Matthew Yglesias's Blog, page 2494

November 19, 2010

Running Toward the Future

Former Danish Prime Minister and current NATO top civilian Anders Fogh Rasmussen explains what the NATO summit in Portgul is all about:

So at a minimum, one thing NATO does is provide something for talented, ambitious politicians from small countries to do. Rasmussen seems to have been a skilled leader of Denmark, and the Nordic center-right parties generally offer a bit of something people all the world over can admire. So maybe when Dominique Strauss-Kahn steps down as head of the IMF we can kick Rasmussen over to an international organization job that has more real authority. His actual background in politics was as a tax/finance guy, not a military guy.

The Means of Production

You can count me as among those who thought having the government step in to prop up General Motors was a bad ahead. Simply put, the history of public ownership of firms in competitive marketplaces is one of bad management and misallocated priorities. But the Government Motors Era looks to have turned out pretty well, with the government earning a decent return on its equity investment and a fair chunk of jobs very genuinely saved.

The key, as Kevin Drum says, is that you always do have the option of not mismanaging your state-owned enterprise: "In the end the Obama administration didn't exercise all that much control over the company . . . in the post-bankruptcy stage, the administration has taken an almost obsessive hands-off attitude toward GM's operations, especially considering that they were a 61% shareholder."

Depending on your attitude toward the Obama administration and toward the United Auto Workers your exact take on this may vary. But I think the important thing is to try to draw some lessons here that can be abstracted away from GM and the Obama administration. In particular, in part we're seeing here a manifestation of the well-known but under-discussed equity premium puzzle. Basically it seems to be the case that if the government borrows money and uses the money to take equity stakes in real firms, the government's superior risk-carrying capacity lets it make money. But that's only if government ownership doesn't induce horrible mismanagement, which it's unwise to count on. The fear of mismanagement is why it wouldn't make sense for the US Treasury to go out and buy 7-Eleven franchises. But in many cases you can avoid this worry. It would, for example, make sense for a portion of the Social Security Trust Fund to be invested in a diversified equity portfolio.

Adventures in Polling Analysis

Anne Kim and Stefan Hankin report the "key findings" of Third Way's latest poll:

In a new post-election survey, Third Way and Lincoln Park Strategies polled 1,000 Obama voters who abandoned Democrats in 2010, either by staying home (the "droppers") or by voting Republican (the "switchers"). This report paints a portrait of these droppers and switchers—the voters that Democrats will need to win again in 2012. Our key findings:

Droppers are more than the base. One in 3 droppers is conservative, 40% are Independents, and they are split about whether Obama should have done more or did too much.

For switchers, it's not just the economy. The economy matters but switchers also overwhelmingly think Democrats are more liberal that they are. Two in three say "too much government spending" was a major reason for their vote.

Republicans won a chance, not a mandate. Only 20% of switchers say that a major reason for their vote was that "Republicans had better ideas," and nearly half say Republicans are more conservative than they are.

Two points here. One, I don't think it's very enlightening to rely on survey data to get people to explain their own voting behavior. Systematic surveys make it very clear that voters, in the aggregate, swing against presidents who preside over poor economic performance (as well as those who preside over elevated incidence of shark attacks) but presumably few swing voters subjectively perceive themselves to be fickely remaking their ideology according to macroeconomic fluctuations.

Second, the treatment of the "independent" vote in this bullet point is naive in the extreme. The result that most self-described independents are in fact consistent partisan voters is well-establishment. If 40 percent of droppers are self-identified independents that mostly goes to show that some non-trivial faction of the Democratic Party's base vote self-identifies as independent.

Do Small Countries Need Banks?

One question posed by the ongoing meltdown in Ireland is whether, assuming the Euro survives, it really makes sense for Ireland to have banks at all. Of course Irish people will still want to lend and invest. But that could be accomplished by letting German banks open branches in Ireland. Access to banking services is an important policy priority, but it seems to necessarily entail government exposure to bad bank risk management. The normal best way to try deal with that is through regulation, but a small country in a currency union with much larger countries could deploy the ultimate regulatory solution—no banks! Let someone else do the regulating and the bailing out.

Giving up your ability to conduct monetary policy carries a heavy price, but for a sufficiently small country it should open up the chance to free ride on someone else's banks.

November 18, 2010

Endgame

About to punch your lights out:

— Eggertson & Krugman "Debt, Deleveraging, and the Liquidity Trap" (PDF).

— Petition to keep Gabe Klein and Harriet Tregoning in office in DC.

— As I've been saying, raising the Social Security eligibility age is the single most regressive option for cutting entitlement outlays.

— The way to cut military spending without imperiling national security is to start fewer wars.

— Weird image.

The new Girl Talk album is both excellent and a great illustration of several of my favorite points about public policy. This is "Oh No".

Hawks of a Feather

This has been implicit in a lot of what I've written recently, but to say it clearly I think climate hawks are making a dangerous mistake by not engaging more deeply with deficit hawks.

One thing that both the Simpson-Bowles and Domenici-Rivlin proposals make clear is that some conservatives now are prepared to concede the need for higher taxes. But they want a hefty chunk of that revenue to come from regressive sources, and they want at least some progressive votes for it. Now, as Paul Krugman argues regressive taxes aren't as bad as many people think. But the fact of the matter is that a VAT as proposed by Domenici-Rivlin is always going to be a very hard sell for the left. This, tough, is where climate hawks can come to the rescue of the cherished ambitions of the center-right. Swap out a VAT and swap in a tax on climate pollution, and we become a constituency that's not just "willing" to swallow the tax but eager to do so.

Putting a price on climate pollution isn't the only thing to be done in an environmental policy, but getting it done would be a huge step forward.

The collapse of the momentum around cap-and-trade has left climate hawks wandering in the wilderness. Under the circumstances, it makes perfect sense to be exploring multiple paths and options. But knocking—hard—on the door of the deficit reduction party and noting that pollution taxes make much more sense than general consumption taxes deserves more consideration than it's currently getting.

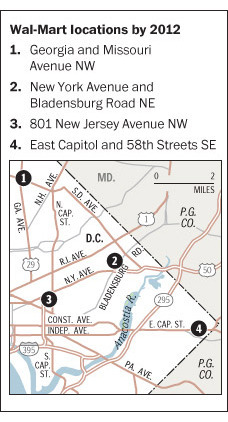

Wal-Mart Coming to DC

I've never lived near a Wal-Mart, and since I don't own a car that means my Wal-Mart shopping experience has been very limited. Apparently, though, their plan to move into Washington, DC includes plans to build a store very close to my apartment. I'll be a real American at last. Currently I cherish my memories of Wal-Marting in Ellsworth, ME and Kitty Hawk, NC but those are places I go on vacation. Now I'll be like a real citizen of the USA. It's very exciting:

The blueprint is part of a national effort by the chain to expand beyond rural and suburban areas, where its low prices and massive stores transformed the retail landscape, into urban markets. Although Wal-Mart already operates stores in Northern Virginia and suburban Maryland, it has never had a store in the District.

The four stores would be built in D.C. neighborhoods where retail options are relatively scarce: on the site of a former car dealership on Georgia Avenue NW; at New York Avenue and Bladensburg Road NE; as part of a new mixed-use development on New Jersey Avenue NW; and at East Capitol and 58th streets SE.

On a more serious note, while of course one has to hope and insist that these projects be well-designed for an urban environment, I think it's very much a good thing whenever major national chain retailers want to move into one's city. The great advantage of dense urban areas as centers of commerce is that they have the customer base to make niche business operations realistic. But the exclusion of big tentpole retailers from these areas makes them less attractive to residents, and drives too much of the city's small-scale retail activity to tiny high-cost low-quality shops rather than to innovative niche firms.

Meanwhile, DC will always have enormous potential for niche retail and small businesses simply because so much of the "bones" of the existing built environment is so clearly unsuitable for giant retail chains. The question the city needs to cope with is how to make it simpler for entrepreneurs to set up businesses in those spaces so that we don't have so many of them lying vacant.

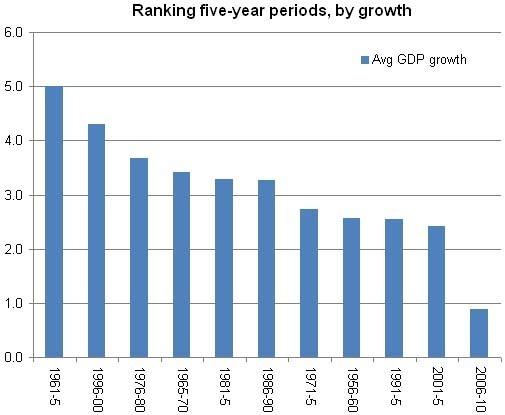

Growth and the Bush Tax Cuts

David Leonhardt notes that evidence of the Bush tax cuts' beneficial impact on growth is difficult to find:

Is there good evidence the tax cuts persuaded more people to join the work force (because they would be able to keep more of their income)? Not really. The labor-force participation rate fell in the years after 2001 and has never again approached its record in the year 2000.

Is there evidence that the tax cuts led to a lot of entrepreneurship and innovation? Again, no. The rate at which start-up businesses created jobs fell during the past decade.

The theory for why tax cuts should create growth and jobs is a strong one. When people are allowed to keep more of each dollar they earn, they are likely to work longer and harder. The uncertainty is the magnitude of this effect. With everything else that's happening in a $15 trillion economy, how large of an effect on growth do tax cuts have?

This is an under-discussed issue but I think it has a relatively clear answer. The theoretical case for the supply-side growth-enhancing impact of tax cuts requires the cuts to be offset with reduced spending. You can see this most clearly if you think about the savings and investment channel. Lower taxes on households will increase household consumption and increase household savings. Insofar as the reduced taxation is concentrated on high-income households, the balance will be tilted toward increasing savings. But if the tax cut is financed by government borrowing rather than reduced spending over 100 percent of the effect will be offset by the borrowing. So nothing is achieved.

On the labor market it's similar. Someone like Greg Mankiw or myself who has the opportunity to do freelance writing work really should respond to transient tax cuts with increased output. But given that the tax cuts will be transient, our current increased output will be reduced in the future with reduced output with taxes are raised. The money has to be repaid, after all, out of tax revenue and with interest. And rational agents making long- or medium-term plans about their own human capital and life decisions should be basically indifferent to transient changes in tax rates. The issue is the long-term tax burden which is determined by the level of spending.

Tax cuts, whether "permanent" or "temporary" are in fact temporary if they're offset by borrowing money. And as Cato's Daniel Mitchell points out "temporary tax cuts have very little pro-growth impact." And not only were the Bush tax cuts not offset by spending reductions, they weren't even permanent in a statutory sense! According to the very economic theory that explains why lower taxes can boost growth, the Bush tax cuts should have done nothing to boost growth. So it's no surprise that nobody can find empirical confirmation of the pro-growth impact.

A Way Out of the Mandate Morass

Mark Kleiman cites the following remarks from the old Mitt Romney as big trouble for his future prospects:

With private insurance finally affordable, I proposed that everyone must either purchase a product of their choice or demonstrate that they can pay for their own health care. It's a personal responsibility principle. Some of my libertarian friends balk at what looks like an individual mandate. But remember, someone has to pay for the health care that must, by law, be provided: Either the individual pays or the taxpayers pay. A free ride on the taxpayers is not libertarian.

Obviously Romney's various flip-flops over the years are a problem for him. But this paragraph also indicates a possible "escape hatch" whereby less-rabid Republicans can come to accept the basic structure of the Affordable Care Act without crossing key taboos. This morning on NPR Rep David Dreier was asked about whether he really wants to repeal subsidies for small businesses that provide insurance to their employees or regulatory bans on rescissions and he said "well, we've said all along that the good parts like that we don't want to repeal." Obviously that's not what people have been saying all along, but it's the reality—there are big portions of this bill that many Republicans won't want to repeal. But the mandate is necessary to make the contraption work, and the mandate is anathema.

Romney's old idea of letting people "demonstrate that they can pay for their own health care" as an alternative to buying insurance could be a way out. The way this worked was that to escape from the mandate, you were going to have to post a bond with the state demonstrating that would be used to pay for your health care if you got sick. If you design this in a sensible way, it has the exact same effect as an individual mandate. But of course it's not an individual mandate. It's just an effort to halt freeloaders. Meanwhile, one somewhat justified complaint insurance companies will have with the Affordable Care Act is the idea that the penalty for non-compliance with the mandate is too low. But getting the penalty made tougher is a total political non-starter, and Republicans would really like to say they repealed the individual mandate. Romney's idea could offer a way out of the trap.

And I think this is the spirit in which you should understand the Brown/Wyden idea—sensible conservative politicians need an exit strategy from "repeal and replace" that doesn't constitute surrender, and it's fitting that the MA GOP should lead the charge.

Galston on Pelosi

William Galston thinks retaining Nancy Pelosi as Minority Leader was a huge mistake, but I think his rhetorical question here makes the case for keeping her:

But in the here and now, the people who crafted and drove the 2009-2010 legislative agenda—including the cap-and-trade bill, reportedly one of Pelosi's top personal priorities—are not the ones who paid the political price for it. What's the logic of patiently rebuilding a Democratic majority—for which Pelosi deserves a considerable share of the credit—only to embark on a strategy seemingly calculated to destroy it? And why should the kinds of Democrats without whom no Democratic majority is possible expect anything better in the future?

The question answers itself: the logic was to pass progressive legislation! As Galston notes, there's necessary a conflict between imperative to re-elect members in marginal districts and the imperative to pass progressive bills in the here and now. Any Speaker is going to put some weight on helping marginal members get re-elected, since that's how you get set the agenda. But a Speaker who counts the marginals as his or her core constituency is going to end up systematically overweighting the re-election campaigns of marginal members over other priorities. A Speaker like Pelosi who comes from the liberal faction is in a position to hold these things in balance. There's definitely a case to be made that something would be gained by replacing Pelosi with a less-unpopular but equally progressive figure (George Miller?) but no such challenger emerged, seemingly because progressive House members feel that Pelosi's tactical acumen would be extremely difficult to replace.

Now she'll try to rebuild a majority under her leadership. And if she succeeds, she'll set about pushing agenda items that may imperil the seats of many of its members. And the logic of doing so will be that the issues are important and all congressional majorities are transient.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers