J. Bradford DeLong's Blog, page 2173

October 19, 2010

Department of "Huh?!": Tim Geithner Edition

Tim Geithner:

Dollar: Geithner Vows US Will Not Devalue Dollar: U.S. Treasury Secretary Timothy Geithner vowed on Monday that the United States would not devalue the dollar for export advantage, saying no country could weaken its currency to gain economic health. "It is not going to happen in this country." Geithner told Silicon Valley business leaders of devaluing the dollar.... "It is very important for people to understand that the United States of America and no country around the world can devalue its way to prosperity, to (be) competitive," Geithner added. "It is not a viable, feasible strategy and we will not engage in it." Answering audience questions before the Commonwealth Club of California in Palo Alto, he said the United States needed to "work hard to preserve confidence in the strong dollar."

Tim Geithner:

In a luncheon with Silicon Valley business leaders Monday, U.S. Treasury Secretary Timothy Geithner said the Chinese yuan is "significantly undervalued."... The G20 finance ministers and central bank governors at the meetings in Gyeongju, South Korea are expected to tackle head-on the disparities in currency policies that are distorting capital flows in the hopes of achieving a more coordinated approach. But U.S. officials have put most of the blame on China's highly restrictive exchange rate regime, which until recently had kept the yuan largely pegged to the dollar. The United States is pressuring China to allow the value of its yuan to rise to take some pressure off capital flows and to rebalance its economy away from exports.... Geithner said in Palo Alto that he believes China will continue to lift the value of its yuan currency to aid the rebalancing of its economy away from exports and toward domestic growth.

Asked how much higher China should allow the yuan to rise, Geithner said: "Higher." "You can't know how far it should go. What you know now is that it's significantly undervalued which I think they acknowledge and it's better for them, and of course very important for us, that it move. And I think it's going to continue to move," Geithner said.

Marty Peretz, Anti-Muslim Bigotry, Rand Paul, Jonathan Chait, and Tbogg

Tbogg writes:

Rand Paul Is A Filthy Genocidal Muslim Mudperson | TBogg: I just wanted to say something really horrible about Rand Paul... [that] would not upset the delicate sensibilities of The New Republic’s Jonathan Chait...

Jonathan Chait, you see, was upset because Rand Paul's opponent Jack Conway called Paul an un-Christian Aqua-Buddha worshipper:

Sympathy For Rand Paul: The ugliest, most illiberal political ad of the year may be this one, from Kentucky Democrat Jack Conway.... I actually don't doubt the implication of the ad, namely that Rand Paul harbors a private contempt for Christianity. He's a devotee of Ayn Rand, who is a fundamentally anti-Christian thinker. And much of Paul's history, which he is frantically covering up in an attempt to pass himself off as a typical Republican, suggests among other things a deep skepticism about religion. The trouble with Conway's ad is that it comes perilously close to saying that non-belief in Christianity is a disqualification for public office. That's a pretty sickening premise for a Democratic campaign.

But as Tbogg notes:

I figured that calling Paul a sub-human tent-sniffing camel-rapist would not upset the delicate sensibilities of The New Republic’s Jonathan Chait since it has never stopped Chait from cashing a paycheck signed by his boss Marty Peretz.

Here is Mark Feeney on the case of Marty:

After blog post, Peretz again in a firestorm: The scene at Harvard looked less like the ’10s than the ’60s. Students stood outside the Science Center chanting “Harvard, Harvard, shame on you, honoring a racist fool!’’ When Martin Peretz, the object of the protest, left the building that Saturday late last month, they trailed behind, heckling and taunting him through Harvard Yard.... Five decades ago, Peretz had been on the other side of the bullhorns and banners.... Now he was being denounced as an anti-Muslim bigot for comments he had written for his blog on The New Republic’s website.

"But, frankly, Muslim life is cheap, most notably to Muslims," Peretz, the magazine’s owner and editor in chief, wrote Sept. 4. "I wonder whether I need honor these people and pretend that they are worthy of the privileges of the First Amendment which I have in my gut the sense that they will abuse." A week later, Peretz apologized for the First Amendment comment....

More than 500 students at Brandeis University, Peretz’s alma mater, signed a petition calling on him to apologize, and Harvard withdrew an invitation for him to speak last month at the 50th anniversary celebration of the university’s social studies program.... Anti-Muslim sentiment has been on the rise.... [T]he Martin Peretz Undergraduate Research Fund would be announced to honor him and the social studies program. Peretz, as assistant professor then lecturer, had taught in the program for many years. The protest took place outside the program’s anniversary celebration.

"It’s like this was waiting to happen, almost," said Joseph Finder, a novelist and friend of Peretz’s since the early ’80s. "For so many years, he’s [ticked] off so many people with so many impolitic or outrageous statements. And there are a lot of people in the academy who are jealous of that power he has. Or there are journalists who didn’t get a job or he’s attacked before."... A sign of the eminence of Peretz’s friends is that $500,000 had been raised for Peretz’s Undergraduate Research Fund before the blog post. A sign of their devotion is that after the controversy started and there were calls for Harvard to reject the money another $150,000 was donated. (Harvard declined to dissociate itself from the fund.)

The man whom The Christian Science Monitor had described in 1974 as a "socialist millionaire professor" had come a long way. "The fact is that Peretz has the social and economic guns to be a bigot," Atlantic senior editor Ta-Nehisi Coates wrote on the magazine’s website last month, "to then be defended by even those who acknowledge his bigotry, and finally be honored at the highest levels of American academia."

Peretz’s Harvard proteges include Jamie Gorelick, a former deputy attorney general, film director Edward Zwick, CNBC personality Jim Cramer, and Washington Post columnist E.J. Dionne. A steady stream of talented Harvard students would move on after graduation to The New Republic, including future editors Michael Kinsley, Hendrik Hertzberg, and Andrew Sullivan....

Critics have charged him with being not just a defender of Israel, but also prejudiced against Arabs. In 2007, Glenn Greenwald, now a blogger for Salon, wrote on his website that "The New Republic is led by someone who harbors — and routinely expresses — what can only be described as pure bigotry towards Arabs and Muslims." Comments Peretz has made on his blog include the application of a barnyard epithet to the description of Jerusalem as "the third holiest city of Islam," on Sept. 8; writing in 2007 that "it is characteristic of the Arabs, who have almost no physicists to speak of... to make their politics a shabby substitute for science"; and to note of Arab extremists, in 2006, "I know that since their passions emerge from Muslim religious belief I should treat them with respect. I can’t. OK, why don’t you try?..."

Hoocudanode?

Kevin Drum:

Is Gridlock Good?: The only other thing I can think of that the administration screwed up seriously is mortgage reform. Again, though, that would have been politically difficult even if they had played all their cards perfectly. Like it or not, the American public hates the idea of seeing their neighbors get bailed out from stupid mortgages. It makes them feel like saps: we scrimped and saved and bought a house we could afford and we're getting nothing. Joe and Betty down the street lived the high life, took out a NINJA loan they knew was way more than they could afford, and now they're getting a taxpayer-funded bailout and living easy. That's not a vote getter.

I think Bruce way overestimates the value of perception. Sure, a better communications strategy might have helped. Getting healthcare done faster might have helped. Beyond that, though, people are mostly reacting to actual pain, and there's surprisingly little Obama could have done about that. A gigantic stimulus and more aggressive action from the Fed might have done the trick, but Republicans and centrist Dems flatly wouldn't have allowed the former and the president has no leverage over the latter. Failing that, balance sheet recessions just take a long time to work through. There's not a lot Obama could have done to change that.

The Treasury had enormous flexibility and freedom to use TARP money to grease the deals for large-scale mortgage reorganization, even with cramdown. And it is hard to object to policies if the Treasury makes money on the deal.

The Obama administration in early 2009 was not nearly as constrained as Kevin Drum imagines.

Compound Interest and Social Discount Rates

John Holbo on Greg Mankiw:

Compound Interest, the Doctrine of Equivocation, and Social Discount Rates — Crooked Timber: In a sense the problem is this: on the assumption that future people are people, too, the wonders of compound interest make it seem insane to do anything but save for five centuries hence.

Indeed. If long-term real interest rates are as Mankiw describes them, then either the future must be so filthy rich and so satiated with wealth that there is no point in saving, or it is profoundly irrational to consume more than bare subsistence today because the opportunity cost in terms of how much you are impoverishing the future is so large.

October 18, 2010

The Fiscal Commission Was Another Enormous Unforced Obama Administration Error

Ezra Klein:

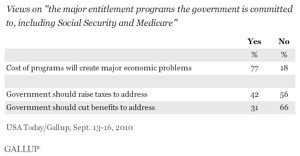

Ezra Klein - Americans prefer tax increases to benefit cuts: In Washington, the fiscal commission -- and the elite consensus -- favors sharp spending cuts over tax increases as a way to plug the entitlement hole. In the country, the preference is just the opposite.... [T]his holds true for every single age group. We're not looking at a situation where the elderly oppose benefit cuts in large numbers, but other demographics are more favorably inclined. In fact, it's the young who are most steadfastly opposed to benefit cuts:

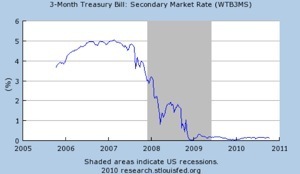

The Federal Reserve Is Going to Wait Until After the Election to Move: Eighteen Months Late and at a Third of the Scale the Economy Calls For

Paul Krugman:

The Unbearable Slowness of Understanding: [Sewell Chan's New York Times] article about how the Fed is gradually coming to realize that low inflation and a liquidity trap might be a problem fills me with despair. I mean, we’ve been there for two years.... Yet we’ve spent most of the last two years worried about the wrong things — inflation, crowding out, invisible bond vigilantes.

Even now, we get things like this:

Many economists remain confident that the United States will avoid the stagnation of Japan, largely because of the greater responsiveness of the American political system and Americans’ greater tolerance for capitalism’s creative destruction. Japanese leaders at first denied the severity of their nation’s problems and then spent heavily on job-creating public works projects that only postponed painful but necessary structural changes, economists say.

There are multiple things wrong with that paragraph — but what on earth would give one reason to consider our political system “responsive”? The truth is that we’re responding worse than Japan did.

And yes, I’m depressed about it.

Buce Asks: "Why Oh Why Can't We Have a Better Press Corps?" (Niall Ferguson/NPR Edition)

Buce:

Underbelly: The Nation's Premier Broadcast Organization Takes a Dive Before Niall Ferguson: Faithful readers will recognize Ferguson as an entertaining teller of tales who has somehow developed the idea that he is a Man of Vision. That's to be expected, I guess; once you bear the weight of two named Harvard professorships, it would be surprising if you retained any sanity at all. So it is hardly surprising that we heard stuff like this:

He beat up on Paul Krugman for endorsing Depression-era deficit spending, without seeming to grasp that Krugman's complaint is that we spent too little in the Depression: caught between Roosevelt's diffidence and the counter-cyclic pressure from the states (sound familiar?) we were left with the need of a great war to bail us out.

He sniped about "Keynesianism" but than morphed into an attack on quantitative easing as if he can't tell the difference between fiscal policy and monetary --i.e., precisely the distinction that lies at the heart of the conflict between Keynes and his free-market critics.

He seems to be under the impression that the Depression was an era of isolated national, as distinct from global, markets. Dear God, has this man never heard of the Gold Standard?

As I say, Ferguson can pontificate all he wants and nothing I can say will slow him down. But what was the reporter doing while all this was going on? Twittering his publicist? I should think that one of DeLong's Political Econ majors ought to be able to pick up on and challenge (seeming) absurdities like this. Why,oh why, as one might say, can't we have a better radio show?

Still, why the introductory hippy punching? Does Buce have to establish that he is a Serious Person?

I often think Brad DeLong goes over the top in his criticism of the press but I hope he wasn't listening to the NPR interview with Niall Ferguson (on All Things Considered) tonight or they would have had to call for the paramedics...

Why Oh Why Can't We Have a Better Press Corps?

Dean Baker points out that David Segal over at the New York Times is not doing much better:

The White House KNOWS That a Foreclosure Moratorium Will Hurt Bank Profits, the NYT Doesn't Know What the White House Thinks: The mind readers at the NYT told readers that:

The Obama administration has resisted calls for a more forceful response, worried that added pressure might spook the banks and hobble the broader economy [emphasis added]."

It is easy to see how a foreclosure moratorium might hurt bank profits.... However, it is not easy to see the chain of events whereby a foreclosure moratorium hurts the broader economy. Certainly Housing Secretary Shaun Donovan couldn't produce a credible story in the piece in the Huffington Post cited in this article.

Donovan uses the absurd story of a young woman who just bought a foreclosed property who he claims would have been unable to achieve her dream of homeownership if a foreclosure moratorium were in place.

Huh? Doesn't the housing secretary know that there is a huge inventory of foreclosed homes that banks are holding off the market waiting for better times? If the pipeline of newly foreclosed homes was temporarily stopped by a moratorium, this inventory would easily keep the market well-supplied with foreclosed properties for long into the future.

And, wasn't one of the main purposes of HAMP to slow the process of foreclosure? The argument was that this slowing was necessary to stabilize the market. Does the Obama administration want to slow or speed up the process of foreclosure, or both? And are both essential for the housing market?

Yes, the Washington Post Should Shut Down Today (Why Oh Why Can't We Have a Better Press Corps?)

And anyone currently working for it who wants to retain their honor, or their reputation, or have a future in journalism should abjectly apologize and look for another job.

The Washington Post:

How not to help homeowners: Right now, the national home vacancy rate is about 10.9 percent -- well above the historical average of 7.7 percent.... [I]t will take until mid-2012 to work through this excess inventory, which amounts to about 4 million homes. Anything that delays this process also postpones the inevitable bottoming out and ultimate stabilization of the U.S. housing market -- and the resumption of broader economic growth. Indeed, banks have already aborted many sales because of concerns over documentation, costing would-be home buyers thousands of dollars each and leaving their families in limbo....

There are big lessons to be learned, especially about how mass securitization of poorly underwritten home loans may have swamped the states' antiquated, cumbersome property registration and foreclosure procedures. It is also true that the scandal underscores the failure of the Obama administration's efforts to prevent foreclosures....

The robo-signed affidavits at issue were part of a technical review of documents, not the actual determination of a borrower's delinquency. By the time robo-signers put pen to paper, default had been well established. An ironic consequence of diverting staff to fixing affidavits now is that it leaves fewer people to modify salvageable loans...

And Dean Baker comments:

Banks Can Hire More Workers: Tell the Post: The Washington Post apparently thinks that banks have a fixed number of employees. This is the only meaning that can be attached to their warning in an editorial arguing a foreclosure moratorium that: "An ironic consequence of diverting staff to fixing affidavits now is that it leaves fewer people to modify salvageable loans."

See, the way this would work is the banks would realize that they need more workers to handle the foreclosure process in a way that complies with the law. (You know, the law, what the rest of us have to obey.) The banks would run help wanted ads, maybe even in the Post, and employ some of the millions of people who have lost their jobs in the downturn. Hiring more workers would of course lower bank profits and dip into executive bonuses, but that is the way things are supposed to work in a market economy.

Yes, the Washington Post Should Shut Down Today (Why Oh Why Can't We Have a Better Press Corps?)

And anyone currently working for it who wants to retain their honor, or their reputation, or have a future in journalism should abjectly apologize and look for another job.

First we have Robert Samuelson:

Can the Fed still rejuvenate the economy?: It is widely, though not universally, assumed that the Federal Reserve will soon move to bolster the economy by trying to nudge down long-term interest rates.... [T]he move would be something of an act of desperation, reflecting a poverty of good ideas to resuscitate the economy.... Chairman Ben Bernanke makes periodic speeches arguing that the Fed still has ample policy tools to revive the economy and reduce the appalling unemployment, despite lowering its short-term interest rate to zero. The reality is otherwise; the Fed's remaining tools are arcane, weak, or both....

Still, there are dangers. When the Fed buys Treasury bonds, it pumps dollars into the economy.... [I]f all the cheap money spurs much higher economic growth, many of these reserves will turn into loans and raise the specter of higher inflation -- "too much money chasing too few goods."... [T]here would be enormous pressure on the Fed not to raise rates while unemployment remains high...

Growth strong enough that inflation begins to rise from its current suboptimally low levels is simply not a problem. It is an advantage.

UPDATE: Dean Baker is on the case:

Robert Samuelson is Worried More Quantitative Easing Could Spark Strong Growth: I'm not kidding, read it for yourself.... [W]e're sitting here in the most prolonged downturn since the Great Depression, with the inflation rate closing in on zero, and Samuelson is worried that we may get a burst of growth that could lead to higher inflation. Only in the Washington Post.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers