Matthew Yglesias's Blog, page 2502

November 10, 2010

Endgame

Save up all your USDs:

— Republicans, especially tea parties, hate free trade deals.

— Bowles-Simpson defense cuts.

— Price indexing of Social Security.

— How to store mattresses legally in the District of Columbia.

— Okalahoma, sharia, and Native Americans.

— DC's long-awaited convention center hotel now under construction.

Soho Dolls knows to fight inflation. Here's "Prince Harry"

US Trade Deficit is Half Oil

A government official emphasized to me today what should be clear to anyone who follows Calculated Risk's charts, namely that a huge element of our trade deficit has nothing to do with China or manufacturing but is instead driven by oil:

Now it's not unusual that the US is a net oil importer. Most countries are. But America is a much more oil-dependent country than other places are. We have more anti-density regulations, more subsidization of big houses, less taxation of gasoline, less investment in mass transit, etc. than most developed countries. This isn't really a coincidence. The United States was a net oil exporter in the late-1940s. So we had a postwar industrial policy paradigm built around suburbanization and powerful firms in the oil and automobile sectors. The problem is that we're not a net oil exporter anymore by a long shot. But we still have a policy paradigm build around encouraging lavish consumption of gasoline. Under the circumstances, we'd have to run a really enormous surplus in goods and services to cover the oil gap.

Preemptive Fiscal Adjustment

All the hot bloggers and think tanks are working on their long-term deficit reduction plans, but I have to say I'm a bit confused as to why. It's definitely true that in principle a country should always have a specific plan for returning to long-term balance. But does that ever actually happen? The budget deficit isn't currently a problem, but it almost certainly will be in the future and that's when congress will act to deal with it.

I think sometimes that people talk so much about the deficit that they forget that big deficits are often a very real problem. It's not a subtle thing. You'll have high interest rates. People will be saying "hey central bank, can you please make interest rates lower." And the central bankers will say "no, we can't, inflation's already at our target level—we won't make policy looser." Then politicians will face a choice between tax hikes (unpopular), spending cuts (unpopular), and slower growth (unpopular) and either the incumbents will reduce the deficit or else the opposition will beat them and either need to reduce the deficit or face electoral defeat on their own.

The big deficit reduction deals of the 80s and 90s didn't just happen for no reason. They happened because the large structural deficits of the Ronald Reagan administration were creating serious economic problems. Today we have serious economic problems, but none of them are caused by the deficit. Inflation is below the Fed's target. They can keep rates low no problem. It would be wise and just and moral for the 112th Congress to pass a judicious long-term debt reduction program, but it doesn't seem even remotely realistic. Is there any precedent for a country doing deficit reduction pre-emptively in the way everyone seems to be suggesting we should?

I Am Fed Up With Rick Perry

Paul Waldmann the following from Rick Perry's book Fed Up! Our Fight to Save America From Washington:

"We are fed up with being overtaxed and overregulated. We are tired of being told how much salt we can put on our food, what windows we can buy for our house, what kind of cars we can drive, what kinds of guns we can own, what kind of prayers we are allowed to say and where we can say them, what political speech we are allowed to use to elect candidates, what kind of energy we can use, what kind of food we can grow, what doctor we can see and countless other restrictions on our right to live as we see fit."

This is a great example of the plague of rhetoric excess that has taken over the American right ever since the inauguration of Barack Obama. I don't believe for a minute that Rick Perry is fed up with motor vehicle safety inspections, bans on private ownership of shoulder-launched missiles, regulation of nuclear power plants, or any of this other stuff. In addition to being Governor, Perry served for two terms as Agriculture Commissioner in Texas and there are still tons of regulations on on growing food. Nor has he done anything to eliminate the Texas Medical Board whose sole mission in life is to tell you which health care professionals you're allowed to see.

Some of these regulations are unwise, some are wise, and absolutely none of them are the subject of controversy between Perry and big government liberals in Austin or Washington or anywhere else. But political entrepreneurs on the right have had enormous fun over the past two years creating this entirely made-up story in which there's some gaping chasm of opinion between the two parties.

Retirement Age

I'm not going to do chapter and verse on the deficit commission leaks that are out today, but it is worth noting that raising the Social Security full benefits retirement are is basically the very most regressive way to reduce entitlement spending.

Dire Consequences of NIH Cuts

I'm pretty sure the new House majority will succeed in enacting pretty severe cuts to means-tested programs that benefit poor people. But any talk of sweeping budget cuts is going to keep running into stories like this one:

Republicans taking control of the House next year would roll back funding to agencies, including NIH, to fiscal 2008 levels, according to a proposal by Rep. Eric Cantor (R-Va.), who is likely to become the chamber's majority leader. That would equate to a 4.3 percent, or $1.3 billion, cut to the agency's $30.8 billion annual budget.

The reduction would be "very devastating" and would demoralize scientists, whose odds of winning a research grant from the agency could drop to about 10 percent, NIH Director Francis Collins said in an interview. Fewer than one in five grant proposals are successful, he said.

NIH-funded research led to the development of drugs that include the cancer therapies Avastin, sold by Roche Holding AG, and Novartis AG's Gleevec, said Jennifer Zeitzer, lobbyist for the Federation of American Societies for Experimental Biology in Bethesda.

Already the talk of focusing on domestic discretionary spending means the GOP will exempt Medicare, Medicaid, the Pentagon, and farm subsidies from the budget ax. So are they really going to cut the NIH? Federal law enforcement programs? The upshot is going to be really bad news for Pell Grants and a handful of other programs that lack constituencies Eric Cantor cares about.

"Iron Law" of Climate Politics Proves Surprisingly Plastic and Devoid of Content

I wasn't impressed with my first contact with Roger Pielke, Jr's concept of climate politics running up against some kind of "iron law," but on the second go 'round things get even worse:

Professor ROGER PIELKE Jr. (Environmental Studies, the University of Colorado): Yeah, I think the iron law of climate policy simply says that while people are willing to bear some cost for environmental objectives, that willingness has its limits. And cap and trade ran up against those limits time and again, and it's not surprising that it failed.

At this point, the "iron law" seems to have been defined down into triviality. It's obviously the case that for all potential issues there's a limit to the cost people are willing to pay to deal with them. The question, obviously, is what that cost is.

Meanwhile, do note that a majority of members of the United States House of Representatives were willing to vote for a cap and trade bill. And the President of the United States was prepared to sign one. So it's not like the whole idea was some kind of wild non-starter. What it couldn't get was 60 votes in the United States Senate. But lots of things can't get 60 votes in the Senate. 70 percent of voters want to repeal Don't Ask Don't Tell and that can't get 60 votes in the Senate.

My "iron law" of American politics goes like this: If there's something 41 Senators genuinely don't want to do, then it won't happen!

Zoellick Clarifies That He's Not for a Gold Standard, He's Just Mumbling Incoherently

We had a lot of excitement yesterday over World Bank President Robert Zoellick seeming to call for a return to a Bretton Woods-style global gold standard system. Today at the G-20 meeting, though, he clarifies that that's not what he meant. However, he doesn't seem to be able to explain what it is he is proposing:

Mr. Zoellick said he thinks the coming monetary system will include a number of reserve currencies, including the dollar, euro, yen and, increasingly, the yuan, though he says the dollar is likely to remain "dominant." He's deliberately sketchy on the role he envisions for gold, calling it a "reference point" and an "alternative monetary asset," and not defining those terms in great detail.

His main point, he said, was to point out that the stupendous rise in gold is a signal that markets are uncertain about the stability of the current exchange system. But he said he wasn't proposing to judge whether currencies are undervalued or overvalued by looking at their price in gold.

He said his comments produced a "huge amount of feedback." People needed to "break away from old shiboliths," that any mention of gold means a return to an inflexible gold standard, he urged.

I really don't think Zoellick can blame outside observers for choosing to interpret him as making coherent, albeit misguided, comments rather than just offering up meaningless jibberish. What does this mean? Transitioning, over time, away from near-universal reliance on the dollar as a reserve currency is an important subject. But why mention gold in this context unless you have a real gold-related proposal?

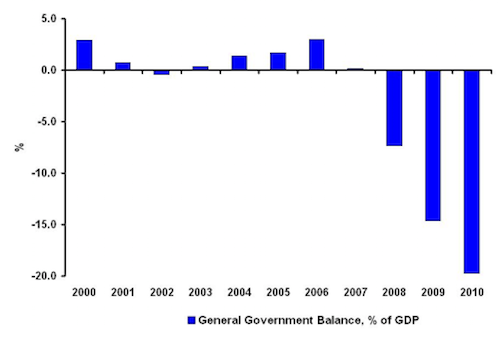

Low Taxes and the Irish Property Boom

Henry Farrell stands up for the view that low taxes were too an important source of the Irish property bubble:

The simplified political economy story goes as follows. Ireland had low nominal and even lower effective corporate tax rates. It also had low personal taxes, both because of the belief that this would foster entrepreneurship etc, and because the government used to periodically sweeten bargains between business and labor by promising tax cuts (which of course favored the rich more than the poor), inter alia buying off unions who might otherwise have started getting feisty about organizing the unorganized bits of the new Irish economy.

The result was that even with booming economic growth, the government faced a fiscal hole. This hole was filled by taxes on property transactions which, as the property market got ever more bubbly, became an ever more important source of government revenue. This provided the government with an extremely strong incentive not to deflate the bubble, reinforcing the already considerable incentives towards inaction resulting from cronyism between politicians and property tycoons, ideological notions about not interfering with 'free' markets etc.

When the bubble burst and the bezzle came into full view, the results were quite unpleasant, as this ESRI graph shows.

As a causal story, I still don't really buy this. We had property booms in the United Kingdom, in Spain, in the United States, in Iceland, etc. all under different tax trajectories. And I can't think of any examples of a government anywhere deliberately acting to deflate asset prices. The fact that the Irish government didn't do so isn't really a fact in need of explanation.

But I now understand that not only was the property bubble, rather than tax cuts, the driver of Irish growth but it was also the driver of Irish tax cuts.

Post-Jewish Zionism

I got the sense talking to people on both sides of the Green Line that grassroots activists in Israel and Palestine haven't totally caught up with the evolution of Israel politics in the United States. It's still the case that if you gaze over at Capitol Hill your typical strongly pro-Israel politician is a Jewish liberal such as Henry Waxman or Anthony Weiner who may feel some dissonance between their general political views and heavily militarized Israeli nationalism. But stories like this one from Rachel Slajda reflect the shape of things to come:

A legal attempt to stop the construction of a mosque in middle Tennessee is getting expensive. The preliminary hearing has dragged on, with several days of testimony stretching over more than a month. The county has added $50,000 to its litigation budget to cover expected defense costs and is warning that that number could go up.

So who's funding the plaintiffs — three local residents who don't have access to taxpayer money?

Their lawsuit is being supported, in part, by a Christian Zionist group called Proclaiming Justice to the Nations. PJTN hired, and is paying, one of the two lawyers for the plaintiffs.

The point here is that PJTN's views on Israel are just part of a larger worldview that casts Muslims and Islam as the enemy. You see a secular version of this in Dutch far-right leader Geert Wilders' strong support of Israel. To Israel's advantage, these are people who won't even be nominally interested in whether or not Israel adheres to human rights norms or other dictates of humane conduct. To Israel's disadvantage, however, these are people for whom the conflict with the Palestinians isn't a problem to be solved. Instead, on this view the whole point of Israel is to wage war against Muslims and peace would render the state superfluous.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers