J. Bradford DeLong's Blog, page 2176

October 15, 2010

Monetary Policy: Ryan Avent Is, I Think, Grasping at Straws

Ryan Avent, I think, misreads Bernanke.

Ryan:

Monetary policy: Time to go to work: [Bernanke] then wraps up drily but tellingly:

In short, there are clearly many challenges in communicating and conducting monetary policy in a low-inflation environment, including the uncertainties associated with the use of nonconventional policy tools. Despite these challenges, the Federal Reserve remains committed to pursuing policies that promote our dual objectives of maximum employment and price stability. In particular, the FOMC is prepared to provide additional accommodation if needed to support the economic recovery and to return inflation over time to levels consistent with our mandate. Of course, in considering possible further actions, the FOMC will take account of the potential costs and risks of nonconventional policies, and, as always, the Committee's actions are contingent on incoming information about the economic outlook and financial conditions.

Having said that inflation is too low and is likely to remain too low for some time and that unemployment is too high and is likely to remain too high for some time, Mr Bernanke says that the Fed is prepared to take action to prevent precisely that eventuality. And that's why most observers feel confident in predicting new easing come November. But questions still loom over precisely what the Fed will do.

Having said that the Federal Reserve will take action if the sky is blue, and having said that the sky is blue, Ben Bernanke then says that the Federal Reserve will take action "if needed," that it will return inflation to "levels consistent with our mandate," but will do so "over time."

Even if "levels consistent with our mandate" does mean an inflation rate a hair below 2%, that is not a declaration that the Federal Reserve is going to act now to accomplish that goal. It is a statement that the Federal Reserve will take steps to accomplish that goal "over time," and only "if needed"--thus stating that such steps are not now needed.

This is very bad.

This is a declaration that whatever quantitative easing program the Federal Reserve embarks on after the election will be designed to be too small to push the annual inflation rate back up to 2%.

Can I please return to my home timeline now?

The Curious Incident of the Government Purchases Expansion in the Nighttime

"But, Holmes, the government did not expand its purchases!" "That was the curious incident."

Paul Krugman:

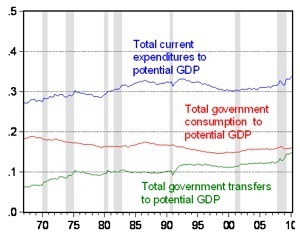

Big Spender Update - NYTimes.com: Menzie Chinn takes on the same territory I’ve examined here and here.... That uptick in transfers at the end is mainly unemployment insurance, plus some Medicaid — that is, it’s safety-net spending in the face of high unemployment. It’s kind of interesting to read Menzie’s comments — many of which assert that he must have left something out. You see, they know that there has been a huge expansion of the government, and any facts suggesting otherwise must be wrong.

Ben Bernanke's Speech Was... Disappointing

I am still surprised at the Fed Chair we have. Where is the Fed Chair who was willing to try to get ahead of the problems in late 2008? Or the "Helicopter Ben" of 2003? Or the student of big downturns in Japan in the 1990s and the U.S. in the 1930s.

It's a very different animal we have today. And this speech didn't do much to convince me that he is going to do what ought to be done.

Bernanke forecasts that growth next year "seems unlikely to be much above its longer-term trend"--that is, that unemployment is likely to rise in the near term and then stay essentially stable through the end of 2011 before it even starts to think about heading down.

In this environment, now is not the time for Bernanke to talk about the costs and risks of expanding the Federal Reserve balance sheet.

And it is also not the time to talk about how monetary policy can be carried out via the Federal Reserve's communications strategy.

Political Economy Major: Request for Student Input

MEMORANDUM

From: J. Bradford DeLong, Chair, Political Economy Major; Alan Karras, Associate Director, International and Area Studies

To: Past and Present Political Economy Majors

Subject: University Review of the Political Economy Major

Up to now the interdisciplinary majors here at the University of California at Berkeley have been omitted from the normal program review process--which means that we have never had a formal chance to make the administration aware of what we are doing well and what we are doing poorly, of whether our resources are in balance with our needs, and of what structural changes need to be made in the major for it to do its job.

Thanks to the initiative of Dean Tyler Stovall, this academic year will see a campus review of the Political Economy major": A written report by the major, an evaluation committee including members from outside the University, and discussions with staff, students, faculty and alumni.

We need you current students in the major to do two things. First, we need you to come to the IAS office, at your leisure, to read the written report. Second, we need you to communicate your views of the major, and of its problems and successes. Therefore we need you to write down your take on the major and to give to us, and we hope you will be willing to meet with the outside committee when it digests all the information and decides who it wants to talk to.

The issues on which we most seek your views are the questions of (i) advising, (ii) admission of Political Economy students to impacted courses run by social science departments, and (iii) the intellectual focus of the major.

Please feel free to ask any questions to either of us at delong@econ.berkeley.edu or karras@berkeley.edu

Does Globalization Relieve Poverty?

MEMORANDUM

From: J. Bradford DeLong, Chair, Political Economy Major

To: Political Economy Majors and Other Interested Students

Subject: Blum Center Lecture: Jan de Vries: Does Globalization Relieve Poverty? Comparing 19th Century and Contemporary Globalization Processes

I have to teach Monday afternoon, or I would go, but our very own Jan de Vries is speaking Monday at 2 PM on the Plaza Level of the brand-new Blum Hall on Northside about globalization and poverty in historical perspective.

It will certainly be worth hearing--and Berkeley's newest building is also worth checking out.

Jan de Vries is Sidney Hellman Ehrman Professor of History and Economics here at the University of California. He is also a Past President of the Economic History Assocation, and was Vice Provost for Academic Affairs of the University of California at Berkeley.

October 14, 2010

Robert Skidelsky on the Pointless Pain Caucus

Robert Skidelsky:

Britain’s austerity apostles duck the debate: What macroeconomic theory do the budget hawks have to subscribe to, to believe that taking £100bn out of the economy in the next four years will produce recovery? And what do the budget doves need to believe to claim the cutters are wrong?

David Cameron, Mr Osborne, and Nick Clegg appear to believe in something called “crowding out”... for every extra pound the government spends, the private sector spends one pound less. Jobs created by stimulus spending are jobs lost by the decline of private spending. Any stimulus to revive the economy is doubly damned: not only does it fail to stimulate, but, because government spending is less efficient than private, it reduces the economy’s longer term recovery potential.... A refinement of this argument is “psychological crowding out”. In this version it is not a shortage of saving, but a shortage of confidence in the government’s creditworthiness – due to a fear of default – which causes interest rates to rise. Either way the deficit “crowds out” private investment. Net stimulus: zero. The supposed implication of this type of argument is that in the short-run the deficit can do no good; and that in the slightly longer term it harms the potential for recovery....

Keynesians say is that when resources are unemployed, government borrowing is not deferred taxation: it brings resources into use that would otherwise be idle.... When the government borrows money for which there is no current business use, this increases people’s incomes and therefore the saving needed to finance the borrowing without interest rates having to rise... the “crowding out” argument is false.... The deficit is the stimulant the economy needs to start growing again: its withdrawal guarantees stagnation or worse.

Why aren’t we having this argument? The reason is that, against its instincts, the last Labour government accepted the pre-Keynesian economics of the cutters.... To promise to cut a little less, and a little slower, than the coalition is an improvement, but not an alternative economic strategy. Only Ed Balls has the economic confidence and pugnacity to argue the Keynesian case. For political reasons he has been denied the shadow chancellor’s job....

[W]hen [an economy] has large unemployed resources, the Keynesian theory is best, and the government should not be ashamed of running a deficit. A properly Keynesian opposition would say that the budget balance should be dictated by economic circumstances, not by some arbitrary timetable.... But I doubt if this opposition will have the courage to do so.

The Underperforming U.S. Health Care System

Matthew Yglesias writes:

Yglesias » Life Expectancy at 65: Aaron Carroll looks instead at life expectancy at 65.... Strong evidence of systematic underperformance in the American system. And yet since we’re talking about Medicare-eligible people here that also suggests that the issue can’t be solved by messing with who has insurance or how insurance-provision is organized. You need to actually delve down into the delivery of health care services.

Liveblogging World War II: October 14, 1940

The Balham Blitz Tube Disaster:

The 14th of October 1940: On the night of October 14 1940 some 500 civilians were sheltering from the bombing in Balham tube station. Two minutes after eight o'clock a 1400kg armour-piercing fragmentation bomb blew a huge crater in Balham High Road above the northern end of the station. A bus then crashed into the crater and ruptured the water and sewage mains. Sand, sludge, sewage and water suddenly gushed into the station. Water-tight doors designed to keep such floods out instead kept this one in. The lights fused, adding to the chaos.

The station was a scene of panic, and though more than 400 managed to escape, 65 or by some account 68 people died in the disaster, most of them drowning. A rescue attempt with a boat sent from Clapham South failed to get through.

News of the event was as far as possible kept under wraps, the government fearing that the grisly death of so many would be a huge propaganda blow and possibly put civilians off using the underground as shelter. Word of mouth spread about the deaths, however, and the work to open the station again lasted until January of 1941, the last bodies being found at the end of December.

An account of the disaster features in Ian McEwan 's novel Atonement, and in the film.

Mortgage Markets: "A Mutant, 20-Tentacled Octopus of FAIL Squirting Poisonous Ink..."

I tell you, intellectual life is certainly more fun since the invention of weblogging...

Ryan Avent:

Mortgage markets: The tangled web they wove: IF YOU want to give yourself a headache and/or become both very confused and very concerned about the state of the financial world, I recommend you attempt to figure out the developing foreclosure mess. It's like a mutant, 20-tentacled octopus of fail squirting poisonous ink at those trying to pin it down.

Those interested in a relatively detailed account of the issues involved are encouraged to read through Mike Konczal's work on the subject. I'll give a ludicrously short version of the story here.

During the housing boom, there was an explosion in the process of mortgage securitisation.... [M]ortgages... would wind up at banks, who would group pools of mortgages together to be chopped up into securities... payments... were filtered through servicers and out to holders of various mortgage bonds. Each step of the way, a lot of paperwork was involved... as the boom geared up and the pace of buying and securitising became frenetic, this important trail of paperwork frequently fell apart.... This is a problem, because some of those documents become very important when a loan goes into default and a foreclosure is sought.... [M]any of the foreclosures... may have been done improperly, or without appropriate paperwork, or with improperly (or perhaps fraudulently) generated paperwork.

And so a real mess has developed....

All that is bad enough as it is. The situation is unlikely to inspire confidence in potential buyers, whom the housing market desperately needs. Congressional action may be necessary (which is a terrifying phrase to utter these days). And there is a very small but real chance that things could get really ugly...>.

And that's just one side of the problem.

The other side... concerns the mortgage securities.... If some share of the loans that went into a particular security weren't properly handled, then the bank that created it could be forced to repurchase it.... Banks could also be targeted in related lawsuits.... People are now spinning scenarios in which the mess adds up to another systemic risk crisis, complete with weekend crisis interventions and, one presumes, a nice blow to the real economy.

Estimates of what this all will actually mean for the broader American economy range from "nearly nothing" to "the end as we know it"...

October 13, 2010

Failure to Brainwash...

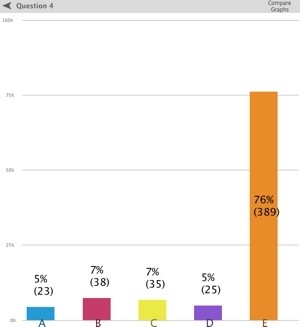

My last iClicker question from today's Econ 1: Principles of Economics lecture:

Ladies and Gentlemen, to your iClickers...

Suppose PDC—Production and Distribution Coordination—decided that we were going to offer four yoga classes at a price of $20/lesson for each student and $200/lesson for each teacher. As before, each class has a capacity of ten students. PDC finds that there are only 25 students and 4 teachers. What should PDC do?

A. Split up the students among the four teachers and announce that the teachers will only be paid $120/lesson.

B. Split up the students among the four teachers and announce that the students will each have to pay $32/lesson

C. Pick one of the teachers by lot and send him or her home, and then go draft 5 passers-by and force them to take the class, charging each student $20/lesson and paying each teacher $200/lesson

D. Draft 15 passers-by and force them to take the class, charging each student $20/lesson and paying each teacher $200/lesson

E. Lower the price charged to $19/lesson and the price paid to $190/lesson, and see if any more students are willing to pay that price and if any of the teachers say they would rather go do something else.

The answer I am looking for, of course, is that PDC should mimic the market by choosing option (E). It should use the price system because that way it can balance capacity and attendance by drawing those 5 potential students whose values of yoga classes are between $19/lesson taken and $20/lesson taken into the activity and excluding the one instructor whose reservation price is $200/lesson taught from the activity, and so be sure that (a) everyone taking yoga values it at more than $19/lesson and (b) everyone teaching yoga has a disutility of less than $190/lesson.

And so social surplus is maximized. (With distributional impacts to be cleaned up later on by other societal mechanisms.)

By contrast, all of the alternatives--down to and including the Stalinoid draft-fifteen-innocent-passersby-at-gunpoint-and-force-them-to-unwillingly-do-the-downward-facing-dog--involve (i) teaching the wrong number of classes and/or (ii) having the classes taught and taken by the wrong people who really would rather be doing something else.

Yet those alternatives attract 24% of responses, even after a full fifty-minute brainwashing session in Wheeler Auditorium.

I am clearly going to have to slow down, and try to brainwash them once again.

Next Monday I am going to have to hit them with the entire argument again, and add to it:

Properties of competitive market equilibrium:

It is where the supply and demand curves cross

Nobody who wants to pay or work is rationed out of the market (poor people may be rationed out because they have low money-metric willingness to pay even though they have high desire)

It is stable

It produces the maximum dollar-value social surplus

Other arrangements have

Some of the wrong people teaching the classes

Some of the wrong people taking the classes

Too few classes being offered

Too many classes being offered

Other allocations leave open side-deals on the table:

Some of them have some of the wrong people teaching the classes

Suppose Greg320--with his reservation price of $200/lesson taught--is assigned to teach one of the three classes.

Suppose Greg305--with his reservation price of $50/lesson taught--is not.

Then: "Psst. Will you teach my class?”

There’s $150 of surplus for them to split

Some of the wrong people taking the classes

Suppose yogastudent#10 is not assigned to take a class

Suppose yogastudent#30 is

Then—“Psst. Will you take my place?”

There is $4 of surplus for them to split

If too few classes are offered, there are side deals

Suppose only two classes are being offered

Then yogastudent#21 through yogastudent#30 meet Greg315 outside

They set up a class

There is $100 of surplus for them to split

If too many classes are offered, there are side deals

Suppose four classes are offered

Yogastudent#31 through yogastudent#40 meet Greg320 for their class

They look at each other

They say: “Let’s just pretend we did this and go home”

And they split $20 of surplus

Allocations that do not mimic the market allocation leave money on the table

Allocations that do mimic the market do not leave any money on the table

You may not like where the money goes, but it is not on the table.

David Romer: Ed Glaeser had some nice stuff about this--where he did random assignment in markets with excess demand and showed the Posner rectangles of welfare loss as well as the Harberger triangles. I think it had some very nice graphs...

Brad DeLong: Should I Google it? Or email Ed?

Christy Romer: (Walks in.) Neither. I can put my finger on it in fifteen seconds. Here it is.

Yep. Ed Glaeser and Erzo Luttmer (2003), "The Misallocation of Housing Under Rent Control" http://www.aeaweb.org/articles.php?doi=10.1257/000282803769206188:

Extra Credit Question: If you want to put your finger on a piece of the literature quickly, you should:

A. Email the author

B. Google it

C. Hope Christy Romer is walking by

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers