Matthew Yglesias's Blog, page 2515

October 29, 2010

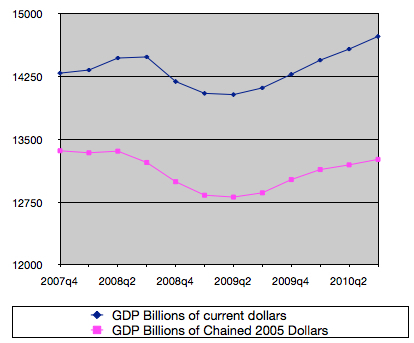

Welcome to the Recovery

Q3 GDP grew at a 2 percent annual rate, which would be okay performance for a full employment economy but is totally insufficient to mobilize the huge number of idle workers today. Here's the shape of the recession and "recovery" in both real and nominal terms:

As you can see, we're still below the peak level of real output attained in Q4 of 2007. But in the intervening years, some new technologies have been invented, some firms have improved their business processes, and the size of the population has grown. We should be able to produce considerably more at the end of 2010 than we were producing at the end of 2007. That we're failing to do so represents a massive failure of the American elite.

The Modular and the Interdependent

This is a post about smartphones, but it seems to be that Horace Dediu's framing of modular vs interdependent systems for different kinds of situations has a broad applicability:

Interdependent systems often lead to higher performance than modular systems because the system is optimized. Engineers can iterate more rapidly to squeeze the maximum performance from sub-systems by connecting them in ways that makes the best complete solution. In contrast, modular systems often lead to lower costs because there are a greater number of suppliers, since interfaces are standardized and pieces can be swapped in and out.

Interdependency is often required to raise the performance of a new solution. In contrast, modularity is required to lower the cost of an overserving solution.

Continued interdependency often drives the performance of that solution beyond that which the target market is willing to pay for. The target market then frequently turns to modular solutions which, at that point, often offer good enough performance along with modularity-driven advantages such as lower cost, convenience, or other benefits.

This puts me in the mind of higher education in the United States. The college experience is a very full-service, highly integrated kind of thing. It's part school, part sleepaway camp, part job-placement service. And it's ungodly expensive. It's possible that a this point in our historical development we could use more modularity. That might allow us to do a better job of holding down costs in some aspects of what needs to be done, and also allow many students to avoid overpurchasing services they don't especially want or need.

October 28, 2010

Endgame

Une presence inconnue:

— Think tanking is hard.

— China builds world's most super super-computer.

— All about QE2.

— The scale of QE we need is considerably above what the Fed seems to be contemplating.

— There are huge impediments to the use of RMB as a reserve currency.

The eight years I spent studying French in school have very little practical purpose, but ability to understand the lyrics to Placebo's "Mars Landing Party" is among them.

The Downward Spiral in Greece

(cc photo by simon_music)

Recession leads to deficits lead to austerity leads to worse growth and bigger deficits:

With economic conditions weaker than expected, tax revenue is coming up short of projections in parts of Europe. As a result, countries struggling with high deficits are now confronting the prospect that they will miss the budget deficit targets forced upon them this year by impatient bond investors.

Greece, for one, looks as if it will run a budget deficit for 2010 greater than the 8.1 percent of gross domestic product it agreed to as part of a rescue package from the International Monetary Fund and the European Union that amounted to more than $150 billion, according to a person briefed on the matter but not authorized to speak about it.

Again, what would normally happen to a Greece-sized country with Greek-sized problems is that the value of its currency would decline. Everyone would, consequently, become quite a lot poorer in "real" terms but the pain would be spread and unemployment wouldn't necessarily skyrocket. The newly poor country would be cheap to visit, its exports would be priced competitively, and import-competing industries would remain in great shape. Things might either stabilize like that, or else structural reforms could be undertaken that lay the groundwork for growth.

Thanks to the Euro, none of that's possible and it's not at all clear to me what the endgame here really is. For understandable reasons, German (and Austrian, Dutch, etc.) taxpayers don't want to bail out the government of Greece. And also for understandable reasons, German policymakers prefer the European Central Bank to run a monetary policy that's appropriate for Germany rather than one that's appropriate for Greece. So Greece is stuck on a path to default.

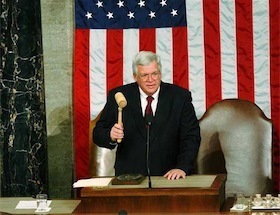

The Point of Winning Elections is to Pass Laws

Both Ezra Klein and my colleague Igor Volsky have some worthy thoughts on the question of how much blame the Affordable Care Act deserves for the Democrats' current political predicament. I would, however, add the obvious point that passing important laws is the reason you try to win elections in the first place so I don't think "you might lose the next election" is ever a very good reason to avoid passing one.

If you want to look at a really poor use of a congressional majority, try to recall the 109th Congress of 2005-2006. You probably can't remember it because they didn't do anything. And the Republicans lost their majority anyway. Or maybe they lost their majority because they didn't do anything. Either way, they didn't do anything and the nature of political majorities is that they all vanish sooner or later. Suppose they'd done something better and had held on for two more years to do nothing as the 110th Congress. What would have happened then? Well, they would have lost in 2008, right? So . . . so what?

Now obviously you don't want to risk a congressional majority over something trivial. But the Affordable Care Act is not a trivial law. It's one of the most important laws of the past thirty years. So then the question becomes, was it important in a good way? I think it was. And that's the job of a congressional majority—to pass important bills that change the world for the better. I think the 111th Congress did a fair amount of that. I'm a climate hawk and if I had to pick one, I would have rather seen an energy bill than a health care bill. But it wasn't in the cards. So hear we are, and I don't think anyone has anything to be ashamed of.

The Failure of the Lawyers' Cartel

In some ways, I think the most interesting part of Annie Lowrey's article on the apparent oversupply of people with JDs is the aside about medical schools:

The demand for lawyers has fallen off a cliff, both due to the short-term crisis of the recession and long-term changes to the industry, and is only starting to rebound. The lawyers that do have jobs are making less than they used to. At the same time, universities seeking revenue have tacked on law schools, minting more lawyers every year.

That has caused some concern among lawyers who think the accrediting organization, the American Bar Association, is doing the profession a disservice by approving so many new schools. (Contrast that with medical schools. They come with much higher startup costs and tend not to be money-makers. Relatively few students get medical degrees every year, and demand far outstrips supply.)

Whenever I talk to people who are considering applying to law school, I always advise them not to do it. Just keep working or go to business school unless you have some very specific passion for lawyering. The days when acquiring a JD as a kind of generic life plan made sense are over.

So that's advice. But from a social point of view, the fact that the lawyers' cartel has failed to erect giant barriers to entry is a good thing. Falling real wages for lawyers is an egalitarian, pro-growth measure. And lawyers still earn above-average incomes—it's not like people are being forced into penury. These are trends that are making legal services more affordable for productive businesses and improving the quality of legal talent the public sector is able to attract without adding to taxpayers' burden.

Contrast this, as Lowrey urges us to, with the medical school situation. Here the American Medical Association is succeeding where the ABA fails. There's no evidence that American doctors are wildly more competent than Finnish doctors but they sure do get paid more. Indeed, they're paid much more than doctors anyplace else in the world. That contributes to high health care costs, and low supply.

A Whale of a Cut

Item #2 on Eric Cantor's YouCut list of programs he wants to terminate is the "Exchanges with Historic Whaling and Trading Partners Program" whose elimination would save $87.5 million over ten years.

Tad DeHaven subjects this to some appropriate derision, noting the less than earth-shattering implications of the reduction: "America is at a 'critical crossroads' and the GOP leadership is offering to cut whaling history subsidies? Congress is bankrupting the nation and the possible next GOP House majority leader – 'never a details man' – can't even specify what he would cut in the budget."

It's actually worse than DeHaven realizes. Eliminating this program was already part of the Obama administration's FY 2011 budget. There's just nothing doing here.

Tax Cuts and Preference-Intensity

Larry Bartels consistently puts out some of the most interesting and journalistically relevant political science around, and now he's doing some blogging for the polling site YouGov. I'm expecting great things. His debut is a brilliant explication of how it is that rescinding tax cuts for the wealthy can be a losing position even though a superficial read of the polls says it's popular. About 11 percent want all the Bush tax cuts repealed (I'm in this group). Then 42 percent—including the median voter—support the President's position, repeal the rich-people-only tax cuts but keep in place the across-the-board ones. Just 28 percent support the pro-rich people position.

But then there's preference-intensity:

Even more importantly, the sizable minority of people who want the tax cuts for affluent taxpayers renewed seem to attach much more weight to this issue than the slim majority who want them to expire. In a statistical analysis taking separate account of prospective voters' broader partisan attachments, those who support President Obama's position on the tax cuts are only 6% more likely than those who are unsure about the issue to say they will vote for a Democratic House candidate. Even those who want to let all the tax cuts expire are only 9% more likely to vote Democratic. By comparison, those who want to keep the tax cuts for affluent taxpayers in place are 22% more likely to say they will vote for a Republican House candidate.

An even more lopsided difference appears in the impact of tax cut preferences on presidential approval. People who support President Obama's position on this issue are only slightly more approving of his overall performance than those who are unsure, while those who want to renew all the tax cuts are moved about five times as far toward disapproving. Among political independents, a whopping 76% of those who want continued tax cuts for the rich say they strongly disapprove of the president's performance; only 27% of those who support his proposal for selective extension of the tax cuts are equally disenchanted.

Some but by no means all of this is just part of the larger "enthusiasm gap" story. But the bigger picture point is that the people who favor tax cuts for the rich really care a lot about this issue. The people who don't favor them aren't nearly as committed. And in politics it's often preference-intensity that matters most. The total absence of some kind of committed, high-intensity pro-revenue voting bloc is one of the most fundamental facts of post-Reagan politics.

Affordable Housing is Inexpensive Housing

(cc photo by sercasey)

If you flip back and forth between writing about the national economy and writing about urban issues, you quickly get a kind of whiplash about home prices. In one context, people want them to go up. In another context, everyone agrees that "affordable housing" is a vital need. And yet affordable housing is housing whose price is, by definition, low.

In other words, what Mark Kleiman said:

I'm also obviously unclear on the concept about housing prices overall. Again, I understand why banks and under-water homeowners want prices to go back up. But from a social perspective isn't it obviously better for housing to be cheaper?

Similarly, I understand why a revival of home construction seems like a good idea to the construction industry, and why people worrying about having adequate demand to return to full employment are hoping for help from that sector. But I can't see any good reason to want housing to take a larger, rather than a smaller, share of consumption and investment.

Like with commodity prices, I guess the bottom line is that you can't draw conclusions purely from the change in price. If the economy revives and incomes go up, the price of housing will increase. But if a series of horrifying tornados destroys all the built structures in the state of Texas, that will also cause the price of housing to increase. Conversely if a neutron bomb hits Manhattan, it'll open up a lot of affordable housing. The issue in all cases is "what's actually happening here" rather than "are houses cheaper."

But the core point, I think, is that it's a kind of folly to think that the best way to deal with distressed mortgages is through efforts to prop up prices and somehow keep housing expensive. What's needed is a process—cramdowns or the like—whereby we can readjust loan burdens downward to something more in line with reality. And more broadly what's needed is fiscal and monetary expansion—up to and including helicopter drops—to bolster incomes across the board. The overly indebted will need to use bolstered income to pay what they owe, and those who are more fortunate will just buy more stuff. Presumably that will lead to an increase in nominal home prices, but that would be a consequence of growth rather than a cause of it.

Business and Its Friends Continue to Whine About Obama as Profits Soar

Every couple of weeks I resolve to remake myself as one of those pundits who writes about how one of the leading problems in the world is that people aren't nice enough to incredibly rich businessmen. I could be the next Sebastian Mallaby! But then I read something one of my role models writes and, frankly, I get kind of mad.

So here's John Gapper in the FT:

FT After enduring torments in George Orwell's 1984, Winston Smith learnt to love Big Brother. After the midterm elections, which are also likely to be painful, Barack Obama should learn to love big business.

The US president, a former community organiser in Chicago whose formative professional experience was helping the dispossessed after steel companies and manufacturers left town, has never shown affection or sympathy for US multinationals. One of his favourite jabs at Republicans is that they seek tax breaks for corporations "to ship jobs overseas".

Poor businessmen!

And here's reality:

Profits have surged 62 percent from the start of 2009 to mid-2010, according to the Commerce Department. That is faster than any other year and a half in the Fabulous '50s, the Go-Go '60s or the booms under Presidents Ronald Reagan and Bill Clinton.

Under another president, especially a Republican president, the data on corporate profits would be envied. George W. Bush, who dedicated a good deal of his presidency to tax cuts aimed at boosting business profits, probably would have loved such results. It took Bush nearly four years to post the gains that Obama has managed in less than half the time.

You would think that hard-nosed businessmen would be sufficiently practical to realize that they're doing well under president Obama and perhaps just stay quiet and enjoy counting their money. But no! They want to whine loudly in public about the fact that the president is saying mean things about them. Is the Fortune 500 being run by seven year-olds?

In substantive news, the rising profits are good news and highlight the need for higher inflation expectations. Firms are earning cash, which means they have the capacity to expand operations, which will reduce unemployment and raise incomes. But with the current depressed state of medium-term expectations there's little reason to do so. Recent talk of Quantitative Easing is, however, already shifting investor thinking in pro-growth directions. The Fed needs to move forward boldly and clearly and stop worrying about mini golf. Businessmen need to worry about running their businesses.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers