Jonathan Clements's Blog, page 285

June 21, 2021

Beyond Saving

I���M CONSERVATIVE, but sometimes even I see the need to change. For instance, I belonged to a high-profile service organization for many years. They���re very proud of their tradition of raising money to give a Webster���s dictionary to each fifth grader in our city.

Let���s face it: These days, no self-respecting fifth grader is going to be caught dead with a hardcopy dictionary. Doesn���t everyone know that kids look up everything online? Traditions die hard���even when they no longer make sense.

Which brings me to saving for college. Should we continue to automatically fund 529 college savings accounts? I���m trying to decide whether to put money in 529 plans for my three grandchildren.

Some parents sacrifice their own retirement savings to make sure their kids��� college education is funded. Others might fail to pay off debt because they feel a duty to stash dollars in a 529. But those good intentions could backfire���in part because money in 529 plans can hurt a family���s financial aid eligibility.

If anyone should know the value of a college degree, it���s me. My degree opened the door to a successful banking career. So why am I having doubts about funding 529 accounts for my three grandchildren? It isn���t that we can���t afford it. Unless financial catastrophe strikes, we should be able to help with college costs. Still, I���m wondering whether saving for college should remain a priority���for five reasons.

First, I recently had a heart-to-heart with one of my sons. He said that, if I hadn���t helped pay for college, he doesn���t think he would have gone. He���s ended up with a good job in the technology sector, but his conversations with friends have convinced him that a college education wouldn���t have been good value if he���d had to borrow to pay for it.

Here���s a stunning statistic that backs up this anecdotal evidence: Nearly half of indebted millennials don't think college was worth it. Why not? The resulting student debt takes years to pay off and hampers their ability to build wealth.

Second, there are fantastic job opportunities available from exceptional companies���with no college degree required. For example, Google wants to disrupt higher education with its Google Career Certificates.

Imagine spending six months in Google���s program at a total tuition cost of around $300. If successful, you have everything you need to be hired by Google for a good job. Google has convinced 50 other large companies to join the program. I���m sure there will be more to come.

Third, instead of college, young adults can take advantage of the growth in real-time learning. Studies indicate we forget some 80% of what we learn over the course of the next 30 days. Meanwhile, many of us have experienced the joy of going to YouTube and learning just what we need to solve a problem.

I have a good friend who runs a successful online business. He has a master���s degree in business, but he���s told me that whatever he learned in college is too old to be of any use. He learns what he needs each day in real time. The world changes way too fast for universities to offer anything relevant to him.

Fourth, COVID-era learning has revealed the stodginess and inflexibility of the current education system. One blogger, Mr. Money Mustache, shared his decision to allow his son to drop out of high school and instead learn at home. Others have also discovered that bland, repetitive teacher-led instruction can be replaced by extremely high-quality instruction using videos and other online resources. It���s hard to imagine a self-educated student, like Mr. Money Mustache���s son, being satisfied with the traditional four-year curriculum that universities currently offer.

Finally, there���s a shortage of workers for high-paying blue-collar jobs. Not everyone is cut out for the corporate world. We still need plumbers and electricians. The popularity of Mike Rowe, host of TV���s Dirty Jobs, is a sign that the old ���you���ve got to get a college degree��� mantra is starting to erode.

I want to be clear: I���m not suggesting everyone quit funding 529 plans. If your children are going to be doctors, a Google certificate won���t cut it and having dollars in a 529 plan is probably an excellent idea. Still, the world of education is changing fast���and perhaps a well-funded college account isn���t the key to getting ahead.

Joe Kesler is the author of

Smart Money with Purpose

and the founder of a

website

with the same name, which is where a version of this article first appeared. He spent 40 years in community banking, assisting small businesses and consumers.��Joe served as chief executive of banks in Illinois and Montana. He currently lives with his wife in Missoula, Montana, spending his time writing on personal finance, serving on two bank boards and hiking in the Rocky Mountains. Check out Joe's previous articles.

Joe Kesler is the author of

Smart Money with Purpose

and the founder of a

website

with the same name, which is where a version of this article first appeared. He spent 40 years in community banking, assisting small businesses and consumers.��Joe served as chief executive of banks in Illinois and Montana. He currently lives with his wife in Missoula, Montana, spending his time writing on personal finance, serving on two bank boards and hiking in the Rocky Mountains. Check out Joe's previous articles.

Let���s face it: These days, no self-respecting fifth grader is going to be caught dead with a hardcopy dictionary. Doesn���t everyone know that kids look up everything online? Traditions die hard���even when they no longer make sense.

Which brings me to saving for college. Should we continue to automatically fund 529 college savings accounts? I���m trying to decide whether to put money in 529 plans for my three grandchildren.

Some parents sacrifice their own retirement savings to make sure their kids��� college education is funded. Others might fail to pay off debt because they feel a duty to stash dollars in a 529. But those good intentions could backfire���in part because money in 529 plans can hurt a family���s financial aid eligibility.

If anyone should know the value of a college degree, it���s me. My degree opened the door to a successful banking career. So why am I having doubts about funding 529 accounts for my three grandchildren? It isn���t that we can���t afford it. Unless financial catastrophe strikes, we should be able to help with college costs. Still, I���m wondering whether saving for college should remain a priority���for five reasons.

First, I recently had a heart-to-heart with one of my sons. He said that, if I hadn���t helped pay for college, he doesn���t think he would have gone. He���s ended up with a good job in the technology sector, but his conversations with friends have convinced him that a college education wouldn���t have been good value if he���d had to borrow to pay for it.

Here���s a stunning statistic that backs up this anecdotal evidence: Nearly half of indebted millennials don't think college was worth it. Why not? The resulting student debt takes years to pay off and hampers their ability to build wealth.

Second, there are fantastic job opportunities available from exceptional companies���with no college degree required. For example, Google wants to disrupt higher education with its Google Career Certificates.

Imagine spending six months in Google���s program at a total tuition cost of around $300. If successful, you have everything you need to be hired by Google for a good job. Google has convinced 50 other large companies to join the program. I���m sure there will be more to come.

Third, instead of college, young adults can take advantage of the growth in real-time learning. Studies indicate we forget some 80% of what we learn over the course of the next 30 days. Meanwhile, many of us have experienced the joy of going to YouTube and learning just what we need to solve a problem.

I have a good friend who runs a successful online business. He has a master���s degree in business, but he���s told me that whatever he learned in college is too old to be of any use. He learns what he needs each day in real time. The world changes way too fast for universities to offer anything relevant to him.

Fourth, COVID-era learning has revealed the stodginess and inflexibility of the current education system. One blogger, Mr. Money Mustache, shared his decision to allow his son to drop out of high school and instead learn at home. Others have also discovered that bland, repetitive teacher-led instruction can be replaced by extremely high-quality instruction using videos and other online resources. It���s hard to imagine a self-educated student, like Mr. Money Mustache���s son, being satisfied with the traditional four-year curriculum that universities currently offer.

Finally, there���s a shortage of workers for high-paying blue-collar jobs. Not everyone is cut out for the corporate world. We still need plumbers and electricians. The popularity of Mike Rowe, host of TV���s Dirty Jobs, is a sign that the old ���you���ve got to get a college degree��� mantra is starting to erode.

I want to be clear: I���m not suggesting everyone quit funding 529 plans. If your children are going to be doctors, a Google certificate won���t cut it and having dollars in a 529 plan is probably an excellent idea. Still, the world of education is changing fast���and perhaps a well-funded college account isn���t the key to getting ahead.

Joe Kesler is the author of

Smart Money with Purpose

and the founder of a

website

with the same name, which is where a version of this article first appeared. He spent 40 years in community banking, assisting small businesses and consumers.��Joe served as chief executive of banks in Illinois and Montana. He currently lives with his wife in Missoula, Montana, spending his time writing on personal finance, serving on two bank boards and hiking in the Rocky Mountains. Check out Joe's previous articles.

Joe Kesler is the author of

Smart Money with Purpose

and the founder of a

website

with the same name, which is where a version of this article first appeared. He spent 40 years in community banking, assisting small businesses and consumers.��Joe served as chief executive of banks in Illinois and Montana. He currently lives with his wife in Missoula, Montana, spending his time writing on personal finance, serving on two bank boards and hiking in the Rocky Mountains. Check out Joe's previous articles.The post Beyond Saving appeared first on HumbleDollar.

Published on June 21, 2021 00:00

June 20, 2021

Taking Precautions

THE FEDERAL RESERVE caught the market by surprise this past week. In fact, it seemed like Fed policymakers caught even themselves by surprise.

Previously, they had been��forecasting��that interest rates would stay near zero through 2023, on the assumption that inflation would remain manageable. But as the country has emerged from hibernation, inflation has run much hotter than expected. As a result, an increasing number of Fed officials��now expect��they���ll have to raise rates much sooner. After so many months of insisting this wouldn���t happen, it took people by surprise to hear the opposite.

How did Fed officials get it wrong? The economy, it turns out, doesn���t always move in a straight line. In recent months, more than half the inflation came from just two areas���lumber and used cars���and for reasons that would have been hard to predict.

The new car market has been in disarray due to a semiconductor shortage, leaving car buyers to chase a limited number of used cars. Result: Used car prices recently logged their��fastest��monthly increase since record-keeping began in 1953. Meanwhile,��lumber��prices���despite a recent retreat���are up more than 100% from pre-pandemic levels. That���s because low mortgage rates coupled with lockdowns have boosted home��construction��and renovation.

The Fed���s difficulty in forecasting inflation illustrates, I think, how hard it can be as an investor to know where things are headed. I often come back to the refrain that ���no one has a crystal ball.��� The Fed���s recent challenges illustrate that reality. But that crystal ball motto is more of an observation than it is actionable advice. What can you, as an individual investor, do to protect yourself from uncertainty when even the Federal Reserve, with all its resources and expertise, has a hard time knowing where things are headed? Below are six recommendations:

1. Dollar allocation.��According to research, asset allocation is the most important driver of portfolio returns. But there���s a step I recommend even before asset allocation: I call it dollar allocation. The idea is to think, at a high level, how you���re allocating each dollar you earn.

The big three, of course, are spending, saving and taxes. The question is, how are you allocating among those categories and within them? This might seem like an elementary question, but many of us run our financial life on autopilot, so it can be eye-opening to take a closer look. Having a better handle on your dollar allocation can help you respond more easily when the economy throws a curveball.

2. Asset allocation.��The split between stocks and bonds is, in my opinion, the most important portfolio decision. But don���t stop there. When you think about asset allocation, go deeper. To assess the risk in your portfolio, I recommend tools like Morningstar���s free Instant X-Ray. This will help shine a light on your portfolio���s exposure���or lack thereof���to each segment of the market, and it can help highlight risks hiding below the surface.

3. Guaranteed income.��Virtually everyone is entitled to Social Security, but only a lucky few will receive traditional pensions. If you want to build more certainty into your financial plan, there���s an easy way to do that: with an annuity. I acknowledge that annuities don���t have a great reputation and I don���t normally recommend them.

But if stability and predictability are paramount, there are two types worth considering: single-premium immediate annuities (SPIAs) and deferred income annuities. SPIAs are attractive because they're generally the most cost-efficient. They���re also very straightforward, making it easy to comparison shop. Deferred annuities, on the other hand, don���t start paying until later in life and thus can provide critical longevity protection.

4. Tax categories.��As I���ve noted a few times in recent weeks, I believe it���s ideal to have assets in each of the three main tax categories: taxable, tax-deferred and Roth. But don���t forget 529 accounts. In some ways, they���re an ideal structure.

Like Roth accounts, 529s grow tax-free. But unlike Roths, you can contribute much more. Limits��vary��from state to state, but these limits are very high���between $200,000 and $500,000 in most cases. In addition, a contribution to a 529 is considered a ���completed gift��� for estate planning purposes, making them very attractive for high-net-worth families. This is a great tool for protecting against the uncertainty of ever-changing tax laws.

5. Debt.��The economist��Hyman Minsky��proposed a theory about economic crises. Paradoxically, he said, financial stability causes financial instability. What he meant is that periods of stability lead people to become overconfident because they assume the good times will last forever.

This, in turn, causes people to be more complacent and less disciplined���and to take on more debt than they can handle. That���s how stability can lead to instability. At a time like this, when everything seems rosy, it���s good to keep this in mind. If something unexpected happens in the economy, people with less debt are generally in a better position. My advice: Maintain a little more discipline than might seem necessary.

6. Mindset.��In the past, I���ve described a concept I call the��five minds��of the investor. In my opinion, the path to success as an investor requires a balancing act, channeling simultaneously the minds of an optimist, pessimist, analyst, economist and psychologist.

To understand why, consider just the past five years. In a lot of ways, it���s felt like an eternity. The stock market has more than doubled���but not without two hard-fought presidential elections, multiple changes to the tax code, a pandemic, a recession, a market crash and, finally, a stunning recovery. And yet, despite all that, here we are, five years later, far wealthier than we were before.

The lesson: Yes, the world is unpredictable. But through all the turmoil, some things are constant. Most important, when you own a stock market index fund, you own a little piece of hundreds of companies, where millions of people wake up every day and go to work to build wealth for shareholders, including you. And when you own U.S. Treasury bonds, you have an IOU from a government that���so far, at least���has never failed to pay its bills.

To be sure, there have been ups and downs���and there will be many more. As we've just seen, even the Fed isn���t all-knowing. But if you keep your eye on those things that are constant, I think that���s the best recipe for protecting yourself from whatever comes next.

Adam M. Grossman��is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on Twitter @AdamMGrossman��and check out his earlier articles.

Adam M. Grossman��is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on Twitter @AdamMGrossman��and check out his earlier articles.

Previously, they had been��forecasting��that interest rates would stay near zero through 2023, on the assumption that inflation would remain manageable. But as the country has emerged from hibernation, inflation has run much hotter than expected. As a result, an increasing number of Fed officials��now expect��they���ll have to raise rates much sooner. After so many months of insisting this wouldn���t happen, it took people by surprise to hear the opposite.

How did Fed officials get it wrong? The economy, it turns out, doesn���t always move in a straight line. In recent months, more than half the inflation came from just two areas���lumber and used cars���and for reasons that would have been hard to predict.

The new car market has been in disarray due to a semiconductor shortage, leaving car buyers to chase a limited number of used cars. Result: Used car prices recently logged their��fastest��monthly increase since record-keeping began in 1953. Meanwhile,��lumber��prices���despite a recent retreat���are up more than 100% from pre-pandemic levels. That���s because low mortgage rates coupled with lockdowns have boosted home��construction��and renovation.

The Fed���s difficulty in forecasting inflation illustrates, I think, how hard it can be as an investor to know where things are headed. I often come back to the refrain that ���no one has a crystal ball.��� The Fed���s recent challenges illustrate that reality. But that crystal ball motto is more of an observation than it is actionable advice. What can you, as an individual investor, do to protect yourself from uncertainty when even the Federal Reserve, with all its resources and expertise, has a hard time knowing where things are headed? Below are six recommendations:

1. Dollar allocation.��According to research, asset allocation is the most important driver of portfolio returns. But there���s a step I recommend even before asset allocation: I call it dollar allocation. The idea is to think, at a high level, how you���re allocating each dollar you earn.

The big three, of course, are spending, saving and taxes. The question is, how are you allocating among those categories and within them? This might seem like an elementary question, but many of us run our financial life on autopilot, so it can be eye-opening to take a closer look. Having a better handle on your dollar allocation can help you respond more easily when the economy throws a curveball.

2. Asset allocation.��The split between stocks and bonds is, in my opinion, the most important portfolio decision. But don���t stop there. When you think about asset allocation, go deeper. To assess the risk in your portfolio, I recommend tools like Morningstar���s free Instant X-Ray. This will help shine a light on your portfolio���s exposure���or lack thereof���to each segment of the market, and it can help highlight risks hiding below the surface.

3. Guaranteed income.��Virtually everyone is entitled to Social Security, but only a lucky few will receive traditional pensions. If you want to build more certainty into your financial plan, there���s an easy way to do that: with an annuity. I acknowledge that annuities don���t have a great reputation and I don���t normally recommend them.

But if stability and predictability are paramount, there are two types worth considering: single-premium immediate annuities (SPIAs) and deferred income annuities. SPIAs are attractive because they're generally the most cost-efficient. They���re also very straightforward, making it easy to comparison shop. Deferred annuities, on the other hand, don���t start paying until later in life and thus can provide critical longevity protection.

4. Tax categories.��As I���ve noted a few times in recent weeks, I believe it���s ideal to have assets in each of the three main tax categories: taxable, tax-deferred and Roth. But don���t forget 529 accounts. In some ways, they���re an ideal structure.

Like Roth accounts, 529s grow tax-free. But unlike Roths, you can contribute much more. Limits��vary��from state to state, but these limits are very high���between $200,000 and $500,000 in most cases. In addition, a contribution to a 529 is considered a ���completed gift��� for estate planning purposes, making them very attractive for high-net-worth families. This is a great tool for protecting against the uncertainty of ever-changing tax laws.

5. Debt.��The economist��Hyman Minsky��proposed a theory about economic crises. Paradoxically, he said, financial stability causes financial instability. What he meant is that periods of stability lead people to become overconfident because they assume the good times will last forever.

This, in turn, causes people to be more complacent and less disciplined���and to take on more debt than they can handle. That���s how stability can lead to instability. At a time like this, when everything seems rosy, it���s good to keep this in mind. If something unexpected happens in the economy, people with less debt are generally in a better position. My advice: Maintain a little more discipline than might seem necessary.

6. Mindset.��In the past, I���ve described a concept I call the��five minds��of the investor. In my opinion, the path to success as an investor requires a balancing act, channeling simultaneously the minds of an optimist, pessimist, analyst, economist and psychologist.

To understand why, consider just the past five years. In a lot of ways, it���s felt like an eternity. The stock market has more than doubled���but not without two hard-fought presidential elections, multiple changes to the tax code, a pandemic, a recession, a market crash and, finally, a stunning recovery. And yet, despite all that, here we are, five years later, far wealthier than we were before.

The lesson: Yes, the world is unpredictable. But through all the turmoil, some things are constant. Most important, when you own a stock market index fund, you own a little piece of hundreds of companies, where millions of people wake up every day and go to work to build wealth for shareholders, including you. And when you own U.S. Treasury bonds, you have an IOU from a government that���so far, at least���has never failed to pay its bills.

To be sure, there have been ups and downs���and there will be many more. As we've just seen, even the Fed isn���t all-knowing. But if you keep your eye on those things that are constant, I think that���s the best recipe for protecting yourself from whatever comes next.

Adam M. Grossman��is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on Twitter @AdamMGrossman��and check out his earlier articles.

Adam M. Grossman��is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on Twitter @AdamMGrossman��and check out his earlier articles.The post Taking Precautions appeared first on HumbleDollar.

Published on June 20, 2021 00:00

June 19, 2021

What Goes Down

IT MIGHT SEEM LIKE an obscure academic question: Do stocks truly follow a random walk or can we count on them reverting to the mean? Depending on which side we favor in this debate, it can make a huge difference to how we invest���and to our confidence as investors.

Like me, many HumbleDollar readers have most or all their investment dollars in index funds. A key reason we invest this way: It���s impossible to predict which stocks will shine because they follow a random walk. In other words, what happens to share prices on Monday tells us nothing about Tuesday, because Tuesday���s price movements will be driven by news that, by definition, isn���t yet known. The upshot: Our best bet is to diversify broadly and at the lowest possible cost, which is what index funds allow us to do.

But I suspect that���again like me���many HumbleDollar readers also believe that markets mean revert. If the stock market plunges this year, we feel that improves the odds that stocks will fare better next year and thus we don���t believe share price movements are completely random. Without this sort of conviction, it would be hard to ride out a major market decline. After all, if we couldn���t count on stock prices bouncing back, why shouldn���t we panic and sell?

It might seem contradictory to assume that the daily movement of individual stocks is random, while also assuming that the overall market reverts to the mean. But I think both beliefs are reasonable. We know it���s extraordinarily difficult to pick stocks that beat the market averages. For proof, look no further than the dismal performance of most actively managed mutual funds. But at the same time, there���s evidence that bad times in the broad market are followed by good.

When some investors use the phrase ���reversion to the mean,��� they use it in a strict sense, believing that the overall market always reverts to some average historical valuation or some average rate of return. But I don���t pretend to know what the market���s ���mean��� is. I don���t think there���s any guarantee that stocks will notch 10% a year, no matter how long we hold them, nor do I think the U.S. market is destined to revert to, say, its 100-year average of 17 times trailing 12-month reported earnings, with a dividend yield of 3.9%. (Today, stocks trade at 44 times earnings and yield 1.4%.)

But I do firmly believe that, when stocks next plunge, good times will return. Why? The stock market���s performance roughly reflects the economy. As the economy grows over time, corporate earnings will increase. In the short term, investors may be more concerned about, say, rising interest rates, political upheaval, accelerating inflation or higher taxes. But sooner or later, they���ll take note of those rising corporate profits and bid up share prices.

What are the investment implications? Instead of panicking when stocks plunge, we ought to feel confident that our portfolio will come back. But our degree of confidence should vary with our investment strategy.

If we own the broad stock market through, say, total market index funds, we know our portfolio will rebound along with the market. That means that, when stocks next nosedive, we should be prepared to rebalance our portfolio, adding to our total stock market index funds, so we maintain our portfolio���s target stock percentage. This will strike some as heresy, but I think that���if a market crash is severe enough���going even further, and overweighting stocks, is a reasonable strategy.

That said, we shouldn���t expect almost immediate gratification, like that enjoyed by those who bought in late February and early March 2020. The recovery from the next stock market crash may take far longer than we would like. Remember 2000-02? U.S. stocks suffered three consecutive losing years. Markets ought to return to their previous all-time highs, but it doesn���t mean they���ll do it quickly.

What if we���re overweighted in, say, growth stocks or value stocks? We can still be confident���but perhaps not so much. In a broad market rally, both growth and value stocks will gain, but there can be big differences in performance. Ditto for large and small stocks, and U.S. and international.

In other words, during a stock market decline, rebalancing from bonds and cash investments to the broad stock market is likely to pay off. But if value stocks outpace growth stocks in any given calendar year, which seems likely in 2021, rebalancing at year-end from value to growth could hurt results. To be sure, if the performance gap is large enough and it goes on for long enough, mean reversion among market segments ought to happen eventually. But different segments of the global stock market can stay out of favor for a decade at a time, as we saw over the past 10 years, when U.S. large-company growth stocks soared, while value stocks, smaller companies and international markets struggled.

One implication: We should be slow to rebalance such market segments. For instance, I have a small-cap value index fund, which���after a long period of lackluster performance���has finally started generating decent returns. I���m in no hurry to lighten up on small-cap value and rebalance back to my target percentage because I figure this trend could run for many years.

What about individual stocks? While the entire stock market and broad market segments should revert to the mean, there are no guarantees with individual companies. In fact, history tells us that most companies suffer subpar stock market performance and have very short lives. The upshot: If you own an individual stock that���s struggling, I���d think long and hard before doubling down. Instead, I���d ask whether the market knows something about the company���s prospects that you don���t���and whether the wise move would be to sell and move the proceeds into a broadly diversified fund.

Latest Articles

HERE ARE THE SIX other articles published by HumbleDollar this week:

Want to hold down taxes in retirement? The key, says Adam Grossman, is to focus not on minimizing taxes in any given year���but instead having a plan to minimize taxes over your lifetime.

"The next time you justify a major expenditure based on what your friends are doing, ask yourself: Is this something you want���or are you trying to keep up with the Joneses?" writes Rob Carrigg, Jr.

How hard will your portfolio get hit in a market crash? How much can you safely spend in retirement? You can answer both questions��by calculating your spendable net worth. Tom Welsh explains how.

"I didn���t know what I wanted to do in retirement, nor how much that would cost," recalls Mike Drak. "Until I nailed that down, I couldn���t feel fine. Instead, I felt uneasy, with the need to have more in savings."

Helping your elderly parents with financial, health and other issues? Drawing on his experience with his mom, dad and in-laws, Howard Rohleder��offers a comprehensive to-do list.

"During the funeral, the priest spoke to the grandchildren," recounts Rick Connor. "He challenged them to think about the fine qualities their grandfather possessed and pick one to emulate."

Jonathan Clements is the founder and editor of HumbleDollar. Follow him on Twitter @ClementsMoney and on Facebook, and check out his earlier��articles.

Jonathan Clements is the founder and editor of HumbleDollar. Follow him on Twitter @ClementsMoney and on Facebook, and check out his earlier��articles.

Like me, many HumbleDollar readers have most or all their investment dollars in index funds. A key reason we invest this way: It���s impossible to predict which stocks will shine because they follow a random walk. In other words, what happens to share prices on Monday tells us nothing about Tuesday, because Tuesday���s price movements will be driven by news that, by definition, isn���t yet known. The upshot: Our best bet is to diversify broadly and at the lowest possible cost, which is what index funds allow us to do.

But I suspect that���again like me���many HumbleDollar readers also believe that markets mean revert. If the stock market plunges this year, we feel that improves the odds that stocks will fare better next year and thus we don���t believe share price movements are completely random. Without this sort of conviction, it would be hard to ride out a major market decline. After all, if we couldn���t count on stock prices bouncing back, why shouldn���t we panic and sell?

It might seem contradictory to assume that the daily movement of individual stocks is random, while also assuming that the overall market reverts to the mean. But I think both beliefs are reasonable. We know it���s extraordinarily difficult to pick stocks that beat the market averages. For proof, look no further than the dismal performance of most actively managed mutual funds. But at the same time, there���s evidence that bad times in the broad market are followed by good.

When some investors use the phrase ���reversion to the mean,��� they use it in a strict sense, believing that the overall market always reverts to some average historical valuation or some average rate of return. But I don���t pretend to know what the market���s ���mean��� is. I don���t think there���s any guarantee that stocks will notch 10% a year, no matter how long we hold them, nor do I think the U.S. market is destined to revert to, say, its 100-year average of 17 times trailing 12-month reported earnings, with a dividend yield of 3.9%. (Today, stocks trade at 44 times earnings and yield 1.4%.)

But I do firmly believe that, when stocks next plunge, good times will return. Why? The stock market���s performance roughly reflects the economy. As the economy grows over time, corporate earnings will increase. In the short term, investors may be more concerned about, say, rising interest rates, political upheaval, accelerating inflation or higher taxes. But sooner or later, they���ll take note of those rising corporate profits and bid up share prices.

What are the investment implications? Instead of panicking when stocks plunge, we ought to feel confident that our portfolio will come back. But our degree of confidence should vary with our investment strategy.

If we own the broad stock market through, say, total market index funds, we know our portfolio will rebound along with the market. That means that, when stocks next nosedive, we should be prepared to rebalance our portfolio, adding to our total stock market index funds, so we maintain our portfolio���s target stock percentage. This will strike some as heresy, but I think that���if a market crash is severe enough���going even further, and overweighting stocks, is a reasonable strategy.

That said, we shouldn���t expect almost immediate gratification, like that enjoyed by those who bought in late February and early March 2020. The recovery from the next stock market crash may take far longer than we would like. Remember 2000-02? U.S. stocks suffered three consecutive losing years. Markets ought to return to their previous all-time highs, but it doesn���t mean they���ll do it quickly.

What if we���re overweighted in, say, growth stocks or value stocks? We can still be confident���but perhaps not so much. In a broad market rally, both growth and value stocks will gain, but there can be big differences in performance. Ditto for large and small stocks, and U.S. and international.

In other words, during a stock market decline, rebalancing from bonds and cash investments to the broad stock market is likely to pay off. But if value stocks outpace growth stocks in any given calendar year, which seems likely in 2021, rebalancing at year-end from value to growth could hurt results. To be sure, if the performance gap is large enough and it goes on for long enough, mean reversion among market segments ought to happen eventually. But different segments of the global stock market can stay out of favor for a decade at a time, as we saw over the past 10 years, when U.S. large-company growth stocks soared, while value stocks, smaller companies and international markets struggled.

One implication: We should be slow to rebalance such market segments. For instance, I have a small-cap value index fund, which���after a long period of lackluster performance���has finally started generating decent returns. I���m in no hurry to lighten up on small-cap value and rebalance back to my target percentage because I figure this trend could run for many years.

What about individual stocks? While the entire stock market and broad market segments should revert to the mean, there are no guarantees with individual companies. In fact, history tells us that most companies suffer subpar stock market performance and have very short lives. The upshot: If you own an individual stock that���s struggling, I���d think long and hard before doubling down. Instead, I���d ask whether the market knows something about the company���s prospects that you don���t���and whether the wise move would be to sell and move the proceeds into a broadly diversified fund.

Latest Articles

HERE ARE THE SIX other articles published by HumbleDollar this week:

Want to hold down taxes in retirement? The key, says Adam Grossman, is to focus not on minimizing taxes in any given year���but instead having a plan to minimize taxes over your lifetime.

"The next time you justify a major expenditure based on what your friends are doing, ask yourself: Is this something you want���or are you trying to keep up with the Joneses?" writes Rob Carrigg, Jr.

How hard will your portfolio get hit in a market crash? How much can you safely spend in retirement? You can answer both questions��by calculating your spendable net worth. Tom Welsh explains how.

"I didn���t know what I wanted to do in retirement, nor how much that would cost," recalls Mike Drak. "Until I nailed that down, I couldn���t feel fine. Instead, I felt uneasy, with the need to have more in savings."

Helping your elderly parents with financial, health and other issues? Drawing on his experience with his mom, dad and in-laws, Howard Rohleder��offers a comprehensive to-do list.

"During the funeral, the priest spoke to the grandchildren," recounts Rick Connor. "He challenged them to think about the fine qualities their grandfather possessed and pick one to emulate."

Jonathan Clements is the founder and editor of HumbleDollar. Follow him on Twitter @ClementsMoney and on Facebook, and check out his earlier��articles.

Jonathan Clements is the founder and editor of HumbleDollar. Follow him on Twitter @ClementsMoney and on Facebook, and check out his earlier��articles.The post What Goes Down appeared first on HumbleDollar.

Published on June 19, 2021 00:00

June 18, 2021

Where Wealth Begins

AT A RECENT FAMILY event, some of the younger adults were asking their uncle what investments they ought to buy. The uncle is a veteran finance professional with a background in alternative investments.

The young men, all in their early 20s, were just starting their careers. They wanted his opinion on hot stocks, cryptocurrencies and nonfungible tokens (NFTs). One of them had recently made several hundred dollars buying and selling an NFT of an NBA image. He had $800 in cash and was looking for the next big thing.

Afterward, I thought about the conversation and wondered how I���d have answered. My conclusion: The best investment these young men could make was building their own human capital.

They���re uniformly smart, healthy and willing to work. I���d argue their greatest asset is the ability to earn an income for decades to come. There are numerous ways to enhance that ability���formal education, training, internships, jobs, informal education. I���m a big believer in lifelong learning.

I���d also encourage them to learn from others. People love to talk about themselves, about what they do and how they got ahead in their careers. You can learn so much from others by asking questions and listening.

Finally, I���d advise these 20-somethings not to be afraid to try new things���and not to be afraid to fail. That���s one of the main ways we grow.

The event that precipitated the original conversation was the funeral for the grandfather of these young men. He was a fantastic example of someone who developed and utilized his human capital to build successful businesses and provide for his family. His life was also a fine example of the American dream.

The grandfather had been born in 1929 in Gromaca, Croatia, a small mountain village just north of Dubrovnik. In his early years, he worked on the family farm and as a butcher in the village. In 1954, he fled the former Yugoslavia by crossing the Adriatic in a small boat. He led eight cousins on this journey, traveling for two nights. They suffered a broken motor and had to row most of the way.

After arriving in Bari, Italy, he found work as a merchant sailor, traveling to the Middle East and South America, while waiting for approval to immigrate to the U.S. In 1956, he settled in Watsonville, California, where he found work in the local orchards. He learned the apple business and ultimately started his own apple farming business. If you like sparkling apple cider, there���s a good chance you���ve tasted his apples.

He also started his own real estate business. With his wife, he bought small houses, which they���d fix up and then sell or rent. The family moved numerous times before finally settling on a 10-acre site in Aptos, California, building a lovely ranch home themselves. By now, they had five children.

Over the 65 years he lived in California, his businesses provided jobs and housing for many people in California���s Central Coast. He worked at least part of every day, whether that meant exploring new properties, repairing a rental home, or climbing a ladder and pruning an apple tree. He remained active in his businesses until age 91.

During the funeral sermon, the priest spoke directly to the grandchildren. He challenged them to think about the many fine qualities their grandfather possessed, and pick one to embrace and emulate. I thought that was great advice. Building wealth takes most of us a lifetime of work���and it���s our human capital that makes it possible.

Richard Connor is��a semi-retired aerospace engineer with a keen interest in finance. He��enjoys a wide variety of other interests, including chasing grandkids, space, sports, travel, winemaking and reading. Follow Rick on Twitter��@RConnor609��and check out his earlier articles.

Richard Connor is��a semi-retired aerospace engineer with a keen interest in finance. He��enjoys a wide variety of other interests, including chasing grandkids, space, sports, travel, winemaking and reading. Follow Rick on Twitter��@RConnor609��and check out his earlier articles.

The young men, all in their early 20s, were just starting their careers. They wanted his opinion on hot stocks, cryptocurrencies and nonfungible tokens (NFTs). One of them had recently made several hundred dollars buying and selling an NFT of an NBA image. He had $800 in cash and was looking for the next big thing.

Afterward, I thought about the conversation and wondered how I���d have answered. My conclusion: The best investment these young men could make was building their own human capital.

They���re uniformly smart, healthy and willing to work. I���d argue their greatest asset is the ability to earn an income for decades to come. There are numerous ways to enhance that ability���formal education, training, internships, jobs, informal education. I���m a big believer in lifelong learning.

I���d also encourage them to learn from others. People love to talk about themselves, about what they do and how they got ahead in their careers. You can learn so much from others by asking questions and listening.

Finally, I���d advise these 20-somethings not to be afraid to try new things���and not to be afraid to fail. That���s one of the main ways we grow.

The event that precipitated the original conversation was the funeral for the grandfather of these young men. He was a fantastic example of someone who developed and utilized his human capital to build successful businesses and provide for his family. His life was also a fine example of the American dream.

The grandfather had been born in 1929 in Gromaca, Croatia, a small mountain village just north of Dubrovnik. In his early years, he worked on the family farm and as a butcher in the village. In 1954, he fled the former Yugoslavia by crossing the Adriatic in a small boat. He led eight cousins on this journey, traveling for two nights. They suffered a broken motor and had to row most of the way.

After arriving in Bari, Italy, he found work as a merchant sailor, traveling to the Middle East and South America, while waiting for approval to immigrate to the U.S. In 1956, he settled in Watsonville, California, where he found work in the local orchards. He learned the apple business and ultimately started his own apple farming business. If you like sparkling apple cider, there���s a good chance you���ve tasted his apples.

He also started his own real estate business. With his wife, he bought small houses, which they���d fix up and then sell or rent. The family moved numerous times before finally settling on a 10-acre site in Aptos, California, building a lovely ranch home themselves. By now, they had five children.

Over the 65 years he lived in California, his businesses provided jobs and housing for many people in California���s Central Coast. He worked at least part of every day, whether that meant exploring new properties, repairing a rental home, or climbing a ladder and pruning an apple tree. He remained active in his businesses until age 91.

During the funeral sermon, the priest spoke directly to the grandchildren. He challenged them to think about the many fine qualities their grandfather possessed, and pick one to embrace and emulate. I thought that was great advice. Building wealth takes most of us a lifetime of work���and it���s our human capital that makes it possible.

Richard Connor is��a semi-retired aerospace engineer with a keen interest in finance. He��enjoys a wide variety of other interests, including chasing grandkids, space, sports, travel, winemaking and reading. Follow Rick on Twitter��@RConnor609��and check out his earlier articles.

Richard Connor is��a semi-retired aerospace engineer with a keen interest in finance. He��enjoys a wide variety of other interests, including chasing grandkids, space, sports, travel, winemaking and reading. Follow Rick on Twitter��@RConnor609��and check out his earlier articles.The post Where Wealth Begins appeared first on HumbleDollar.

Published on June 18, 2021 00:00

June 17, 2021

Rough Start

RETIREMENT AT FIRST is fun and feels pretty good. No more setting an alarm. No more dealing with a long commute. No demanding work schedule that leaves you exhausted most evenings.

Best of all, no one is telling you what to do. You can sleep in or travel to all those places you dreamed about. You can golf as much as you like or spend lots of time with the grandkids.

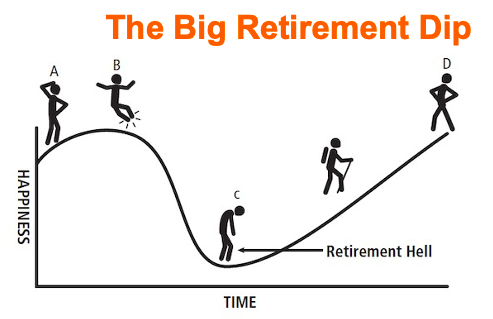

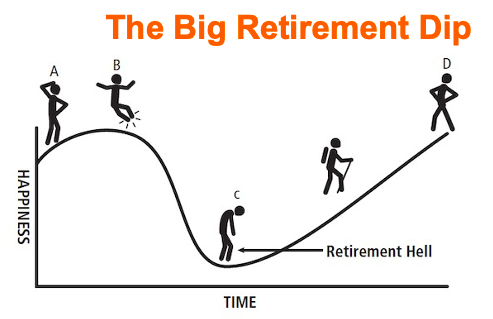

You���re as free as a bird. For some���those I call comfort-oriented retirees���this will be enough. But at some point, many retirees will feel a need to do something else���something more meaningful, interesting and challenging. This is when the slide down into retirement hell begins. That brings me to the graph below, which is from my new book.

In retirement hell, you get a feeling of being incredibly lost and vulnerable. Your heart isn���t into the hobbies and activities that used to bring you joy. The life of leisure that you dreamt about for so long becomes empty and meaningless. This is when the depression sinks in.

When I was forced out of my banking career, I was happy. I had been planning on leaving anyway because the stress was getting to me and I really didn���t like working there anymore. Getting that severance check at age 59 made me feel like I���d won the lottery. Things seemed good until that first Monday morning hit.

My wife had gone to work and I found myself sitting at home alone. Things were pretty quiet. I missed the phone calls and daily emails I used to get at work. I started to get a little antsy. I couldn���t even hang out with my friends because all of them were still working.

What was really frustrating was that neither my friends nor my wife could understand what I was going through. They couldn���t relate to me being unhappy. It just didn���t make any sense to them.

I had trouble sleeping most nights and would get this ringing in my ears from all the stress I was experiencing. After falling asleep, I���d usually wake up around 2 a.m. and spend the rest of the night tossing and turning. That���s when the fear would creep in.

My wife would sometimes wake up and ask me what���s wrong.

I would say something like, ���I���m worried we don���t have enough money saved up.���

She���d say, ���Don���t worry, we���re fine.���

For the record, my wife is an investment advisor who manages our portfolio and pays the bills, so she has a good grasp of what fine is. But hearing her say that just stressed me out more. I couldn���t relate to what fine was. I sure wasn���t feeling fine.

Eventually, I realized it was my fault. The problem: I wasn���t able to define fine. I didn���t know what I wanted to do in retirement, nor how much that would cost. Until I nailed that down, I couldn���t feel fine. Instead, I felt uneasy, with the need to have just a little bit more in savings.

Once I finally figured out what I wanted to do in retirement���and confirmed that we had sufficient retirement cash flow to cover that���I slept better at night. Knowing that we had enough allowed me to start focusing on the possibilities instead of the problems. That���s when I started on the road out of retirement hell.

Mike Drak is a 38-year veteran of the financial services industry. He���s the author of

Retirement Heaven or Hell

, which was just published, as well as an earlier book,

Victory Lap Retirement

. Mike works with his wife, an investment advisor, to help clients design a fulfilling retirement. For more on Mike, head to��

BoomingEncore.com

. His previous articles were Who Are You and��Retirement Preview.

Mike Drak is a 38-year veteran of the financial services industry. He���s the author of

Retirement Heaven or Hell

, which was just published, as well as an earlier book,

Victory Lap Retirement

. Mike works with his wife, an investment advisor, to help clients design a fulfilling retirement. For more on Mike, head to��

BoomingEncore.com

. His previous articles were Who Are You and��Retirement Preview.

Best of all, no one is telling you what to do. You can sleep in or travel to all those places you dreamed about. You can golf as much as you like or spend lots of time with the grandkids.

You���re as free as a bird. For some���those I call comfort-oriented retirees���this will be enough. But at some point, many retirees will feel a need to do something else���something more meaningful, interesting and challenging. This is when the slide down into retirement hell begins. That brings me to the graph below, which is from my new book.

In retirement hell, you get a feeling of being incredibly lost and vulnerable. Your heart isn���t into the hobbies and activities that used to bring you joy. The life of leisure that you dreamt about for so long becomes empty and meaningless. This is when the depression sinks in.

When I was forced out of my banking career, I was happy. I had been planning on leaving anyway because the stress was getting to me and I really didn���t like working there anymore. Getting that severance check at age 59 made me feel like I���d won the lottery. Things seemed good until that first Monday morning hit.

My wife had gone to work and I found myself sitting at home alone. Things were pretty quiet. I missed the phone calls and daily emails I used to get at work. I started to get a little antsy. I couldn���t even hang out with my friends because all of them were still working.

What was really frustrating was that neither my friends nor my wife could understand what I was going through. They couldn���t relate to me being unhappy. It just didn���t make any sense to them.

I had trouble sleeping most nights and would get this ringing in my ears from all the stress I was experiencing. After falling asleep, I���d usually wake up around 2 a.m. and spend the rest of the night tossing and turning. That���s when the fear would creep in.

My wife would sometimes wake up and ask me what���s wrong.

I would say something like, ���I���m worried we don���t have enough money saved up.���

She���d say, ���Don���t worry, we���re fine.���

For the record, my wife is an investment advisor who manages our portfolio and pays the bills, so she has a good grasp of what fine is. But hearing her say that just stressed me out more. I couldn���t relate to what fine was. I sure wasn���t feeling fine.

Eventually, I realized it was my fault. The problem: I wasn���t able to define fine. I didn���t know what I wanted to do in retirement, nor how much that would cost. Until I nailed that down, I couldn���t feel fine. Instead, I felt uneasy, with the need to have just a little bit more in savings.

Once I finally figured out what I wanted to do in retirement���and confirmed that we had sufficient retirement cash flow to cover that���I slept better at night. Knowing that we had enough allowed me to start focusing on the possibilities instead of the problems. That���s when I started on the road out of retirement hell.

Mike Drak is a 38-year veteran of the financial services industry. He���s the author of

Retirement Heaven or Hell

, which was just published, as well as an earlier book,

Victory Lap Retirement

. Mike works with his wife, an investment advisor, to help clients design a fulfilling retirement. For more on Mike, head to��

BoomingEncore.com

. His previous articles were Who Are You and��Retirement Preview.

Mike Drak is a 38-year veteran of the financial services industry. He���s the author of

Retirement Heaven or Hell

, which was just published, as well as an earlier book,

Victory Lap Retirement

. Mike works with his wife, an investment advisor, to help clients design a fulfilling retirement. For more on Mike, head to��

BoomingEncore.com

. His previous articles were Who Are You and��Retirement Preview.The post Rough Start appeared first on HumbleDollar.

Published on June 17, 2021 00:00

June 16, 2021

Keeping Up

I���VE WORKED AS a financial advisor for 25 years and yet I���m still struck by how many people fall for one of the oldest cons in the book: keeping up with the Joneses.

Being ostentatious is no longer seen as d��class��, at least in America. Instead, it���s a requirement for reality TV, the currency of Instagram Influencers and a proxy for achievement on Facebook. Why be rich when we can appear rich?

We���re hardwired to act this way. A 2013 study titled Keeping Up With the Joneses found that humans are greatly influenced by group behavior, often assigning value to others and what they own, even when no other information was available. Similarly, a 2015 study by German neuroscientists used functional magnetic resonance imaging to measure brain activity in participants as they outdid and were outdone by others. When they saw themselves as performing better, they experienced a boost in the same area of the brain that���s triggered by a gambler���s high. What happened when they couldn���t keep up with the Joneses? They showed activity in an area of the brain associated with feeling pain.

���Pop��� Momand is often credited with popularizing the phrase, ���Keeping up with the Joneses.�����His syndicated daily cartoon ran from 1913 to 1938. It focused on the hapless McGinis family and their misadventures, as they tried and failed to keep up with their never-to-be-seen neighbors, the Joneses. The Joneses canoed, so the McGinises tried it, only to end up in the water. Mr. Jones wears pink socks, so Mrs. McGinis dresses her husband in pink socks and a ridiculous fuzzy hat, all in an ill-fated attempt to show up their neighbor.

We all try to keep up with the Joneses. The thinking is simple: If the neighbors can afford it, why can���t we? This type of decision-making stems from a cognitive bias that psychologists call the anchoring effect. We take a sliver of information, such as the neighbors remodeling their kitchen, and decide it's time we did the same.

Unfortunately, we can justify almost any behavior if we look around���because it���s highly likely someone else is already doing it. This is our herd mentality, an instinct that helped our nomadic ancestors to survive. But today, it can lead to a series of bad financial decisions. You sat in first class the last time you flew, so there���s no going back to coach. Your kids made friends at that private school, so you can���t pull them out now. The perceived social contract of your chosen lifestyle makes your decisions for you.

You may be able to pay that tuition, make those car payments and continue to vacation in Instagram-worthy locales, but that doesn���t necessarily mean this spending is sensible. Managing money is about putting yourself in a position where someday you���ll be financially independent. If you���re well on your way and you���re saving enough, great, you might even be the Joneses. But if you're trying to keep up, then it���s a slippery slope that can often lead to overspending and under-saving.

Another reason to avoid such competitive consumption: You have no idea what���s really going on over at the Joneses. Yes, you might appear to be in a similar financial position because your houses are alike, you work in related fields or you share similar backgrounds. But as I���ve learned in my years as a financial advisor, it���s tough to get an accurate picture of a family���s finances unless they let you look under the hood.

There may be circumstances you have no idea about. Maybe the Joneses have trust funds that pay them income every month. Maybe those trust funds pay their kids' tuitions all the way through college. Or perhaps the Joneses just earn way more money than you think. Professions such as doctors and lawyers have vast income ranges. It's possible that you think your neighbors are making $200,000 when they���re really making $800,000.

An additional reason to avoid mimicking the Joneses: What if they���re in way over their heads? Perhaps they���re suffering from what humorist Robert Quillen described in 1928 as, ���Americanism: Using money you haven't earned to buy things you don't need to impress people you don't like." Maybe they���re living off their credit cards, that summer house they refer to as theirs is owned by grandma, and their last Google search was ���how to file for bankruptcy.���

From what I���ve seen, keeping up with the Joneses is an epidemic in America. It���s a significant contributor to under-saving, excessive debt and the looming retirement crisis. But it isn���t too late to break the cycle. The next time you justify a major expenditure based mostly on seeing what your friends or neighbors are doing, stop and ask yourself: Is this something you truly want���or are you just trying to keep up with the Joneses?

Rob Carrigg, Jr.

, is a Certified Financial Planner in Portsmouth, New Hampshire. He is a problem solver who works to simplify people���s financial lives. Rob���s current passions are jam bands, pickleball and coaching his eight-year-old���s lacrosse team.

Rob Carrigg, Jr.

, is a Certified Financial Planner in Portsmouth, New Hampshire. He is a problem solver who works to simplify people���s financial lives. Rob���s current passions are jam bands, pickleball and coaching his eight-year-old���s lacrosse team.

Being ostentatious is no longer seen as d��class��, at least in America. Instead, it���s a requirement for reality TV, the currency of Instagram Influencers and a proxy for achievement on Facebook. Why be rich when we can appear rich?

We���re hardwired to act this way. A 2013 study titled Keeping Up With the Joneses found that humans are greatly influenced by group behavior, often assigning value to others and what they own, even when no other information was available. Similarly, a 2015 study by German neuroscientists used functional magnetic resonance imaging to measure brain activity in participants as they outdid and were outdone by others. When they saw themselves as performing better, they experienced a boost in the same area of the brain that���s triggered by a gambler���s high. What happened when they couldn���t keep up with the Joneses? They showed activity in an area of the brain associated with feeling pain.

���Pop��� Momand is often credited with popularizing the phrase, ���Keeping up with the Joneses.�����His syndicated daily cartoon ran from 1913 to 1938. It focused on the hapless McGinis family and their misadventures, as they tried and failed to keep up with their never-to-be-seen neighbors, the Joneses. The Joneses canoed, so the McGinises tried it, only to end up in the water. Mr. Jones wears pink socks, so Mrs. McGinis dresses her husband in pink socks and a ridiculous fuzzy hat, all in an ill-fated attempt to show up their neighbor.

We all try to keep up with the Joneses. The thinking is simple: If the neighbors can afford it, why can���t we? This type of decision-making stems from a cognitive bias that psychologists call the anchoring effect. We take a sliver of information, such as the neighbors remodeling their kitchen, and decide it's time we did the same.

Unfortunately, we can justify almost any behavior if we look around���because it���s highly likely someone else is already doing it. This is our herd mentality, an instinct that helped our nomadic ancestors to survive. But today, it can lead to a series of bad financial decisions. You sat in first class the last time you flew, so there���s no going back to coach. Your kids made friends at that private school, so you can���t pull them out now. The perceived social contract of your chosen lifestyle makes your decisions for you.

You may be able to pay that tuition, make those car payments and continue to vacation in Instagram-worthy locales, but that doesn���t necessarily mean this spending is sensible. Managing money is about putting yourself in a position where someday you���ll be financially independent. If you���re well on your way and you���re saving enough, great, you might even be the Joneses. But if you're trying to keep up, then it���s a slippery slope that can often lead to overspending and under-saving.

Another reason to avoid such competitive consumption: You have no idea what���s really going on over at the Joneses. Yes, you might appear to be in a similar financial position because your houses are alike, you work in related fields or you share similar backgrounds. But as I���ve learned in my years as a financial advisor, it���s tough to get an accurate picture of a family���s finances unless they let you look under the hood.

There may be circumstances you have no idea about. Maybe the Joneses have trust funds that pay them income every month. Maybe those trust funds pay their kids' tuitions all the way through college. Or perhaps the Joneses just earn way more money than you think. Professions such as doctors and lawyers have vast income ranges. It's possible that you think your neighbors are making $200,000 when they���re really making $800,000.

An additional reason to avoid mimicking the Joneses: What if they���re in way over their heads? Perhaps they���re suffering from what humorist Robert Quillen described in 1928 as, ���Americanism: Using money you haven't earned to buy things you don't need to impress people you don't like." Maybe they���re living off their credit cards, that summer house they refer to as theirs is owned by grandma, and their last Google search was ���how to file for bankruptcy.���

From what I���ve seen, keeping up with the Joneses is an epidemic in America. It���s a significant contributor to under-saving, excessive debt and the looming retirement crisis. But it isn���t too late to break the cycle. The next time you justify a major expenditure based mostly on seeing what your friends or neighbors are doing, stop and ask yourself: Is this something you truly want���or are you just trying to keep up with the Joneses?

Rob Carrigg, Jr.

, is a Certified Financial Planner in Portsmouth, New Hampshire. He is a problem solver who works to simplify people���s financial lives. Rob���s current passions are jam bands, pickleball and coaching his eight-year-old���s lacrosse team.

Rob Carrigg, Jr.

, is a Certified Financial Planner in Portsmouth, New Hampshire. He is a problem solver who works to simplify people���s financial lives. Rob���s current passions are jam bands, pickleball and coaching his eight-year-old���s lacrosse team.The post Keeping Up appeared first on HumbleDollar.

Published on June 16, 2021 00:00

June 15, 2021

Portfolio Acid Test

MANY OF US HAVE much of our wealth in stocks and bonds���and that raises some nagging questions. How safe is this money? What do I own that I can really count on? If I���m retired, how much of this portfolio can I afford to spend in the year ahead? These concerns grow when markets seem high.

How can we get some perspective on these questions? We might try calculating our ���spendable net worth.��� What���s that? It���s basically our net worth���our assets, excluding the value of our primary residence, minus all debt���with a discount applied that reflects the market risk involved.

To assess market risk, we need to ask, ���How bad could things get?��� Fortunately (or unfortunately), we can draw on recent experience. Twice this century, the stock market has fallen by 50%. During recent recessions, investment grade corporate bonds and high-yield junk bonds also got hit hard, albeit to a lesser degree���and those recessions seem to happen at least once a decade.

Looking at performance in recent recessionary periods can help us estimate how bad things could get. We can use these historical price drops for different asset classes to come up with market risk discount rates, and we can then apply these discounts to a portfolio���s various investment categories to come up with spendable net worth.

Suppose we estimate that the worst-case market risk discounts���in other words, the potential price declines���are 50% for stocks, 35% for high-yield bonds and 20% for investment grade bonds. Let���s also assume we have a $1 million portfolio comprised of $500,000 in stocks, $350,000 in investment grade corporate bonds and $150,000 in junk bonds. Applying the market risk discounts to each asset class would give us a consolidated risk discount of $372,500, or 37% of the portfolio���s value. This is the money that���s at risk���and it leaves us with a total spendable net worth, or SNW, of $627,500.

We can think of the $1 million as divided between a $627,500 low-risk segment���the SNW���and a $372,500 high-risk segment that���s equal to the market risk discount. A more conservative portfolio, with less in stocks and junk bonds, would have a lower risk discount. Think of spendable net worth as a kind of acid test. It makes us think hard about our risk tolerance���and whether we���re comfortable with the amount of money that���s at risk.

There are some difficult tradeoffs here. To get the higher return offered by stocks, we need to accept a steeper market discount and hence a lower spendable net worth. If we move $1,000 of cash into stocks, we drop our SNW by $500. A younger investor might make that bet, while an older investor might shy away. But whatever our age, our portfolio���s asset allocation should be driven by the level of SNW with which we feel comfortable���because there���s a risk that the rest of our net worth could be lost in pursuit of higher returns.

Spendable net worth can also help retirees with long-range planning. Retirees want to know how much of their portfolio they can safely spend this year, while leaving enough to cover their remaining years. To find that number, we might divide our current SNW by our estimated life expectancy.

Take the example above, with its spendable net worth of $627,500. If we expect to live 30 more years, the low-risk annual spending amount would be $627,500 divided by 30, or $21,000. That spending amount rises to $33,000 if full net worth is used. Which number should we use? We might pick an annual spending amount somewhere between these two limits, depending on our risk tolerance.

The annual spending calculation assumes that our portfolio���s after-tax return will match our rising living costs, so our spending can climb along with inflation. This is arguably a conservative assumption. What if it���s wrong? If we recalculate our spending budget each year based on remaining life expectancy and current portfolio values, we���ll be compelled to adjust our spending���for better or worse.

If we do spend based on SNW, rather than based on full net worth, it���ll also impact how much we end up bequeathing. Let���s assume a retiree holds annual spending to each year���s SNW budget and lives to his or her full life expectancy. At the time of death, the retiree���s remaining portfolio value would equal the market risk discount that was applied to his or her full net worth. In other words, at the time of death, the unspent market risk discount amount becomes the estate value that���s available to our retiree���s heirs. Throughout retirement, the market risk discount value is, in effect, earmarked for the heirs.

Tom Welsh is a certified management accountant in Raleigh, North Carolina. He has been the chief financial officer at several manufacturing companies and is founder of��

Value Point Accounting

, where he helps businesses manage product and customer profitability. His previous articles��were Better Than Nothing,��Five Lives and��

Pay to Play

. Tom can be reached at��

tomgwelsh@valuepointaccounting.com

.

Tom Welsh is a certified management accountant in Raleigh, North Carolina. He has been the chief financial officer at several manufacturing companies and is founder of��

Value Point Accounting

, where he helps businesses manage product and customer profitability. His previous articles��were Better Than Nothing,��Five Lives and��

Pay to Play

. Tom can be reached at��

tomgwelsh@valuepointaccounting.com

.

How can we get some perspective on these questions? We might try calculating our ���spendable net worth.��� What���s that? It���s basically our net worth���our assets, excluding the value of our primary residence, minus all debt���with a discount applied that reflects the market risk involved.

To assess market risk, we need to ask, ���How bad could things get?��� Fortunately (or unfortunately), we can draw on recent experience. Twice this century, the stock market has fallen by 50%. During recent recessions, investment grade corporate bonds and high-yield junk bonds also got hit hard, albeit to a lesser degree���and those recessions seem to happen at least once a decade.

Looking at performance in recent recessionary periods can help us estimate how bad things could get. We can use these historical price drops for different asset classes to come up with market risk discount rates, and we can then apply these discounts to a portfolio���s various investment categories to come up with spendable net worth.

Suppose we estimate that the worst-case market risk discounts���in other words, the potential price declines���are 50% for stocks, 35% for high-yield bonds and 20% for investment grade bonds. Let���s also assume we have a $1 million portfolio comprised of $500,000 in stocks, $350,000 in investment grade corporate bonds and $150,000 in junk bonds. Applying the market risk discounts to each asset class would give us a consolidated risk discount of $372,500, or 37% of the portfolio���s value. This is the money that���s at risk���and it leaves us with a total spendable net worth, or SNW, of $627,500.

We can think of the $1 million as divided between a $627,500 low-risk segment���the SNW���and a $372,500 high-risk segment that���s equal to the market risk discount. A more conservative portfolio, with less in stocks and junk bonds, would have a lower risk discount. Think of spendable net worth as a kind of acid test. It makes us think hard about our risk tolerance���and whether we���re comfortable with the amount of money that���s at risk.

There are some difficult tradeoffs here. To get the higher return offered by stocks, we need to accept a steeper market discount and hence a lower spendable net worth. If we move $1,000 of cash into stocks, we drop our SNW by $500. A younger investor might make that bet, while an older investor might shy away. But whatever our age, our portfolio���s asset allocation should be driven by the level of SNW with which we feel comfortable���because there���s a risk that the rest of our net worth could be lost in pursuit of higher returns.

Spendable net worth can also help retirees with long-range planning. Retirees want to know how much of their portfolio they can safely spend this year, while leaving enough to cover their remaining years. To find that number, we might divide our current SNW by our estimated life expectancy.

Take the example above, with its spendable net worth of $627,500. If we expect to live 30 more years, the low-risk annual spending amount would be $627,500 divided by 30, or $21,000. That spending amount rises to $33,000 if full net worth is used. Which number should we use? We might pick an annual spending amount somewhere between these two limits, depending on our risk tolerance.

The annual spending calculation assumes that our portfolio���s after-tax return will match our rising living costs, so our spending can climb along with inflation. This is arguably a conservative assumption. What if it���s wrong? If we recalculate our spending budget each year based on remaining life expectancy and current portfolio values, we���ll be compelled to adjust our spending���for better or worse.

If we do spend based on SNW, rather than based on full net worth, it���ll also impact how much we end up bequeathing. Let���s assume a retiree holds annual spending to each year���s SNW budget and lives to his or her full life expectancy. At the time of death, the retiree���s remaining portfolio value would equal the market risk discount that was applied to his or her full net worth. In other words, at the time of death, the unspent market risk discount amount becomes the estate value that���s available to our retiree���s heirs. Throughout retirement, the market risk discount value is, in effect, earmarked for the heirs.

Tom Welsh is a certified management accountant in Raleigh, North Carolina. He has been the chief financial officer at several manufacturing companies and is founder of��

Value Point Accounting

, where he helps businesses manage product and customer profitability. His previous articles��were Better Than Nothing,��Five Lives and��

Pay to Play

. Tom can be reached at��

tomgwelsh@valuepointaccounting.com

.

Tom Welsh is a certified management accountant in Raleigh, North Carolina. He has been the chief financial officer at several manufacturing companies and is founder of��

Value Point Accounting

, where he helps businesses manage product and customer profitability. His previous articles��were Better Than Nothing,��Five Lives and��

Pay to Play

. Tom can be reached at��

tomgwelsh@valuepointaccounting.com

.The post Portfolio Acid Test appeared first on HumbleDollar.

Published on June 15, 2021 00:00

June 14, 2021

Helping Mom and Dad

LIKE MANY BABY boomers, my wife and I have watched our parents go from total independence to assisted living to death. We���ve been thankful that, at key moments, they made the difficult decisions themselves, without our prompting. These decisions included when to give up the family home in favor of moving to a continuing care retirement community, when to give up their car and driver���s license, and when to move to assisted living.

Our parents were organized and realistic people who trusted us to act for them in increasingly significant ways as they moved from one stage to the next. Because of their recognition of what they could and couldn���t do, they were able to ease these transitions. Below are five categories of steps they took, sometimes with our help. These steps protected their assets while they were alive and ensured that their assets were all accounted for after they died. Also, their actions ensured that, after their death, complications and potential family squabbles were minimized.

They each put in place key estate planning documents: a will, a revocable living trust with one of us as trustee, a financial durable power of attorney designating one of us to act on their behalf in business matters, and a living will and durable power of attorney for health care. With these as a foundation, they made sure that their accounts were titled properly, so they were held within the trust.