Jonathan Clements's Blog, page 286

June 9, 2021

Good Not Great

But don't be fooled: While I bonds are a fine choice for super-conservative investors, you'll get that 3.54% annualized yield for just six months and thereafter the yield could be far lower.

I bonds feature a variable interest rate that floats with inflation. That floating rate resets each May and November based on recent inflation. The latest adjustment moved the annualized floating rate up from the Nov. 1, 2020, figure of 1.68%.

There���s also a fixed rate component to the bonds���a yield over and above inflation���but that yield is zero for I bonds bought during the current six-month purchase period, which started May 1. In other words, if you purchase I bonds today, your pretax return will equal the inflation rate.

We���ve all seen the recent headlines about rising prices. Home values, food, raw materials and even wages are seeing upward pressure. Economists at Bank of America Global Research expect 12-month inflation to peak at 3.7% in February 2022. For 2021 and 2022, Bank of America sees core inflation, which excludes food and energy, to hum along at 2.9% and 2.7%, respectively.

While simply matching inflation doesn���t seem so bad when savings accounts, money market funds and many high-quality bonds are yielding less than inflation, I bonds come with drawbacks. Here are key facts you need to know about I bonds:

We don���t know what the rate will be at the Nov. 1 reset. The new annualized rate could be well below the current 3.54%.

When you redeem an I bond or when it matures, the interest is taxable at the federal level, but it isn���t subject to state and local taxes. That makes I bonds more attractive if you live in a high-tax state. But wherever you live, the net result is that, if you buy I bonds today, your after-tax return will be less than the inflation rate.

You���re limited to purchasing $10,000 of I bonds each calendar year. You can push that $10,000 annual limit to $15,000���but only if you have a $5,000 federal tax refund that you use to buy I bonds.

You can���t sell an I bond in the first 12 months after you purchase. Meanwhile, if you redeem in the first five years, you lose the last three months of interest.

Let���s say you bought $10,000 of Series I bonds today and wanted to sell after a year. What���s your net return? We���ll assume the interest rate stays the same at the November reset. If you invest $10,000 at 3.54%, you���d earn $354, but you would give back a quarter of the interest due to the early redemption penalty. That would leave you with 2.655%. You would then have to pay tax on the $265.50 in interest. If you���re in the 22% federal tax bracket, you���d be left with a 2.07% after-tax return���not exactly the road to riches, but not bad for a pretty much no-risk investment.

By contrast, the current SEC 30-day yield on the iShares Core U.S. Aggregate Bond ETF (symbol: AGG) is 1.33%, which would be 1.04% after-tax, assuming a 22% rate. The ETF could also suffer a capital loss if interest rates head higher.

The bottom line: Series I savings bonds look appealing and strike me as an okay investment for conservative investors. But don���t count on earning 3.54% for years to come. Moreover, compared to the iShares fund, we���re talking about perhaps a 1% net return difference on a $10,000 investment over the next year, equal to $100. That���s nothing to sniff at���but there are probably bigger financial issues to focus on.

Mike Zaccardi is an adjunct finance instructor at the University of North Florida, as well as an investment writer for financial advisors and investment firms. He's a CFA�� charterholder and Chartered Market Technician��, and has passed the coursework for the Certified Financial Planner program. Follow Mike on Twitter @MikeZaccardi, connect with him via LinkedIn, email him at MikeCZaccardi@gmail.com��and check out his earlier articles.

Mike Zaccardi is an adjunct finance instructor at the University of North Florida, as well as an investment writer for financial advisors and investment firms. He's a CFA�� charterholder and Chartered Market Technician��, and has passed the coursework for the Certified Financial Planner program. Follow Mike on Twitter @MikeZaccardi, connect with him via LinkedIn, email him at MikeCZaccardi@gmail.com��and check out his earlier articles.

The post Good Not Great appeared first on HumbleDollar.

June 8, 2021

Happy I Had Medicare

When he responded, ���No, you're not,��� I knew this wasn���t going to go well.

I gave him my explanation of what might be causing my physical condition. After listening intently, he said, ���I���m not buying it. I don���t believe what you���re telling me. That���s not what���s causing your problem. We need to run some tests on you.��� He also suggested I see a specialist. Between the two of them, they ran me through a month-long battery of tests, one after another.

I tried to remain positive by telling myself there���s nothing seriously wrong with me, because I take good care of myself. But after a while, the unknown began to wear me down and my mind went to places I didn���t want to go.

I started going over my finances to make sure everything���s in order. I thought, ���I���m glad my wife and I consolidated our financial accounts. It'll make it easier for her to manage if something unexpected happens to me.��� I thought of things around the house that needed to be addressed. I fixed the annoying garage door that seems to have a mind of its own. Another thought that kept banging around inside my head: Maybe I should have claimed Social Security at an earlier age.

I kept my medical adventure to myself, telling only my wife and a close friend who���s fighting his own health care battles. My reason: I just wasn't ready to share it with anyone else.

As I went through this medical ordeal, I was glad I���d chosen federally run Medicare instead of opting for Medicare Advantage, the private insurance alternative. Because I have traditional Medicare, I didn���t have to wait to get approval for any of the tests and for my appointment with the specialist. Also, I wonder if Medicare Advantage would have approved all the tests that my doctors recommended. Even if a Medicare Advantage plan had approved them, how long would it have taken and how much would the co-payments have been? These are the types of things you don���t think about until something happens to you.

Medicare Advantage is okay if you're fairly healthy. But if you have something seriously wrong, you���re relying on a private insurer with a network of doctors to provide you with timely, adequate and affordable health care. With traditional Medicare, you have more control over health care decisions. For instance, I could have easily gotten a second opinion or changed doctors if I were dissatisfied. That alone greatly eased my mind while going through this ordeal.

At this point, my medical problem seems to have gone away and, so far, they haven���t found anything wrong with me. I can see the light at the end of the tunnel.

My specialist, however, wanted to run one more test on me to make sure something hadn���t gone undetected. Before he starts the exam, he explains that I���m going to feel some discomfort. To help me feel more at ease, he and his assistant talk to me while they perform the procedure.

The assistant is a young man going to the University of California, Irvine. He begins the conversation by asking me if I have any vacation plans and what I do for fun. He tells me he���s applying for medical school and has been writing a lot of essays. I tell him I do some writing myself.

This catches my doctor���s attention, who finally speaks up. ���What do you write about?��� he asks.

���I write about personal finance,��� I say. There���s dead silence for about a minute. There are no follow-up questions. I get the feeling that my doctor and his assistant are disappointed. They were probably hoping I wrote about something more exciting. Then again, maybe they think that, at this moment, there are more important things to discuss than money.

Dennis Friedman retired from Boeing Satellite Systems after a 30-year career in manufacturing. Born in Ohio, Dennis is a California transplant with a bachelor's degree in history and an MBA. A self-described "humble investor," he likes reading historical novels and about personal finance. Check out his earlier��articles��and follow him on Twitter @DMFrie.

Dennis Friedman retired from Boeing Satellite Systems after a 30-year career in manufacturing. Born in Ohio, Dennis is a California transplant with a bachelor's degree in history and an MBA. A self-described "humble investor," he likes reading historical novels and about personal finance. Check out his earlier��articles��and follow him on Twitter @DMFrie.The post Happy I Had Medicare appeared first on HumbleDollar.

June 7, 2021

A Better Retirement

I recently passed a milestone: the three-year anniversary of the day I left my 40-year banking career. What have I learned over the past three years? I’ve found that a good retirement has three key elements: sound finances, wellness, and intentionality about managing time.

1. Finances. I watched some of Berkshire Hathaway’s annual meeting last month. As usual, Warren Buffett was a master teacher. He showed the top 20 companies in the world as of 1989. His point? Not one of those companies is in the top 20 today.

He also showed the top 20 companies today. It’s an impressive list. We might think of them as great companies to own for the next 30 years. But if history offers any lesson, it’s that most—and perhaps all—will lose their dominance.

That made me think about my own finances. I probably have an actuarial life expectancy of 20 years or so. My wife is a few years younger, so—to be conservative—I think we should use a 30-year investment planning time horizon. Given the demise of the 20 largest companies over the past 30 years, what’s a good plan for managing our exposure to stocks over the next 30 years?

Buffett’s example made clear the compelling logic of owning low-cost index funds that invest in all publicly traded stocks. As some giant companies fall, others will emerge. As index investors, we will profit by participating in this creative destruction. We will own the next Amazon or Apple.

Buffett has said his estate plan calls for trustees to invest 90% of his assets in a low-cost S&P 500 index fund. My portfolio has a little more diversification, including a total world stock index fund. As innovation and prosperity spread to other countries, it makes sense to me to diversify outside the U.S.

One caveat: I don’t want my day-to-day bill paying to depend on stock market performance. That would be too stressful. I like a retirement income plan that also uses Social Security, any pension income and other fixed income-like annuities to pay ongoing bills.

2. Wellness. Humans have no doubt looked for a fountain of youth ever since they discovered they were aging. But it’s reached a new frenzy with baby boomers like me. I’ve been through enough diets, supplements and exercise routines to write a book.

The pursuit of eternal youth is epitomized by the $1 million that’ll go to the winner of the Palo Alto Longevity Prize. It’s called “a science competition dedicated to ending aging.” To my knowledge, no one has collected yet.

If there’s a way to hold off the frailty that comes with aging, I’d like to participate. But—aware that frauds work most effectively with those looking for miracles—I also know that selling anti-aging wares can be a fertile field for scammers.

My advice: Treat this subject the same way you handle your finances. As an investor, I keep an eye on current events. But I seldom act on anything except advice from financial experts I trust.

Similarly, there are exciting developments in anti-aging that are worth keeping an eye on. I’m intrigued by the emerging science of senolytics that tries to remove harmful cells that afflict the elderly. It shows some promise, but it’s probably years away from being anything that you and I can benefit from.

On the other hand, there’s a lot of trusted, actionable advice we can immediately implement. A pain doctor told me his healthiest patients are hikers. I frequently go for long hikes, as well as regularly visiting the gym. Nutritionists consistently advise eating lots of natural foods for their vitamin and mineral content. That’s also good advice.

But whenever we’re tempted to buy into a new health craze or an incredible investment opportunity, it’s good to remember the story of Stephen Greenspan. He wrote a book on gullibility, including how to avoid it.

Unfortunately, shortly after the book was published in 2008, it was revealed that he was an investor in Bernie Madoff’s Ponzi scheme. If a gullibility expert can be duped, clearly the rest of us need to be on our guard.

3. Managing time. I love no longer going to the office five or six days a week. But I need something to look forward to each morning besides coffee. Among the unhappy retirees I’ve talked to, most are bored because they don’t have anything to do. That can usually be fixed.

If you’re searching for ideas for how to spend your time, think about old interests you weren’t able to pursue in the past. My quirky desire: Learn more about Western philosophy. I’m up to my neck trying to understand Thomas Aquinas’s view of natural law. I’m sure that sounds weird to most people, but that’s the point of retirement. We can pursue interests unique to who we are.

Joe Kesler is the author of

Smart Money with Purpose

and the founder of a

website

with the same name, which is where a version of this article first appeared. He spent 40 years in community banking, assisting small businesses and consumers. Joe served as chief executive of banks in Illinois and Montana. He currently lives with his wife in Missoula, Montana, spending his time writing on personal finance, serving on two bank boards and hiking in the Rocky Mountains. Check out Joe's previous articles.

Joe Kesler is the author of

Smart Money with Purpose

and the founder of a

website

with the same name, which is where a version of this article first appeared. He spent 40 years in community banking, assisting small businesses and consumers. Joe served as chief executive of banks in Illinois and Montana. He currently lives with his wife in Missoula, Montana, spending his time writing on personal finance, serving on two bank boards and hiking in the Rocky Mountains. Check out Joe's previous articles.The post A Better Retirement appeared first on HumbleDollar.

June 6, 2021

Taking Sides

Last week, I mentioned that Ray Dalio, a prominent hedge fund manager, had recently said that bonds ���have become stupid.��� I disagreed, but not because of the facts. There���s no disputing the impact of today���s low rates. But I think the wisdom of owning bonds depends on what you���re trying to accomplish. If you���re a hedge fund manager like Dalio, your objectives will be different from those of an individual investor. For a hedge fund, maybe bonds��are��stupid. But for an individual investor, they might make a ton of sense. It���s a matter of perspective.

Below are five other issues that I also see as matters of perspective.

1. Asset allocation.��Investment advisor and author William Bernstein is often��quoted��as saying, ���When you���ve won the game, stop playing.��� In other words, if you���ve already accumulated enough savings to meet your needs���or if you���re on track to���then you should dial back your portfolio���s risk. There���s no sense continuing to take risk when you don���t need to. Warren Buffett has��expressed��the same sentiment: ���It���s insane to risk what you have and need in order to obtain what you don���t need.���

Suppose you���ve saved $5 million for retirement and only need $100,000 on top of Social Security to meet your expenses. With these numbers, implying a modest 2% withdrawal rate, you���d be in great shape. If you took Bernstein���s approach, you would manage your portfolio conservatively to avoid jeopardizing that strong position. But some might reach precisely the opposite conclusion, reasoning that with $5 million in the bank and modest needs, you could afford to take��more��risk.

What���s the right answer? My view is that there isn���t one. It will depend on your goals and what���s most important to you. Are stability and security most important, or are you looking to grow your portfolio as much as possible? Where you come out on this question is an entirely personal decision.

2. Alternative investments.��David Swensen was the longtime manager of Yale University���s endowment before he passed away recently. Swensen was a pioneer in developing��complex��investment strategies. But in a��book��he wrote for individual investors, Swensen advocated the exact opposite approach. His advice: Buy simple, low-cost index funds and steer clear of complexity.

Swensen had concluded that individuals simply didn���t have the resources to pursue the same strategies that worked for an endowment. Many investors have accepted this message and don���t pursue complex strategies. But nothing is absolute. I know plenty of individuals who have done well with private equity, angel investments and other non-standard investments, including cryptocurrencies.

I still don���t recommend such investments. But I don���t think anyone can say they���re wrong per se, especially if you���re at the stage I referenced above, where you can afford more risk. It���s a matter of perspective.

3. Retirement income.��When claiming Social Security, the math says that most people will benefit by waiting until age 70, when they can collect the largest possible monthly check. Personally, that���s what I usually recommend. But I appreciate that there���s another point of view.

Some people who try to wait until 70 are filled with financial stress during their 60s as they wait for their 70th birthday. In my view, that���s hardly a victory. This is another case where it isn���t just about the math. As long as you aren���t jeopardizing your plan by claiming��too��small a benefit��too��early, no one should say in absolute terms that it���s wrong to start benefits a little earlier. As with bonds, perhaps you���re giving up some number of dollars, but you���re also gaining something in return: stability and peace of mind. It���s a matter of perspective.

4. Prepaying mortgages.��Among the questions I get most frequently: If I can afford to pay off my mortgage, should I? This question is tricky, I think, because it seems like a straightforward financial decision. But when it comes to your home, no question is purely financial. There���s always an emotional component.

For that reason, I���ve observed a spectrum in how people think about mortgages. Some point to the numbers and conclude that they���re better off borrowing as much as they can when rates are low. That would allow them to invest more productively elsewhere. But others don���t care what the numbers say. They derive so much satisfaction from being debt-free that they never give a second thought to the potentially more productive investments that they gave up. Again, neither of these points of view is necessarily right or wrong. It���s a matter of perspective and what matters most to you.

5. Estate planning.��Today, the federal estate tax stands at a hefty 40% for families whose assets exceed a certain threshold. If your family is in that category���or expects to be���there���s a clear incentive to pursue tax-saving strategies.

But other families aren't as aggressive. They see these strategies as adding unwanted complexity to their lives. It's true that implementing these kinds of strategies requires upfront time and cost. In addition to legal fees, there���s the mental energy of moving assets around and tracking those changes. There are ongoing costs, too. An irrevocable trust, for example, requires an independent trustee���and trustees generally like to be paid. In addition, these trusts require their own tax return.

For those reasons, I have seen more than one high net worth family decide that they don���t want to spend their days working on estate planning. Instead, they simply accept that some part of their assets will be paid to the government. Or they structure things so that any amount that can���t pass tax-free to their children will be donated to charity. What's the right answer for your family? Again, it depends on your priorities. It's a matter of perspective.

Adam M. Grossman��is the founder of Mayport, a fixed-fee wealth management firm. In his series of free��e-books, he advocates an evidence-based��approach to personal finance. Follow Adam on Twitter @AdamMGrossman��and check out his earlier articles.

Adam M. Grossman��is the founder of Mayport, a fixed-fee wealth management firm. In his series of free��e-books, he advocates an evidence-based��approach to personal finance. Follow Adam on Twitter @AdamMGrossman��and check out his earlier articles.The post Taking Sides appeared first on HumbleDollar.

June 5, 2021

Life Cycle

I started cycling seriously in 2005, when foot problems forced me to cut back on running. That was the year I bought my ���starter��� bike���part aluminum, part carbon���purchased for $1,000 from a bike shop that was going out of business. Within a few months, I added the special pedals with the shoes that clip in.

Early on, I had my fair share of embarrassing falls, the result of stopping suddenly but failing to escape the pedals, which would leave me lying on the ground, my feet still firmly attached to the bike. But those weren���t my six accidents. Instead, these were the six:

I hit a pothole and went over the handlebars. I briefly thought, ���so this is what it���s like to fly,��� before landing on my chin. I immediately sat up and had this terrible sense that, when I opened my mouth, all my teeth would drop out. They didn���t.

I went around a corner too fast and the bicycle slipped on gravel. I landed hard on my hip but got back up and rode 25 miles. Later that day, while having dinner with friends, I felt something growing in my khakis. It turned out to be a massive hematoma on my right hip. The emergency room doctor was impressed.

The big one was 2011. The bicycle slid out from under me while crossing a wet metal bridge. I briefly lost consciousness and got an ambulance ride to the nearest hospital, where my face needed a dozen stitches and an x-ray found I had a broken shoulder blade. But the big issue turned out to be my left hand, which needed to be surgically repaired. The accident was the inspiration for my novel 48 and Counting . Some readers loved it, others not so much.

In 2016, as I was approaching a traffic light, my bicycle started fishtailing like crazy. It turned out someone���a leaky truck, I presume���had dumped a bunch of oil on the road. I deliberately forced the bike to the ground, rather than careen into the intersection, and was rewarded with some handsome bruises and oil from head to toe.

Last year, I had to stop suddenly, tumbling off my bicycle and badly cutting my elbow, which I bandaged with the mask I was carrying. The good news: I avoided the car that was about to hit me.

Last week, a van suddenly appeared in front of me as I entered an intersection. I had the right of way���there was no stop sign for me���but that���s scant comfort when you have an altercation with a far larger vehicle. The apologetic driver said he couldn���t see me because his view was blocked by a truck on the side of the road. I hit the van���s side and ended up on the asphalt, with a few cuts and bruises, or what cyclists call ���road rash.��� Fortunately, neither the van nor I were going especially fast. I walked the bike home, straightened out the handlebars and then headed back out for my 20-mile ride. (You know what they say about getting back on the horse.)

As I recount this history, I can imagine what you���re thinking, because I���m thinking it, too. Six accidents in 16 years? This guy is going to get himself killed. And, indeed, that���s how my 75-year-old father died in 2009, struck by a speeding car while riding his bicycle in Key West, Florida, where he had lived for the prior 15 years.

When I was at boarding school in England, I never thought of myself as an athlete. Quite the opposite. I was the small kid who was relentlessly bullied, in part because I had this strange half English, half American accent. But in my 30s, I discovered I could run long distances at a decent clip and, ever since, I���ve prided myself on staying in shape. But it���s now dawning on me that the rewards may no longer be worth the risk, and I need to find a kinder, gentler way to exercise.

What does this have to do with money? I have the same thought about my stock-heavy portfolio. Are the potential rewards still worth the risk?

I must confess, I don���t much care for growing old. Yes, it���s better than the alternative. But I hate the sense that parts of my life are slowly getting taken from me. I have to be more careful about what I eat. I can no longer run regularly. I don���t sleep as well. I can no longer invest solely for the long term. It seems age brings with it a host of drawbacks, all fraught with reminders of our mortality:

Rising caution. Whether we own a bicycle, a computer, a car or a stock portfolio, there���s a good chance that there���s a crash somewhere in our future. The question is, how bad will it be���and can we cope with the fallout?

I���ve long been a fairly fearless stock market investor, keeping a high percentage of my portfolio in stocks and happily buying during market declines. But I realize I need to temper my appetite for risk, because the time is fast approaching when I���ll be living largely or entirely off my savings.

Diminishing ability. As I discussed in early May, I���ve started to ponder the implications of the reduced physical and mental ability that come with advancing age. I���ve already traded down to a smaller home and I���m planning to radically simplify my finances.

Shrinking time. Fingers crossed, I���m hoping for another 25 to 30 years. But how do I want to use that time? At some point, most of us will decide we���ve had enough career accomplishments and it���s time to devote more hours to parts of our life that we���ve neglected. When I was a teenager, I would merrily lose myself in a novel for an entire day. I can���t imagine finding the time to do that right now���but I wouldn���t mind trying it again one of these days.

Declaring victory. How much money is enough? This is both a career and an investment question. When do we quit earning an income and when do we stop focusing on an ever-larger net worth? I don���t have a good answer. But I find I���m thinking less about accumulating more���and more about enjoying what I have.

Latest Articles

HERE ARE THE SIX other articles published by HumbleDollar this week:

Suppose you pay 1% in annual fund expenses and 1% for financial advice. How much would it cost you over a lifetime of investing? John Lim runs the numbers. They aren't pretty.

"I���ve seen life dry up for people, no matter whether they���re rich or poor," writes Don Southworth. "When we say 'no' to our dreams, to the adventures of spirit and life that beckon to us, a little bit dies inside."

Retired and looking to borrow? As Jiab and Jim Wasserman discovered, if you don't have a regular income, it's tough to get approved for a loan, no matter how big your nest egg.

Dick Quinn considers himself thrifty. But even he balks at the frugality embraced by some followers of the financial independence/retire early (FIRE) movement.

"The role of bonds is to provide downside protection," says Adam Grossman. "When stocks were down more than 30% last year, retirees who needed cash hardly worried whether their bonds had lost a few percent to inflation."

Bitcoin, inflation and meme stocks may have others transfixed. But at HumbleDollar, readers seem more interested in the nitty-gritty of personal finance. Check out May's seven most popular articles.

Jonathan Clements is the founder and editor of HumbleDollar. Follow him on Twitter @ClementsMoney and on Facebook, and check out his earlier��articles.

Jonathan Clements is the founder and editor of HumbleDollar. Follow him on Twitter @ClementsMoney and on Facebook, and check out his earlier��articles.The post Life Cycle appeared first on HumbleDollar.

June 4, 2021

Show Me the Cash

The upshot: We decided to purchase some rental properties. We have one rental unit already���our former home���but we plan to make it our home once again. With the help of our property manager, Jeannette, who is also a realtor, we searched for and found one property we liked, and with a price that was already reasonable but which we hoped to negotiate lower. We thought we could jump to the front of the buyer���s queue by offering cash. Jeannette said we would need to show the seller proof of sufficient cash on hand.

That���s when the problems arose.

We didn���t want to just show our Vanguard Group brokerage statement, because that would tip the seller as to how much cash we had available, likely making her hold firm on the price and reject our request to pay for improvements in the heating and air conditioning system. Jiab called Vanguard to inquire if the folks there would issue a ���line of credit��� letter for the amount we wished to offer.

We had more than enough cash to buy the property three times over and we could have borrowed the necessary sum using a margin loan���and yet they declined. They didn���t want to take the risk of backing us, despite the cash they were so graciously holding for us.

Not to be thwarted, Jiab called around to see if we could quickly qualify for an investment loan for the amount we wished to offer. We didn���t need the loan, but we could use a preapproval letter to show the seller our ability to pay.

We didn���t qualify, even with our 800-plus credit scores.

Apparently, real estate loan systems are set in formulaic stone, where the key factor is the loan-to-income ratio. As retirees, our income is low. Wealth���as in cash on hand���apparently doesn���t factor into the formula. Our sons, who are just starting out in the work world and so have a solid income but no accumulated wealth, could better qualify for a loan than we could. It seems you could win a $1 billion lottery, but���if you then quit your job���you might nix your ability to get a loan.

Why didn���t we simply open a financial account elsewhere and move part of our cash into that account, shielding it from the seller���s view? That would have taken longer than our five-day option period.

Don���t get us wrong. We���re not advocating going back to the purely subjective It���s a Wonderful Life days when George Bailey��gave a loan to his friend Ernie because he believed him to be good for it. In that sort of world, totally inappropriate factors���such as race and gender���became systematically factored in. We must continue to guard against such biases in lending and, when we do see them, address and��eliminate them.

On the other hand, the cold, formulaic real estate lending analysis of today seems geared solely toward people who want to leverage their income into accruing debt to gain housing. Jiab spent years in credit risk management for a major bank. She, of course, looked at debt-to-income ratios to assess risk, but she also considered other mitigating factors, including wealth and credit scores. Such factors should be included as well.

Jiab found another lender who was willing to give us a preapproval letter, but it took time and searching on her part. Evidently, this second company did factor in credit scores and assets into its loan approval logic. Meanwhile, our realtor also suggested depositing the money with the title company as a neutral third party to verify we had the funds. This could have triggered more fees, plus it would have locked away the money prematurely before closing.

In the end, we showed the seller an email confirming a wire transfer from Vanguard to our bank account for the amount of the asking price. This seemed to satisfy the seller and her realtor.

There are more and more retirees who, by luck or hard work, rely less on income and more on the nest egg they���ve built over the years. Maybe the lending system should stop punishing them for finishing the rat race early.

Jiab and Jim Wasserman just returned to Texas after spending the first three years of their retirement in Spain. Check out earlier articles by both��Jiab and Jim.

Jiab and Jim Wasserman just returned to Texas after spending the first three years of their retirement in Spain. Check out earlier articles by both��Jiab and Jim.The post Show Me the Cash appeared first on HumbleDollar.

June 3, 2021

What a Drag

Here are some pictures of Lower Manhattan. It���s dotted with the skyscrapers that comprise the financial district, home to some of Wall Street���s largest firms. Just the seven largest U.S. banks together are worth more than $1.5 trillion (yes, trillion). This is just the tip of the financial industry iceberg. Charging 1%, it seems, can really add up.

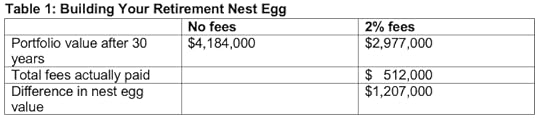

But let me show you how 1% can affect your bottom line. Imagine you contribute the maximum allowable to your 401(k) plan every year for the next 30 years. I���ll assume the contribution limit increases at 3% each year, as it has for the past three decades. I���ll also assume you invest that money entirely in stocks and earn 10% a year, which is the historical average. How much would you have in your 401(k) by 2051?��The answer, assuming you could avoid paying all fees, is $4,184,000, as you���ll see in table No. 1.

Now, take the same portfolio but subtract 1% in fees for your mutual funds and another 1% in fees charged by your financial advisor. That means your investments would grow at 8% a year, instead of 10%. How much would your portfolio be worth in 2051? The answer: $2,977,000.

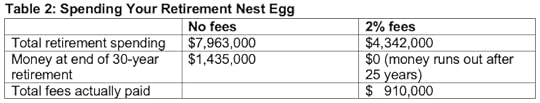

But that���s only half of the picture. We also need to examine what happens during retirement. Let���s assume you and your spouse live another 30 years in retirement. (For a 65-year-old opposite gender couple, there���s a 46% chance of at least one person surviving to age 95.) During this time, you spend down your 401(k) using the 4% rule. I���ll assume a 5% rate of return to reflect the more conservative portfolio one should have in retirement. Meanwhile, annual inflation runs at 3%. The results for the ���no fees��� and ���2% fees��� scenarios are summarized in table No. 2.

The ���total fees actually paid������the $512,000 before retirement and the $910,000 during retirement���is the dollar amount that was actually subtracted from your portfolio and paid to the mutual fund managers and your financial advisor. You may notice that the difference in nest egg value after 30 years of saving money���$1,207,000���is far larger than the $512,000 in total fees paid. That���s due to the effect of compounding. Every $1 paid out in fees is $1 less that can compound in the future.

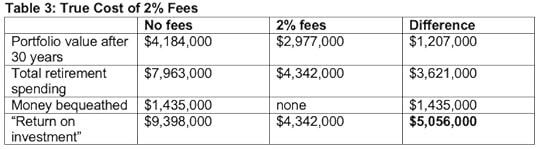

In fact, while the ���total fees actually paid��� are substantial, they grossly underestimate the true cost of financial advice. What really matters is how much you���re able to spend in retirement and pass on to your heirs or give to charity at the end of your life. Remember that in both the ���no fees��� and ���2% fees��� scenarios, the exact same dollar amount���$927,721���was saved and contributed to the 401(k). The ���return on investment��� is the sum of your retirement spending and any bequest. This bottom line is summarized in table No. 3.

In our example, the true cost of 2% is more than $5 million over a lifetime. In fact, it���s even worse than that, since the ���2% fees��� portfolio ran out of money after just 25 years in retirement. Imagine the stress of watching your 401(k) balance dwindle to zero in your later retirement years.

I know what you���re thinking: A truly no-fee portfolio is simply not realistic. I beg to differ. Today, Fidelity Investments offers two total stock market index funds���one for the U.S. and another covering international markets���that both have expense ratios of zero. Fidelity also has a broadly diversified U.S. bond fund that sports an expense ratio of 0.025%. For a portfolio with 60% stocks and 40% bonds, the blended average expense ratio using these three funds would be 0.01%. That���s pretty close to zero in my book.

What about the services of a financial advisor? If you own a three-fund portfolio and can perform simple arithmetic, do you really need the help of a financial croupier? I would argue not. Now, there are certainly services that financial advisors provide besides portfolio management and those services can be valuable, but you could pay an advisor on an hourly basis for them.

The stark reality is that many people pay far more than 2% to financial intermediaries. Mutual funds are plagued by myriad hidden fees. High turnover in taxable accounts produces significant tax drag. Not many financial advisors will put you in a three index-fund portfolio. How could they justify their fee? Instead, many will put you into complex portfolios with alternative asset classes that not only underperform the simple three-fund portfolio, but also charge even higher fees. And when formerly highflying funds begin to underperform, your advisor may swap them out for funds with better recent track records. Such performance chasing will further detract from your returns. Finally, some unscrupulous brokers or advisors may even churn your account, racking up hefty commissions at your expense.

The solution to Wall Street���s ���just 1%��� is what I call the three golden rules of investing. First, invest in the entire market using index funds. Second, keep expenses as low as possible. Finally, buy and hold.

Indeed, buy and hold is your best defense against the financial equivalent of Newton���s law of motion. As Warren Buffett put it, ���For investors as a whole, returns decrease as motion increases.��� By following the three golden rules, you���re all but guaranteed to outperform 90% of investors over the long run.

Just for fun, I also looked at the other side of the equation, namely your ���advisor���s portfolio.��� Assuming the 2% fees went to a single person, how much would the advisor���s portfolio grow as a result of the fees you paid? I assume the advisor is in the no-fee portfolio earning 10% a year. By the time you reach retirement, your advisor���s nest egg���courtesy of your fees���would be worth $1.2 million.

John Lim is a physician and author of "How to Raise Your Child's Financial IQ," which is available as both a free PDF and a Kindle edition.��Follow John on Twitter @JohnTLim��and check out his earlier articles.

John Lim is a physician and author of "How to Raise Your Child's Financial IQ," which is available as both a free PDF and a Kindle edition.��Follow John on Twitter @JohnTLim��and check out his earlier articles.The post What a Drag appeared first on HumbleDollar.

June 2, 2021

Too Frugal for Me

I REGULARLY READ blogs written by those who retired early to a life of ultra-frugality. Do you consider yourself careful with money? Even so, I doubt you���d enjoy the frugal lifestyle of many followers of the FIRE (financial independence/retire early) movement.

I certainly wouldn���t. If I go on another cruise, I won���t be booking an inside cabin. I can���t imagine my wife buying clothes from a thrift store and wearing them for the next 10 years. Things that strike me as too frugal: Never going out to eat. Never traveling. Not owning a car. Living on a remote piece of land and chopping firewood for heat. Picking up toys from the curbside for the kids. Moving to Mexico for the low cost of living.

And, no, I���m not trusting my eyeglasses to an online service to save money. Don���t get me wrong: I shun designer frames and designer everything else. I lean toward frugality. I avoid impulse shopping, buying the latest trendy thing and accumulating unnecessary stuff. Still, you usually get what you pay for. Have you ever read about the things you should never buy from a dollar store?

But it isn���t just the extreme frugality of the FIRE folks that bothers me. Rather, it���s also the related claim that they���re financial independent.

Don���t get me wrong: I���m not mocking these frugal folks, nor am I being a snob. But it���s important to understand the lifestyle necessary to be financial independent if you���re living on a tiny budget.

To be sure, these folks seem happy with their choices. Many are actually income-earning bloggers, authors and podcasters who are sought out by the media. In that regard, I���m jealous. Nobody seeks me out. Being an old school dinosaur is not news.

One blogger claims to have lived on $7,000 a year or less for a decade. Another says his family of five lives on $40,000 a year and spent just $296 on groceries in March. The U.S. Department of Agriculture puts a low-cost grocery plan for a family of four at $892.90 per month. Even a thrifty food plan is estimated at $676.80 per month.

This same family pays almost zero for health insurance premiums because they keep their income low enough to collect Affordable Care Act subsidies. Meanwhile, in March, their ���net worth went up $68,000 to end the month at $2,648,000.��� The lesson: Because the government typically counts income but not wealth, some of the frugal few are able to qualify for subsidies and tax credits.

A couple, who ���retired��� 30 years ago at age 38, says that ���as of the end of 2020 we spent $28,133 or $76.87 per day. Plus we blew the $2400.00 stimulus check on repairs in our humble abode in the States. Our average spending for 30 years of financial independence or 10,950 days, is $23,241 annually or $63.67 per day.��� They now live in Mexico mostly, travel and have lived around the world. Frankly, it���s all beyond my comprehension, but it seems to work for them.

When I stopped working after a 50-year career, I retired. Now, I���ve learned that retired may not mean what I thought it did. Some people claim to be retired early when, in fact, they simply left their current job for something less demanding���a life of doing your own thing, so to speak, but not actually ceasing to work for income. Does the $6.70 I earn each month from my blog make me a hypocrite?

Each to his or her own. But where would we be if everybody retired at age 38?

Richard Quinn blogs at QuinnsCommentary.com. Before retiring in 2010, Dick was a compensation and benefits executive.��Follow him on Twitter��@QuinnsComments��and check out his earlier��articles.

Richard Quinn blogs at QuinnsCommentary.com. Before retiring in 2010, Dick was a compensation and benefits executive.��Follow him on Twitter��@QuinnsComments��and check out his earlier��articles.

The post Too Frugal for Me appeared first on HumbleDollar.

June 1, 2021

May’s Hits

"I typically keep enough cash to finance our normal expenditures for at least six years," writes Andrew Forsythe. "In fact, with the current bubbly stock market, I’m above that level."

Yes, if you expect your tax bracket to be higher once you're retired, a Roth conversion can be a smart move. But as Adam Grossman explains, converting also offers four other key benefits.

Rick Connor and his wife just retired to the Jersey Shore. Sound appealing? Rick offers four tips for those looking to downsize.

Worried about getting sued? Adam Grossman makes the case for buying umbrella liability insurance—and talks about how to pick the right policy.

"If you’re like me, you’re always looking for ways to make your life less stressful," writes Dennis Friedman. "Here’s one thing you can do with your money that can be a big help: Organize and consolidate."

"Bonds shouldn’t be viewed as the same as cash," writes David Powell. "Both can be a good diversifier for stocks—and bonds are often better—but cash investments are the place for money you’ll need soon."

Remember the three-legged retirement stool? Phil Kernen says it's time to revive and revise the idea—with a focus on ensuring tax flexibility in retirement.

What about our weekly newsletters? Last month's two best read were Built for Ease and Not So Different. Meanwhile, the most popular Voices questions asked about how to get a good deal on a car and where to stash money you'll spend soon. Not sure how to log on so you can comment? Click here.

Jonathan Clements is the founder and editor of HumbleDollar. Follow him on Twitter @ClementsMoney and on Facebook, and check out his earlier articles.

Jonathan Clements is the founder and editor of HumbleDollar. Follow him on Twitter @ClementsMoney and on Facebook, and check out his earlier articles.The post May’s Hits appeared first on HumbleDollar.

May 31, 2021

Answering the Call

ON NEW YEAR���S DAY 1994, life was looking pretty good. I was age 35 and, despite not having a college degree, was slowly climbing the corporate ladder. I���d just finished the most lucrative year of my career, and a semi-promotion promised to increase my income by 50% to 100%. My wife Kathleen was happily home-schooling our six- and 13-year-old boys, and we were thinking about buying a bigger house.

Then life happened.

On Jan. 4, my wife got the call from her doctor that her recent medical tests hadn���t turned out well. She had early stage breast cancer. That night, as we lay in bed, I blurted out something I probably shouldn���t have. But I believed it to be true. ���This is going to be one of the best things that ever happened to us.��� My terrified wife didn���t yell at me or punch me out. Instead, we held each other, and hoped and prayed that something good might come from our fear that she had a potentially terminal disease.

The next few weeks would change our lives. My company was supportive of me taking time off to be with Kathleen during her treatments, but that time wasn���t enough. The company was downsizing and, although I wasn���t in the demographic they were targeting, I decided to take early retirement so I could be with my family fulltime. As Kathleen completed her radiation treatments, I told her we should follow one of our dreams and use most of my severance package to buy a used RV and take a trip around the country with our boys. At first, she thought I was insane. I had no job, she was recovering from cancer and we had never driven an RV before. Her friends, however, convinced her it was a once-in-a-lifetime opportunity. On April 9, we set off to see the country.

We were on the road for almost three months, traveling 10,000 miles and making memories that have never left us. My wife healed. I visited a seminary for the first time and began thinking about becoming a minister one day. When we returned home, we decided to move to a slower-paced life in Pacific Grove, California, where I got a new job. Kathleen found her perfect job driving the local library���s bookmobile���three months behind the wheel of a 27-foot RV was good experience���and I found a new religious tradition. I started seminary less than two years later.

Those of us who dabble in financial advice and counseling like to talk about financial security. "If a person has had the sense of the Call���the feeling that there���s an adventure for one���and if one doesn���t follow that, but remains in the society because it is safe and secure, then life dries up," wrote Joseph Campbell.

I remember reading those words when I was in my 20s. Safety and security, or the illusion of them, have their place in life. But if we have heard the whispers or shouts of a call���of something we know in our hearts we must do���safety and security can and will never take its place. Unexpected events in life, whether they be getting cancer, changing careers or suffering financial hardship, have a way of forcing us to look in the mirror and take stock of our life.

Every spring, I think back to 1994 and all that unexpectedly happened���not only the memories of seeing much of the country for the first time, being locked up with four other people (we took our nephew, too) in a cozy RV, and reconnecting with who and what was most important in my life, but also of the urge and the deep knowing that leaving my job and being with my family was the only thing I could do. I had the faith that doing the ���right��� thing and taking the adventure of our lifetimes would lead to peace and joy.

Looking back, it was a risky move. It would be more than 20 years before I would make as much money as I did in 1993. My financial advisor wasn���t a fan of me leaving my job, and he certainly wasn���t a fan of me leaving the workforce and entering a seminary two years later. I remember how many people told us that they too dreamed of quitting their jobs and seeing the country through an RV windshield. But they didn���t think they could do it. Most of those people had bigger houses than us, and probably a bigger net worth, as well.

I learned that we can follow all the expert guidance in the world about money and financial planning and financial security, but sometimes that won���t be enough. I���ve seen life dry up for people, no matter whether they���re rich or poor. When we say ���no��� to our dreams, to the adventures of spirit and life that often unexpectedly beckon to us, a little bit dies inside. Answer the call, trust the inner wisdom that whispers to you and say ���yes��� to your next adventure. A different���and perhaps even more meaningful���safety and security await. I���ll be eternally grateful that two scared people listened to that whisper in January 1994. And I hope you do, too.

Don Southworth is a semi-retired minister, consultant and tax preparer living in Chapel Hill, North Carolina. He recently completed his Certified Financial Planner education.��

Don is passionate about the intersection between spirituality and money, and he encourages people to follow their callings wherever they lead.��Follow Don on Twitter

@calltrepreneur

. His��previous article was Twin Certainties.

Don Southworth is a semi-retired minister, consultant and tax preparer living in Chapel Hill, North Carolina. He recently completed his Certified Financial Planner education.��

Don is passionate about the intersection between spirituality and money, and he encourages people to follow their callings wherever they lead.��Follow Don on Twitter

@calltrepreneur

. His��previous article was Twin Certainties.

The post Answering the Call appeared first on HumbleDollar.