Matthew Yglesias's Blog, page 2480

December 3, 2010

Endgame

He's gonna let you down and gonna break your back, for a chance:

— WikiLeaks is not a technical one.

— The college wage premium in China is $44 a month.

— Silvio Berlusconi .

— Home mortgage interest tax deduction is terrible.

— Doom.

I feel like Barack Obama could learn some negotiating lessons from the Strokes. Here's "Take It Or Leave It".

Jobs and Trade

(cc photo by Hugo90)

Martha C White has a nice longish piece in Slate looking at the murky question of what actually goes into a bilateral free trade agreement and who does it help. I wanted to comment on one aspect of this, which is the question of trade and jobs:

The jobs question is one that has long vexed trade policy analysts. NAFTA supporters point to the economic growth and low unemployment the United States saw through most of the '90s; detractors point to the drop in manufacturing jobs from the time of the agreement's implementation to today. Both arguments weaken when taken in context. Yes, America's economy expanded in the 1990s, but recent re-evaluations of the numbers indicate that the growth might have been overstated, weakening the argument that NAFTA was as much of a game-changer as its champions claim. Conversely, our manufacturing sector has been shedding jobs since the mid-'70s, when the number of Americans working in that sector peaked at around 18 million; laying blame at the feet of an agreement that came along two decades after the peak points the finger at the wrong culprit.

One thing it's worth observing here is that over the long-term the impact on jobs of any kind of international economic agreement is going to be zero. Finland has fewer jobs than Canada which has fewer jobs than Mexico which has fewer jobs than China. Which is to say that over the long-term, the vast majority of able-bodied adults in a country who want jobs are going to find jobs. Right now the labor market is the United States is the worst it's been in decades, but even so most people are employed. So the big long-term determinant of how many jobs you have is how many people you have. Clearly, though, Finland is richer than Canada which is richer than Mexico which is richer than China. And this is the issue here. If Barack Obama proposed a magic "full employment by reducing average living standards to Mexican levels" law, I would not applaud him. Cyclical unemployment is bad, but massing reductions in per capita GDP are worse.

So the question we're really asking with trade policy is "does it help us increase our growth rate?"

Constructive Advice for The Left

(cc photo by Infrogmation)

Duncan Black complains:

One thing that's been true since I've been paying attention is that everything The Left does is wrong. By The Left I mean everyone to the left of the basic governing power. Third Parties are bad, sitting out elections are bad, putting pressure on elected reps is bad, protesting is bad, primary campaigns are bad, media criticism might hurt their feefees and is bad, saying mean things about Rush Limbaugh is bad, actually discussing your views honestly is bad, etc. Obviously the failure of The Left to take control and run the country does suggest that it is doing something wrong, but no one ever really offers much constructive advice other than…please STFU.

I sympathize with this, but I also think the post is very typical of what's wrong with "The Left" in this sense. What's needed is less whining and more doing. Doing what? Doing politics, of course. That means that every time there's an election you're eligible to vote in—be it a primary election or a general election—you look at which are the two candidates most likely to win and you vote for the better one. And you encourage your friends and coworkers to do the same. You should donate money to the PACs of politicians who you like. You should volunteer in person to do election work near where you live. And you should donate money to organizations that you like. When there are issues being debated, you should write to your elected representatives. You should consider running for local office, and you should urge good people you might know to consider running. If you have local elected officials who you like, you should encourage them to run for higher office.

At any rate, this is getting to be a long and boring list so I'll stop. It's dull because it's obvious and it's dull because participating constructively in politics is dull. As Max Weber said it's like "the strong and slow boring of hard boards." One strategy that works well for wealthy interest groups to is to spend money hiring other people to do a lot of the boring legwork. If you're not a wealthy interest group, this is going to be hard to execute and you're stuck with just doing a bunch of boring stuff yourself.

The alternative, I guess, is that you could try a civil rights movement redux strategy. But that's not "protests" it's open defiance of the legal order, complete with subjecting yourself to massive violence by the state and by formal and informal terrorist organizations.

Jobs By Sector (an Exercise in Austro-Keynesianism)

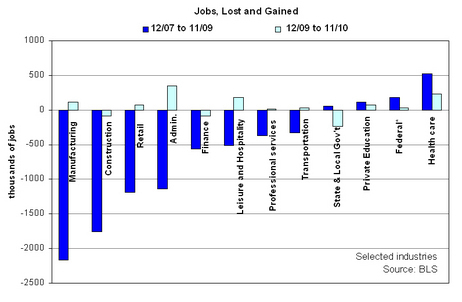

An excellent chart from Jacob Goldstein shows where jobs were lost during the recession and what kind of rebound we've had:

So this shows us a few things. One is to underscore the oddness of Naryan Kocherlakota's observation that "the Fed does not have a means to transform construction workers into manufacturing workers." It's true, they don't. But the biggest source of job losses is that we've transformed manufacturing workers into unemployed people, and the Fed really should have a means to transform the vast majority of unemployed manufacturing workers into employed manufacturing workers.

And this is how it looks across the board. You do have a big hit to finance and a bigger hit to construction, but the combined finance & construction share of the job losses is less than 50 percent. The manufacturing, retail, administration, leisure & hospitality, professional services, and transportation sectors all went down when aggregate spending went down and have recovered weakly as aggregate demand recovered weakly.

Policies that boosted aggregate would have majorly mitigated these losses.

The construction and state/local pictures, meanwhile, should be separated from finance. You could have eliminated the state/local losses via revenue sharing, or you might have deemed that to be an undesirable policy. Similarly with construction. Many, though not all, of these construction workers who've been sitting around collecting unemployment checks could instead have been paid to construct things. That could mean weatherization retrofits, it could mean mean train tracks, it could mean large obelisks. Spending money on construction projects at the pace and scale needed to put half of these people to work would have in practice entailed undertaking some low-social-value projects. But would the social value have been lower than the social value of having the unemployed workers do nothing? I don't see it.

We're experiencing a massive and largely avoidable plague of idless in which the country is producing far fewer goods and services than it is capable of producing.

GDP Growth, Not Spending Restraint, Is Key to Moderating Health's Share of the Economy

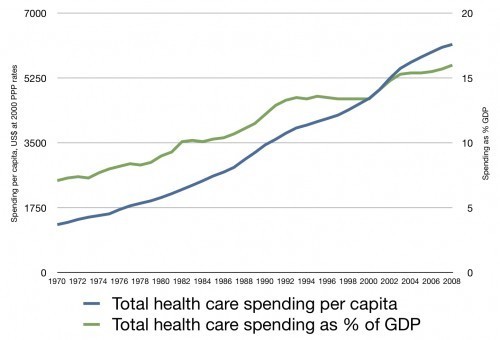

Aaron Carroll delivers on my suspicion that the flatlining of health care spending as a percent of GDP in the 1990s is mostly about rapid GDP growth during that decade:

There was a moderation of the rate of increase in the nineties, but clearly growth as such is playing a big role here. This is sort of an obvious point, but the implication is that the debate over "health care costs" is a little bit misguided. Making it easier for English-speaking college graduates to move to the United States would reduce health spending as a share of GDP, but it's not something a blue-ribbon commission on health care costs is going to come up with.

Mental Prisoner of the Congress

An except from the President's statement on the Simpson/Bowles Commission:

This morning, my budget director, Jack Lew, spoke with Chairman Bowles and invited the entire Commission in to meet with him and Secretary Geithner to discuss the Commission's proposals. Overall, my goal is to build on the steps we've already taken to reduce our deficit, like slowing the growth of health care costs, proposing a three-year freeze in non-security discretionary spending and a two-year pay freeze for federal civilian workers, and restoring the rule that we pay for all of our priorities.

I have various disagreements with this, but I think this also illustrates the extent to which the former-Senator President his senior staff full of former legislative aids have become mental prisoners of the legislative process. "Restoring the rule that we pay for all of our priorities" is a references to re-adopting statutory PAYGO rules in the congressional process. That might or might not be a good idea, but if the President does think it's a good idea he can adopt the same thing unilaterally. He just needs to say "I will veto any bill that increases the deficit relative to current law."

He needs to really, really mean it. When people say "what about the AMT patch?" he could say "I'm for AMT patches, but only if they're paid for." When people say "what about the Bush tax cuts?" he could say "I'm for middle class tax cuts, but only if they're paid for." When people say "whata bout the doc fix?" he could say "I'm against cutting Medicare reimbursement rates, but only if it's paid for." Repeat that enough times and suddenly it becomes congress' problem. Congress wants an AMT patch? Fine, then congress needs to pay for it. There are lots of things the President can't do in the legislative process, but refusing to sign deficit-increasing bills is something he definitely can do.

The Trouble With Fiscal Stimulus

There's been a fair amount of blogospheric bemoaning of the failure of policymakers to adequately embrace the idea of fiscal stimulus as a macroeconomic stabilization policy. And as readers know, I'm very sympathetic to that point of view. But at some point when your side of the argument fails to carry the day, you do need to start thinking about why you're not persuading people.

And in this case, I think the problem is pretty clear: In the absence of broad political consensus about the appropriate size and scope of the public sector, efforts at fiscal expansion will necessarily get bound up with these debates. For example, many liberals view the idea of a payroll tax holiday with suspicion because they suspect the revenue losses will provide further grist for the argument that Social Security is "bankrupt" and benefits need to be cut. Conversely, conservatives are reluctant to support "temporary" increases in the generosity of social welfare programs out of fear that in the future allowing those increases to expire will be characterized as a "cut."

Or at the state and local level, anyone who's thinking seriously about the issue ought to see that the middle of a recession is a terrible time to implement major cutbacks in public spending. But at the same time, people who believe in good faith that state and local spending is above the optimal level will understandably agree with Rahm Emannuel that you don't want to let a good crisis go to waste. After all, were center-left Keynesian economics bloggers issuing table-thumping condemnations of state and local spending increases in 2004-2007? Bemoaning the fact that we'd entered a new "dark age" of macroeconomic understanding where policymakers didn't realize that under the circumstances states and municipalities ought to be trimming its workforce and accumulating huge surpluses? I think I missed that.

It seems to me that Germany and Sweden entered the recession with less Keynesian political cultures, but more consensus about the long-term equilibrium level of public spending. And not coincidentally, both of those countries did a much better job of executing the "stimulus in the downturn, then move to consolidation when growth returns" move than America has.

So the practical problem facing proponents of a large fiscal role in stabilization is to come up with ideas that work given this setting. That means, I think, doing something to stop state and local fiscal policy from being pro-cyclical and it means doing something to elaborate rule-based monetary policy measures for when nominal interest rates are close to zero.

Savings, Investment, and "Big Government"

Reihan Salam recommends the following insights from Matt Continetti, attempting to referee a debate between David Brooks and Arthur Brooks:

I think we need to distinguish between a government that finances long-term investment and a government that finances present consumption. Hamilton, the Whigs, Lincoln, and TR sought to improve American infrastructure and level the playing field so that young men of talent could overturn entrenched market incumbents. Growth was the result. Yet the American welfare state, as presently composed, is devoted almost entirely to consumption in the form of Social Security, Medicare, Medicaid, and interest on the debt. The money spent on education, R&D, and infrastructure is a pittance by comparison. The one place where we actually do massively invest in (global) public goods is defense. But of course that's where everyone wants to cut.

So I'm generally in favor of anything that softens conservative rigidity on the question of "big government." And I take the spirit of the suggestion here to be the right one—we ought to think about how much value we're getting rather than how much we're spending, per se.

But I think the consumption/investment dichotomy doesn't capture value all that well. For one thing, in operational practice this is largely semantics. Since Bill Clinton emerged on the scene the political convention is to use "investment" to mean "spending I favor" whereas "out-of-control spending means "spending I oppose." Hence to John McCain we invest in nuclear missiles but merely spend on bear DNA research, whereas I would say we're spending on nuclear missiles and investing in scientific research. One man's high speed rail investment is another man's pork-barrel scheme. This is particularly true because the closer a public expenditure comes to resembling a private capital investment the more vulnerable it becomes to public choice critique. There's no issue of government being "bad at" disbursing Social Security checks, whereas the skill with which a national high-speed rail network would be managed is open to question.

Last, though not least, lines are hard to draw. Medicare is obviously a heavy subsidy for old people's consumption of health care services. But that, in turn, constitutes a heavy subsidy for medical-related R&D spending. America has the world's most bloated health care sector but we're also world leaders in pharmaceuticals, biotech, medical equipment, etc., and I doubt this is a coincidence. Any kind of in-kind social welfare provision is in part a form of industrial policy. In the classic Milton Friedman critique of the welfare state, this is a problem. But in the Continetti/Brooks/Salam reformulation of the critique, it ought to look more like a feature. I wouldn't swing 100% to the "just send money" side of the argument, but on the whole I think Friedman has the better of the argument.

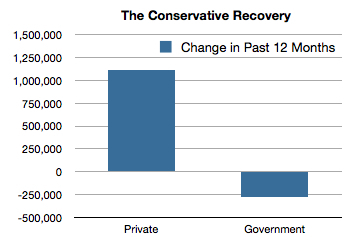

The Conservative Recovery

I posted this chart when the November jobs numbers came out:

Today's report, which is being called bad numbers, we learned of 50,000 new private sector jobs and the loss of 11,000 more public sector jobs.

To me, this really does seem like a bad result. But conservatives in the audience need to recognize that we're getting what they say they want. The private sector is growing and the public sector is shrinking. If you're disappointed in the results, you can perhaps consider reviving your view of the desirability of executing this shift in the middle of a collapse in aggregate demand. But what you can't do is say that the bad economy is somehow being caused by an Obama-era slide toward socialism. The slide isn't happening. The explosion in government isn't happening. The public sector is shrinking.

For the Record…

I really wonder what's happening, subjectively, inside the heads of people who oppose repealing Don't Ask Don't Tell. Do any of them think they're on the right side of history here? That people are going to look back from 2040 and say "if only we'd listened to John McCain thirty years ago?"

So we should just put it down fo the record here. In 2010 when faced with the opportunity to follow all of our important allies down the road of equality, a whole bunch of conservative politicians just decided that their ethics doesn't make room for the idea that gay and lesbian Americans are human beings whose interests should count in deliberations. They refused to articulate exactly what it is that they think gay and lesbians Americans are if not free and equal citizens of the United States. But they made it clear through their words and needs that whatever it is gay and lesbians Americans are, it's not free and equal citizens of the country. They're some kind of subordinate class whose interests can and should be sacrificed to the alter of political expedience or knee-jerk prejudice or something else. It's repugnant and despicable.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers