Jonathan Clements's Blog

November 30, 2025

Happy Hour, or The Panic Button? Why Early Retirement Anxiety Is Real.

Drleftys comment on a recent thread about retirement anxiety got me thinking: Dana isn't alone in this. Why does the early"golden age" so often feel more like free-fall, and what can we do about it?

For decades, you've been sold the vision: retirement is the ultimate prize. A perpetual vacation where the most stressful decision is whether the day starts with a third cup of coffee or a walk in the park. But for many who actually arrive there, that reality turns out to be slightly different. It's less "golden age" and more a state of low-grade, constant existential anxiety. This isn't just about putting one's feet up; it's about having the three main scaffolding beams of adult life simultaneously chainsawed out from under you: professional identity, assured income, and daily structure.

For forty years, your job title served as the answer to "Who are you?" It's a status symbol, and a huge chunk of one's identity. The moment the working life ends, that credential vanishes. If someone asks a new retiree what they do, the reply is simply, "Oh, I'm retired." And often, you can see the social downgrade happening right there. One goes from being a respected professional to feeling like they're wearing an invisibility cloak, just a person who knows what day the recycling gets picked up. The struggle to fill that void with "meaningful hobbies" can be harder than it sounds.

Most people approaching retirement run the numbers a hundred times and have been good savers. Intellectually, they are fine. But knowing that in your head and feeling it in your gut are two totally different experiences. When you're working, the money goes in. Every few weeks, a reassuring electronic deposit. Now? It's only going out. You are watching the account balance shrink, line by line, month by month. That psychological switch, from accumulator to liquidator, can be jarring.

Adding to this is the vague, creeping fear of outliving one's resources, the phantom menace of longevity. The biggest worry isn't just the current withdrawal rate; it's being 95, healthy, and trying to remember where the emergency jar of pennies was hidden. Suddenly, having to make complex, personal investment decisions feels like a much heavier burden than any deadline ever faced at work.

Work might have been a time sink, but it was a helpful one. It provided structure. The alarm went off, people knew where they had to be, and they knew how to fill 80% of the day. That comfortable order is now replaced by a giant, slightly scary expanse of unscheduled time.

At first, many find this bliss. But soon, you realize you're constantly feeling a bit disoriented, like waking up on a Sunday, but it's Tuesday. And that instant social life of the office? Gone or greatly reduced. Furthermore, for some, the unexpected intimacy of spending 24/7 together can strain relationships, adding a layer of mild domestic tension to the external, existential kind.

So, the retirement that was promised? It requires some effort. It means that retirees stop passively waiting for the good life to happen and instead actively build a new one: constructing a new identity, mastering a new spending plan, and intentionally replacing the social ecosystem that vanished. Otherwise, this great "freedom" can just feel like floating off down the river of life without a paddle.

Nobody can prescribe a bespoke solution. For myself, it was having a ten-year cash buffer to defeat the financial anxiety, ramping up my already established sporting commitments, and volunteering to run sporting clinics to combat directionlessness, and having an already well-rounded social and family life. But that's me. Everyone needs to grab that paddle, the river doesn't care if you're ready, it just keeps moving.

The post Happy Hour, or The Panic Button? Why Early Retirement Anxiety Is Real. appeared first on HumbleDollar.

November 29, 2025

How to build your nest egg

In a couple of weeks I'll turn 85. As far as my financial acumen goes, I owe a lot to my Dad. Back in the 40's he was already investing in the Market and he also did his own taxes as well as those of our neighbors where I grew up in the Bronx. He and my Mom managed to actually save some money even though he never made the big bucks. The secret was to live within your means and to spend your money wisely

With those lessons in mind, I started investing early on and I did my own taxes. I was aided by reading Kiplinger magazine and other financial journals as a help to decide where to invest without the expense of an advisor. When my job started to offer a deferred compensation plan I also invested through that.

People, you don't need degrees in finance to do this stuff.

The post How to build your nest egg appeared first on HumbleDollar.

The 4 Year Rule for Retirement Spending

Ben Carlson's column today is a reprint of a method for sustainable retirement spending. You start by calculating your spending requirements in retirement (although I don't see an allowance for inflation) and have four year's worth set aside in cash or cash equivalents by the time you retire. Then there are rules for when you withdraw from cash or stock, and when you replenish cash. It sounds like the remainder of the portfolio is all in stock. I didn't follow that method, as I only have 50% of my portfolio in stock, but it is an interesting approach, and worked for him, despite starting retirement in early 2000.

The post The 4 Year Rule for Retirement Spending appeared first on HumbleDollar.

November 28, 2025

Decision Frameworks

McPhee was suffering from writer’s block. As he described it, “I had assembled enough material to fill a silo, and now I had no idea what to do with it.”

Investors find themselves in a similar situation today. There’s no shortage of financial information around us. But that doesn’t make it easier to know what to do with it.

When it comes to financial decision-making, there is, of course, one fundamental problem: None of us can see around corners. But that doesn’t leave us completely empty-handed. Whenever possible, I suggest employing decision frameworks. They can help us to do the best we can in the absence of complete information.

Here are four such frameworks you might consider as you look ahead to the new year.

Trading decisions

Suppose you’re lukewarm on an investment and thinking of selling it. How should you think through this decision?

To start, you might evaluate the investment’s merits. If it’s an individual stock, you could examine its valuation and study the company’s financials. If it’s a fund, you could look at its track record and management fees. And if it’s held in a taxable account, you could also check its tax efficiency.

Against those factors, you would then assess the tax impact of selling your shares. But how should you weight each factor in your decision? A fund might be tax-inefficient, for example, but have a good track record. When making decisions like this, the framework I suggest is to evaluate three factors: risk, growth potential and tax impact. And I would consider them in that order.

Estate taxes

The federal estate tax can be punitive for those with assets over the lifetime exclusion. Under current law, that’s $15 million per person, but it’s a political football and could easily change down the road. Many states also impose their own estate taxes, with much lower exclusions. For those with assets even in the neighborhood of the applicable exclusion, it might seem like an obvious decision to pursue estate tax strategies.

Indeed, many families conclude that it’s worth virtually any amount of time, effort and cost to limit their exposure to these steep taxes. That’s a logical conclusion, but it’s not the only way.

Other families take a different view. They reason that if their estates will be subject to tax, then, by definition, their children will be receiving substantial sums. Since that’s the case, they don’t see the need for acrobatics to leave their children even more, especially since those strategies usually introduce cost and complexity.

The most typical estate tax strategy, for example, is an irrevocable trust. In addition to the legal work required to set one up, these trusts require third-party trustees, and trustees typically ask to be compensated. This kind of trust also requires a separate tax return each year. Also, assets in trusts like this don’t benefit from a cost basis step-up at death, making the tax benefit a little more uncertain.

Estate tax strategies, in other words, might make sense, but they aren’t the obvious “right” answer in all cases. That’s why, as you think through this question for your own family, you might employ this simple framework: Start by asking yourself which objective is more important: to keep taxes to an absolute minimum or, on the other hand, to keep complexity to a minimum. Let that be your guide.

Portfolio construction

How much effort should you put into your portfolio? Author Mike Piper draws an apt analogy. Building a portfolio, he said, is like making a fruit salad. Here’s how he explained it:

“If you choose to have just 3-4 ingredients in your fruit salad instead of 7, that’s fine…There’s no one single recipe that beats the others…And you don’t have to be super precise about it—a little more or less of something than you had intended is not a disaster.”

It’s an important point. Because there are so many available investment options, and because there is so much information and commentary around us, it can sometimes feel like we need to do more to optimize our investments. The reality, though, is that this is a choice.

Just as with estate tax strategies, you might yield a benefit by fine tuning your portfolio, but you shouldn’t feel compelled to. The most important thing is that it be reasonable. As long as you aren’t taking inordinate risk, it’s a choice whether you choose to have five, 10 or 500 holdings in your portfolio. As Piper points out, you won’t necessarily go wrong with whichever path you choose, so choose the path that suits you.

A 360-degree view

Earlier in my career, I worked as an investment analyst at a firm where we were responsible for picking stocks. In discussing an idea with a colleague one day, it occurred to us that if you knew enough about any given stock, you could easily make an argument either for or against that stock. It was in the eye of the beholder.

Consider a stock like Nvidia. On the one hand, it’s the dominant player in a fast-growing market and has enviable profit margins. But those margins are inviting competition, and there are concerns that the market is becoming saturated.

Which set of arguments is correct? As with all financial decisions, we can’t know without the benefit of hindsight. That’s why I suggest what I call the “five minds” approach. Instead of taking a single position on a given question, try to look at it from all sides, balancing the viewpoints of an optimist a pessimist, an analyst, a psychologist and an economist.

How would this work in practice? If there’s an idea that looks like it makes sense, pause and ask what the opposing argument might be. If you’re looking at a question through a quantitative lens, pause and ask what the qualitative factors might be.

And always consider the broader context. Suppose, for example, you’re considering a Roth conversion. A key element in that equation is whether future tax rates will be higher or lower than they are today. To help answer this question, we could consult history as a guide, looking at historical tax rates and government debt levels.

No one has a crystal ball. But since that’s the case, frameworks like this can help us manage through decisions with incomplete information.

Adam M. Grossman is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on X @AdamMGrossman and check out his earlier articles.

Adam M. Grossman is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on X @AdamMGrossman and check out his earlier articles.The post Decision Frameworks appeared first on HumbleDollar.

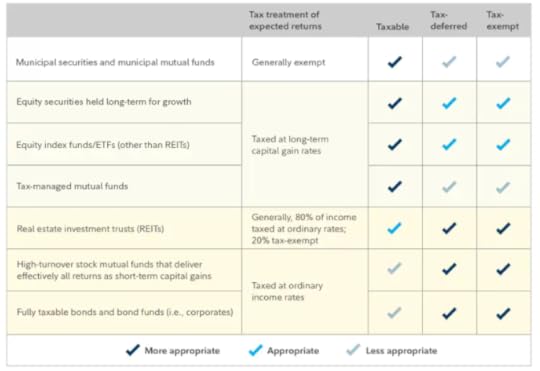

Asset Location Decisions

As you know, we have 3 main investment accounts:

Taxable account. A traditional brokerage account where you are taxed every time you dividends or sell investments at a gain.

Tax deferred account. Traditional 401(k), 403(b), and traditional IRAs allow taxes to be deferred to the future. You pay taxes when your investments are withdrawn, and generally come with an immediate tax deduction.

Tax exempt account. Roth IRA, Roth 401(k), and Roth 403(b) allow you to avoid future taxes while providing no immediate tax deduction. The growth of these accounts is tax free.

Asset location

Say, as part of your investment strategy, you want to start putting money in bonds. You have a 401(k), Roth IRA, and a brokerage account. Where do we put them?

Brokerage account

When you hold bonds, like BND (Total Bond Fund ETF), you pay taxes on non-qualified dividends (e.g. interest from the bond) up to a max rate of 37%, plus net investment income tax, if applies. This means that if you receive $1,000 from the bond, you will pay approximately $370 in taxes if you are in the highest tax bracket.

Of course, not all of us are in such bracket, and perhaps a more reasonable number would be ~$220-240 for most people. But is taxable brokerage the right choice for you? Not really. You would be paying $200+ every year, plus state/local taxes.

Personally, I'm 100% invested in equities, because I want to be aggressive with my portfolio in my 20s, but if I did have bonds, I wouldn't hold them in a brokerage account.

Roth IRA/Roth 401k

When you purchase bonds in a Roth IRA, you will not pay taxes on the interest since it’s a tax-free account!

That’s much better than the $200+ in taxes you would pay in a brokerage account.

But is it the best choice? Well, bonds are considered “fixed income” funds, and they don’t grow much. Since Roth IRA is a tax-free account (meaning we pay no taxes when we sell these investments), we want as much growth as possible in it. Bonds would hinder that performance.

So, holding bonds is better than brokerage, but likely not the most ideal place.

Traditional 401(k)/403(b)

By holding bonds in an account like a traditional 401(k)/403(b), the interest income avoids immediate taxation, compounding tax free until withdrawal.

So, we avoid the ~$200+ of taxes and aren’t sacrificing the tax-free compounding like we are with a Roth IRA. This makes the pre-tax 401(k) the perfect location for bonds.

Of course the 401(k)/403(b) choices are limited and are provided by your employer. So, if they don’t offer a bond fund, you might not have a choice.

Some other examples:

REIT stocks/ETFs also pay non-qualified dividends and would follow similar logic like bond funds.

Actively managed funds (I’m strongly against these, as I believe passive funds are the best & lowest fees) have a lot of turnover, so they ideally shouldn’t be in a brokerage account due to capital gain distributions.

Stocks that pay 0% dividends (like Netflix) are the most efficient to hold within the brokerage account, but may need a more robust overall investing plan.

I really like this visual from Fidelity to reference:

But how much does this matter? Vanguard's research finds that a thoughtful asset location strategy can add significantly more value than an equal location strategy. The value added typically ranges from 5 to 30 basis

points of after-tax return, depending on circumstances (e.g. income, portfolio size)

Overall, I hope you think about all of your investments & how they get taxed.

Bogdan Sheremeta is a licensed CPA based in Illinois with experience at Deloitte and a Fortune 200 multinational.

Bogdan Sheremeta is a licensed CPA based in Illinois with experience at Deloitte and a Fortune 200 multinational.The post Asset Location Decisions appeared first on HumbleDollar.

My Investing Journey, Just Do It

I began contributing to an IRA in the 80s, buying certificates of deposit at the local bank. Pretty soon I began thinking about investments. I knew almost nothing about the stock market, still, I knew I needed to be in it. I remember watching the nightly news, where the anchors always reported what the DOW did that day, never a mention of that other thingy…. What was it called…. The S&P500?

I started reading up on the stock market, learning only enough to be dangerous to myself. The thought of investing was infesting me. At some point I was contacted by a smiling and dialing registered rep from IDS.

I soon rolled over my IRA CDs, all $3500 of them, into a mutual fund and an Real Estate Investment Trust (REIT). Soon after that Black Monday happened. My mutual fund was down hundreds of dollars. Was the world coming to an end? I felt I would throw up. Still, I held on and soon learned that what goes down, usually goes back up pretty quickly. As for the REIT, I watched it go down with every quarterly report. There was no secondary market for it, no buyer for several years. When I was finally able to dump it, I lost about 40%. No more REITs for me.

In the 90s I took over managing my own money. I spread my investments out in several managed mutual funds. I wish I had known Jonathan back then, because the hot managed funds I chose were nearly clones of each other. By the time the 2001 bear market came to an end, most of the stellar growth from the 90s had evaporated.

Around that time came a period when I became securities licensed. I briefly worked for a financial company that was owned by a large insurance company. We had an investment specialist, and he taught me much about analyzing mutual funds. He was, however, all about selling managed funds with front end loads and 12b1 fees, and seemed convinced that he could beat the indexes.

By the time the 2008 financial crisis rained down on the market, I was using either balanced funds or target date funds, still all were managed. They proved superior to my fund picking skills, largely because they dealt better with controlling allocations.

It’s only been in the last five or so years that I have switched most of our investments into index or ETFs. I stubbornly hang on to a few managed funds, but in total they represent less than 30% of our portfolio.

Earlier I posted about consolidating most accounts into Fidelity. That has worked out very well so far. I like the platform and find the website intuitive enough; their phone reps have been perfect whenever I needed them.

I leave about 20% of our assets with an advisor, whose referrals were a huge help when I was building my income tax practice. He does not charge me much, and uses ETFs in my account.

Over 40 or so years of saving/investing, I have made plenty of mistakes. Still, I kept plugging away, and although I surely could have made better decisions along the way, things turned out okay. The old Nike slogan comes to mind; Just Do It.

The post My Investing Journey, Just Do It appeared first on HumbleDollar.

Property taxes, our schools, our towns and seniors. Shared responsibility.

Taxes have been a regular topic on HD and why not, they are critical for both our personal finances and running our society. To say people have different views about taxes is a major understatement.

One of the current hot issues is property taxes. Movements are afoot to stop property taxes- at least for those “retired,” over age 65 or who have no mortgage. The logic of any of that escapes me.

However, the level of support among seniors seems quite high and to my way of thinking a bit selfish and shortsighted. The reasoning given for support is seniors are on a fixed income, taxes keep increasing, surviving spouses can’t afford to stay in their home of decades and my favorite - seniors already paid their dues and should not pay more.

That gets us to core of HD-prudent long-term financial planning, anticipating the future, income streams, accruing adequate resources, including for survivors. But the thing is, too many people don’t get it or ignore those responsibilities.

Following is my itemized property tax bill for the current year.

County tax $2663.04

Country open space tax $120

District school tax $4976.65

Regional school tax $3566.80

Local municipal tax $ 2488.33

Municipal open space tax $ 90.38

Total $13,905

Keep in mind this is for a condo, one unit in a building with twelve units. There are nine buildings in total on about 16 acres. Even though we don’t directly own the land, our portion is assessed at $195,000.

As you can see, over 60% of the bill is for schools. That allocation is typical. NJ schools are ranked #3 in the nation. Is there a direct correlation between between high taxes and schools? There is some relationship. States that spend more (NJ, NY, CT, MA, VT) consistently rank in the top 5–10 on most outcome measures. States that spend the least (MS, OK, AZ, ID, UT) tend to rank in the bottom quartile, but there are other factors so it is not a perfect correlation.

Property taxes have been used to fund schools since the 1840s. The reason property taxes are used by municipalities is because they are stable and predictable and relatively easy to adjust. Sales and income taxes are more variable and less reliable because they are subject to economic conditions and changes in the incomes of the people living in and moving in and out of the community. It is hard for a school system and municipality to manage fixed costs with variable tax income. Some localities think by relying more on state revenue the local tax burden can be eased. Critics note that doing so can also subvert local control over school spending, something typically highly valued.

The majority of states have one or more programs to ease the property tax burden on those in need, most programs age based. The rallying cry that seniors should not lose their homes is a red herring. That rarely happens. In fact, 0.05% of homeowners of any age actually lose a home for unpaid taxes and even then they keep all the equity after the tax bill is paid.

So, why shouldn’t every homeowner pay property taxes with shared relief for those truly in need?

The post Property taxes, our schools, our towns and seniors. Shared responsibility. appeared first on HumbleDollar.

The Magic of the Season: From Turkey to Rollercoaster Spending in 72 Hours.

Black Friday's is considerably less heartwarming than Thanksgiving. The term allegedly emerged in Philadelphia during the 1960s, coined by police officers who dreaded the chaotic day after Thanksgiving when hordes of shoppers and tourists would flood the city ahead of the Army-Navy football game. Retailers initially disliked the term before eventually rebranding it as the day when stores finally moved from being "in the red" to "in the black", a more palatable story about profitability rather than chaos. What began as a localized shopping event has since transformed into a cultural event that now kicks off weeks before the actual football game.

Cyber Monday is the even younger sibling in this duo of commercial holidays, born in 2005 when the National Retail Federation noticed a spike in online sales on the Monday after Thanksgiving. The reasoning was simple: people returned to their office computers with faster internet connections than they had at home and used their lunch breaks to snag deals they'd missed over the weekend. It's rather fun to think about it now, given that we all carry supercomputers in our pockets with speeds that would have seemed like science fiction back then. Yet the tradition stuck, and now both days serve as bookends to a shopping weekend that's become as much a part of the holiday season as turkey, stuffing and indigestion tablets.

And so we once again enter that great financial high-wire balancing act that defines the period between Thanksgiving and Christmas. Your credit card sits in your wallet, practically humming with nervous energy, knowing full well it's about to get quite the workout over the coming weeks. There's an almost inevitability to it all, gift lists multiplied by shipping deadlines, divided by whatever's left in the checking account after yesterday's feast.

You tell ourselves I'll be sensible this year, that we'll stick to budgets and make thoughtful, affordable choices. Yet somehow, come January, we'll find ourselves staring at statements and wondering how exactly we convinced ourselves that Aunt Linda absolutely needed that premium cheese-of-the-month subscription. The juggling act is real, the plates are spinning, and we've got about four weeks to keep them all in the air before we can collapse into the new year and pretend we meant to do it all along.

To paraphrase that seasonal movie: happy holidays, have a fiscally responsible spending period…ya filthy animals.

The post The Magic of the Season: From Turkey to Rollercoaster Spending in 72 Hours. appeared first on HumbleDollar.

November 27, 2025

Most of all … Be Grateful

My Thanksgiving Wishes

May you share your table with the ones you love most.

May your hearts be as overflowing as your plates.

May warm conversation and laughter ring through your home.

May you hold space for the ones you're missing and find solace in memories.

May you savor the perfect dessert.

May you feel peaceful, restful, and most of all ... Grateful.

The post Most of all … Be Grateful appeared first on HumbleDollar.

HSA Proposal

A new bill was introduced on 11/20 in Congress to amend some HSA rules. It still has to go through the Ways and Means, House and Senate.

I doubt it will get through this year, but it's good to be aware of potential changes.

If enacted, all the changes would go effective after December 31, 2025, but it's very unlikely.

In particular, there are 2 main proposals:

> Income limits

> 2 Year rule

Currently, there is no income limitation to contribute to an HSA. This makes it an effective tax strategy for high earners to lower their taxes.

The new proposed bill would create an income limitation where if you make more than $240,000 (single) or $340,000 (married jointly) you will get $0 deduction for contributing to an HSA.

The contribution deduction would phase out if you make more than $200,000 (single) or $300,000 (married jointly).

In addition, currently, the HSA contribution submitted via payroll, isn't subject to the 7.65% FICA tax.

The proposed bill would change that and you contributions would be subject to the FICA tax.

The proposed bill would also change the rules so you can only reimburse yourself for expenses if you do it within 2 years of paying the expense. Any reimbursement after the 2-year window will no longer count as a qualified medical expense.

This rule would apply to expenses paid or distributions made after Dec 31, 2025.

The bill also adds new substantiation rules for HSA distributions, requiring that expenses be properly documented before they qualify as tax free (hopefully you've done that before anyways)

HSA trustees will also be responsible for determining whether distributions are adequately substantiated.

So, what do we do now? Nothing. I suggest business as usual, but continue monitoring the progress on this.

If this ever does become law, it might be wise to reimburse yourself for all the prior expenses before this passes.

What are your thoughts on this?

The post HSA Proposal appeared first on HumbleDollar.