gets sustained by the advertising revenues paid by customers paying for visibility on the platform.

Other asymmetric business models examples

In general, business models where the user and customer are not the same people can be classified as asymmetric.

Therefore the attention generated by the free service or product gets monetized indirectly. Google and Facebook are classic examples. Other platforms like Netflix simply monetize their users‘ data by providing them with a subscription service, thus this is an asymmetric model where user/customer matches.

Asymmetric business models if used properly can scale quickly, however, those are also usually built on large numbers.

Examples of asymmetric business models:

How Does Google Make Money? It’s Not Just Advertising! How Does Facebook Make Money? Facebook Hidden Revenue Business Model ExplainedThe Google of China: Baidu Business Model In A NutshellHow Does Twitter Make Money? Twitter Business Model In A NutshellHow Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

Resources:

What Is Business Model Innovation And Why It MattersWhat Is a Business Model? 30 Successful Types of Business Models You Need to KnowBusiness Strategy: Definition, Examples, And Case StudiesMarketing Strategy: Definition, Types, And ExamplesPlatform Business Models

The post Asymmetric Business Models In A Nutshell appeared first on FourWeekMBA.

Business Analysis: How To Analyze Any Business

Business analysis is a research discipline that helps driving change within an organization by identifying the key elements and processes that drive value. Business analysis can also be used in Identifying new business opportunities or how to take advantage of existing business opportunities to grow your business in the marketplace.

A quick intro to the Business Analysis framework

On FourWeekMBA I’ve looked at hundreds of business models of companies from high-tech industries (Alphabet’s Google, Amazon, Facebook, Apple, and Microsoft) to more traditional industries, like luxury empires (LVMH, Kering Group, Tiffany, Brunello Cucinelli, Prada) and more.

I’ve analyzed from listed, public companies, for which data can be found in financial statements to small businesses for which data is not publicly available.

As I received this question over and over again, I thought to show a simple framework to analyze any business. For the sake of this framework, we’ll leverage on business analysis to reverse engineer a business to either help it grow or to gather insights that can help us grow our own company.

Keep in mind the business analysis requires a good amount of creativity, and while a single framework is a good starting point, you will need to use your experience, understanding of the industry and what is available out there to draw a picture of what you’re looking at.

In short, I think an effective approach to business analysis is that of the artist, rather than the scientist.

Thus, while we’ll be using a few data points to understand a business, we want to keep our minds able to connect the dots in several areas to draw a picture that unlocks strategic insights that we can test.

For the sake of providing a framework as a starting point to analyze any sort of business, you’ll need to answer a few simple questions, each addressing a key element of the business:

How does it make money? (revenue generation) Where’s the real cash? (cash generation)What’s the key asset? (core asset)Who’s the key stakeholder? (stakeholder profiling)What player is competing for the same customer? (context mapping) What’s the key touchpoint between the brand and the customer? (core distribution)How does the company spend money? (cost structure)

Let’s analyze each of those elements to uncover and draw the picture of any business.

How does it make money?

Revenue streams are important as a baseline to understand any business. Following the money can be very powerful in business as it unlocks a set of questions that will help us drill down into the current picture but also to draw some possible conclusions about future operations and strategy.

For instance, if you look at Google revenue streams it’s interesting to notice a few things right away:

[image error]Google primarily makes money via its advertising network that in 2017 generated 86% of its revenues. Then, the other side of the business – almost 13% of its revenues in 2017 – comprised money from the Apps, in-app purchases, and digital content in the Google Play store, Google Cloud offering and Hardware products. The remaining part is attributable to Google’s “other bets” a set of risky businesses Google is betting on.

The company still primarily makes money from advertisingGoogle revenue streams are diversified (even though advertising is still the primary revenue stream)A very small percentage of Google’s revenues come from other bets

From those simple statements, we can drill further down and look at each revenue stream:

Advertising revenues: Google makes money by two primary mechanisms: Google Ads and Google AdSense Other revenues: that comprises things like in-app revenues, but also hardware devices which Google sells Other bets: it comprises investments in other ventures

From this first look, we can depart from looking at other bets and other revenues. Not because those are not important for the future. Quite the opposite, one of the hidden gems of Google‘s success in the next ten, twenty years might hide there.

But here we’re not trying to predict the future, which is impossible. We want to reverse engineer the current business to gather some insights which will help us drive our own strategy now (for instance, if you’re building a business today by gaining organic traffic from Google understanding its logic helps a lot!).

Therefore, we’ll decide to drill down more

Why? We want to uncover where the real cash is.

Where’s the real cash?

When asking “where’s the real cash?” we’re not talking about cash flows, but rather about margins. In short, for companies like Netflix which run cash negative business models, it would be misleading to ask where’s the cash.

Instead, we want to look at the part of the business that has high-profit margins. For instance, if we look at Google’s advertising machine we can notice a few things:

[image error]Google generated over $116 billion from advertising revenues in 2018, which represented 85% of its total revenues. Of those revenues over 70% came from traffic via Google’s main properties (Google search engine, YouTube, Gmail, and others). Google’s main properties are monetized primarily via a cost-per-click mechanism. Network members’ sites are primarily monetized on a cost-per-impression basis. Google also spent over $26 billion in 2018 to sustain its traffic on both its properties and as a revenue-share mechanism with its network members (AdSense and AdMob).

To build a cash cow the company might do the following:

Give up part of the margins on a line of business to strengthen another more strategic and scalable part of the business (think of how Google splits revenues with network members thus giving up a good chunk of margins, yet by making its search pages way more valuable for users, and advertisers)Build a freemium part of the business which while doesn’t get monetized it helps amplify the brand and to build a valuable core asset monetized asymmetrically (we’ll see what that means)

What’s the key asset?

[image error]Alphabet’s Google key asset, its search results page, which for over two decades helped Google become a trillion-dollar company!

The key asset is the main property that enables the company to make money in the long run.

For a tech business like Google that is represented by its search results pages, which endowed by users’ data and algorithms make them extremely valuable to advertisers.

If we think of a smaller business or a non-tech company that can be represented by its premises or its brand.

For instance, for a small Boutique hotel, its location is the key asset. For a luxury company, its brand is the most important asset.

The former is physical and easily identifiable. The latter is instead non-physical and abstract, yet still extremely valuable as it enables companies like Prada, LVMH, Tiffany and other luxury brands to capture high margins.

Therefore depending on the company, the main asset might be the technology, data or brand. Or better yet a mixture of those things.

Who’s the key stakeholder?

If you look at a companies’ like Amazon the complexity of the business goes well beyond a regular company. In short, at this stage, it’s important to highlight the difference between small businesses which are more linear in how they approach customers.

And platform business models that instead have a more complex value chain.

[image error]Linear business models create value by selling products down the supply chain. Platform business models create value by enabling exchanges among consumers.

We could make this process harder and harder by finding more business types, classifying them in B2B, B2C, B2B2C and more. Or we can take a simpler approach.

Who’s the key user/customer and what’s the value provided to her?

[image error]A company like Amazon has multiple value propositions, as it serves several target customers in different markets. With its mission “to be Earth’s most customer-centric company, where customers can find and discover anything they might want to buy online and endeavors to offer its customers the lowest possible prices,” Amazon value propositions range from “Easy to read on the go” for a device like Kindle, to “sell better, sell more” to its marketplace.

In Amazon’s case, for instance, the company has multiple products and each of them has a different value proposition. Therefore, focusing on them all would be a mistake, as we want to go back and reconsider.

Who’s the Amazon repeat customer?

The customer who goes back to the Amazon e-commerce platform to buy over and over again is the key customer and where the company has built its success.

When you do look at the customer from that perspective, you stop assuming that Amazon Prime is another revenue stream, and instead, you understand that besides that, that is a way for Amazon to lock-in loyal customers and make their repeat purchases convenient (Prime Customers won’t pay for delivery).

The same happens if you go back and ask a similar question for a company like Google.

Who’s the person that drives up the value of the most important company’s asset?

If you look at Google‘s business model it’s easy to get fooled:

[image error]

You might assume that as Google makes money by selling advertising to businesses, it will be the advertiser who pays Google to be the most valuable customer.

Yet, in Google‘s case, the most valuable customer is the one who doesn’t pay: its users

[image error]Google’s mission statement is to “organize the world’s information and make it universally accessible and useful.” Its vision statement is to “provide an important service to the world-instantly delivering relevant information on virtually any topic.” In 2019, Sundar Pichai emphasized a renewed mission to allow people “to get things done!”

That is because Google runs an asymmetric model. In short, the company won’t monetize directly its users, but it will monetize the core asset which is built on top of the free users‘ attention.

[image error]In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus have a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility.

Where free users provide valuable data to Google‘s algorithms, the company matches its technology with the users‘ data and sells part of that as paid adverting.

In short, in an asymmetric model user and customers are not the same.

In a more symmetric model instead, users and customers are the same stakeholders. The customer wearing the hat of the user provides valuable data to the platform. The company refines that data through proprietary algorithms and as a result, it gives back a valuable service to its customers.

That is how the Netflix business model works.

In those cases when the user is what provides valuable data to the core asset of the company, it’s important to understand that the tech company will prioritize its strategy around the user over time.

What player is competing for the same customer?

Once found the key stakeholder, the person who helps the company build its most valuable asset, we can zoom out a bit and understand the context in which the company operates.

[image error]A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company. To find comparables you can look at two key profiles: the business and financial profile. From the comparable company analysis, it is possible to understand the competitive landscape of the target organization.

One way to find comparable companies to map out the context is to look for those organizations that match the business and financial profile.

We do that because there is no company operating in a vacuum. And even when a company which is better suited to help customers get things done might dominate.

In many other circumstances, better distribution strategy, capital moats, and more effective business models can help companies dominate beyond the value provided by their core products.

That’s why context matters.

In Google‘s case we’ll look at the other players which are also grabbing the attention of users around the globe:

[image error]According to eMarketer, in the US alone, digital advertising spending will be around $129 billion. Within this market, the most significant players are companies like Google ($116 billion in 2018 from search advertising), Facebook (over $55 billion in advertising revenues in 2018), Amazon (over $10 billion in 2018 from product advertising), Twitter (with $2.6 billion in advertising in 2018), and Microsoft’s Bing (search advertising for about $7 billion in 2018)

An attention-based model usually follows an asymmetric monetization strategy. Therefore, given Google‘s key stakeholder (its users), and the fact that it’s an attention-based model, we can understand right away what products/platforms in the marketplace are comparable:

Google (Alphabet)YouTube (Alphabet)Facebook Instagram (Facebook)Bing (Microsoft)TwitterTikTok (ByteDance)DuckDuckGoAmazon

Therefore, in order for Google to keep its competitive advantage is important to keep an eye on these.

*Note: The reason why Amazon is on the list as its website is one of the most important product search engines, intercepting the commercial intents of billions of people in the western world.

What’s the key touchpoint between the brand and the customer?

While disruptive startups built their name and grabbed market shares quickly by breaking down the trade-off between value and cost (at the basis of a blue ocean strategy) there is another component of the success of any organization which can’t be ignored: distribution.

Distribution is the key touchpoint that makes customers connect with a brand, that enables companies to monetize their core assets and that enables them to keep tight long-term control over their business.

The importance of a distribution strategy can’t be overstated. Distribution isn’t just about delivering a product in the hands of the key customer that is also about:

Enabling the company to be perceived inline with its pricing strategy and the brand’s identityBuilding up the habits that enable users/customers to become champion of the product (just like you can’t stop using Google)Build competitive moats

How does the company spend money?

[image error]The cost structure is one of the building blocks of a business model. It represents how companies spend most of their resources to keep generating demand for their products and services. The cost structure together with revenue streams, help assess the operational scalability of an organization.

How the company spends its money informs about how it’s investing back into strengthening its core asset, thus building future growth.

[image error]TAC stands for traffic acquisition costs, and that is the rate to which Google has to spend resources on the percentage of its revenues to acquire traffic. Indeed, the TAC Rate shows Google’s percentage of revenues spent toward acquiring traffic toward its pages, and it points out the traffic Google acquires from its network members. In 2017 Google recorded a TAC rate on Network Members of 71.9% while the Google Properties TAX Rate was 11.6%.

Where do you find the data?

A set of useful resources to find the data you need to analyze several businesses are:

EDGAR FilingsCrunchbaseOwler SimilarWebLinkedIn

It’s important to remark that when it comes to data it’s not important how many data points you find. Often it requires a bit of creativity to ponder the right question.

In that case, a single data point can tell you a lot about a business.

FourWeekMBA business analysis framework summarized

To analyze any business you can ask a few simple questions:

How does it make money? (revenue generation) Where’s the real cash? (cash generation)What’s the key asset? (central asset)Who’s the key stakeholder? (stakeholder profiling)What player is competing for the same customer? (context mapping) What’s the key touchpoint between the brand and the customer? (core distribution)How does the company spend money? (cost structure)

Each of those questions will lead to an understanding of the several blocks that make up internal and external strategic forces that shape the business.

FourWeekMBA resources used to draw the framework:

What Is Business Model Innovation And Why It MattersWhat Is a Business Model? 30 Successful Types of Business Models You Need to KnowBusiness Strategy: Definition, Examples, And Case StudiesMarketing Strategy: Definition, Types, And ExamplesPlatform Business Models

Business model case studies:

How Does PayPal Make Money? The PayPal Mafia Business Model ExplainedHow Does WhatsApp Make Money? WhatsApp Business Model ExplainedHow Does Google Make Money? It’s Not Just Advertising! How Does Facebook Make Money? Facebook Hidden Revenue Business Model ExplainedThe Google of China: Baidu Business Model In A NutshellHow Does Twitter Make Money? Twitter Business Model In A NutshellHow Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedHow Amazon Makes Money: Amazon Business Model in a NutshellHow Does Netflix Make Money? Netflix Business Model Explained

The post Business Analysis: How To Analyze Any Business appeared first on FourWeekMBA.

January 18, 2020

Scale Matters In Marketing: Communication Strategies For Unconventional Business People

An effective communication strategy starts with a clear brand identity, by defining clear boundaries and compromises your brand will not take in the marketplace. Based on that, understanding, whether context, formats, and scale are in line with your business message to prevent a loss of identity.

What business communication is about?

One of the key tenets of content syndication is you take a piece of content, break it down in small parts and spread it around several platforms when you do that you amplify your message. This kind of thinking isn’t only limiting but dangerous for whoever is trying to build a successful marketing strategy.

Primarily an effective communication strategy should start by clear brand identity and look at the following:

Context: What kind of behaviors this type of communication and platform incentivizes? Format: What format is available on that platform? And scale: How fast a message can spread on the platform given the context and format?

In this article, I want to highlight some of the thoughts I had hanging in my mind about communication for business.

Let me tell you why.

Clear brand identity? It’s about what you’re not about

Usually, a clear brand identity starts by identifying the core values. And that is fine. But in reality, strong brand identity starts by setting clear boundaries around what you’re not about.

Therefore, make sure to define the compromise your brand is not willing to take in the marketplace and make sure you comprise that in your message and you treasure it as the most valued asset.

For instance, “FourWeekMBA is not about quick business education for the sake of it, it’s about the minimum dose of business education that leads to action, rather than paralysis.”

So from a negative statement, a positive outcome is born.

Preserving your brand identity is the key to an effective communication strategy to prevent your message to get lost.

The message is the context

A message has meaning based on the context it sits. Communication between two people, it’s not the same as a group chat, where more complex social dynamics kick in.

Therefore, when communicating it’s critical to understand the context the message is getting delivered. Because the same message delivered through different context changes the meaning.

The same words spoken within different contexts are not the same message!

If you are at a company retreat and you’re giving a motivational talk to your employees, that might be well received and understood in that context (remember you might be sharing the same company’s culture).

The same speech recorded and shared across social media can be a disastrous endeavor.

Not only the communication will change from one to a few (the boss and its employees) to many (people sharing it on social media) but the message will get out of the context it was thought for, thus changing its whole meaning.

When that happens, things can get messy. That is why it might be better to avoid any sort of communication there, rather than wanting to be “innovative” yet risking a complete disaster.

The format is the message

Another element to take into account is the format. An article can be summarized in a post. But while an article can conceive several ideas a post will communicate a single, clear idea.

That is why taking the same message to spread it across different platforms won’t work. In some cases, a message can be adapted to several formats, but that is not always the case.

For instance, an article can be adjusted and summarized in a LinkedIn post. However, a LinkedIn post to work has to have certain features that make it aligned with the platform dynamics.

For instance, on LinkedIn, a short story might work better to conceive the idea of the article. In short, if you have a short story within the article you want to start from there to amplify the article.

Therefore, the question becomes whether using a format that a platform makes available (on Twitter, for instance, tweets and tweetstorms work well, on Instagram stories go viral, and on TikTok duets spread quickly) is in line with your communication style.

If so, you can adjust the message to fit the format without using its essence. But keep in mind that if the message scales, the more it does the more it might change its original meaning.

Are you ready to take that risk?

A tweetstorm is not a blog post

According to some, the first tweetstorm appeared maybe when venture capitalist Marc Andresseen broke the boundaries of Twitter‘s 140 characters a new format on a new platform was born.

While a tweetstorm might seem just like a short-form article, it’s a completely different form of communication and that’s due to the scaling of the message.

When a tweetstorm gets released, the fact that its length is that of a short-form article might trick you to believe it has the same property. Yet they are not the same thing.

A tweetstorm is a one to many, only at the moment, it gets shared. Yet at the moment that spreads that same tweetstorm will become a many to many communication, and the message which once you controlled and it was yours will be adjusted to the scale it reaches.

Thus, if you have expressed an idea which is prone to be understood by a small group of people, are you sure that the tweetstorm is the best place to start? In short, to keep the same property of the message probably a newsletter would do the job way better?

Network effects and scaling

When a message scales it changes its core properties. That implies also a change of meaning on the other side. That is why it’s important to understand how prone is a message to scale, given the context, format, and platform where it gets delivered.

A blog post has a different scaling propensity than a twitter post or a TikTok video. A newsletter, for instance, is usually a one to one communication and remains so up to a certain extent (unless you launch the same message to hundreds of thousands people).

Why does it all matter?

Context, format, and scale influence your communication and based on the message you want to deliver it’s important to know what you’re doing to prevent disasters.

Because while we all want to communicate on the web, and most of us do at amateurish level, it’s also important if you’re building a business, to understand the hidden risk of communication done wrong.

Key takeaways

When communicating you are explaining to people what is your identity, why you exist, what your business is about and this all helps to build your business’ personality, what marketers call a brand.

A brand is valuable as it enables a business to scale beyond the person who created it. In short, people can relate also to an abstract entity, called brand, as soon as they can perceive this abstract entity has human-like features.

This demands your communication flow to be in line with what you want to conceive. The era of digital platforms seems to demand brand to be there just for the presence’s sake (everyone is there so I must be too).

That makes small brands, but also larger ones to fall into the trap of losing their message just because they adapt, without too much thinking at the format the platform offers.

We saw in this article, how context (what kind of behaviors the platform incentivizes?), format (what format is available on that platform?) and scale (how fast a message can spread on the platform?) can change the meaning of your message altogether.

This brings a loss in translation which can translate in loss of brand equity. Therefore, before committing for all the platforms out there ask yourself:

Is this platform in line with my brand identity? Is there a format available on the platform which will enable us to preserve the meaning of the message?How prone is the message to scale? And if it does would it lose its original meaning?

Other business resources:

What Is a Business Model? 30 Successful Types of Business Models You Need to KnowWhat Is a Business Model Canvas? Business Model Canvas ExplainedBlitzscaling Business Model Innovation Canvas In A NutshellWhat Is a Value Proposition? Value Proposition Canvas ExplainedWhat Is a Lean Startup Canvas? Lean Startup Canvas ExplainedHow to Write a One-Page Business PlanThe Rise of the Subscription EconomyHow to Build a Great Business Plan According to Peter ThielWhat Is The Most Profitable Business Model?The Era Of Paywalls: How To Build A Subscription Business For Your Media OutletHow To Create A Business ModelWhat Is Business Model Innovation And Why It MattersWhat Is Blitzscaling And Why It MattersSnapshot: One Year Of “Business Model” Searches On Google In ReviewBusiness Model Vs Business Plan: When And How To Use ThemThe Five Key Factors That Lead To Successful Tech StartupsTop 12 Business Ideas with Low Investment and High ProfitBusiness Model Tools for Small Businesses and StartupsHow To Use A Freemium Business Model To Scale Up Your Business

The post Scale Matters In Marketing: Communication Strategies For Unconventional Business People appeared first on FourWeekMBA.

January 12, 2020

Next Practices in Change Management Strategies: it takes an innovating mind

Success has no Plan B. It requires a strong clear vision. And, if you can’t put that vision to paper, it’s not going happen. But, for all the videos and Instagram moments around us, we are not very good at seeing what needs to be seen in organizational change management.

To manage the change — from inside and outside, you must understand the nature of change, discover the most fitting business model for change, and build in a fluid, flexible change management strategy.

Organizations are natural and organic.

Stakeholders create and develop organizations. As I said in The Change Champion’s’ Field Guide (2013), organizations exist “because they are held within the minds of interconnected and interdependent people. [As such] They are an elaborate demonstration of the potential for human imagination.” Survival depends on their ability to grow, and growth means change.

Organizational change is not transformational if it is mainly transactional, so you must learn to draw new models to capture rapidly evolving value propositions. The pulls of Artificial Intelligence, transhumanism, robotics, and more demand more fluid, dynamic, and integrated pictures. Legacy approaches to next-generation innovation and expectations just cannot do the job anymore.

Change can mean running in place —

There is a physics to business change. All organizations have a degree of potential energy that may or may not become kinetic. All things being equal (as they never are), the energy will express itself according to certain laws of force, velocity, and inertia. Each and all are functions of weight. density, and gravity.

Theorists work most comfortably when these assumptions are firm: “If A, B, and C are true under conditions D, E, and F, then ….” Having set up such parameters, they proceed to drape a skin upon the bones.

The Aristotelian logic appeals to accountants, actuaries, and auditors. With business so attached to its financing and P&L, this binary approach plays a continuing prominent role in management thinking. But it also constrains the ability to envision business futures and manage change.

Traditional logic does provide a common vocabulary and process to set up standards of operation, best practices, and reporting metrics. As a discipline and universal standard, the logic is healthy. As a record of past-to-recent transactions, it is handy. But it remains descriptive, not prescriptive. The data may indicate trends, but if the trends were sacred, you could bet Wall Street on them. Classic logic cannot see around corners where lies much shaping, informing, and threatening change.

Straightening change out —

The strong trust in the logic-defining “old math” spurs makers and shakers to roll things out with most business strategies illustrated as horizontal lines. Resources pass-through procurement and processing to delivery. An occasional line inclines up and to the right; the arrows always point right. And, sometimes they are segmented by downs markers or graph grids.

You learn this from board games. Checkers move forward — or not. The Game of Life takes you through pre-ordained rites of passage to victory if you play “fair.” Monopoly introduces some strategy for those smart enough to die rich. And, success in Sorry depends on the odds and your willingness to betray your friends and family.

Figure 1 forms a typical legacy business model where everything drives right on some bias that right is positive.

Figure 1: Typical Legacy Business Model

[image error]

The horizontal mindset is governing, traceable, and lends itself to SmartArt, Excel, Gantt Charts, calendars, and flowcharting software. You can suggest some parallel movement of functions by adding cells below these titles to integrate their roles. They can be fitted with resources, inventory, prices, counts, receivables, and other numbers. The resulting vertical silos and matrices are, then, useful — given what they are.

However, each increment assumes it carries the preceding forward. In his paper on “Mission, Vision, Strategy: Discernment in Catholic Business Schools” (2012), Wolfgang Grassl wrote, “Planning is by its nature directed at a goal or purpose. In a sequential process, every stage captures a fraction of what the previous stage required. Ultimate success is then a multiplicative function of successive stages.”

This multiplicative assumption that things follow-through is woefully naïve considering the accelerating dynamic of contemporary innovation. It has no room for the outcome of our research, reported in Best Practices in Leadership Development and Organizational Change (2015), that found “A majority of our world’s best organizations describe leadership development and organization changes as ‘the real work of the organization’.”

Contemporary business management change —

Twelve-column spreadsheets cannot capture the fluid dynamic of innovation. Legacy business models treat progress as accumulation and aggregation. They prioritize quantification; even quality control is a tick on a checklist.

Despite the angular layout of the Business Model Canvas created by Alexander Osterwalder and Yves Pigneur (2004), the components surround the Value Proposition, that unique something that separates your product or service from the competition. It has proven a flexible launch vehicle creating business models for innovative futures.

Traditional business models have sought to produce outputs efficiently and economically. Economic exchange at any level is about creating value for money. Writing for The European Journal of Management (2008), Stephen L. Vargo and colleagues noted, “that value is fundamentally derived and determined in use – the integration and application of resources in a specific context – rather than in exchange – embedded in firm output and captured by price.” Value for money increases when the change is fit for purpose, for time, and for purpose.

Vargo went on to observe that values then derive from an understanding that “(1) service, the application of competencies (such as knowledge and skills) by one party for the benefit of another, is the underlying basis of exchange; (2) the proper unit of analysis for service-for-service exchange is the service system, which is a configuration of resources (including people, information, and technology) connected to other systems by value propositions; and (3) service science is the study of service systems and of the co-creation of value within complex configurations of resources.”

To reach such understanding means seeing business change as biochemical, hormonal, and emotional as well as categorical, transactional, and reductive — emotional connectedness being the key. Fortunately, you now see software able to draw flows, tides, and feedback — the strategic change management tools organizations can build dreams upon.

Feeding futures forward —

The concept of the Theory of Change shown here in Figure 3 can be fun. But this change management tool is more than illustrative. The picture is a collaborative process during which stakeholders provide inputs, establish orders, and negotiate differences — and have fun doing it.

Figure 3: Theory of Change visual notes

All rights reserved © Emily Shepherd, 07/29/2013

[image error]

The visual notes become a loose display of the central values, functions, and processes while acknowledging the assumptions and risks involved. At this, it is an imaginative equivalent of the sticky notes and magic markers used to create Figure 4.

Figure 4: Design Thinking for Advocacy

Image attributed to Christine Prefontaine at Flikr.com

[image error]

This tactical approach to change management supports decision making at crucial growth points and informs a strategy of continuing innovative growth.

Discern, deliberate, and decide —

Change prompts resistance from people, policies, and processes. Walter Earl Fluker, Executive Director at Morehouse College, feels “To discern, deliberate, and decide effectively, leaders at the intersection must reexamine their core values and assumptions about identity (character); clarify relationships with others in their environment who are involved in and will influence their discernment, deliberation, and decision making (civility); and maintain strong ties with their primary network of discourse and practice (community).”

It is here, for example, we were able to help a major regional healthcare provider better serve its “community of caring.” Brainstorming, discovery, and data drove a discerning decision on forging new relationships with medical providers across the region setting a course to create collaborative arrangements with hospitals so they all could survive in a hyper-competitive healthcare/clinical landscape where small hospitals were getting eaten up.

Change management strategy starts with this discernment, the asking of “What’s going on?” That differs from examining the “why” and “how” — both of which are retro focused. Change must anticipate the rise and risk of intersections where core assumptions and values must center thought and action.

Where change confuses invention and innovation—

The ill-fated launch of Google “Explorer” Glasses provides positive lessons in business modeling and effective change management. Google co-founder Sergey Brin had launched an empowering initiative to spur innovation. In at least one case, it triggered a rush to market.

It produced an inventive technology putting the power of a full computer into the arm of nerdy spectacles. Steven Levy, writing for Wired.com (2017) noted, “The original Glass designers had starry-eyed visions of masses blissfully living their lives in tandem with a wraparound frame and a tiny computer screen hovering over their eye.”

Asking $1,500 a pair, Google marketed what was an unproven prototype. It promised facial recognition, social media access, and unlimited Android applications. With the tech media overexcited about its production and promise, somebody failed to consider tech defects and the universal fear of its invasion of privacy issues. The failure in the process (if not in ethics) proved a major embarrassment for Google — not enough to damage the tech behemoth but embarrassing, nonetheless.

The value proposition of the first launch appears to have offered a unique device to a public at large already committed to buying on Amazon. Google wanted to capture a segment of the IoT market before Apple or others had developed the product. Instead, they pushed a faulted high-dollar item to an audience addicted to new devices. So, Google went back to its drawing board to create, prototype, test, and improve its technology, lower its price, and focus its marketing.

Google’s Glass Enterprise Edition 2 launched in 2019, a $999.99 utility device sold to businesses that manage the device’s proprietary software. Its website features videos of use among farmers, doctors, technicians, and factory workers completing work with the aid of remote advice or documents. The content addresses discernment. In the words of Ian Altman in Forbes (2015), the new approach admits that “Companies often forgot (or don’t know) what questions customers really ask during the decision-making process.”

The Google Enterprise’s new strategy serves major business clients in manufacturing (GE), logistics (DHL), healthcare (Sutter Health), and others to use a more attractive and versatile pair of glasses with a faster-charging longer-lasting battery addressing original objections about performance glitches. And, user businesses have readily accessible transparency to the device’s specs and testing results.

Enterprise addresses a market of specific customized work functions. The Guardian’s John Naughton remarked, “It’s what technology is for: supplementing rather than replacing human intelligence.” In this case, there are at least three useful applications according to Mark Sullivan of FastCompany.com (2019) paraphrased here:

Coaching: Employees have access to training manuals, standard operating procedures, and dos and don’ts about product assembly, maintenance, and repair.Supervision: Supervisors or mentors can observe work and offer direction, advice, and correction.Inspection: Worker wearers can record and file work for quality purposes.

By understating the glasses’ capability, limiting the internet reach, and narrowing the camera’s purpose, Google’s Enterprise has effectively eliminated privacy issues. And, unless Apple meets Google head-on, Google will have recovered from its early decision-making failures.

Where to go from here —

An effective and transforming roadmap for change management must respect some facts:

Binary linear logic may manage process, but it provides no strategy for transformational change.While change is certain, nothing about it is certain.Uncertainty presents queries — not confusion. It is leadership’s opportunity to discern direction aligned with the organization’s evolving vision and mission.

Innovation proceeds from the future, not the past. It awaits discovery, so organization requires readiness more than satisfaction, an opportunity rather than chance, and confidence before engineering.

Michelangelo believed his statue was living in the marble; all he had to do was chip away “the superfluous material.” Henry James set out to find a “figure in the carpet.” A mind open to fluidity, dynamism, and flexibility will find its roadmap rather than build and impose a framework that only confirms its accumulated experience.

References

Altman, I. (2015, April 28). Why Google Glass Failed And Why Apple Watch Could Too. Retrieved from Forbes.com: https://www.forbes.com/sites/ianaltma...

Carter, L. (2005). Best Practices in Leadership Development and Organizational Change. (l. Carter, D. Ullrich, & M. Goldsmith, Eds.) San Francisco, CA: John Wiley & Sons. Inc.

Carter, L. (2013). The Change Champion’s Field Guide (2nd ed.). (L. Carter, R. Sullivan, M. Goldsmith, D. Ulrich, & N. Smallwood, Eds.) San Francisco, CA: John Wiley & Sons, Inc.

Fluker, W. (2009, Fall). Leading Ethically at the Intersection Where Worlds Collide. Leader to Leader, 54, 32-38. San Francisco, CA: John Wiley & Sons, Inc. doi:10.1002/ltl.362

Grassl, W. (2012). Mission, Vision, Strategy: Discernment in Catholic Business Schools. Retrieved from Academia.edu: https://www.academia.edu/2731809/MISS...

Levy, S. (2017, July 18). Google 2.0 is a Startling Second Act. Retrieved from Wired.com: https://www.wired.com/story/google-gl...

Naughton, J. (2017, July 23). The rebirth of Google Glass shows the merit of failure. Retrieved from The Guardian: https://www.theguardian.com/commentis...

Osterwalder, A., & Pigneur, Y. (2010). Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers. San Francisco, CA: John Wiley & Sons, Inc.

Sullivan, M. (2019, May 20). Google says the new Google Glass gives workers “superpowers”. Retrieved from Fast Company.com: https://www.fastcompany.com/90352249/...

Vargo, S., Magliob, P., & Akaka, M. (2008, June). On value and value co-creation: A service systems and service logic perspective. European Management Journal, 26(3), 145-152.

Find more resources at louiscarter.com

The post Next Practices in Change Management Strategies: it takes an innovating mind appeared first on FourWeekMBA.

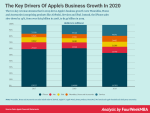

What drove Apple growth in 2019? A look at Apple business growth for 2020

Apple’s business model can be broken down in two primary categories:

Products: the products lines comprise things like iPhone, iPad, Mac, and wearable, home and accessories devices (Apple Watch, AirPods and more)Services: the services business comprises primarily: 1. Digital Content Stores and Streaming Services, comprising purchases on the App Store but also subscription services like Apple Music, Apple TV. 2. Other services comprise AppleCare+ (“AC+”) and the AppleCare Protection Plan, which are fee-based services that extend the coverage of phone support eligibility and hardware repairs. 3. Apple’s Cloud Services (iCloud), 4. Licensing where Apple licenses the use of certain of its intellectual property and provides other related services. And 5. Other services including Apple Arcade

, a game subscription service; Apple Card

, a game subscription service; Apple Card , a co-branded credit card; Apple News+, a subscription news and magazine service; and Apple Pay, a cashless payment service.

, a co-branded credit card; Apple News+, a subscription news and magazine service; and Apple Pay, a cashless payment service.What drove Apple’s sales in 2019?

As pointed out on Apple’s financial statements for 2020:

iPhone net sales decreased during 2019 compared to 2018 due primarily to lower iPhone unit sales.

Mac net sales increased during 2019 compared to 2018 due primarily to higher net sales of MacBook Air, partially offset by lower net sales of MacBook® and MacBook Pro®

iPad net sales increased during 2019 compared to 2018 due primarily to higher net sales of iPad Pro.

Wearables, Home and Accessories net sales increased during 2019 compared to 2018 due primarily to higher net sales of AirPods and Apple Watch.

Services net sales increased during 2019 compared to 2018 due primarily to higher net sales from the App Store, licensing and AppleCare.

What countries drove Apple’s revenues?

As pointed out by Apple’s financial statements:

Americas net sales increased during 2019 compared to 2018 due primarily to higher Services and Wearables, Home and Accessories net sales, partially offset by lower iPhone net sales.

Europe net sales decreased during 2019 compared to 2018 due to lower iPhone net sales, partially offset by higher Wearables, Home and Accessories, and Services net sales. The weakness in foreign currencies relative to the U.S. dollar had a significant unfavorable impact on Europe net sales during 2019.

Greater China net sales decreased during 2019 compared to 2018 due primarily to lower iPhone net sales, partially offset by higher Wearables, Home and Accessories and Services net sales.

Japan net sales decreased during 2019 compared to 2018 due to lower iPhone net sales, partially offset by higher Services and Wearables, Home and Accessories net sales.

Rest of Asia Pacific net sales increased during 2019 compared to 2018 due primarily to higher Wearables, Home and Accessories and Services net sales, partially offset by lower iPhone net sales.

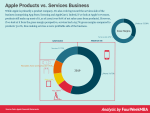

How is Apple business broken down between services and products?

[image error]While Apple is primarily a product company. It’s also evolving toward the services side of the business (comprising App Store, licensing and AppleCare). Indeed, if we look at Apple’s revenues, products still make up most of it, as of 2019 (over 70% of sales came from products). However, if we look at it from the gross margin perspective services had in 2019 63.7% gross margins compared to products’ 32.2%, thus making services a more profitable side of the business.

Source and references: Apple financial statements 2020

What was Apple’s revenue in 2019?

In 2019 Apple made over $260 billion in revnues. Apple’s revenues primarily came from products (over 80%) like iPhone, iPad, Mac, with a fast growth in sales for Wearables, Home and Accessories, which represented the fastest growing segment in 2019 (41% growth), together with the services business.

Where does Apple’s revenue come from?

Apple’s revenues as of 2019 still came primarily from iPhone sales (over 54%). Other products were Mac (about 10% of net sales), iPad (over 8% of net sales); Wearables, Home, Accessories Devices (over 9% of net sales); and Services which contributed almost 18% of the net sales.

What percent of Apple revenue is iPhone?

Apple’s revenues as of 2019 still came primarily from iPhone sales (over 54%). In 2019 sales of iPhones slew down, while sales of Wearables, Home, Accessories Devices grew substantially.

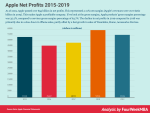

Is Apple consistently earning a profit?

As of 2019, Apple posted over $55 billion in net profits. This represented a 21% net margins (Apple’s revenues were over $260 billion in 2019). This makes Apple a profitable company. If we look at the gross margins, Apple products’ gross margins percentage was 32.2%, compared to services gross margins percentage of 63.7%. The decline in net profits in 2019 compared to 2018 was primarily due to a slow down in iPhone sales, partly offset by a fast growth in sales of Wearables, Home, Accessories Devices.

Read next:

The Power of Google Business Model in a NutshellHow Does Google Make Money? It’s Not Just Advertising!How Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedHow Amazon Makes Money: Amazon Business Model in a NutshellHow Does Netflix Make Money? Netflix Business Model ExplainedHow Does Spotify Make Money? Spotify Business Model In A NutshellThe Trillion Dollar Company: Apple Business Model In A NutshellHow Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

Other resources for your business:

Business Strategy: Definition, Examples, And Case StudiesWhat Is a Business Model? 30 Successful Types of Business Models You Need to KnowWhat Is a Business Model Canvas? Business Model Canvas ExplainedBlitzscaling Business Model Innovation Canvas In A NutshellWhat Is a Value Proposition? Value Proposition Canvas ExplainedWhat Is a Lean Startup Canvas? Lean Startup Canvas ExplainedHow to Write a One-Page Business PlanThe Rise of the Subscription EconomyHow to Build a Great Business Plan According to Peter ThielWhat Is The Most Profitable Business Model?The Era Of Paywalls: How To Build A Subscription Business For Your Media OutletHow To Create A Business ModelWhat Is Business Model Innovation And Why It MattersWhat Is Blitzscaling And Why It MattersSnapshot: One Year Of “Business Model” Searches On Google In ReviewBusiness Model Vs Business Plan: When And How To Use ThemThe Five Key Factors That Lead To Successful Tech StartupsTop 12 Business Ideas with Low Investment and High ProfitBusiness Model Tools for Small Businesses and StartupsHow To Use A Freemium Business Model To Scale Up Your Business

The post What drove Apple growth in 2019? A look at Apple business growth for 2020 appeared first on FourWeekMBA.

January 10, 2020

The Trillion-Dollar Company: Apple Business Model In A Nutshell

Apple has a business model that is broken down between products and services. Apple is still a product company where the iPhone represented over 54% of Apple’s revenue in 2019, in decline. Other fast-growing segments are services (digital content, cloud, licensing) and the wearables and accessories (AirPods and Apple Watch).

The Trillion-dollar company

With a market capitalization of over a trillion dollar as of January 2019, Apple is among, if not the most valuable brand in the world.

[image error]

To gain a bit of context of how big Apple has become if we take the US GDP figure for 2019 at over 21 trillion, this means Apple represents over 6% of the total economic output of the wealthiest country on earth.

If we take Apple, Amazon and Google market cap combined (the total is over $3.2 billion), those tech giants represent over 15% of the total economic output of the US.

Of course, nothing compared to the 1930s, when J.D. Rockefeller personal wealth represented about 1.5% of the US economic output. Yet, there is no doubt that for a few the Internet has represented the new oil.

As large political organizations (I believe states and nations will not be able anymore to slow down those tech giants) like the EU or the US federal government will regulate more and more, the so far not so regulated web, those companies might shrink in size.