J. Bradford DeLong's Blog, page 2172

October 21, 2010

What Would Milton Friedman Say About Fed Policy Under Bernanke? - Investors.com

David Beckworth emails:

Greetings from Texas. Since you just had a post on Milton Friedman, I thought you might like this Op-Ed I coauthored on him. It is in the Investor’s Business Daily today and makes the case that Friedman would be calling for more Fed action. http://www.investors.com/NewsAndAnalysis/Article.aspx?id=551040

And here it is:

What Would Milton Friedman Say About Fed Policy Under Bernanke?: [W]at would Milton Friedman say about our current monetary policy?

First, [he would say that] low interest rates do not necessarily mean monetary policy is loose.

Friedman criticized the policies of the Fed in the 1930s and the Bank of Japan in the 1990s on this very point. Both central banks claimed to be highly accommodative at these times, pointing to low interest rates as evidence of easy monetary policy. Friedman countered, however, that low interest rates may reflect a weak economy rather than easy monetary policy.

Back in 1997, in fact, he called the idea of identifying low interest rates with easy monetary policy an interest-rate fallacy. The only time low interest rates do indicate loose monetary policy is when they are below the neutral interest-rate level.... The implication for today's Fed is that although its target federal funds rate is low, its stance still may not be very stimulative given that the neutral interest rate is also low....

Second, [he would say that] the Fed should aim to stabilize inflation expectations. In his 1992 book "Money Mischief," Friedman called for legislation requiring the Fed to stabilize the spread between the nominal yield on regular Treasury bonds and the real yield on inflation-protected Treasury bonds (TIPS).... Friedman wanted the Fed to target expected inflation, and to promote price stability. As a forward-looking approach, this would also avoid the "long and varying lag" problems associated with backward-looking monetary policy...

links for 2010-10-21

@delong When will you integrate this into your pedagogy? Perhaps never? Amusing Hayek vs Keynes rap: http://youtu.be/d0nERTFo-Sk

– Andy Maddocks (AndyMaddocks) http://twitter.com/AndyMaddocks/statu...

(tags: from:AndyMaddocks)

Hey Washington Post — It's Called Social Media: Tech News «

Friedman: Comments on the Critics

Cuts in Britain Ignore Views of Keynes - NYTimes.com

The Myth of Expansionary Fiscal Austerity | Reports

Rortybomb

TaxVox: the Tax Policy Center blog :: Pledging Our Way to Fiscal Disaster

An Intellectual Diary - Ta-Nehisi Coates - Personal - The Atlantic

FT.com / US / Economy & Fed - Fed eyes flexible approach to fresh stimulus

FT.com / US / Politics & Foreign policy - Foreclosure crisis tops Obama agenda

FT.com / Comment / Opinion - The Tea Party will prove transient

Understanding Virginia's History Textbook Lie - Ta-Nehisi Coates - National - The Atlantic

A plain blog about politics: Is Howard Kurtz Always This Awful?

Microsoft spares tablet users from Windows Phone 7 | Mobile platforms - InfoWorld

News Desk: Shouts & Murmurs: Three Things to Do When Clarence Thomas's Wife Calls You : The New Yorker

Technology: Rise of the machines | The Economist

October 20, 2010

Why oh Why Can't We Have a Better Press Corps? (Yet Another Atlantic Monthly Edition)

Henry Farrell on Clive Crook:

Expertise — Crooked Timber: Clive Crook on his blog today

idolizing experts and disdaining the supposedly ignorant masses is at least as dangerous. The intelligent use of experts is not straightforward. Technical expertise tends to be narrow, sometimes extremely narrow. Many policy-oriented experts are only too pleased to exceed their limits, pronouncing widely and authoritatively on matters they understand hardly any better than non-experts.

My immediate reaction while reading this was that even if the underlying claim is right, it still sounds a bit rich when it comes from someone whose paid job is every week to pronounce widely and authoritatively on matters where he does not possess any obvious expertise. And then I read the next sentence.

Economists and climate scientists spring instantly to mind.

Most readers of Crooked Timber are probably unaware of the little spot of bother that Crook got into over climate science a couple of months ago....

I have no direct knowledge of the intervening discussions which led to Crook publishing rather substantially amended versions of his original posts some weeks later. But whatever their motivations, they represent a quite remarkable volte face. This bit in particular presents a striking contrast....

I am not competent to discuss the science, and do not pretend to be. But here is what I see when I read the “trick” email and then the Penn State report. An explanation is required. The report offers only half an explanation: “trick” means “statistical method”. No contrary opinions are sought or heard. On this basis the report finds “no substance” in the criticism.

Suggestions that it is hard to ‘keep a straight face’ while entertaining the notion that climate scientists had meant the word ‘trick’ to refer to a statistical method and that Mann’s account “strains credulity” have been replaced with vaguely-worded platitudes about the “judgment calls” involved in dealing with data series that have gone funny in recent decades. The claim... that it is an ‘insult to one’s intelligence’ to suggest that the Climategate emailers were not being deliberately misleading has disappeared entirely.

I don’t know exactly why Crook climbed down in this abject fashion. To use his own term, these posts are “mealy-mouthed apologies,” albeit “mealy-mouthed apologies” of the kind that clearly had some considerable difficulty making it past the craw.... It is obvious to anyone who spends any time at all with statistically minded scientists (and social scientists) that they commonly use the term ‘trick’ in just the way that the reports suggest it was used. When a statistician talks about e.g. a clever statistical trick, they are usually not suggesting that they want to lie with numbers, and you are likely to get very confused if you think that they are.

Hence, Crook’s imputation that the “trick” was surely employed toward dishonest ends, was not only potentially libelous, but a clear demonstration that he simply didn’t know what he’s talking about. He had no expertise on the topic, and under his own rules, should have shut up about it. If he had, it would have spared him some considerable embarrassment.

S>umming up, I can certainly understand why Crook has an animus against climate scientists. I can even understand why, in some intellectually confused fashion, he links discussions of climate science to the question of what happens when people pronounce confidently on topics where they have no legitimate expertise, and suffer the painful consequences. But his memory seems to be malfunctioning. It wasn’t the climate scientists who got their arses handed back to them on a plate. It was Clive Crook. I trust he’ll be grateful for the reminder.

It Is Not Just John Maynard Keynes, It Is Milton Friedman Who Is Being Thrown Over the Side

Any time that the views of Milton Friedman are denounced as those of a left-wing semi-socialist kook, something has gone very, very wrong.

Has something gone very very wrong? Yes, it has.

Landon Thomas covers the train wreck, but does not include my observations about not Keynes but Friedman:

Cuts in Britain Ignore Views of Keynes: The British economist John Maynard Keynes may live on in popular legend as the world’s most influential economist. But in much of Europe, and most acutely here in the land of his birth, his view that deficit spending by governments is crucial to avoiding a long recession has lately been willfully ignored.... George Osborne, chancellor of the Exchequer, delivered a speech on Wednesday that would have made Keynes — who himself worked in the British Treasury — blanch. He argued forcefully that Britons, despite stumbling growth and negligible bank lending, must accept a rise in the retirement age to 66 from 65 and $130 billion in spending cuts that would eliminate nearly 500,000 public sector jobs and hit pensioners, the poor, the military and the middle classes because of what he insisted was the overwhelming need to reduce the country’s huge budget deficit.... [A]cross Europe, where the threat of a double-dip recession remains palpable, what is most surprising is not simply that governments from Germany to Greece are slashing public outlays but that the debate hinges more on how fast to do so....

“Everything Keynes established about the primacy of maintaining demand at a steady pace is gone,” Brad DeLong, a liberal economist and blogger at the University of California, Berkeley, said mournfully. “Europe obviously thinks it can focus on sound finances while the U.S. manages world demand,” he said in a telephone interview, “but unfortunately we are not doing that.”...

[I]n Europe there is hardly a policy maker to be found who is making the argument that governments need to spend more, not less. This is particularly true in Britain, where a combination of collapsing tax revenues and government spending to prop up banks and support the unemployed during the financial crisis has contributed to a budget deficit equal to 11 percent of G.D.P., second highest in Europe after Ireland....“In the U.S., central bank memory is ingrained in the Depression, while in the U.K. it is being bailed out by the I.M.F.,” said Michael Saunders, an economist with Citigroup in London. “That gives policy makers different sets of priorities.”... An opinion poll on Sunday revealed that while the public worries about the fairness of cuts and the government jobs to be lost, 45 percent supported the program, with 23 percent opposed...

So let me add the rest of what I said that Landon Thomas should have included in his article. Let me point out that it is not just Keynes that is being thrown over the side, but Milton Friedman and his teachers--most notably Jacob Viner--as well.

And let me doing so by turning the microphone over to Milton Friedman and listen to what he says of those who preach fiscal (and monetary!) austerity during depression:

[A] debate on Keynes between Abba P. Lerner and myself... in the late 1940s.... Lerner was trained at the London School of Economics, where the dominant view was that the depression was an inevitable result of the prior boom... that the monetary authorities had brought on the depression by inflationary policies before the crash and had prolonged it by "easy money" policies thereafter; that the only sound policy was to let the depression run its course, bring down money and costs, eliminate weak and unsound firms.... It the was London School (really Austrian) view that I referred in to my "Restatement" when I spoke of "the atrophied and rigid caricature [of the

quantity theory]... described by the proponents of the new income-expenditure approach, and with some justice."...

The intellectual climate at Chicago had been wholly different. My teachers... blamed the monetary and fiscal authorities for permitting banks to fail.... [T]hey issued repeated pronunciamentos calling for governmental action to stem the deflation... "large and continuous deficit budgets to combat the mass unemployment and deflation of the times... Federal Reserve banks systematically pursue open-market operations with the double aim of facilitating necessary government financing and increasing the liquidity of the banking structure." ... Keynes had nothing to offer those of us who had sat at the feet of Simons, Mints, Knight, and Viner....

[A] talk Viner delivered in Minneapolis on February 20, 1933, on "Balanced Deflation, Inflation, or More Depression."...

It is often said that the federal government and the Federal Reserve system have practiced inflation during this depression no and that no beneficial effects resulted from it. What in fact happened was that they made mild motions in the direction of inflation, which did not succeed in achieving it....

[If] a deliberate policy of inflation should be adopted, the simplest and least objectionable procedure would be for the federal government to increase its expenditures or to decrease its taxes, and to finance the resultant excess of expenditures over tax revenues either by the issue of legal tender greenbacks or by borrowing from the banks...

Why Are Clarence and Virginia Thomas Still Harrassing Anita Hill?

Andy Borowitz has the how-to-deal-with-the-situation guide:

News Desk: Shouts & Murmurs: Three Things to Do When Clarence Thomas’s Wife Calls You: Like many Americans, over the past several years I have been the recipient of multiple unwelcome voicemails from the wife of Supreme Court Justice Clarence Thomas. These calls have come in the middle of the night, at the crack of dawn, even at the dinner hour favored by telemarketers. Regardless of the time of day, all of these voicemails have one thing in common: she always sounds like she’s drunk-dialing me, except she appears to be completely sober.

I know what you’re saying: “It’ll never happen to me. Virginia Thomas doesn’t even have my phone number!” Well, that’s what I thought, and several years of trauma counseling later, I’ve come to realize (the hard way) what a fool’s paradise I was living in. Consider this: according to a recent study, the odds of Virginia Thomas leaving a threatening voicemail for you are higher than those of Christine O’Donnell correctly identifying the First Amendment. With those grim statistics in mind, here are three simple steps you can take if and when Mrs. Clarence Thomas calls:

Start apologizing the moment you hear her voice. Remember, like a bear at a campsite, Virginia Thomas does not want to eat you, she’s only after your food, and in this case, your apology is the only thing protecting you from Mrs. Thomas mauling you to death. If apologizing does not work, clap your hands loudly into the receiver in the hopes of scaring her away.

When she says, “This is Virginia Thomas,” reply, “No, this is Virginia Thomas. Who’s calling? Wait a minute—is that you, Anita Hill?” When she denies being Anita Hill (and she will), say, “There you go again, with your infernal lies. This is like Clarence’s confirmation hearings all over again. You disgust me, Anita Hill.” With any luck, accusing her of being Anita Hill will disorient her long enough for you to summon help.

Get in the habit of answering your phone, “Long Dong Silver residence.”

One final note: if you get a call in the middle of the night and there is silence on the other end, that is not Virginia Thomas. That is Clarence Thomas.

October 19, 2010

Barack Obama Is Once Again Far Off Message

Ezra Klein watches the train wreck:

Ezra Klein - Why does Obama keep telling reporters there are 'no shovel-ready projects'?: Perhaps I should've written this post before interviewing Jared Bernstein, the vice president's chief economist, on the same subject. But if you read that interview closely, you'll see a White House that doesn't exactly know what to do with the president's comments. The administration doesn't think the stimulus failed. At the end of the day, the law met its spending targets. As promised, it dispensed with 70 percent of the funds within two years. Most of the remaining money will pay out when projects that are underway reach completion. Today, the White House released a video in which Austan Goolsbee, the chairman of the Council of Economic Advisers, argues that the intervention saved the job market (though by looking only at private-sector jobs, he stacks the deck, as the public sector is where recent job losses have been concentrated).

So why did the president tell Peter Baker -- and before him, David Brooks -- that there are no "shovel-ready programs"? Those were three of the most important words used to sell the program -- and the president's decision to walk them back is giving plenty of ammunition to his enemies. And shovel-ready is not a controversial concept: It's what Rep. Pete Sessions, the Dallas conservative, called his city's rail project when he wrote Transportation Secretary Ray LaHood asking for some of the stimulus funding that he opposed.

And Sessions is no isolated case: Over the past two years, the stimulus has funded more than 15,000 transportation projects. In total, it's funded more than 75,000 projects. Those efforts weren't ready for shovels the morning after the bill passed, but it didn't take more than a couple of months to break ground on many of them, and all of them hit within the stimulus's two-year target range.

And even if the president was disappointed by the progress, why is he giving ammunition to the stimulus's critics only weeks before the midterm election? He couldn't have told Baker they'd conduct the interview Nov. 3?

The big news on the stimulus going into November should've been this report from the Center for Public Integrity pulling together the many, many letters Republican lawmakers sent asking the administration to use the stimulus to fund projects in their district and saying, forthrightly, that those projects would create jobs and improve the economy. Obama should be going around the country, setting up a podium at each of those projects and making clear just what it is the stimulus did, and just what it was that Republicans opposed. Instead, he's telling reporters that the foundational phrase of his sales pitch for the stimulus was a mistake, which implies to voters that the Republicans are right when they say the stimulus didn't work.

File this one under "unforced errors," I guess.

And here is poor Jared Bernstein trying to deal with the damage:

Ezra Klein - Are there 'shovel-ready projects?' An interview with Jared Bernstein.: Ezra Klein: The president has now told at least two journalists that "there’s no such thing as shovel-ready projects.” He obviously believes it. But what, exactly, does he mean?

Jared Bernstein: The president definitely had some initial frustration that projects were taking longer to get up and running than he wanted. About 100 days into the stimulus, the president and the vice president spoke to the agencies about speeding things up and laid out ambitious targets. And ultimately, they met and exceeded every one of those targets. The fact is that there are more than 75,000 infrastructure projects up and running today and creating jobs.

EK: What were the targets? How did the White House judge whether the stimulus was working?

JB: The most salient target was to spend 70 percent by September 30th, 2010. And we hit that target. We expected to have saved or created around 3.5 million jobs by this point, and according to the estimates of outside evaluators like the Congressional Budget Office, we hit that target, too. If you want more targets, read the report from the vice president that we released last week. It lists more of the specific goals the president set at that 100-day mark, like seeing 100 airports being improved, 1,500 highways being improved, 360 military facilities being repaired, and many more, by September 2009. And the agencies met or exceeded every one of those goals.

EK: You said you've spent about 70 percent of the money in the first two years. Where's the other 30 percent?

JB: The rest of that money is obligated, meaning that it's supporting projects that are under contract but are not yet completed. The way the spending works is that we don't provide the final check until the project is done. Just like if you pay someone to add on to your house, you make some initial payments, but you don't let go of all the money until the project is done. So the majority of that 30 percent are payments to come for projects that aren't finished. Then there are some tax receipts that are slotted to pay out over the next few months and things like Medicaid and food assistance.

EK: None of this really explains Obama's disappointment with shovel-ready projects. You're saying the work fulfilled expectations. He keeps telling reporters that it didn't.

JB: Very early on in the Recovery Act, the VP went to visit this bridge in Pennsylvania that was a good candidate for repair. He asked “how shovel-ready is it?” It happened that the engineer was there and said, “hold on, I’ve got the blueprints right over here in my car.” He actually got them and showed them to the VP. They quickly got a transportation grant to fix the bridge but didn’t start construction for a few months because the local government didn’t want to have to divert traffic patterns until the summer. Now the project is completed. That’s just the way these things unfold sometimes. There’s often going to be some wiggle between approval and shovels in the ground. The point is there are now tens of thousands of projects creating good jobs and we should build on that momentum.

EK: The White House is asking Congress to put in a lot more money for infrastructure repair. But a lot of my readers are skeptical. We've spent more than $100 billion, we've started more than 75,000 projects, we're skeptical that this spending can come online as quickly as we'd like to see it move. Is there really more to do, and can it be done in an effective manner?

JB: This isn't hard to conceive of once you spend some time in this world: One program I liked in the Recovery Act was the 48C tax credit to incentivize the production of clean energy manufacturing products here in the United States. Thanks to this program, we've broken ground on nine new advanced-battery factories, and we think we can double that in the next few years and give the U.S. a global footprint in that industry. The smart grid program installed more than two million smart meters. There's just so much to be done in the infrastructure space, whether that's repairing our infrastructure or building out things like smart-grid systems and high-speed rail.

Problem Set 5

Econ 1: Fall 2010: U.C. Berkeley: Files for October 20 "Short Run and Long Run" Lecture

Expansionary Government Spending to Boost the Economy Was Not Tried--Except, of Course, in China

Paul Krugman

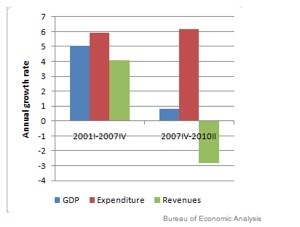

Even More On The Origins of the Deficit - NYTimes.com: Let’s look at trends in GDP, spending, and revenues over two periods — one designed to capture “normal” growth, the other the economic crisis.... During the pre-crisis period, spending grew slightly faster than GDP — that’s Medicare plus the Bush wars — while revenue grew more slowly, presumably reflecting tax cuts. What happened after the crisis? Spending continued to grow at roughly the same rate — a bulge in safety net programs, offset by budget-slashing at the state and local level. GDP stalled — which is why the ratio of spending to GDP rose. And revenue plunged, leading to big deficits.

But I’m sure that the usual suspects will find ways to keep believing that it’s all about runaway spending.

Department of "Huh?": Do They Understand What's in the Health Care Bill? Edition

I don't know what the hell these people think that they are saying. There is no way that you can argue that, because of the health-care reform bill, workers who want minimum wage jobs will be unable to find them.

John Goodman:

The $6-an-Hour Health Minimum Wage | John Goodman's Health Policy Blog: Most people intuitively know that the worst thing government can do in the middle of the deepest recession in 70 years is enact policies that increase the expected cost of labor. Yet that is exactly what happened last spring, with the passage of the Affordable Care Act (ACA). How bad is it? Right now we’re estimating the cost of the minimum benefit package that everyone will be required to have at $4,750 for individuals and $12,250 for families.... In four years’ time, the minimum cost of labor will be a $7.25 cash minimum wage and a $5.89 health minimum wage (family), for a total of $13.14 an hour...

Arnold Kling:

Health Care Costs and Wages: John Goodman writes,

In four years' time, the minimum cost of labor will be a $7.25 cash minimum wage and a $5.89 health minimum wage (family), for a total of $13.14 an hour or about $27,331 a year. (I think you can see already that no one is going to want to hire low-wage workers with families.)

Read the whole thing. As you know, I have been making similar points, but I don't blame the new health care law so much. This is already an issue before the new law takes effect...

Tyler Cowen:

Marginal Revolution: Sentences to ponder:

In four years' time, the minimum cost of labor will be a $7.25 cash minimum wage and a $5.89 health minimum wage (family), for a total of $13.14 an hour or about $27,331 a year.

That's John Goodman, via Arnold Kling.

Repeat after me:

There is no employer mandate in the bill. Employers will still be able to offer workers $7.25/hour to work.

There is no employer mandate in the bill. Employers will still be able to offer workers $7.25/hour to work.

There is no employer mandate in the bill. Employers will still be able to offer workers $7.25/hour to work.

There is no employer mandate in the bill. Employers will still be able to offer workers $7.25/hour to work.

There is no employer mandate in the bill. Employers will still be able to offer workers $7.25/hour to work.

There is no employer mandate in the bill. Employers will still be able to offer workers $7.25/hour to work.

There is no employer mandate in the bill. Employers will still be able to offer workers $7.25/hour to work.

There is no employer mandate in the bill. Employers will still be able to offer workers $7.25/hour to work.

There is no employer mandate in the bill. Employers will still be able to offer workers $7.25/hour to work.

There is no employer mandate in the bill. Employers will still be able to offer workers $7.25/hour to work.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers