Matthew Yglesias's Blog, page 2500

November 13, 2010

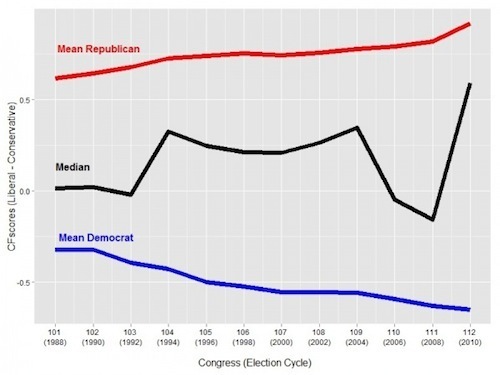

112th House Likely to Be Most Conservative Ever

According to Adam Bonica, the 112th House of Representatives will be the most conservative and most polarized House on record:

To an extent, though, I do think these comparisons are hard to make. Back in the good old days of the 108th Congress one thing that distinguished the really right-wing Republicans from the Bush/Hastert/McConnell leadership cadres is that the super-conservatives didn't like the idea of adding a prescription drug benefit to Medicare. These days I don't hear anyone, no matter how conservative, talking about repealing that.

Paying for the Smithsonian

It's hardly the biggest deal in the world, but I think the Simpson-Bowles proposal to start charging admission at Smithsonian museums is a great example of a kind of pennywise and pound-foolish thinking about spending that often afflicts the political system.

Here's the thing. Building these museums, acquiring the collections, and keeping them running is a fairly expensive undertaking. There are some real benefits to having a National Gallery of Art, but there are also costs associated with it. However, the marginal cost of having an additional person visit the National Gallery is extraordinarily low. And presumably "people might visit the museum" is high on the list of possible benefits of having a National Gallery of Art. What you would ideally do with these kind of public services—be it a museum or a subway or whatever—is take a good hard look at whether or not you really believe in providing the service. And if you do, you provide it for free so that as many people as possible can benefit. If you develop a problem of overcrowding, then you start charging admission to ration capacity. And if you decide the tax burden involved in continuing to provide the service is too high, then you shut down or privatize the thing in question.

"Health Care Costs"

As Stan Collender says the key thing for any fiscal adjustment plan to say on the cut side isn't really how much money you're cutting, it's what things do you want the government to stop doing. Once you name the things, you can total up the savings. Then you can either say you've cut enough, or else you can go back and name more things.

Among other things, I think talking in these terms would help clarify what it is people are saying about Medicare. Right now what Medicare basically is is an unconditional guarantee to provide unlimited health care services to senior citizens. The question we face is whether we want to keep doing that. If we do, we need to pay a lot more in taxes. If we don't, then we need to decide what the alternatives are.

The most straightforward thing would be to put Medicare on a fixed budget. Then Medicare administrators would need to ration Medicare dollars. This is a big conservative bugaboo, but conservatives don't like unlimited spending either so Paul Ryan came up with the idea of putting Medicare on a fixed budget and privatizing Medicare. This lets naïve people tell themselves that Ryan has devised an alternative to rationing whereby privatization saves money. But what actually saves money in the Ryan Roadmap is the hard cap on Medicare spending. The difference is that under his plan insurance companies would make the rationing decisions instead of Medicare administrators.

A semi-alternative to either of these things is just to start paying less money per unit of service. Medicare isn't a monopsony purchaser, but it is a sufficiently big market that relatively few providers will just say no to it. The issue here is that profits drive innovation. If we start paying less for prescription drugs, the prescription drug industry will attract less capital. If we start paying doctors lower salaries, medical school admissions will get less competitive. I think there are some okay options along these lines, but there's still only so far you can really press them. If the government is willing to pay whatever it is that "health care for old people" costs then, over time, health care costs, and thus federal spending, are bound to increase faster than GDP.

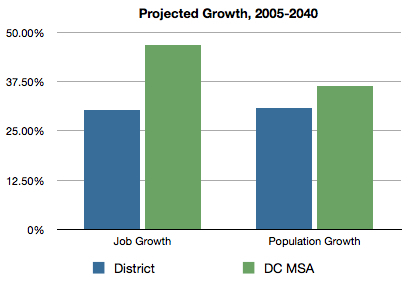

DC Should Aim to Grow, Rather Then Shrink, as a Share of the DC Area

Via Eric Weber the latest growth forecasts for the Washington DC area foresee strong growth in both population and employment in both the city and the surrounding area:

I don't think DC residents should reconcile ourselves to accepting the idea that our city will grow slower than the metropolitan area as a whole. If we allowed for the construction of taller office buildings downtown, more employment than this would located in the District. This would allow for lower tax rates and better city services, both of which would make the city a more attractive place to live. Combine that with the fact that proximity to employment is a factor people consider when choosing where to live, and we could see much stronger population growth.

That would mean shorter commutes, less sprawl, a more efficient regional economy, and less pollution.

Much the same, I might add, applies to the inner suburbs of Arlington, Montgomery, Prince George's, and Fairfax Counties all of which are projected to see slower-than-DC population growth. These territories contain many more people and occupy much more space than DC itself. And they're nice places to live. But land use regulation tends to prevent them from becoming denser, and pushes people ever-further out onto the fringe.

November 12, 2010

Endgame

Electricity favors us:

— Real Talk from Steven Pearlstein: there's no non-objectionable way to reduce overall consumption.

— George W Bush needs to show better judgment about ghost writers.

— Tabbi on foreclosures.

— MyBikeLane.

— Repeating the same mistakes in Kandahar.

Maria Taylor, "Cartoons and Forever Plans"

Farm Subsidies and Fine Print

Vicki Hartzler beat longtime Democratic Representative Ike Skelton in Missouri and at first glance appears to be delivering some much-needed Real Talk on farm subsidies:

The congresswoman-elect would exempt some of the federal budget's high-cost categories — including Social Security, Medicare and the Pentagon budget — from cutbacks. But she would not exempt agricultural subsidies, another major area of federal spending popular in rural areas such as west-central Missouri's Fourth District. Among the many farms to receive such subsidies is the 1,700-acre Hartzler farm, which — according to the Environmental Working Group's "Farm Subsidy Database" — received about $774,000 in federal payments (mainly commodity subsidies for corn, soybeans and wheat) from 1995 through 2009.

"Everything should be on the table," she says. While she says some agriculture programs represent a "national defense issue" because they help guarantee that "we have a safety net to make sure we have food security in our country," Hartzler adds: "Should we continue the CRP [Conservation Reserve] program, where you pay farmers to not plant ground and set it aside for awhile? I'm not sure. The time for that may be over."

That sounds decent, but as Sallie James observes when you peer into there's much less here than meets the eye:

Let's be clear about what Ms. Hartzler is talking about here. Those "some" agricultural programs she says should be guaranteed on "national defense" grounds (see below) are what we commonly think about as "farm subsidies" — payments to farmers to produce certain commodities, whether those payments are funded by taxpayers or consumers. They encourage overproduction and thus alienate our trade partners, complicate efforts to make global trade freer, harm poor farmers abroad and damage America's reputation in the process. They cost us billions of dollars a year.

What she's talking about cutting isn't the main suite of farm price support programs. Instead she's "open to cutting farm programs that at least pretend to have environmental benefits." These programs aren't my favorite idea about how to spend money, but paying land-owners to maintain their land in ecologically sound ways is much less pernicious than paying them to overproduce corn and soybeans. What's more, it's a much smaller share of the overall budgetary pie.

If You Want Liberals to Like a Deal, You Need to Invite Liberals to the Table

I'm not surprised that liberals don't like the Simpson-Bowles proposals and I'm not surprised that people who aren't liberal disagree with liberals about that. But I am surprised that there are people out there professing to be surprised that liberals are hostile to the proposal. But what are liberals supposed to think? It's a proposal hashed out between a conservative Republican and a moderate Democrat. So of course liberals don't like it. Imagine the conservative reaction to a deficit proposal written by Lincoln Chaffee and Russ Feingold.

That's not to say that pursuing a conservative-moderate deal was a bad idea. Self-identified conservatives outnumber self-identified liberals by a large margin and moderates are a much bigger force in the Democratic coalition than in the Republican one. So if you want a deal, appointing an orthodox conservative Republican and a moderate Democrat from North Carolina makes a lot of sense.

But it also makes sense that liberals won't be happy with the results.

Interest on Reserves

If the country's political press could redirect 10 percent of the attention currently being paid to the House Democratic leadership race and the GOP pre-campaign for 2012 to one thing I would suggest the Federal Reserve's interest on reserves program. Insofar as people pay any attention to this issue, it comes via the suggestion that monetary stimulus can't work because the Fed has already increased the money supply a lot and all that's happened is that banks are holding more reserves at the Fed. I don't think that's quite right, but the core observation about soaring excess reserves is accurate. But then the analysis just stops.

But it should continue. In late 2008, the Fed for the first time ever said that if banks wanted to hold extra reserves they would get interest payments in exchange for doing so. Then they raised the interest rate. And then they raised it again. Via Scott Sumner, Louis Woodhill makes a very strong argument that this has been a massively underrated factor in producing the recession. The IOR payments led to a steep decline in the velocity of money, which in turn led to a collapse in Aggregate Demand.

Crucially, the Fed has never really explained why they're doing this. The program was started at a chaotic time when lots of stuff was happening very quickly. At the time, the stated rationale was that the Fed's counter-crash measures might work too well and prompt a need for a rapid change of course in an anti-inflationary direction. This could be achieved, they said, by hiking the IOR payments even higher. So the Fed believes that IOR payments are contractionary. But obviously nothing has happened in the two years since the IOR payments were started that supports the idea that we need more contraction. On the contrary, we need more expansion. This could be easily tested by cutting the right from 0.25 percent to 0.15 percent and gauging market expectation. But the Fed's not doing it.

Germany and China

David Shorr writes from Seoul, South Korea that we should pay more attention to Germany's trade surplus:

Germany is one of those countries that sells stuff rather than buying. Here's the point about Chancellor Merkel's statements: she talks a lot about Germany's exports as a a success of their competitiveness and not very much about needing Germans to buy more. As with China, Germany is quite happy to chug along with export-led growth, thankyouverymuch. This begs the question — if Americans become less profligate (and households have already shown they can reduce consumer debt — then who will pick up consumer demand where we left off?

I think it's wrong to put China and Germany in the same box here. The reason is that if you look at the Eurozone as a whole (or the EU-27 as a whole, or various other broader metrics) the overall surplus is pretty small as a share of GDP. Germany is (along with Sweden and the Netherlands) the export-oriented part of Europe sort of like how the Seattle or New York City areas of the United States are the export-oriented parts of our country.

That's not to say the relationship between Germany, the Eurozone, and the world is unproblematic. On the contrary, it's a total disaster. The Irish situation is a mess, and the Eurozone-wide growth rate is abysmal which means there'll be more trouble ahead for Greece, Portugal, Spain, and Italy soon too. When the Euro was proposed, skeptics posited that the labor market wasn't nearly integrated enough to make it work, but most European leaders forged ahead anyway. The result is an urgent problem, but it's a very different one from the China situation.

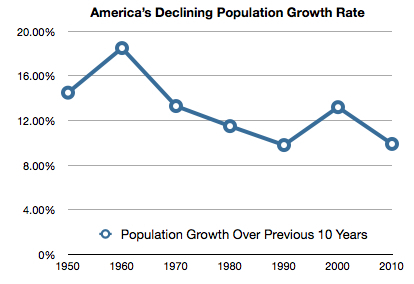

Immigration and Social Insurance

You hear a fair amount about immigration in the United States and you also hear a fair amount about Social Security. But you hear shockingly little about the interplay between the two. Consider, however, that the overwhelming reason Social Security is facing a post-2037 budgetary shortfall is that population growth in the United States has been decelerating:

This is a free society, and if people choose to have fewer children than they used to that's fine by me. I think that if we had more sensible policies around child care and housing the birth rate would probably edge up a bit. But of course there's another way to increase the population growth rate. That would be to be more welcoming to people who'd like to move here. America's gotten into the odd habit of thinking of ourselves as a country that's burdened by the desire of other people to move here. But nobody thinks that way about a town or a neighborhood. Being a desirable place to live is an asset that we should take advantage of. About 165 million people say they'd like to move to the United States. It obviously wouldn't be feasible for all of them to show up tomorrow all at once, but we could accommodate many more of them than we're currently planning on, and doing so would strengthen our country in very many ways.

It's true that higher levels of legal immigration aren't the most politically popular thing around. But neither are tax hikes or benefit cuts. And unlike those, more immigration will actually boost our productivity and our growth rate.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers