Steve Bull's Blog, page 154

December 8, 2022

Arctic Ocean overheating

Arctic sea ice extent was 10.31 million km² on December 4, 2022. At this time of year, extent was smaller only in two years, i.e. in 2016 and 2020, both strong El Niño years. With the next El Niño, Arctic sea ice extent looks set to reach record lows.

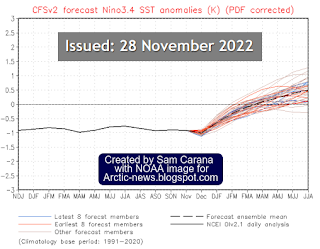

The NOAA image on the right indicates that, while we’re still in the depths of a persistent La Niña, the next El Niño looks set to strike soon.

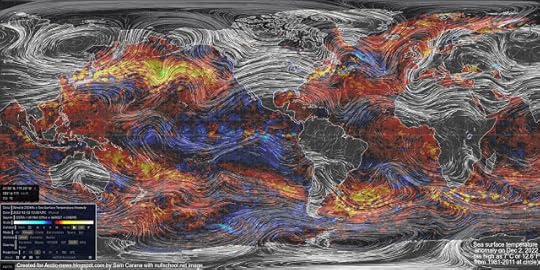

The NOAA image on the right indicates that, while we’re still in the depths of a persistent La Niña, the next El Niño looks set to strike soon.The image below shows high sea surface temperature anomalies near the Bering Strait on December 2, 2022, with a “hot blob” in the North Pacific Ocean where sea surface temperature anomalies are reaching as high as 7°C or 12.6°F from 1981-2011. The Jet Stream is stretched out vertically from pole to pole, enabling hot air to enter the Arctic from the Pacific Ocean and from the Atlantic Ocean.

The image below shows a forecast for December 5, 2022, of 2m temperature anomalies versus 1979-2000, with anomalies over parts of the Arctic Ocean near the top end of the scale.

The image below shows a forecast for December 5, 2022, of 2m temperature anomalies versus 1979-2000, with anomalies over parts of the Arctic Ocean near the top end of the scale.

On December 6, 2022, the Arctic was 6.63°C or 11.93°F warmer compared to 1979-2000, as illustrated by the image below.

On December 6, 2022, the Arctic was 6.63°C or 11.93°F warmer compared to 1979-2000, as illustrated by the image below.

The image below shows the daily average Arctic air temperature (2m) from 1979 up to December 6, 2022.

The image below shows the daily average Arctic air temperature (2m) from 1979 up to December 6, 2022.

Given that we’re still in the depth of a persistent La Niña, these currently very high air temperature anomalies indicate that ocean temperatures are very high and that ocean heat is heating up the air over the Arctic.

Additionally, ocean heat is melting the sea ice from below.Accordingly, Arctic sea ice has barely increased in thickness over the past 30 days, as illustrated by the navy.mil animation on the right.

This leaves only a very short time for Arctic sea ice to grow back in thickness before the melting season starts again, which means that there will be little or no latent heat buffer to consume heat when the melting season starts.

…click on the above link to read the rest…

Our Obsession With Economic Growth is Deadly

When the Bullseye is the Wrong Target

Guy R. McPherson, Beril Kallfelz-Sirmacek, and William M. Kallfelz, 30 November 2022, Medium: The largest elephant in the room: aerosol masking.

Relevant articles:Counterpunch, 25 November 2022:

Harper’s, December 2022: (This article ignorantly cheers for near-term human extinction, thereby ignoring the aerosol masking effect and the rapid rate of environmental change associated with the demise of humans from Earth)

AVID Audio Course Description (Conservation Biology)

Latest Peer-Reviewed Journal Article:

McPherson, Guy R., Beril Sirmack, and Ricardo Vinuesa. March 2022. Environmental thresholds for mass-extinction events. Results in Engineering (2022), doi: https://doi.org/10.1016/j.rineng.2022....

Global Dimming Keeping the Planet Habitable

If you have not already seen it, visitors to this blog will have an interest in this 50-min documentary, “BBC Global Dimming Documentary”, via Gail Zawacki at her Wit’s End blog.

It relates to evidence obtained from the three-day aircraft grounding that occurred after 9/11 and the profound effects that just the U.S. Commercial Aircraft Flying has on Earth’s atmosphere. (One degree Centigrade increase within three days.)

Quoting Professor Guy McPherson ;

“The impact of the aerosol masking effect has been greatly underestimated, as pointed out in an 8 February 2019 article in Science. As indicated by the lead author of this paper on 25 January 2019: “Global efforts to improve air quality by developing cleaner fuels and burning less coal could end up harming our planet by reducing the number of aerosols in the atmosphere, and by doing so, diminishing aerosols’ cooling ability to offset global warming.” The cooling effect is “nearly twice what scientists previously thought.” That this February 2019 paper cites the conclusion by Levy et al. (2013) indicating as little as 35% reduction in industrial activity drives a 1 C global-average rise in temperature suggests that as little as a 20% reduction in industrial activity is sufficient to warm the planet 1 C within a few days or weeks.”

Guy and I both believe a serious economic crash could be the end of us!

None of these risks operate in a vacuum, they are all connected.

Imagine what the carbon footprint of the largest most brutal military on the planet must be?

“According to its own study, in 2013 the Pentagon consumed fuel equivalent to 90,000,000 barrels of crude oil. This amounts to 80% of the total fuel usage by the federal government. If burned as jet fuel it produces about 38,700,000 metric tons of CO2…”

…click on the above link to read the rest…

UK Warned by Farmers That It Is Facing a Food Supply Crisis

Pigs are judged at the Dorset County Show, Dorchester, England, on Sept. 4, 2022. (Finnbarr Webster/Getty Images)

Pigs are judged at the Dorset County Show, Dorchester, England, on Sept. 4, 2022. (Finnbarr Webster/Getty Images)In an emergency press conference, the National Farmers Union (NFU) said the government needed to step in to assist farmers who are under severe strain.

The British farming industry is facing major issues across almost all sectors, with the price of animal feed and nitrogen fertiliser, and fuel skyrocketing. The union warned that yields of crops will likely slump to record lows this year with farmers also considering reducing the size of their herds.

Under Threat

In the emergency press conference, NFU president Minette Batters said that “shoppers up and down the country have for decades had a guaranteed supply of high-quality affordable food produced to some of the highest animal welfare, environmental, and food safety standards in the world.”

“That food, produced with care by British farmers, is critical to our nation’s security and success. But British food is under threat,” she added.

“We have already seen the egg supply chain crippled under the pressure caused by these issues and I fear the country is sleepwalking into further food supply crises, with the future of British fruit and vegetable supplies in trouble. We need government and the wider supply chain to act now—tomorrow could well be too late.”

According to the NFU, since 2019 the price of wholesale gas has increased by 650 percent, with nitrogen fertiliser up by 240 percent and agricultural diesel up 73 percent. Furthermore, animal feed raw material has increased by 75 percent.

Nearly 1 in 10 NFU members who produce beef said they were considering reducing the size of their herd in the next 12 months.

…click on the above link to read the rest…

December 7, 2022

Glencore Says This Time Is Different for Coming Copper Shortage

(Bloomberg) — Glencore Plc added its voice to a chorus of miners warning of coming copper shortages, arguing that a “huge deficit” is looming for the crucial industrial metal.

Chief Executive Officer Gary Nagle said that while some people were assuming that the industry would lift supplies as it had in previous cycles to meet a forecast increase in demand driven by the energy transition, “this time it is going to be a bit different.”

He presented estimates showing a cumulative gap between projected demand and supply of 50 million tons between 2022 and 2030. That compares with current world copper demand of about 25 million tons a year.

“There’s a huge deficit coming in copper, and as much as people write about it, the price is not yet reflecting it,” Nagle said.

Copper miners and analysts have been warning of growing deficits starting in the mid-2020s, driven by rising demand for copper in wind and solar farms, high voltage cables, and electric vehicles. While most analysts believe that prices will rise from current levels around $8,500 a ton, there is some disagreement about how large the copper shortages might be.

Still, Nagle said that Glencore, which is one of the world’s top copper miners and traders, will wait to lift its own output of the metal until the world is “screaming” for it. “We want to see that deficit,” he said.

Nagle said that Glencore could lift its annual copper production by more than 60% from current levels of 1 million tons with expansions of its current assets. The company is also eyeing a $5.6 billion new-build project at El Pachon in Argentina.

Europe’s Energy Crisis Is Reshaping Geopolitics

Europe’s energy crisis is about far more than just energy. It’s also the impetus for a major geopolitical reconfiguration at a global scale. No one knows exactly what the world’s energy and political landscapes will look like when the dust settles (which, by the way, will be years from now) but it’s guaranteed that it will be markedly different than it was the day before Russia – historically the largest exporter of oil and natural gas to the European Union by a long shot – illegally invaded Ukraine.

This year’s annual energy outlook from the International Energy Agency (IEA) warns that we are currently living through a “global energy crisis of unprecedented depth and complexity,” and that “there is no going back to the way things were” before the unprecedented dual shocks of the novel coronavirus pandemic and Russia’s war in Ukraine. Together, these events have already reconfigured the energy trade worldwide, but the shockwaves to the global economy are just getting started.

Many look at Europe’s current energy deficit as a kind of heroism, as the European Union has taken a huge economic hit in order to impose energy sanctions on the Kremlin – the one kind of sanction that could really cripple the Russian economy in the hopes of ending the war in Ukraine. “In the struggle to help Ukraine and resist Russian aggression, Europe has displayed unity, grit and a principled willingness to bear enormous costs,” the Economist recently reported.

…click on the above link to read the rest…

December 6, 2022

Zoltan Pozsar: Gold At $3,600 Is Not Improbable If US Refill Reserves With Russian Oil

In his latest dispatch, Credit Suisse contributor Zoltan Pozsar shifted focus on his ongoing series about Bretton Woods III where commodities will dictate the new world order.

Instead, the author zeroed in on the depleting Strategic Petroleum Reserve (SPR) of the United States, posing the query of what comes next after the White House shipped its last scheduled release.

“Now that SPR releases are over, production cuts by OPEC+, re-routing [of Russian crude oil from Europe to Asia], and price caps (not to mention the risk of China re-opening due to protests), the question for the U.S, becomes what to do with the SPR? Release more? Refill?” pondered Pozsar.

Back in September, as well, US President Joe Biden’s administration said it is looking at refilling its oil reserves should crude oil prices drop below US$80 a barrel. The prices have traversed the levels below that said mark but the White House moved the price target lower in October after it announced its plan to release 15 million barrels of oil more.

“The Administration is announcing its intent to use SPR repurchases to add to global crude oil demand at times when the price of West Texas Intermediate (WTI) crude oil is at or below about $67 to $72 per barrel,” the White House statement then read.

After the US Department of Energy sold the last batch of crude oil from the historic SPR release, the reserves continue to bleed in the hopes of managing rising inflation and local energy prices. The current level is now below the 400-million barrel-mark, poised to hit a nearly 4-decade low.

…click on the above link to read the rest…

Doomberg: How to Fix the World (and if not, how to prepare)

A conversation with the legendary Substacker Doomberg, in which he discusses big picture topics like the economy, government policies, and emergency preparedness.

A bit about my guest: Doomberg is a fellow Substack author – one of the most successful writers on the network. They write about economics, finance, energy, and a bit of politics. I highly recommend checking them out, especially if you are looking for a break from the standard news cycle. Doomberg is consistently unique in its coverage.

I can’t remember for certain, but I believe Doomberg was my initial introduction to Substack. In April of 2021, I caught them on an episode of the Grant William’s Podcast and was intrigued by, not only the Green Chicken, but their clear and seamless articulation of complex economic matters. Their rise has been meteoric, impressive to watch, and well-earned. It inspired me to write my own thoughts on a Substack (after failing to convince my friends to debate these issues with me). I only have 1.6k followers, but the journey has launched a new career path for me as I published my work at various mainstream outlets as well. Just two weeks ago, I accepted a ‘Business Reporter’ role at the Epoch Times.

I’ve had brief run-ins with Doomberg in some of my previous jobs, and they were nice enough to participate in this discussion with me. We start off by asking why Doomberg is a “prepper” and dive into various topics like economics and his view of an ideal government.

With that, enjoy:

(yes that’s my real name in the corner)

Peter Schiff: You Think Inflation Is Bad Now? Wait Until Next Year!

Peter Schiff recently appeared on Real America with Dan Ball to talk about the economy, energy prices, and inflation. Peter said if you think inflation was bad this year, wait until next year with a much weaker dollar.

Dan set the interview up with a list of tech firms set to lay off employees. He asked how people can say the economy is just fine when you have tens of thousands getting laid off, nobody has any savings, and when the housing market is tanking.

Peter said they’re going to keep saying that, but it simply isn’t true. He pointed out that the entirety of the Q3 GDP increase was from a decrease in the trade deficit.

It’s not like it went away. It just got slightly less enormous than it had been. And that was for two reasons. The strong dollar enabled us to buy imports cheaper. But also, all that oil that was released from the Strategic Petroleum Reserve, we got to export that, so that increased our exports and reduced our deficit. And so that helped us out.”

But those impacts are already starting to reverse. The dollar is tanking.

And all of the economic data that’s come out so far on the fourth quarter suggests that GDP in the fourth quarter is going to be negative again.”

That would mean a drop in GDP in three of the four quarters in 2022. And Peter said the Q4 drop could be the biggest yet.

As far as the petroleum reserves, Peter said we’re going to run out sometime next year.

And I think in California, by the time Biden finishes his first term, and hopefully his only term, I bet you guys in California will be paying $10 a gallon for gas.”

…click on the above link to read the rest…