Matthew Yglesias's Blog, page 2498

November 15, 2010

Nomination Fights To Come

With President Barack Obama seeking to move an ambitious legislative agenda through the molasses-like United States Senate,* it was fairly easy for Mitch McConnell and his colleagues to obstruct a given person's nomination simply by threatening to drag things out. After all, Harry Reid and the White House had better things to do with their pressure floor time than quibble about district court nominees. But just as losing control of the House of Representatives increases Obama's leverage over Bibi Netanyahu, with any hope of progressive legislation 100 percent dead in the House it would now make sense to dedicate much more Senate floor time to nominations.

Brian Beutler reports that advocates are making the case:

"Reid should concentrate Floor time on must pass bills, message and other votes that highlight differences and important matters that are or should be non-controversial, including confirming lifetime federal judges," Glenn Sugameli, an advocate for swift judicial confirmations, tells TPM. "All of Obama's nominees to circuit and district courts have had the support of their home-state Republican and Democratic senators and the vast majority have been non-controversial nominees who have been approved by the Judiciary Committee without objection and approved unanimously when they finally receive usually long-delayed Floor votes."

"If one or more Republican senators force cloture votes on consensus nominees, they will accurately be seen as mindlessly obstructionist," Sugameli says. "If they do not, nominees will be confirmed quickly."

We'll see if it happens, but it ought to.

That said, a serious push on nominations could become yet another test of the McConnell Way. My intuition is that blanket obstruction would prompt an initially flurry of high-minded denunciations of the GOP, but that if McConnell holds firm it will turn out that a strategy of deliberately sabotaging the executive branch is highly effective. The worse conditions become in the country, the more the President and his party will suffer politically. The idea that swing voters will be able to accurately identify who's responsible for bad conditions sounds nice, but flies in the face of all the evidence.

Alternate Budget Calculators

Something worth saying explicitly about any kind of budget deficit calculator is that what looks like a decent answers ends up having a lot to do with who frames the calculator. When I used the NYT calculator to generate a budget plan I ended up with some fairly conservative ideas. By contrast, when I used CEPR's calculator I did the following:

— Fed buys and holds $1 trillion in bonds.

— Downward adjustment of Social Security COLA 0.3 percentage points.

— Higher Social Security benefits for low-income people.

— Quick end to wars in Afghanistan and Iraq.

— Cut missiles and missile defense.

— Cut size of conventional forces.

— Impose "upstream" price on GHG emissions.

— Increase gasoline tax by 50 cents per gallon.

— Public option in ACA exchanges.

— Convert home mortgage interest tax deduction to a 15% credit.

— Financial speculation tax.

That got the 2020 debt-to-GDP ratio all the way down to 50 percent. The only conservative idea in there is a very modest cut in Social Security benefits that's used to finance more generous benefits for the most elderly people. It's true that the ecological tax increases will be fairly regressive in their impact, but much less so than broad cuts in Social Security benefits or discretionary spending would be. And crucially though the tax increases in this proposal are pretty large, they should have a minimal—or even positive—impact on the efficiency with which the overall economy operates. All in all, an excellent deal.

That said, the really crucial thing to recognize about this alternative proposal is that all this stuff merely forestalls the arrival of budgetary doom. That's because, as Ezra Klein emphasizes, the long-term budgetary doom is all about the cost of old people's health care. Mostly Medicare but also Medicaid as well. And that, in turn, isn't really about any flaws in the design of the programs. It's about the fact that the programs are designed to give senior citizens all the health care that they need and and "health care" constitutes a moving target whose price keeps going up. The only things that really cope with that are some form of cost-effectiveness rationing, some form of price controls (which would make more things cost effective), or else just covering fewer people.

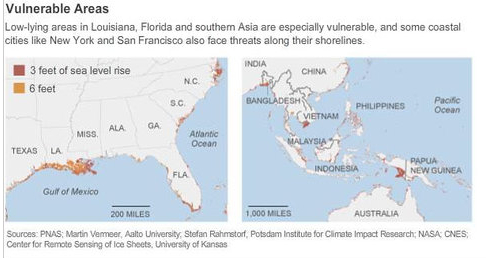

Sea Level Rise

For all the reasons that preemptive fiscal adjustment is unlikely to happen, it's very politically challenging to get members of congress to take action now to forestall the climate disaster that's looming in the future. But while the DC elite is obsessed with trying to force the issue on fiscal adjustment, support for acting on climate is melting away. But Justin Gillis reminds us that glaciers are melting too, and worse than we thought a few years ago:

As a result of recent calculations that take the changes into account, many scientists now say that sea level is likely to rise perhaps three feet by 2100 — an increase that, should it come to pass, would pose a threat to coastal regions the world over.

And the calculations suggest that the rise could conceivably exceed six feet, which would put thousands of square miles of the American coastline under water and would probably displace tens of millions of people in Asia.

The scientists say that a rise of even three feet would inundate low-lying lands in many countries, rendering some areas uninhabitable. It would cause coastal flooding of the sort that now happens once or twice a century to occur every few years. It would cause much faster erosion of beaches, barrier islands and marshes. It would contaminate fresh water supplies with salt.

In Asia where they're poor, the cost of adjusting to the new higher sea level will mostly express itself in terms of massive refugee flows, flooding, starvation, violence, and death. Here in the United States we have the resources to conduct major population evacuations. So think repeated iterations of Hurricane Katrina rather than mass starvation. But it would really make an awful lot more sense to just start restructuring the tax code to make people pay for pollution rather than for working.

What's Up With the Heat?

A reader asked me to comment on the surprisingly weak performance thus far of the 6-4 Miami Heat. The issue, obviously, is that the team has no chemistry. With Wade and James on the same squad, there's no "alpha dog" player. And the lack of such a dog means the team lacks "killer instinct" and doesn't inspire fear in its adversaries. These guys are friends, they came to Miami together because they wanted to play together. That's nice, but there's no friends in sports. A winning team is led by stone-cold assassins who want to beat the best players in the game, not chums who'd prefer to team up and hang out. Something like that.

What I actually think, meanwhile, is that Miami's +9.4 point differential is tied with New Orleans for best in the league. So if Miami doesn't step things up, we should expect them to assemble one of the best records in the league over the course of the next 72 games. What's more, the currently injured Mike Miller is an underrated player whose return will help the team a lot.

So my prediction is that Miami will be fine, and by the end of the season sports pundits will be offering us a lot of narratives about the improved chemistry among the big three. It's possibly the case that the return of Miller will play a role in this narrative, since him getting on the floor should in fact lead the team to get better. The fact that Miller is a white guy further militates in the direction of underrating his actual basketball abilities, but vastly overstating his ability to provide "veteran leadership" that provides his talented African-American colleagues with the "intangibles" they need to win.

Boosting the Economy

Asked to offer a short-term idea for improving the economy, Bruce Bartlett hits upon the interest on reserves issue: "One idea would be to emulate Sweden and tax excess reserves rather than subsidizing them as the Fed now does by paying banks 0.25% per year on money that is not lent."

It's an open question in my mind how much of a difference this would make, but the direction seems obvious. Paying interest on excess reserves is a novel policy concept and a contractionary one. We should turn it in the other direction.

Meanwhile, this is probably just wishful thinking, but is it totally insane to think that with Republicans picking up tons of governor's mansions and state legislative houses, that conservatives will start to realize that having continued waves of state and local budget crises is not in the national interest? I know a lot of conservative politicians at least claim to welcome the opportunity posed by a crisis to start slashing state budgets. But historically the actual practice of politicians at the state and local level has been to welcome the opportunity to forestall difficult choices. And the United States Congress can, by appropriating additional state

and local fiscal aid, facilitate the postponement of difficult choices. And in macroeconomic terms, this is a terrible moment for state governments to be making tough choices. Tax hikes, hidden tax hikes, service reductions, furloughs, and layoffs all make it much more difficult for the private sector to rebound.

Petraeus and Karzai

Joshua Partlow and Karen DeYoung report that General David Petraeus is none too happy with Afghan President Hamid Karzai:

General David H. Petraeus, the coalition military commander in Afghanistan, warned Afghan officials Sunday that President Hamid Karzai's latest public criticism of U.S. strategy threatens to seriously undermine progress in the war and risks making Petraeus's own position "untenable," according to Afghan and U.S. officials.

Officials said Petraeus expressed "astonishment and disappointment" with Karzai's call, in a Saturday interview with The Washington Post, to "reduce military operations" and end U.S. Special Operations raids in southern Afghanistan that coalition officials said have killed or captured hundreds of Taliban commanders in recent months.

I don't really get this. Everyone's looking for a viable exit strategy from Afghanistan. And what better strategy than a handshake with the President of Afghanistan over a concrete plan for a reduced tempo of operations followed by a steady withdrawal of American soldiers? The premise of a counterinsurgency operation in Afghanistan is that we're there to help the Afghan government. That strategy can't work if the Afghan government doesn't share our vision, and the strategy lacks legitimacy if the Afghan government doesn't back it. Watch Michael Cohen's head explode over this if you like.

One interesting wrinkle in this is that Abdullah Abdullah, a leading figure in the non-insurgent opposition to Karzai, has basically reacted to the interview by slamming Karzai as soft on the Taliban. I'm not sure that what Abdullah thinks about this matters, but it's a reminder that Karzai would face political constraints in any effort to reach a power-sharing deal with the Taliban. Tajik and Uzbek leaders, Northern Alliance veterans, etc., could all plausibly defect from any such arrangement.

Orszag on Simpson-Bowles on Social Security

I don't really agree with Peter Orszag's general sentiment that the Simpson-Bowles report deserves more warm fuzzies from the White House, but I agree with his assessment that the section of their report dealing with Social Security isn't that far from the mark. And he correctly identifies the main flaw in their proposal as the idea of increasing the retirement age.

To spell this out a bit, on the one hand poorer people tend to work in more physically taxing jobs. So this is a higher burden on them. But what's more, poorer people have a shorter life expectancy than richer people and this gap appears to be widening. So if you let the retirement age increase according to some metric indexed to the overall growth of life expectancy you're talking about an extremely regressive measure that cuts benefits most sharply to the most vulnerable. This should really be avoided. There's more Simpson-Bowles could have done on the tax side, and there are other ways to approach the benefits issue that put the burdens of adjustment more on those who can afford to bear them. That's an important flaw, and it should be fixed. But it does leave us with the point that the commissioners' Social Security proposals contain mostly reasonable ideas and it's a framework within which liberals could work.

Why We Need More Money

I saw this on the FT earlier today:

Münchau is, quite clearly, correct. Only fiscal integration can make this work. Equally clearly, that's not going to happen. So if you look at these headlines and respond, what you're going to do is become more inclined to have dollars. In light of the chaos, money and money-like instruments looks better than less liquid assets and dollars look better than euros. Which means the United States needs a more expansionary monetary policy in response.

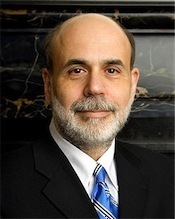

Monetary Mysteries

A bunch of conservative economists and political strategists have signed a letter saying they "believe the Federal Reserve's large-scale asset purchase plan (so-called 'quantitative easing') should be reconsidered and discontinued." That much is clear. Not clear is why they think that. This is their stab at an explanation:

We subscribe to your statement in the Washington Post on November 4 that "the Federal Reserve cannot solve all the economy's problems on its own." In this case, we think improvements in tax, spending and regulatory policies must take precedence in a national growth program, not further monetary stimulus.

This is like telling the head of the Detroit Department of Sanitation that you oppose his effort to improve trash collection in the city because Detroit's problems can't be solved by trash collection alone and improved public safety ought to take precedence over picking up the garbage. The guy's in charge of picking up the garbage and he's supposed to do the best darn job of it that he can.

In much the same way, Ben Bernanke and his colleagues on the Federal Reserve Open Market Committee are supposed to make monetary policy. Ideally, they'll make monetary policy correctly. Obviously the Fed can't solve all of America's problems. But it should solve the problems that it can solve.

Some of these folks may be perfectly genuinely hard money cranks, but the message here if taken literally is quite different. They're saying the Federal Reserve could alleviate economic suffering, but should avoid doing so in order to squeeze the American people into accepting more rightwing tax and regulatory policies. Then once the fiscal and monetary measures Doug Holtz-Eakin and Bill Kristol like are implemented, the Fed can perhaps relent and allow the economy to grow.

College Administrator Incentives

Tamar Lewin writes on the latest data about college and university president compensation, which was high and rising as of 2008.

It would be wrong to say that college tuition costs have tended to skyrocket in the United States because of the very generous compensation packages of some university presidents. But it's definitely worth dwelling a bit on the incentives that administrators face. These are "non-profit" institutions, but they're not charities being run on volunteer labor. The people making the decisions have real financial interests at stake. The way a lot of industries are structured, the best way to get rich is to think up a way to produce whatever it is you're producing cheaper. That way you can cut prices, increase sales volume and market share, all while increasing per unit profit margins. Not everything in the business world works like that, of course, but some of it does—especially the parts where you don't see endlessly increasing prices.

Higher education in America just doesn't work like that. The precise mechanisms through which you get to be one of the highest-paid university presidents are a bit opaque to me (and it's worth keeping in mind that there's more to compensation than salary), but they don't have anything to do with the idea of offering a good value to students. So it's natural that the key institutions don't really focus on value.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers