J. Bradford DeLong's Blog, page 2161

November 8, 2010

At Ohio State: Macroecomics in Historical Perspective

November 7, 2010

In Which Bob Zoellick Makes His Play for the Stupidest Man Alive Crown

The last thing that the world economy needs right now is another source of deflation in a financial crisis. And attaching the world economy's price level to an anchor that central banks cannot augment at need is another source of deflation--we learned that in the fifteen years after World War I.

Which is why Bob Zoellick says that we need it.

Alan Beattie watches the intellectual train wreck:

Zoellick seeks gold standard debate: Leading economies should consider readopting a modified global gold standard to guide currency movements, argues the president of the World Bank. Writing in the Financial Times, Robert Zoellick, the bank’s president since 2007, says a successor is needed to what he calls the “Bretton Woods II” system of floating currencies that has held since the Bretton Woods fixed exchange rate regime broke down in 1971. Mr Zoellick, a former US Treasury official, calls for a system that:

is likely to need to involve the dollar, the euro, the yen, the pound and a renminbi that moves towards internationalisation and then an open capital account.... The system should also consider employing gold as an international reference point of market expectations about inflation, deflation and future currency values.... Although textbooks may view gold as the old money, markets are using gold as an alternative monetary asset today.”

They do not. They simply do not. That is not true. Markets are using gold as a speculative asset and a hedge. They are not using it is a medium of exchange, a unit of account, or a safe store of nominal value.

He really may be the Stupidest Man Alive.

Alan Beattie politely says:

Although there are occasional calls for a return to using gold as an anchor for currency values, most policymakers and economists regard the idea as liable to lead to overly tight monetary policy with growth and unemployment taking the brunt of economic shocks...

Department of "Huh?!" (Structural Unemployment Edition)

Why oh why can't we have a better press corps?

Allison Schrager:

Fiscal policy: Digging oneself into a hole?: A few weeks ago I heard Robert Solow, Nobel Laureate for his work on economic growth, say fiscal stimulus via government spending was necessary and the most effective tool we currently have to reduce unemployment. Paul Krugman has not been shy about advocating a similar position. At last week's Buttonwood gathering Joe Stiglitz also favoured a Keynesian style push. Chicago’s Ragu Rajan was more sceptical, and thought it would be better to focus on long-term structural problems like a labour force that lacks globally competitive skills and income inequality. The Minneapolis Fed’s Narayana Kocherlakota also doubts how effective stimulus will be when it seems that much of unemployment is structural and not easily remedied by government expansion...

I know of no evidence that much of unemployment is structural and not easily remedied by government expansion.

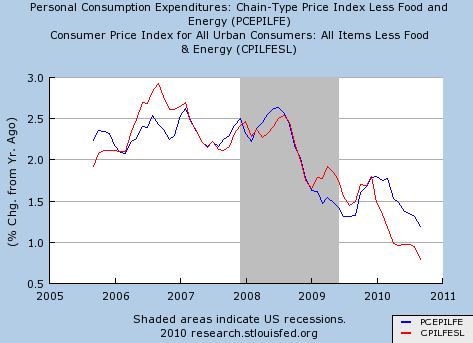

If unemployment were structural, and not easily remedied by government expansion, inflation right now would be stable or rising. It is not:

This is not rocket science, people!

The Wall Street Journal Op-Ed Page Lies All the Time, About Everything

Why oh why can't we have a better press corps?

Allan Meltzer dropped off my list of reliable commentators in the late 1990s, when he accused Larry Summers and Bob Rubin of breaking the law during the Mexican Peso Crisis of 1995. Now he has woken Paul Krugman's ire:

Meltzer Misleads: Reading Allan Meltzer’s latest, you might think that the CPI and the PCE deflator — two alternate measures of inflation — were telling dramatically different stories about what was happening to the US economy.... Yes, there was brief bulge in the PCE deflator early this year — which in itself raises questions about how reliable a measure it is. But basically, both show a steady trend toward lower inflation. Which is, by the way, the opposite of what Meltzer told us to expect.

Indeed. Meltzer:

Meltzer: Milton Friedman vs. the Fedm: In the late 1980s, former Fed Chairman Alan Greenspan encouraged everyone to watch... the PCE deflator. Since then, the Fed has used that measure as its inflation target. Recently, without much publicity, the Fed switched to the consumer price index (CPI). The reason? From 2003 to 2009, the two measures moved together. In 2010, they diverged—and the CPI shows substantially less inflation than the PCE. Even so, the most recent PCE deflator shows inflation running at around 1.2% annually, about where the Fed says it wants to hold the inflation rate. And it has been between 1.5% and 1.8% for a year. There is no sign of deflation.

The Fed says that it wants to hold the inflation rate at 2% per year, not 1.2% per year.

Oh Boy...

Mark Thoma:

Economist's View: "Federal Reserve Reflects on its History": Bernanke says he's not trying to create inflation as a means of stimulating the economy:

After its big move to boost economy, Federal Reserve reflects on its history, by Neil Irwin, Washington Post: ...Fed Chairman Ben S. Bernanke and a long list of past and present Fed officials gathered this weekend for a conference on the history of the central bank.... Speaking at the "Return to Jekyll Island" conference sponsored by the Atlanta Fed, Bernanke argued that the steps are not as revolutionary as many observers in the financial markets and the news media have suggested.

There's a sense out there that, quote, quantitative easing or asset purchases are some completely foreign, new, strange kind of thing and we have no idea what... is going to happen. Quite the contrary - this is just monetary policy.... It will work or not work in much the same way that ordinary, more conventional, familiar monetary policy works.... I have rejected any notion that we are going to try to raise inflation to a super-normal level in order to have effects on the economy.

"We're not in the business of trying to create inflation," Bernanke said. Rather, he said, the Fed is trying to avoid a further drop in inflation...

And Mark Thoma is upset:

Since an increase in inflationary expectations is one potential way to stimulate the economy, Bernanke is "blocking one of the main channels through which his policy might actually work."

Yep. This is not good at all. "Crying 'Fire! Fire!' in Noah's Flood" indeed...

Where is the Ben Bernanke who had such a willingness to do what economic stability required in the fall of 2008? What happened to him?

Why Are the Technocrats of the Center Missing in Action?

Robert Rubin disappoints Felix Salmon:

Rubin’s unhelpful fiscal exhortations: Oh dear, what have I signed up for? No sooner do I agree to start blogging more about economic journalism than I find this op-ed from Robert Rubin in the FT. It’s a pretty sorry specimen, and I do hope it’s not representative of the genre. The op-ed, which is written in borderline-unreadable technocratese, has a simple structure: there are headwinds in the economy. What should we do about them? Spending more might be problematic. Expansionary monetary policy likewise. So what should be done? The administration should be more business-friendly. And it should put together a “serious fiscal plan”.

Rubin is long on assertion and scaremongering, and short on actual argument.... It’s really hard for me to see how Rubin gets to his “likely on balance” conclusion that stimulus will be counterproductive. Does Rubin really think it probable that the announcement of extra government spending would cause some kind of crazy market crash? And “business uncertainty about future economic conditions and policy” is a pretty weak replacement for the bond vigilantes....

Rubin is incredibly light on the specifics of exactly what he means by “real, trusted and enacted long-term structural deficit reduction.”... Rubin wants to see “public investment and reform in economically critical areas, such as education, healthcare costs, infrastructure, immigration and others”; he gives no corresponding list of areas which might see spending cuts. And his list of tax hikes is limited to letting the Bush tax cuts on income over $250,000 a year expire. Which is all well and good, but is hardly going to move the needle on the debt/GDP ratio. Rubin ratchets up the unintended irony in his conclusion:

Despite substantial legislative actions over the past year and a half, there is widespread and serious concern about the willingness to work across party and ideological lines and to make the tough decisions, necessary to meet our challenges.

Well yes, Bob. But how do you expect the government to make tough decisions if you, a semi-retired technocrat with no public office at all, can’t even bring yourself to name them? It’s all well and good to talk about fiscal prudence in the abstract: the difficult thing is enacting it in reality. And you’re not being remotely constructive on that front.

Indeed.

It is disappointing.

And it is not just Rubin: all the bipartisan technocrats of the center appear to be wringing their hands and calling for a plan without saying what it should be.

Here is what Rubin should have said.

Here is the platform for the bipartisan technocrats of the center:

Ten-Year PAYGO: a 2/3 supermajority in both houses commitment to ten-year PAYGO starting now, and a pledge by every president and presidential candidate that they will veto all bills that do not meet ten-year PAYGO standards. Everything Congress passes must be projected to reduce the outstanding national debt within ten years.

"Starting now" means starting now: no middle-class tax cut this month or next month without a pay-for within ten years. Taking current law rather than current policy as our baseline and requiring PAYGO for everything gets our 25-year fiscal gap down to 1.2% of GDP (as opposed to 4.8% of GDP) and gets our 50-year fiscal gap down to 0.8% of GDP (as opposed to 6.9% of GDP). Our long-run deficit problem is overwhelmingly due to things that Congress is about to do, not things that Congress has done.

Carbon tax: a 1.0% of GDP carbon tax is the best policy to provide American businesses with the incentives they need to invent the clean energy technologies of the future. Half of it should be channeled into the Social Security Trust Fund to improve its solvency. Half should be used to help close our remaining operating fiscal gap.

Pick-your-poison: Additional stand-by tax increases and stand-by spending cuts to close the remaining 0.3% of GDP long-run fiscal gap.

Private add-on Social Security accounts: At their option, all Americans can add up to 2% of their Social Security wages to a private Social Security account run through the U.S. government's Thrift Savings Program. Private contributions will be matched two-for-one by the federal government out of carbon tax revenue

Recovery: when every fired local, state, and federal worker takes a private sector job down as well and when the U.S. government can borrow at today's absurdly-low terms, it is criminal stupidity not to pull government spending forward into the present and push taxes back into the future (all within the ten-year PAYGO rule, of course). Since the macroeconomic situation is worse now than it was ever projected to get when the first Recovery Act was passed and since the U.S. government can borrow on better terms now than it could at the time of the first Recovery Act, it is time for a second Recovery Act--fifty percent federal government purchases and aid to the states, fifty percent tax cuts--somewhat larger than the first was.

Certainty: The principal sources of uncertainty in American economics right now are three: we don't know how the long-run fiscal gap will be closed (but we think it will be), we don't know how our health-care system will be reformed and transformed (but we know it will be), and we don't know what our policy toward global warming will be in a generation (but we know that we will have one). The best things the government could do to diminish uncertainty would be to: (1) commit immediately to the full implementation of the version of RomneyCare-plus-cuts-in-Medicare-and-taxes-on-gold-plated-health-plans that was this year's PPACA, (2) commit immediately to a long-run climate policy in the form of a carbon tax coupled with research incentives for future energy technologies, and (3) commit immediately to a plan to cover the long-term fiscal gap.

That's a seven-point plan. That's a seven-point plan that everybody centrist and deficit-hawkish in the reality-based community should be willing to commit to today.

November 6, 2010

The Pointless Pain Caucus Is Inventing Reasons on the Fly to Object to Quantitative Easing...

Paul Krugman:

Bernanke And The Shibboleths - NYTimes.com: [W]e have an excess of desired saving over desired investment, even at a zero interest rate.... How did this happen?... [O]ver-borrowing in the past has left large parts of the world credit-constrained, forced to deleverage... even a zero interest rate isn’t enough to persuade the unconstrained players to increase spending by enough to offset these cuts. Yet interest rates can’t go below zero; which poses a problem. For the world as a whole, savings must equal investment.... So this incipient excess of savings leads to a depressed world economy, in which income falls to match the amount people are able/willing to spend.

So what can policy do?

It can try to achieve negative real interest rates by creating expectations of inflation....

Alternatively, governments can step in and spend while the private sector won’t.

Finally, central banks can try to circumvent the zero lower bound.... [W]e only have zero rates at the short end, and it’s possible, though not certain, that you can get at least some traction by buying those longer-term bonds.

But now that we’re in this situation, VSPs around the world are objecting to all of these possible actions. Inflation targets are horrible because we must have price stability. Fiscal policy is unacceptable because we must have balanced budgets. QE is outrageous because that’s not what central banks are supposed to do.

Notice that in each case the objection is based on a shibboleth. Price stability is treated as an absolute virtue, without any model to explain why. The same with budget balance. And those who are horrified at the idea of expansionary monetary policy have been inventing concepts on the fly to justify their position.

The simple fact is that we have a global excess supply of savings, which is doing terrible things to workers. The reasonable thing is to do something about it; it’s deeply unreasonable, and deeply irresponsible, to invent reasons not to act...

Economic History at U.C. Berkeley

Kathleen Maclay:

11.02.2010 - Grant launches Berkeley Economic History Lab: The University of California, Berkeley's Department of Economics is the recipient of a $1.25 million grant from the Institute for New Economic Thinking (INET) to develop a Berkeley Economic History Laboratory. The new lab will train economists to be more historically literate so they can better contribute to policy debates.... The award is the largest of 30 first round grants announced recently by the institute, which was established in 2009 with a $50 million pledge from financier George Soros to improve economics through educational initiatives, conferences and grants. It further boosts the field of economic history at UC Berkeley's economics department, already home to one of the nation's leading graduate programs for economic historians. The Berkeley Economic History Laboratory (BEHL) was proposed by UC Berkeley economic historian Barry Eichengreen, who will serve as its principal investigator.

"It took the most serious financial crisis in 80 years – unfortunately – to remind economists of the value of historical knowledge and analysis," said Eichengreen. "We now need to capitalize on that awareness by increasing the supply of young scholars with historical training and skills who can contribute to the debate over economic and financial reform." "If there is a 'Berkeley School,' its distinguishing characteristic is the use of historical materials to address policy-relevant issues of current concern," Eichengreen wrote in the lab proposal. Eichengreen was joined last Thursday in a conversation on campus about the new lab with INET executive director Robert Johnson and fellow UC Berkeley economic historians Bradford J. DeLong and Christina Romer. "You guys are going to be the generators of new economic thinking," Johnson told economics students in the audience.

Romer, recently back at UC Berkeley after serving as chair of President Obama's Council of Economic Advisors, stressed the importance of using history as a tool to help answer "enormous questions that have effects on the entire planet." As examples, she cited the economic crisis's impact on long-term growth, impacts of the federal stimulus package on jobs and prospects for the Federal Reserve Bank's anticipated quantitative easing to boost the banking system's money supply.

Eichengreen said the lab should help leverage UC Berkeley's existing strengths in economic history, encourage other institutions to forge similar paths, and "not only train specialist economic historians, but also infuse a historical sensibility into the work of economists who self-identify as working in other areas." All this, he said, will help make economics a more fundamentally historical, institutional and empirical social science.

With INET funds, the department will increase the number of historically literate economists doing policy-relevant research and newly-minted UC Berkeley graduates with Ph.Ds in economic history.... UC Berkeley's Department of Economics has one of the only top-ranked Ph.D. programs in the nation that requires a semester-long introduction to economic history for all first-year students, who must earn a B- or better to advance their studies and write a dissertation...

Might Health Care Reform Save Money More Quickly than I Expect?

Perhaps:

Kolstad and Kowalski: Evidence from Massachusetts on the Impact of Health Care Reform: [T]he Massachusetts reform gives us a novel opportunity to examine the impact of expansion to near-universal health insurance coverage among the entire state population.... We use a difference-in-difference strategy that compares outcomes in Massachusetts after the reform to outcomes in Massachusetts before the reform and to outcomes in other states.... [R]eform increased insurance coverage among the general Massachusetts population. Our main source of data is a nationally-representative sample of approximately 20% of hospitals in the United States. Among the population of hospital discharges in Massachusetts, the reform decreased uninsurance by 36% relative to its initial level. We also find that the reform affected utilization patterns by decreasing length of stay and the number of inpatient admissions originating from the emergency room. Using new measures of preventive care, we find some evidence that hospitalizations for preventable conditions were reduced... hospital cost growth did not increase after the reform in Massachusetts relative to other states.

Tim Pawlenty vs. John Boehner

A Republican who still has some sense of honor vs. one who does not.

Alex Seitz-Wald watches the cat fight:

How House Republicans Are ‘Lying To You’ About Spending Cuts: [M]ost Republicans in Congress refuse to propose specifics that would actually cut spending in any significant way. Recognizing the extreme unpopularity of cutting Social Security and Medicare, and the aversion of their base to military cuts, these self-styled fiscal conservatives often take entitlement and defense spending off the table, removing nearly 60 percent of the federal budget from scrutiny. Of the remaining spending, another sizable portion goes to debt payments — which are untouchable — and most Republicans also take homeland security and other security spending off the table, leaving only a small fraction of the total federal budget from which to find cuts.

Despite this stark reality, Republicans still try to claim the mantle of fiscal responsibility....

Appearing on MSNBC’s Morning Joe today, Minnesota Gov. Tim Pawlenty... [tells us that] anybody says they want to cut spending but won’t touch entitlements or defesne is “lying to you”:

HOST: What are you going to cut?

PAWLENTY: If you look at a pie chart of federal outlays, discretionary spending being the red, non-discretionary being the blue. The blue is already over the over the half way mark and it’s growing in double digits. Anybody who comes in here and tells you they’re not going to cut anything other than waste fraud and abuse, they’re not going to touch entitlements — they’re lying to you. If you want to deal with the spending issue, in terms of total federal outlays, you got to deal with interest on the national debt, Social Security, Medicare, Medicaid — if you have the time I can walk you through my ideas. But that’s the truth, you got to do entitlement reform, particularly if you’re going to hold defense harmless...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers