J. Bradford DeLong's Blog, page 2169

October 25, 2010

links for 2010-10-25

FT.com / Comment - Man in the News: The people's princeling: Xi Jinping

http://www.bos.frb.org/RevisitingMP/papers/Clarida.pdf

That Worry About Providing Health Insurance Is Small Businesses' Number One Problem Is Nothing New... - Grasping Reality with Both Hands

Matthew Yglesias and Ryan McNealy: Niall Ferguson Debates Himself - Grasping Reality with Both Hands

Cosmopolitan social democracy — Crooked Timber

October 24, 2010

Foreclosure Nation

xkcd: The Economic Argument

Rich Clarida Says: "We Ought to Have Knowed"

Somebody whose name I forget--was it Jim Hamilton?--sends me to a nice paper by Rich Clarida

Rich Clarida: This Jackson Hole consensus as summarized well by Bean et al. (2010) embraced the following seven pillars

Discretionary fiscal policy was seen as generally an unreliable tool for macroeconomic stabilization.

Monetary policy, conducted via setting a path for the expected short term interest rate, was therefore to be assigned the primary role for macroeconomic stabilization.

Because the transmission mechanism for monetary policy was presumed to operate mainly through longer-term interest rates. expectations of future policy rates were central and credibility of policy was essential to anchor these expectations.

Central bank instrument – if not goal - independence of the political process was important to supporting central bank credibility.

Setting targets for intermediate monetary aggregates... fell out of or never gained favor.... as historical velocity relationships between these aggregates , nominal GDP >growth, and inflation appeared to break down....

The efficient markets paradigm was seen as a working approximation to the functioning of real world equity and especially credit markets....

Price stability and financial stability were seen as complementary....

As noted above, pre-crisis discussions of monetary policy took financial stability for granted, and workhorse models used for teaching (Clarida, Gali, Gertler 1999, 2002; Woodford 2003) and even the much larger models used for policy analysis routinely assumed financial frictions were irrelevant for policy design...

[...]

Financial history suggests “never again” eventually becomes “this time it is different” and as Rogoff and Reinhart (2009) remind us, throughout history “this time it is different” eventually sets the stage for the next financial crisis. This is especially true when, as emphasized by Minsky (1982) , the “this time it is different” wisdom supports and encourages greater and greater use of leverage.... [I]mportantly, this channel is missing in the justly celebrated and influential Bernanke – Gertler model (1999) presented at Jackson Hole in 1999. In that model, the bubble affects real activity... a wealth effect on consumption... the quality of firms’ balance sheets depends on the market values of their assets rather than the fundamental values.... B and G assume that—conditional on the cost of capital—firms make investments based on fundamental considerations.... This assumption rules out the arbitrage of building new capital and selling it at the market price cum bubble - the Ponzi finance stage of a bubble in the Minsky nomenclature

In the case of the current crisis, the this time it was supposed to be different because securitization and the expertise of the ratings agencies in assessing default risk correlations across various tranches of structured products was in theory supposed to make the financial system more stable and reduce systemic risk.... Of course it was recognized that originate and distribute business model of the ‘shadow banking system’ had its flaws.... But the cost of poor security selection would be spread, it was thought, among millions of investors around the world who bought these securities.... It was supposed to be the brave new world of ‘originate and distribute’ financial intermediation and for twenty years it was – until in July 2007 when it was no longer...

[...]

With the benefit of hindsight (excepting rare examples such Rajan (2005) and McCulley (2007) two of very few to foresee the essential contours of the growing systemic instability being created by the shadow banking system) and authoritative, post- mortem research such as that in the Pozsar et. al., it seems clear – at least to this author - that the financial crisis and the credit and securitization bubble that preceded it resulted not only from spectacular failures in securities markets - to allocate capital and price default risk - but serious failures also as well by policymakers to adequately understand, regulate, and supervise these markets. Policymakers, academics, and market participants simply didn’t know what they didn’t know...

[...]

[A] central bank can everywhere and always put a floor on any nominal asset price (or set of nominal asset prices) for as long as it wants regardless of 1) how ‘credible’ it’s commitment is 2) how expectations are formed or 3) how term or default premia are determined.... [T]he central bank simply needs to stand ready to buy government bonds with maturities at that point on the curve whose yields it wants to cap by posting a bid each day at the minimum nominal prices it stands ready to support.... The central bank can, if it so desires, robustly put a ceiling on the yield of any bond, public or private, it chooses to target...

[...]

According to monetary theory, central banks have at least two powerful – and complementary – tools to reflate a depressed economy: printing money and supporting the nominal price of public and private debt. As discussed above, a determined central bank can deploy both tools for as long as it wants regardless of 1) how ‘credible’ it’s commitment is 2) how expectations are formed or 3) how term or default premia are determined. There are two fundamental questions. First, can these tools, aggressively deployed, eventually generate sufficient expectations of inflation so that they lower real interest rates? Forward looking models generally predict that the answer is yes.... A second question relates to the monetary transmission mechanism itself. In a neoclassical world that abstracts from financial frictions, a sufficiently low , potentially negative real interest rate can trigger a large enough intertemporal shift in consumption and investment to close even a large output gap. But in a world where financial intermediation is essential, an impairment in intermediation – a credit crunch – can dilute or even negate the impact of real interest rates on aggregate demand.... Deleveraging and the collapse of the shadow banking system that intermediated so much credit before the crisis continue to represent a significant headwind that presents a challenge to policy effectiveness.

Belle Waring "Congratulates" Megan McArdle

Belle Waring:

Odds — Crooked Timber: I congratulate journalist Megan McArdle for having the good fortune to encounter such a talkative fellow passenger on the D.C. bus the other day.

Yesterday, I rode the bus for the first time from the stop near my house, and ended up chatting with a lifelong neighborhood resident who has just moved to Arizona, and was back visiting family. We talked about the vagaries of the city bus system, and then after a pause, he said, “You know, you may have heard us talking about you people, how we don’t want you here. A lot of people are saying you all are taking the city from us. Way I feel is, you don’t own a city.” He paused and looked around the admittedly somewhat seedy street corner. “Besides, look what we did with it. We had it for forty years, and look what we did with it!”

He’s a little off, because I think black control of Washington D.C. officially occurred only in 1975 when Parliament’s “Chocolate City” was released.

DeLong Smackdown Watch: Against Money-Financed Fiscal Expansion, For Open Market Operations in Equity Indexes

Hoisted from comments: Nick Rowe writes:

Why Quantitative Easing Needs to Involve Securities Other than Government Securities: OK. Start with the Fed buying bridges. That will work. Now, wouldn't it be nice if the Fed could also sell those bridges again later, if it needs to, as it probably will. Bridges aren't very liquid. And, the Fed is good at clipping coupons on bonds, but perhaps not very experienced at collecting tolls on bridges. Hmmm. Maybe if the Fed just bought shares in bridges instead, that would be as good as bridges, but even better from the practical point of view. Hmmm. Why stop at bridges? Why not buy shares in everything? Why not just buy the Wilshire 5000, or some such index?

links for 2010-10-24

BBC News - Spending Review: Chancellor's speech in full

The New York Times Torture Euphemism Generator! - Boing Boing

Lest We Forget: How The Banks Are REALLY Screwing Us In The Foreclosure Mess « The Inverse Square Blog

letter.ly admin

Too much focus on the yuan? | vox - Research-based policy analysis and commentary from leading economists

A Closer Look at Early Voting in Colorado - Marc Ambinder - Politics - The Atlantic

October 23, 2010

Liveblogging World War II: October 24, 1940

As Hitler returns from his interview with Franco, Petain comes to his train in Montoire for an interview. A week later, Petain would announce: "I enter today on the path of collaboration...”

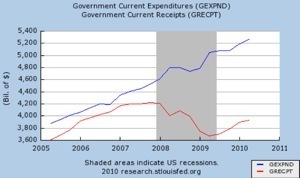

The Measure of Our Inability to Do the Right Thing

Mark Thoma reads his Sunday New York Times before I do, and writes:

Economist's View: Romer: Now Isn’t the Time to Cut the Deficit: Christina Romer doesn't even bother to try to make an argument for additional fiscal intervention with an eye toward job creation. She has, apparently, given up all hope that fiscal policymakers will provide the additional help that the economy needs. Instead, she is doing her best to prevent Congress from making things worse...

Indeed. With the output gap at a post-WWII high, and with current forecasts projecting no shrinkage of the output gap at all over the next year, now is a time to twiddle all of the policy knobs the government has at its disposal up to 11: federal purchases increases, tax postponements, aid to states, partial or full nationalization of mortgage finance, loan guarantees, raising inflation targets, talking down the dollar, quantitative easing--especially since the expansion of government spending to offset the fall in private demand in the recession never happened.

But what Christina Romer feels is her best and highest use is to attempt to freeze policy and keep it from getting even worse:

Now Isn’t the Right Time to Cut the Budget Deficit: THE clamor to cut the budget deficit is deafening.... Make no mistake: persistent large budget deficits are a significant problem. Government borrowing in good times crowds out private investment and lowers long-run growth.... So the question is not whether we need to reduce our deficit. Of course we do. The question is when.

Now is not the time. Unemployment is still near 10 percent.... Tax cuts and spending increases stimulate demand and raise output and employment; tax increases and spending cuts have the opposite effect. This is a basic message of macroeconomics and a central feature of public- and private-sector forecasting models. Immediate moves to lower the deficit substantially would likely result in a 1937-like “double dip” as we struggle to recover from the Great Recession.

Some advocates of austerity argue that, contrary to the conventional view, fiscal tightening now would lower long-term interest rates and improve confidence so much that the impact could be positive. But an ambitious new study in the World Economic Outlook of the International Monetary Fund confirms that fiscal consolidations — that is, deliberate deficit reductions — typically reduce growth.... The recent experience of countries already carrying out austerity measures is consistent with the central finding of the I.M.F. study. Ireland, Greece and Spain have all had rising unemployment after moving to cut deficits....

But once the economy has substantially recovered, the Federal Reserve will be ready to raise interest rates. At that point, the Fed could help maintain growth by instead continuing very low rates as the deficit is reduced. Waiting for conventional monetary policy to be back on line is like waiting for the anesthesiologist to arrive before doing surgery.

True believers might say we should never wait, because a slow-growing tumor could turn virulent. But we need to think about actual risks. Today, markets are willing to lend to the American government at the lowest 20-year interest rate since 1958. In the crisis of 2008 and 2009, money flowed to the United States because it was seen as the safest spot in the storm. There is no evidence that we have to act immediately.

Countries that enjoy the markets’ confidence have another reason to wait. Greece and other troubled nations on the periphery of the euro zone can no longer borrow at affordable rates. They must immediately cut expenditures and raise taxes, despite the terrible toll on employment and output. Countries like the United States, Germany and France can play an essential role as sources of growth and demand for the world economy. Strengthening our economies will help keep the world from slipping into another recession, and allow for continued healing of vulnerable financial markets here and abroad....

The best thing would be for Congress to pass a plan now that will reduce deficits when the economy is back to normal.... History shows that well-designed backloaded plans are credible. For example, changes to Social Security eligibility and taxes have been passed years, if not decades, before they took effect. And in an environment like today’s, when Congress has again agreed to pay-as-you-go rules, deviating from planned reforms forces countervailing actions. Such backloaded deficit reduction would not hurt growth in the short run — and could raise it. If uncertainty about future budget policy is harming confidence, as some business leaders suggest, spelling out future spending and tax changes could be helpful...

China doesn't worry about how it must cut its budget deficit in the midst of an economic downturn.

Liveblogging World War II: October 23, 1940

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers