Steve Bull's Blog, page 153

December 9, 2022

Americans Dumbed Down on Russia

Five years ago today, Congress learned from sworn, horse’s-mouth testimony that there is no technical evidence that Russia (or anyone else) hacked the DNC emails showing how the DNC had stacked the deck against Bernie Sanders, Hillary Clinton’s rival for the Democratic nomination.

I can almost hear readers new to this website cry out in disbelief: “That cannot be. Official Washington and the media assured us that the Russians hacked those emails in order to help Trump win. And didn’t Obama throw out 35 Russian diplomats in reaction? And what about those 12 Russian intelligence agents indicted for hacking?” Were U.S. officials and media mistaken?

No, not mistaken. They were lying.

“But … but, does this mean Special Counsel Robert Mueller knew there was no concrete evidence of Russian hacking just six months into his 22-month investigation into Trump-Russia collusion?”

Get Him Under Oath

On December 5, 2017, Shawn Henry, head of the cyber security firm CrowdStrike, testified to the House Intelligence Committee that there was no technical evidence that Russia hacked the DNC emails that WikiLeaks published in July 2016. CrowdStrike had been hired by the DNC and the Clinton campaign (with the FBI’s blessing) to investigate “Russian hacking”.

Shawn Henry is a protégé of former FBI Director Robert Mueller (from 2001 to 2012), for whom Henry served as head of the Bureau’s cyber-crime investigations unit before he went to CrowdStrike. What are the chances that Shawn Henry did not keep his former mentor, the Special Counsel, informed of this critical factoid?

Why are some of you readers just now learning about this – five years after that testimony? Short answer: Adam Schiff (D, CA), chair of the House Intelligence Committee was able to keep Henry’s unclassified testimony secret from Dec. 5, 2017 until May 7, 2020, when he was forced to release it. Schiff gave the silencer-baton to friends in the corporate media, who have now suppressed Shawn Henry’s testimony for longer than even Schiff could.

…click on the above link to read the rest…

What is the Next Thing that Will hit us? Brace for it, Because it may be Huge

Despite having ancient seers (the “haruspices”) as ancestors, I don’t claim to be able to predict the future. But I think I can propose scenarios for the future. So, what could be the next big thing that will hit us? I suggest it will be the disruption of the oil market caused by the recent measure of a price cap on Russian oil.

Do you remember how many things changed during the past 2-3 years, and changed so unbelievably fast? There was a pattern in these changes: one element was that we were told they were just temporary, another was that they were done for our sake. We were told that we needed “Two weeks to flatten the curve,” and that “the sanctions will cause the Russian economy to collapse in two weeks,” and many more things. Then, our problems will be solved and the world will return to normal. But that didn’t happen. Instead, the result was a “new normal,” not at all like the old one.

Now, the obvious question is “what next?” More exactly, “what are they going to hit us with, next time?” There is this idea that there may be a new pandemic, a new virus, or the old one returning. But, no. They are smarter than that — so far they have always been one step, maybe two, ahead of us. They are masters of propaganda, they know that propaganda is all based on memes and that memes have a finite lifetime. Old memes are like old newspapers, they are not interesting anymore. A particular bugaboo can’t scare people for too long, and the idea of scaring us with a pandemic virus is past its usefulness stage. They may have probed us with the “monkeypox” pandemic, and they saw that it didn’t work. It was obvious anyway. So, now what?

…click on the above link to read the rest…

Noam Chomsky: “We’re on the Road to a Form of Neofascism”

The ground is well prepared for neofascism to fill the void left by class war wrought by neoliberalism, says Chomsky.

Trump supporters near the U.S. Capitol on January 6, 2021, in Washington, D.C.SHAY HORSE / NURPHOTO VIA GETTY IMAGES

Trump supporters near the U.S. Capitol on January 6, 2021, in Washington, D.C.SHAY HORSE / NURPHOTO VIA GETTY IMAGESNeoliberalism has reigned supreme as an economic philosophy for nearly half a century. But neoliberal policies have wreaked havoc around the world, reversing most gains made under managed capitalism after the end of the Second World War. Neoliberalism works only for the rich and the huge corporations. But the failures of neoliberalism extend beyond economics. They spread into politics as the processes of social collapse bring into play menacing forces with promises of a return to lost glory. This is the basic thrust of neofascist movements and parties in today’s world, and it is neoliberalism that has created the conditions for the resurgence of right-wing extremism, as Noam Chomsky explains in the exclusive interview below for Truthout. Meanwhile, protests have become far more widespread in the era of late capitalism, so the struggle for an alternative world is very much alive indeed!

Chomsky is institute professor emeritus in the Department of Linguistics and Philosophy at MIT and laureate professor of linguistics and Agnese Nelms Haury Chair in the Program in Environment and Social Justice at the University of Arizona. One of the world’s most-cited scholars and a public intellectual regarded by millions of people as a national and international treasure, Chomsky has published more than 150 books in linguistics, political and social thought, political economy, media studies, U.S. foreign policy and world affairs…

…click on the above link to read the rest…

Climate Change Lockdowns? Yup, They Are Actually Going There…

I suppose that we should have known that this was inevitable. After establishing a precedent during the pandemic, now the elite apparently intend to impose lockdowns for other reasons as well. What I have detailed in this article is extremely alarming, and I hope that you will share it with everyone that you can. Climate change lockdowns are here, and if people don’t respond very strongly to this it is likely that we will soon see similar measures implemented all over the western world. The elite have always promised to do “whatever it takes” to fight climate change, and now we are finding out that they weren’t kidding.

Over in the UK, residents of Oxfordshire will now need a special permit to go from one “zone” of the city to another. But even if you have the permit, you will still only be allowed to go from one zone to another “a maximum of 100 days per year”…

Oxfordshire County Council yesterday approved plans to lock residents into one of six zones to ‘save the planet’ from global warming. The latest stage in the ’15 minute city’ agenda is to place electronic gates on key roads in and out of the city, confining residents to their own neighbourhoods.

Under the new scheme if residents want to leave their zone they will need permission from the Council who gets to decide who is worthy of freedom and who isn’t. Under the new scheme residents will be allowed to leave their zone a maximum of 100 days per year, but in order to even gain this every resident will have to register their car details with the council who will then track their movements via smart cameras round the city.

Are residents of Oxfordshire actually going to put up with this?

…click on the above link to read the rest…

BIS warns of $80 trillion of hidden FX swap debt

Dubbed the central bank to the world’s central banks, the BIS raised the concerns in its latest quarterly report, in which it also said this year’s market upheaval had, by and large, been navigated without many major issues.

Having repeatedly urged central banks to act forcefully to dampen inflation, it struck a more measured tone this time around and also picked over the ongoing crypto market problems and September’s UK government bond market turmoil.Its main warning though was what it described as the FX swap debt “blind spot” that risked leaving policymakers in a “fog.”FX swap markets, where for example a Dutch pension fund or Japanese insurer borrows dollars and lends euro or yen in the “spot leg” before later repaying them, have a history of problems.

They saw funding squeezes during both the global financial crisis and again in March 2020 when the COVID-19 pandemic wrought havoc that required top central banks like the U.S. Federal Reserve to intervene with dollar swap lines.

The $80 trillion-plus “hidden” debt estimate exceeds the stocks of dollar Treasury bills, repo and commercial paper combined, the BIS said, while the churn of deals was almost $5 trillion per day in April, two thirds of daily global FX turnover.

For both non-U.S. banks and non-U.S. ‘non-banks’ such as pension funds, dollar obligations from FX swaps are now double their on-balance sheet dollar debt, it estimated.“The missing dollar debt from FX swaps/forwards and currency swaps is huge,” the Switzerland-based institution said, describing the lack of direct information about the scale and location of the problems as the key issue.

…click on the above link to read the rest…The US is a rogue state leading the world towards ecological collapse

It’s not just indifference. It’s an active, and deadly, cavalier attitude towards the lives of others: an example other nations follow

Illustration: Eleanor Shakespeare

Illustration: Eleanor ShakespeareThere are two extraordinary facts about the convention on biological diversity, whose members are meeting in Montreal now to discuss the global ecological crisis. The first is that, of the world’s 198 states, 196 are party to it. The second is the identity of those that aren’t. Take a guess. North Korea? Russia? Wrong. Both ratified the convention years ago. One is the Holy See (the Vatican). The other is the United States of America.

This is one of several major international treaties the US has refused to ratify. Among the others are crucial instruments such as the Rome statute on international crimes, the treaties banning cluster bombs and landmines, the convention on discrimination against women, the Basel convention on hazardous waste, the convention on the law of the sea, the nuclear test ban treaty, the employment policy convention and the convention on the rights of persons with disabilities.

In some cases, it is one of only a small number to refuse: the others are generally either impoverished states with little administrative capacity or vicious dictatorships. It is the only independent nation on Earth not to ratify the convention on the rights of the child. Perhaps this is because it is the only nation to sentence children to life imprisonment without parole, among many other brutal policies. While others play by the rules, the most powerful nation refuses. If this country were a person, we’d call it a psychopath. As it is not a person, we should call it what it is: a rogue state.

…click on the above link to read the rest…

BlackRock: Prepare For Recession “Unlike Any Other”… And What Worked Before “Won’t Work Now”

The world’s largest investment manager has gone all in – and says a global recession is right around the corner. What’s more, the financial tricks deployed by Central Banks in the past ‘won’t work this time.’

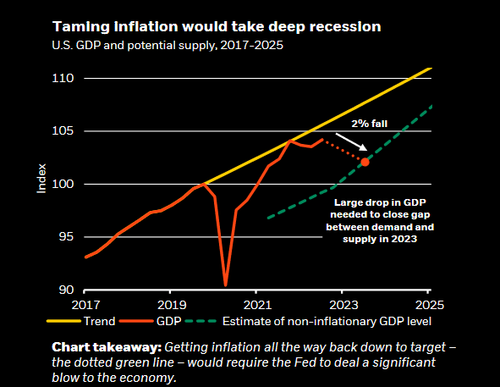

According to BlackRock, the global economy has entered a phase of elevated volatility, and that a recession is imminent due to central banks aggressively boosting borrowing costs to tame inflation. Their actions, according to a team of BlackRock strategists, will ignite more market turbulence than ever before.

“Recession is foretold as central banks race to try to tame inflation. It’s the opposite of past recessions,” the team wrote In their 2023 Global Outlook (embedded below), which says that the global economy has already exited a four-decade period of stable growth and inflation, and has now entered a period of heightened instability.

And when things get bad, “Central bankers won’t ride to the rescue when growth slows in this new regime, contrary to what investors have come to expect. Equity valuations don’t yet reflect the damage ahead.”

“What worked in the past won’t work now,” said the strategists. “The old playbook of simply ‘buying the dip’ doesn’t apply in this regime of sharper trade-offs and greater macro volatility. We don’t see a return to conditions that will sustain a joint bull market in stocks and bonds of the kind we experienced in the prior decade.”

So what can actually tame inflation? A deep recession, according to the report.

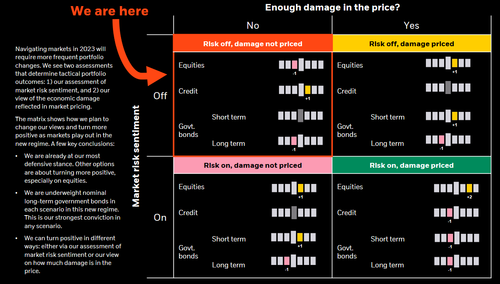

To navigate the coming storm, BlackRock recommends more frequent portfolio changes and taking a more “granular view on sectors, regions and sub-asset classes.”

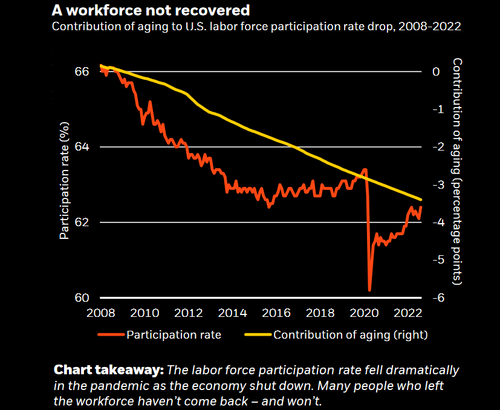

Compounding the issue is aging workforces around the world – which is one key reason that the supply of US labor is struggling to keep up with demand.

…click on the above link to read the rest…

December 8, 2022

Long-Delayed Cold Weather To Blanket Much Of US

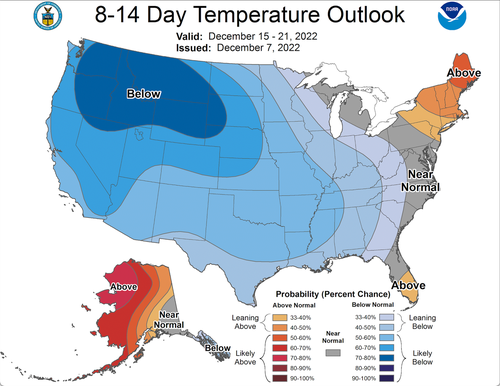

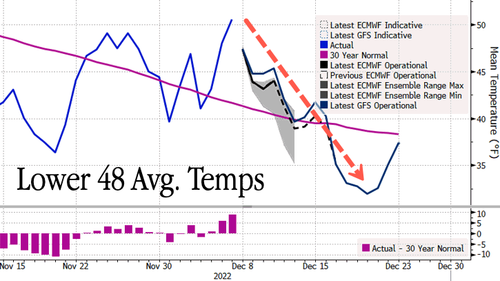

An update to the Climate Prediction Center’s official 8-14 day outlook for pre-Christmas forecasts more than two-thirds of the Lower 48 will be colder than average, with near-normal temperatures for the Mid-Atlantic and above-average temperatures for the Northeast.

NOAA’s temperature outlook forecasts the West, Southwest, and Midwest, as well as parts of the Southeast (excluding coastal areas), will experience below-average temperatures between Dec.15-21. The forecast was issued on Dec. 7. As for the Mid-Atlantic, temperatures are expected to be around average, while temperatures in the Northeast will be above average.

Lower 48 average temperatures are currently well above average. On Wednesday, the national average was 10 degrees above a 30-year mean, though forecasts show a cold pattern will begin at the end of this week and push temperatures down well below average through Dec. 21.

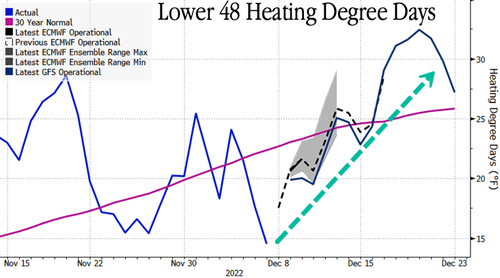

Heating demand is expected to rise ahead of Christmas.

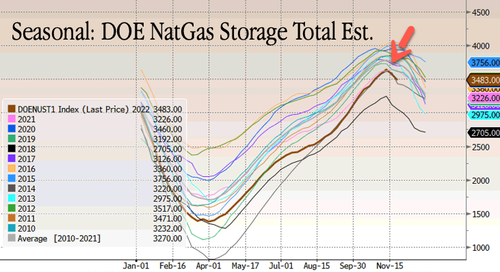

Houston-based energy firm Criterion Research pointed out on Nov. 23, “The United States has officially flipped over to withdrawal season.”

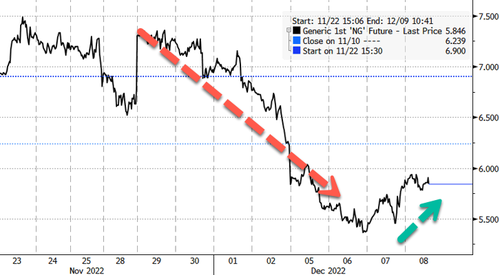

US natural gas futures bid yesterday after falling more than 27% since late November after weather forecasts for the US switched from cold to warm. Cold weather is finally on the way, which could put a bid under NatGas.

As for the Northeast, The Washington Post said, “The Mid-Atlantic and Northeast still appear on track to turn more wintry during the second half of the month. As Christmas approaches, if you’re rooting for snow, waiting is often the hardest part.”

Nigeria Limits ATM Withdrawals To $45 Per Day To Force Govt-Controlled Digital Payments

A staggering number of Nigerians love Bitcoin, but hate government cryptocurrency (CBDCs).

In April, leading cryptocurrency exchange KuCoin noted that 35% of the adult population in Nigeria – roughly 34 million adults aged 18-60, own bitcoin or other cryptocurrencies. But when it came to the country’s Central Bank Digital Currency (CBDC), the eNaira, it was a massive failure.

According to Bloomberg, only 1 in 200 Nigerians use the eNaira – despite government implemented discounts and other incentives, implemented as desperate measures to increase adoption.

Now, the government is looking to boost digital payments by limiting ATM withdrawals to just 20,000 naira, or roughly US$45 per day, Bloomberg reports, citing a circular sent to lenders on Tuesday. The previous withdrawal limit was 150,000 naira (US$350).

Weekly cash withdrawals from banks are now limited (without fee) to 100,000 naira (US$225) for individuals, and 500,000 naira (US$1,125) for corporations. Any amount above this will incur a fee of 5% and 10% respectively.

The action is the latest in a string of central bank orders aimed at limiting the use of cash and expand digital currencies to help improve access to banking. In Nigeria’s largely informal economy, cash outside banks represents 85% of currency in circulation and almost 40 million adults are without a bank account.

The central bank last month announced plans to issue redesigned high value notes from mid-December to mop up excess cash and it’s given residents until the end of January to turn in their old notes. The bank also plans to mint more of the eNaira digital currency, which was launched last year but has faced slow adoption. -Bloomberg

What’s more, new rules which will take effect Jan. 9 will ban the cashing of checks above 50,000 naira (US$112) over-the-counter, and 10 million naira (US$22,480) through the banking systems. Point-of-sale cash withdrawals have been capped at 20,000 naira ($45).

…click on the above link to read the rest…

The macroeconomics of bank-created money and a Modern Debt Jubilee as a way out of the private debt trap

My friend Dr. Sabri Oncu has established an innovative seminar program at Kadir Has University in Turkey. Called the “Kadir Has Lectures on Global Political Economy”, it has had lectures from a number of non-mainstream economists, including Ann Pettifor, Frances Coppola, Yanis Varoufakis, and Jan Kregel.

Forthcoming lecturers include Louis Philippe Rochon and Matias Vernengo. You can find the series here: https://www.youtube.com/playlist?list=PLF796nZs0vOE-Rbrquqdfdrm0ck92lMjI

In my lecture, I explain how bank credit adds to aggregate demand and income, and therefore how capitalism’s great crises–the Great Depression, the Great Recession, the Panic of 1837, and so on–were caused by credit turning negative.

I also explain how we could remedy the economy via a “Modern Debt Jubilee”. Of course, since Neoclassical economists dominate economic policy, I know that this policy has no better than a snowflake’s chance in Hell of being implemented.

I’ve attached the PDF of my slides here as well (unfortunately Substack doesn’t support Powerpoint files: if you want to download them, please go to the Patreon page https://www.patreon.com/posts/75639086.

Building a New Economics is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

[image error]Keen2022macrobomdandmoderndebtjubilee6.01MB ∙ PDF File