Matthew Yglesias's Blog, page 2257

June 30, 2011

Columbia Heights As Property Of The Sherman Brothers

Here's a cool find on the New Columbia Heights Blog, it seems that the parcel of land currently housing the DC USA shopping mall was formerly two parcels one owned by General William T Sherman and the other owned by his brother, John Sherman, a US Senator, Secretary of State, and Secretary of Treasury. The non-martial Sherman, I learned yesterday, is also the namesake of Sherman Avenue that runs east of there.

DC, I feel, doesn't always do the best job of explicating its history to people who move here but as with any other place that people have been living and working in for hundreds of years there's tons of fascinating nuggets here and there. And as the national capital, we've obviously been home to a disproportionate number of noteworthy historical figures over the years.

Learning From Trinity College

Great Kevin Carey piece about how one relatively obscure Catholic college for women produced a disproportionate share of high-achieving alumnae at a certain point in time:

[Cathie] Black wasn't the only one on Sister Claydon's radar. Other Trinity alumnae who have received notes in recent years include Kathleen Sebelius (Class of '70), the two-term governor of Kansas and current secretary of health and human services, and Nancy Pelosi (Class of '62), the first woman to serve as speaker of the U.S. House of Representatives and the most powerful female politician in American history. In fact, when Forbes magazine recently published its list of the 100 most powerful women in the world, only Princeton undergraduate alumnae outnumbered those of tiny, little-known Trinity College.

The Washington, D.C., area is replete with landmarks— Ford's Theater, the Watergate Hotel, the homes of Frederick Douglass and Red Cross founder Clara Barton—where, at a particular moment in time, history was made. There is no official placard marking Trinity College as such a site, but there probably should be. For roughly twenty years in the 1960s and '70s, the small, austere, and relatively obscure women's college graduated prominent female scientists, scholars, doctors, educators, judges, and public servants in numbers far out of proportion to its size. The true import of this achievement is only now being realized, as the school's graduates hit the pinnacle of their careers. The historic advances of last year's health care reform effort, for example, bear the fingerprints of an uncanny number of Trinity alumnae.

Fascinating read.

US Living Standards Are Lower That Most Americans Realize

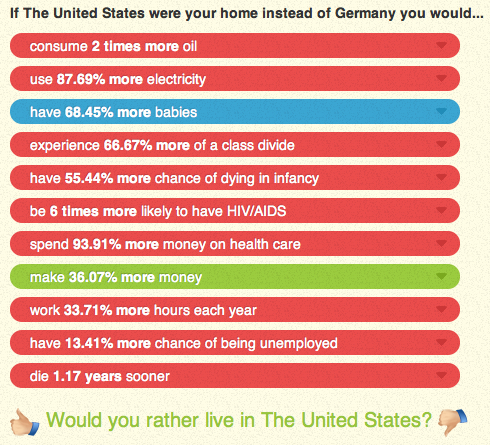

Via Tyler Cowen, a useful comparison of German and American living standards:

Cowen says he'll take America. And I would too. Not only do we have better food and music, but like Cowen I have a fun job and I'm in good health. Under the circumstances, the "work longer hours for more money much of which is clawed back by health care costs" trade looks okay. But differently situated people will look on this differently. What's important, I think, is that conventional American dialogue about this tends not to acknowledge how many countries there now are out there where the GDP per hour worked is at-or-near American levels and greater American output is caused by Americans working more. I'd say the Dutch seem to have outpaced us in material living conditions for the average person, for example. But the idea that it might even be possible for some other country to be more prosperous than the USA rarely seems to be considered.

Law & Order: Bloggy Intent

I've been called for jury duty today which, obviously, will interfere with posting. You should expect content at a reduced pace and of course if I'm put on a trial may be gone for a few days.

June 29, 2011

Sonia Sotomayor: An Appreciation

The first I ever heard of Sonia Sotomayor, I was having drinks with some progressive law professors and they were basically trashing her. They thought she'd be a likely Barack Obama Supreme Court nominee, and while they allowed that she was a demographically appealing Puerto Rican woman who'd likely reach the correct conclusions on points of constitutional and statutory interpretation, she wasn't "brilliant" enough for their tastes. This struck me as a possibly sexist viewpoint to take, but I also thought sort of a viewpoint that was besides the point. The Court plays a quasi-political role, and insofar as the justices do something important other than vote the right way, it's act as public figures who articulate a point of view. And here the essence of the problem is less to wow law professors than it is to engage persuasively with citizens. The kind of person who makes a successful law professor say, "wow she's be a really great law professor!" isn't really the same as the kind of person who'd be a great justice.

And as a great David Fontana piece at TNR explains, that's exactly what Sotomayor has done on the bench, using her standing as a Supreme Court justice to address not only narrow legal arguments but also broader audiences:

Many newspapers reported about her June appearance sponsored by the Juvenile Diabetes Research Foundation where Sotomayor "open[ed] up about her diabetes" with "heartfelt remarks." Two days before that, they covered Sotomayor throwing out the first pitch at Wrigley Field (appropriately wearing a Cubs jersey rather than a jersey of her beloved Yankees). Sotomayor is also at work on a book—but not one on legal theory. Instead, her publisher has revealed that it is a "coming-of-age memoir by an American daughter of Puerto Rican immigrants."

What's more, while some of her colleagues are known for communicating their messages primarily to elite audiences, Sotomayor has been speaking to a range of groups. She shared her perspective about persistent barriers to equality with audiences at several elite law schools and with a community college in the Bronx that helped her mother become a nurse several decades ago. During a visit in which she judged a moot court proceeding involving law students at Berkeley, Sotomayor also made a visit to a local elementary school with a commitment to diversity and a prominent foreign language program. She has also regularly visited with various groups who have come to see the Supreme Court, from special needs children to senior citizens to veterans.

I think that's good stuff. Supreme Court justices have relatively little in the way of formal incentives to show hustle or to expand the appeal of their brand. But Sotomayor appears to have genuine passion for her public role, and is articulating her vision not just to law professors who've made up their minds already, but to the kind of people who need to hear from role models and iconic figures.

Nancy Pelosi, Time Lord

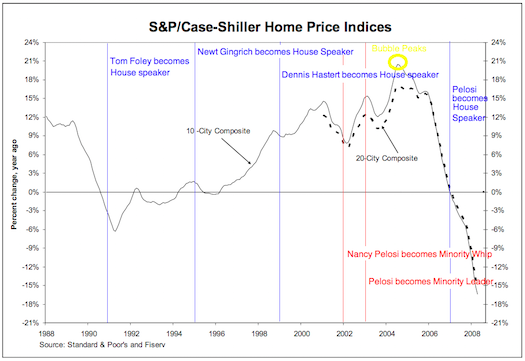

Mickey Kaus lauds Walter Russell Mead's argument that the real culprit in the Housing crisis was Fannie Mae and Freddie Mac, and the real culprits behind Fannie and Freddie are the liberals:

Reckless Endangerment gives the best available account of how the growing chaos in the mortgage and personal finance markets and the rampant bundling of dubious loans into exotically toxic securities plunged the world, and millions of American families, into the gravest financial crisis since World War Two. It is gripping reading as well, and its explanations are clear enough that readers without any background in finance will have no trouble following the plot. The villains? An unholy alliance between Wall Street, the Democratic establishment, community organizing groups like ACORN and La Raza, and politicians like Barney Frank, Nancy Pelosi and Henry Cisneros. (Frank got a cushy job for a lover, Pelosi got a job and layoff protection for a son, Cisneros apparently got a license to mint money bilking Mexican-Americans of their life savings in cheesy housing developments.)

Here's a helpful timeline I drew up that you shouldn't need an extensive background in political science to understand:

Are we supposed to believe that Pelosi did all this mischief from the minority bench of the US House of Representatives? That much of it happened before she even led the Minority caucus? That, if true, would be a genuinely extraordinary tale of how it is the President of the United States, the entire Senate, and the Speaker of the House were foiled in their efforts to overhaul the American financial system by Pelosi's wiles. Alternatively, maybe during her four-year spell as Speaker, Pelosi traveled back in time and forced the congress to forego appropriate regulation. Either way, it's an impressive show.

No, The American Recovery And Reinvestment Act Did Not Create The Tax Preference For Corporate Jets

President Obama, speaking today, sought to emphasize exactly how extreme congressional republican hostility to tax revenue is by repeatedly noting that they preferred defaulting on the federal government's obligations to even closing a tax provision that subsidizes the use of corporate jets. Naturally, since current conservative orthodoxy is that all measures to raise tax revenue constitute job destroying tax hikes, it is in fact the case that the right opposes curbing tax subsidies for corporate jets. But since that's embarrassing to them, some folks are putting out a new myth that the tax subsidy in question was created by the American Recovery and Reinvestment Act.

The truth is that, much as you would expect, the White House negotiating team isn't nearly that stupid. The source of the confusion is that congress passed a "bonus depreciation" law in 2008 as an economic stimulus measure, and ARRA continued it. This depreciation is a broad (albeit temporary) provision that includes to a wide range of capital goods including both commercial and corporate aircraft. By contrast, the tax break at issue in the negotiations is a 1987 provision of the tax code that allows corporate jets to be depreciated over a five-year period rather than the seven-year period required for commercial aviation. This is not something Barack Obama created, not something Barack Obama has ever supported, and not anything that has anything to do with the stimulus bill. It is, instead, a small but real subsidy that distorts the economy at the margin by encouraging large firms to invest in corporate jets rather than paying for commercial airfare.

We may be in for a dozen rounds of this kind of myth-making. The White House has put on the table the idea that we should raise tax revenue without necessarily raising tax rates. That means closing loopholes. But congressional Republicans say they're opposed to any increases in tax revenue. Now everyone knows that the tax code contains lots of unjustifiable loopholes, so the White House can gain a strong rhetorical upper hand by highlighting specific loopholes. Since the GOP has committed itself to defending each and every loophole no matter how absurd they're going to need to engage in a lot of desperate smokescreens like this to avoid engaging directly with the core question.

The Hard Road To Higher Ed Innovation

By Matthew Cameron

Yesterday's Brookings Institution event "PhDs, Policies and Patents" focused on ways the government can invest in research and technology that will spur innovation and lead to long-term economic growth. Although much of the discussion had to do with biomedical advancements and infrastructure development, the lessons from the conference relate to higher education as well. Specifically, there is tremendous potential to use online technology to lower the skyrocketing cost of college attendance. This is necessary because expanding access to higher education is a surefire way to boost innovation and the nation's economic prospects – individuals who graduate from college conduct more research, develop more technologies, and earn higher incomes than non-degree holders.

Unfortunately, a combination of skewed incentives, backwards priorities and traditionalist mindsets make this a difficult objective to achieve. Universities have little reason to cut costs because their reputations directly benefit from higher per student academic spending. So even if a school achieves cost savings without sacrificing quality – say, by replacing large, intro-level lectures with online courses – it will be regarded as less prestigious by many ranking methodologies. Public colleges face an additional problem. State support for higher education has declined steadily during the past few decades, and recent budget crises have exacerbated this trend. This means that if public schools save money by embracing online courses, state legislatures likely will view it as an opportunity to further reduce their appropriations to higher education. This means the benefits of cost savings would not accrue to students through reduced tuition but rather to state governments that could avoid raising taxes or cutting other services. Finally, university faculty view online technology as a threat to their role at the heart of the higher education system. This was evident during an exchange between George Mason University Prof. Tyler Cowen and Stanford University Prof. Tim Bresnahan at yesterday's conference. When Cowen raised the possibility of universities employing fewer professors once online courses are widespread, Bresnahan responded defensively by asserting that he does more than just teach.

Obviously, Bresnahan has a point – the specialized expertise and personalized guidance that professors can convey to students in higher-level college courses truly is indispensible. For entry-level lectures with hundreds of students, however, faculty members often don't do much more than teach. They don't grade papers, they don't meet their students and they aren't able to delve into the finer details of the subjects they teach. These classes aren't just a waste of students' money, however; they're also a drain on professors' time. If they were freed from their obligation to teach such classes, professors would be able to devote more effort toward their niche in the higher education system – stimulating students' intellectual curiosity through personal interactions and engaging learning experiences.

All of which is to say the problem the U.S. faces today isn't how to make higher education more affordable. Rather, it's convincing various groups that doing so will benefit them.

Nut Graf From Judge Sutton's Decision

This is, I think, the key paragraph:

The Court has upheld other federal laws that involved equally substantial, if not more substantial, incursions on the general police powers of the States and the autonomy of individuals. If, as Wickard shows, Congress could regulate the most self-sufficient of individuals—the American farmer—when he grew wheat destined for no location other than his family farm, the same is true for those who inevitably will seek health care and who must have a way to pay for it. And if Congress could regulate Angel Raich when she grew marijuana on her property for self-consumption, indeed for selfmedication, Raich, 545 U.S. at 6–7, and if it could do so even when California law prohibited that marijuana from entering any state or national markets, it is difficult to see why Congress may not regulate the 50 million Americans who self-finance their medical care.

To me, the beginning of wisdom on the Affordable Care Act litigation is just to start with the observation that lots of people think Wickard and Raich were wrongly decided. Which is fine. But "I want the courts to overturn existing precedents and strike down a new law" is different from "Congress has committed an unprecedented infringement of my liberty."

DeMint Won't Listen As Geithner Explains Why Failing To Hike Debt Ceiling Would Impair American Credit

Failing to increase the debt ceiling in a timely manner does not, as such, require the United States to default on the interest it owes on existing debt. The Treasury Secretary has the authority to "prioritize" payments and could, therefore, reneg on monies owed to defense contractors, Social Security recipients, doctors who treat Medicare patients, or anyone else who's legally entitled to funds Congress has appropriated. In terms of America's standing in international financial markets, this decision to pay bondholders rather than other legitimate claimants would probably be preferable, but as Treasury Secretary Timothy Geithner explained today in a letter to Senator Jim DeMint, that's not to say it would have no consequences.

For example, "There is no guarantee that investors would continue to re-invest in new Treasury securities" once it became clear that the US political process was prepared to stiff people who are owed money. Ratings agencies have already made it clear that they would regard any prioritization scheme with suspicion." And as Geithner says, "We should not and must not gamble with the full faith and credit of the United States," which is "too precious an asset to risk."

In response, DeMint essentially stuck his fingers in his ears:

Sen. Jim DeMint (R-S.C.) maintained Wednesday that the government has "numerous tools" available to avoid a default, and that one would only occur if Geithner was unwilling to use them.

"Secretary Geithner's approach to dealing with the looming debt crisis is to take his hands off the wheel and let the car careen over the cliff," he said.

This completely fails to grasp the force of Secretary Geithner's point. But to try to restate it, markets charge different interest rates to different sovereign states. Generally speaking, large high-income, politically stable sovereigns get the best rates. That's because large rich countries have the greatest ability to raise the funds needed to pay off debts, and politically stable countries are the most reliable in terms of actually living up to their commitments. And the United States, as the largest, richest, and longest-running political democracy in the world, pays the lowest rates. German rates are higher than ours, and Britain and France pay higher rates than Germany's. What Geithner is saying is that even if he avoids technical default by stiffing someone other than bondholders, this will still naturally lead some people to re-evaluate the theory that we're the most creditworthy country on earth. People who don't pay what they owe start looking like bad credit risks no matter who it is exactly who doesn't get paid.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers