J. Bradford DeLong's Blog, page 2163

November 3, 2010

Paul Krugman on the Strange Death of Expansionary Fiscal Policy

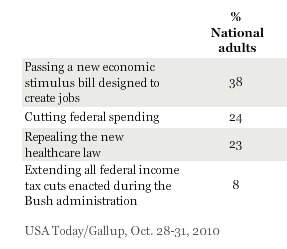

A plurality of voters want to see a new economic stimulus bill--called a stimulus--to create jobs. Even 18% of Republicans and 32% of independents think a new job-creating stimulus bill should be Congress's highest priority. Yet is Congress going to pass one? No. Is the Treasury leveraging up its TARP money and using it to stimulate the economy? No. The Federal Reserve--well, the forecasts are that the Federal Reserve's quantitative easing programs may add between 0.2% and 0.5% to economic growth next year, although I do not see how the estimates can be so high unless the program has a large effect on inflation expectations.

This is an absolutely remarkable government that we have. And an absolutely remarkable political class.

Paul Krugman takes on the Very Serious People:

The Strange Death of Fiscal Policy - NYTimes.com: One clear result of the midterms is that we won’t have anything like a further round of stimulus. And this, in turn, means that the narrative all the Very Serious People will tell is that fiscal policy was tried, it failed, and that’s that.

But the real facts don’t at all support the conventional wisdom.

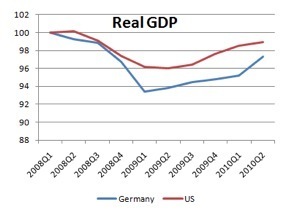

Actually, let me focus on an international comparison. You often hear the US experience contrasted with Germany: America, we’re told, went for Keynesian policies, while Germany chose austerity, and Germany did better.

But as far as GDP is concerned, Germany did not, in fact, do better.

This is, I think, the most amazing thing I hear as I wander around talking to the necktie-wearing class: they genuinely do think that real GDP in Germany fell less than real GDP in America--and I cannot figure out where this belief cam from.

Paul goes on:

Yes, Germany did better on employment — but this reflects policies that American conservatives surely don’t support, including employment subsidies, strong unions, and rules making it difficult to fire workers.

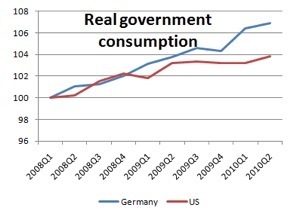

And what may be even more surprising: if we look at actual government purchases of goods and services, as opposed to transfer payments (many of them just payments from the federal government to states), Germany was more Keynesian than the United States:

So, it’s an amazing thing: Obama and company have managed to convince people that big government failed, without actually delivering big government.

The Mountain Labored, and Gave Birth to a Mouse

The Federal Reserve says:

FRB: FAQ: the Federal Reserve's responsibilities fall into four general areas... (1) conducting the nation's monetary policy by influencing money and credit conditions in the economy in pursuit of full employment and stable prices...

Greg Robb:

Fed to buy $600 billion in government bonds The Fed: The Federal Reserve pledged on Wednesday to start a controversial new billion bond-buying spree to rescue the economy from its current doldrums. The Fed said it would buy up to $600 billion in long-term Treasurys until the end of June 2011, about $75 billion this month, in a strategy called quantitative easing.... To implement the Federal Reserve’s new policy of quantitative easing, the New York Fed plans to buy $850 billion to $900 billion in Treasury notes over the next five months, including $600 billion in new purchases and about $250 billion to $300 billion to reinvest the proceeds of maturing mortgage-backed securities, the New York Fed announced Wednesday. The average duration of Treasurys purchased by the Fed will be five to six years...

The five-year note carries an interest rate of 1.17% per year. The Federal Reserve is thus changing the supply of assets by taking onto its own balance sheet... wait for it... wait for it... duration risk that the market is currently willing to pay $7 billion a year to avoid.

To take $7 billion a year of duration risk off of the private sector's books in a global economy that still has more than $60 trillion of financial assets is a change in "credit conditions" equivalent to what would be achieved in normal times by a coordinated one basis point reduction in short-term interest rates by the world's central bankers.

Unless this moves inflation expectations in a serious way, it is hard to see why they came out here.

Files for November 3 Lecture: Monopolistic Competition

Can Obama Get and Stay on Message?

The message is PAYGO. Any proposal that does not pay for itself over the next ten years--any proposal projected to increase the debt relative to baseline as of 2020, and not to reduce the debt thereafter--gets vetoed.

Can he get on and stay on message?

November 2, 2010

John Scalzi: Vote Cat Says: "Vote!"!

November 1, 2010

Liveblogging World War II: November 2, 1940

U.S. Attorney General Robert Jackson:

Robert Jackson: In this election, every citizen must vote as if that vote alone would decide the election. If any of your friends tell you that they intend to vote for Willkie, ask them to stop and think seriously about the consequences of such an act. What do they really know about Willkie? They know only what the advertising experts have told them. They know only that because he owns some farms in Indiana he has been offered as a friend of the farmer; that because he had some summer jobs in factories as a youngster, he is being paraded as a friend of labor; that because he was a lawyer and lobbyist for a big utility system, he is being hailed as a business executive....

[A]s a result of his brilliant handling of America’s foreign affairs, President Roosevelt today is feared in some capitals, beloved in others, respected throughout the world. Nobody—no thinking person—can in good conscience vote for Willkie unless he knows what his foreign policy will be. What do they really know about Willkie? They know only what the advertising experts have told them. Anyone who intends to vote for Willkie had better ask himself what kind of man Willkie would be on the cold morning after election, after the honeymoon of election promises is over....

[Do we know whether] Willkie would be able to control the financial and business powers behind him who might have their own selfish ideas on what our foreign policy should be? We know what Roosevelt’s foreign policy is and we know that the country thoroughly approves it. In our national self-interest, we cannot afford to risk a change. We have had a vigorous foreign policy for seven and a half years. Any shift at this time would mean giving up the valuable momentum that has been building up in those years....

The President has backed business when Wall Street would not back it [and he has] backed the American home [when] bankers did not even make gestures. President Roosevelt fought the fight for the American farmer as no man has fought it before. Franklin D. Roosevelt was the first President to have a living faith that labor could be trusted to make its own collective bargains with employers, faith that a system could be set up which ultimately, and when it was accepted by employers, would result in the settlement of labor disputes by reason instead of force...

Ooeee! Ooeee! Ooeee!!!

My first cup of caffeinated coffee from Pert's in six months!

I have been drinking decaf from Peer's and halfcaf from Starbuckd.

Mocha Sanani press-and-go!

Yowza!!

This Pointless Stealing of Chairs from the Wheeler Auditorium Greenroom House to Stop!

The New York Times Starts Liveblogging the Civil War

Ben Bernanke Could Fix the Economy Pretty Quickly

Paul Krugman:

The End Of Western Civilization: Gauti Eggertsson writes in to follow up on my piece on quantitative easing in the Great Depression. He points me to a 2008 paper (pdf) in which he shows that the coming of FDR, combined with America’s exit from the gold standard, was seen by markets as a huge regime change; it was, said FDR’s own budget director, “the end of Western civilization.”

This regime change immediately shifted expectations of future inflation, well before there was any actual surge in monetary base. That, rather than the quantitative easing per se, is how monetary policy — or more accurately, expectations of future monetary policy — gained some traction in the 30s liquidity trap.

Again, an important lesson — but how relevant is it to current circumstances? Bernanke, unfortunately, cannot convince people that he’s bringing the end of Western civilization.

Ben Bernanke could do the near-equivalent from the perspective of fixing the economy fairly rapidly: any moment he wishes, he could announce that he no longer think the Federal Reserve's inflation target should be 2% per year but rather 4% per year--and that he will strive to hit that target.

But he is not going to do anything like that anytime soon, is he?

Barack Obama: master of zero-dimensional chess...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers