J. Bradford DeLong's Blog, page 2167

October 27, 2010

The Oscar for Best Parody in a Comment Section Goes to Nobby Nobs

Let me turn things over to... Nobby Nobbs:

Britain Prepares to Humiliate Itself - Grasping Reality with Both Hands: What a complete NOB!! You must surely be joking with this blatent nonsense...Keynes was a TOOL pure and simple. I'm sure that Wall Street and the Baron's (more arseholes) would be more than willing to keep the UK up to their ears in debt. But guess what, the UK Govt has finally got the message that you don't cut under duress, you cut before you are forced to which opens up choices and greater freedom...

Freedom, that's a word that you clearly don't understand. When you are in debt, you are in servitude, you may prefer that, but I think I speak for all sensible, right-minded people with an ounce of common-sense that you should desist from writing this rubbish when you clearly don't have a Scooby Doo about economics or Good Housekeeping and financial rectitude. Enjoy debt slavery you Keynesian apologist loser...

To understand this comment, you need to know who Nobby Nobbs is. From Wikipedia:

"Nobby" Nobbs is untidy, smelly, and despite being human, about the same height as a dwarf. He therefore carries a certificate signed by the Patrician to prove that he's a human being. The text of this note... states that on the balance of probability, he is a human being. A running joke is the inability of others to believe this, despite—or even because of—the evidence. In fact, in Hogfather, even Death himself was unable to discern Nobby's species....

Sergeant Fred Colon [is] his partner and longterm friend. Together, Nobby and Colon have managed to have many strangely philosophical (or just strange) conversations, including one on whether Death has a first name, or even any friends to call him it. Oddly enough, these conversations hint at Nobby being more intelligent than Colon, with Nobby continually pointing out fatal flaws in Colon's statements and arguments, and Colon mentally scrambling to come up with an answer (this is not unlike some of the byplay in the Laurel and Hardy films). He is fond of folk dancing.

As a child he was a street urchin, that is, small, prickly, and smelling of fish, and a major source of information for various city notables.... The young Nobby sometimes refers to his father as "Number One Suspect", and is afraid of going to prison because his father is currently in there....

He believes he is in a romantic relationship with Verity "Hammerhead" Pushpram, a girl who runs a fish stall and gets her nickname from the fact that her eyes appear to be looking in opposite directions. However, this "relationship" seems to consist solely of her hitting him with a fish and telling him to bugger off. He remains "faithful" to her, however....

According to the Pratchett Portfolio, his typical sayings is: "'tis a lie sir, i never done it" (like all other 'typical sayings' in the Portfolio [except that of the Death of Rats] he has not actually been recorded saying it).

During Nobby's time in Klatch he "got in touch with his feminine side," and is quite fond of wearing women's clothing. This can occasionally be useful, as he dressed up as an old lady as part of a Traffic scam before being stopped by Vimes...

Britain Prepares to Humiliate Itself

Mark Thoma tells me that my Project Syndicate column is out:

The Humiliation of Britain - Project Syndicate: BERKELEY – At the end of 2008, as the financial crisis hit with full force, the countries of the world divided into two groups: those whose leaders decided to muddle through, and China. Only the Chinese took seriously Milton Friedman’s and John Maynard Keynes’s argument that, when faced with the possibility of a depression, the first thing to do is use the government to intervene strategically in product and financial markets to maintain the flow of aggregate demand.

Then, at the start of 2010, the countries that had been muddling through divided into two groups: those where government credit was unimpaired continued to muddle through, while countries like Greece and Ireland, where government credit was impaired, had no choice but to pursue austerity and try to restore fiscal confidence.

Today, another split is occurring, this time between those countries that are continuing to muddle through and Great Britain. Even though the British government’s credit is still solid gold, Prime Minister David Cameron’s administration is about to embark on what may be the largest sustained fiscal contraction ever: a plan to shrink the government budget deficit by 9% of GDP over the next four years.

So far, China is doing the best in dealing with the financial crisis. The mudding-through countries lag behind. And those where confidence in the government’s liabilities has cracked, forcing the government into austerity, are doing worst.

Now the question is: will Britain – where confidence in the government has not cracked and where austerity is not forced but chosen – join the others at the bottom and serve as a horrible warning?

Cameron’s government used to claim that its policies would produce a boom by bringing a visit from the Confidence Fairy that would greatly reduce long-term interest rates and cause a huge surge of private investment spending. Now it appears to have abandoned that claim in favor of the message that failure to cut will produce disaster. As Chancellor of the Exchequer George Osborne put it:

“The emergency Budget in June was the moment when fiscal credibility was restored. Our market interest rates fell to near-record lows. Our country's credit rating was affirmed. And the IMF went from issuing warnings to calling our Budget ‘essential’ Now we must implement some of the key decisions required by that Budget. To back down now and abandon our plans would be the road to economic ruin.”

But if you ask the government’s supporters why there is no alternative to mammoth cuts in government spending and increases in taxes, they sound confused and incoherent. Or perhaps they are merely parroting talking points backed by little thought.

What is so bad about continuing to run large budget deficits until the economic recovery is well established? Yes, the debt will be higher and interest on that debt will have to be paid, but the British government can borrow now at extraordinarily favorable terms. When interest rates are low and you can borrow on favorable terms, the market is telling you to pull government spending forward into the present and push taxes back into the future.

Advocates of austerity counter that confidence in the government’s credit might collapse, and the government might have to roll over its debt on unfavorable terms. Worse, the government might be unable to refinance its debt at all, and then would have to cut spending and raise taxes sharply.

But that is what the British government is doing now. How is the possibility that a government might be forced into radical fiscal consolidation an argument for taking that step immediately, under no duress and before the recovery is well established?

To be sure, back in the 1970’s, confidence in the credit of the British government collapsed, forcing it to borrow from the IMF so that spending could be cut and taxes raised gradually rather than abruptly. But that is why Keynes and Harry Dexter White established the IMF in the first place. An IMF program restores confidence in the fiscal soundness of governments that markets distrust. The lending allows the necessary medium- and long-term spending cuts and tax increases to be undertaken at a more appropriate time.

Borrowing from the IMF may be humiliating for government officials. But businesses establish lines of credit for future contingencies all the time, and they don’t think there is anything humiliating about resorting to them when those contingencies come to pass. And what, really, is so humiliating about borrowing from your own citizens?

Britons, as Osborne knows, are willing to lend to their government on an enormous scale – and on terms that are more generous than those on offer from the IMF. And, if one is worried that the British people might change their minds, well, the princes of Wall Street or the barons of Canary Wharf or US Treasury Secretary Tim Geithner would certainly be willing to sell derivatives contracts to protect Britain against exchange-rate risk for the next several years.

To borrow from your own people is especially non-humiliating when your economy is in depression, when the interest rates at which you can borrow are at near-record lows, and when every economic argument cries out for spending now and taxing later.

What is humiliating is to have a government that cuts a half-million public-sector jobs and causes the loss of another half-million jobs in the private sector. In an economy of 30 million jobs, that translates into an increase in the unemployment rate of 3.5 percentage points – at a time when no sources of expanding private-sector demand exist to pick up the slack. Britain’s finest hour this is not.

Who the Fracking #$*@&^# Frack Is Taking the Chairs Out of the Wheeler Auditorium Green Room?

Yes, I Am Proud of Obama's PPACA

Health care reform is a very good thing, and something to be really proud of.

Let me outsource this to Aaron Carroll

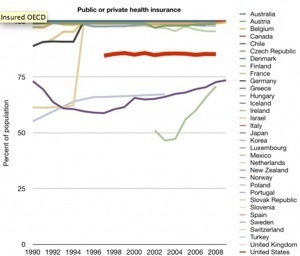

A reminder of where we are | The Incidental Economist: As the rhetoric heats up before the election, I’d like to give you a quick reminder of why we needed (and still need) health care reform....

That thick red line is the United States. For the record, we’re beating Mexico, Turkey, and Chile. But every other OECD country – every single other one listed there – has figured this out. I’ve been spending a lot of time recently talking about the cost and quality of the health care system, but let’s not forget access. We’re terrible. There are so many countries bunched near 100% that you can’t see them all; picking out the very few that aren’t is easy.

Say what you will about the PPACA, but it was designed primarily to get at this issue. It’s not perfect, and it won’t get us to 100% insured, but it will get us closer. Our goal at this point should be to keep pushing to get us up with everyone else, not to return us to this.

Econ 1: Fall 2010: Files for October 27 "Monopoly" Lecture

I Am A Weirdo...

On the BART back from downtown San Francisco yesterday, only 2 of the 60 people in my car got off at Orinda. Only 3 of the 60 people in my car got off at my stop--Lafayette.

The reason is clear as you get off at the Lafayette stop in the median strip of the ten-lane California Scenic Highway 24: the big electronic sign says:

OAK ARPT: 19 MIN

DWNTWN SF: 22 MIN

SF ARPT: 27 MIN

$10 dollars, 40 minutes each way, and you are very likely to have to stand for at least one of the legs as opposed to 22 minutes each way and then having to brave the parking situation downtown.

It simply doesn't make individual sense unless your trips to DWNTWN SF have to be made at the peak commute hours when Teh Bridge is "backed up"...

links for 2010-10-27

Infrastructure spending: False expectations | The Economist

Political economy: Gridlock for equities | The Economist

NASA moon impact blasted into material that's 5% water

Leader of the Labour Party Ed Miliband's speech to the CBI | The Labour Party

Why We Should Fear Deflation

Washington Post Scolds Richard Cohen for Crude Talk With Female Aide | The New York Observer

Department of "Huh?!": John Cochrane Edition - Grasping Reality with Both Hands

@delong wonders if John Cochrane has no friends: http://bit.ly/aHregW

– Modeled Behavior (ModeledBehavior) http://twitter.com/ModeledBehavior/st...

(tags: from:ModeledBehavior)

October 26, 2010

Hoisted from the Archives: DeLong (1999), "Should We Fear Deflation?"

Deflation

J. Bradford DeLong

University of California at Berkeley, and

National Bureau of Economic Research

http://www.j-bradford-delong.net

delong@econ.berkeley.edu

April, 1998

For the Brookings Panel on Economic Activity,

March 25-26, 1999

Post-meeting draft

Introduction

After more than sixty years, deflation has reappeared

as something to worry about. In the past six months major newspapers

printed 438 articles classified under the keyword "deflation"--compared

to 36 such in the first half of 1997 and 10 such in the first

half of 1990. For sixty years, ever since the middle years of

the Great Depression, next to no one had worried about deflation.

Next to no one had seen actual falls in the price level as even

a remote possibility. Now people do.

The post-Korean War 1950s and the early 1960s saw measured

rates of inflation as low as those of today. Yet then people

worried not about deflation but about inflation. Only in the

late 1990s, not in the 1950s or 1960s, have inflation rates of

two percent per year or less called forth fears of deflation.

Source: Bureau of Labor Statistics.

In the past, low inflation did not induce forth fears of deflation

because observers believed that the institutions created

by the Keynesian revolution had a bias toward inflation. Yet

today this belief is gone, or at least greatly attenuated. What

happened to the built-in bias toward inflation that past economists

believed was inherent in post-WWII institutions? I suspect that

the institutional bias toward inflation was never as large as

many economists believed, and that it has recently been reduced

or eliminated by the growth of countervailing forces.

Given that deflation is back on the agenda, should it be feared?

Perhaps we should not worry about deflation because the probability

that it will come to pass is infinitesimal. Perhaps we should

not worry about deflation because it is not especially damaging.

If costs of inflation and deflation are roughly equal--if our

social loss function is symmetric around zero as a function of

the deviation from price stability--then there is more to fear

from renewed inflation than from deflation, for the price level

is still rising.

I tentatively conclude that there is reason to fear deflation.

The probability of serious deflation or of events that do the

same kind of damage to the economy that deflation does is low,

but it is not zero. There is good reason to fear that our social

loss function is asymmetric: that deflation does more macroeconomic

damage than an equal and opposite amount of inflation.

The root reason to fear deflation is that the nominal interest

rate is bounded below at zero. Significant deflation--even completely

anticipated deflation--thus generates high real interest rates

and large transfers of wealth from debtors to creditors. By contrast,

significant anticipated inflation does not generate abnormally

low real interest rates (although significant unanticipated inflation

is associated with large transfers of wealth from creditors to

debtors).

Deflation's high real interest rates depress investment, lower

demand, and raise unemployment. Deflation's transfers of wealth

from debtors to creditors diminish the economy's ability to keep

the web of credit and financial intermediation functioning. Such

disruption of the financial system puts additional downward pressure

on investment, demand, and unemployment.

Thus it seems to me to be hard to argue that our social loss

function is symmetric, and that deflation is not to be especially

feared. It is easier to argue that the chances of deflation coming

to pass are very low. Yet I suspect that they are not as low

as we would like to believe, for the Federal Reserve's power

to offset surprise downward shocks to the price level is low.

Inflationary Bias

From its beginning the Keynesian Revolution brought fears

of inflation. Before the ink was dry on the copies of Keynes's

General Theory, Jacob Viner already warned that:

...[i]n a world organized in accordance with Keynes' specifications

there would be a constant race between the printing press and

the business agents of the trade unions, with the problem of

unemployment solved if the printing press could maintain a constant

lead...

A quarter century later in his AEA presidential address Arthur

Burns argued that Viner's fears had come true: that the post-World

War II world was one of constant wage-push inflation.

Viner's and Burns's fears have been developed and sharpened

by Finn Kydland and Edward Prescott, who pointed out that a benevolent

central bank possessing discretion and the ability to induce

unanticipated shifts in aggregate demand will be under great

temptation to try to take advantage of any short-run Phillips

curve boost employment and production. The rational expectations

equilibrium will be dissipative: workers and managers will expect

such actions from the central bank, and in equilibrium production

and unemployment will be unaffected but inflation will be higher

than desirable.

This Kydland-Prescott framework suggests two ways to counter

this institutional bias towards inflation created by central

bank possession of discretion and concern over high

unemployment. First-- Kydland and Prescott's preference--make

sure central banks are bound by rules and do not possess

discretion. Second--a line of thought associated with

Ken Rogoff--appoint central bankers who are unconcerned high

unemployment.

The pattern of economic policymaking in the 1990s suggests

that both of these ways of modifying institutions to diminish

inflationary bias have been adopted. The U.S.'s central bank

today appears to follow the rule (in the sense of Blinder

(1998) although perhaps not in the sense of Kydland and Prescott

(1977)) of giving first and highest priority to attaining near

price stability. The past decade has seen the flowering of a

common culture of central banking in which control of inflation

comes first, and always taking the long view is applauded. And

some central bankers at least appear to have been appointed with

an eye toward their relative lack of concern with--or disbelief

in their power to affect--the level of unemployment. The result

is a situation in which long-time inflation hawks criticize the

European Central Bank for pursuing overly-tight monetary policy,

and in which the ECB president announces--with euro-zone inflation

approaching one percent per year and euro-zone unemployment approaching

ten percent per year-- that the ECB "will act, should the

need arise, to prevent either inflationary or deflationary pressures..."

Thus it appears that attempts to reform institutions to eliminate

inflationary bias have been successful, or perhaps that the bias

toward inflation seen in the 1960s and 1970s was not so much

the result (as Kydland and Prescott theorized) of the game-theoretic

structure of the interaction between central bankers and the

economy or (as Burns theorized) of the absence of fear of high

cyclical unemployment, but instead the result of painful misjudgments

about the structure of the economy and the slope of long-run

Phillips curves that were corrected after the 1970s.

Why We Should Fear Deflation: Economic History

In the early 1920s most economists treated "inflation"

and "deflation" as symmetric

...evils to be shunned. The individualistic capitalism of

today, precisely because it entrusts savings to the individual

investor and production to the individual employer, presumes

a stable measuring rod of value, and cannot be efficient--perhaps

cannot survive--without one.

Deflation was dangerous because entrepreneurs were necessarily

long real and short nominal assets:

...the business world as a whole must always be in a position

where it stands to gain by a rise... and to lose by a fall in

prices.... [The] regime of money-contract forces the world

always to carry a big speculative position [long real assets],

and if it is reluctant to carry this position the productive

process must be slackened.... The fact of falling prices

injures entrepreneurs; consequently the fear of

falling prices causes them to protect themselves by curtailing

their operations; yet it is upon the aggregate of their individual

estimations of the risk, and their willingness to run the risk,

that the activity of production and of employment mainly depends...

The fact of falling prices bankrupted entrepreneurs. The fear

of falling prices led them to unwind their positions, close down

productive operations, and reduce output and employment.

The coming of the Great Depression, however, shifted economists'

focus away from balanced fears of inflation and deflation and

to the conclusion that deflation was deeply dangerous, and to

be avoided at all costs. Economists' analyses of the root causes

of the Great Depression were (and continue to be) widely divergent.

Nevertheless, alomost every analyst of the Great Depression placed

general deflation--and the chain of financial and real bankruptcies

that it caused--at or near the heart of the worst macroeconomic

disaster the world has ever seen.

Each analysis focused on a different channel. Irving Fisher

stressed that past deflation meant bankruptcy or near-bankruptcy

for leveraged operating companies and nearly all financial institutions.

Friedman and Schwartz stressed the harm inflicted by deflation

on banks' balance sheets by reducing the nominal value of collateral

and diminishing debtors' ability to service loans: resulting

financial-sector bankruptcies led to sharp rises in reserves-to-deposits

and currency-to-deposits ratios, lowering the money stock and

aggregate demand in the absence of adequate Federal Reserve response.

Peter Temin focused on rising risk premia on corporate debt over

1929-1933: deflation-driven corporate balance sheet deterioration

increased risk and drove a wedge between low short-term interest

rates on safe assets like government bonds and high long-term

interest rates on corporate debt.

Barry Eichengreen wrote of the fear that countries would depreciate

their currencies, and how this fear forced country after country

to adopt deflationary policies to reduce the price level and

shrink the money supply. Charles Kindleberger wrote of how currency

depreciation exerted deflationary pressures: a small country

that reduced the value of its currency discovered that its businesses

and banks had borrowed abroad in gold, and could no longer

service their debts. Christina Romer argued that even those who

were not heavily long equities found it advisable to cut back

on spending and increase liquidity margins in the aftermath of

the 1929 stock market crash.

All of these channels share common features. First is that

nominal interest rates cannot fall below zero. Hence banks could

not respond to anticipated deflation by paying negative interest

on deposits: if they could, then the key banking-crisis channel

that Friedman and Schwartz see as the principal cause of the

Great Depression would have been much weaker. Businesses could

not rewrite their debt contracts ex post to diminish the

effect of falling demand and prices on their balance sheets:

if they could, then the wedge between Treasury and corporate

interest rates that Peter Temin focuses on would have been much

smaller. Exchange rate depreciation did not, in 1931 any more

than in 1997, carry with it a writing-down of the hard money

or hard currency debts that domestic firms owed to foreign nationals:

if it had, then the channel that Kindleberger notes would have

been much weaker. The increases in uncertainty and falls in consumer

wealth that Romer focuses on would have had only trivial effects

on purchases of durable commodities had not consumers feared

that in the future they might want to have very liquid balance

sheets of their own.

Second is a common focus on financial fragility: the belief

that the interruption of the chain of financial intermediation

has disastrous consequences for production and employment, whether

the disruption occurs at the level of bank creditors (as in Friedman

and Schwartz, in which it is increases in currency-to-deposits

and reserves-to-deposits ratios that does the work), of operating

companies (as in Keynes's or Fisher's stories of entrepreneurs

unhedged against price level declines), of banks themselves (as

in Temin, in which the deterioration of bank debtors' balance

sheets does the work), of companies with foreign liabilities

(as in Kindleberger), or of consumers who no longer dare to be

short in nominal terms to finance their purchases of durable

assets (as in Romer).

In all of these channels sharp deterioration in debtor balance

sheets leads to desires on the part of both debtors and creditors

to unwind their positions and boost their liquidity, and to sharp

reductions in business investment and consumer spending.

Economists do not have satisfactory theories of why borrowers

choose to borrow and lenders choose to lend in unstable units

of account, or of why demand is so sensitive to credit-market

disruptions. Economic theory tells us that debt contracts are

good ways to reduce the principal-agent problems that arise when

investors confront entrepreneurs and managers who have vastly

greater knowledge of a firm's circumstances and opportunities.

Economic theory tells us that when borrowers' balance sheets

are impaired such debt contracts no longer work. But there is

no theoretical reason why such contracts should be written in

potentially unstable units of account, or why they should not

condition on observed macroeconomic variables.

Nevertheless, debtors borrow and creditors lend in nominal

terms--whether consumers financing purchases of durables, banks

taking deposits from households, real estate developers pledging

land and property as collateral, or companies borrowing from

banks. Such debt contracts interpret nominal deflation and the

consequent difficulty in servicing or repaying the loan as a

signal that the debtor has failed to properly manage their enterprises,

and hence that the enterprise needs to be restructured or liquidated.

This confusion of nominal deflation with entrepreneurial failure

is what makes a deflation such a dangerous exercise.

How dangerous? We do not know. We do not know how financially-fragile

the U.S. economy is today, either in the sense of how vulnerable

financial-sector and non-financial-sector entrepreneurial net

worth is to deflation or how much reduction in aggregate demand

would be caused by impaired financial-sector and non-financial-sector

balance sheets. The U.S. economy has not experienced deflation

since World War II. We know that economic historians blame debt-deflation

and financial-fragility channels for the greatness of the Great

Depression. We have no reliable evidence on the strength of these

channels today.

The (relatively poor) data on aggregate movements in production

and prices before World War II can be used to support the claim

that the association of price changes and output changes is non-linear,

with larger falls in prices associated with proportionately greater

falls in output. A simple regression of peacetime annual changes

in industrial production on the change and the squared change

in the wholesale price index is certainly not inconsistent with

the existence of a powerful non-linear deflation channel--as

long as the World War I years are excluded, and as long as 1920-1921

is excluded as well.

Source: NBER Macro History database.

There is sound reason for the exclusion of the 1920-21 data

point as an outlier. Coming immediately after the World War I

inflation, the 1920-21 deflation came before businesses and financial

institutions had had sufficient opportunity to rebalance their

portfolios and readjust their degrees of leverage. Thus financial

and non-financial balance sheets were unusually strong, and financial

and non-financial net worth were unusually high in 1920-1921.

The economy was thus less vulnerable to the channels through

which deflation reduces production: the fact that 1920-1921 does

not fit the correlations found in the rest of the data can be

read as evidence for, not evidence against, the importance of

debt-deflation channels back before World War II.

But an economist willing to try hard enough can always find

sound reason for excluding an influential and inconvenient observation.

Moreover, these (relatively poor) pre-World War II data on

industrial production and wholesale price index changes are of

doutbful relevance for the U.S. economy today. And we lack data

and convincing theory needed to identify how much of the correlation

between changes in prices and changes in industrial production

back before World War II reflects movements along an aggregate

supply curve and not any destructive consequences of deflation.

Why We Should Fear Deflation: Present Vulnerability

Alternative Channels that Impair Balance Sheets

If the danger of deflation springs from its effect on net

worth and depends on the degree of financial fragility in the

economy, then economies may well have more to fear than declines

in broad goods-and-services price indices alone. If securities

and real estate holdings have been pledged as collateral for

debt contracts, then large-scale asset price declines also trigger

the confusion of macroeconomic events with entrepreneurial failure

that makes deflation feared.

Is the United States today potentially vulnerable to large-scale

asset price declines in this way? In real estate no. In the stock

market yes. Perhaps fundamental patterns of equity valuation

have truly changed, as investors have recognized that the equity

premium over the past century was much too large--in which case

stock prices have reached a permanent and high plateau. But it

seems more likely that there are substantial risks of stock market

declines on the order of fifty percent back to Campbell-Shiller

fundamentals.

Source: Robert Shiller (1987), Market Volatility.

A second source of potential deflation-like pressure--seen

during Sweden's exchange rate crisis of 1992, during Mexico's

exchange rate crisis of 1994-5, during the East Asian crises

of 1997, as well as in Great Depression-era events like the Austrian

financial crises of 1931--arises out of large-scale foreign-currency

borrowing by banks, companies, and governments in countries whose

exchange rates then sharply depreciate.

Exchange rate depreciation is a standard reaction to a sudden

fall in foreign demand for a country's goods and services exports

(on the current account) or property (on the capital account).

When demand for a private business's products falls, the business

cuts its prices. When demand for a country's products falls,

a natural reaction is for the country to cut its prices, and

the most way to accomplish this is through exchange rate depreciation.

But if governments, banks, and non-financial corporations

have borrowed abroad in hard currencies, depreciation writes

up the home-currency value of their debts and impairs their balance

sheets in the same fashion as conventional goods-and-services

price index deflation.

We know that other countries certainly have been vulnerable

to this form of financial market disruption. Is the U.S. vulnerable?

Not today. U.S. gross external obligations of $7 trillion or

so are overwhelmingly equity or dollar-denominated investments.

But will they still be dollar-denominated come the end of the

year 2000, when they will amount to perhaps $9 trillion, and

when these gross obligations are part of a net investment position

of more than -$2 trillion?

The Limits of Monetary Policy

Moreover, even a pure commodity price deflation may not be

as unlikely as we hope.

How adept is monetary policy at controlling the price level?

The answer has always been--or at least since Milton Friedman

stated that monetary policy works with "long and variable

lags"--"not very." Power and precision are two

different things.

Modern estimates of the impact of monetary policy shocks on

production, employment, and the price level continue bear out

this assessment. Authors like Christiano, Eichenbaum, and Evans

are very pleased that they find substantial agreement on the

qualitative impact of changes in monetary policy (as measured

by the short-term interest rates that the Federal Reserve actually

controls) "in the sense that inference is robust across

a large subset of the identification schemes that have been considered

in the literature." But the confidence intervals surrounding

their point estimates are large. Moreover the time delay in the

effect of a change in monetary policy is large as well: not until

some eight quarters after the initial interest rate shock has

the impact of a change in interest rates had anything near its

long-run effect on the rate of inflation (or deflation). According

to Christiano, Eichenbaum, and Evans, a one percentage point

upward shift in the federal funds rate is associated with a less

than one tenth of one percent decrease in the annual rate of

inflation even ten quarters out.

Monetary policy remains the tool of choice for stabilization

policy. The lags associated with Presidential and Congressional

changes in spending plans and tax rates are even longer and more

variable than the lags associated with monetary policy. But in

the UnitedStates today monetary policy has no appreciable effect

on the rate of price change for a year and a half after its implementation,

and has nothing close to its full long-run effect on the rate

of price change until two and a half years have passed. Moreover,

there are important policy recognition and policy formulation

lags as well in the making of monetary policy. The FOMC's reliable

information flow is at least one quarter in the past. The FOMC

is a committee that moves by consensus guided by its chair, and

committees that move by consensus rarely act quickly.

How Large Are Price Level Shocks?

If we today could reliably and precisely forecast what the

price level would be two and a half years hence, the long and

variable lags associated with monetary policy would not be worrisome.

But we cannot do so. In the years since 1950 the standard deviation

of the price level two and a half years hence is 6.6%. A little

of this variation can be attributed to systematic policy. Conditioning

on the level of CPI inflation today accounts for less than a

third of the two and a half-year-ahead variance in the price

level, and reduces the standard error of the price level two

and a half years out to only 5.5%. Conditioning on both inflation

and unemployment reduces the standard error of the price to only

5.4%. And conditioning on inflation, unemployment, and current

nominal interest rates reduces the standard error only to 4.8%.

The most significant improvement in forecasting comes from

conditioning on the identity of the Federal Reserve Chair, which

reduces the standard error to 3.8%. But fitting a step function

to any process will improve the fit. I see little in the views

and characters of Arthur Burns and Alan Greenspan that would

lead the replacement of the first by the second to generate an

immediate nine percent fall in one's estimate of the price level

two and a half years out. It strains credulity to believe in

a +26 percent effect on the price level from any chair, even

G. William Miller.

TABLE 1: STANDARD DEVIATION

OF 30-MONTH-AHEAD PRICE LEVEL CHANGES

Standard Deviation and Conditioning

Variables

6.6%: --None--

5.5%: 12-mo inflation rate

5.4%: 12-mo inflation rate, capacity utilization rate

5.3%: 12-mo inflation rate, unemployment rate

4.8%: 12-mo inflation rate, unemployment rate, federal funds

rate

4.8%: 12-mo inflation rate, unemployment rate, federal funds

rate, 10-yr Treasury rate

3.8%: 12-mo inflation rate, unemployment rate, identity of

Federal Reserve chair

Nevertheless, even a 3.8% standard deviation tells us that--if

the normal distribution applies appropriate--that there is once

chance in twenty that the price level two and a half years hence

will be more than seven and a half percent higher or lower than

we forecast. At current rates of inflation, an unanticipated

fall in the price level of more than five percent before the

Federal Reserve can react seems to be an event that would happen

once every forty years. Is this a high risk of a serious deflation?

No, but it is large enough to be worrisome.

Reasons for Confidence

Is such instability enough to make a debt-deflation spiral

set in motion by unanctipated commodity price declines a serious

threat? Probably not.

First, it may well be that it takes a bigger economic shock

to induce a certain amount of deflation than it takes to induce

the same amount of accelerating inflation or of disinflation.

If so, calculations of price-level variability from an era of

accelerating inflation and disinflation are unreliable guides

to the potential for deflation. It takes a much greater contractionary

impulse to cause deflation than to cause disinflation.

Second, a large chunk of the post-1960 variance in changes

in the rate of inflation comes from the relatively narrow period

of the turbulent 1970s. The years between 1971 and 1983 inclusive--one

third of the sample--account for ninety percent of the squared

deviations of CPI inflation around its mean. Since 1984 the standard

deviation of two-and-a-half year ahead changes in CPI inflation

is only a third the full-sample standard deviation. Perhaps episodes

of variability like the 1970s oil shocks and the breakdown of

confidence in the Federal Reserve's commitment to price stability

will not happen again because of increasing levels of knowledge

about how to make monetary policy.

It is easy to make such arguments in the United States, where

monetary policy makers have been skillful and astonishingly lucky

over the past decade. It is, however, harder to make this argument

from policy making competence elsewhere in the world. In Japan

producer prices are 5% lower than they were a year ago, and over

the past three months have fallen at a rate of 10% per year.

Estimates of the output gap relative to potential in Japan today

range between 8 and 25 percent of current GDP. In the euro zone

inflation is less than one percent per year, and unemployment

approaches ten percent. These macroeconomic problems are different

from those of the 1970s. They are not less serious. And they

do not appear to be consistent with greatly increased skill in

the making of monetary policy.

Conclusion

Our ability to forecast and control the price level at a time

horizon that corresponds to the effective range of monetary policy

is low. Our policy instruments are powerful, but they are imprecise

and are subject to long and variable lags. Moreover, other sets

of circumstances than general goods-and-services price declines

alone could set in motion the economic processes that we fear

from deflation.

Thus there seems to be reason to fear deflation.

But there is no reason-at least not yet--to be very afraid.

The institutional structures of our labor market provide us with

insurance against debt-deflation as in the argument of Akerlof,

Dickens, and Perry (1996)--although note that this insurance

comes at a substantial price: in their model the natural rate

of unemployment rises substantially as the inflation rate hits

zero. The relatively high price level variability of the 1970s

may truly be a thing of the past, not a thing to fear in the

future.

But if the volatility of the 1970s does come again, and if

deflation is not much harder to cause than disinflation, and

given that monetary policy is an imprecise instrument that works

with long and variable lags, what then? If your loss function

is asymmetric--if moderate deflation is much more damaging than

moderate inflation--and if the variance of outcomes around targets

is large, then the conclusion is obvious: good monetary policy

should aim for a rate of price level change consistently on the

high side of zero.

After all, in a still-impoverished world, it is worse to provoke

unemployment than to disappoint the rentier.

References

George Akerlof, William Dickens, and George Perry, "The

Macroeconomics of Low Inflation," Brookings Papers on

Economic Activity Vol. 1996, No. 1 (Spring 1996), pp. 1-59.

Ben Bernanke, "Nonmonetary Effects of the Financial Crisis

in the Propagation of the Great Depression," American

Economic Review Vol. 73, No. 2 (June 1983), pp. 257-76.

Ben Bernanke and Mark Gertler, "Agency Costs, Net Worth,

and Business Fluctuations," American Economic Review

Vo. 79, No. 1 (March 1989), pp. 14-31.

Ben Bernanke and Mark Gertler, "Financial Fragility and

Economic Performance," Quarterly Journal of Economics

Vol. 105, No. 1 (February, 1990), pp. 87-114.

Mauro Boianovsky, "Wicksell on Deflation in the Early

1920s," History of Political Economy Vol. 30, No.

2 (Spring 1998).

Ricardo Caballero and Mohamad Hammour, "The Cleansing

Effect of Recessions ," American Economic Review Vol.

84, No. 5 (December 1994), pp. 1350-68.

Lawrence Christiano, Martin Eichenbaum, and Charles Evans, "The

Effects of Monetary Policy Shocks: Evidence from the Flow of

Funds," Review of Economics and Statistics, Vol 78,

No. 1 (February 1996), pages 16-34.

Lawrence Christiano, Martin Eichenbaum, and Charles Evans,

"Monetary Policy Shocks: What Have We Learned and to What

End?" NBER Working Paper No. 6400 (February 1998).

J. Bradford DeLong, "American Fiscal Policy in the Shadow

of the Great Depression", in Michael Bordo, Claudia Goldin,

and Eugene White, eds., The Defining Moment: The Great Depression

and the American Economy in the Twentieth Century (Chicago:

University of Chicago Press, 1997).

J. Bradford DeLong and Lawrence H. Summers, "The Changing

Cyclical Variability of Economic Activity in the United States,"

in Robert Gordon, ed., The American Business Cycle: Continuity

and Change (Chicago: University of Chicago Press for the

NBER, 1986).

Barry Eichengreen, Golden Fetters: The Gold Standard and

the Great Depression (New York: Oxford University Press,

).

Irving Fisher, "The Debt-Deflation Theory of Great Depressions,"

Econometrica Vol. 1, No. 4 (October, 1933), pp. 337-57.

Douglas Gale and Martin Hellwig, "Incentive-Compatible

Debt Contracts I: The One-period Problem," Review of

Economic Studies Vo. 52, No. 5 (Octobert, 1985), pp. 647-63.

Friedrich Hayek, "The System of Intertemporal Price Equilibrium

and Movements in the 'Value of Money'," in Israel Kirzner,

ed., Classics in Austrian Economics: A Sampling in the History

of a Tradition. Volume 3. The Age of Mises and Hayek.

(London: Pickering and Chatto, 1994 [orig. pub. 1928), pp.

160-98.

Friedrich Hayek, The Road to Serfdom (London, 1944).

Walter Heller, New Dimensions of Political Economy

(Cambridge: Harvard University Press, 1965).

John Maynard Keynes, A Tract on Monetary Reform (London:

Macmillan, 1924).

John Maynard Keynes, The General Theory of Employment,

Interest and Money (London: Macmillan, 1936).

Charles Kindleberger, The World in Depression

Finn Kydland and Edward Prescott, "Rules Rather than

Discretion: The Inconsistency of Optimal Plans," Journal

of Political Economy Vol. 87, No. 3 (June, 1977), pp. 473-492.

George Perry (1998), "Is Deflation the Worry?" (Washington

D.C.: Brookings Institution, Policy Brief #41).

Christina Romer, "Is the U.S. Economy More Stable?"

Journal of Economic Perspectives (forthcoming).

Christina Romer, "The Great Crash and the Onset of the

Great Depression," Quarterly Journal of Economics

Vol 105, No. 3 (August 1990), pp. 597-624.

Robert Shiller (1987), Market Volatility (Cambridge:

MIT Press).

John Taylor, "Is There a Role for Fiscal Policy in Macroeconomic

Stabilization?" Journal of Economic Perspectives

(forthcoming).

Robert Townsend, "Optimal Contracts and Competitive Markets

with Costly State Verification," Journal of Economic

Theory Vol. 21, No. 5 (October, 1979), pp. 265-93.

Jacob Viner, "Mr. Keynes on the Causes of Unemployment,"

The Quarterly Journal of Economics, Vol. 51, No. 1. (Nov.,

1936), pp. 147-167.

Your Father Was a Hamster! And Your Mother Smells of Elderberries!

David Frum taunts:

Reversing Brad DeLong’s Question: During the Bush years, Berkeley economist and uber-blogger Bradford DeLong taunted Bush supporters.... As voters head to the voting booths in November , they might reverse that question:

Give me one single example of something with the following three characteristics:

It is a policy initiative of the current Obama administration [ie, no continuations of pre-existing successful Bush policies: TARP, surge in Iraq, etc.]

It was significant enough in scale that I’d have heard of it (at a pinch, that I should have heard of it)

It has not utterly failed to produce the results promised.

Touché...

Well, first of all it is Daniel Davies's question and not mine: he gets the credit...

Second, the ARRA--which would have been a McCain initiative had he won, by the way, or so his advisors say, even though opposed by every single Republican office-holder today--looks very much like it has achieved the results promised--even though it was done at only about 5/8 of the scale Obama proposed (the necessity of getting Voinovich, Snowe, and Collins on board to do pretty much anything weakened it) and what was proposed was only about 2/3 of what was appropriate.

Third, the bank stress tests--opposed by every single Republican office-holder today, by the way--appear to have performed much better than I at least expected (although HAMP and PPIP do not look like successes).

Fourth, the auto rescue--opposed by every single Republican office-holder today, by the way--has also performed much better than I at least expected.

Fifth, health care reform--also a Romney initiative, by the way, even though opposed by every single Republican office-holder today--appears to be performing, so far, as expected: providers are gearing up to deal with an inflow of more patients able to get insurance and insurance companies are thinking hard about how to handle themselves in the new market structure that will emerge after 2014--although, of course, health care reform was also weak tea relative to what ought to have been done, as the necessity of lining up sixty senators including a bunch of DINOs made itself felt.

Sixth, financial reform--also a McCain initiative, by the way, even though opposed by every single Republican office-holder today--appears to be performing as expected. At least, shady mortgage and other companies that function by making borrowers bear risks they don't understand appear to be scared of Elizabeth Warren.

Seventh, the TARP--also a McCain and a Romney and a Giuliana and a Paulson initiative, by the way, even though opposed by every single Republican office-holder today--has performed as well as expected. And it is important to note that the Republican legislators of Washington DC appear now, to a man, to be opposed to it.

Eighth, the focus on Afghanistan appears to be performing as well as focuses on Afghanistan ever do.

Ninth, the carbon tax--a Republican initiative pushed hard by Republican economists like Dick Schmalensee, Jim Poterba, Greg Mankiw, etc., even though opposed by every single Republican office-holder today--well, it did not pass because Republicans blocked it.

Tenth, cap-and-trade--also a McCain and a Romney and a Giuliani initiative, by the way, even though opposed by every single Republican office-holder today--well, it did not pass because Republicans blocked it.

Consider what the world would look like if the current crop of Republican candidates had been in control over the past two years: no TARP, no auto rescue, no financial reform, no stress tests, no ARRA. It would look much bleaker than the current picture looks.

Now I don't doubt that David Frum and his friends could have done a better job of governing America over the past two years if they had had total power over the U.S. government and if they had had omniscient prescient 20/20 hindsight about everything--and if they somehow could be convinced not to have launched a war on Iran in early 2009. But if they had lacked hindsight? I think that they would have done worse than Obama, even if they could have been restrained from launching a war on Iran in early 2009.

And, of course, David Frum and his friends are not the current Republican Party seeking office this November. They are a despised and exiled remnant, wandering through the desert of Sinai, longing for the fleshpots of Egypt with no manna in sight...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers