J. Bradford DeLong's Blog, page 2162

November 6, 2010

Austin Frankt: Keep Your Eye on the Prize

Was health care reform worth it? Yes:

Austin Frakt: Beyond Washington | The Incidental Economist: The principal way in which health reform is good for health is that it provides access to insurance for tens of millions of Americans. A secondary way is that it aims to increase the efficiency and quality of our health system through payment incentives and reduction of health care of low marginal value, in exchange for increasing provision of health care with high marginal value.

But let’s just take insuring the uninsured. Many, many, many, many, many, many studies using the best statistical techniques find that insurance is good for health. Aaron and I have written about them numerous times, so I won’t do a literature review in this post. (Follow the “many” links provided above.)

Given the importance of health reform for health, the interpretation of the question “Was health reform worth it?” in political terms, and only political terms, misses a lot. Even if health reform is responsible for a significant part of the mid-term’s outcome–and I don’t think it was–that it was worth it is not even a question in my mind. If one thinks that our health insurance system requires major reform, and I believe it does (who doesn’t?), then that’s the right thing to do. In fact, it was the right thing to do years ago.

Was health reform worth it? Looking beyond Washington and focusing on health, the answer is clearly “yes.” Even if the politics don’t justify it, the health of Americans does.

Department of "Huh?!" (Sebastian Mallaby Edition)

"Huh?!" is Greg Ip's reaction to Sebastian Mallaby of the Council on Foreign Relations, which has indeed fallen on sad times:

QE2 and the Fed: QE is unconventional monetary policy, but it is monetary policy nonetheless. When either conventional or unconventional monetary policy eases, certain things are supposed to happen: long-term yields fall, stocks rise, the exchange rate declines. All of which is happening now. If the Fed had just cut the Federal funds rate from 3.5% to 2.75% (roughly the equivalent of what its $600 billion in Treasury purchases should achieve), we should have expected exactly the same results, without [Mallaby's] sturm und drang about currency wars.... [C]urrency manipulation... unsterilised foreign-exchange intervention, for example, such as the Swiss National Bank and Bank of Japan.... But that’s not what the Fed is doing. It is simply trying to do to long-term rates what it has already done with short-term rates....

I think [Mallaby's confusion] stems from a misconception of what QE does.... Purchasing bonds with newly-created bank reserves will only expand the overall domestic supply of credit if banks on-lend the extra reserves. That is not happening.... Nor does QE create foreign liquidity; the Fed can do many things, but printing foreign currency is not one of them....

The Fed does not create Brazilian reals: but it may make investors willing to pay more for real-denominated assets. Before foreign countries try to resist that, they should first ask if they should. Many of these countries need to reorient their economies from exports to domestic demand. A higher currency helps. And if it’s happening too quickly, they can use macroprudential regulation at home....

One thing other countries should not do is ask America to leave unused one of the few effective policy tools it has left to stimulate the domestic economy. The world needs higher unemployment and deflation in America like a hole in the head.

Indeed. If there was one big lesson from 2008-2009, it is that the rest of the world has an even greater interest in full employment in America than America does.

November 5, 2010

Yay!

"Nonfarm payroll employment increased by 151,000 in October, and the unemployment rate was unchanged at 9.6 percent." finally, a good payroll report: enough jobs to actually reduce the unemployment rate if things continue at this pace.

November 4, 2010

Well, It Depends What "Nearly" Means, Doesn't It?

Larry Meyers says Bernanke has "nearly begged" for fiscal stimulus. David Leonhardt says that he has not begged for fiscal stimulus. Seems to me both are right--for a Federal Reserve definition of "nearly":

Has Bernanke Pleaded?: WLaurence H. Meyer, a former Federal Reserve governor, said the following in today’s Times:

Bernanke has said that fiscal stimulus, accommodated by the Fed, is the single most powerful action the government can take for lowering the unemployment rate, when short-term rates are already at zero… He has nearly pleaded with Congress for fiscal stimulus, but he can’t count on it.

I am among Mr. Meyer’s many admirers, but I don’t think that’s quite right. Yes, if you go back and read Mr. Bernanke’s recent speeches and Congressional testimony, you will see he believes that last year’s stimulus bill helped the economy and that more government spending or tax cuts now would help again. But he has made a deliberate choice to avoid making that point strongly or clearly.... Mr. Bernanke had perhaps more ability to influence this debate than anyone else. Imagine if he had given a speech earlier this year, as the economy started to falter, that included something along the lines of:

Last year’s stimulus program was not perfect, and we will never know its precise effect on the economy. But the available evidence — including the Fed’s own analytical tools and those of the Congressional Budget Office and private economists, as well the timing and pattern of spending by consumers, businesses and governments — suggests that the program made a major difference. It appears that more than one million jobs, and perhaps substantially more, would not exist now had the program not been enacted. Similarly, additional fiscal stimulus today, in the form of government spending or tax cuts, could play an important role in helping the economy to continue to recover from the recent financial crisis, especially if this short-term stimulus were paired with policies to reduce the deficit in future years.”

An argument like this would have made national headlines and cut through some of the more frivolous criticism of the stimulus. It may even have affected the debate as much as Alan Greenspan’s endorsement of the Bush tax cuts did in 2001. We’ll never know because Mr. Bernanke opted not to use his bully pulpit. That’s certainly his right as Fed chairman, but I don’t think he deserves credit today for trying.

Department of "Huh?!" ("When the Economy Started to Falter" Edition

Methinks David Leonhardt is in danger of becoming a Very Serious Person. For he writes:

Was That a Plea From Bernanke?: Imagine if [Bernanke] had given a speech earlier this year, as the economy started to falter...

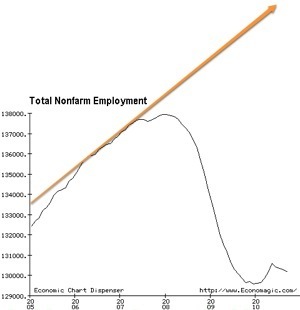

If you simply look at the graph of employment and of the population growth-driven trend, you see that the economy could not "start to falter" "earlier this year" because the economy has been faltering nonstop since late 2007. There is a temporary blip in employment from temporary census hiring. That is it. Otherwise the economy had faltered, was faltering, is faltering, and in all likelihood will continue to falter.

It is not that there was a normal "recovery" that then, unexpectedly, turned into a jobless recovery. It is that there never was a "normal" recovery in the first place.

And I, at least, could never see the logic behind forecasting models that were predicting a "normal" recovery. The Recovery Act federal stimulus was timed to start to ebb in the summer of 2000. State-level fiscal contraction was in train.

The problem was--as my daughter said at the time--that Bernanke and company were placing excessive weight on the second derivative. "Getting worse more slowly" is not the same thing as "better," and nobody should ever fit a quadratic to any time series and trust the forecast without a good warrant for doing so.

Resist the call of the Dark Side, David!

How Is That Voting Against Health Care Reform Working for You?

Josh Marshall:

Crushed: Of the 39 Dems who voted against Health Care Reform, 12 are going to be returning in the next Congress.

Barack Obama, Master of Zero-Dimensional Chess

The on-message line from the Obama administration is that every policy change must put the national deficit on a path to sustainability--no policy changes that do not include within themselves provisions to shrink the national debt relative to baseline ten years hence and thereafter.

That is not what we are getting:

Gibbs Says Obama ‘Open’ to Extending Upper-Income Tax Cuts By Roger Runningen

Nov. 4 (Bloomberg) -- The Obama administration is “open”

to extending tax cuts for upper-income individuals in order to

win extensions for middle-income families, White House press

secretary Robert Gibbs said.

Gibbs reinforced remarks by President Barack Obama

yesterday that he is ready to negotiate with Republicans who are

pushing to extend Bush-era tax cuts that are set to expire at

the end of the year...

Two Years Late and Many Dollars Short

I remember back two years ago, talking to a future subcabinet Obama official, asking what was the Plan B in case the Recovery Act that they could get through Congress turned out to be too small. He told me that there were lots of other things that could and would be done--the Treasury could leverage up its TARP money and use it to stimulate the economy, and Fannie Mae and Freddie Mac could restructure mortgage finance, and the Federal Reserve could act to raise inflation expectations and change asset supplies via quantitative easing.

Now David Leonhardt looks back on all the things the Fed has done--or, rather, not done--over the past two years:

Fed’s More Aggressive Move May Not Go Far Enough: For much of the last year, there were three basic camps on what the Federal Reserve should be doing. One focused on the risks of the Fed’s taking more action to help the economy. This camp — known as the hawks, because of their vigilance against inflation — worried that the Fed could be sowing the seeds of future inflation and that any further action might cause global investors to panic. Another camp — the doves — argued instead that the Fed had not done enough: inflation remained near zero, and unemployment near a 30-year high. In the middle were Ben Bernanke and other top Fed officials, who struggled to make up their minds about who was correct. For months, they came down closer to the hawks and did little to help the economy. On Wednesday, they effectively acknowledged that they had made the wrong choice.

The risks of inaction have turned out to be the real problem.

The recovery has not been as strong as the Fed forecast.... Since May, the economy has lost 400,000 jobs.... What’s striking about the last six months, however, is how much more accurate the doves’ diagnosis of the economy has looked than the hawks’. Early this year, for example, Thomas Hoenig, president of the Kansas City Fed and probably the most prominent hawk, gave a speech in Washington warning about the risks of an overheated economy and inflation. Mr. Hoenig suggested that the kind of severe inflation that the United States experienced in the 1970s or even that Germany did in the 1920s was a real possibility. When he gave the speech, annual inflation was 2.7 percent. Today, it’s 1.1 percent.

The doves, on the other hand, pointed out that recoveries from financial crises tended to be weak because consumers and businesses were slow to resume spending. Around the world over the last century, the typical crisis caused the jobless rate to rise for almost five years....

[G]lobal investors have continued to show no signs of panicking. If anything, as the economy weakened over the summer, investors became more willing to lend money to the United States, viewing its economy as a safer bet than most others. After the Fed’s announcement on Wednesday, many of the hawks who warned about inflation earlier this year repeated those warnings anew. The Cato Institute, citing a former vice president of the Dallas Fed, said the new program would “sink” the economy. Mr. Hoenig provided the lone vote inside the Fed against the bond purchases. It’s always possible that the critics are correct and that, this time, inflation really is just around the corner. But there is still no good evidence of it. The better question may be whether the Fed is still behind the curve....

“I’m a little disappointed,” said Joseph Gagnon, a former Fed economist who has strongly argued for more action. The announced pace of bond purchases appears somewhat slower than Fed officials had recently been signaling, Mr. Gagnon added, which may explain why interest rates on 30-year bonds actually rose after the Fed announcement.

One thing seems undeniable: the Fed’s task is harder than it would have been six months ago. Businesses and consumers may now wonder if any new signs of recovery are another false dawn. And although Mr. Bernanke quietly credits the stimulus program last year with being a big help, more stimulus spending seems very unlikely now.

Unfortunately, in monetary policy, as in many other things, there are no do-overs.

The Republicans Announce Their Eagerness to Serve Their Banking-Sector Masters

Rarely do you get such a blatant announcement by a legislator that he has been captured by his campaign contributors:

Yglesias » Rep Spencer Bachus (R-Alabama) Plots to Weaken Financial Regulation, Strengthen Banks: I think relatively few people understand that one of the principal substantive complaints the new Republican House majority has about Barack Obama is that he’s been unkind to the incumbent firms in the financial services sector. But here’s Spencer Bachus, the likely new chair of the relevant committee, firing warning shots on behalf of Wall Street:

Spencer Bachus, a potential Republican chairman of the House financial services committee, has fired the first salvo in a battle with regulators – warning them against harming US banks by curbing their trading activity. [...]

Underlining the change in Congress, Mr Bachus, who as ranking Republican on the committee could replace Barney Frank as chairman of the panel, expressed concern that shareholders of Goldman Sachs and JPMorgan Chase will be hurt because the banks will be less profitable. [...]

“The derivatives provisions in Dodd-Frank alone… as they stand now they’re going to take a trillion dollars out of our economy. Think how many jobs that’s going to kill,” he said.

Rising stars in the conservative media firmament have painted an appealing picture over the past two years of a populist right outraged by allegedly undue entanglement between government and big business and eager to help out the little guy. But this is the reality. The article is via Tyler Cowen who remarks “It is difficult to fathom how that last paragraph can make any sense, other than as fabrication.”

This is simply another example of why friends simply do not let friends vote Republican, ever.

Looking Back at the Past: Bruce Bartlett on the Ignorance of the Tea Party Crowd (March 17, 2010)

Bruce Bartlett:

Ignorance Is Bliss for the Tea Party Crowd: Back when I used to listen to Rush Limbaugh there was one thing in particular he used to say that I agreed with. Over and over he said that liberals defined themselves largely by the worthiness of their objectives and the sincerity of their motives. The actual results of their policies didn’t matter at all.... Today, however, conservatives have largely adopted the liberal operating assumption and now also define themselves by the righteousness of their motives. This fact became very obvious to me this week when I examined the knowledge that tea party demonstrators on Capitol Hill had on the subject of taxation....

On March 16 the tea party crowd showed up for yet another demonstration on Capitol Hill in Washington. Curious about the factual knowledge that these people have regarding the issues they are protesting, my friend David Frum enlisted some interns to interview as many tea partiers as possible on a couple of basic questions. They got 57 responses--a pretty good sized sample from a crowd that numbered between 300 and 500 people.... Tea partiers were asked how much the federal government gets in taxes as a percentage of the gross domestic product. According to Congressional Budget Office data, acceptable answers would be 6.4%, which is the percentage for federal income taxes; 12.7%, which would be for both income taxes and Social Security payroll taxes; or 14.8%, which would represent all federal taxes as a share of GDP in 2009. Not everyone follows these numbers closely and tea partiers may have been thinking of figures from a few years ago, before the recession when taxes were higher. According to the CBO, the highest figure for all federal taxes since 1970 came in the year 2000, when they reached 20.6% of GDP. As we know, after that George W. Bush and Republicans in Congress cut federal taxes and they fell to 18.5% of GDP in 2007, before the recession hit, and 17.5% in 2008. Tuesday's tea party crowd, however, thought that federal taxes were almost three times higher than they actually are. The average response was 42% of GDP and the median was 40%....

Tea party goers also seem to have a very distorted view of the direction of federal taxes. They were asked whether they are higher, lower or the same as when Barack Obama was inaugurated last year. More than two-thirds thought that taxes are higher today and only 4% thought they were lower; the rest said they are the same. As noted earlier, federal taxes are very considerably lower by every measure since Obama became president. And given the economic circumstances, it's hard to imagine that a tax increase would have been enacted last year. In fact, 40% of Obama's stimulus package involved tax cuts. These include the Making Work Pay Credit, which reduces federal taxes for all taxpayers with incomes below $75,000 by between $400 and $800. According to the JCT, last year's $787 billion stimulus bill, enacted with no Republican support, reduced federal taxes by almost $100 billion in 2009 and another $222 billion this year. The Tax Policy Center, a private research group, estimates that close to 90% of all taxpayers got a tax cut last year and almost 100% of those in the $50,000 income range. For those making between $40,000 and $50,000, the average tax cut was $472; for those making between $50,000 and $75,000, the tax cut averaged $522. No taxpayer anywhere in the country had his or her taxes increased as a consequence of Obama's policies.

It's hard to explain this divergence between perception and reality. Perhaps these people haven't calculated their tax returns for 2009 yet and simply don't know what they owe. Or perhaps they just assume that because a Democrat is president that taxes must have gone up, because that's what Republicans say that Democrats always do. In fact, there hasn't been a federal tax increase of any significance in this country since 1993....

Probably the simplest motivation the tea partiers have is the one that Howard Beale (actor Peter Finch) gave in the 1976 movie Network. "I'm mad as hell and I'm not gonna take it any more!"... In this sense, the tea parties are simply the latest manifestation of populism.... Unfortunately for the tea party populists, there is no evidence in American history that populism has ever had a meaningful effect on policy. Even when the movement had a charismatic and articulate leader in William Jennings Bryan, the populists only elected a handful of members to Congress and never achieved the presidency. One reason is that the major parties co-opted populist issues and leaders, which bought time until the populist impulse burned itself out like a brush fire. Whatever the future of the tea party movement in American politics, it's a bad idea for so many participants to operate on the basis of false notions about the burden of federal taxation...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers