Matthew Yglesias's Blog, page 2482

December 2, 2010

TALF

Read the gory details here.

I don't really have a problem with any of this. All these TALF profits were made without taking anything away from anybody else. The essence of an economic depression is that it's possible for policymakers to spur actual increases in output via various kinds of easing. But the natural questions to ask are "why not more?" and "why not for more people?" Why the obsession with doing easing through the credit channel? The circumstances called for monetary expansion—more monetary expansion than we got—but there's no good reason not to funnel the money directly to households.

Emerald Twighlight

A few links on Ireland. One from Niam Hardiman does a great job of explaining what's actually happening. Here Barry Eichengreen loses his cool. Tyler Cowen is pithy: "Fiscal union was, is, and will remain a fantasy. The best the eurozone could have done was to abolish national banking systems and have a truly European banking market. It's too late for even that, though."

Speaking of the last point, it was observed to me yesterday that in a curious way the creation of the Euro didn't abolish the Eurozone national central banks. Normally, a country's "lender of last resort" and a country's "monetary authority" are the same institution—the central bank. But that's not the case for Europe. The lender of last resort for Ireland is the Central Bank of Ireland, but the Central Bank can't print money. Consequently, the Eurozone national central banks (In Ireland, Portugal, Spain, etc.) can actually be subject to runs and liquidity crunches. Which is just to say that Europe doesn't even have monetary integration in the way we would normally understand it.

Last point would be that as best I can tell public statements from German politicians and commentary in the German press seems to be creating a bit of a dream world in which "irresponsible" Irish business activity is to be contrasted with "prudent" German business activity, and Germans are properly resentful in a nationalistic way about being asked to "bail-out" said Irish. In reality, the Irish government is in crisis because Ireland's banks are in crisis. Ireland's banks are in crisis because they invested too much money in property ventures that have gone bust—that's irresponsible. But the nature of the crisis is that Irish banks owe a lot of money to various creditors, a great many of whom are French and German banks. Which is just to say that French and German banks made, through the intermediary of the Irish banking system, a bunch of irresponsible investments in Irish real state. That's the exact same thing as what the Irish banks did.

Tax Cut Mania

Internal Revenue Service Building (cc photo by scotteric)

Economist Mom has an excellent head-banging-against-the-wall account of the insane tax cut debate unfolding in Washington today:

The fiscal policymaking in this town seems totally schizophrenic right now. What a juxtaposition to have President Obama's deficit-reduction commission release its final report while the Administration "negotiates" with Congress on whether all of the Bush tax cuts, or just most of them, should be permanently extended (and deficit financed). The media has been reporting that whether the bulk of the Bush tax cuts will be extended or not is not the issue–it is whether the upper-bracket ones benefitting only the rich will be included as well, and what constitutes "rich." (That floor may be moving up all the way to $1 million.)

Let's remember that the permanent extension of "just" the "middle-class" Bush tax cuts, as President Obama has proposed, would add about $2.2 trillion to the debt over the next ten years–without interest costs and without the associated extension of Alternative Minimum Tax relief. Such extension would preserve the full value of Bush tax cuts for 97-98 percent of households while continuing to give the largest dollar value of tax cuts to those above the $250,000 threshold.

In other words, there's no debate in Washington about whether rich people should get a permanent tax cut. Nor is there any debate in Washington about whether rich people's tax cut should be financed by long-term borrowing. Nor is there any debate about whether rich people should get a bigger tax cut than middle class people. But we "can't afford" unemployment insurance, we "can't afford" to pay bank regulators competitive salaries.

We have a bipartisan consensus that the short-term deficit should be made smaller and the long-term deficit should be made bigger even when all the economic logic points in the opposite direction.

Chris Dodd on the Senate

Departing Senator Chris Dodd did a farewell speech yesterday in which he made the case against Senate reform. This section of the address serves, however, to illustrate how weak the case is:

We one hundred Senators are but temporary stewards of a unique American institution, founded upon universal principles. The Senate was designed to be different, not simply for the sake of variety, but because the framers believed the Senate could and should be the venue in which statesmen would lift America up to meet its unique challenges.

As a Senator from the State of Connecticut—and the longest serving one in its history—I take special pride in the role two Connecticut Yankees played in the establishment of this body.

It was Roger Sherman and Oliver Ellsworth, delegates from Connecticut to the Constitutional Convention in 1787 who proposed the idea of a bicameral national legislature.

This starts with the idea that the Senate was designed for some incredibly noble and high-minded reason. But it concludes with the real reason—some states, Connecticut among them, wanted to create a mechanism whereby their interests would be over-weighted relative to the interests of large states like Virginia. So a hard-nosed political bargain was struck, and the result was a politically feasible path to a set of institutional arrangements that were superior to the Articles of Confederation than proceeded them.

And this is precisely the spirit in which reform should proceed. You start with a desire for a fairer and more efficacious system, you blend that with the willingness to drive some hard-nosed bargains, and you add in a dash of creative thinking. Jeff Merkley's modest reform idea seems to me to be in that spirit.

December 1, 2010

Endgame

Untouchable like Elliot Ness:

— Where are the health care entrepreneurs?

— FreeDarko gives us the best all-time Jewish-American basketball team.

— I think I forgot to blog about the giant Omri Casspi billboards I saw in Tel Aviv.

— Hamas says it would accept the results of a referendum on any peace deal.

— You're no longer free to move about the country.

The first time I came to California, I was disappointed to see it's not really as portrayed in 2Pac's "California Love" video, but given the intractable budget situation we get closer every day.

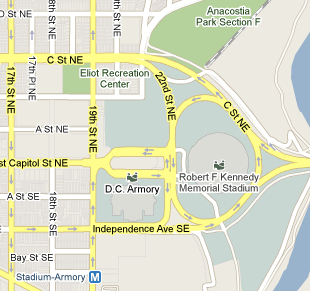

Football Stadiums Belong on the Periphery

As a football fan, I'd of course be plenty happy to see the Redskins play someplace more convenient to get to than FedEx Field way out in the middle of nowhere. And as a fan of seeing more development in Washington, DC I usually like development-happy city councilman Jack Evans. But I have a very hard time seeing the logic of this plan:

Evans envisions a $2 billion to $3 billion project to tear down RFK, located on the shores of the Anacostia River just over 20 blocks due east of the Capitol Building, and build a new, 110,000-seat stadium with a retractable roof.

Such a facility could be home to much more than the Redskins, he adds.

"You build a 110,000-seat stadium with a retractable roof, and you get the World Cup," says Evans. "And the Olympics would also be something we could compete for."

The fundamental problem with football in an urban setting is that the NFL plays very few games. You've got 8 regular season home games. Throw in a bit of preseason and playoff appearances and you're still looking at a facility that's empty on 95 percent of days. That's an inherently low-intensity land use and like other low-intensity land uses—farms, airports, etc.—it belongs to be way out somewhere where land is cheap and space is plentiful. Which is to say it belongs far from the city center and, in DC's circumstances, that means outside the city limits. The fact that you might or might not attract some World Cup matches or Olympic events every couple of decades doesn't challenge this calculus in any meaningful way.

From a pure urban planning perspective the ideal thing would be a combined football/baseball/soccer stadium that would be used quite frequently and could be located nearer to the urban core at a more accessible location. But it seems that football, baseball, and soccer team owners all have a strong preference to play in sport-specific stadia. And fortunately in the United States of America land per se is not in short supply so it's very possible to allocate plenty of land to low-frequency sporting events. But land in the middle of big cities is in fact scarce and should be reserved for things that are used frequently.

So what should be done with the current RFK Stadium site and its associated parking lots? This seems easy to me—build a neighborhood there! We've got empty space, a metro station, river-frontage, everything you could ask for. Demarcate some of the land to be a new park (this is my key concession to the insidious park lobby), sell the rest of it to developers, let them build some stuff, and then watch in amazement as the property tax revenue flows in.

Fixing the Fed

I liked Matt Stoller's post about the need for progressives to respond to the Palinite challenge to the Federal Reserve with something more and better than reflexive defense of the existing accountability-free arrangement.

I'm of the technocratic temperament, so I think Stoller may find my own ideas on this score insufficiently populist, but it seems to me that the path to accountability starts with a more reasonable division of responsibility. One of the key problems with the existing "dual mandate" is that while the full employment side is routinely ignored in practice the very vagueness of the idea of simultaneously advancing two goals makes it impossible to draw a real criteria of what constitutes acceptable performance. A better set of monetary institutions would start, I think, with a single clear mandate. That could be an inflation target—deliver 2 percent per year. Or it could be a level target—deliver 2 percent annual growth in the price level. Or it could be a nominal expenditure target—deliver 5 percent annual growth in aggregate demand. Then instead of hearings being a farce of secrecy and grandstanding, things would be pretty clear-cut. Either the Fed would deliver on its target and officials would get a nice round of applause, or else results would be off-target and members of congress would be justified in yelling and demanding various people's heads.

But then suppose the Fed is hitting its target (whatever that target may be) but people are unhappy with the overall macroeconomic results. Well then congress should change the target. The key here to me is that a clear division of responsibility—the Fed is supposed to hit a nominal target, and congress is supposed to set a nominal target that leads to good outcomes—promotes accountability. You're not happy with what's going on? You check who's to blame. Is the Fed delivering what congress told it to deliver? If not, blame the Fed. If yes, blame congress.

Inflation in China

Unlike the United States, China is not burdened by massive excess capacity and idling of usable resources. Also unlike the United States, China has a very real inflation issue to deal with:

Government ministries are pitching in. The banking regulator is trying to boost loans to agricultural projects. Representatives of the State Council, China's cabinet, are traversing the nation on a food-price inspection tour, and the agriculture ministry is issuing optimistic updates on the planting of winter wheat.

"What the government has been trying to do so far is . . . control inflationary expectations through propaganda," says Arthur Kroeber, managing director of Dragonomics, a Beijing research firm. China's civil affairs ministry has ordered local governments to step up welfare payments to ensure the poor can afford food.

Beijing is handing out one-time subsidies of Rmb100 ($15) to more than 220,000 low-income workers. In Shaanxi province, the government has set aside Rmb60m to help university dining halls cover costs.

What's both maddening and frustrating about this is that the simplest measure to curb China's inflation is also the measure the US wants to see to help our shortfall in aggregate demand—let the currency float. A more valuable Chinese currency would increase real wages (and thus the affordability of basic commodities like food) without locking in inflationary expectations of nominal wage hikes. Meanwhile, it would assist in global rebalancing, boost demand for American-made products, and generally be in the interests of most Chinese people and most non-Chinese people. But China's export lobby seems to have an iron grip on the government and the PRC is determined to try every possible anti-inflation measure except the best one available.

Density in Delhi

I like to complain about undue regulatory restrictions on dense development in the United States, but as Lydia Polgreen explains in the New York Times the situation is much worse in India:

A recent report by the McKinsey Global Institute estimated that by 2030, 70 percent of India's jobs would be created in cities, and about 590 million Indians would live in them. To provide enough housing and commercial space, it said, India must build the equivalent of the city of Chicago every year. [...]

Like those of many Indian cities, Delhi's building codes and zoning laws were written for a much smaller city in a different time, with policies that actively discourage growth.

The number of floors in most neighborhoods is capped at five stories, and in many areas fewer. The government largely controls land, and government approval for new development is difficult to obtain, even to house the wealthy and middle class, never mind the poor.

Continued urbanization is India's best hope for economic growth and lifting more of its people out of poverty. But to organize in an economically optimal way, a poor country of over a billion people needs to be able to put some tall apartment buildings together. And that's to say nothing of the ecological issues at stake in deciding whether metropolitan India will be characterized by massive sprawl or efficient use of land.

Iran, Saudi Arabia, and "Western Civilization"

Eli Lake, who loves a good tu quoque more than he loves being coherent, did an interesting tweet yesterday, sarcastically jabbing "So from now on, if you think Iran is a threat to western civilization, you're just being #neoconsaudiarabian."

And, of course, he's quite right. Anyone who shorthands the idea that it's "neocons" who are very alarmed by the prospect of rising Iranian military capacity is eliding the fact that the government of Saudi Arabia also appears to find this very alarming. That said, I think the real point to be made here is that heavy Saudi concerns about Iranian military strength totally undermine the idea that there's some kind of clash of civilizations pitting "western civilization" against Islamism or some such. The Saudi government, just like the Israeli government, is concerned that growth in Iranian capabilities will diminish its influence in the region. There's obviously an ideological element to these conflicts, but to see them primarily in this light would be a huge mistake. Even before the revolution Iran was seeking to enhance its regional standing via a nuclear weapons program and other powers in the region would naturally find that alarming. That's fine, and it's also fine for the United States to find it alarming. But you need to put the interests at stake in perspective. The regional balance of power in the Persian Gulf should be of some concern to the United States of America but not the same kind of concern that we would muster over a genuine threat to western civilization as such.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers