J. Bradford DeLong's Blog, page 2175

October 16, 2010

The Crime of Misleading the Assembly of Athens and Causing It to Make a Bad Decision...

What was this called in Greek--the crime of misleading the Assembly?

Keith Werhan:

(1) The Athenian law against misleading the demos. Athens, like political communities before and since, adopted laws that dealt harshly with those who would overthrow or otherwise subvert the democracy. Perhaps the most distinctive Athenian provision against subversion was the law, dating perhaps from the early years of the classical democracy, that prescribed the death penalty for Assembly speakers who misled the demos. n294 Every citizen had legal standing to commence such a prosecution, which could be lodged against any rhetor who had advocated an Assembly decision resulting in harm to the polis. The Athenians regarded an Assembly action gone awry as the product of the demos having been deceived by "mischievous advice." When an action turned out badly, the speaker's deception was revealed. In the Athenian view, an Assembly speaker who misled the demos into acting to the detriment of the polis engaged in misconduct tantamount to treason, on a par with those who sought to subvert the democracy or who betrayed Athens to one of its enemies.

An early and classic example of the crime of misleading the demos involved Miltiades, the general (strategos) who had led the Athenian forces to victory at the battle of Marathon. In Herodotus' account, Miltiades, basking in the glow of that triumph, convinced the Assembly to raise an expeditionary force under his command, "without saying against what country . . . [it] would be used--only that . . . [the Athenians] would grow rich if they followed him." According to Herodotus, Miltiades' actual motive was personal. He sought revenge against the Parians for a past wrong. The Paros expedition was an embarrassing failure. Miltiades returned to Athens wounded and humiliated, whereupon the Assembly tried and convicted him for having misled the demos into approving the expedition. Miltiades avoided the death penalty, but he died of his wounds before he could pay the substantial fine that the Assembly had levied upon him...

Keith Werhan (2009), "The Classical Athenian Ancestry of American Freedom of Speech" Supreme Court Review 293.

There must be a single Greek word for this, or at the very least a short phrase. What is it? Is this the graphe paranomon?

Who Are You and What Have You Done with Our Ben Bernanke?

Edmund Andrews asks a question of the Fed Chair:

My theory on Ben Bernanke: [O]ne has to ask: what took Bernanke so long to reach this decision. At the end of the day, his rationale boils down to something that critics -- even laymen like me -- have been saying and writing for months: unemployment is higher than the Fed wants and inflation is lower than the Fed wants, so there is no good reason for not easing policy further.

One explanation is politics. Fed governors and regional Fed presidents have been split between hawks and doves, and the Fed likes to maintain as much consensus as possible. But I think there's a more basic reason: Bernanke has been worried that another round of easing might not accomplish much. And he has good reason to worry. Spectacularly low interest rates have done little to spark demand, as evidenced by the massive volume of excessive reserves that banks are parking at the Fed. I think Fed officials are worried that they will be seen as powerless, that they have run out of tricks and that the central bank's authority and mystique will suffer a long-term blow.

If that's the case, it's a bad reason. Bernanke was brilliantly bold in his initial responses to the financial crisis and the downturn. But he lost his nerve more recently, and held back when he should have forged ahead.

Parroting Supply and Demand: Department of "Huh?!"

Myron Scholes appears not to understand the basics of supply and demand:

Guest Contribution: Myron Scholes on Whether QE2 Will Work: Myron Scholes, the Nobel Prize-winning retired Stanford University finance economist, contemplates the prospects for another round of Federal Reserve quantitative easing, and wonders if it’ll work as well as the Fed hopes.

Some possibilities:

(1) Maybe in short run, QE reduces the risk premium and encourages investment. Encouraging investment is good. The problem is that this isn’t a rational argument. The risk premium can’t be affected by flows. Investors will sell risky assets to government and buy bonds. The Fed could end up holding all risky assets; investors will hold safe assets. The risk premium stays the same...

If the Federal Reserve holds all the risky assets, then the risk associated with them is borne by taxpayers as a whole.

Taxpayers as a whole are different from investors as a whole.

Thus if the Fed buys risky assets for safe assets, it reduces the quantity supplied of risky assets to be held by private investors. As quantity goes down, price goes up. As the price of risky assets rises, the spread between their expected returns and those of safe assets goes down.

In other words: the risk premium does not stay the same. It goes down.

This is not rocket science, people.

I can still hear Milton Friedman:

Brad. Supply and demand curves are never horizontal. They are never vertical. If somebody says that quantities change without changing prices, or that prices change without changing quantities, hold tightly onto your wallet--there is something funny going on.

To claim that shifting risk off of investors and onto taxpayers has no effect on risk premia because "U.S. persons own the Fed.... society still has the risk. The risk doesn’t go away, any more than the risk of holding subprime mortgages went away before the crisis. We cannot structure the risk such that it disappears..." is the kind of mistake that--well, that not even a parrot would make.

We can (and do) argue about how much quantitative easing would reduce risk premia. But the assumption that the relevant demand curve is flat--that seems to me to be a mistake that a properly-trained parrot would not make.

Barack Obama Needs to Get Back on Message

Paul Krugman:

The Boehnerization of Barack Obama: Why has stimulus become a dirty word? Many reasons, I guess: an inadequate plan combined with a wildly overoptimistic forecast was more or less guaranteed to create the impression of a failed program. But it’s also true that the president himself has had a deeply self-destructive tendency to echo his opponents’ arguments. My original invisible bond vigilantes post was inspired, in part, by Obama’s decision to go on Fox News and declare that we needed to cut the deficit to avoid a double dip. Then, in July, he repeated almost verbatim John Boehner’s justly mocked claim that since the private sector is tightening its belt, the government should do the same.

And he’s done it again:

Nonetheless, Obama said that just as people and companies have had to be cautious about spending, “government should have to tighten its belt as well. We need to do it in an intelligent way. We need to make sure we do things smarter, rather than just lopping something off arbitrarily without having thought it through.”

As I wrote back in July,

We’ll never know how differently the politics would have played if Obama, instead of systematically echoing and giving credibility to all the arguments of the people who want to destroy him, had actually stood up for a different economic philosophy. But we do know how his actual strategy has worked, and it hasn’t been a success.

October 15, 2010

Liveblogging World War II: October 16, 1940

Time magazine:

NAVY: Fleet Ready? - TIME: Into the sunny bays at San Pedro and San Diego last week stood 24 ships of the U. S. Fleet, back from Honolulu to give officers and men shore leave in California. At the docks their women waited—wives with babies their husbands had not yet seen, wives whose honeymoons had been cut short when the Fleet sailed to Pearl Harbor six months ago, sailors' girls, sailors' mothers. The air jangled with the familiar sounds of "the Fleet's in"—the rattle of anchor chains, the shrill of boatswains' pipes—finally the lilting bugle notes of liberty call. Over the sides of the stern grey ships, up from the bowels of four submarines poured officers and men, into motor launches, gigs, barges. Ashore they disappeared like snow in spring. The grey ships, manned by skeleton crews, quieted down.

High above the battleship New Mexico still floated the four-starred flag of the CINCUS. And below decks, for the next five days, tall, slow-spoken Admiral James Otto Richardson, Commander in Chief U. S. Fleet, worked at his desk, writing, reading, conferring. At week's end the blue flag came down and the CINCUS, in mufti, went over the side. That day he took a plane for Washington, this week sat down to talk with Secretary of the Navy Frank William Knox.

What SECNAV and CINCUS had to say to each other they kept to themselves. They had plenty to talk about. Across the Pacific the clouds massed darkly. Japan, junior member of the Axis, was talking of war if the U. S. didn't like her idea of running the Orient (see p. 40). What goat-faced Fleet Admiral Prince Hiroyasu Fushimi had up his Oriental sleeve, neither Frank Knox nor Jo Richardson knew. But Frank Knox had talked tough too, had said that "if a fight is forced upon us we shall be ready." At week's end he called up the naval reserve.

Theoretically, the Fleet is always ready, but for 1940 warfare its readiness had qualifications. On the credit side, the Fleet had never before had the top-flight personnel that now man its ships. A majority of its enlisted men are high-school graduates. Its officers are well educated, carefully selected, bear down hard on training. It has a substantial sprinkling of oldtime sailormen, does a crack job of gunnery, engineering, flying, seamanship. In tonnage and gun power it is superior to anything Japan can put on the seas.

On the debit side, the Navy was undermanned by 15%. Jo Richardson needed men faster than the training stations can turn them out. Although officers say that new Navy men learn in three months what took oldtimers three years, the Fleet needs more training—for its gun crews, its engineering forces, even for the hard-eyed, diligent young officers that Navy expansion promoted to the command of battleship and cruiser gun turrets long before their time. With an expansion of 70% ahead of it for the two-ocean Navy, it will need intensive training for a long time to come.

Barack Obama Goes Off Message

This is bad. Very off message. He ought to know better.

As long as the jobless recovery continues and as long as interest rates on federal debt remain very low, the U.S. government should be filling jobs rather than leaving them vacant.

Joe Davidson:

Obama says federal jobs may stay vacant, doesn't rule out furloughs: Facing Republican complaints about big government and federal salaries, President Obama said Friday that agencies might leave some vacancies unfilled as his administration looks for ways to save money. He did not rule out furloughing employees, as has happened in some states, but he warned that such action could result in loss of services.

Speaking to members of the Trotter Group, an organization of black columnists, Obama deflected complaints, by Republicans on Capitol Hill and conservative think tanks, that federal employees are overpaid. He said his team has examined pay levels, "and the data we get back indicates that high-skilled workers in government are slightly underpaid. Lower-skilled workers are slightly overpaid relative to the private sector. "That's not surprising," he added, "because it's a unionized workforce."

Nonetheless, Obama said that just as people and companies across the country have had to be cautious about spending, "government should have to tighten its belt as well. We need to do it in an intelligent way. We need to make sure we do things smarter, rather than just lopping something off arbitrarily without having thought it through." Obama has asked agencies to develop plans for cutting budgets 5 percent. But how that would be done would be decided on a case-by-case basis, he said. "In some cases, they may say we don't need to fill vacancies," he said...

Can I please go back to my home timeline now?

Ezra Klein on Fixing the Mortgage Mess

Ezra:

Four ways the foreclosure mess could be used to help homeowners: Foreclosures have paused. There's renewed recognition that the business practices behind the housing bubble were a mixture of insane and fraudulent. The banks will probably need some government help again.... Our response to the financial crisis had three parts: The bank and auto bailouts, the stimulus, and the efforts to help homeowners facing foreclosure. The bailouts worked pretty well. The stimulus was much too small, but at least did what it said it was going to do.

The help for homeowners, however, has been a disaster.

Blame the Home Affordable Modification Program. It's a voluntary program in which participating mortgage servicers can renegotiate terms with struggling homeowners.... Most of the homeowners who were eligible for the program were never told of it. Many of those who did enroll were bounced out.... Most of the program's money hasn't even been spent.... [W]e're on track to see a record number of foreclosures this year, and then we're predicted to set another record in 2011.

We can do better.... Repair HAMP: The problem with HAMP is that it leaves mortgage modifications up to the banks, and they're not much interested in modifying those mortgages.... [H]ave the Treasury Department empower housing counselors to modify the mortgages... and banks would have three months in which to challenge the new terms.... Cramdown: The original theory of HAMP was that it would be the carrot... but there'd also be a stick. That stick was cramdown... empowering bankruptcy judges to modify the principal.... Mandatory mediation.... A mandatory mediation program would force [banks] to sit down with homeowners... make a good-faith effort to figure out a way forward. A program along these lines has been extremely successful in Philadelphia. Right-to-rent: Under a right-to-rent program, foreclosed homeowners would have the option of renting their home at fair-market value for five years...

The failure of HAMP is a big black eye for the Obama Treasury Department. So far it is batting two for five--the stress tests were a success, the auto rescue was a success, but HAMP and PPIP have not been and the bank rescue failed in its task of making sure that government help was charged to banks at "a penalty rate."

Will the Partisan Republican Supreme Court Rule That RomneyCare Is Unconstitutional?

Henry Farrell directs me to Orin Kerr, who pulls up a quote from Justice Kennedy, who would be the swing vote in any such declaration:

The Volokh Conspiracy » One Perspective on the Scope of Federal Power “In the Commercial Sphere”: I recently was reminded of this quote about Commerce Clause doctrine and I thought I would put it out there for comment in light of the recent debates on the constitutionality of the individual mandate:

[T]he Court as an institution and the legal system as a whole have an immense stake in the stability of our Commerce Clause jurisprudence as it has evolved to this point. Stare decisis operates with great force in counseling us not to call in question the essential principles now in place respecting the congressional power to regulate transactions of a commercial nature. That fundamental restraint on our power forecloses us from reverting to an understanding of commerce that would serve only an 18th century economy, dependent then upon production and trading practices that had changed but little over the preceding centuries; it also mandates against returning to the time when congressional authority to regulate undoubted commercial activities was limited by a judicial determination that those matters had an insufficient connection to an interstate system. Congress can regulate in the commercial sphere on the assumption that we have a single market and a unified purpose to build a stable national economy.

CNN's preeminent legal analyst points out that this quote is from Kennedy's concurring opinion in Lopez (1995).

That was the opinion that struck down the no-guns-near-schools law.

So for all of Kennedy's fancy rhetoric about not destabilizing the post-New Deal legal structure of commerce cause jurisprudence, Kennedy nonetheless voted in that case for a narrow conception of the commerce clause that... destabilized the post-New Deal legal structure of commerce clause jurisprudence

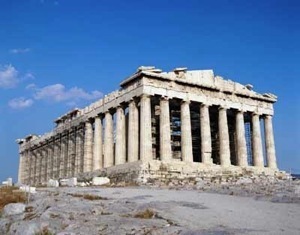

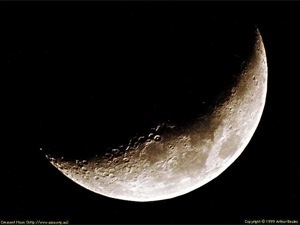

Which Picture Looks Best?

Jo Walton Is Smart

She is driven round the bend by Robert Heinlein's failure to understand the Law of the Reverend Thomas Bayes:

Jo Walton: A self-aware computer and a revolution on the moon: Having said that, I have two problems with Mike. One is the figuring the odds for the revolution. I’d have bought it if he did it once. It’s the complex refiguring and odds changing and--no. People complain about the Dust hypothesis in Permutation City, that you can’t calculate things out of order, and this is worse. You can’t work out odds of 7 to 1 against and then say they will keep getting worse until they get better. It makes no sense...

She is right. It makes no sense at all. It shows a deep fundamental confusion about probability at a core level.

Indeed, if I believed in franchise restrictions (which I don't) I would be much more eager to exclude people who fail to understand probability at this level from the franchise than--Heinlein's favorite hobbyhorse--to exclude people who cannot do a quadratic equation. A book in which (a) things are going better than expected but (b) the odds of success are going down is an intellectual atrocity.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers