Barbara Friedberg's Blog: Barbara Friedberg Personal Finance, page 12

January 24, 2021

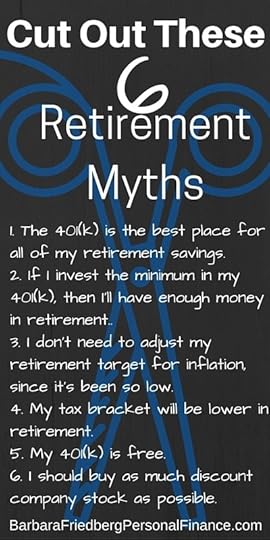

The Truth About the 401k – Myths Exposed

Find out how 401(k) myths can hurt your long-term wealth. Yes, it is important to invest in your workplace 401(k), but there’s more to retirement investing than that!

You need to choose investment wisely and also invest outside of your 401(k) account as well. Learn the truth about the 401k and how to maximize retirement investing.

401k Myth #1 – The 401k is the Best Place for All of My Retirement SavingsNot necessarily.

There are many different type...

January 6, 2021

Flipping Website—Strategies for Profits

“Flipping” is a well-known term in most side hustles. Flipping means buying and then reselling for a profit. From flipping small items like thrift store finds to flipping real estate, there is a market for flipping no matter your niche. Websites are no different: with an eye for potential, you can make money flipping websites.

*This article contains affiliate links to help pay for this website.

What is Website Flipping?

Website flipping is ...

December 30, 2020

Investing in Real Estate Notes Guide

If you’re interested in building wealth through real estate but want to avoid the management headaches of owning actual property then investing in real estate notes might be for you. Sometimes called mortgage notes, these financial assets can be bought when a mortgage lender sells the note attached to that loan to an investor who then takes over the loan.

This allows the lender to get cash today when they need it and offers a unique opportunity for an interested investor. The original borrowe...

December 5, 2020

Being a Landlord Sucks-Should I Invest in Real Estate?

With interest rates still very low, you may be wondering if investing in real estate is worth it. Its all quite glamorous when you read the no money down success stories. There are more than enough real estate gurus available to show you the way.

But before you buy, heres why you might not want to invest in real estate, now, or ever. In fact, I gave up owning rental property decades ago because being a landlord sucks.

*This article contains affiliate...

December 3, 2020

27 Creative Ways To Make Money Fast – Unique Side-Hustle Gigs

At age 16, I wanted a job. So I did what any 16 year old would do before the internet, I looked at the employment section in the newspaper. It’s hard to imagine a time before the internet, where the best ways to make money in high school, were listed in the newspaper.

Since I wanted to learn how to make money in high school fast, and I couldn’t work during the day, the Avon sales ad caught my attention. No age discrimination and I ...

November 18, 2020

Learn About Real Estate Crowdfunding and Investing Without the Hassle

Don’t let the headaches of real estate investing keep you from diversifying your portfolio into one of the best long-term assets.

Despite what you might hear on the 3am infomercials, real estate investing is hard work.

Barbara explained in an earlier post about why she gave up being a landlord decades ago because of the constant headaches.

I can relate. I started buying rental property early in my 20s. I had worked a...

Achieve Simple Financial Success with 5 Good Financial Habits

Guest Contributor, Tina Roth

Developing ‘good habits’ has become an industry. From Charles Duhigg of The Power of Habit to Gretchen Rubin’s, Better Than Before: What I Learned About Making and Breaking Habits–to Sleep More, Quit Sugar, Procrastinate Less, and Generally Build a Happier Life, creating good habits is important across the spectrum or our lives. This article will show you how to be financially successful with a few good financial habits. Simple financial success is not rocket sci...

October 28, 2020

Pros and Cons of REITs – Should I Invest?

Long before Modern Portfolio Theory proved the benefit of diversification, “Don’t put all your eggs in one basket” was practiced. Intuitively, it makes sense to spread your income and investing risk around. The rationale behind diversification and asset allocation is that when one asset goes down in value, another may go up. Spread your investments and risk around and you’ll decrease the volatility of your returns.

For example,...

October 5, 2020

7 Unique Ways to Save Money – Financial Freedom Within Reach

By Barbara Friedberg in Saving

Saving is one of the most challenging aspects of “adulting.” While most people want to save, only a few accomplish it. But for those who do, the results of saving up life-changing. Look at saving money through a unique lens. Replace the “money” reference with “freedom”. The more money you save, the more freedom you have in your future life.

Here are top 7 unique ways to save money and achieve...

September 30, 2020

Checkbook IRA – Ultimate Guide to a Self-Directed IRA

A Checkbook IRA includes the features of a traditional or Roth IRA, but has one distinct difference: the account holder, not a custodian, has control over the investments. This makes Checkbook IRAs a good option for hands-on, confident investors. It lowers the amount of fees paid to account custodians and makes access to your IRA quicker and easier.

*This article contains affiliate links to help pay for this website.

Checkbook IRAs are also good choices for ...

Barbara Friedberg Personal Finance

- Barbara Friedberg's profile

- 63 followers