Matthew Yglesias's Blog, page 2255

July 1, 2011

Laura D'Andrea Tyson Can't Possibly Be Treasury Secretary

I've heard some chatter that were Timothy Geithner to step down, Laura Tyson might replace him as Treasury Secretary but it's clear from what she's wrote today that she's far too sensible to be confirmed:

But with substantial excess capacity in the economy, there is no evidence that the federal deficit is driving up interest rates and crowding out private spending. What's slowing the pace of recovery is not too much government borrowing but too little private spending. [...] The primary cause of the jobs crisis is a lack of demand, the same problem that bedeviled the economy in the 1930s. Consumers, long the primary engine of economic growth in the United States, are in the midst of an unprecedented retrenchment. [...] But the overwhelming evidence suggests the opposite: when the economy has excess capacity, high unemployment and weak private demand, cuts in government spending reduce growth and eliminate jobs. [...] But in the next few years, the priorities of fiscal policy should be growth and jobs.

Crazy talk.

Corey Maye To Be Freed

Excellent news today from Radley Balko:

After 10 years of incarceration, and seven years after a jury sentenced him to die, 30-year-old Cory Maye will soon be going home. Mississippi Circuit Court Judge Prentiss Harrell signed a plea agreement Friday morning in which Maye pled guilty to manslaughter for the 2001 death of Prentiss, Mississippi, police officer Ron Jones, Jr.

Per the agreement, Harrell then sentenced Maye to 10 years in prison, time he has now already served. Maye will be taken to Rankin County, Mississippi, for processing and some procedural work. He is expected to be released within days.

Maye's story, a haunting tale about race, the rural south, the excesses of the drug war, the inequities of the criminal justice system and a father's instincts to protect his daughter, caught fire across the Internet and the then-emerging blogging world when I first posted the details on my own blog in late 2005.

You should read the whole story. It's really amazing stuff. Obviously Balko doesn't want to toot his own horn too much here, but it appears that he saved an innocent man's life in a completely extraordinary way.

The Alternatives To The Debt Ceiling Constitutional Option Are Also Open To Constitutional Question

As people continue to debate the legal issues surrounding the possibility that President Obama will simply cite constitutional considerations and refuse to abide by the statutory debt limit, one thing I want to bring into view is the fact that the legal dubiousness of this has to be weighed against the legal dubiousness of the other options. The conventional idea is that absent a debt ceiling increase, the Treasury Department should stop issuing new debt and start a process of payment prioritization by which the administration decides which bills get paid and which don't get paid.

This, however, seems to me to be illegal. The law says that senior citizens are entitled to their Social Security checks. The law says that funds have been appropriated for the Elementary and Secondary Education Act. Federal employees have contracts. Federal contractors also have contracts. It's not clear that anyone would have standing to sue if Obama refused to abide by the debt ceiling. But it seems perfectly clear that if the government promised to pay you to do some work, and then just doesn't pay you that you have grounds for a legal complaint. The president must "take care that the laws be faithfully executed" and the appropriations bills are real laws. Congress passed them. What you have here is a conflict between the government's legal obligation to pay money and the government's legal obligation to cease issuing new debts. Either path seems about equally arbitrary and illegal. The issue, after all, is that congress has passed contradictory laws. The tax code raises so much revenue, but legally authorized expenditures require so much money, and legally authorized borrowing doesn't cover the gap. So what's a president to do?

Canada Day

As a known Canadaphile, I feel obliged to recognize that today is Canada Day and mark the occasion with one of Canada's fine exported music videos:

Canada Day, for those who don't know, celebrates the passage of the British North America Act of 1867, later retconned to be known as the 1867 Constitution Act. This act amalgamated the previously freestanding colonies of New Brunswick, Nova Scotia, and Canada into a single federation. It also re-split Upper Canada and Lower Canada into separate provinces of Ontario and Quebec. Ironically, though the confederation talks were held in Prince Edward Island, the island wound up not liking the terms and stayed aloof from Canada for several years after the foundation of the country.

One of the main ideas of confederation, as I understand it, was fear that the United States would try to conquer the area. We forget it today, but America tried to conquer Canada during the Revolution and again during the War of 1812, and various related schemes were tossed around throughout the first half of the 19th century. The Civil War demonstrated the ability of the United States to forge a powerful central government and deploy its industrial might for military purposes, making confederation seem more urgent. Obviously, such conquest never occurred a fact that I, for one, lament.

This Old Housing Sector Subsidy

Via Greg Mankiw, a Pew survey on a much more consequential tax loophole than the corporate jet business:

Investment in owner-occupied housing faces an effective marginal tax rate of just 3.5 percent. In contrast, investment in the business sector faces an effective tax rate of 25.5 percent. This leads to a tax-induced bias for capital to flow into housing-related uses rather than other types of projects. As a result, businesses are less likely to purchase new equipment and less likely to incorporate new technologies than otherwise might be the case. Less business investment results in lower worker productivity and ultimately lower real wages and living standards. While the housing sector provides employment and has other positive effects on the overall economy and on society, the resources employed in the housing sector displace investment that would otherwise occur in the business sector were it not for the favored tax treatment of housing. The resulting distortion in the allocation of capital likely lowers overall output, because resources are allocated based on tax considerations rather than economic merit. In effect, the United States has chosen as a society to live in larger, debt-financed homes while accepting a lower standard of living in other regards.

It's worth emphasizing how different something like this is from a well-designed subsidy to ensure the availability of affordable housing. Two kinds of things render housing unaffordable. One is that some people have very low incomes. The other is that there are regulatory restrictions on how densely you can build houses on scarce land. If you relax those restrictions, the quantity of housing goes up and more people can afford it. And if you direct subsidies at poor people as opposed to richer people, then their ability to afford housing goes up. But the home mortgage interest deduction "upside down" and gives you more subsidy the richer you are. The upshot, as Pew says, is much more about encouraging people to invest in bigger homes rather than smaller ones than it is about making housing affordable to the marginal family.

Higher Speed Rail

Phil Longman makes the case that what America needs is not so much true high-speed rail as incremental improvements to existing mid-speed rail:

This principle is also illustrated by Amtrak's highly successful "Cascades" service on the 187-mile line between Portland and Seattle. The Spanish-designed Talgo "tilt" train sets look futuristic, and with their on-board bistros and comfy chairs they are a joy to ride. But because they run on conventional track through mountainous country shared by freight trains, their current top speed is only 79 mph, and their average speed is just 53. Still, that's enough to make taking the train faster than driving, and ridership has swelled to more than 700,000 passengers a year. Using federal stimulus dollars plus state spending, work is currently under way to boost top train speeds to 110-125 mph, simply by adding better signaling and more sidings to let freight trains get out of the way. This incremental investment will also boost reliability and allow for increased frequency, which will further bump up ridership. But numerous studies show there is no point in making trains go faster than 125 mph on a segment this short because of the great cost involved and the limited gains to total trip times. Moreover, if a new bullet train line were built between Portland and Seattle, the tremendous cost of its construction would require fares too high for all but well-heeled business travelers to afford.

I think that's more or less correct. The current state of passenger rail in the United States is sufficiently lousy that there's plenty of room for incremental engineering improvements rather than dramatic new best-in-the-world projects. But the best case for incremental improvements is probably that until we sort out things like wildly overprescriptive FRA safety regulations it's all genuinely new projects are going to be way less cost effective than they could be.

That said, I do find the whole conversation slightly frustrating. The United States is a really big country. You wouldn't hear a debate in "Europe" about whether "Europe" should be building a train from Madrid to Barcelona "or" a train connecting the cities of the Rhineland. Nothing about doing a Portland-Seattle upgrade actually prevents you from building a brand new true HSR connection elsewhere in the country. The overall pot of infrastructure spending money in the United States is currently too low, which prompts a bunch of should-be-avoidable conversations about project priority.

Awesome Sauce

I try not to spend my life consumed with envy for super-successful businessmen, but I like that if Mark Zuckerberg says he'll make an "awesome" announcement next week not only will the announcement be covered but even the announcement of the announcement garners attention:

Chief Executive and founder Mark Zuckerberg told reporters in a visit to Facebook's Seattle office on Wednesday that the company planned to "launch something awesome" next week.

Awesome.

Will China Face A Sovereign Debt Crisis?

I say no. China is a giant country with nuclear weapons. But apparently some analysts don't see it that way:

"Last year, 55 percent of GDP was contributed by infrastructure investment — in other words bank lending," said Carl Waters, an American investment banker until recently based in China and co-author of "Red Capitalism." "If you keeping making bad loans that don't pay back, you're going to run out of money sooner or later." [...]

"China is already rapidly becoming significantly leveraged," said Waters. "If you look at what happened in Greece or Ireland or Portugal when a country is leveraged, it has to borrow more and more to meet its interest obligations. That makes it less and less possible to invest in projects that will grow your GDP."

Analogies between the situation facing Greece, Ireland, and Portugal and the situation facing China strike me as totally confused. One thing that can happen to a country (call it Iceland) is that foreigners might become willing to lend lots of Euros to your businessmen. Those businessmen might then invest those Euros in funding business activity that leads to a lot of economic growth. But then people lose faith in the future of your growth, especially once they recognize how much of it is based on inflows of foreign capital that are based on assumptions of high future growth. Then they stop lending you the money, and you have a crisis on your hands. Icelandic people owe more Euros to foreigners than they have. The result is some form of default, followed by a collapse in the value of your currency, a big shock to real living standards, and then you rebuild. If your country is Ireland or Portugal or Greece, you can add to the list of problems that your currency can't collapse because you're using the Euro. You might also be bound up in a set of political arrangement with Germany and France that allow them to coerce you into not defaulting.

China, whether or not you think it's economy is heading for a crash, has none of those characteristics. China has not seen large net inflows of foreign capital. Indeed, China has a giant stockpile of foreign reserves. China does not have an overvalued currency, it has an undervalued one. And if you look at issues ranging from currency valuation to the Dalai Lama it's perfectly clear that nobody can coerce the Chinese government into doing anything it doesn't want to do.

China's actual economic problems are, if you ask me, fairly banal and interesting primarily because of the scale of the country. A lot of places experience rapid growth and then fall into a "middle income trap" once the thing they've gotten really good at, low wage export-oriented manufacturing growth, stops working as a source of future growth. The PRC leadership is well aware of this problem and is trying to avoid it, but it's not clear that they'll succeed. And since over a billion people live in China, it's a really big deal. But it is what it is. China is growing very fast. It might stop growing very fast. But it's not going to have a Greek-style crisis because China is nothing like Greece.

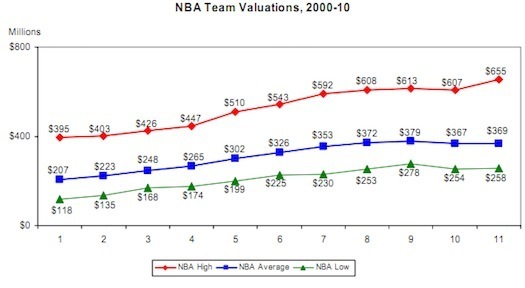

Almost All NBA Team Owners Have Made Profitable Investments

Michael Wilbon's curtain raiser on the NBA lockout repeats the sin of looking at the fiscal state of sports-related firms with reference to their annual cash flow:

The NBA, meanwhile, has teams losing real money. The league says 22 of 30 are operating in the negative; the players association would surely say it's fewer than that. Either way, it's reasonable — if not downright inescapable — to conclude there are NBA teams awash in red ink.

Normally when we talk about firm performance we make at least some reference to share prices or other measures of equity value. This is especially true when we're talking about owners who are, by definition, the people who own the equity. Microsoft is considerably more profitable than Twitter, but someone who bought a large stake in Twitter four years ago is in much better shape than someone who spent an equivalent sum buying a stake in Microsoft. I would say that this is especially the case when it comes to something like these sports teams since the accounting profit or loss can be easily manipulated. For example, the Washington Wizards are owned by the same corporate entity that owns the Verizon Center in which they play. By shifting around the Wizards' rent payments to the arena you can manipulate the team's cost structure in arbitrary ways. Similarly, if I owned a profitable team and wanted to make the profits go away I might hire myself and my friends at high salaries. None of this speaks to the actual value of owning the firm. What's more, a sports team isn't like a dry cleaning business. Owning and managing a basketball team would be fun. If Ted Leonsis offered to gift me the Wizards with the proviso that the team loses $10,000 a year that would come out of my pocket, I'd leap at the opportunity. Indeed, the number of people who would like to own an NBA franchise far exceeds the number of NBA franchises available. Which is why WR Hambrecht's comprehensive analysis (PDF) of the financial stake of pro sports teams in the United States confirms the obvious point that NBA teams have a large and positive equity value:

When you think about it, the remarkable thing about pro sports is that it's possible to make any money at all owning teams. If someone put the New York Knicks up for auction under the condition that any profits the team makes will be annually stacked up in Madison Square Park (former home of the Garden!) and lit on fire, I would expect to see a large number of bids by consortia of wealthy NYC-area basketball fans. Under the circumstances, it's interesting that in recent years the vast majority of NBA owners have actually been making profitable capital investments:

It's particularly worth noting that several of the teams who've lost the most franchise value have been fairly catastrophically mismanaged (I'm looking at you Minnesota), which is hardly the NBAPA's fault. All things considered, the vast majority of the owners have nothing to complain about in terms of their financial fortunes over the past few years (years that have been unkind to the finances of many Americans!) and among the minority who may have "lost money" in some real sense, most primarily have themselves to blame and all are in possession of valuable financial assets. Even the lowly Memphis Grizzlies are estimated to be worth $266 million.

[UPDATE] Here's a very useful post from Deadspin about how profits can turn into losses via the magic of accounting. There's not even anything particularly dishonest about this. There's a reason that accounting is a profession. You can't just look at a firm in terms of naive cash flow, but once you go beyond that deciding what is and isn't profitable gets complicated. The question "how much would I have to pay to take this team off your hands," by contrast, admits of a fairly unambiguous interpretation.

The Problem Of The Older Unemployed

Recessions tend to lead to higher unemployment among the young than the old. But older workers have more severe problems. As Naomi Cohn writes:

Like my readers, despite my persistence, I could not find a job. In all that time, I had about half a dozen interviews. Most of them were conducted by men who were significantly younger than me. Some of my interviewers asked questions that revealed their possibly unconscious age discrimination. One, for example, asked nonchalantly, "so, how old are your kids?" It was clear in most of the interviews that they were looking for someone with whom they would feel comfortable socially — and a fifty-two-year-old woman was not that person.

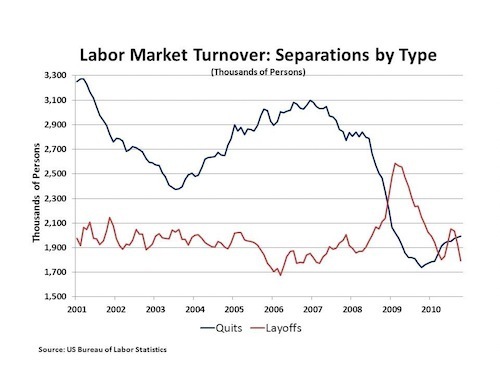

It's also worth noting that there's a special problem here in a non-recession context. If you look at the JOLTS data, it's clear that even during periods of healthy growth, plenty of people get laid off. A recession doesn't so much reflect a spike in people leaving their jobs as much as it does a collapse in new hiring. Indeed, people get so afraid to quit during a recession that quits + layoffs actually declines and the unemployment increase is on net entirely a matter of nobody getting hired:

So what's the deal with these people who get laid off during a period of economic growth? Well, if you're 25 and working in a low-level job at a firm that goes out of business because the managers made some bad decisions, then if there's no recession you can probably just get a low-level job at some better managed firm that's hiring. But if you're 55, you probably get paid more than you did 30 years ago. That greater pay represents, in part, firm-specific knowledge and skills that you've developed. And now that you've been laid off due to firm mismanagement, the value of those skills has declined sharply and you're only qualified for jobs that a younger, less-skilled person version of yourself would have been qualified for. But that younger-version of you wasn't just less-skilled he was also younger, and it thus made more more sense for firms to invest in your training and skills. This gets even worse if you're thinking about people who are victims of industry collapse rather than firm collapse. Being good at managing an evil soulless chain record store like HMV was a very valuable skill acquired through years of hard work, until suddenly it was nearly worthless.

To an extent, this is just the nature of life, and you wouldn't want an economy in which mismanaged firms didn't go out of business and technological change didn't upend industries. But it does reflect one of the myriad problems with the idea of raising the Social Security age, an idea that's curiously punitive to the worst-off and most unlucky people. What's more, it highlights the case for some further expansion of the welfare state into some form of comprehensive wage insurance to mute the impact of these kind of shocks on ordinary people.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers